Best receipt scanning apps for businesses in the US [February 2026]

In 2026, managing business expenses and personal receipts has become increasingly streamlined thanks to advanced receipt scanning apps. These digital tools eliminate the hassle of paper clutter, reduce the risk of lost receipts, and simplify tax preparation and expense reporting.

With optical character recognition (OCR) technology now more accurate than ever, modern receipt scanners can instantly extract key information like merchant names, dates, amounts, and payment methods.

Whether you're a freelancer tracking deductible expenses, a small business owner managing employee reimbursements, or simply someone who wants to stay organized, receipt scanning apps have become essential tools for financial management. They integrate seamlessly with accounting software, offer cloud storage for secure access anywhere, and can save hours of manual data entry each month.

What are receipt scanning apps?

Receipt-scanning apps are digital tools that convert physical or digital receipts into organized, searchable data. These applications use smartphone cameras or scanners to capture receipt images, then automatically extract key information such as merchant names, dates, amounts, and purchased items.

Businesses, freelancers, and individuals use these apps to streamline expense tracking, simplify tax preparation, and eliminate paper clutter. By digitizing receipts, users can quickly access transaction records, generate expense reports, and maintain accurate financial documentation without manual data entry or physical storage concerns.

How do receipt scanning apps work?

Capturing the receipt image accurately

The process begins when users photograph receipts using their smartphone camera or upload digital copies. The app's interface guides proper alignment and lighting to ensure clear image capture. Advanced apps support batch scanning for multiple receipts simultaneously.

Some applications also accept emailed receipts or connect directly to email accounts, automatically importing digital receipts from online purchases and eliminating the need for manual uploading.

Optical Character Recognition (OCR) processing

Once captured, OCR technology analyzes the receipt image and converts printed text into machine-readable data. The software identifies and extracts critical information, including vendor names, transaction dates, tax amounts, payment methods, and line items.

Modern OCR engines handle various receipt formats, fonts, and languages while adapting to different paper qualities, faded ink, or slightly damaged receipts for accurate data extraction.

Automatic categorization and tagging

After data extraction, the app automatically assigns categories to expenses based on merchant type and purchased items. Machine learning algorithms improve categorization accuracy over time by learning from user corrections.

Receipt scanning apps for businesses often provide customizable category structures that align with company-specific accounting requirements and industry standards for streamlined bookkeeping.

Data validation and error checking

The system performs quality checks to verify extracted data accuracy and completeness. Algorithms flag inconsistencies such as missing dates, illegible amounts, or unusual transaction patterns. Users receive notifications about potential errors requiring review.

The app may cross-reference extracted amounts with totals to ensure mathematical accuracy. This validation layer reduces verification time while maintaining data integrity for reliable records.

Syncing with expense management tools

Validated receipt data automatically syncs with integrated accounting software, expense management platforms, or cloud storage systems. This seamless connectivity eliminates duplicate data entry across multiple systems.

Users can export reports in various formats compatible with QuickBooks, Xero, SAP Concur, and other financial tools. Real-time synchronization ensures all stakeholders have access to current expense information for timely approvals and reimbursements.

Storing and organizing receipts

Digital receipts are securely stored in cloud-based databases with robust search and filtering capabilities. Users can retrieve specific receipts using parameters like date ranges, amounts, merchants, or categories.

The app maintains original receipt images alongside extracted data for audit purposes. Organizational features include folders, tags, and custom labels. Encrypted storage protects sensitive financial information while ensuring compliance with data retention regulations.

Comparing the best receipt-scanning apps

Best receipt-scanning apps in the US in 2026

Managing business expenses has never been easier. Receipt-scanning apps automate expense tracking, eliminate manual data entry, and streamline reimbursement processes.

Whether you're a freelancer, small business owner, or enterprise finance manager, these 12 apps offer powerful solutions for digitizing and organizing your receipts efficiently in 2026.

