14 best fuel cards for businesses in the US for February 2026

Choosing the best fuel cards for business in the US can significantly improve how you manage transportation expenses. Whether you operate a large fleet or a few vehicles, using a fuel card for businesses helps control costs, track fuel usage, and streamline reporting.

The best business fuel cards and fleet fuel cards for business offer tailored solutions with built-in controls and discounts.

From small startups to established enterprises, finding the best fuel card for small businesses means selecting one that fits your fuel spending needs. This guide compares top providers to help you select the best fleet fuel cards for 2026.

What is a fuel card?

A fuel card is a payment card issued by providers to businesses for purchasing fuel and related services. Unlike traditional credit cards, the best fuel cards for business are designed specifically to manage vehicle fuel expenses.

Whether you're managing a small delivery service or a national fleet, a fuel card for businesses allows you to track spending by vehicle or driver. The best business fuel cards often come with features like spending limits, detailed reporting, and fuel rebates.

For small businesses, the best fuel card for small businesses helps improve cost efficiency, reduce misuse, and simplify expense reporting, making fuel cards essential tools in fleet fuel cards for business management.

How do fuel cards work?

Fuel cards work like debit or credit cards but are tailored for fuel and vehicle-related purchases. When employees use a fuel card at participating gas stations, the transaction details—such as amount, location, and time—are captured and sent to the business.

This allows real-time tracking and better oversight. The best fuel cards for business offer controls to limit spending and prevent misuse. Many fleet fuel cards for business also integrate with accounting systems to streamline reporting.

For small companies, using the best fuel card for small businesses means gaining transparency and control over fuel expenses. The best business fuel cards help centralize payments, reduce fraud, and improve overall fuel management for businesses of all sizes.

14 Best fuel cards for US businesses in 2026

Finding the best fuel cards for business can significantly reduce your company’s fuel costs and simplify expense tracking.

Whether you're a small fleet or a large logistics enterprise, choosing the right fuel card for businesses in the US in 2026 means looking at features, flexibility, and value tailored to your unique needs.

1. Volopay prepaid cards

● Overview

Volopay’s prepaid cards are more than just fuel cards for businesses—they're smart expense management tools that enable full control over fuel and travel-related spending.

Designed for modern finance teams, these cards combine the convenience of digital automation with real-time visibility, making them one of the best fuel cards for business operations in the US.

● Key features

Volopay prepaid cards offer real-time expense tracking, individual spending limits, seamless integration with accounting software, and global acceptance.

Businesses can issue unlimited cards for employees, automate and customize approvals, and gain complete oversight on T&E expenses, including fuel. With the added benefit of advanced fraud protection, Volopay ensures every transaction is secure and accounted for.

● Advantages

Volopay cards streamline fuel expense reporting, reduce the risk of overspending, and support multiple currencies—ideal for US businesses operating globally.

The system's automation saves hours of manual reconciliation and boosts overall transparency. These capabilities make it one of the best business fuel cards for startups and growing enterprises alike.

● Limitations

While Volopay cards are powerful, they may not be suitable for businesses that prefer traditional fuel network tie-ins like discounts at specific gas stations.

Also, as prepaid cards, they require upfront loading, which may not appeal to businesses reliant on credit-based fuel solutions.

● Target customers

Volopay’s prepaid fuel cards suit startups, tech firms, and global businesses seeking control over distributed team spending without the complexity of credit checks or fuel-specific network limitations.

2. AtoB fuel cards

● Overview

AtoB fuel cards are modern, tech-powered solutions designed to simplify fleet fueling and cut operational costs. Unlike traditional options, AtoB functions more like a credit card with advanced controls and zero hidden fees.

Accepted universally, this fuel card for businesses provides real-time tracking and customizable restrictions, making it one of the best fuel cards for business-focused fleets in 2026.

● Key features

AtoB fuel cards offer universal station acceptance, no transaction or setup fees, and smart controls to manage fuel-only spending. Businesses also gain access to real-time purchase alerts, direct API integrations, and spending insights.

The AtoB mobile app enhances driver convenience, allowing card management, nearby fuel station location, and digital card use on the go—perfect for today’s mobile-first operations.

● Advantages

With no fuel network restrictions and flexible payment terms, AtoB fuel cards deliver unmatched freedom for fleet operators. The cards help prevent fraud and overspending through driver-specific limits.

They also offer robust reporting tools that improve budgeting accuracy. It’s a standout choice among the best business fuel cards available in the US.

● Limitations

AtoB cards may not offer fuel discounts as high as those from brand-specific programs like Shell or ExxonMobil. Also, new businesses with limited credit history may face eligibility challenges during the application process.

While digital features are a strong point, businesses preferring traditional paper-based workflows might find the transition demanding.

● Target customers

AtoB fuel cards are ideal for logistics companies, delivery fleets, and service-based businesses needing a flexible, tech-driven fuel card for businesses that prioritize data control, convenience, and operational efficiency.

3. WEX fuel cards

● Overview

WEX fuel cards are among the most widely used fuel management solutions in the US, designed to support businesses of all sizes. Whether you operate a small fleet or manage a large enterprise, WEX offers a flexible fuel card for businesses.

With detailed reporting and expense tracking, WEX remains one of the best fuel cards for business operations in 2026.

● Key features

WEX fuel cards provide access to over 95% of U.S. fuel stations, GPS-enabled tracking, purchase controls, and fraud protection. Their robust dashboard allows real-time insights into driver behavior and fuel usage.

Businesses can also set limits based on location, time, or dollar amount. Integration with accounting software simplifies fuel expense reconciliation and streamlines back-office operations.

● Advantages

The WEX network’s vast acceptance makes it extremely convenient for nationwide fleets. Its comprehensive control features help prevent misuse and reduce overall fuel costs.

With 24/7 customer service and customizable plans, WEX adapts to diverse business needs. It's a top-tier option among the best business fuel cards offering high-level visibility and reliability.

● Limitations

Some users report high fees, including transaction and late payment charges. Discounts on fuel may be lower than those from brand-specific cards.

New users might also experience a learning curve navigating the WEX online portal. These factors should be considered before choosing this fuel card for businesses prioritizing cost savings and simplicity.

● Target customers

WEX fuel cards are perfect for companies managing regional or national fleets that need detailed control, real-time data, and broad acceptance, especially logistics, transportation, and field service businesses.

4. Coast fleet fuel cards

● Overview

Coast fleet fuel cards are designed with modern businesses in mind, offering smart, secure, and flexible expense management. These cards work at any gas station that accepts Visa, giving your team freedom without compromising control.

Coast is becoming a strong contender among the best fuel cards for business, especially for companies seeking a digital-first solution with customizable controls.

● Key features

The Coast fuel card for businesses includes real-time spend tracking, automated expense reporting, and card-level purchase controls. Users can set limits by merchant category, time, day, or transaction amount.

The platform integrates with popular accounting tools and supports instant card issuing, pausing, and termination. Coast also eliminates traditional fees like setup, annual, and per-card charges.

● Advantages

Coast fuel cards offer unmatched flexibility and are accepted almost everywhere Visa is. Real-time controls and instant notifications ensure transparency and reduce misuse.

The modern dashboard and automated receipts simplify reconciliation. These features make Coast one of the best business fuel cards for startups, small fleets, and digitally focused operations.

