Volopay: Simplifying hospitality expense management in Australia

Overseeing expenses across a manufacturing operation requires handling raw material purchases, supplier invoices, equipment maintenance, fleet costs, utility bills, and employee reimbursements. Without consolidated visibility, you're monitoring spending across multiple systems, pursuing approvals through email chains, and uncovering budget overruns only when it's too late to intervene.

Manufacturing expense management turns this confusion into control. When you unify all spending onto a single platform, you gain real-time visibility into where every dollar travels, automate approval workflows that previously consumed days, and enforce spending policies that defend your already thin margins before expenses grow out of control. Every dollar you allocate to raw materials, machinery maintenance, or operational overhead directly influences your bottom line.

In an industry where profit margins often exist in single digits, overlooked spending can shift a profitable quarter into a loss. What you actually need is complete financial control from a single dashboard where you can observe pending supplier payments, examine departmental spending against budgets, and assess cost trends before they become problems.

Gain full visibility into all manufacturing expenses

You can't optimize costs you can't see. When supplier payments flow through accounts payable, employee expenses get reimbursed through HR, and operational bills land in different systems, you're making financial decisions with incomplete information.

Volopay's unified expense management gives you a single source of truth for all spending. You see raw material purchases alongside utility bills, fleet expenses next to employee reimbursements, and contractor payments in the same view as equipment leases.