1. Volopay

● Overview

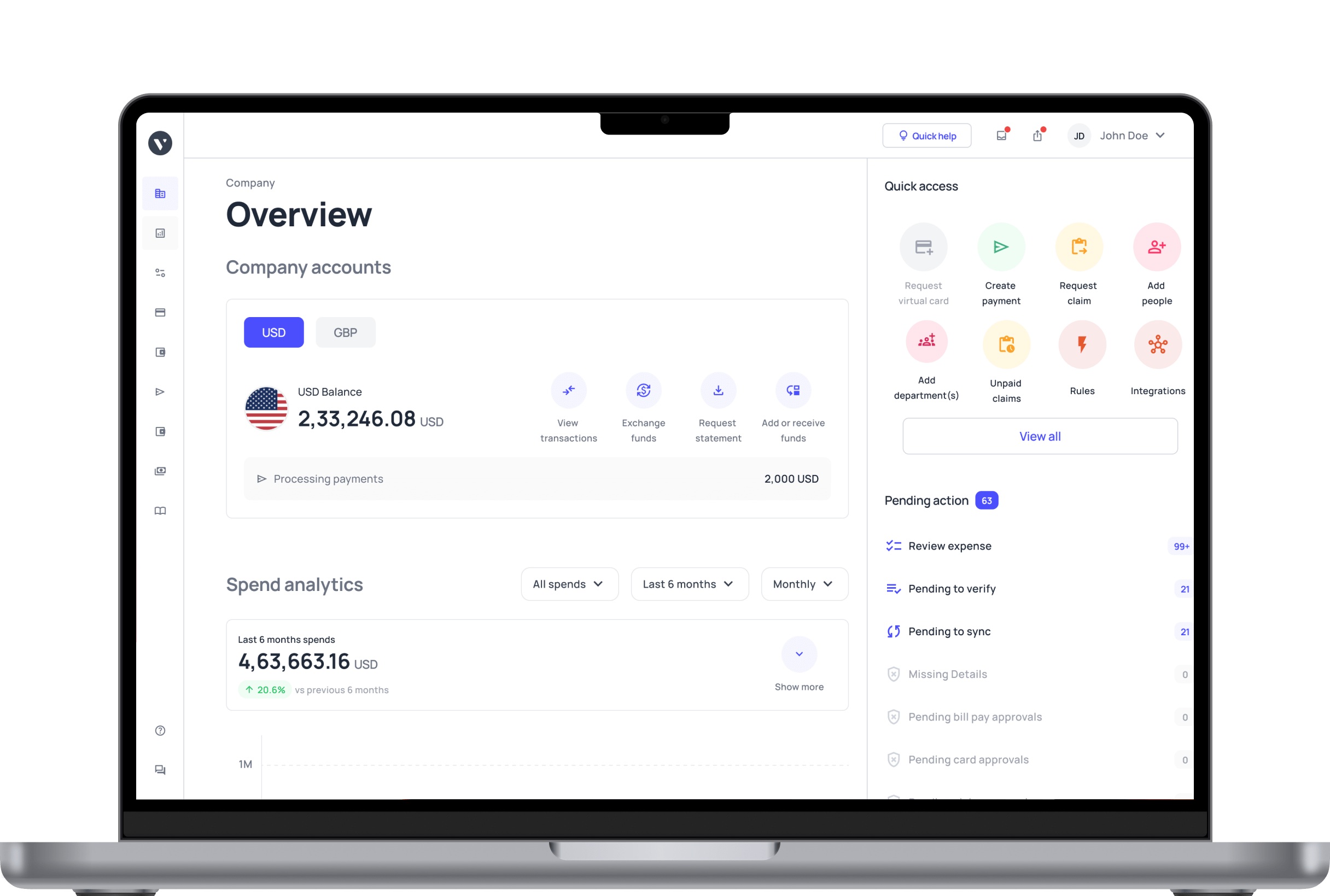

Volopay's comprehensive spend management platform combines receipt scanning with corporate cards and automated accounting workflows.

You can capture receipts instantly through the mobile app, match them to transactions, and sync data directly with your accounting software. The best receipt scanning apps for businesses like Volopay eliminate manual reconciliation and provide real-time visibility into company spending.

● Key features

Volopay offers AI-powered OCR technology for automatic data extraction, multi-currency support, corporate card integration, and customizable approval workflows.

You'll benefit from automated expense categorization, real-time spend tracking, accounting software integrations (Xero, QuickBooks, NetSuite), policy compliance alerts, and detailed analytics dashboards that provide insights into your organization's spending patterns.

● Benefits

You gain complete real-time spend visibility with automated receipt matching, reduce processing time by up to 90%, enforce policy compliance automatically, and integrate seamlessly with existing accounting systems. Volopay's unified platform eliminates the need for multiple tools while providing superior control over business expenses.

● Limitations

Volopay's comprehensive features come with a learning curve for new users. The platform is primarily designed for businesses rather than individual freelancers, and pricing may be higher for someone looking for nothing more than basic receipt-scanning solutions.

● Target audience

Growing businesses, mid-market companies, and enterprises are seeking integrated spend management solutions with corporate card programs and advanced expense automation capabilities.

2. Expensify

● Overview

Expensify is one of the most popular expense management platforms in the US, offering robust receipt-scanning capabilities powered by SmartScan technology.

You can photograph receipts, and the app automatically extracts merchant details, dates, amounts, and tax information. Expensify handles everything from individual expense reports to complex corporate reimbursement workflows.

● Key features

Expensify provides SmartScan receipt recognition, automatic expense categorization, mileage tracking with GPS, credit card transaction syncing, multi-level approval workflows, and per diem calculations.

You'll access real-time expense reporting, international currency support, accounting software integrations, receipt storage, and both mobile and desktop platforms for flexible expense management.

● Benefits

You receive fast reimbursements through direct deposit, enjoy a simple user interface design, benefit from extensive integration options, and access comprehensive reporting tools. Expensify's SmartScan technology delivers high accuracy rates, significantly reducing the time spent on expense management tasks.

● Limitations

Some users report occasional scanning errors requiring manual corrections. The pricing structure can become expensive for larger teams, and certain advanced features are locked behind higher-tier plans. Customer support response times vary based on subscription level.

● Target audience

Businesses of all sizes, from freelancers and consultants to large enterprises requiring scalable expense management and comprehensive reimbursement solutions.

3. Zoho Expense

● Overview

Zoho Expense is part of the extensive Zoho business suite, delivering powerful receipt scanning and expense tracking capabilities. You can capture receipts through the mobile app, automatically extract data, and create expense reports in seconds.

As one of the leading receipt scanner apps for businesses, Zoho Expense integrates seamlessly with other Zoho products.

● Key features

Zoho Expense offers auto-scan receipt technology, mileage tracking, multi-currency support, customizable expense categories, automated approval workflows, and credit card feed integration.

You'll benefit from per diem allowances, trip expense tracking, corporate card reconciliation, distance calculation tools, and integrations with popular accounting platforms, including QuickBooks and Xero.

● Benefits

You enjoy affordable pricing tiers suitable for various business sizes, seamless integration within the Zoho ecosystem, intuitive mobile and web interfaces, and customizable expense policies. Zoho Expense provides excellent value for money with comprehensive features at competitive rates.

● Limitations

Receipt scanning accuracy occasionally requires manual review. The interface can feel cluttered with numerous features, and advanced customization options have a steeper learning curve. Support for certain niche integrations outside the Zoho ecosystem may be limited.

