Capital budgeting: Meaning, importance, process & techniques

Making smart long-term investment decisions is crucial for business success. In this article, you will learn about capital budgeting in financial management, understand its importance, and explore how it works step-by-step to support your overall business budget.

Whether you're new to the topic or want to refine your approach, grasping the essentials of what is capital budgeting will help you make informed, strategic choices that align with your business goals and financial stability.

What is capital budgeting?

Capital budgeting is the financial process businesses use to evaluate major investment projects and expenditures. It aims to efficiently allocate resources to high-return, low-risk projects with significant costs and long-term impacts, such as equipment purchases, product launches, or expansion.

By understanding capital budgeting in financial management, you gain the ability to make better investment decisions based on systematic evaluation rather than intuition. It ensures that every dollar spent on new initiatives aligns with broader business objectives.

Learning different capital budgeting techniques will also empower you to select the right analytical methods for various types of investments. Ultimately, effective capital budgeting strengthens a company’s financial health, ensuring its growth and sustainability over time.

How does capital budgeting work?

Capital budgeting involves a structured decision-making process that helps businesses choose profitable long-term investments. By understanding how capital budgeting techniques are applied and how they align with different types of business budgets, you can confidently manage project evaluations, allocate resources effectively, and support broader financial planning.

Identification

The first step in the capital budgeting process is identifying potential investment opportunities. You must recognize projects that could benefit the company, whether it's opening a new branch, purchasing updated machinery, or entering a new market.

At this stage, it’s important to assess opportunities broadly without immediate judgment. By keeping the focus wide, you ensure no valuable idea is overlooked in your capital budgeting in financial management process.

Evaluation

Once opportunities are identified, the next step is to evaluate them thoroughly. Here, you'll analyze the expected costs, revenues, risks, and timeframes for each project.

Financial metrics like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period are commonly used. Learning capital budgeting techniques ensures you can apply the right evaluation method depending on project complexity, allowing you to predict future benefits more accurately and prioritize wisely.

Selection

After evaluating all options, you must select the projects that best meet financial and strategic objectives. Selection criteria often include return on investment, alignment with company goals, and acceptable risk levels.

Choosing projects using structured methods, rather than intuition, reduces the chance of errors and improves organizational performance. By mastering the art of project selection within capital budgeting in financial management, you enhance your company's chances of sustainable growth.

Implementation

The final phase is implementation. After selecting the best investment projects, you’ll allocate the necessary financial resources and initiate project execution. Careful monitoring during this stage ensures that projects stay within budget and on schedule.

Adjustments may be needed if unexpected costs or delays arise. Effective implementation closes the loop in your understanding of what is capital budgeting, ensuring that strategic decisions turn into tangible, profitable outcomes.

Importance of capital budgeting

With capital budgeting, you gain a structured framework for evaluating investment options. Instead of relying on guesswork, you use financial tools and capital budgeting techniques to project future cash flows and returns.

This approach empowers you to compare alternatives objectively and choose investments that match your business’s growth strategy.

Informed decisions lower the chances of financial missteps, helping you make better use of limited resources and fostering stronger, more sustainable results over time.

Capital budgeting isn’t just about making investment decisions; it’s also about tracking performance. You can set benchmarks for project outcomes and measure success against expectations.

Monitoring project results holds teams accountable and provides valuable lessons for future investments. This feedback loop enhances organizational learning and improves financial discipline.

Over time, refining your capital budgeting processes based on past performance ensures better decision-making and more consistent returns across all projects.

Capital budgeting provides a roadmap for long-term strategic growth.

By identifying and funding high-return projects, you create pathways for business expansion, product development, and market entry. Planning investments with precision also ensures alignment with the company's broader vision.

When you apply structured investment analysis, you safeguard your future growth prospects and move toward achieving ambitious business objectives. This proactive approach to financial planning boosts confidence in your expansion strategies.

Businesses often face competing demands for limited financial resources. Capital budgeting enables you to prioritize projects based on their strategic value and expected returns.

By systematically assessing opportunities, you ensure that your capital is allocated to the most beneficial investments. Efficient allocation not only maximizes potential profits but also prevents unnecessary spending.

Having a clear understanding of what is capital budgeting strengthens your ability to use your financial resources where they will have the greatest impact.

Every investment carries an element of risk, but capital budgeting helps you manage and mitigate these uncertainties.

Through detailed analysis, you can forecast potential challenges and develop strategies to address them. Evaluating risk factors like market fluctuations, regulatory changes, and operational issues is critical.

By incorporating risk assessments into your capital budgeting in financial management process, you reduce surprises and protect your investments, ensuring the business remains resilient in the changing economy.

Maximize your budget’s potential with Volopay's expense management software

Objectives of capital budgeting

The objectives of capital budgeting go beyond simply approving projects. They ensure that investments contribute positively to the company's value and stability. By mastering capital budgeting techniques, you enhance your ability to achieve key financial and strategic goals effectively.