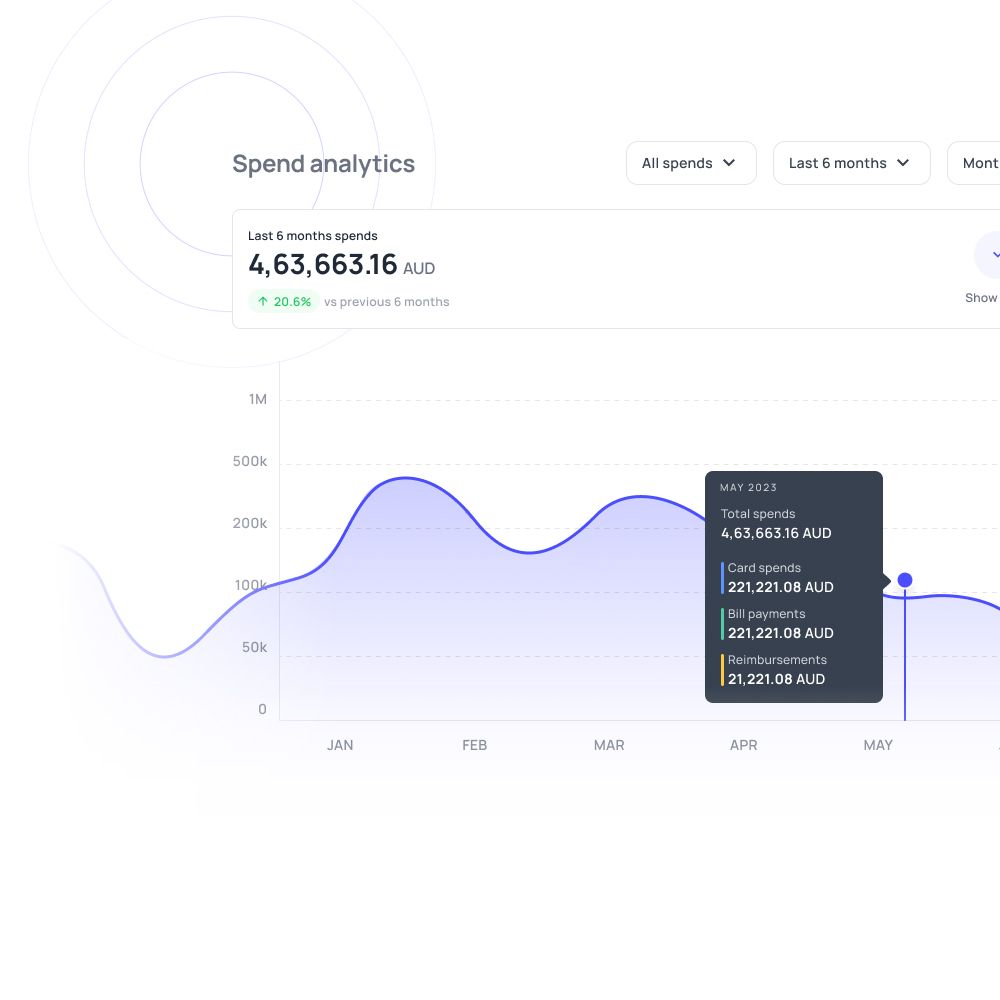

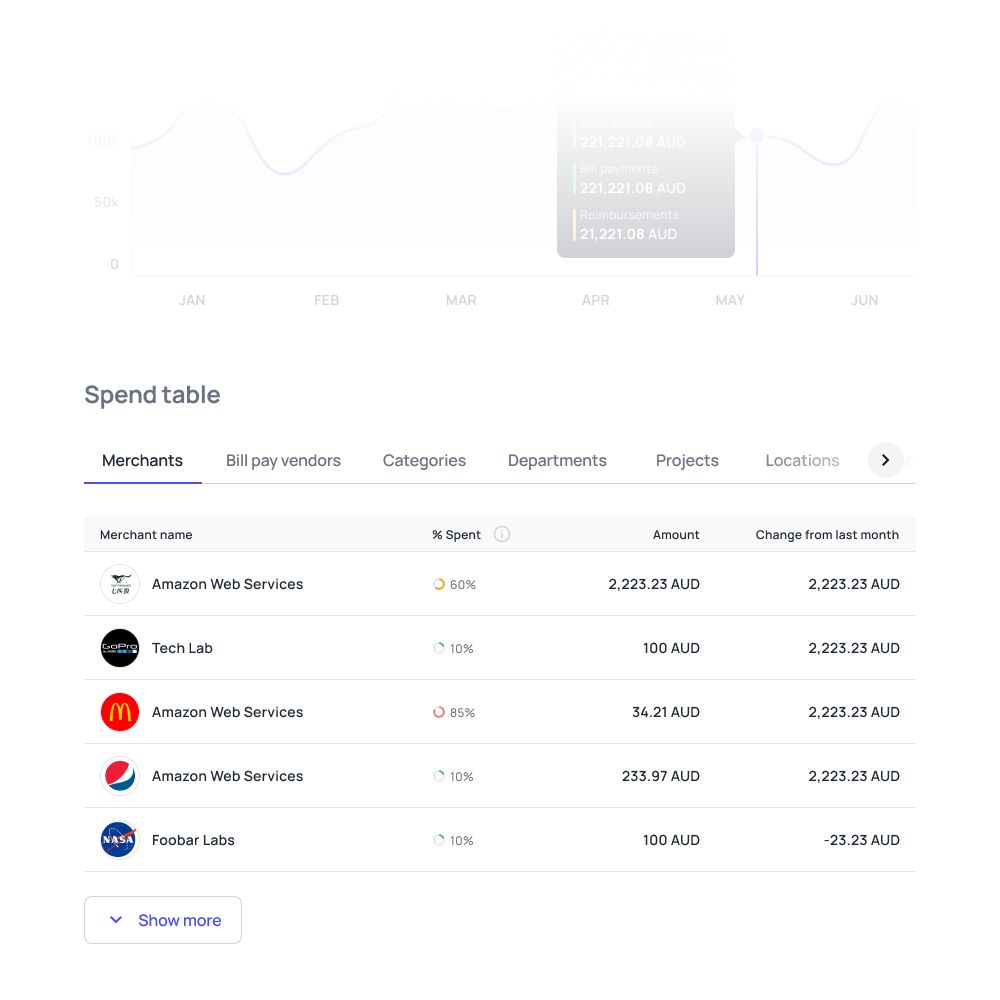

Real-time dashboards show department-level spending, category breakdowns, and budget utilization without waiting for month-end reconciliation. You can track spending by cost center, project, or production line. You understand which suppliers represent your largest expenses and where costs are trending above historical averages.