● Limitations

Unlike some traditional fleet cards, Coast doesn’t provide fuel rebates or volume-based discounts. Businesses operating in areas with limited Visa acceptance might face challenges.

Also, some users may prefer more robust telematics or reporting tools. While great for flexibility, it may not suit those prioritizing fuel savings above all.

● Target customers

Coast fuel cards are ideal for tech-forward businesses, startups, and SMEs that need flexible controls, broad acceptance, and seamless integrations to streamline their fuel and fleet expense management.

5. Exxon Mobil fleet cards

● Overview

Exxon Mobil fleet cards offer tailored solutions for businesses of all sizes, helping them manage fuel expenses across a vast network.

Accepted at over 12,000 Exxon and Mobil stations nationwide, these cards provide detailed reporting, security features, and purchase controls.

As one of the best fuel cards for business, it delivers both savings and streamlined fleet management.

● Key features

Exxon Mobil’s BusinessPro cards offer online account access, customizable driver profiles, purchase alerts, and advanced reporting tools. Businesses can set daily, weekly, or monthly spending limits. The cards also support fuel-only purchases and vehicle-specific tracking.

With fraud prevention measures and PIN authorization, this fuel card for businesses helps protect against unauthorized usage and keeps budgets in check.

● Advantages

The Exxon Mobil fleet card stands out with flexible controls, extensive fuel network coverage, and competitive rebates.

It simplifies expense tracking with real-time analytics and digital receipts. Businesses seeking control over driver purchases and those refueling within the Exxon and Mobil network find this to be one of the best business fuel cards available.

● Limitations

A primary drawback is limited station acceptance outside the Exxon and Mobil network, which can restrict fleet flexibility.

Additionally, while the card offers rebates, they depend on volume, favoring larger fleets. Smaller businesses might not benefit from maximum savings.

The lack of universal acceptance may hinder multi-state or national operations.

● Target customers

Exxon Mobil fleet cards are ideal for businesses that primarily operate near Exxon and Mobil stations, require tight purchase controls, and want advanced reporting for fuel management without switching to a universal card.

6. Shell fleet cards

● Overview

Shell fleet cards are designed to support businesses in managing fuel expenses effectively across Shell’s vast network. These cards offer significant rebates, robust controls, and real-time expense monitoring.

Counted among the best fuel cards for business, Shell’s offerings are especially beneficial for companies looking to save on fuel costs and improve driver accountability.

● Key features

Shell fleet cards come with online management tools, real-time alerts, and customizable limits for each cardholder. The cards offer detailed reports, tax-friendly receipts, and fraud protection. Shell also provides fuel-only controls, spending limits, and driver ID authentication.

This makes Shell’s fuel card for businesses an efficient tool for monitoring and controlling company-wide fuel spending.

● Advantages

Shell fleet cards offer up to 6¢ per gallon in rebates, ideal for cost-conscious fleets. They include advanced purchase controls, user-friendly dashboards, and acceptance at over 14,000 Shell locations.

This makes them one of the best business fuel cards for companies wanting consistent savings, detailed tracking, and widespread station availability.

● Limitations

Shell fleet cards are not universally accepted outside Shell-branded locations, which can restrict route flexibility for national fleets.

Additionally, rebate amounts depend on fuel volume, which may not suit smaller businesses. Integration with third-party fleet management software is also somewhat limited compared to newer, tech-forward card providers.

● Target customers

Shell fleet cards are perfect for regional fleets, small-to-medium businesses, and cost-focused companies that regularly fuel at Shell stations and prioritize rebate savings, card-level controls, and detailed transaction visibility.

7. Sunoco fleet cards

● Overview

Sunoco fleet cards offer reliable solutions for fuel expense management and driver control. Accepted at over 5,000 Sunoco locations, these cards support businesses with flexible spending limits, online account access, and purchase tracking.

As one of the best fuel cards for business, Sunoco provides competitive rebates and expense reporting to help streamline operations for fleets of all sizes operating in the eastern and southern U.S.

● Key features

Sunoco fleet cards include customizable driver profiles, purchase controls, real-time alerts, and online dashboards. They offer transaction-level reporting and easy integration with accounting systems. With fuel-only controls and PIN security, the card enhances fuel oversight.

This fuel card for businesses also helps prevent misuse with advanced fraud detection tools and supports both small and large fleets looking for dedicated fuel management solutions.

● Advantages

Sunoco cards deliver up to 6¢ per gallon in rebates and detailed transaction records. Businesses benefit from flexible card limits, driver-level controls, and expense management tools.

The cards are especially effective for regional businesses looking to consolidate fuel expenses and maintain strong cost control across their operations using a single, branded card.

● Limitations

The Sunoco fleet card’s primary limitation is its restricted acceptance outside Sunoco stations, limiting flexibility for fleets operating nationally. Smaller fleets may not qualify for the highest rebate tiers.

Additionally, the system lacks more advanced telematics or fleet tracking integrations offered by some competitors in the best business fuel cards segment.

● Target customers

Sunoco fleet cards are ideal for businesses operating primarily in the eastern U.S., requiring control over fuel spend, and seeking rebates at Sunoco locations to better manage fleet-related expenses.

8. Fuelman fleet cards

● Overview

Fuelman fleet cards are designed for businesses looking for wide acceptance and tight fuel expense controls. With access to a network of over 50,000 fuel locations, these cards combine flexibility with functionality.

As one of the best fuel cards for business, Fuelman provides customizable controls, security features, and fuel insights, helping businesses improve efficiency and reduce costs across in-town and regional fleets.

● Key features

Fuelman cards come with driver ID and PIN authorization, spending controls, and real-time reporting. They support maintenance tracking, fraud prevention, and card-level restrictions. The platform offers fuel-only limitations, tax reporting, and mobile account access.

This makes Fuelman a powerful fuel card for businesses that need scalable, easy-to-manage fuel expense tools backed by a vast acceptance network throughout the United States.

● Advantages

Fuelman cards stand out for their wide acceptance and advanced account controls. The tiered rebate structure rewards higher fuel usage, helping fleets save more as they grow.

They support integration with fleet management tools, simplifying budgeting and oversight.

Fuelman is particularly beneficial for businesses with diverse fueling needs across urban and suburban routes.

● Limitations

Some businesses may find Fuelman’s fees higher than competitors, particularly for smaller fleets. The card may have limited benefits outside of fuel purchases.

Additionally, rebate qualifications depend on monthly volume, which might disadvantage low-usage companies. Customer support experiences can also vary, affecting the overall value for certain businesses.

● Target customers

Fuelman fleet cards are well-suited for medium to large businesses operating in-town fleets that require comprehensive spending oversight, wide acceptance, and advanced controls to manage their fuel and vehicle-related expenses.

9. Corpay One fuel cards

● Overview

Corpay One fuel cards are tailored for businesses seeking automation, cost control, and secure fuel expense management. Accepted across major national fuel networks, they offer flexible controls and seamless accounting integration.

As one of the best fuel cards for business, Corpay helps streamline fuel purchases while enhancing visibility into employee spending and improving operational efficiency across small to mid-sized fleets.