1. Maximise shareholder value

One of the primary objectives of capital budgeting is to enhance shareholder wealth. When you invest in projects that offer strong returns and sustainable growth, the company's valuation rises, benefiting its owners.

Choosing investments wisely based on their expected cash flows and profitability aligns your business activities with shareholder interests. Sound capital budgeting strengthens trust among investors and improves your organization’s market reputation, positioning it favorably for future opportunities.

2. Improve resource allocation

Efficient use of financial and operational resources is crucial for a company’s long-term success. Capital budgeting helps you identify which projects deserve investment based on thorough evaluation.

This systematic approach eliminates waste and optimizes the use of funds. When every dollar is directed toward high-value activities, your organization becomes leaner, more productive, and better prepared for competitive challenges.

Better resource allocation ultimately leads to stronger financial health and operational efficiency.

3. Manage risks

Capital budgeting allows you to quantify and control financial risks associated with large investments. By analyzing different project scenarios and stress-testing assumptions, you build a clearer picture of potential vulnerabilities.

Understanding risk factors enables you to prepare mitigation strategies, such as diversifying investments or adjusting operational plans. Proactively managing risks through the capital budgeting process ensures that your business remains stable and flexible, even when faced with unpredictable changes in the market environment.

4. Increase profitability

Choosing the right projects through careful capital budgeting directly impacts profitability. When you approve investments that offer higher returns relative to costs, your bottom line strengthens over time.

A focus on profitable projects ensures that financial resources are used effectively, enabling your company to achieve a healthy operating margin. This emphasis on profitability is a key reason why mastering capital budgeting in financial management is critical to sustained business success in highly competitive industries.

5. Enhance competitiveness

Companies that invest wisely in innovation, technology, and market expansion stay ahead of the competition. Capital budgeting ensures that you make strategic investment decisions that enhance your company’s ability to outperform rivals.

Staying competitive requires constant evaluation of where and how to deploy your resources. Structured investment analysis allows you to seize growth opportunities before competitors do, maintaining your leadership position and driving continuous improvement in all operational areas.

6. Support long-term growth

Long-term business growth depends on consistent, well-planned investment. Capital budgeting helps you identify projects that not only provide immediate benefits but also lay the foundation for future expansion.

By continuously aligning your investments with evolving market trends and technological advancements, you ensure the organization remains future-ready. Strategic capital investments drive innovation, open new revenue streams, and fortify your company’s market presence, ensuring lasting success in an ever-changing business environment.

Types of capital budgeting

Understanding different types of capital budgeting methods is essential for making informed investment decisions. By applying the right techniques, you can better evaluate the profitability, risks, and overall value of projects. Mastering these approaches strengthens your skills in managing capital budgeting techniques and securing better financial outcomes for your business.

Discounted cash flow (DCF) methods

DCF methods are based on the principle that the value of money changes over time. These methods help you evaluate the profitability of projects by considering the present value of expected future cash flows. Two key DCF methods are:

● Net present value (NPV)

NPV calculates the difference between the present value of cash inflows and outflows over a project’s lifetime. If the NPV is positive, the investment is typically considered viable. Mastering NPV techniques is critical for strong capital budgeting in financial management.

● Internal rate of return (IRR)

IRR is the discount rate that makes the NPV of an investment zero. You can use IRR to compare the profitability of different projects and choose the most beneficial one.

Non-DCF methods

Non-DCF methods are simpler and focus on the basic recovery of investment costs without adjusting for the time value of money. These methods are useful when you need a quick estimate of a project’s potential.

● Payback period

This method calculates how long it will take for you to recover your initial investment from the project’s cash flows. Shorter payback periods are usually more attractive.

● Accounting rate of return (ARR)

ARR measures the expected return based on accounting information rather than cash flows. It compares the average annual profit to the initial investment, providing a straightforward profitability metric for evaluating capital budgeting scenarios.

Hybrid methods

Hybrid methods combine elements of DCF and non-DCF approaches to provide a more balanced evaluation. These methods help you make nuanced decisions about complex projects.

● Profitability index (PI)

PI is the ratio of the present value of future cash flows to the initial investment. A PI greater than 1.0 indicates a good investment.

● Modified internal rate of return (MIRR)

MIRR addresses the limitations of traditional IRR by assuming reinvestment at the project's cost of capital rather than at the IRR itself. Using hybrid methods refines your ability to apply capital budgeting in financial management in real-world business contexts.

Features of capital budgeting

Capital budgeting in financial management is the process of evaluating potential investments or projects to determine their financial viability. It is crucial for making informed investment decisions that align with your organization's goals. By assessing capital budgeting techniques, businesses can prioritize resources and ensure long-term profitability.

Large investments

Capital budgeting often involves substantial financial outlays. Organizations invest in assets like machinery, technology, or infrastructure, with the expectation of long-term returns.

These decisions in capital budgeting (in financial management) can significantly impact your company's ability to generate revenue and profits over time.

These investments often shape a business’s operations for years, so evaluating them requires thorough return analysis and a clear risk management strategy.