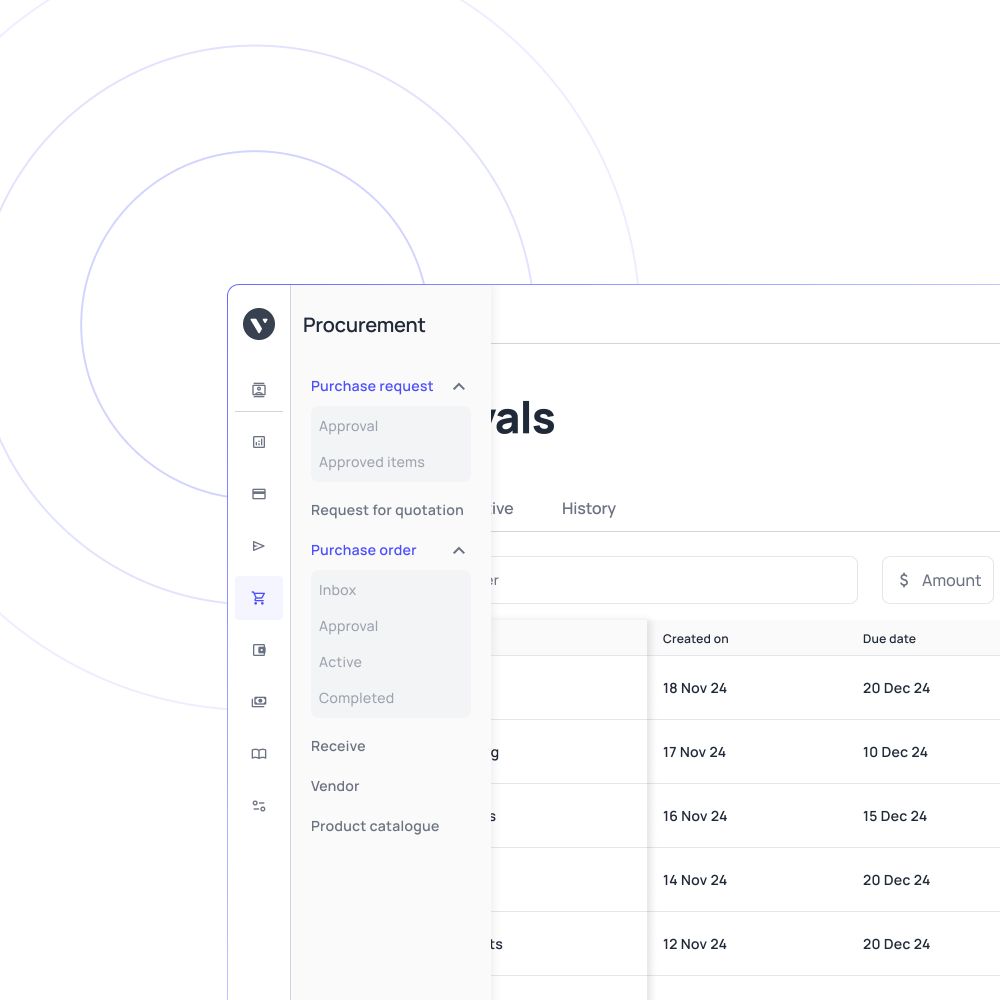

Manage raw material procurement & payments

Raw materials represent your largest expense category, yet many manufacturers still manage these purchases through disconnected processes. Purchase orders get created in one system, invoices arrive by email, and payments finally get processed manually through bank transfers.

Expense management for manufacturing companies connects procurement directly to payment processing. When supplier invoices arrive, they're matched automatically against POs and routed to the appropriate approver.