● Key features

Corpay One fuel cards offer customizable controls, spending limits, fuel-only restrictions, and real-time transaction visibility.

The card integrates directly with Corpay’s broader spend management platform, allowing users to manage fuel, T&E, and other expenses in one place.

As a fuel card for businesses, it emphasizes simplicity, automation, and real-time control over driver-level and category-level spending.

● Advantages

The Corpay One card’s strength lies in combining fuel card functionality with overall expense automation.

Businesses can access real-time data, implement advanced controls, and streamline their reconciliation process. Its broad station acceptance and accounting integration make it a versatile option among the best business fuel cards, especially for tech-driven organizations.

● Limitations

Corpay One may not offer as many volume-based rebates as fuel-brand-specific cards. Businesses not using their expense platform might miss out on key features.

Additionally, new users could face a learning curve when navigating the full platform. Its features are best leveraged when used with Corpay’s full suite of financial tools.

● Target customers

Corpay One fuel cards cater to tech-savvy businesses looking to automate spend, consolidate fuel and non-fuel expenses, and manage small to mid-sized fleets through a unified digital platform.

10. 7-Eleven fleet cards

● Overview

7-Eleven offers a range of fleet cards designed to provide businesses with control over fuel expenses. Accepted at over 8,200 locations, including 7-Eleven, Speedway, and Stripes, these cards offer tiered rebates and customizable controls.

As one of the best fuel cards for business, 7-Eleven's options cater to various fleet sizes and needs, ensuring efficient fuel management.

● Key features

The 7-Eleven fleet cards come in three variants: Business Fleet, Business Universal, and Commercial Fleet Mastercard®. Features include online account management, real-time transaction tracking, and customizable spending limits.

The Business Universal card extends acceptance to 95% of U.S. fuel locations, while the Commercial Fleet Mastercard® offers universal acceptance wherever Mastercard® is accepted, making it a versatile fuel card for businesses.

● Advantages

7-Eleven fleet cards provide up to 5¢ per gallon in rebates, depending on monthly fuel volume.

The cards offer robust controls, fraud protection, and detailed reporting, aiding businesses in monitoring fuel expenses effectively. Their widespread acceptance and tiered rebate structure make them a competitive choice among the best business fuel cards.

● Limitations

While offering extensive coverage, the highest rebates are limited to purchases at 7-Eleven, Speedway, and Stripes locations.

Out-of-network transactions may incur additional fees. Businesses operating in regions without a strong presence of these stations might find the card less beneficial compared to other fuel card options.

● Target customers

Ideal for small to medium-sized businesses with fleets operating near 7-Eleven, Speedway, and Stripes locations, seeking a fuel card for businesses that offers control, rebates, and extensive network coverage.

11. Ramp fuel cards

● Overview

Ramp offers a modern approach to fleet fuel management with its universally accepted corporate cards. Designed for businesses seeking flexibility and control, Ramp's solution integrates spend management software with fuel purchasing.

As one of the best fuel cards for business, it provides real-time insights, customizable controls, and rewards, making it a compelling fuel card for businesses aiming for efficiency and savings.

● Key features

Ramp's fleet cards are accepted anywhere Visa is accepted, eliminating network restrictions. Features include real-time transaction tracking, customizable spending limits, and detailed reporting by driver, vehicle, or category.

The platform also offers automated receipt matching features and integration with accounting software, providing a comprehensive fuel card for businesses that value automation and control.

● Advantages

Ramp's fuel cards offer an average of 5% savings through efficient expense management.

The universal acceptance ensures flexibility, while the platform's automation reduces administrative workload. Its user-friendly interface and robust controls position it among the best business fuel cards for companies embracing digital solutions.

● Limitations

Ramp does not offer traditional fuel rebates based on volume, which might be a drawback for businesses prioritizing per-gallon discounts.

Additionally, the platform's advanced features may require a learning curve for teams unfamiliar with digital expense management tools.

● Target customers

Best suited for tech-savvy businesses seeking a fuel card for businesses that offers universal acceptance, real-time control, and integration with financial systems to streamline fuel expense management.

12. BP Plus fuel card program

● Overview

BP's Fuel Plus Program offers businesses a dedicated fuel card solution with access to over 6,800 BP and Amoco locations across the U.S. Designed to provide control and savings, this program includes volume-based rebates and comprehensive reporting tools.

As one of the best fuel cards for business, it caters to fleets seeking efficiency and cost management.

● Key features

The Fuel Plus card includes features like driver ID prompts, odometer readings, and customizable purchase controls. Businesses can set spending limits and access detailed transaction reports.

The card also supports tax-exempt reporting and offers online account management, making it a robust fuel card for businesses focused on compliance and oversight.

● Advantages

BP's Fuel Plus Program provides up to 7¢ per gallon in volume-based rebates, aiding in fuel cost reduction.

The extensive network of BP and Amoco stations ensures accessibility, while the program's controls and reporting tools enhance operational efficiency, solidifying its place among the best business fuel cards.

● Limitations

The Fuel Plus card is limited to BP and Amoco stations, which may not be ideal for fleets operating outside these networks. Businesses requiring broader station access might consider the BP Business Solutions Mastercard® for wider acceptance.

● Target customers

Ideal for businesses with fleets operating primarily near BP and Amoco stations, seeking a fuel card for businesses that offers rebates, control, and detailed reporting for fuel expense management.

13. Costco Anywhere Visa® Business Card by Citi

● Overview

The Costco Anywhere Visa® Business Card by Citi combines fuel rewards with broader business spending benefits. Offering high cashback rates on gas and other categories, it's a versatile option for businesses.

As one of the best fuel cards for business, it provides value beyond fuel purchases, making it suitable for companies seeking comprehensive rewards.

● Key features

Cardholders earn 5% cashback on gas at Costco and 4% on other eligible gas and EV charging purchases for the first $7,000 annually.

Additional rewards include 3% on restaurants and travel, 2% on Costco purchases, and 1% on other purchases.

The card also offers no annual fee with a paid Costco membership, enhancing its appeal as a fuel card for businesses.

● Advantages

The card's high cashback rates on fuel and other categories provide significant savings. Its broad acceptance wherever Visa is accepted adds flexibility.

For businesses already using Costco, the additional rewards on Costco purchases further enhance its value among the best business fuel cards.

● Limitations

The 5% cashback on gas is capped at $7,000 annually, after which it drops to 1%.

Additionally, the card requires a Costco membership, and rewards are issued annually, which may not suit businesses seeking more frequent cashback redemption.

● Target customers

Best suited for businesses that frequently purchase fuel and other goods at Costco, seeking a fuel card for businesses that offers high cashback rates across multiple spending categories.

14. Comdata fleet cards

● Overview

Comdata offers fleet fuel cards tailored for businesses of various sizes, providing tools to manage fuel expenses effectively. With acceptance at over 8,000 locations, including major truck stops, Comdata's fleet fuel cards offer discounts, fraud protection, and detailed reporting.

Recognized as one of the best fuel cards for business, Comdata supports efficient fleet operations through its comprehensive features.

● Key features

Comdata's fleet cards include customizable spending limits, real-time alerts, and transaction controls. The platform offers detailed reporting, tax-exempt purchasing, and integration with fleet management tools.