Risk and uncertainty

Capital budgeting decisions come with inherent risk and uncertainty. Forecasting future returns is challenging, especially when considering economic fluctuations, market shifts, or unexpected costs.

Effective management of capital budgeting techniques, businesses can help mitigate some of these risks and prepare for various market conditions and adjust their strategies accordingly.

Additionally, risk factors such as inflation, currency exchange rates, or technological disruptions must be considered to ensure that the investment remains viable over time.

Irreversible commitments

Once capital budgeting decisions are made, they are often irreversible. The investments are sunk costs, and the ability to recover them is limited.

This factor underscores the importance of choosing capital budgeting techniques and making accurate decisions early in the process. Making irreversible commitments means that companies must weigh the potential benefits against the risks before moving forward.

Furthermore, even though the investments are irreversible, continual evaluation during the life cycle of the project allows for adjustments to minimize any negative financial impact.

Dynamic process

Capital budgeting in financial management is a dynamic process. Projects evolve over time, and periodic evaluations are necessary to ensure that initial expectations align with actual outcomes.

Revisiting and adjusting the budget is crucial for maintaining financial integrity and achieving long-term goals. Additionally, changes in market conditions, business strategies, or even regulatory frameworks may require project modifications.

Regular assessments help identify any deviations from the planned trajectory and offer opportunities for course correction to ensure project success and alignment with organizational objectives.

Qualitative factors

While capital budgeting techniques are primarily quantitative, qualitative factors also play a role in decision-making.

Considerations like customer satisfaction, brand reputation, and employee impact are equally important in capital budgeting in financial management decisions.

For instance, a new project might improve customer service, boost brand image, or provide a competitive edge that cannot be captured by financial numbers alone.

Assessing these factors with the data provides a full view of the investment’s potential.

Long-term horizon

Capital budgeting decisions typically focus on projects with a long-term horizon. These initiatives require significant investment and often span multiple years before generating returns.

Their extended duration demands careful planning to ensure that vendor payment management and other financial processes remain stable, making effective business budget planning a critical component throughout the project lifecycle.

Additionally, long-term projects are subject to fluctuating market conditions, so flexibility in planning and resource allocation is essential. Ensuring these projects are well-managed over time is key to overall financial stability.

Revolutionize your budgeting with Volopay's streamlined expense tracking!

Capital budgeting process

Capital budgeting in financial management is a structured and systematic process used by organizations to evaluate and make decisions on long-term investments. By assessing various financial factors, it ensures that decisions align with strategic goals and financial objectives.

The goal of capital budgeting in financial management is to allocate resources efficiently, ensuring that capital is invested in projects that maximize value and contribute to the company's growth and sustainability.

Project identification

The first step in the capital budgeting in financial management process is identifying potential projects. Companies typically seek investments that align with their strategic goals, such as improving infrastructure, expanding operations, or developing new products.

Identifying relevant opportunities ensures that the resources invested will generate value. During this phase, it is important to determine what is capital budgeting for your business, as this sets the stage for the entire evaluation process.

Project evaluation

Capital budgeting techniques come into play when evaluating the feasibility of a project. The evaluation step helps assess whether a project will meet financial goals and provide the anticipated returns.

It involves methods to assess financial viability and risks associated with the project. The key is to ensure that these techniques offer accurate predictions of profitability, helping you decide whether or not to move forward with the project.

Estimating cash flows

Estimating cash flows is one of the most critical steps in capital budgeting in financial management. By forecasting cash inflows and outflows, including those tracked through petty cash accounting, you can determine the potential profitability of a project.

Accurate and reliable cash flow estimates ensure that decisions are based on realistic financial projections, giving a clearer picture of what is capital budgeting and how it will affect your financial position. This estimation also helps in identifying potential shortfalls or surpluses in funding.

Choosing an evaluation method

There are various capital budgeting techniques available to assess the financial viability of a project. The most commonly used methods include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period to assess financial viability and risks associated with the project.

Choosing the right capital budgeting in financial management technique ensures that your analysis is aligned with company goals and financial expectations.

Risk assessment

Risk assessment is a vital aspect of capital budgeting in financial management. It involves evaluating the uncertainties and risks associated with a project, such as market fluctuations, regulatory changes, or technological advancements.

Effective capital budgeting techniques help mitigate these risks by providing reliable financial forecasts, including sensitivity analyses that evaluate how changes in certain variables might impact the project’s success. Risk assessment ensures that you are prepared for potential challenges and can make well-informed decisions.

Project selection

Once all potential projects have been evaluated, the next step is to select the most suitable one. Selection is based on financial metrics like NPV, IRR, and Payback Period, as well as other factors such as alignment with strategic objectives.

By prioritizing projects that offer the best return on investment, companies can ensure that limited resources are allocated efficiently. The decision-making process involves not only analyzing financial data but also considering long-term business goals and market conditions.

Project implementation

Once a project is selected, the implementation phase begins. This involves allocating resources, assigning responsibilities, and ensuring that the project follows the planned schedule.

