Best business expense trackers in the US for February 2026

In 2026, modern businesses face increasingly complex financial landscapes that demand smarter ways to manage spending. Traditional spreadsheets and manual entries no longer suffice for tracking diverse expenses across multiple platforms. This shift has led to the rise of some of the best business expense trackers, offering real-time visibility, automation, and data accuracy.

In this article, you’ll discover how advanced tracking tools empower you to control budgets efficiently, minimize human errors, and streamline reimbursement processes. Whether you manage a small team or a growing enterprise, understanding these innovations will help you stay competitive and make smarter financial decisions in today’s fast-paced business environment.

What is a business expense tracker?

A business expense tracker is a digital tool that records, organizes, and analyzes company spending in real time. Unlike manual tracking, a business expense tracking system automates data entry, categorizes expenses, and syncs seamlessly with accounting software.

Using an automated business expense tracker, you can monitor transactions, manage receipts, and ensure compliance effortlessly. These tools eliminate guesswork, helping you maintain financial transparency and accuracy.

By centralizing your spending data, an expense tracker gives you actionable insights that simplify reporting, budgeting, and future financial planning for your business. Ultimately, it empowers you to make more informed financial decisions with greater confidence.

How does a business expense tracker work?

1. Capturing and classifying business spend

With business expense tracker apps, you can automatically capture expenses through digital receipts, card transactions, or invoice uploads. The system intelligently categorizes each expense into relevant accounts, such as travel, meals, or office supplies.

This automated process eliminates manual entry errors and ensures consistent categorization, improving accuracy and efficiency across your organization’s expense management workflow.

2. Real-time monitoring of employee and vendor costs

A business expense tracking system enables you to monitor spending activities as they happen. You can track employee reimbursements, vendor payments, card spends, and project-based expenses in an instant.

Real-time transaction updates provide immediate visibility into cash flow and spending trends, helping you make informed financial business decisions while maintaining complete control over budgets and departmental costs.

3. Policy enforcement and approval workflows

The best business expense trackers ensure compliance by automatically applying company policies to every transaction. You can set spending limits, approval hierarchies, and custom workflows to match your organization’s structure.

Automated alerts flag violations, while digital approvals simplify the process, ensuring transparency, faster reimbursements, and greater accountability in business expense management.

Best business expense trackers: At a glance

Best business expense trackers in the US in 2026

Companies are now increasingly turning to digital tools to simplify financial management. The best business expense trackers help you gain transparency, automate reporting, and reduce manual workload.

These platforms integrate with accounting systems, streamline approvals, and ensure compliance. Below, discover two leading solutions reshaping how businesses manage their expenses efficiently.

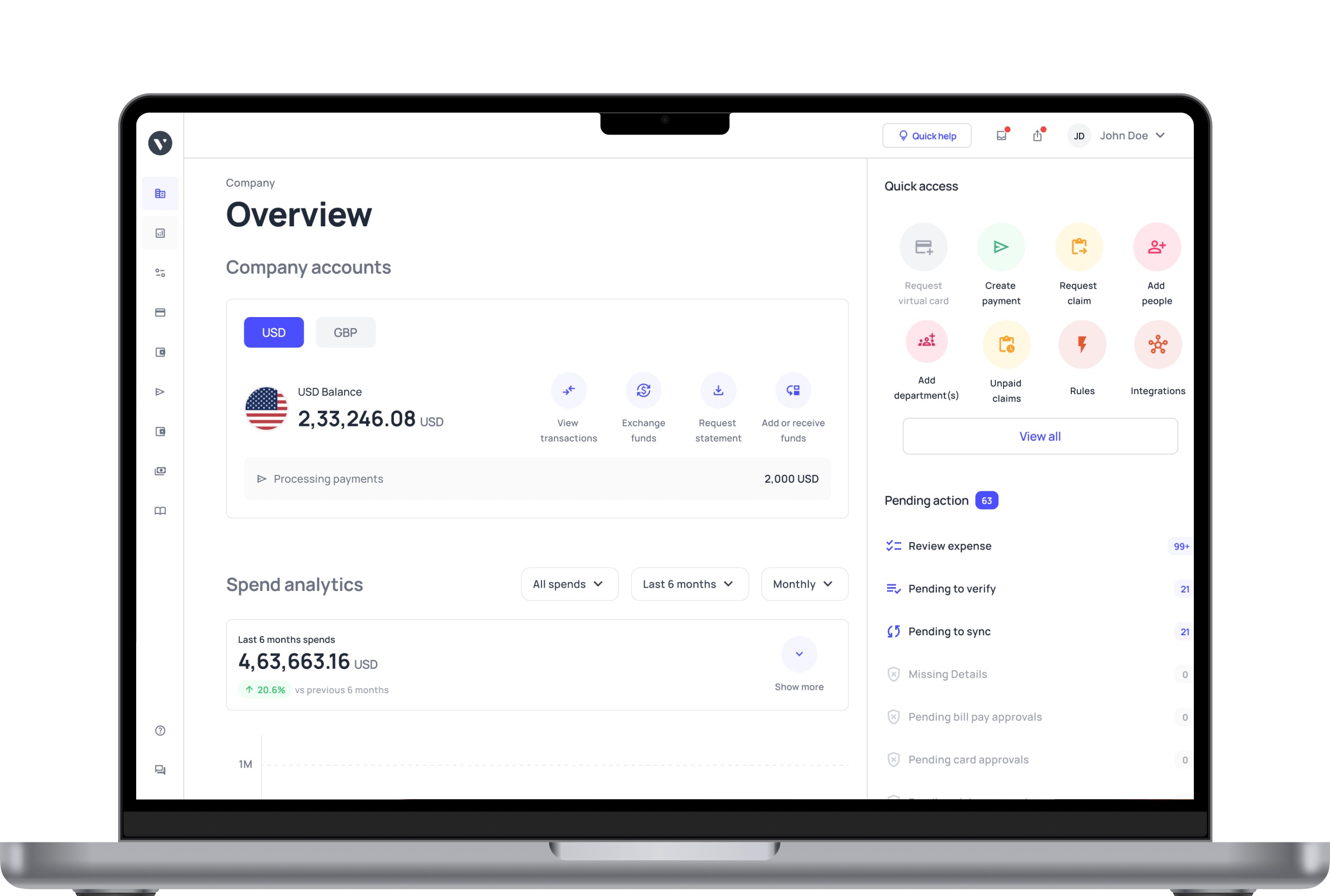

1. Volopay

Key features

Volopay combines smart corporate cards, automated workflows, and seamless integrations to simplify expense tracking. It functions as an automated business expense tracker, offering real-time visibility into company spending.