● Target audience

Small to medium-sized businesses, particularly those already using Zoho products, seeking affordable and integrated expense management solutions.

4. Emburse

● Overview

Emburse delivers enterprise-grade expense management with sophisticated receipt-scanning capabilities through its Certify and Chrome River products.

You can capture receipts via mobile apps, email, or text message, and Emburse's AI technology automatically extracts and categorizes expense data. The platform offers comprehensive compliance monitoring and reporting tools for large organizations.

● Key features

Emburse provides AI-powered receipt capture, automatic expense categorization, policy compliance enforcement, multi-entity support, advanced approval workflows, and travel booking integration.

You'll access real-time spend analytics, VAT/GST reclaim support, audit trail capabilities, corporate card reconciliation, and robust integrations with major ERP and accounting systems.

● Benefits

You receive enterprise-level security and compliance features, benefit from highly accurate data extraction, access comprehensive reporting and analytics, and enjoy scalable solutions that grow with your organization. Emburse excels at handling complex, multi-national expense management requirements.

● Limitations

Emburse's enterprise focus means higher pricing that is unsuitable for small businesses or individuals. The platform's extensive features require significant onboarding time, and the interface complexity may overwhelm users accustomed to simpler solutions. Implementation timelines can be lengthy.

● Target audience

Large enterprises and multinational corporations require sophisticated expense management, compliance controls, and integration with complex financial systems.

5. QuickBooks Online

● Overview

QuickBooks Online includes receipt-scanning functionality as part of its comprehensive accounting platform. You can snap photos of receipts, and QuickBooks automatically matches them to transactions, extracts relevant data, and categorizes expenses.

This integration creates a seamless workflow from receipt capture to financial reporting within a single trusted accounting environment.

● Key features

QuickBooks Online offers receipt capture and matching, automatic expense categorization, bank feed synchronization, invoicing and payment processing, tax preparation tools, and financial reporting.

You'll benefit from mileage tracking, vendor management, inventory tracking, project-based expense allocation, and access to a comprehensive accounting ecosystem within one platform.

● Benefits

You gain unified accounting and receipt management in one platform, eliminating data transfer between systems. QuickBooks' widespread adoption ensures excellent accountant compatibility, extensive third-party integrations, and comprehensive support resources. The platform simplifies tax preparation with organized expense documentation.

● Limitations

Receipt scanning features are less advanced than specialized expense apps. The learning curve for full accounting functionality can be steep for non-accountants. Pricing increases with additional users, and some features require higher-tier subscriptions.

● Target audience

Small businesses, self-employed professionals, and accountants seeking integrated receipt scanning within a full-featured accounting platform.

6. Fyle

● Overview

Fyle revolutionizes expense management with text message-based receipt submission and real-time expense tracking. You can simply text your receipts to Fyle, and the platform instantly extracts data and creates expense entries.

This innovative approach eliminates app-switching and makes expense reporting effortless, particularly appealing to mobile-first organizations seeking streamlined workflows.

● Key features

Fyle provides text-to-expense functionality, real-time credit card feed integration, automatic receipt matching, Gmail and Outlook plugins, multi-level approval workflows, and mileage tracking.

You'll access advanced analytics, policy compliance checks, per diem management, corporate card reconciliation, and integrations with major accounting systems, including QuickBooks, Xero, and NetSuite.

● Benefits

You experience unprecedented ease of use with text-based submissions, eliminate manual data entry completely, receive real-time expense notifications, and benefit from automatic credit card reconciliation. Fyle's innovative approach significantly reduces the time employees spend on expense reporting.

● Limitations

The text-message feature may not suit all organizational cultures. Some users prefer traditional app interfaces over SMS-based interactions. Advanced reporting features require familiarization, and pricing scales with team size, potentially becoming costly for larger organizations.

● Target audience

Modern businesses and mobile-first teams seeking innovative, user-friendly expense management with minimal friction in the submission process.

7. SAP Concur

● Overview

SAP Concur is the industry-leading travel and expense management solution for enterprises. You can capture receipts through mobile apps or email, and Concur automatically extracts data with industry-leading accuracy.

The platform integrates expense management with travel booking, creating a comprehensive solution that handles the entire business travel and expense lifecycle.

● Key features

SAP Concur offers ExpenseIt receipt capture, automatic itemization, travel booking integration, multi-currency support, VAT/GST reclaim, automated approval workflows, and compliance management.

You'll benefit from corporate card integration, travel itinerary management, spend analytics, policy enforcement, audit capabilities, and seamless integration with SAP and other major ERP systems.

● Benefits

You receive best-in-class receipt scanning accuracy, comprehensive travel and expense integration, enterprise-grade security and compliance, global support for international operations, and powerful analytics for spend optimization. SAP Concur's established market position ensures continuous innovation and reliability.

● Limitations

SAP Concur's enterprise pricing is prohibitive for small businesses. Implementation requires significant time and resources; the platform's complexity can overwhelm occasional users, and some interface elements feel dated compared to newer competitors. Customer support quality varies.

● Target audience

Large enterprises and multinational corporations with significant travel programs require integrated travel booking and comprehensive expense management solutions.

8. ShoeBoxed

● Overview

Shoeboxed specializes in receipt digitization and document management, offering both app-based scanning and mail-in service options.

You can photograph receipts with your phone or physically mail them to Shoeboxed, where a human verification team processes them for maximum accuracy. This hybrid approach ensures reliable data extraction for tax preparation and bookkeeping.

● Key features

Shoeboxed provides mobile receipt scanning, a mail-in receipt processing service, business card scanning, mileage tracking with GPS, expense categorization, and receipt organization by vendor, date, or category.

You'll access searchable receipt archives, customizable expense reports, IRS-accepted scanned receipts, accounting software integrations, and both digital and physical receipt management.

