Financial data security: 5 best practices to stay safe

Your small business might be putting too much effort into financial planning. But if the same priority isn’t given to financial security, you will lose more than you earn.

Financial data security is important to secure business finances and lay a solid technical foundation.

Big companies give equal importance to this and invest in high-quality infrastructure to protect their financial data system.

Is it possible for SMBs to make similar efforts to plan their financial data protection? Is it a one-time effort or takes consistent measures?

Why is financial data security important?

Financial data security means safeguarding your financial data, including transaction details, vendors' and clients' banking information, credit and debit cards owned, statements, bills and receipts, and any information related to your company’s money.

Financial security can also mean the protection of physical and tangible assets.

The list of items your financial data system encompasses will tell you why business data security is essential.

As banking operations are becoming increasingly online, it’s easy for the fraudsters to pry at your confidential information and steal money. What’s more valuable than money is your brand value and the trust your customers have over you. This asset can be at stake when your financial data protection is flawed.

When a perpetrator enters your financial data system, they find a way into your dealers' and customers’ accounts, making you responsible for this catastrophe.

Your financial data can tell a lot about your company’s funding, debts, revenue, future plans, investments, and many more. Losing them to the wrong hands can collapse your economic construction.

Financial security is vital to maintaining your professional values and good business relationships.

By establishing internal safeguards for business, you can build a strong wall around your financial data and hide it from the world of malicious hackers.

5 ways to keep a company’s financial data secure

You can secure business finances and data by making small changes in your accounting and finance habits.

Here is what you should do to keep your business data security always intact.

1. Check your credit report and bank activity regularly

Regularly monitor your credit card activity and quarterly or monthly credit report to notice anomalies.

Check your bank statements thoroughly to see if there are any unapproved transactions. This smart monitoring can also help you in financial planning.

2. Examine your company's operating expenses

Evaluate your whole payment strategy to see how strong and foolproof your financial data protection is.

Have an expense application that smartly displays every business transaction.

Find out the fixed and variable expenses and the modes you pay them through. This can give you an idea to plan and execute the transactions safely.

3. Prioritize data security

You know how crucial financial data security is to your business. Prioritize that at any cost than other accounting and economic aspects.

Create and stick to financial data security compliance and governance policies and educate your employees on that.

As your employees play a huge role in carrying out financial data protection, it’s vital they be aware of it.

4. Business accounts vs. banks

Business accounts are current accounts specifically created for business banking operations. These accounts are offered by both traditional banks and modern fintech institutions.

Both have their pros and disadvantages. Decide what works best for your business and its financial security and structure.

Generally, business accounts are safer and more convenient than traditional bank accounts, given how your data is handled and stored and the benefits you get without leaving your desk.

5. Safeguard your relationships with suppliers

Your suppliers are the people you regularly transact with. Choose your suppliers wisely and select payment methods that are not only convenient but secure too.

Make your suppliers acknowledge your financial data security compliance for safe payments and secure data handling.

Financial data security best practices

Whether your business operates online or offline, business data security must be given importance to keep your business safe and afloat.

By taking the following steps, you can take care of financial data security and secure business finances.

Use cloud-based services

Using desktop-based applications or manual systems can create weak spots in your financial data system.

These weak spots are a great source of information leakage or burst, causing you a bad name and reputation.

Every business-related tool is available in cloud versions, which is simple to install and use, and your information will not be located on a hard disk or a physically existing system but cloud that assures your financial data security.

Two-factor authentication

Have you noticed employees sharing passwords within their teams? Having two-factor authentication is a way to protect your confidential information as it requires more than a shareable password.

It can be a biometric authentication, an email OTP, or a token generator. Investing in this can strengthen your financial data system.

Implement role-based access

Establishing role-based access is one of the key steps while setting up internal safeguards for business. Role-based access means giving only the required access to employees based on their roles.

For example, if there is a group of shared files, an analyst will be able to access only what their role requires them to use.

Cloud-based applications make this a cakewalk to set up and manage permissions in a large enterprise.

Train your staff to recognize security threats

Security training and drills should be a part of your employees’ internal training. They should know how to handle a business data security compromise and reach out at the right time for damage control. Also, they should be taught to avoid security concerns and identify red flags.

When your team operates in remote locations, your data security can be even more vulnerable. So, your employees play a role in keeping your financial data security together.

Secure remote access to your network

As mentioned above, remote teams are becoming more prevalent everywhere. Remote access can make your organizational data safety complex and problematic because you never know where a problem can arise.

A robust system should be in place to protect your data shared over the network.

You can use private networks like VPN, which gives secure, regulated entry to your network and helps in financial data protection.

Is expense management software the key to protecting financial security?

What type of solution are you currently using to handle your financial data? If that’s not a cloud-based expense management software, then it’s highly recommended you think about it to secure business finances.

Your payment volume can be low, but it’s still data that ought to be protected.

An expense management software brings regulation and protection to every transaction you make. You don’t need to take any external measures to take care of your financial data when there is a cloud-based expense management system.

While making safe and closed transactions, you can keep your financial data away from prying eyes. Different levels of access to different employees make it easier to control role-based access.

You don’t need multiple apps to make payments and save the data junks in various places.

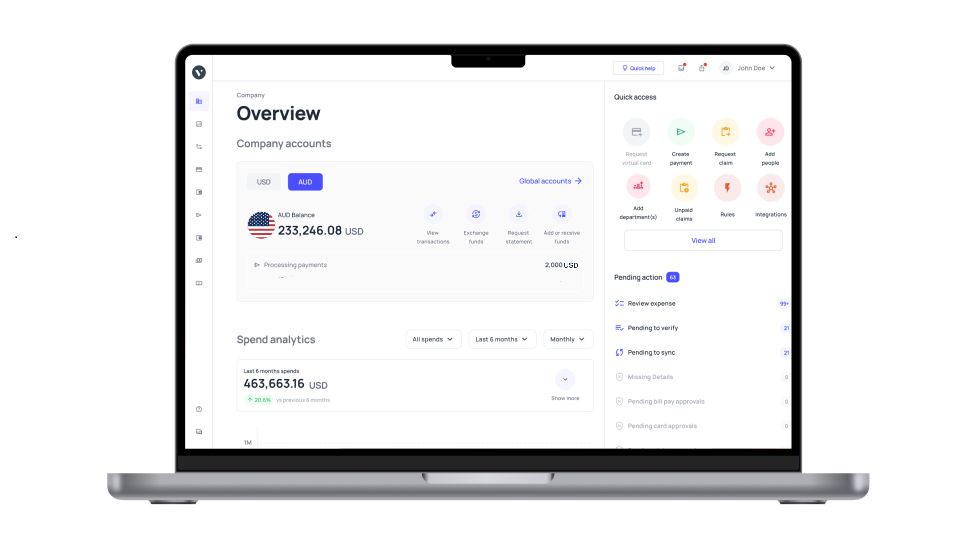

With an expense management app, your financial data systems is located in one place as you have multiple options for a myriad of payment needs.

In the name of financial security and safety, you are not going to compromise on your accounting convenience.

Modern expense management apps are designed to take the manual workload off of accounting and speed up the payment process. In return for swift payments, you get automated internal safeguards for business that safely locks up your financial data in the cloud.

Automate payments and keep your financial data confined with Volopay

To safely transact without worrying about financial data security, get Volopay, an all-in-one expense management software.

Our bank-grade security protocols will ensure that your financial data is safe and secure. Never be bothered about payment deadlines or subscription overdue, as Volopay has schedule and auto payment options.

Every business expense will start and end within Volopay, giving no chance for a swindler to steal your data.