You can manage reimbursements, set spending limits, and sync data with accounting tools. Volopay’s automation ensures accuracy, compliance, and faster financial reporting across departments and teams.

Pros

You gain complete control over business spending with real-time insights and automated reporting. The platform’s integrations with major accounting tools reduce reconciliation time.

Its prepaid corporate cards simplify employee expenses while maintaining policy compliance, making Volopay a powerful all-in-one platform for modern business expense management and financial transparency.

Cons

Volopay’s advanced automation and corporate card features may feel overwhelming for very small businesses with limited expense activity.

Some users may face an initial learning curve when setting up multi-level approval workflows or integrating multiple accounting platforms within the first few weeks of implementation.

Best suited for

Ideal for startups and mid-sized businesses seeking automated expense tracking with integrated cards and multi-level approval workflows.

2. Wave

Key features

Wave offers free expense tracking, accounting, and invoicing for small businesses. Its intuitive interface allows you to upload receipts, categorize expenses, and track payments effortlessly.

The platform’s built-in reporting and budgeting tools help you stay on top of cash flow while simplifying compliance and year-end tax preparation efficiently.

Pros

You benefit from a cost-effective, easy-to-use expense tracking system designed for freelancers and small teams. The seamless connection with Wave’s accounting suite ensures smooth bookkeeping and faster reconciliations.

Its mobile access and automated categorization make daily expense management simple, reducing administrative time and manual entry errors significantly.

Cons

Wave’s limited scalability and lack of advanced automation features make it unsuitable for larger organizations. It doesn’t offer corporate cards or complex approval workflows, restricting its use for businesses requiring deeper visibility and control over multiple cost centers or global expense management operations.

Best suited for

Best for freelancers and small business owners needing a simple, free expense tracking and accounting solution.

3. SAP Concur Expense

Key features

SAP Concur Expense automates travel and expense management through smart integrations, mobile accessibility, and policy enforcement. You can capture receipts digitally, approve expenses instantly, and sync with accounting systems.

Its analytics dashboard gives you complete visibility into employee spending, helping you streamline reimbursements, ensure compliance, and improve financial decision-making efficiently.

Pros

You benefit from comprehensive automation that minimizes manual work and ensures compliance. Its scalability suits large enterprises managing global expenses.

The mobile app enhances convenience for traveling employees, while real-time reporting improves accuracy and financial transparency across departments, enabling faster approvals and simplified audit readiness.

Cons

Implementation and customization can be complex for smaller organizations. The interface may feel dated compared to newer platforms, and users often report higher subscription costs.

Occasional syncing delays with accounting software or travel booking systems may disrupt workflow consistency during high-volume expense submission periods.

Best suited for

Best for large enterprises managing global travel and expense operations requiring compliance and scalability.

4. Expensify

Key features

Expensify simplifies expense reporting through receipt scanning, mileage tracking, and automated categorization. You can capture expenses using the mobile app, which syncs instantly with accounting platforms.

The software offers card integrations, multi-policy approvals, and reimbursement automation, making it ideal for businesses seeking a flexible and reliable expense management experience.

Pros

You’ll appreciate Expensify’s user-friendly design and fast receipt scanning feature. Its automation minimizes manual entry, and real-time syncing ensures up-to-date expense data.

The solution integrates smoothly with accounting software, simplifying reconciliation and reporting, while built-in compliance checks maintain spending accuracy across multiple departments and policy rules.

Cons

Expensify’s advanced plans can be expensive for smaller teams. Some users experience occasional syncing delays and limited customization in approval workflows.

Customer support response times can vary, especially during high-traffic periods, which may cause minor interruptions in expense reporting and reimbursement management efficiency.

Best suited for

Ideal for small to mid-sized businesses seeking flexible, automated expense management with mobile accessibility.

5. Ramp

Key features

Ramp combines smart corporate cards, automated expense categorization, and powerful analytics for full visibility into company spending.

You can track expenses in real time, set spending limits, and integrate data directly into accounting tools. The platform’s automation eliminates manual reporting, helping you reduce waste and optimize company budgets effectively.

Pros

You gain instant visibility into all spending with automated categorization and reporting. Ramp’s real-time insights help identify savings opportunities quickly.

The platform simplifies employee expense submissions, enhances approval accuracy, and integrates seamlessly with accounting systems, allowing you to maintain tighter budget control across departments and cost centers efficiently.

Cons

Ramp’s focus on automation may feel unnecessary for very small teams. Its card-based system limits usability for companies without dedicated employee spend programs.

Some users may face integration setup challenges initially, particularly when connecting with less common financial software tools or custom-built ERP systems.

Best suited for

Perfect for growing startups and enterprises seeking automation-driven spend visibility and real-time insights.

6. QuickBooks Online

Key features

QuickBooks Online offers integrated expense tracking, invoicing, and accounting within one platform. You can link bank accounts, categorize transactions automatically, and manage reimbursements efficiently.