During this phase, capital budgeting in financial management techniques remains crucial, especially in terms of tracking expenses and ensuring payments are processed efficiently for external contractors and suppliers. It is essential to ensure that the project stays on track and that funds are utilized optimally.

Performance monitoring and review

After the project is underway, it's essential to monitor its progress. Performance tracking allows you to compare actual results against forecasted cash flows and timelines.

If there are discrepancies, adjustments can be made to ensure the project remains aligned with strategic goals. This review process is essential for maintaining the financial integrity of the project and ensuring that it adheres to the expectations outlined during the capital budgeting in financial management phase.

Capital constraints

Capital constraints refer to the limitations organizations face when allocating funds across multiple projects. As capital is often limited, prioritization is critical to ensure that the most promising and strategically aligned projects receive funding.

By applying the best capital budgeting in financial management techniques, you can effectively allocate limited resources to projects that promise the best returns and meet business objectives. This helps optimize capital allocation and minimize the risk of underfunding essential projects.

Cost of capital

Understanding the cost of capital is vital when evaluating the financial feasibility of a project. The cost of capital represents the minimum return required by investors and creditors to justify funding a project.

Accurately assessing this cost ensures that you only pursue projects that are expected to generate returns above this threshold. This concept is central to capital budgeting in financial management because it directly impacts project selection and the evaluation of financial viability.

Qualitative factors

Although capital budgeting in financial management primarily relies on quantitative data, qualitative factors should also be considered. These can include a project’s alignment with long-term business objectives, its impact on the company’s reputation, and its effects on employee morale.

For example, some projects may not immediately appear profitable but could contribute to the company’s overall brand image, employee satisfaction, or long-term competitive advantage. Including these qualitative factors in your capital budgeting process helps ensure a well-rounded decision-making approach.

In conclusion, the capital budgeting in financial management process is a crucial tool for organizations seeking to make informed, data-driven decisions about long-term investments.

By applying the right capital budgeting techniques and considering both financial and qualitative factors, you can ensure that your company makes the best use of its resources and achieves long-term success.

Capital budgeting techniques and methods

Capital budgeting techniques and methods help determine the profitability and feasibility of projects. The primary techniques include Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, Accounting Rate of Return (ARR), Profitability Index (PI), and Modified Internal Rate of Return (MIRR). Understanding the benefits and limitations of each method allows for informed decision-making.

1. Net Present Value (NPV)

● Definition

Net Present Value (NPV) is the difference between the present value of cash inflows and outflows over a project's life. It helps evaluate whether a project will generate a positive return.

● Formula of NPV

NPV = ∑ (Cash inflow / (1 + discount rate)^t) - Initial investment

● Advantages of NPV

-Provides a clear measure of profitability.

-Consider the time value of money.

-Helps prioritize projects based on financial benefit.

● Limitations of NPV

-Dependent on accurate cash flow forecasts.

-Sensitive to changes in the discount rate.

-Difficult for projects with long-term returns.

● Example

A project with an initial investment of $500,000 and expected cash flows of $100,000 annually for 5 years has an NPV of $50,000, suggesting it's a profitable investment.

2. Internal Rate of Return (IRR)

● Definition

Internal Rate of Return (IRR) is the discount rate that makes the NPV of a project equal to zero. It helps determine the rate of return at which a project breaks even.

● Formula of IRR

IRR is found by solving for the discount rate in the NPV equation where NPV = 0.

● Advantages of IRR

-Easy to compare projects.

-Considers the time value of money.

-Provides an intuitive measure of profitability.

● Limitations of IRR

-May give multiple solutions for non-conventional cash flows.

-Assumes reinvestment at the IRR rate.

-Less effective for mutually exclusive projects.

● Example

For a project with a $200,000 investment and cash inflows of $50,000 annually, the IRR might be 12%, suggesting a reasonable rate of return.

3. Payback Period (PP)

● Definition

Payback Period measures how long it takes to recover the initial investment from project cash flows.

● Formula of PP

Payback Period = Initial investment / Annual cash inflows

● Advantages of PP

-Simple to calculate.

-Quick assessment of liquidity risk.

-Useful for short-term projects.

● Limitations of PP

-Ignores the time value of money.

-Does not consider cash flows after the payback period.

-Can mislead for long-term projects.

● Example

For a $200,000 project with $50,000 annual returns, the payback period is 4 years.

4. Accounting Rate of Return (ARR)

● Definition

ARR is a cost accounting metric used in management accounting that measures the return generated from an investment relative to its cost It is calculated by dividing the average annual profit by the initial investment.

● Formula of ARR

ARR = (Average annual profit / Initial investment) × 100

● Advantages of ARR

-Easy to understand and calculate.

-Useful for evaluating project profitability.

-Focuses on accounting profit.

● Limitations of ARR

-Ignores the time value of money.

-Based on accounting profits rather than cash flows.

-Can be biased by depreciation methods.

● Example

An investment of $500,000 with annual profits of $50,000 results in an ARR of 10%.

5. Profitability Index (PI)

● Definition

Profitability Index (PI) is the ratio of the present value of future cash flows to the initial investment.