Additional features like Comchek® for driver payments and access to discounts on tires and maintenance services enhance its utility as a fuel card for businesses.

● Advantages

Comdata provides fuel discounts and extensive network coverage, aiding in cost reduction. Its robust controls and reporting tools enhance oversight, while additional services like Comchek® streamline driver payments.

These features position Comdata among the best business fuel cards for companies seeking comprehensive fleet management solutions.

● Limitations

Some features may be more beneficial for larger fleets, potentially offering less value to smaller businesses. Additionally, the complexity of the platform might require a learning curve for new users.

Businesses should assess their specific needs to determine if Comdata's offerings align with their operations.

● Target customers

Ideal for medium to large-sized businesses operating extensive fleets, seeking a fuel card for businesses that offers discounts, control, and comprehensive fleet management tools to optimize operations.

Fuel cards vs credit cards vs prepaid cards: What’s the difference?

Managing business expenses efficiently is crucial, especially when it comes to fuel costs. With various payment options available, understanding the differences between fuel cards, credit cards, and prepaid cards is essential.

Each offers unique benefits and limitations. This guide delves into their distinctions to help you choose the best fuel card for your business needs.

1. Primary purpose

● Fuel cards

Fuel cards are specialized payment tools designed exclusively for purchasing fuel and related vehicle expenses. They offer businesses the ability to monitor and control fuel spending, often providing discounts and detailed reporting.

As one of the best fuel cards for business, they streamline fuel expense management and enhance operational efficiency.

● Credit cards

Business credit cards are versatile financial instruments that allow companies to make various purchases, from office supplies to travel expenses. While not limited to fuel, they often come with rewards programs and credit-building opportunities.

However, they may lack the specialized controls and reporting features found in a dedicated fuel card for businesses.

● Prepaid cards

Prepaid cards require funds to be loaded in advance, functioning similarly to debit cards. They offer businesses a way to manage spending without the risk of accruing debt.

While they provide control over expenses, they may not offer the same level of reporting or discounts as the best fuel cards for business.

2. Spending control

● Fuel cards

Fuel cards provide robust spending controls, allowing businesses to set limits on fuel purchases, restrict non-fuel transactions, and monitor usage by driver or vehicle.

These features help prevent unauthorized spending and ensure that fuel expenses align with company policies, making them an ideal fuel card for businesses seeking stringent oversight.

● Credit cards

While business credit cards offer flexibility, they may lack granular spending controls. Companies can set overall credit limits, but restricting specific types of purchases or monitoring individual employee spending requires additional oversight.

This can make it challenging to manage fuel expenses effectively compared to using the best fuel cards for business.

● Prepaid cards

Prepaid cards offer inherent spending control by limiting expenditures to the preloaded amount. Businesses can allocate specific funds for fuel, ensuring that spending stays within budget.

However, they may not provide detailed controls over transaction types or real-time monitoring, which are features commonly found in a dedicated fuel card for businesses.

3. Reporting and tracking

● Fuel cards

Fuel cards excel in providing detailed reporting and tracking capabilities. Businesses can access real-time data on fuel purchases, monitor usage patterns, and generate reports for accounting purposes.

This level of insight is invaluable for managing fuel expenses and optimizing fleet operations, solidifying their status as the best fuel cards for business.

● Credit cards

Business credit cards offer basic reporting features, such as monthly statements and transaction summaries. While useful for general expense tracking, they may lack the detailed analytics and categorization specific to fuel expenses.

This can make it harder for businesses to monitor and control fuel spending compared to using a specialized fuel card for businesses.

● Prepaid cards

Prepaid cards typically provide limited reporting features, focusing on balance information and transaction history. While sufficient for basic tracking, they may not offer the comprehensive analytics or integration with accounting systems that businesses require.

This limitation can hinder effective fuel expense management when compared to the best fuel cards for business.

4. Integration with accounting tools

● Fuel cards

Many fuel cards offer seamless integration with accounting and fleet management software. This connectivity allows for automatic data synchronization, reducing manual entry and errors.

Such integration streamlines financial processes and enhances accuracy, making fuel cards an efficient tool for businesses aiming to optimize their fuel expense management.

● Credit cards

Business credit cards may offer integration with accounting software, but the level of detail and categorization can be limited. Fuel expenses may not be distinctly separated, requiring additional effort to analyze and manage.

This can complicate fuel expense tracking compared to using a dedicated fuel card for businesses with specialized integration features.

● Prepaid cards

Prepaid cards often lack direct integration with accounting systems. Businesses may need to manually input transaction data, increasing the risk of errors and inefficiencies.

This lack of integration can hinder comprehensive financial oversight, making prepaid cards less suitable for businesses seeking streamlined fuel expense management compared to the best fuel cards for business.

5. Security features

● Fuel cards

Fuel cards offer enhanced security features, including PIN protection, purchase restrictions, and real-time alerts for suspicious activities. These measures help prevent fraud and unauthorized use, providing businesses with peace of mind.

Such security protocols are essential for companies managing multiple drivers and vehicles, reinforcing the value of fuel cards for businesses.

● Credit cards

Business credit cards come with standard security features like fraud detection and liability protection. However, they may not offer the same level of transaction-specific controls as fuel cards.

This can expose businesses to higher risks of unauthorized fuel purchases, making them less secure for managing fuel expenses compared to dedicated fuel cards.

● Prepaid cards

Prepaid cards provide basic security features, such as PIN protection and limited spending capabilities. While they reduce the risk of overspending, they may lack advanced security measures like real-time alerts or purchase restrictions.

This can make them less effective in preventing fraud compared to the best fuel cards for business.

6. Rewards and rebates

● Fuel cards

Fuel cards often come with rewards and rebates tailored to fuel purchases. Businesses can benefit from per-gallon discounts, volume-based rebates, and loyalty programs.

These incentives directly reduce fuel costs, enhancing the appeal of fuel cards as the best fuel cards for business that is seeking to maximize savings on fuel expenses.

● Credit cards

Business credit cards typically offer rewards programs that include cashback, points, or travel miles. While these rewards can be valuable, they are generally not fuel-specific.

This means businesses may not see significant savings on fuel expenses, making credit cards less effective than fuel cards for businesses focused on reducing fuel costs.

● Prepaid cards

Prepaid cards rarely offer rewards or rebates. Their primary benefit lies in spending control rather than incentives.

Without fuel-specific discounts or loyalty programs, businesses may miss out on potential savings, making prepaid cards less advantageous compared to the best fuel cards for business aiming to optimize fuel expenditures.

7. Billing and repayment

● Fuel cards

Fuel cards typically operate on a charge account basis, requiring full payment of the balance each billing cycle. This structure encourages disciplined spending and avoids interest charges.

For businesses seeking to manage fuel expenses without accruing debt, fuel cards offer a practical and financially responsible solution.

● Credit cards

Business credit cards allow for revolving credit, enabling businesses to carry a balance and make minimum payments.

While this provides flexibility, it can lead to interest charges if balances are not paid in full. This can increase overall expenses, making credit cards less ideal for managing fuel costs compared to fuel cards.

● Prepaid cards

Prepaid cards require funds to be loaded in advance, eliminating the need for billing or repayment. This pay-as-you-go model prevents debt accumulation but requires proactive fund management.