Its mobile app lets you capture receipts and monitor spending from anywhere. The system ensures accuracy, real-time updates, and simplified tax preparation for business owners.

Pros

You benefit from an all-in-one accounting and expense management solution. The automation saves time on manual data entry, while customizable reports enhance financial decision-making.

Its widespread compatibility with third-party tools and strong cloud-based performance make daily financial management smoother and more reliable for business operations.

Cons

Advanced features may be overwhelming for beginners. Subscription costs increase with team size and additional modules. Occasional syncing issues or slower processing during heavy data loads can affect efficiency, especially when managing high transaction volumes or multiple business accounts simultaneously across departments.

Best suited for

Ideal for small to mid-sized businesses needing integrated accounting and expense tracking in one platform.

7. Brex

Key features

Brex offers corporate cards, expense tracking, and real-time analytics in a single platform. You can automate approvals, monitor budgets, and sync transactions with accounting software.

Its AI-powered insights help you control spending efficiently while maintaining compliance. Brex also supports multi-currency transactions, making it ideal for globally operating businesses.

Pros

You gain powerful automation, centralized visibility, and seamless integrations with accounting tools. Brex’s smart controls simplify reimbursements, manage budgets, and reduce administrative effort.

The platform’s advanced analytics and mobile accessibility provide actionable insights, helping you improve financial efficiency and maintain better oversight of company-wide spending activities in real time.

Cons

Brex’s eligibility requirements may restrict smaller startups. Some users find its advanced analytics features complex initially. Integration customization can take time for non-standard workflows, and certain reporting options may require upgrades, which could limit affordability for small organizations seeking simpler expense management capabilities and tighter budget control.

Best suited for

Perfect for fast-growing startups and global companies seeking automated, analytics-driven expense management.

8. Zoho Expense

Key features

Zoho Expense streamlines expense reporting through automation, receipt scanning, and mileage tracking. You can set multi-level approvals, enforce spending policies, and integrate seamlessly with Zoho Books or other accounting software.

The mobile app enables easy expense capture, while real-time tracking ensures compliance and visibility across departments and business entities.

Pros

You benefit from a cost-effective, user-friendly tool with robust automation and flexible integrations. Zoho’s real-time policy enforcement ensures compliance, while detailed reporting improves budgeting accuracy.

Its mobile accessibility and cloud storage simplify recordkeeping, providing small businesses with an affordable yet scalable expense management solution that enhances operational efficiency.

Cons

Zoho Expense’s customization options may feel limited for enterprises with complex workflows. Integration with non-Zoho accounting systems may require additional configuration.

Some users report occasional delays in syncing transactions and approvals, particularly during peak usage or when managing multi-entity financial data across multiple departments simultaneously.

Best suited for

Best for small to mid-sized businesses seeking affordable, automated expense reporting with compliance tracking.

9. Emburse

Key features

Emburse simplifies business spending through corporate cards, automated reimbursements, and policy compliance tools. You can capture receipts digitally, categorize expenses automatically, and track spending in real time.

Its advanced approval workflows and analytics provide better control over budgets, helping you manage company finances efficiently and reduce compliance risks significantly.

Pros

You benefit from automated reporting, intuitive design, and flexible approval controls. Emburse integrates seamlessly with accounting systems, reducing manual data entry.

The platform’s real-time analytics enhance budget visibility, while its mobile access ensures smooth expense submission and approval processes for teams working remotely or across departments.

Cons

Emburse’s pricing can be higher for smaller teams. Some users report occasional syncing delays with third-party accounting platforms. Advanced analytics and policy configuration options may require training, making onboarding slightly time-consuming for businesses with limited internal accounting or administrative resources initially.

Best suited for

Ideal for mid-sized businesses needing flexible, automated expense management and policy compliance.

10. Airbase by Paylocity

Key features

Airbase by Paylocity unifies expense management, bill payments, and corporate cards into one automated platform. You can track all company expenses in real time, set spending limits, and manage reimbursements seamlessly.

The system integrates with major accounting software, ensuring compliance and transparency while improving spend control and operational efficiency.

Pros

You gain centralized visibility into all company spending with automated reporting and policy enforcement. Airbase simplifies approvals, reduces manual work, and provides real-time analytics.

Its integration with Paylocity’s payroll tools enhances financial accuracy, enabling streamlined expense management for growing organizations managing complex or distributed financial operations.

Cons

Airbase’s advanced features and integrations may be overwhelming for small businesses. Pricing can be higher compared to simpler tools, and customization might require additional setup time.

Some users experience a learning curve when managing multiple workflows or connecting custom accounting systems for the first time.

Best suited for

Best for mid-sized to large businesses seeking unified expense and spend management automation.

11. FreshBooks

Key features

FreshBooks combines expense tracking, invoicing, and accounting in one easy-to-use platform. You can connect bank accounts, capture receipts, and categorize expenses automatically.

Its real-time dashboards show cash flow and spending trends clearly. FreshBooks also simplifies tax preparation by organizing deductible expenses, ensuring accuracy and compliance throughout your financial processes.

Pros

You enjoy an intuitive interface ideal for freelancers and small teams. Automated expense categorization and invoice management save time, while mobile accessibility enables expense tracking on the go.

The system’s built-in reports enhance financial visibility, helping you make smarter business decisions with greater confidence and precision daily.

Cons

FreshBooks offers limited scalability for larger companies with complex accounting needs. Advanced features like inventory tracking or multi-user permissions require higher-tier plans.

Some users experience delays during data synchronization, particularly when managing multiple clients or high transaction volumes across different financial categories simultaneously each month.

Best suited for

Perfect for freelancers and small businesses seeking simple, integrated accounting and expense tracking.

12. Rydoo

Key features

Rydoo automates expense reporting, mileage tracking, and policy enforcement through an intuitive platform. You can upload receipts, approve expenses instantly, and integrate data with accounting or ERP systems.

