Company spending policy - Best practices and what to include

When running a business, your employees are bound to incur expenses in order to generate revenue and keep the growth trajectory scaling upwards. Employees cannot recklessly spend the company’s funds for maintaining sales and earning profits. There have to be underlying principles or guidelines governing these expenditures.

One way to guide employee expenses is by implementing a company spending policy. Even if you are a small business with a handful of employees, you still need to monitor your spending habits.

By developing expense policies, you gain granular insights into business expenses, helping in establishing expense accountability while keeping your employee expenses manageable.

What is company spending policy?

A company spending policy is a formal set of guidelines that clearly defines what qualifies as an expense and what does not. Additionally, the policy also mentions reimbursement, i.e., expenses are reimbursable and cannot be reimbursed by the company.

In case there is no well-explained expense policy, you are encouraging your employees to make those expenses that do not fall under reimbursable expenses. Since the company did not mention any maximum amount, employees can get headless while using the company’s funds.

Why create a company spending policy for employees?

An ambiguous and ill-defined employee spending policy results in chaos and confusion between management and employees. It booms the risk of expense fiddling, approving unauthorized reimbursements, and data mismatch increasing employee dissatisfaction.

Below mentioned are the reasons to adopt and cherish company spending policy.

1. Setting clear employee expectations

Your employees are the primary users of a company spending policy. Therefore, the policy should be defined to make it reasonably easy to implement and communicate to employees. A well-structured company policy for employees will allow employees to understand what the company expects from them when making purchases/ payments on behalf of the company.

Guidelines will help them know which expense categories fall under their radar and the expenses they cannot incur.

Moreover, the policy displays other details like the reimbursement process, a reimbursement timeline, documents required to support the expenses, and how the company is willing to settle the matter in case of a dispute. Clearly defined objectives of corporate policy help employees understand what way the company is heading.

2. Streamlines reimbursement process

With employees knowing what expenses are within their limits, they try to be more responsible and attentive while spending. By understanding the policy requirements, they know how the reimbursement process shall take place, and the ways employees need to support this process.

Therefore, they keep all the documents and reports handy to ensure the uninterrupted flow of the process.

While on the flip side, in the absence of the expense reimbursement policy, employees might not know what expenses are supposed to be incurred, what maximum limit they can spend, and which costs fall under the reimbursement policy.

3. Unified expense workflow

With a standard and consistent expense policy implemented company-wide all the expenses will be governed by a single procedure. This means all the rules and regulations for all business expenses shall be the same, the expense categories will not vary, and the reimbursement process will remain intact. Causing uniformity across the company.

4. Spend controls and insights

Through the spending limit policy, companies gain insights into the ways employees are spending the company’s funds. Which department/ activity/ project requires the most funds, and are they making judicious use of their budgets?

These policies also help in identifying spend-thrift departments and areas of the company. This allows managers to take action against such activities by adequately implementing spend controls.

Points to consider when creating spending policies

Well, because every company has a diverse workforce and its own set of expenses, there’s no one-size-fits-all approach to spending policy. Each company must create its custom-fit employee spending policy based on its assumptions and expectations.

But here are specific pointers that guide to ensure company expense policy compliance. Read the tips below and understand the keys to a successful company spending policy and what to consider while drafting spending policies.

Expense categories

Mention your expense categories and the expenses that fall under those categories very clearly. Leave no scope for doubt when it comes to which expense category is allowed and which is not.

Spending limits

Clear the maximum amount of spending against each expense category. Beyond the ceiling, the company is not liable for any reimbursement.

Keep it simple

Keep your policy to the point by mentioning all the required details. Declutter all the fluff!

Update regularly

Owing to the dynamic nature of the business environment, expenses keep on fluctuating. Therefore, keep updating the policy according to the current scenario. Not to mention – communicate with employees after making changes.

Keep it tax compliant

Keep your company policy aligned with tax policies. Know which expenses are taxable and which are not. Also, which expenses are illegal to incur.