● Benefits

You receive human-verified data accuracy through the mail-in service, benefit from IRS-compliant receipt storage, enjoy flexible scanning options, and access excellent organization tools for tax preparation. Shoeboxed's unique mail-in service appeals to those preferring physical receipt handling.

● Limitations

Mail-in processing adds 24-48 hour delays compared to instant scanning. The platform offers fewer advanced expense management features than comprehensive solutions, and the mail-in service incurs additional costs. Integration options are more limited than enterprise platforms.

● Target audience

Freelancers, self-employed professionals, and small business owners prioritizing accurate receipt digitization for tax preparation and basic bookkeeping.

9. Wave

● Overview

Wave provides completely free accounting software with integrated receipt scanning capabilities, making it an attractive option for budget-conscious businesses. You can capture receipts through the mobile app, and Wave automatically extracts transaction details and matches them to bank transactions.

As one of the best receipt scanning apps, Wave eliminates expenses while delivering essential functionality.

● Key features

Wave offers mobile receipt capture, automatic data extraction, bank connection and transaction matching, invoicing and payment processing, accounting and bookkeeping tools, and financial reporting.

You'll access income and expense tracking, sales tax management, receipt storage, vendor management, and basic business analytics—all without subscription fees for core features.

● Benefits

You pay nothing for essential accounting and receipt scanning features, making Wave ideal for startups and bootstrapped businesses. The platform provides genuinely useful functionality without forced upgrades, includes unlimited receipt scanning, and offers straightforward, user-friendly interfaces for accounting invoices.

● Limitations

Wave's free model means limited customer support compared to paid platforms. Advanced features like payroll and payment processing incur additional fees. The platform offers fewer integrations than competitors, and receipt scanning accuracy occasionally requires manual review.

● Target audience

Freelancers, solopreneurs, and very small businesses seeking free accounting software with integrated receipt scanning capabilities.

10. Neat

● Overview

Neat focuses on document management and bookkeeping automation, offering powerful receipt and document scanning with intelligent organization.

You can scan receipts, invoices, and other business documents through desktop scanners or mobile apps, and Neat automatically extracts data and organizes everything into searchable archives. The platform bridges document management and expense tracking effectively.

● Key features

Neat provides AI-powered receipt and document scanning, automatic data extraction and categorization, cloud-based document storage, advanced search capabilities, and accounting software integrations.

You'll benefit from expense reports, mileage tracking, contact management from business cards, vendor organization, customizable folders and labels, and both desktop scanner and mobile app support.

● Benefits

You gain comprehensive document management beyond simple receipt scanning, benefit from excellent organization tools, access powerful search functionality across all documents, and enjoy flexible scanning options with both mobile and desktop hardware. Neat excels at maintaining organized business records.

● Limitations

Neat's desktop software can feel dated compared to cloud-native competitors. Pricing is higher than basic receipt apps, the learning curve for advanced features is moderate, and mobile app functionality is more limited than the desktop version.

● Target audience

Small businesses, accountants, and bookkeepers needing comprehensive document management with receipt scanning and organization capabilities.

11. Dext Prepare

● Overview

Dext Prepare (formerly Receipt Bank) is designed specifically for accountants and bookkeepers managing client expenses. You can submit receipts via mobile app, email, or fetch them directly from suppliers, and Dext automatically extracts data with exceptional accuracy.

The platform's focus on accounting professional workflows makes it invaluable for firms managing multiple client books.

● Key features

Dext Prepare offers automatic supplier fetching, multi-method receipt submission, bank statement processing, invoice and bill scanning, automatic data extraction, and direct publishing to accounting software.

You'll access client-specific organization, two-way sync with Xero and QuickBooks, expense categorization, approval workflows, and comprehensive audit trails for accountant oversight.

● Benefits

You experience accounting-software-optimized workflows, benefit from automatic supplier data retrieval, reducing manual submissions, access superior accuracy through advanced OCR technology, and gain efficiency with direct publishing to accounting platforms. Dext significantly reduces bookkeeping time for accounting professionals.

● Limitations

Dext Prepare's accounting-professional focus makes it less suitable for direct business use. Pricing is higher than that of consumer-focused apps, the interface assumes accounting knowledge, and some features require specific accounting software partnerships. Individual businesses may find alternatives more appropriate.

● Target audience

Accounting firms, bookkeepers, and financial professionals managing expense processing and bookkeeping for multiple clients.

12. Veryfi

● Overview

Veryfi delivers AI-powered receipt and document processing with exceptional accuracy and speed. You can capture receipts through mobile apps, email, or API integration, and Veryfi's advanced machine learning extracts data in real-time.

The platform offers both consumer expense management and developer-focused API services, making it versatile for various implementation approaches.

● Key Features

Veryfi provides real-time OCR processing, line-item extraction from receipts, multi-language support, fraud detection capabilities, API access for custom integrations, and offline receipt scanning.

You'll benefit from automatic categorization, tax calculation, vendor recognition, duplicate detection, compliance checks, and integrations with major accounting platforms and custom business applications.

● Benefits

You receive industry-leading accuracy rates above 98%, experience lightning-fast processing speeds, benefit from privacy-focused architecture with on-device processing options, and access flexible API integration for custom workflows. Veryfi's technology foundation ensures reliable, scalable expense processing.

● Limitations

Veryfi's advanced features come with premium pricing higher than basic alternatives. The platform's API-first approach may require technical expertise for optimal implementation. Consumer-facing features are less developed than enterprise OCR capabilities. Support documentation assumes technical familiarity.

● Target audience

Developers building custom expense solutions, tech-savvy businesses requiring API integrations, and organizations prioritizing accuracy and processing speed.