While this can aid in budgeting, it may lack the convenience and structured billing of the best fuel cards for business.

What are the different types of fuel cards for businesses?

1. Fleet fuel cards

Fleet fuel cards are specifically designed for companies that manage multiple vehicles. These cards help track fuel expenses across a fleet, offering real-time data, purchase controls, and custom reporting.

Fleet cards are often considered among the best fuel cards for business as they support detailed expense monitoring and reduce the administrative burden for fleet managers.

2. All brand (universal) fuel cards

Universal fuel cards, also known as all-brand cards, offer the flexibility to be used at a wide network of fuel stations across different brands. These cards are perfect for businesses with drivers traveling across various regions.

A fuel card for businesses with universal access ensures greater convenience and better route planning without being tied to specific stations.

3. Single brand (brand-specific) fuel cards

Single-brand fuel cards can only be used at a specific fuel provider’s stations. They’re ideal for businesses operating in limited geographical areas where a particular brand dominates.

These cards often come with brand-specific discounts and loyalty benefits, making them cost-effective if your operations are closely tied to that fuel provider’s network.

4. Prepaid fuel cards

Prepaid fuel cards require funds to be loaded in advance, offering built-in spending controls and no risk of debt. They are a simple yet effective fuel card for businesses wanting tight budget control without credit checks or complicated approval processes.

While they lack some advanced features, they work well for small teams or temporary use.

5. Charge cards

Charge cards allow businesses to pay for fuel purchases with a set billing cycle, often requiring full payment at the end of the period. They typically come with detailed reporting and strong control features.

Businesses looking for structured expense tracking and clear monthly statements often view charge cards as one of the best fuel cards for business.

What are some benefits of fuel cards for businesses?

1. Track fuel spend by driver or vehicle

Fuel cards enable tracking fuel purchases by individual drivers or specific vehicles. This visibility helps identify unusual spending patterns and reduce unauthorized usage. The best fleet fuel cards provide detailed logs of transactions, aiding better decision-making and expense control.

For businesses managing multiple vehicles, this functionality makes a fuel card for businesses a vital tool for monitoring usage and promoting accountability at every operational level.

2. Assign cards to specific employees or vehicles

With the best fuel cards for business, companies can assign each card to a specific driver or vehicle. This assignment limits card misuse and provides transparency into who’s spending what.

The best fleet fuel cards also allow businesses to configure usage rules per card, which ensures employees only use the card within their assigned limits. This targeted control streamlines fleet expense management across all departments.

3. Get real-time transaction alerts

Receive instant alerts for every transaction made with your fuel card. Real-time notifications help spot misuse quickly and respond promptly. With the best fuel cards for business, alerts can be configured by time, amount, or location.

These proactive features are especially useful for fleet managers who want tight control over expenses, making the best fleet fuel cards a security asset for modern businesses.

4. Set daily or weekly spending limits

Fuel cards come with customizable spending limits that can be set daily or weekly. This control ensures that employees stay within allocated budgets. Spending caps prevent fuel fraud and overuse, especially for field staff or long-haul drivers.

A fuel card for businesses that includes these limit-setting features is ideal for maintaining strict expense policies and avoiding unexpected spikes in fuel costs.

5. Integrate fuel data with accounting software

One of the standout features of the best fuel cards for business is their ability to integrate directly with accounting platforms. By syncing fuel transaction data with your financial software, you save time and reduce manual entry errors.

This streamlined integration allows for faster reconciliation and more accurate financial records—especially beneficial during audits or when evaluating overall fleet cost-effectiveness.

6. Generate tax-compliant fuel reports

Using a fuel card for businesses simplifies tax season by generating detailed, tax-compliant reports automatically. These reports categorize expenses by type, location, and user, making it easier to claim deductions or comply with local tax requirements.

This benefit not only saves time but also ensures financial accuracy and helps avoid penalties due to incomplete or improperly formatted expense documentation.

7. Simplify IFTA and IRS reporting

For businesses operating across state lines, fuel cards help simplify reporting under the International Fuel Tax Agreement (IFTA) and IRS compliance.

The best fuel cards for business track and categorize fuel purchases based on jurisdiction, making it easier to calculate taxes owed.

This reduces administrative workload and eliminates guesswork during fuel tax reporting, ensuring that businesses remain compliant with regional fuel tax regulations.

8. Eliminate manual reimbursements

Fuel cards eliminate the need for manual reimbursement processes. Instead of asking employees to keep receipts and submit expense claims, the card automatically records each transaction.

This automation reduces paperwork, speeds up processing, and minimizes errors.

By using a fuel card for businesses, companies can streamline employee reimbursements and focus resources on strategic activities rather than chasing receipts or verifying claims manually.

9. Enhance fuel transaction security

Security is a major concern for fleet managers. Fuel cards come with PIN protection, customizable restrictions, and real-time tracking, which reduce the risk of theft and misuse. These safeguards help businesses detect fraud early and limit spending to authorized locations and times.

The best fuel cards for business offer multi-layered security features, ensuring that every transaction is valid and traceable.

10. Centralize all fuel-related costs in one system

Fuel cards allow businesses to consolidate all fuel-related expenses into a single, centralized platform. This provides a clearer overview of spending trends and simplifies budgeting and forecasting.

Instead of juggling multiple invoices and expense reports, companies using a fuel card for businesses benefit from unified dashboards and summaries that capture every transaction, making fleet fuel management far more efficient and transparent.

What are the costs associated with issuing fuel cards for your business?

Card issuance or setup fees

Most providers charge a one-time card issuance or setup fee when you open a new account. This cost usually covers administrative processes like account creation, card printing, and shipping.

When comparing the best fuel cards for business, look for those with no or low setup fees to minimize upfront investment for your fleet operations.

Transaction fees

Some fuel cards for businesses charge a fee per transaction, especially if used outside the preferred network. These charges can add up quickly for high-usage fleets.

The best fuel cards for business typically offer free or discounted transactions within their partner networks, helping you reduce recurring expenses and maintain tighter control over your fuel costs.

Late payment penalties

Late payments can trigger penalty charges ranging from flat fees to a percentage of the outstanding balance. The best fuel cards for business will clearly outline late fee structures in their terms.

Timely repayment is key to avoiding unnecessary costs and maintaining your company’s creditworthiness when using any fuel card for businesses.

Replacement card fees

Lost or damaged cards often incur a replacement fee, typically between $5–$15. While it might seem minor, repeated replacements can become expensive.

Look for fuel cards for businesses that offer free or discounted replacements. The best fuel cards for business may also provide digital options to reduce reliance on physical cards altogether.

Minimum spend requirement

Some fuel card for businesses options have minimum monthly spending thresholds to maintain a fee-free status. Failing to meet this limit may trigger extra charges.

When evaluating the best fuel cards for business, choose one that suits your fleet’s fuel consumption patterns and doesn’t penalize lower-volume operations with excessive minimum spend requirements.

Annual fees

Annual fees are common among premium fuel cards for businesses, especially those offering advanced tracking or reward features. These fees typically range from $25 to $100 per card.

The best fuel cards for business justify these costs with added benefits like better reporting, savings on fuel, or broader acceptance networks across the U.S.

Inactive card fees

Providers may charge inactivity fees for cards unused over a specific period, such as 60 or 90 days. These costs can quietly eat into your budget.