● Formula of PI

PI = Present value of future cash flows / Initial investment

● Advantages of PI

-Provides a measure of profitability relative to cost.

-Useful when comparing multiple projects.

-Considers the time value of money.

● Limitations of PI

-Can be misleading for projects with large initial investments.

-Does not provide exact profit amounts.

-Assumes future cash flows are predictable.

● Example

A project with a $100,000 investment and a present value of $150,000 in future cash flows has a PI of 1.5, indicating a profitable investment.

6. Modified Internal Rate of Return (MIRR)

● Definition

MIRR addresses the issues of traditional IRR by assuming reinvestment at the cost of capital rather than the IRR itself.

● Formula of MIRR

MIRR = (Terminal value of inflows / Present value of outflows) ^ (1/n) - 1

● Advantages of MIRR

-Eliminates multiple IRR problems.

-Assumes realistic reinvestment rates.

-More accurate for long-term projects.

● Limitations of MIRR

-More complex to calculate.

-Can still be misleading for projects with irregular cash flows.

-Does not account for external economic factors.

● Example

For a $100,000 investment and expected cash inflows of $25,000 per year, the MIRR might be 10%, providing a more accurate return estimate.

Factors affecting capital budgeting

Capital budgeting decisions are influenced by various internal and external factors. These factors determine how resources are allocated and which projects will provide the most significant return on investment.

1. Internal factors

● Cost of capital

The cost of capital is one of the most significant internal factors influencing capital budgeting. It represents the rate of return required by investors and lenders to provide funds for a project. A lower cost of capital can make investments more viable, while a higher rate may limit project selection.

● Capital constraints

Organizations often face capital constraints, which limit the funds available for investments. These constraints require companies to prioritize projects with the highest potential return. This limitation can impact decision-making, forcing businesses to carefully select projects based on their financial constraints.

● Risk tolerance

The level of risk a company is willing to take plays a crucial role in capital budgeting. Companies with a higher tolerance for risk might be more inclined to invest in high-risk, high-return projects, while risk-averse companies may prefer safer investments with steady returns.

● Investment horizon

The investment horizon defines the length of time a company expects to hold an investment before liquidating or realizing the returns. A long-term horizon allows businesses to invest in larger, more capital-intensive projects, while a shorter horizon requires focusing on quicker returns.

● Company strategy and objectives

A company’s strategy and objectives directly affect capital budgeting decisions. Capital budgeting in financial management helps companies align investments with their broader goals, such as expanding into new markets, developing new products, or increasing operational efficiency.

2. External factors

● Economic conditions

The broader economic environment can significantly influence capital budgeting decisions. Economic conditions, such as inflation rates, interest rates, and economic growth, can affect the cost and feasibility of projects. A strong economy generally encourages more investments, while economic downturns may make companies more cautious.

● Industry trends

What is capital budgeting and how it is applied can vary significantly across different industries. Changes in industry trends, such as technological advancements, consumer behavior, and competitive pressures, can impact the potential returns on investment and influence project selection.

● Government policies and regulations

Government policies and regulations, such as taxes, subsidies, or restrictions, can significantly impact capital budgeting decisions. Capital budgeting techniques may need to be adjusted based on changes in regulations that affect project profitability or operational costs.

● Social and environmental considerations

Today, companies increasingly consider social and environmental factors when making capital budgeting decisions. Factors like sustainability, community impact, and environmental regulations may affect whether projects are approved or prioritized.

● Market access and availability of resources

Access to markets and the availability of resources such as labor, raw materials, and technology can greatly impact capital budgeting decisions. If market access is restricted or resources are scarce, the viability of certain projects may decrease.

Leverage Volopay to monitor and manage your capital budget with ease!

Capital budgeting examples

A manufacturing company is considering investing in new machinery to improve production efficiency.

They use capital budgeting in financial management methods like NPV to assess the returns that exceed the initial investment.

The company also considers the capital constraints and its long-term strategy of expanding production capacity.

A retail company is planning to open a new store location.

They perform a capital budgeting analysis using techniques like the Payback Period to determine how long it will take to recover the initial investment.

They also evaluate potential risks like changes in consumer behavior and economic conditions that affect foot traffic and sales.

A tech startup is considering an investment in software development for a new product.

They apply capital budgeting techniques like Internal Rate of Return (IRR) to determine if the potential returns from the product launch justify the significant development costs.

They also evaluate the market access for the product and the investment horizon for realizing returns.

Advantages of capital budgeting

Capital budgeting plays a pivotal role in guiding businesses toward sound investment decisions. It allows companies to evaluate the potential returns of different projects and make choices that support their long-term growth and profitability.

Improved long-term decision making

One of the key advantages of capital budgeting is that it facilitates improved long-term decision making. By analyzing potential investments through various techniques like NPV and IRR, companies can make decisions that will benefit them in the long run, ensuring they prioritize projects that align with their strategic goals.

Maximizing shareholder wealth

Capital budgeting in financial management is essential for maximizing shareholder wealth. By selecting projects that offer high returns relative to their risk, businesses can enhance profitability, ultimately increasing the value of the company and benefiting its shareholders. It helps organizations prioritize investments that generate the most value.