Importance of receipt scanning apps for businesses

Receipt scanning apps transform how your business handles expense documentation by digitizing receipts instantly, extracting key data automatically, and organizing financial records in real time.

The benefits of receipt scanning apps include eliminating paper clutter, reducing processing time, and gaining complete visibility into company spending. These tools empower you to make faster reimbursements, maintain accurate audit trails, and ensure compliance with tax regulations effortlessly.

Growing volume of digital and paper receipts

Your business generates hundreds of receipts monthly across multiple payment methods and vendors, creating overwhelming documentation challenges. Receipt scanning apps centralize all receipt formats paper, email, and digital into one searchable system, preventing loss and disorganization.

Example: Before, employees stored receipts in wallets, often losing them before month-end reporting. Now, you capture receipts instantly via mobile camera, and the app archives them automatically with timestamps and vendor details.

Eliminates manual data entry

Manual receipt transcription consumes valuable hours and introduces costly errors into your financial records. Receipt scanning apps use optical character recognition to extract amounts, dates, vendors, and tax information automatically, freeing your team for strategic work.

Example: Before, your accounting staff spent three hours weekly typing receipt details into spreadsheets. Now, you scan receipts, and data populates expense fields automatically within seconds, reducing processing time by up to 90%.

Simplify expense tracking and reimbursements

Tracking employee expenses becomes effortless when you digitize receipts immediately after purchase and link them to specific projects or cost centers. You accelerate reimbursement cycles, improve employee satisfaction, and maintain real-time visibility into spending patterns across departments.

Example: Before: Employees submitted monthly expense reports with attached paper receipts, waiting three weeks for reimbursement. Now: They scan receipts immediately, and you approve expenses within 48 hours through a mobile app.

Ensure compliance and audit readiness

Tax authorities require substantiated expense documentation with specific details preserved for years. Receipt scanner apps for businesses create tamper-proof digital records with metadata, ensuring you meet IRS requirements and respond confidently to audits with organized, searchable archives.

Example: Before: You scrambled through filing cabinets for days during an audit, missing some receipts entirely. Now: You retrieve any receipt instantly by date, amount, or vendor through keyword search in your digital archive.

Integrates seamlessly with expense and accounting tools

Your receipt scanning app should connect directly with QuickBooks, Xero, SAP Concur, or your existing financial systems. You eliminate double-entry, synchronize data bidirectionally, and maintain consistent financial records across platforms without manual exports or imports.

Example: Before: Staff exported CSV files from expense tools and manually imported them into accounting software on a weekly basis. Now: Scanned receipts flow automatically into your accounting software, updating general ledger entries in real time without human intervention.

Supports remote and distributed teams

Modern workforces operate across time zones and locations, requiring cloud-based expense management accessible anywhere. Receipt scanning apps enable your remote employees to submit expenses instantly from their smartphones, while you maintain centralized oversight and approval workflows.

Example: Before: Remote employees mailed physical receipts to headquarters, delaying reimbursements by weeks. Now: Your global team scans receipts immediately after purchases, and you approve them from any device within minutes.

Key features to look for in receipt-scanning apps

Understanding essential features helps you select receipt scanning solutions that match your business workflows, integrate with existing systems, and scale with growth. You should prioritize accuracy, automation, accessibility, and security when evaluating options for your organization.

1. AI-driven OCR for accurate extraction

The best receipt scanning apps employ advanced optical character recognition technology that reads printed and handwritten text with 95%+ accuracy.

You capture merchant names, transaction amounts, dates, tax values, and payment methods automatically, even from crumpled or faded receipts, reducing manual corrections.

2. Auto categorization and tagging

Intelligent apps learn your expense categories and automatically apply appropriate tags based on merchant type, amount patterns, and historical data to enhance financial accuracy.

You maintain consistent coding across all expenses, simplify report generation, and enable detailed spending analysis by category, department, or project without manual sorting.

3. Cloud storage with remote access

Cloud infrastructure ensures you access receipts securely from any device while maintaining automatic backups and disaster recovery.

You eliminate physical storage costs, retrieve documents instantly during audits, and scale storage capacity seamlessly as your business grows without infrastructure investments.

4. Multi-platform and mobile app integration

Your receipt scanning solution should function seamlessly across iOS, Android, web browsers, and desktop applications for maximum convenience and efficiency.

You empower employees to capture receipts using their preferred devices, while managers review and approve expenses from any platform, ensuring consistent functionality regardless of technology choices.

5. Real-time sync with finance tools

Leading receipt scanners synchronize bidirectionally with accounting platforms like QuickBooks, Xero, FreshBooks, and enterprise ERP systems instantly.

You eliminate data lag, ensure financial records reflect current expenses, and enable accurate cash flow forecasting with up-to-the-minute spending visibility across your organization for better financial control.

Limitations of receipt-scanning apps

1. Inconsistent OCR accuracy for low-quality images

Optical character recognition struggles with poor lighting, creased paper, or faded ink, leading to incomplete data extraction. A faded gas station receipt or a folded paper invoice might fail to scan correctly.

In such a case, users must manually re-enter information, defeating automation's purpose. Image quality directly impacts recognition rates, requiring multiple scan attempts and causing workflow delays.

2. Limited features in free or basic plans

Free versions typically restrict monthly scan volumes, storage capacity, and export options, forcing upgrades for essential functionality. A small business exceeding ten receipts monthly may hit limits immediately.

Advanced features like multi-currency support, custom categories, and integration capabilities remain locked behind premium tiers, increasing operational costs unexpectedly.

3. Security and data privacy concerns

Uploading sensitive financial documents to unreliable, low-trust third-party servers raises significant data breach and unauthorized access risks. A receipt containing sensitive credit card information could expose payment data if servers are compromised.