The best fuel cards for business offer flexibility by waiving these charges or notifying administrators beforehand, ensuring you aren’t penalized for temporarily idle drivers or vehicles.

Interest charges

If your fuel card for businesses functions like a credit card, carrying a balance may result in interest charges. These rates vary by provider and credit profile.

To avoid high interest costs, consider the best fuel cards for business with longer grace periods or zero-interest terms, especially if you intend to carry over balances monthly.

Which factors affect fuel card approval in the US?

1. Business credit history

A strong business credit profile significantly improves your chances of approval. Issuers of the best fuel cards for business often review your company’s credit score, trade lines, and payment history. Consistent, on-time payments to vendors and lenders demonstrate financial responsibility.

Poor or nonexistent credit may limit your options or result in stricter terms for your fuel card for businesses.

2. Business age and registration status

Lenders prefer businesses that are officially registered and have been operational for some time. Startups may struggle with approval unless they provide personal guarantees.

When applying for the best fuel cards for business, ensure your business entity is properly registered with local, state, and federal agencies.

Registration adds credibility and increases your chances of securing a fuel card for businesses.

3. Monthly fuel spend or fleet size

Your average monthly fuel expenditure or fleet size plays a big role in determining eligibility. Most providers require a minimum spend threshold to qualify for the best fuel cards for business.

The more vehicles you manage or fuel you purchase, the better your negotiation power. Clearly outlining your fleet usage can help you secure a more suitable fuel card for businesses.

4. Time in business

The longer your business has been operational, the more favorably you're viewed by providers. Companies with several years of verifiable operations are more likely to get approved for the best fuel cards for business.

Time in business signals stability and experience, both important factors when determining risk and responsibility for repayment on a fuel card for businesses.

5. Outstanding debts or delinquencies

Unpaid debts or previous delinquencies can harm your chances of getting approved. Issuers will look for red flags such as defaulted loans or accounts in collections. Clean up your records before applying.

The best fuel cards for business often require a clean or manageable debt history to approve an application for a fuel card for businesses without added scrutiny.

6. EIN (Employer Identification Number) verification

Most providers require a valid EIN to confirm your business identity. This helps ensure that your company is legitimate and registered with the IRS.

Applying for the best fuel cards for business without an EIN can delay or even halt your approval.

Accurate EIN information strengthens your application and ensures smoother processing for a fuel card for businesses.

7. Business bank account status

Having an active and healthy business bank account is essential. Providers may request statements to verify income, cash flow, and spending habits. An account in good standing reflects financial stability, a trait issuers value.

If you’re aiming for the best fuel cards for business, make sure your business account is active, with no overdrafts, before applying for a fuel card for businesses.

8. Industry type or risk category

Some industries are considered higher risk than others. For instance, startups or companies in volatile markets may face more scrutiny.

Fuel card providers carefully assess the risk category of your industry to determine your eligibility. The best fuel cards for business often have flexible criteria, but understanding your industry’s classification can help you choose the right fuel card for businesses.

9. Personal credit of the business owner (for small businesses)

If your business is new or has limited credit, issuers may review the personal credit score of the owner. This is especially true for small businesses and sole proprietors.

Strong personal credit can help you qualify for the best fuel cards for business. Be prepared for a soft or hard pull when applying for a fuel card for businesses under your name.

10. Prior relationships with financial institutions or fuel card providers

Existing banking or vendor relationships can positively impact your fuel card application.

A proven track record of responsible account management makes issuers more confident. Providers offering the best fuel cards for business may consider your history with their financial services.

Previous positive interactions can improve approval chances and even lead to better terms on your fuel card for businesses.

What are the documents required to apply for a fuel card in the USA?

1. Business identification

To begin your application, you'll need official documents that verify your business identity. This includes your business name, type of ownership, and the legal entity under which you operate.

These documents are crucial when applying for the best fuel cards for business, as they confirm your company’s existence and legitimacy in the eyes of the fuel card provider.

2. Business registration documents

You must submit copies of your business registration certificates issued by local, state, or federal authorities. These may include Articles of Incorporation or an LLC agreement.

Most fuel card for businesses applications won’t move forward without verified registration, especially if you’re targeting the best fuel cards for business with more extensive features and controls.

3. Proof of business address

Providers require proof of your business’s physical location. This can be a utility bill, lease agreement, or bank statement showing your registered address.

It helps validate your company’s operating presence and supports your eligibility for the best fuel cards for business, which often come with region-specific offers or nationwide fuel station access.

4. Personal identification

Especially for small businesses, you’ll be asked to submit a government-issued ID, such as a driver’s license or passport. Fuel card providers use this to verify the identity of the business owner or responsible party.

A valid ID strengthens your credibility, helping you qualify for a fuel card for businesses without unnecessary delays.

5. Business bank account details

You’ll need to share active business bank account information for automatic payments or verification. Fuel card companies may request recent statements to check your financial activity.

For the best fuel cards for business, maintaining a healthy and verifiable business account increases your approval chances and helps facilitate seamless billing processes.

6. Financial statements

Annual balance sheets, profit and loss statements, or recent cash flow records are commonly required. These documents help assess your financial health and spending capacity.

Providers offering the best fuel cards for business rely on these statements to determine credit limits and the viability of issuing cards to your company.

7. Personal credit report

If your business is new or lacks credit history, a personal credit check may be necessary. Some fuel card issuers assess the business owner's personal score as a secondary measure.

This is especially important for accessing the best fuel cards for business, which often have flexible but thorough evaluation criteria.

8. Business tax returns

You may need to provide one or two years’ worth of business tax returns. These documents validate your reported income and business activity.

They also serve as proof of stability and are commonly reviewed when applying for a fuel card for businesses, especially those offering high limits or extended repayment terms.

9. Driver and vehicle details

Fleet-based businesses may be asked to submit information about drivers and vehicles. This helps assign and monitor cards accurately.

Details like license plate numbers, vehicle type, and employee names are useful for tracking fuel usage effectively with the best fuel cards for business, which offer real-time monitoring and spending controls.

10. Corporate tax ID number

Also known as the EIN (Employer Identification Number), this is crucial for any business application. Fuel card issuers use it to verify your business with the IRS.

Without this, approval for any fuel card for businesses becomes unlikely, especially if you're applying for the best fleet fuel cards with corporate-level benefits.