Effective resource allocation

Capital budgeting ensures that resources are allocated effectively. It allows companies to evaluate the costs and returns of potential investments and directs resources toward projects with the highest expected returns. This process helps businesses optimize their use of financial and human resources, ensuring they make the most of their available capital.

Increased strategic alignment

Capital budgeting also promotes increased strategic alignment. By evaluating projects through the lens of corporate goals and strategies, companies can ensure that their investments contribute directly to achieving their objectives. This alignment makes it easier to integrate investments into the overall strategic plan, leading to more cohesive business growth.

Enhanced risk management

Capital budgeting enables businesses to assess the risks associated with different projects. Using techniques like sensitivity analysis, companies can identify potential issues and evaluate the impact of various risk factors on a project's outcome. This enhanced risk management helps businesses mitigate risks and make more informed investment decisions.

Limitations of capital budgeting

Despite its numerous advantages, capital budgeting also has certain limitations. These limitations stem from the inherent complexities in forecasting and the assumptions used during the decision-making process.

Difficulty in forecasting

One of the primary limitations of capital budgeting is the difficulty in forecasting future cash flows.

External factors such as the ever changing market conditions, economic trends, and consumer behavior can be unpredictable, making it challenging to accurately estimate the future returns on an investment.

Reliance on assumptions

Many capital budgeting techniques rely on assumptions that may not always hold true.

These assumptions, such as projected growth rates, inflation rates, and market demand, may change over time, impacting the accuracy of the capital budgeting analysis. This reliance on assumptions can lead to misleading results.

Time-consuming process

The capital budgeting process can be time-consuming, as it requires detailed financial analysis, market research, and risk assessments.

For organizations with limited amount of resources, this lengthy process may delay important business decision-making and slow down the implementation of investment projects.

Not always quantifiable

While capital budgeting primarily focuses on quantitative metrics, it often overlooks qualitative factors that can be crucial in decision-making.

Factors such as employee morale, brand reputation, and environmental impact are difficult to quantify, but they can play a significant role in the long-term success of a project.

Tools for capital budgeting

Capital budgeting plays a crucial role in decision-making processes for businesses, particularly when determining whether or not to invest in long-term projects. To support these decisions, businesses rely on various tools to analyze potential investments, evaluate cash flows, and forecast future performance.

These tools not only streamline the budgeting process but also enhance accuracy, making it easier to decide on investments with high growth potential. In this section, we explore some of the most widely used tools for effective capital budgeting.

1. Spreadsheet software

Spreadsheet software, such as Microsoft Excel or Google Sheets, is one of the most widely used tools in capital budgeting in financial management due to its flexibility, cost-effectiveness, and ease of use.

Businesses typically use spreadsheets for tasks like creating financial models, calculating key metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period, and organizing financial data for various projects.

Spreadsheets allow for customization, which makes them an ideal tool for small to medium-sized businesses. Users can build complex models, perform scenario analysis, and assess the viability of potential investments without needing specialized software.

Many templates are available for common capital budgeting calculations, simplifying the process and improving the speed of decision-making. The main advantage of spreadsheet software is its flexibility. Users can manipulate and update data with ease, allowing for quick recalculations and adjustments in response to changes in assumptions.

However, one of the drawbacks is that it can become cumbersome as the number of projects increases or if more complex analysis is needed. Still, for many businesses, spreadsheets remain a primary tool in the capital budgeting process due to their accessibility and cost-effectiveness.

2. Financial modeling software

Financial modeling software offers advanced features for businesses that need a high level of accuracy and sophistication in their capital budgeting processes. These tools are specifically designed to help companies forecast financial performance, assess the impact of investment decisions, and simulate a wide range of financial scenarios with respect to the process of financial modeling.

Popular platforms like MATLAB, Quantrix, and Adaptive Insights enable businesses to build detailed, multi-variable financial models.

Unlike basic spreadsheet software, financial modeling tools can manage complex calculations, integrate historical data with predictive models, and account for various internal and external factors that influence financial outcomes. These capabilities are particularly valuable when evaluating large capital expenditures, long-term investments, or high-uncertainty projects.

Additionally, many of these tools include built-in templates for different types of financial models, such as discounted cash flow (DCF), sensitivity analysis, and scenario planning, streamlining capital budgeting for specific industries or business needs.

While these tools offer exceptional precision and analytical depth ideal for complex projects or large enterprises, they can be costly and often require specialized training to use effectively.

3. Online capital budgeting tools

Online capital budgeting tools have gained popularity in recent years due to their user-friendly interfaces and cloud-based access. These tools are typically web-based applications that offer pre-built templates, financial calculators, and reporting capabilities specifically designed for capital budgeting tasks.

Some examples of online tools include Finmodelslab, Budgeto, and PlanGuru. These platforms enable businesses to calculate essential capital budgeting metrics such as NPV, IRR, and the Payback Period with minimal effort.