Automated processing means suppliers receive payment within days instead of weeks, positioning you to negotiate better payment terms or volume discounts that improve your working capital position.

Control operational bills and overhead expenses

Electricity bills, facility maintenance, equipment service contracts, insurance premiums, and software subscriptions create recurring expenses that slowly erode your margins without active management. These operational costs require constant monitoring to prevent wastage.

Centralized bill management helps you see upcoming payments before they're due, track spending against budgets, and spot opportunities to renegotiate contracts. When power costs spike unexpectedly, you investigate immediately rather than discovering the increase during budget reviews.

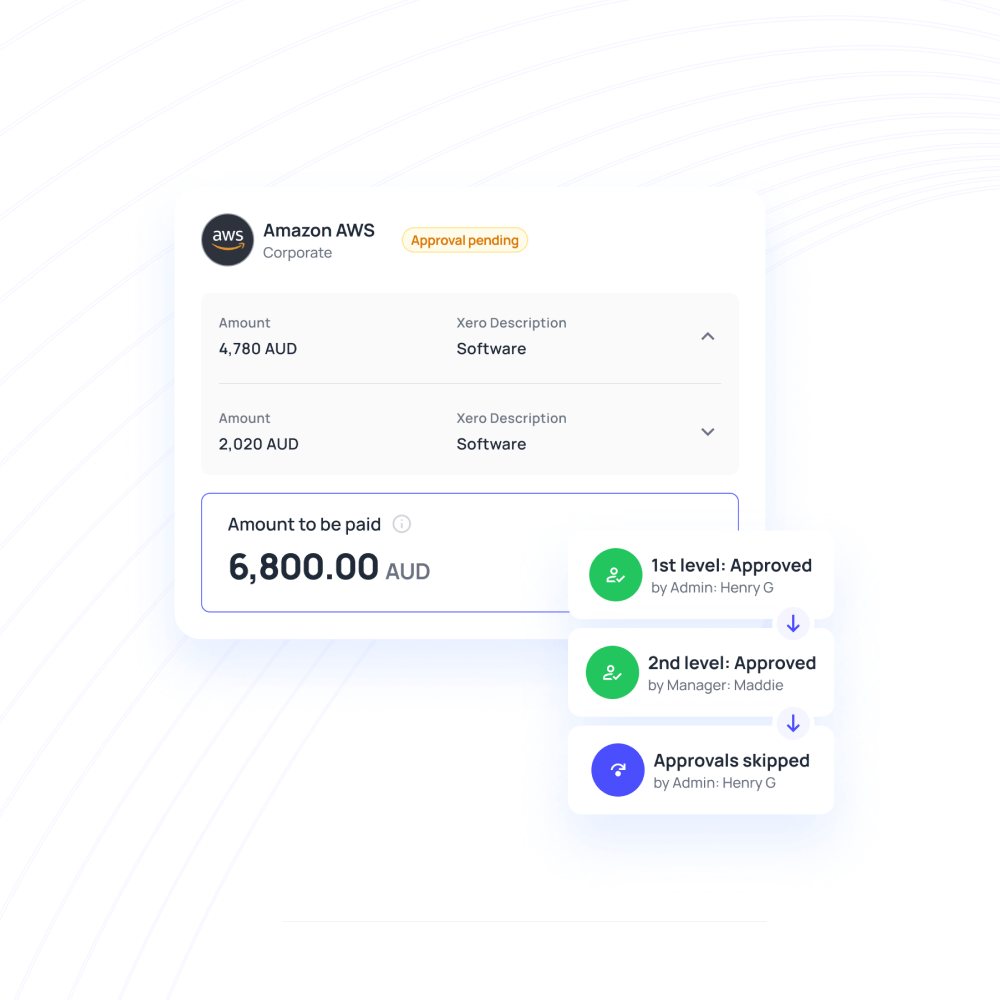

Automated approval workflows ensure appropriate oversight without creating bottlenecks. Routine bills under a certain threshold get paid automatically, while larger expenses are routed to managers for review.