What to include in your expense policy?

Keeping your expense policy brief and on-spot is critical to its effective implementation. Below mentioned are the items to be included in your company expense policy:

1. Expense categorization

The main component of your company expense policy is the expense category as decided by the organization.

This states which expenses are allowed to be reimbursed by the company. In general, here are a few expense categories which every organization adopts.

• Travel expenses - Air, rail, and road travel, mileage, car hire, foreign currency charges, Visa, parking and toll, hotel charges, and other expenses.

• Food and meal charges

• Employee health charges - Insurance, regular health checkups, etc.

• Entertainment - Office celebrations, functions, parties.

• Office equipment - Office furniture, stationery, cell phone bill, etc.

2. Rules and regulations

The company expense policy document dictates the rules will govern all the reimbursable expenses for the employees. The organization can form a Zero Tolerance policy against any fraud and bribery. The outcomes of such fraud should be known to every employee, along with the consequences.

3. Legal obligations

Management should check the acts or bills administering the expense and reimbursement procedure. Certain payments are taxable, and any misinformation at the time of filing them can cost both time and money to the company.

Therefore, the expense policy should adhere to the legal boundaries administering it.

4. Reimbursement procedure

Another critical component of a full-fledged expense policy is its reimbursement procedure. The draft should clearly explain the process for availing of the reimbursement. All the necessary documents and pre-requisites should be fulfilled by the employee.

In the case of any fraud with receipts or other documents, indicate the repercussions.

5. Management’s responsibilities

The document should contain the hierarchy of powers among the managers. It should be able to reflect which manager is concerned with what matters.

It states how the managers should accept the claims, reimburse them and ensure policy compliance.

Common expense policy issues to avoid

Expense policies are the guiding force of your business expenses. They directly impact your employee spending habits, cash flow, efficiency ratios, and overall business performance. Therefore, companies need to be vigilant while drafting and implementing expense policies. Below mentioned are some of the mistakes to look for in your expense policy:

1. Paper reporting

Paperless reporting is what is the need of the hour. Paper reporting unnecessarily complicates the business processes and makes employees lethargic and error-prone by repeating the same task.

Needless to say they are way too time-consuming and labor-intensive activities that drain out the efficiency of workflows. Shifting to automated software instantly spills out the results for you. Their ability to make processes and workflows more efficient, robust and streamlined is unmatched. Additionally, they are less bound to make errors or omissions.

2. Corporate expense fraud

Creating a spending limit policy does not ensure protection from fraud and unnecessary expenses. Employees still need to be monitored and held accountable for their actions that violate the company’s values and policies.

Usually, employees are fully aware of the loopholes and vulnerabilities in the company's processes this results in them taking advantage of this and ends with financial fraud. Your expense policy should be outlined in a way that leaves no scope for employees to exploit any loophole and use it for their benefit.

An undefined and loose employee spending policy drastically increases the chances of employee fraud like claiming for more than spent or reimbursements for personal expenses.

3. Ignoring tax policies

Tax policies strictly govern business expenses. The Internal Revenue Service (IRS) defines what qualifies as a business expense, how to record these expenses, which rules apply for which accounting method, and what expenses are tax exempted.

Not abiding by the rules laid down by your tax authorities could trigger them to look for your financial statements.