Users sacrifice control over confidential business data, facing compliance challenges with regulations like GDPR, particularly when vendor security practices remain opaque.

4. Duplicate or mismatched receipts

Apps occasionally create multiple entries from single receipts or incorrectly categorize transactions, corrupting financial records. A coffee shop receipt might appear twice in monthly reports, artificially inflating actual expenses.

Manual reconciliation becomes necessary to identify and merge duplicates, undermining automation benefits and consuming valuable time during tax preparation or audit processes.

5. Dependence on internet and cloud connectivity

Cloud-based receipt management requires stable internet access, limiting functionality in areas with poor connectivity or during network outages. A traveling salesperson in remote locations cannot upload receipts until connectivity is restored, creating processing backlogs.

Offline capabilities remain limited in most applications, preventing real-time expense tracking and delaying critical financial documentation when immediate access proves essential.

Overcoming receipt-scanning limitations with modern technology

Improving OCR accuracy with enhanced processing

Advanced machine learning and artificial intelligence enhance character recognition even with challenging images, crumpled documents, or inconsistent lighting.

Modern systems automatically adjust contrast, remove shadows, and sharpen text before processing. A wrinkled receipt from a taxi ride now extracts accurately, reducing manual corrections and improving overall data quality significantly.

Preventing lost or duplicate receipts

Intelligent deduplication algorithms identify identical receipts using transaction amounts, timestamps, merchant names, and image fingerprints to eliminate redundant entries.

Hash-based verification ensures each receipt is processed only once. A dinner receipt accidentally scanned twice automatically flags as a duplicate, maintaining clean financial records and preventing inflated expense reports without requiring manual intervention.

Simplifying multi-device and cloud access

Cross-platform synchronization enables seamless access across smartphones, tablets, and computers with real-time updates across all devices instantly.

The best receipt scanner apps automatically back up data to secure cloud storage, ensuring information availability anywhere. A manager reviews employee expenses on a desktop while team members submit receipts via mobile, maintaining perfect synchronization.

Leveraging automation for real-time insights

Automated categorization and intelligent rule-based processing deliver instant spending analytics, budget tracking, and expense trend identification without manual intervention.

Machine learning recognizes patterns and suggests appropriate categories automatically. A restaurant receipt immediately categorizes under business meals, calculating tax deductions and flagging budget thresholds, enabling proactive financial management.

Connecting to accounting and expense platforms

Seamless API integrations with QuickBooks, Xero, SAP Concur, and other financial systems eliminate manual data entry and ensure consistent records.

Automated synchronization pushes expense data directly into accounting workflows. A scanned hotel receipt automatically creates corresponding entries in accounting software, matching transactions with bank feeds and simplifying month-end reconciliation.

How AI and automation are transforming receipt management

Artificial intelligence has revolutionized receipt management by transitioning from basic optical character recognition to sophisticated machine learning systems that understand context, detect anomalies, and predict spending patterns.

Modern AI algorithms automatically extract, categorize, and validate expense data with remarkable accuracy, reducing manual processing time by up to 80%. Natural language processing interprets merchant names, identifies tax-deductible items, and flags policy violations in real-time.

Automation streamlines approval workflows, generates compliance reports, and provides actionable insights through predictive analytics. Businesses now leverage AI-powered systems to eliminate human error, accelerate reimbursement cycles, improve financial visibility, and make data-driven budgeting decisions that enhance operational efficiency and profitability significantly.

The future of receipt-scanning technology

AI-driven predictive expense management

Future systems will forecast spending trends, recommend budget adjustments, and proactively alert managers about unusual expenditure patterns before overspending occurs. Predictive algorithms analyze historical data to anticipate seasonal fluctuations and departmental needs.

For instance, your marketing team's conference expenses can trigger automatic budget reallocation suggestions, enabling strategic financial planning and preventing budget overruns through intelligent forecasting capabilities.

Voice and image recognition enhancements

Voice-activated receipt capture will enable hands-free expense logging while driving or traveling, with conversational AI extracting details from spoken descriptions. Advanced image recognition will identify items within receipts, automatically itemizing purchases.

A user could simply state "log lunch meeting expenses" while the system photographs the receipt, extracting individual meal items and attendee counts automatically for effortless expense tracking.

Blockchain for expense transparency

Distributed ledger technology will create immutable expense records, ensuring tamper-proof audit trails and eliminating fraudulent claim manipulation permanently. Smart contracts automatically verify receipt authenticity against merchant databases and payment networks.

A submitted restaurant receipt instantly validates against blockchain-recorded transaction data, preventing duplicate claims and providing stakeholders with transparent, verifiable expense documentation throughout organizations.

Integration with digital wallets and payment APIs

Direct connections with banking APIs will automatically capture transaction metadata at the purchase point, eliminating manual scanning entirely. Digital receipts transfer instantly from payment platforms into expense systems for improved data accuracy.

A contactless payment at a coffee shop immediately populates expense reports with merchant details, amounts, and timestamps, creating seamless expense documentation without user intervention.

Security and compliance in receipt-scanning apps

Implementing receipt-scanning systems in your organization

Evaluate existing expense and receipt processes

Begin by analyzing your current expense management workflow to identify bottlenecks and pain points. Document how employees submit receipts, approval timeframes, and reconciliation challenges.

Assess the volume of transactions, common error types, and time spent on manual data entry. This baseline measurement helps quantify improvement opportunities and establishes clear metrics for success after implementation.

Choose the right receipt-scanning solution

Research the best receipt scanning apps that align with your business size and industry requirements. Compare features like OCR accuracy, multi-currency support, mobile accessibility, and integration capabilities.

Request demos and trial periods to test real-world performance with your actual receipts. Consider scalability, pricing models, and vendor support quality before making your final selection decision.