Streamline trade and subcontractor payments

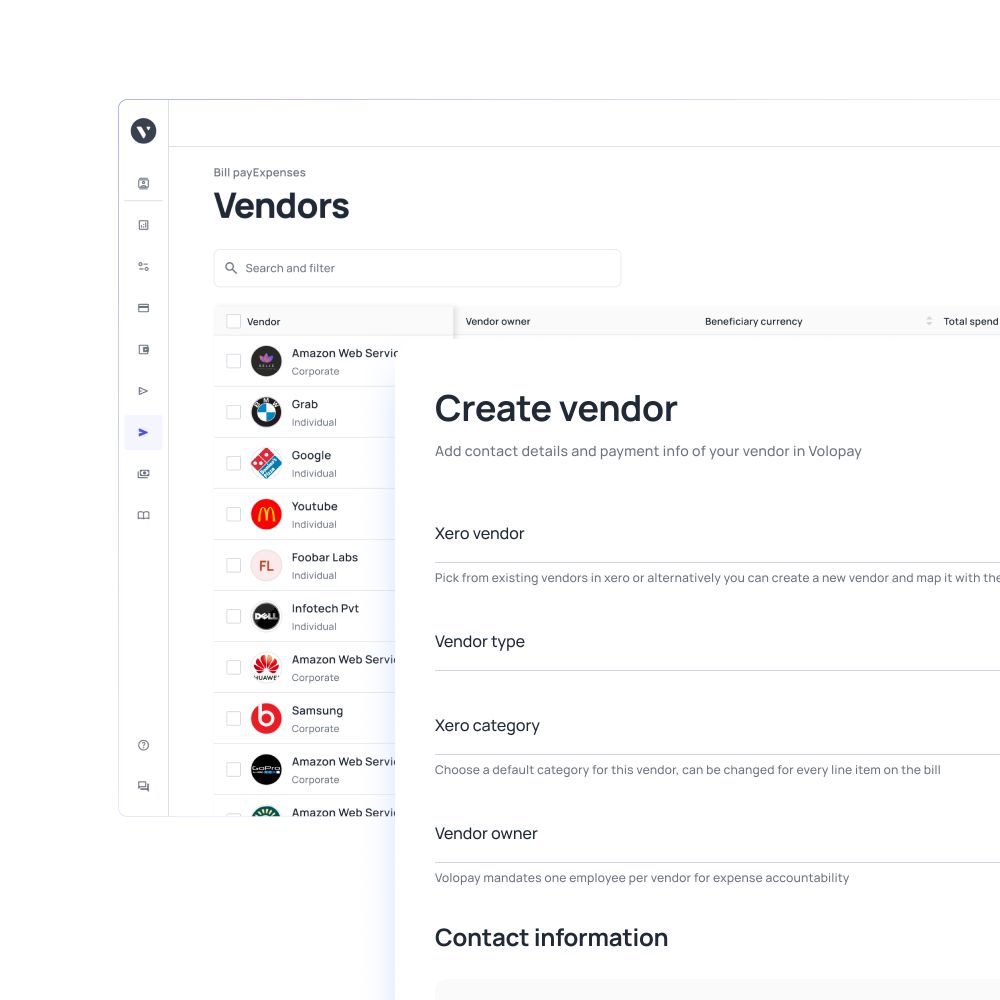

Manufacturing facilities rely on specialized contractors for maintenance, repairs, installations, and technical services. Managing these payments typically means collecting ABN details, tracking invoices manually, and issuing payments while maintaining proper documentation.

Volopay's vendor management system centralizes contractor information, payment terms, ABN records, and transaction history in one location. When a contractor submits an invoice, the system automatically verifies they're an approved vendor, validates ABN details, routes the invoice to the appropriate approver, and schedules payment according to terms.