Real-time analytics improve visibility into company spending, while mobile accessibility allows quick submission and management of expenses from anywhere easily.

Pros

You benefit from real-time expense visibility and seamless automation. Rydoo’s intuitive mobile app simplifies approvals, while automatic policy enforcement ensures compliance.

The software’s integration with major accounting systems minimizes manual work, allowing smoother operations and faster reimbursements across teams, departments, and global business locations effectively and efficiently.

Cons

Rydoo’s pricing may be higher for smaller organizations. Some users face a learning curve when customizing workflows or using advanced analytics features.

Occasional sync delays with external accounting tools can occur, particularly during bulk data uploads or complex, multi-department expense reporting cycles in large enterprises.

Best suited for

Best for mid-sized and global businesses needing automated, policy-driven expense management.

13. Shoeboxed

Key features

Shoeboxed simplifies expense management through receipt scanning, expense categorization, and mileage tracking. You can mail physical receipts for digital conversion or upload them via the mobile app.

The platform automatically extracts key details, organizes expenses, and generates IRS-accepted reports, making it ideal for tax preparation and audit-ready documentation.

Pros

You save time by automating receipt management and expense categorization. Shoeboxed’s digital storage ensures all records remain secure and easily accessible.

Its mileage tracker enhances accuracy, while integration with accounting tools simplifies financial organization, helping you stay compliant and eliminate manual paperwork from your expense management process.

Cons

Shoeboxed’s manual receipt mailing feature can slow processing times. Its mobile app may lack some advanced automation found in newer tools.

Subscription costs increase with higher document volume, which might make it less cost-effective for businesses managing large-scale expense reporting regularly each month or quarter.

Best suited for

Ideal for freelancers and small businesses focused on receipt and mileage tracking.

14. Everlance

Key features

Everlance specializes in mileage and expense tracking for self-employed professionals and mobile teams. You can automatically track trips via GPS, categorize business expenses, and export IRS-compliant reports.

The app provides real-time reimbursement tracking, cloud synchronization, and integration with accounting systems, helping you maintain accurate, paperless financial records effortlessly.

Pros

You benefit from effortless mileage tracking with precise GPS automation. Everlance’s intuitive app simplifies expense recording, ensuring compliance with tax standards.

Its reporting and reimbursement features save time, while automatic syncing with bank accounts keeps your financial data current and easily accessible for audits or tax filing.

Cons

Everlance’s focus on mileage tracking limits advanced expense management capabilities. Its features may not suit large organizations with complex workflows.

Some users report GPS inaccuracy in low-signal areas and slower sync speeds during high activity, especially when tracking multiple simultaneous trips or reimbursements daily.

Best suited for

Perfect for freelancers and remote workers needing reliable mileage and expense tracking.

15. Fyle

Key features

Fyle automates expense management by integrating directly with email, credit cards, and accounting software. You can submit receipts instantly, categorize expenses automatically, and monitor spending in real time.

The platform’s AI-driven system enforces policies, simplifies audits, and accelerates reimbursements, helping you streamline financial operations efficiently across all business departments.

Pros

You gain seamless expense tracking through email and card integrations. Fyle’s AI automation reduces manual entry, while real-time policy checks ensure compliance.

The intuitive dashboard improves financial visibility, and mobile access allows employees to record and approve expenses quickly from anywhere, improving accuracy and reducing administrative workload.

Cons

Fyle’s pricing may be high for smaller teams with basic needs. Initial setup and integration with custom accounting systems can take time.

Some users report occasional delays during bulk expense submissions or multi-departmental report syncing, particularly in organizations managing large volumes of employee reimbursements monthly.

Best suited for

Ideal for mid-sized businesses seeking AI-driven expense automation with real-time compliance.

16. Payhawk

Key features

Payhawk combines corporate cards, expense tracking, and invoice management in one unified platform. You can automate data capture, enforce spending policies, and integrate with ERP systems for real-time visibility.

The system supports multi-currency payments, enabling global teams to manage expenses efficiently while maintaining compliance and simplifying financial workflows company-wide.

Pros

You benefit from comprehensive spend control and seamless accounting integration. Payhawk’s automation minimizes errors and manual entry.

Its corporate cards with built-in limits simplify employee spending, while multi-currency support makes international expense management smooth, enhancing global financial transparency and accountability across departments and entities.

Cons

Payhawk’s enterprise-level features may exceed smaller companies’ requirements. Subscription pricing can be high for startups. Some users note minor delays during international transaction syncing and limited customization in reporting, especially when managing region-specific tax or compliance needs across multiple global business locations.

Best suited for

Best for global enterprises seeking unified card-based expense and invoice management.

Why businesses need more than just basic expense tracking

1. Turning expense data into insights

Modern tools like business expense trackers transform raw expense data into actionable insights. You can analyze spending trends, vendor performance, and team-specific costs to identify inefficiencies.

For instance, spotting duplicate subscriptions or inflated travel expenses helps you reallocate budgets effectively, optimize workflows, and strengthen long-term operational efficiency across departments.

2. Reducing audit risk with compliance

Using advanced expense tracker apps for business ensures every transaction meets company and regulatory standards. Automated policy checks flag out-of-policy expenses instantly, reducing audit risks.

For example, automated receipts and digital trails simplify audits, ensuring your business maintains accuracy, transparency, and compliance with internal and external financial regulations efficiently.

3. Enabling smarter budgets & forecasts

An automated business expense tracker provides real-time visibility that drives data-backed decisions. You can forecast budgets based on live expense patterns, improving financial predictability.

For example, automatic categorization of expenses reveals spending trends, helping you plan cash flow better, set realistic departmental limits, and achieve higher financial control and stability.

Centralizing your business expenses before implementation

Consolidating all corporate payment channels

Before adopting the best business expense tracking apps, centralize all payment accounts. Previously, teams used separate platforms for cards, reimbursements, and bills.