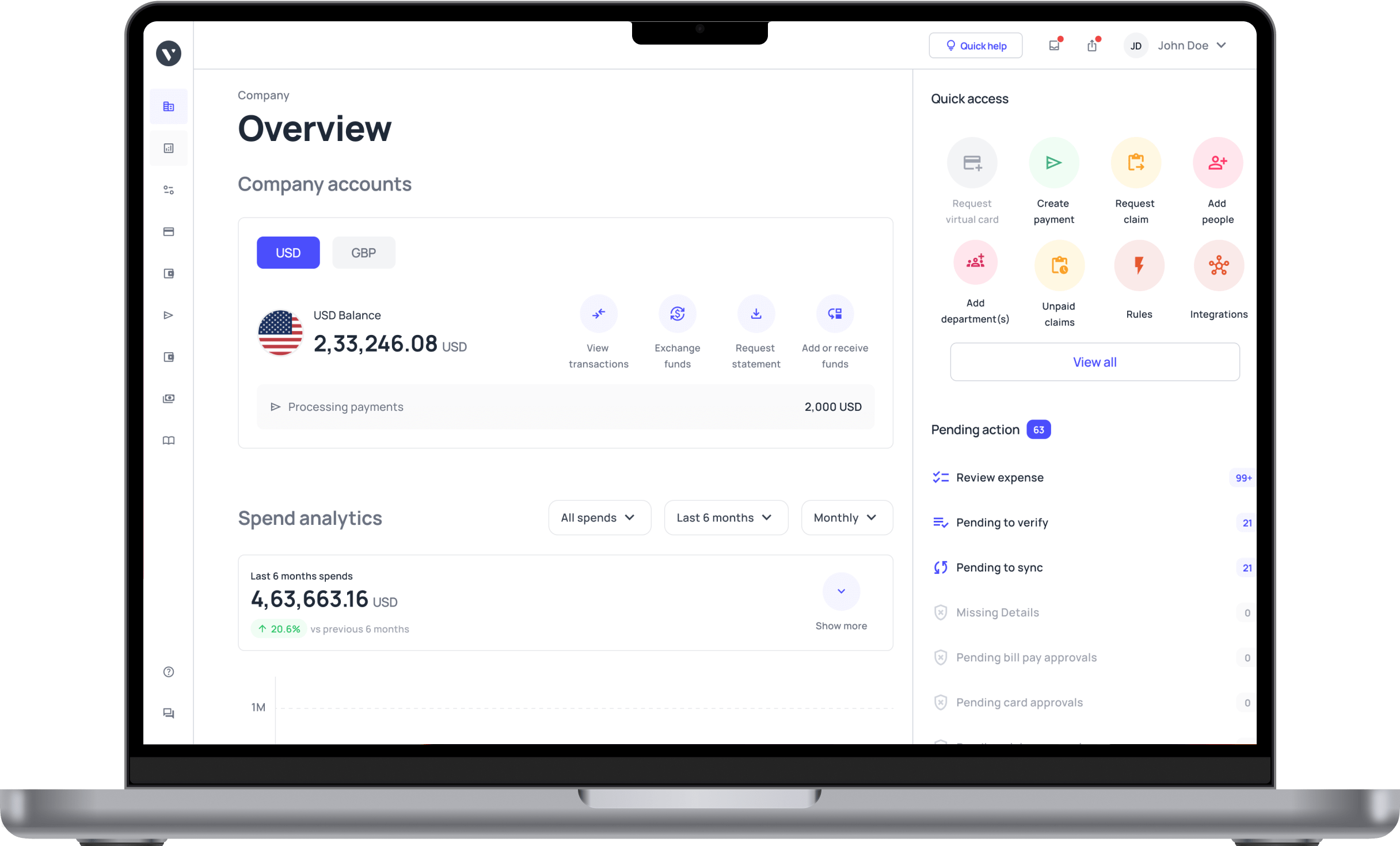

Get started with Volopay

● Reimbursements: Easy filing for reimbursement to the employees. Instantly reimburse them for out-of-pocket expenses.

● Approval policy: Implement your expense policy through the means of approval policy. Create spending limits and approvers for different amounts.

● Department-based policies: Volopay allows you to create individual policies for your department only.

● Expense policy checks: Only expenses that pass your company’s pre-defined expense policy are submitted for approval.

● Mileage rates: Configure mileage rates and instantly get reimbursement into your bank account.

● Detect duplicate entries: Volopay runs policy checks and flags any duplicate entries.