They allow for easy input of cash flow data and automatically generate key financial indicators. These tools also provide the flexibility to analyze multiple projects, compare different investment scenarios, and assess potential risks in real-time.

The primary benefit of online capital budgeting tools is their accessibility. As they are hosted in the cloud, users can access these tools from anywhere with an internet connection, making them an excellent option for teams working remotely or across different locations.

Additionally, many of these tools allow for collaboration among team members, which can speed up the decision-making process. The major limitation, however, is that some online tools may not offer the level of customization or complexity that larger businesses or industries with specialized needs may require.

4. Enterprise resource planning (ERP) systems

Enterprise resource planning (ERP) systems are comprehensive software platforms that integrate various business functions, including financial management, human resources, supply chain management, and more.

Popular ERP systems such as SAP, Oracle, and Microsoft Dynamics are widely used by large businesses to streamline operations and improve data accuracy.

For capital budgeting, ERP systems offer real-time visibility into an organization’s financial health, making it easier to track capital expenditures, manage cash flows, and evaluate the financial impact of various projects, including those related to IT budgeting. By consolidating data across departments, ERP systems ensure that both operational and technology investment decisions are aligned with overall financial goals.

By consolidating data from multiple departments, ERP systems support departmental budgeting and ensure that capital budget decisions are based on comprehensive, up-to-date information across the entire organization.

One of the key advantages of ERP systems is their ability to integrate with existing financial processes and software, allowing businesses to manage budgeting and financial planning within one unified platform. This eliminates the need for manual data entry or exporting information between separate software solutions, reducing errors and improving efficiency.

However, ERP systems can be complex and costly to implement, and small businesses may find them less accessible due to their high upfront costs and the need for specialized training.

If you're a small business looking to streamline your capital budgeting process without the complexity or cost of large-scale tools, check out our blog on Effective budgeting tips for small businesses for practical strategies and accessible solutions tailored to your needs.

Take your capital budgeting process to the next level with Volopay!

Role of expense management software in easier capital budgeting

Expense management software simplifies and strengthens capital budgeting by automating routine financial tasks. Manual methods often lead to errors and inefficiencies, especially when tracking large-scale investments.

Automation reduces data entry mistakes, speeds up approvals through configurable workflows, and streamlines report generation. This frees finance teams to focus more on high-value activities like evaluating capital projects and conducting risk assessments.