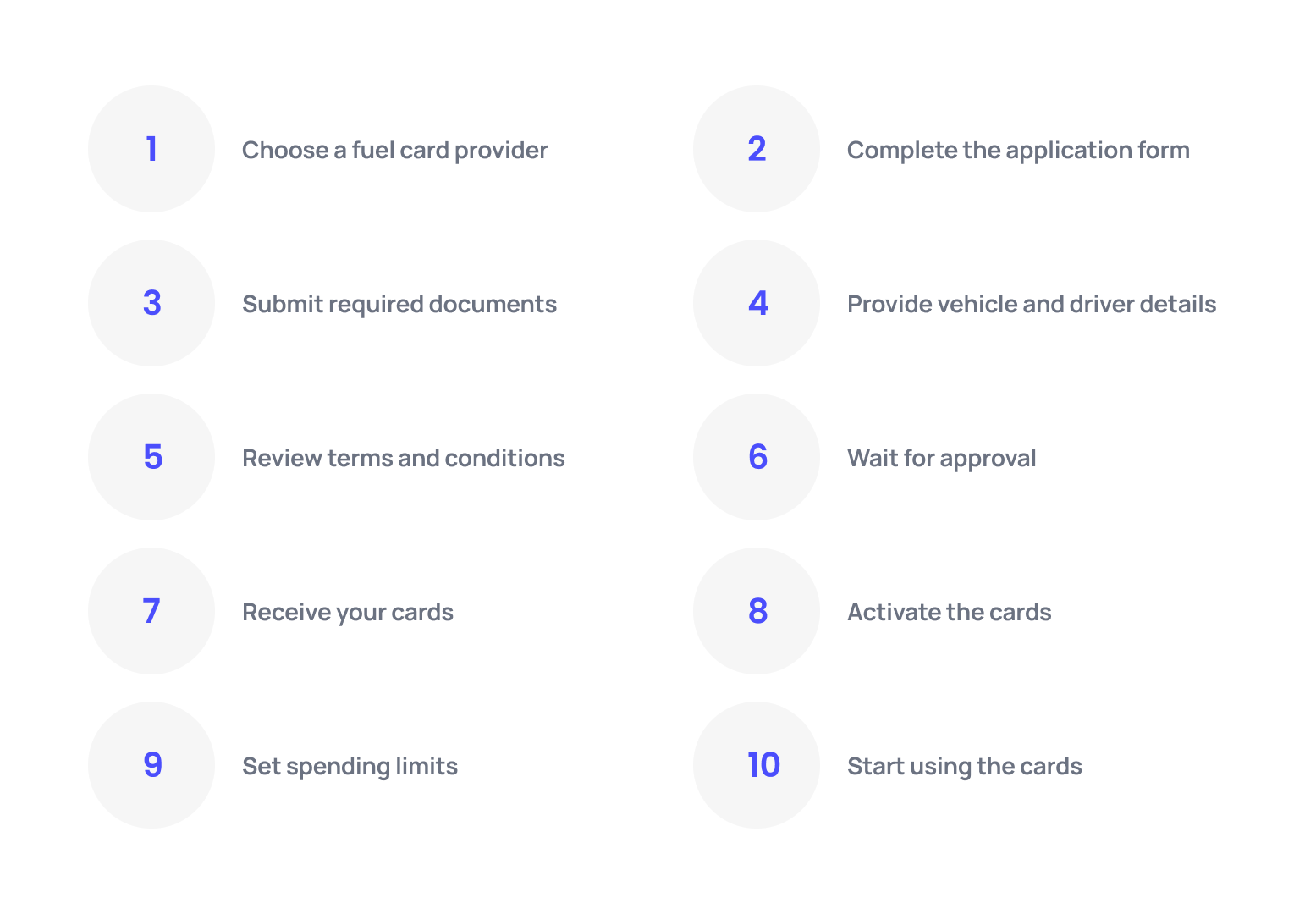

How to apply for a fuel card in the US?

1. Choose a fuel card provider

Start by researching the best fuel cards for business based on your needs—fleet size, fuel network, or reporting features. Consider whether you need a universal card or a brand-specific one.

Look for cards that integrate with accounting tools and offer rewards, especially if your business does high-volume fuel purchasing regularly.

2. Complete the application form

Visit the provider’s website to access the online application form. Fill in your business name, address, industry type, and contact details.

Applying for a fuel card for businesses typically requires you to specify your monthly fuel spend and fleet size to help determine your eligibility and credit limit during the evaluation.

3. Submit required documents

Upload all necessary documents such as business registration, proof of address, bank statements, and tax ID. The best fuel cards for business require verified documentation to ensure your application is processed efficiently and approved swiftly.

Providing accurate, up-to-date files increases your approval chances and shortens the review process.

4. Provide vehicle and driver details

Fuel card providers often ask for vehicle registration numbers and employee names who’ll be authorized to use the cards.

This allows you to track fuel expenses by vehicle or driver. The fuel card for businesses will be linked accordingly, helping improve accountability and reduce unauthorized spending or misuse.

5. Review terms and conditions

Carefully review all terms, including fees, repayment schedules, interest charges, and transaction limits. Some of the best fuel cards for business offer flexible repayment, while others have strict conditions.

Make sure you understand penalty clauses, usage restrictions, and available rebates before signing up to avoid issues later.

6. Wait for approval

Once your documents are submitted and reviewed, your application will undergo a credit check. Approval time varies by provider but usually takes a few business days.

Companies offering the best fuel cards for business often provide quick decisions if your business has strong financials and meets eligibility requirements.

7. Receive your cards

After approval, your fuel cards will be shipped to your business address. Depending on the provider, delivery may take up to 7–10 business days.

Once received, check the quantity, user details, and activation instructions. The fuel card for businesses kit typically includes setup guides and customer service information.

8. Activate the cards

Follow the provider’s activation instructions—usually via phone or online dashboard. Confirm that each card is properly linked to the assigned driver or vehicle.

Activation of your fuel card for businesses is mandatory before use and ensures the spending controls, alerts, and reporting tools are fully functional from day one.

9. Set spending limits

Use your online dashboard to assign daily, weekly, or monthly limits per card. This helps control fuel costs and minimizes misuse.

The best fuel cards for business allow real-time control of card limits and let you disable cards remotely if unauthorized spending occurs, ensuring full oversight and operational security.

10. Start using the cards

Once activated and configured, distribute the cards to authorized employees. Start fueling at approved stations and monitor spending through the provider’s dashboard.

A fuel card for businesses simplifies payments, automates reporting, and helps businesses save money while keeping track of every gallon used across the fleet.

Factors to evaluate when selecting a fuel card for your business

1. Wide acceptance

Look for a fuel card with wide network coverage so your team isn’t restricted to limited fuel stations.

The best fuel cards for business are accepted at thousands of locations nationwide, giving you operational flexibility and ensuring that drivers can always find a nearby fuel station without delays or route changes.

2. Fuel discounts and rebates

A key benefit of using a fuel card for businesses is the opportunity to save money through fuel discounts and cashback offers.

The best fuel cards for business provide volume-based rebates or brand-specific discounts, helping lower fuel costs over time, especially if your fleet has high monthly fuel expenses.

3. Customizable spending limits per vehicle/driver

Being able to set daily, weekly, or monthly spending limits for each vehicle or driver helps control expenses. The best fuel cards for business offer customizable controls, ensuring you can prevent overspending, misuse, or unauthorized purchases.

Tailoring limits improves accountability and aligns spending with your business's fuel consumption policy.

4. Detailed fuel transaction reporting

Accurate, real-time reporting of every fuel purchase is essential for monitoring and optimizing costs. The best fuel cards for business provide comprehensive transaction logs, including fuel type, location, time, and driver ID.

These reports allow you to identify spending trends and detect unusual behavior across your fleet operations.

5. Advanced security features

Security should be a top priority. Opt for fuel cards that offer PIN protection, driver verification, and real-time alerts.

The best fuel cards for business also include fraud detection features to minimize the risks of card misuse or theft, helping you protect your financial data and reduce unauthorized fuel purchases.