After consolidation, all data was synced into one dashboard, reducing reconciliation time by as much as 40% and eliminating confusion about duplicate or missing transactions across business payment channels effectively.

Integrating bank feeds and virtual card providers

Centralizing financial data simplifies monitoring. Earlier, the managers used to download the financial statements from multiple banks manually.

After integrating virtual card and bank feeds, transactions synced automatically into one ledger, cutting administrative hours by up to 30% and ensuring every expense appeared instantly, helping finance teams maintain complete real-time visibility and reporting accuracy.

Capturing invoice data from accounts payable systems

Linking AP systems to your expense platform prevents double entries. Initially, invoices were uploaded manually, leading to delays and mismatched payments.

Once integrated, invoice data flowed automatically, reconciling faster and improving accuracy. This integration reduced manual entry time by as much as 35%, streamlining reporting and boosting vendor payment efficiency across departments.

Syncing employee reimbursements and petty cash accounts

Previously, employees tracked reimbursements separately, creating inconsistent records. After centralizing reimbursements and petty cash within one platform, all expenses are updated automatically.

This reduced spreadsheet errors, cut significant reconciliation time, and ensured reimbursement requests followed the same approval flow, improving financial accuracy and employee satisfaction significantly.

Establishing a unified data format and approval flow

Earlier, departments used different templates for approvals and expense reporting. After implementing a unified data structure, all expense records followed the same format and workflow.

This alignment reduced back-and-forth communication, shortened approval timelines by up to 40%, and ensured consistent, policy-compliant data ready for audits and real-time reporting.

Building a strong business expense policy framework

1. Defining clear spending categories and limits

You should start by clearly defining spending categories such as travel, meals, and office supplies. Assign limits to each based on department size and budget priorities.

This structure prevents overspending, simplifies reporting, and allows your finance team to monitor spending trends while promoting accountability and consistent expense management practices.

2. Setting approval hierarchies and escalation rules

Establish a transparent approval hierarchy to maintain control over company expenses. Assign roles such as managers, finance leads, and executives for progressive authorization.

Include escalation rules for exceptions or urgent approvals. This layered system reduces bottlenecks, strengthens compliance, and ensures every expense is reviewed by the right authority.

3. Creating digital policy documents for employees

Transform traditional policy manuals into easily accessible digital formats. Host them on your internal portal or expense management platform for quick reference.

This ensures employees understand spending rules, reduces policy violations, and encourages compliance. Real-time updates keep guidelines current, fostering clarity and accountability across all business functions and teams.

4. Ensuring policy alignment with tax and compliance standards

Regularly review and update expense policies to match evolving tax codes and financial regulations. Aligning internal processes with compliance requirements prevents penalties and ensures audit readiness.

Standardized documentation and digital audit trails help your business maintain transparency, supporting long-term credibility and trust with regulatory bodies and stakeholders.

Transitioning from evaluation to implementation

Aligning platform capabilities with business goals

Before implementation, confirm that your chosen expense management platform supports your strategic objectives. Ensure it offers automation, analytics, and scalability aligned with your financial goals.

This alignment helps maximize efficiency, minimize manual intervention, and ensure technology supports measurable business growth and operational consistency across departments effectively.

Defining implementation scope and timeline

Outline a clear project scope detailing which departments, payment systems, and expense categories will transition first. Set a timeline with realistic milestones for testing, onboarding, and full deployment.

A structured schedule ensures smoother adoption, minimizes workflow disruptions, and provides accountability throughout the implementation process for measurable success.

Preparing teams for process change

Prepare employees through training sessions and step-by-step onboarding guides. Explain how the new system simplifies submissions, approvals, and reporting. Address concerns early to ensure user adoption.

Well-informed teams adapt faster, use the system effectively, and help achieve smooth transitions with minimal productivity loss during implementation and operational change.

Establishing success metrics and KPIs

Define measurable success indicators such as approval time reduction, expense accuracy, and compliance rate. Track progress regularly to assess impact.

Setting KPIs helps identify improvement areas and ensures your expense management system delivers measurable value, improving financial transparency and overall process efficiency across the organization continuously.

Technical checklist: Data migration, cleaning, and mapping for business expense tracking software

Auditing and cleansing legacy data

You should begin by reviewing historical financial data for duplicates, inconsistencies, and outdated entries. Remove redundant records, correct categorization errors, and standardize formats.

This ensures clean, reliable data enters your new expense tracking software, preventing reconciliation issues and improving the accuracy of expense reports and overall financial analysis later.

Establishing clear data field mapping between systems

Identify every relevant data field, such as expense category, vendor name, and payment date. Carefully map each field from your legacy system to its counterpart in the new expense management platform.

Proper and detailed mapping ensures seamless migration, eliminates missing or duplicate data, and maintains integrity across all transaction records for smooth ongoing business operations.

Testing the API/integration connection and data flow

Before going live, test your system’s API connections to confirm secure, real-time data exchange between applications. Validate synchronization accuracy across expense categories, payments, and reimbursements.

This proactive testing ensures stable integrations, prevents data loss, and guarantees continuous workflow automation without technical disruptions during or after deployment.

How to organize your business expenses efficiently across accounts and tools

1. Defining chart of accounts and cost centers

Establish a structured chart of accounts aligned with your financial reporting framework. Assign cost centers to departments, projects, or teams to track spending at granular levels.

This organization simplifies analysis, supports budget control, and enables clearer visibility into business expense allocation across the entire company structure.

2. Streamlining vendor invoice and bill pay systems

Unify vendor invoicing and bill payment workflows into a single, centralized platform. This reduces duplicate entries and payment delays while improving transparency.

By digitizing invoice approvals and automating reminders, you ensure accurate payments, maintain vendor relationships, and strengthen overall financial efficiency across your expense management ecosystem effectively.