You maintain complete payment records showing what services were performed, who approved the work, and when payment was made for BAS reporting and audit purposes.

Manage fleet and transportation expenses

If you operate delivery vehicles, forklifts, or company transportation, fuel costs, maintenance, and repairs create complex tracking challenges. Drivers make purchases at different locations, receipts get lost, and you lack visibility until statements arrive weeks later.

Fleet management through corporate cards with built-in controls gives drivers purchasing power while maintaining oversight. You issue cards with spending limits and category restrictions that allow fuel and maintenance purchases but block unrelated spending.

Real-time transaction data shows you exactly what each vehicle costs to operate. You track fuel efficiency across your fleet, identify vehicles with higher-than-average maintenance costs, and ensure drivers follow approved maintenance schedules.

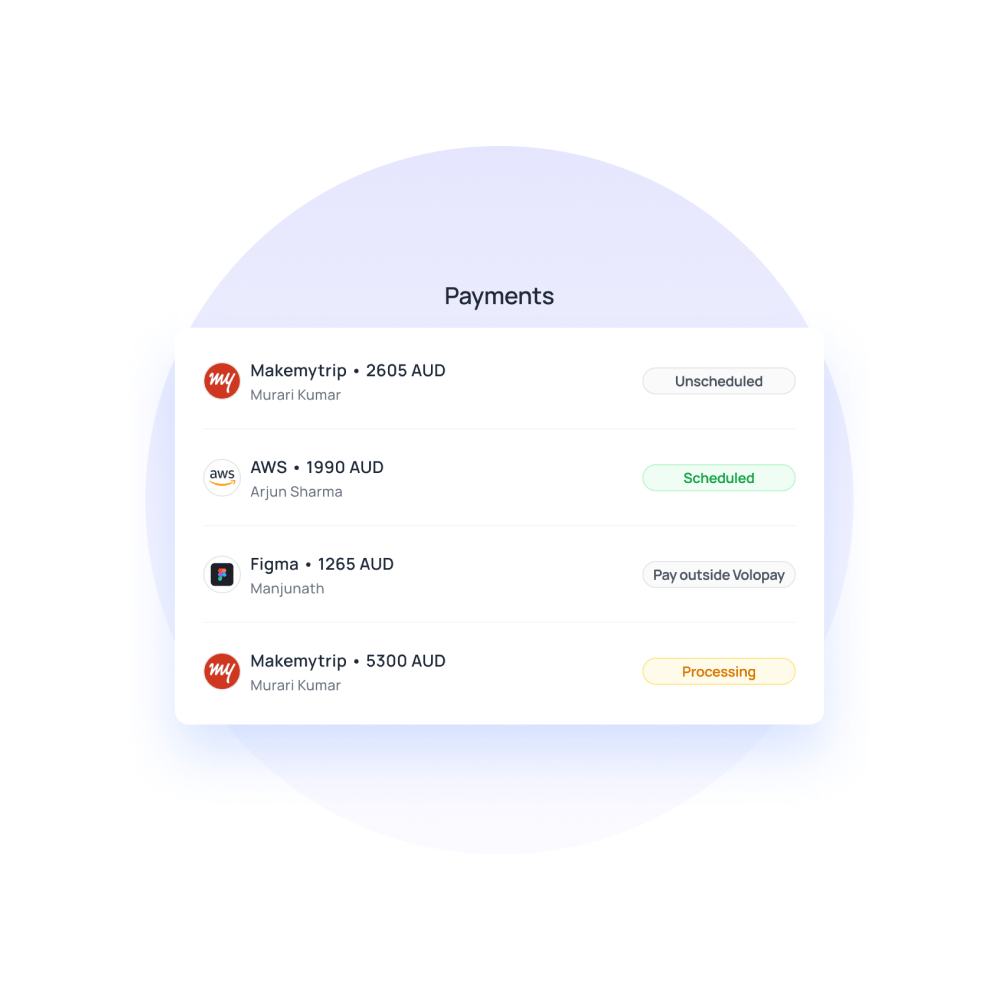

Automate supplier & vendor invoice payments

Manual accounts payable processing creates bottlenecks that delay payments, damage supplier relationships, and consume significant staff time. Your AP team manually enters invoice data, validates GST details, routes paper documents for approval, and processes payments one at a time.