Integrate with accounting and expense platforms

Connect your receipt-scanning solution with existing accounting software, ERP systems, and payment platforms through APIs or native integrations. Map data fields correctly to ensure seamless information flow between systems.

Test the integration thoroughly with sample transactions to verify accuracy and completeness. Establish automated workflows for receipt approval, coding, and posting to eliminate duplicate data entry.

Train teams and standardize usage

Develop comprehensive training materials, including video tutorials, quick-reference guides, and FAQ documents for all users. Conduct hands-on workshops demonstrating receipt capture, expense submission, and approval processes.

Create clear policies defining acceptable receipts, submission deadlines, and quality standards. Designate system champions within departments to provide ongoing peer support and reinforce best practices.

Track adoption and measure efficiency gains

Monitor usage metrics, including submission rates, processing times, and error frequencies, to gauge adoption success. Compare pre-implementation and post-implementation data for processing speed, compliance rates, and administrative costs.

Gather user feedback regularly through surveys and focus groups to identify improvement opportunities. Calculate ROI by measuring time savings, reduced errors, and faster reimbursement cycles.

Maximizing efficiency with receipt-scanning workflows

Standardizing receipt capture procedures

Establish clear protocols for capturing receipts across your organization. Define acceptable image quality standards, required information fields, and submission deadlines. Train your team on proper scanning techniques to ensure consistency.

Create templates or checklists that guide employees through the capture process, minimizing variations that complicate downstream processing and ensuring every receipt meets your documentation requirements.

Automating categorization and approvals

Leverage receipt scanner apps for businesses that use artificial intelligence to automatically extract data and assign expense categories. Configure approval workflows that route submissions to appropriate managers based on amount thresholds or department codes.

Set up rule-based systems that flag anomalies while expediting routine expenses. This automation reduces processing time and allows your finance team to focus on exceptions rather than routine transactions.

Integrating with expense reports and accounting

Connect your receipt scanning system directly to your expense management platform and accounting software. Enable seamless data transfer that eliminates redundant entry and maintains accuracy across systems.

Ensure captured receipt information automatically populates expense reports with vendor names, amounts, dates, and tax details. This integration creates a unified financial ecosystem where receipt data flows effortlessly into general ledgers and financial statements.

Reducing manual review and errors

Implement validation checks that verify receipt data against company policies before submission. Use optical character recognition technology that achieves high accuracy rates, minimizing transcription errors.

Establish exception-based review processes so that only flagged items require human intervention. This approach dramatically reduces the time your team spends on verification while improving data quality and compliance with your expense policies and regulatory requirements.

Optimizing workflow for remote teams

Deploy cloud-based receipt management solutions that enable employees to submit expenses from anywhere using mobile devices. Create digital approval chains that function independently of physical location, ensuring timely processing regardless of where managers work.

Establish clear communication channels for questions about submissions. Provide virtual training sessions that keep remote team members aligned with your procedures, maintaining workflow efficiency across distributed workforces.

How to organize receipts for easy tax season prep

1. Choose a system: Digital or physical

Decide whether you'll maintain digital records, physical files, or a hybrid approach. Digital systems, such as using some of the best apps to scan receipts, offer searchability and backup advantages, while physical filing may suit smaller operations.

Consider your business size, transaction volume, and comfort with technology. Whichever you choose, commit to one primary system to avoid confusion and fragmentation of your records.

2. Set up your categories for efficiency

Create expense categories that align with your tax forms and business structure. Common categories include office supplies, travel, meals, utilities, and professional services. Ensure your categories match IRS classifications to simplify tax preparation.

Consider subcategories for detailed tracking if your business has complex operations. Document your category definitions so everyone handling receipts applies them consistently throughout the year.

3. Capture receipts consistently

Scan or file receipts immediately after each transaction don't let them accumulate. Make receipt capture a non-negotiable part of completing any business purchase.

Keep your scanning app readily accessible on your phone or establish a designated scanning station in your office. Set reminders to process receipts daily or weekly, depending on your transaction volume, preventing the overwhelming backlog that makes organization difficult.

4. Add context to your receipts

Annotate each receipt with relevant details: business purpose, client or project name, and attendees for meals. This context proves invaluable during audits and helps you remember transaction details months later.

Include mileage information for travel expenses and note whether purchases were partially personal. These annotations transform raw receipts into comprehensive documentation that supports your deductions and business decisions.

5. Create a regular review schedule

Establish monthly or quarterly reviews of your receipt collection to identify missing items, verify categorizations, and reconcile with bank statements. Use these sessions to address discrepancies while details remain fresh.

Your regular reviews prevent year-end surprises and distribute the organizational workload throughout the year. They also help you spot spending patterns and opportunities to optimize your business expenses.

6. Always maintain complete receipt backups

Maintain redundant copies of your receipt records to protect against loss. If you use digital systems, back up to cloud storage and an external hard drive. For physical receipts, create digital scans as secondary records since thermal paper fades over time.

Store backups in separate physical locations to protect against disasters. Your backup strategy should ensure you can reconstruct your financial records even if your primary system fails.

Common receipt management mistakes and how to avoid them

Choosing the right receipt-scanning app for your business

1. Evaluate business size and expense volume

Consider your company's scale and monthly transaction frequency when selecting a solution. Small businesses with fewer than fifty receipts (monthly) may need only basic scanning features, while enterprises require robust multi-user capabilities.

Assess whether you need individual licenses or team accounts with administrative controls. Your expense volume directly impacts storage requirements, processing speed needs, and the sophistication of features you'll actually utilize.

2. Assess integration and compatibility requirements

Examine how the app connects with your existing accounting software, expense management platforms, and enterprise resource planning systems. Verify compatibility with your devices and operating systems to ensure seamless adoption across your team.