3. Mapping tax and regulatory requirements by geography

If your company operates across regions, align expense categories with local tax laws and compliance requirements. Create location-specific rules for VAT, GST, or sales tax reporting.

This ensures consistent tax treatment across geographies, reduces compliance risks, and simplifies audits, improving regulatory accuracy and operational consistency globally.

4. Standardizing receipt requirements and digital formats

Define clear rules for receipt submission, including acceptable formats, file sizes, and image clarity. Standardization ensures every expense entry includes compliant documentation.

Encouraging digital receipt uploads through your expense platform reduces paper handling, enhances traceability, and simplifies audit preparation by keeping records accessible and properly organized.

5. Setting up default categorization logic

Implement automation rules that categorize transactions based on vendor type, department, or spending purpose. Default categorization reduces manual data entry errors, accelerates reporting, and ensures uniform classification across all expenses. This logical setup enhances visibility, accuracy, and control within your centralized expense tracking system from day one.

Essential features every modern expense tracker should have

Mobile capture and multi-device accessibility

You should choose a business expense tracker app that lets employees upload receipts, record mileage, and submit claims directly from mobile devices. Multi-device compatibility ensures access anywhere, streamlining workflows for hybrid teams.

This convenience accelerates reimbursements and gives finance teams real-time visibility into spending patterns without manual consolidation delays.

Intelligent receipt/OCR scanning & categorization

An automated scanning feature reads receipts instantly using optical character recognition (OCR) and assigns categories automatically. You save time while minimizing errors caused by manual entry.

This intelligent categorization in the best business expense tracking apps improves accuracy, compliance, and efficiency, making expense submission faster and stress-free for employees.

Integration with accounting, banking, and ERP systems

Your expense tracking software should integrate seamlessly with accounting tools, bank feeds, and ERP systems. These integrations synchronize expense data, automate journal entries, and eliminate duplicate work.

A well-connected platform enables real-time visibility into financial health, making expense management effortless across departments and financial systems simultaneously.

Role-based access, spend controls, and policy engines

Modern systems let you define permissions by role, department, or seniority, ensuring only authorized users can approve or modify data. Built-in spend controls and policy engines automatically flag violations, keeping expenditures within limits.

This configuration protects your financial integrity, enhances data accuracy, and simplifies compliance with internal and external spending regulations effortlessly.

Data analytics, dashboards, and spend forecasting

You gain valuable insights through visual dashboards and real-time analytics that track expenses across departments, vendors, and categories. Predictive forecasting tools identify trends and optimize budgets.

Advanced analytics in business expense tracker apps help you make informed financial decisions, manage cash flow, and uncover opportunities for strategic cost savings.

Multi-currency and cross-border support

If your organization operates globally, multi-currency capabilities are vital. These allow automatic conversion and consistent reporting across geographies.

Integrated exchange rate updates and international policy support ensure accuracy, enabling finance teams to manage cross-border transactions efficiently and maintain compliance with global accounting standards seamlessly.

Regulatory compliance and audit trail management in expense tracking

Ensuring data security and retention compliance

Your business expense tracking system should use encryption, secure cloud storage, and user authentication to protect sensitive financial information.

Retention schedules must comply with SOX, GDPR, and other regional data laws. These safeguards ensure your company meets legal standards and maintains long-term data integrity for audits.

Establishing clear and traceable audit trails

Audit trails record every transaction, modification, and approval within your expense management platform. Access logs, version histories, and timestamped actions create transparency.

This traceability helps you verify compliance, detect irregularities early, and maintain a verifiable record for both internal reviews and external financial audits effortlessly.

Meeting global financial reporting standards (GAAP, IFRS, SOC 2)

Modern expense systems automatically align data classification and reporting with standards like GAAP, IFRS, and SOC 2. You can ensure consistent accounting treatment across entities and simplify external audits.

This standardization improves accuracy, strengthens credibility, and supports cross-border financial consolidation under recognized international frameworks.

Detecting and preventing expense fraud proactively

Built-in fraud detection algorithms monitor transactions in real time, flagging anomalies or duplicate entries. You can configure alerts for suspicious claims and enforce segregation of duties to reduce manipulation risks.

These proactive controls enhance accountability, transparency, and trust within your organization’s expense management framework effectively.

How to choose the right expense tracker for your business

Selecting the right expense tracker helps you align its features with your company’s financial goals. When considering features to look for in a business expense tracker, ensure the tool supports scalability, automation, and compliance for future growth. The best expense tracking apps offer flexibility, accuracy, and real-time insights for long-term financial control.

1. Match platform size with your spend volume and user count

You should choose a platform that fits your business size and transaction volume. Scalable trackers can support expanding teams, growing budgets, and multiple departments without slowing performance or increasing manual work. Matching capacity ensures smooth functionality and reliable reporting as your business scales over time.

2. Prioritize ease of use and employee adoption

An expense tracker is only effective when your employees use it consistently. Choose a solution with an intuitive interface, mobile accessibility, and guided workflows.

This encourages quick adoption, reduces training needs, and ensures everyone submits accurate expense data on time without relying on manual entry or reminders.

3. Check integration capacity and future scalability

Select an expense tracker that connects easily with your accounting, payroll, and ERP systems. A platform with open APIs supports automation and minimizes data silos.

You can future-proof your system by ensuring that it scales with new software, departments, and global operations as your business grows.

4. Evaluate pricing models and total cost of ownership

Look beyond subscription fees and compare the overall cost of implementation, integration, and maintenance. The most suitable expense tracker delivers measurable ROI by cutting manual hours and preventing compliance errors. You should evaluate flexible plans that align with your budget and expected transaction volume effectively.

5. Assess security, compliance, and data sovereignty

Your expense tracker should safeguard financial data through encryption, access control, and regional compliance. Check that the platform meets standards like SOC 2 and GDPR.