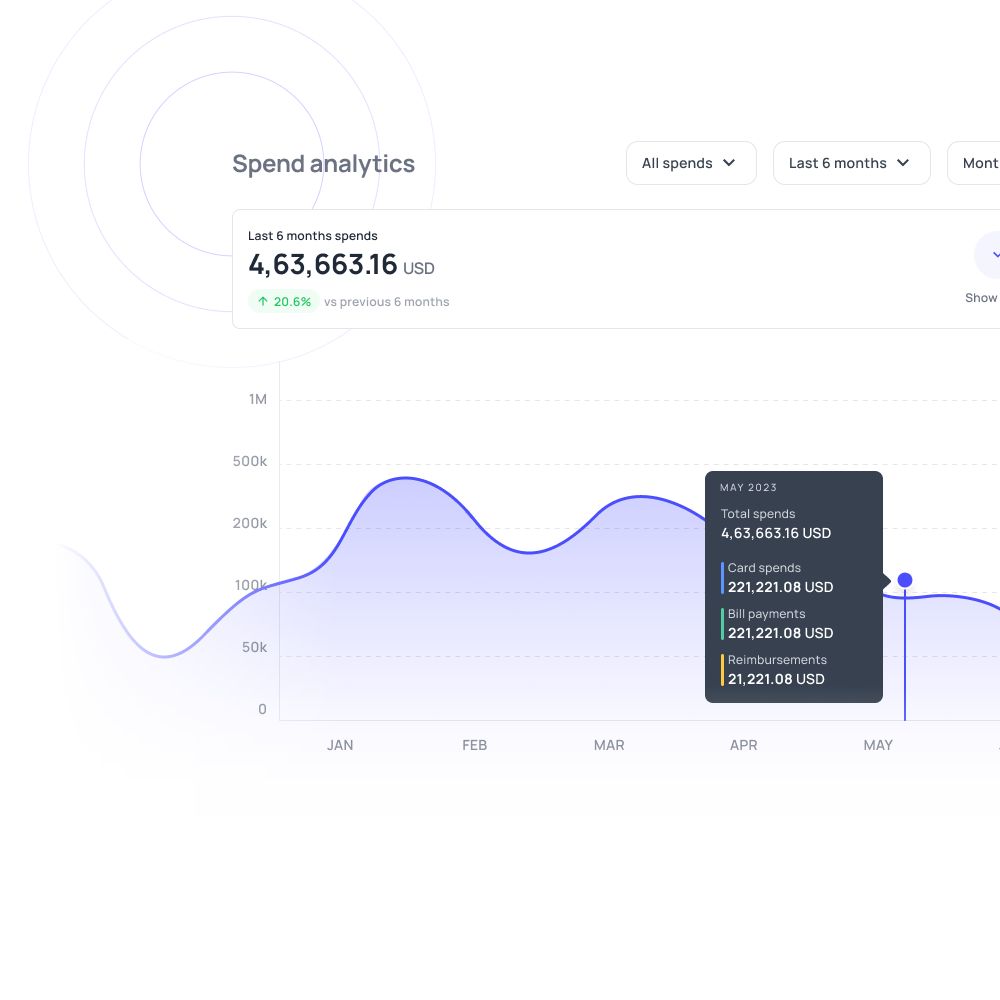

Real-time visibility and data-driven insights enable more informed decision-making throughout the capital budgeting process. With up-to-date spending data and customized financial reports, businesses can monitor project costs as they occur, detect overruns early, and make timely adjustments. These tools also enhance cash flow forecasting by identifying trends and supporting more accurate capital planning, ensuring that investments align with organizational goals.

Modern platforms improve the process of budgetary control, enforce compliance, and support strategic financial planning. Expense software helps manage vendor contracts, ensures timely payments, and automatically flags out-of-scope or non-compliant expenses.

Advanced analytics offer insights into spending patterns and opportunities for cost optimization, helping businesses allocate capital more effectively and transform budgeting into a strategic advantage.

How Volopay can help your business?

Capital budgeting can often be a complex and time-consuming process, especially for businesses dealing with multiple projects and varying investment sizes. With the right tools and features, businesses can streamline their budgeting processes and make more accurate decisions. Volopay offers a range of solutions designed to address the challenges businesses face during the capital budgeting process.

Volopay’s all-in-one expense management platform integrates seamlessly with your financial systems, providing businesses with real-time insights into their spending and capital expenditures. This can help improve the process of capital budgeting in financial management by providing up-to-date data on project costs, cash flows, and financial performance.

One of Volopay’s standout features is its ability to automate and customize approval workflows for payments and budget allocations. This ensures that funds are only allocated to approved projects, reducing the chances of overspending or misallocation of resources. Furthermore, Volopay’s expense tracking tools give businesses a clearer picture of how funds are being spent across different projects, making it easier to track progress and make informed decisions.

In addition to providing visibility into budget spending, Volopay simplifies vendor payments with the help of its comprehensive vendor management system, ensuring that expenses related to capital projects are processed efficiently and on time. This improves cash flow management and helps businesses stay on track with their capital budgeting goals.

By automating administrative tasks, Volopay reduces the time spent on manual processes, freeing up resources for more strategic decision-making.

Ultimately, Volopay’s business budgeting platform is designed to support businesses in managing their capital budgeting process with greater ease, efficiency, and accuracy. Whether you are a small startup or a large corporation, Volopay’s solutions provide the tools needed to streamline your capital budgeting tasks and ensure that your investment decisions are based on reliable, up-to-date data.

Unlock smarter spending and informed budgeting decisions with Volopay

FAQs on capital budgeting

Regular budgeting is concerned with short-term financial management, focusing on operating expenses, revenues, and cash flows within a set period. In contrast, capital budgeting in financial management focuses on long-term investment projects, which require extensive financial analysis. While regular budgeting ensures day-to-day operational efficiency, capital budgeting in financial management ensures that large-scale investments align with long-term financial strategies.

By selecting profitable projects, capital budgeting in financial management directly contributes to shareholder wealth maximization. The projects chosen through capital budgeting techniques like NPV and IRR are intended to generate returns above the cost of capital, thereby increasing the value of the company and, in turn, enhancing shareholder wealth.

Inflation influences capital budgeting by diminishing the real value of future cash flows. It necessitates adjusting cash flow projections and discount rates to account for inflation, ensuring accurate valuation and effective decision-making for long-term investments.

Capital budgeting should be evaluated at least once a year, though more frequent assessments may be required in fast-changing industries or economic conditions. Regular evaluations help maintain alignment with strategic goals and allow for timely adjustments based on market shifts.

Scenario analysis in capital budgeting examines investment performance under various hypothetical situations. It allows decision-makers to understand the impact of different market or economic conditions on a project, supporting better risk assessment and strategic planning.

Regulatory shifts can significantly affect capital budgeting by altering project feasibility, compliance requirements, and associated costs. They may introduce new obligations or opportunities, requiring organizations to adapt their capital allocation strategies accordingly.

The time value of money is essential in capital budgeting because it acknowledges that future cash flows are less valuable than current ones. Forecasts must discount future cash inflows to present value to ensure accurate investment appraisals.

Benchmarking in capital budgeting allows organizations to compare project outcomes with industry standards or past performance. It aids in setting realistic goals, identifying improvement areas, and refining investment decision-making processes.

Capital budgeting decisions are shaped by factors like projected returns, associated risks, strategic alignment, resource availability, market conditions, innovation trends, regulatory changes, and the overall financial objectives of the company.

The timing of cash flows is vital in capital budgeting because earlier inflows contribute more to a project’s net present value. Projects with quicker returns often rank higher, influencing prioritization and investment strategies.