Look for solutions offering API access for custom integrations if you use specialized business tools. Strong integration capabilities eliminate duplicate data entry and create efficient workflows that connect receipt capture directly to your financial processes.

3. Prioritize security and compliance features

Select receipt scanner apps for businesses that offer bank-level encryption, secure cloud storage, and role-based access controls to protect sensitive financial data. Verify the provider's compliance with regulations relevant to your industry, such as GDPR, SOC 2, or HIPAA, if applicable.

Review data retention policies and backup procedures to ensure they meet your legal obligations. Strong security features protect your business from data breaches and ensure audit-ready documentation.

4. Compare cost vs. functionality

Analyze pricing structures whether per-user subscriptions, transaction-based fees, or flat monthly rates—against the features you genuinely need. Avoid paying for advanced capabilities your business won't use, but don't sacrifice essential functions to save minimal costs.

Calculate the total cost of ownership, including setup fees, training expenses, and potential integration charges. Request trials to evaluate whether premium features justify higher price points for your specific workflows.

5. Consider user experience and support

Test the app's interface for intuitiveness, as complicated systems reduce adoption rates among your team. Evaluate mobile and desktop experiences since employees may use both depending on their roles.

Review customer support options live chat, phone support, response times, and available documentation. Strong user experience and responsive support minimize disruption during implementation and ensure your team can quickly resolve issues that arise during daily operations.

Streamline receipt management and expenses with Volopay

Managing receipts shouldn't drain your finance team's productivity. You're juggling paper trails, missing documentation, and endless reconciliation cycles that could be automated.

Volopay transforms your expense management by digitizing receipts instantly, categorizing transactions automatically, and integrating seamlessly with your existing accounting systems. Say goodbye to manual data entry and hello to real-time visibility across all business spending.

Smart receipt capture and auto-categorization

You can snap a photo of any receipt and watch Volopay's OCR technology extract every detail vendor name, amount, date, and tax information with remarkable accuracy.

Among the best receipt scanning apps for businesses, Volopay automatically categorizes expenses based on your predefined rules and merchant patterns.

You'll eliminate manual sorting while maintaining granular control over your spending categories, ensuring every transaction lands exactly where it belongs in your financial records.

Centralize management of all business spend

Volopay's corporate cards, reimbursements, invoice payments, and vendor expenses are all visible in one unified dashboard. You gain complete visibility into who's spending what, when, and why, across every department and location.

No more scattered spreadsheets or delayed expense reports. You can set spending limits, enforce approval workflows, and track budget utilization in real time, giving you the command center your growing business demands.

Integration with accounting and ERP tools

You're already using QuickBooks, Xero, NetSuite, or SAP why start over? Volopay syncs bidirectionally with your accounting ecosystem, pushing transaction data and pulling the chart of accounts automatically.

You can eliminate duplicate data entry and reduce reconciliation time by up to 90%. Every receipt, approval, and payment flows directly into your general ledger with the correct coding, maintaining data integrity across your entire financial infrastructure.

Compliance, security, and audit readiness

You can't afford compliance gaps or data breaches. Volopay safeguards your financial data with bank-grade encryption, role-based access controls, and detailed audit trails that track every action.

You'll meet tax regulations effortlessly with automatic receipt retention, GST/VAT capture, and policy enforcement at the point of transaction. When auditors come knocking, you'll pull comprehensive reports in minutes not days with complete documentation attached to every expense.

Mobile and multi-platform accessibility

Your team works everywhere airports, client sites, home offices and your expense solution should too. Volopay's mobile app lets you and your employees submit receipts, request approvals, and check balances from any device, anywhere.

Whether you're on iOS, Android, or desktop, you experience the same intuitive interface with full functionality. Real-time notifications keep everyone informed, ensuring expenses never get stuck in approval limbo while you're on the move.

Bring Volopay to your business

Get started now

FAQs

Yes, you can use scanned receipts for tax filing in most jurisdictions. Tax authorities generally accept digital copies if they're legible, contain all required information, and are stored securely. Always verify your local tax regulations for specific requirements.

You won't lose critical documentation when using Volopay. Once you've scanned and uploaded a receipt, it's permanently stored in the cloud with backup redundancy. You can access, download, or reprint it anytime, eliminating the risk of lost paper receipts affecting your records.

You can trust that reputable receipt-scanning apps like Volopay employ bank-grade encryption, secure cloud storage, and strict access controls. Your financial data is protected both in transit and at rest, with compliance certifications ensuring your information meets international security standards.

Yes, you can capture receipt images offline using receipt scanning apps with cross-device sync. Your scanned receipts are stored locally on your device and automatically sync to the cloud once you reconnect to the internet, ensuring you never miss documenting an expense while traveling.

Absolutely. You can scan receipts directly within Volopay's dashboard using your smartphone camera or by uploading images. The built-in OCR technology instantly extracts transaction details, eliminates manual entry, and automatically matches receipts to corresponding card transactions for seamless reconciliation.

Yes, you'll receive automatic alerts for duplicate submissions and missing receipts. Volopay's intelligent system flags transactions without attached documentation and identifies potential duplicate entries, helping you maintain accurate records and prevent fraudulent or erroneous expense claims before they're processed.

You can configure multi-level approval workflows based on amount thresholds, departments, or expense categories. Approvers receive instant notifications, review receipts and details in-app, and approve or reject with one click, eliminating email chains and accelerating your reimbursement cycle significantly.

You'll generate comprehensive tax reports instantly by filtering expenses by date range, category, or tax classification. Volopay automatically captures GST/VAT information from receipts, maintains compliant documentation, and exports tax-ready reports that integrate directly with your accounting software, making filing effortless.