Data sovereignty ensures records remain protected within approved jurisdictions, providing you with the confidence to maintain transparency and regulatory compliance across your organization.

Common business expense tracking challenges and solutions

Benefits of using a business expense tracker

Enhanced cost control and spend visibility

Using expense tracker apps for business allows you to monitor every transaction as it occurs. Automation centralizes spending data, highlights spending patterns, and flags cost anomalies.

This real-time transparency helps you manage budgets proactively, prevent overspending, and ensure that company resources are allocated efficiently across departments and projects.

Reduced reimbursement turnaround time

Automated expense trackers accelerate reimbursement cycles by eliminating manual verification steps. Employees can submit expenses with attached receipts instantly, while finance teams approve requests faster through pre-set workflows.

This speed ensures employees get reimbursed promptly, improving satisfaction, maintaining trust, and reducing administrative backlog for finance departments handling high transaction volumes.

Improved policy compliance and audit readiness

Modern expense trackers automatically apply policy checks before approval, preventing non-compliant or duplicate submissions. Every transaction is recorded with timestamps, receipts, and approver details.

These audit-ready records simplify compliance reporting, reduce risk exposure, and ensure adherence to both internal financial policies and external regulatory standards effortlessly.

Real-time financial insights for decision-making

With automated data collection, you gain real-time access to categorized spend reports and trend analytics. These insights help you forecast expenses, compare department performance, and adjust strategies promptly.

Decision-makers can act on accurate, up-to-date information, improving operational agility and aligning financial goals with evolving business objectives.

Strengthened cash flow and budget accuracy

Expense trackers streamline cash flow management by syncing actual and projected spend. Automated categorization prevents unnoticed leaks and optimizes fund allocation.

You can track pending reimbursements and vendor payments precisely, ensuring budgets remain accurate and aligned with your company’s financial health, strategic priorities, and forecasting goals.

Best practices for maximizing efficiency with your expense tracker

Optimizing your expense tracker’s performance requires establishing automation-friendly practices and promoting employee engagement. You should align tracking rules with company policies, review data quality consistently, and ensure workflows remain scalable.

These best practices help you extract maximum value from automation, improving visibility, compliance, and overall financial control effortlessly.

1. Real-time policy enforcement at the point of spend

Enable automated checks at transaction initiation to prevent policy violations early. By enforcing limits, categories, and approval rules in real time, you reduce compliance errors and administrative rework.

This proactive enforcement ensures consistency across teams while maintaining transparency throughout the spending lifecycle from submission to reconciliation.

2. Enforce the 'snap, submit, and forget' cultural standard

Encourage employees to capture receipts instantly using their mobile devices. When submission becomes an automatic habit, expense management stays up to date without reminders.

This culture of instant documentation reduces missing receipts, accelerates approval processes, and creates accurate, complete financial records with minimal effort from employees.

3. Standardize and simplify the chart of accounts mapping

Define uniform categories and cost centers that align with your accounting framework. Simplifying account mapping minimizes confusion, ensures consistent expense categorization, and improves reporting accuracy.

With standardized mapping, you can consolidate data seamlessly across systems, supporting effortless financial integration and cross-departmental budget visibility over time.

4. Schedule quarterly reviews for budget and policy synchronization

Conduct quarterly reviews to align expense policies and budgets with evolving company goals. These sessions help you adjust spending limits, update approval hierarchies, and evaluate workflow efficiency.

Regular policy audits ensure your expense tracking system continues to reflect current operational priorities and regulatory compliance requirements effectively.

5. Implement an audit-by-exception only workflow

Adopt a review process focused only on anomalies and flagged expenses. Automation handles compliant transactions, freeing finance teams from unnecessary manual checks.

This exception-based approach reduces administrative workload, accelerates reimbursements, and enhances compliance monitoring, allowing auditors to focus on high-risk or irregular financial activities efficiently.

Key metrics to measure your expense tracker’s impact

Time per expense report and approval cycle

Track the total time taken from expense submission to final approval to gauge efficiency improvements. Shorter processing times indicate streamlined workflows, fewer manual touchpoints, and higher productivity.

By continuously monitoring this metric, you can identify bottlenecks, optimize approval hierarchies, and ensure faster reimbursements without compromising compliance or accuracy.

Rate of policy violations or non-compliant spend

Measure the percentage of expenses flagged for policy violations or unapproved categories. A lower violation rate demonstrates stronger policy adherence and effective automation.

Tracking this metric helps you assess how well employees follow spending rules, ensuring reduced audit risks, improved accountability, and long-term compliance with internal financial standards.

Percentage of expenses captured and reconciled automatically

Monitor how many expenses are automatically categorized and reconciled without manual input. A higher percentage signifies advanced automation and system reliability.

This metric helps you understand efficiency gains, data accuracy, and the level of integration between your expense tracker, accounting tools, and corporate card management platforms.

Employee satisfaction/reimbursement turnaround time

Evaluate employee feedback on the ease and speed of reimbursement processes. Quick reimbursements lead to better morale, increased adoption of digital tools, and reduced frustration.

This metric bridges finance efficiency with employee experience, showcasing how automation positively impacts workplace satisfaction and overall operational productivity within your organization.

Leveraging automation and AI in expense tracking

1. AI-powered receipt scanning and categorization

Modern expense trackers use AI to read receipts, extract key details, and automatically categorize transactions. This eliminates manual data entry errors and accelerates processing.

You gain cleaner, structured data that improves reporting accuracy while freeing employees and finance teams from repetitive administrative tasks in real time.

2. Predictive budgeting and spend forecasting

AI-driven analytics predict future expenses based on past spending behavior, vendor trends, and seasonal fluctuations. This predictive insight helps you make informed financial decisions, allocate budgets effectively, and prevent overspending.