6. Seamless integration with accounting systems

Look for fuel cards for businesses that integrate easily with popular accounting software like QuickBooks, Xero, or NetSuite. This saves time, reduces manual entry, and ensures accuracy in bookkeeping.

The best fuel cards for business streamline reconciliation and reporting for both fuel expenses and overall financial management.

7. No hidden fees or charges

Always check the fee structure. Some fuel cards for businesses may include hidden costs like setup fees, transaction charges, or annual dues.

The best fuel cards for business are transparent about their pricing, ensuring you don’t end up paying more than expected or facing surprise charges down the line.

8. Flexibility for fuel and vehicle expenses

Select a fuel card for businesses that covers more than just fuel, such as maintenance, oil changes, and vehicle washes. This adds convenience and consolidates all related expenses.

The best fuel cards for business offer flexible categories, enabling broader use and simplifying fleet-related financial tracking in one platform.

9. 24/7 customer support

Round-the-clock customer service is vital if drivers encounter issues on the road. The best fuel cards for business offer dedicated support via phone, chat, or email.

Reliable assistance can minimize downtime and keep operations running smoothly, especially in the case of lost cards or transaction errors.

10. Mobile app and online management

A user-friendly mobile app and online dashboard allow you to manage cards, monitor transactions, and adjust settings in real-time.

The best fuel cards for business offer intuitive digital tools to streamline expense management and offer complete visibility, right from your phone or desktop, anytime, anywhere.

What are the essential steps for effective fuel card management?

1. Assign cards to employees/vehicles

Start by assigning each fuel card for businesses to a specific driver or vehicle. This ensures accountability and provides clear visibility into who is using which card.

The best fuel cards for business let you track spending patterns, making it easier to pinpoint discrepancies or misuse if they occur.

2. Set spending limits and controls

Use your provider’s dashboard to set daily, weekly, or monthly limits. The best fuel cards for business allow for customizable spending thresholds by cardholder, fuel type, or location.

This control helps prevent overspending, restricts unauthorized purchases, and aligns spending with your business budget and fuel usage policy.

3. Monitor transactions in real-time

Choose a fuel card for businesses that offers real-time transaction monitoring. Instant alerts on every transaction let you detect unusual activity quickly.

The best fuel cards for business provide mobile and web access to dashboards, helping managers respond promptly to misuse or spending irregularities, even when on the go.

4. Review and analyze fuel expenses regularly

Conduct regular reviews of your fuel expenses to identify cost-saving opportunities. The best fuel cards for business offer detailed reports that break down spending by date, driver, or vehicle.

Analyzing these patterns allows you to adjust routes, improve fuel efficiency, and reduce unnecessary or excessive fueling.

5. Integrate data with accounting software

Integration with accounting tools streamlines reconciliation. Many fuel cards for businesses are compatible with platforms like QuickBooks or Xero.

The best fuel cards for business automate transaction syncing, reducing manual errors and ensuring accurate financial records for reporting, tax deductions, and budget forecasting.

6. Enforce policies to prevent misuse

Establish clear policies about how and when fuel cards should be used. Require drivers to submit receipts or log fuel purchases.

The best fuel cards for business let you lock or deactivate cards instantly, making it easier to enforce compliance and minimize the risk of fraudulent or unauthorized transactions.

7. Ensure timely payments to avoid fees

Timely payments prevent late fees and maintain your business credit score. Set up automated reminders or enroll in auto-pay through your fuel card for businesses dashboard.

The best fuel cards for business offer flexible billing cycles, helping you stay financially organized and avoid unnecessary interest or penalties.

Optimize fleet expense management with Volopay

Managing transportation expenses across multiple platforms and cards can be cumbersome. Hence, to simplify your expense management, we recommend Volopay, which offers an all-inclusive solution on a single platform. Experience the convenience of streamlined transportation expense tracking and management with Volopay's prepaid cards and its unique features.

1. Simplified expense management

Volopay eliminates the need for juggling spreadsheets, paper receipts, and scattered fuel card systems. With its unified dashboard, businesses can control fuel and travel expenses in one place.

When comparing the best fuel cards for business, Volopay's expense management system stands out as a centralized solution that ensures consistency, compliance, and efficiency in managing corporate transportation and fleet-related expenses.

2. Enhanced control

Gain full control over your transportation expenses by setting limits, approval workflows, and custom rules with Volopay. Unlike traditional fuel card for businesses options that only offer fuel-related controls, Volopay enables broader spend control across categories.

Whether for fleet fuel or vehicle maintenance, you can control every payment type and monitor expenses proactively to avoid overspending.

3. Tailored expense allocation

With Volopay, you can allocate expenses directly to specific cost centers, departments, or projects. This level of customization is rarely found in the best fuel cards for business.

The ability to tag each transaction ensures accurate budgeting and better visibility, empowering your finance team to break down transport-related costs in a more meaningful and strategic manner.

4. Real-time tracking

Track every transaction as it happens with Volopay’s real-time tracking features. This surpasses traditional fuel card for businesses platforms by offering instant insights into all vehicle-related expenses.

Notifications for each swipe, digital receipt capture, and live analytics enable you to act swiftly on suspicious activity and maintain full transparency at every level.

5. Comprehensive reporting

Volopay generates automated, tax-compliant reports tailored to your business needs. When stacked against the best fuel cards for business, Volopay’s reporting tools go a step further by consolidating fuel, tolls, maintenance, and other transportation expenses.

Custom filters and data exports help streamline audits, ensure regulatory compliance, and support financial planning with ease.

6. Convenient payments

Make on-the-go payments effortlessly through physical cards or virtual cards issued by Volopay. Unlike many fuel card for businesses options that are fuel-only, Volopay supports wider spending, including parking and repairs.

This flexibility simplifies operations for logistics-heavy teams and enhances payment convenience for field employees handling multiple expense categories daily.

7. Ultimate alternative

If you’re exploring the best fuel cards for business, Volopay offers a smarter alternative. It integrates fuel management with broader expense control, delivering unmatched flexibility and precision.

From issuance to reconciliation, every step is optimized for businesses that demand more than just fuel tracking. Volopay's all-in-one business fleet expense management cards empower teams with tools to scale confidently and cost-effectively.

FAQs

Yes, many of the best fuel cards for business offer wide network coverage, including rural and independent stations. Always check card acceptance details before choosing your fuel card provider.

Absolutely. A fuel card for businesses helps small fleets monitor expenses, control spending, and access discounts. Even with a few vehicles, you can streamline and centralize fuel expense management effectively.

Yes, the best fuel cards for business let you assign cards to various drivers or vehicles under one account. You can track usage individually and maintain spending control across your fleet.

Definitely. A top-rated fuel card for businesses provides detailed tracking features, letting you view each driver or vehicle’s fuel consumption separately for better accountability and cost control.

Yes, Volopay is ideal for small businesses. While it’s not just a fuel card for businesses, its broader features help you manage all fleet-related and fuel expenses on one platform.

Yes, Volopay allows you to assign cards to specific employees or vehicles. You can track each transaction, making it a great alternative to traditional best fuel cards for business.

Yes, Volopay offers more flexibility than a standard fuel card for businesses. You can use it for tolls, parking, repairs, and other transport expenses, making expense management simpler.