By proactively planning, you maintain greater financial stability and adapt swiftly to changing operational or market conditions.

3. Proactive fraud detection and anomaly alerts

AI algorithms analyze expense data continuously to identify unusual or duplicate transactions. Automated anomaly alerts allow you to act quickly on potential fraud cases.

This proactive monitoring enhances data security, prevents financial leakage, and strengthens trust in your expense tracking system’s integrity and overall governance controls.

4. Intelligent recommendations for cost savings

AI systems analyze historical data to uncover saving opportunities, such as vendor negotiations or policy adjustments. These intelligent recommendations empower you to optimize budgets and reduce unnecessary spend.

Over time, automation learns from patterns, suggesting smarter, data-backed strategies that enhance cost efficiency and financial sustainability.

Scaling your expense tracking as your business grows

Adding new users and departments

As your company expands, you can easily onboard new employees and departments without operational delays. Configurable access controls, role-based permissions, and approval hierarchies ensure smooth scaling.

This flexibility allows consistent policy enforcement and visibility while maintaining accountability across multiple teams and departments as business structures become more complex.

Expanding integration with additional platforms

You can integrate your expense tracking system with more tools like CRM, ERP, or payroll platforms. Expanded integration simplifies data flow, eliminates duplication, and enhances accuracy.

By connecting all systems, you create a unified ecosystem that supports smooth collaboration, faster decision-making, and more efficient financial operations company-wide.

Managing multi-currency and international spend

When your business grows globally, managing multi-currency transactions becomes crucial. Automated currency conversion and localized compliance rules help you track spending accurately.

These capabilities allow you to manage expenses from various countries seamlessly, ensuring consistency, compliance, and transparency across all your international operations and financial reporting processes.

Upgrading to advanced features or enterprise plans

As your needs evolve, upgrading to advanced or enterprise plans ensures scalability and efficiency. You gain access to automation tools, analytics dashboards, and AI-based insights.

These capabilities empower you to handle higher transaction volumes, optimize reporting accuracy, and maintain control while supporting long-term business expansion seamlessly.

Automate your business expense management with Volopay

How Volopay simplifies expense tracking for U.S. businesses

Volopay helps you automate, track, and control every business expense efficiently. Designed for growing U.S. companies, it centralizes spending, enforces compliance, and improves financial visibility.

With real-time reporting, AI-powered categorization, and seamless integrations, you can streamline operations, eliminate manual errors, and enhance control over budgets across multiple departments.

Centralized control of payments and expenses

Volopay gives you a unified platform to manage all company expenses, from vendor payments to reimbursements. You can set budget limits, monitor spending patterns, and ensure real-time compliance.

This centralized control enhances transparency and eliminates inefficiencies by consolidating all financial transactions into one streamlined, easily accessible system.

Real-time expense visibility across teams

You gain full visibility into every transaction as it happens. Volopay’s real-time dashboard allows you to monitor spending by department, employee, or project.

This visibility enables proactive financial control, faster approvals, and better forecasting, ensuring that your company’s resources are used efficiently and aligned with strategic goals.

Automated receipt capture & reconciliation

With Volopay, receipts are automatically scanned, matched, and reconciled with corresponding transactions. This eliminates manual errors, accelerates month-end closing, and ensures audit-ready accuracy.

You can maintain cleaner financial records, simplify expense management, and save significant time while focusing on higher-value financial and operational priorities within your organization.

Smart corporate cards for instant control

Volopay’s smart corporate cards let you manage spending in real time. You can issue virtual or physical cards, set spending limits, and track transactions instantly.

This feature improves accountability, prevents overspending, and provides better control over team expenses while promoting a culture of responsible financial management.

Seamless integration with top accounting tools

Volopay integrates effortlessly with top accounting software like QuickBooks, NetSuite, and Xero. This synchronization ensures error-free data transfer, eliminates redundant manual entry, and speeds up reconciliation.

You can maintain accurate, up-to-date financial records while simplifying workflows and improving the accuracy of your company’s overall financial reporting.

Bring Volopay to your business

Get started now

FAQs about business expense trackers in the US

An automated expense tracker eliminates spreadsheets by using digital data capture, real-time syncing, and AI categorization. You save time, reduce human error, and gain instant visibility into company spending patterns and financial control.

Expense trackers enforce preset spending policies, approval workflows, and instant alerts for suspicious activity. You can monitor compliance automatically, preventing duplicate claims, unauthorized purchases, and policy breaches before reimbursement.

Yes, they use bank-grade encryption, role-based access, and two-factor authentication. You can ensure sensitive financial data remains protected while maintaining compliance with international privacy and data protection regulations.

Absolutely, small businesses gain faster approvals, reduced manual entry, and cost savings. You can streamline processes, improve cash flow, and make informed spending decisions with affordable, scalable expense tracker apps for business.

Volopay automates expense recording, approval routing, and reconciliation. You can manage budgets, track employee spending, and generate real-time reports for complete visibility, ensuring smooth financial operations and smarter decision-making.

Yes, Volopay uses AI to categorize transactions and reconcile expenses automatically. You can eliminate manual work, maintain accurate records, and close books faster with error-free reporting and built-in compliance.

Volopay provides real-time tracking, automation, and multi-level approval workflows. Unlike traditional tools, you gain instant visibility, control, and integration across all expense categories within one unified system.

Yes, employees can use Volopay’s mobile app to capture receipts instantly. You can submit, track, and approve expenses remotely, ensuring faster reimbursements and smoother operations from anywhere.

Volopay enforces real-time policy checks at submission. You can restrict non-compliant entries, set approval limits, and receive automated alerts for any violations, maintaining consistent adherence to company expense rules.

Yes, Volopay supports multi-currency and multi-entity tracking. You can manage global expenses seamlessly with automated conversions, localized reporting, and consolidated dashboards for accurate international financial management.