Manufacturing spend management software transforms AP into an automated workflow. Invoices arrive via email and get automatically matched to purchase orders. The system extracts invoice data, including ABN and GST amounts, using OCR technology, eliminating manual data entry and reducing errors in compliance.

With Volopay’s AP automation software, you schedule payments strategically to maximize cash flow while maintaining good supplier relationships. Batch payments to multiple vendors get processed with a single approval, and you can choose the optimal payment method, whether that's direct bank transfer, BPAY, or PayID.

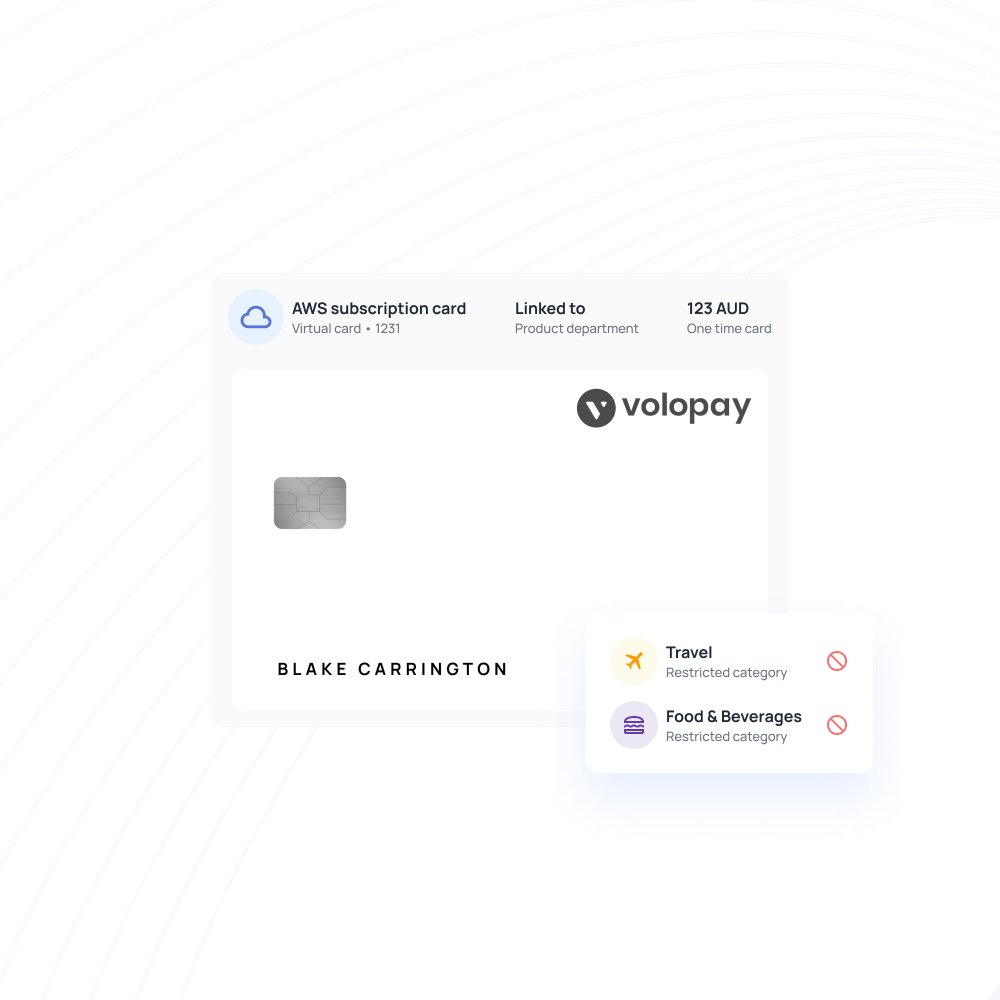

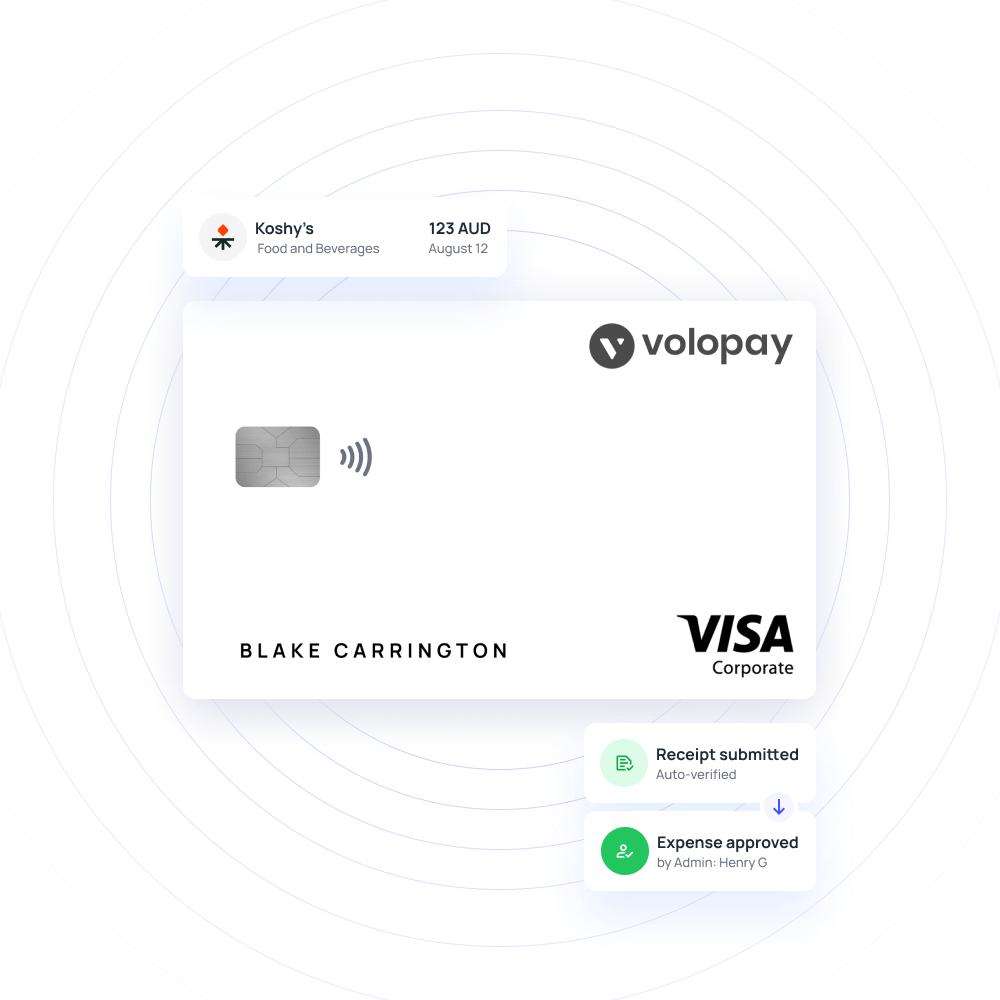

Issue corporate cards for employees & operations

Traditional reimbursement processes create friction and delays. Employees pay out of pocket, submit expense reports with paper receipts, wait for manager approval, and finally receive reimbursement weeks later. This system frustrates employees and creates cash flow challenges.

Corporate cards with embedded controls flip this model. You issue physical or virtual cards to employees with preset spending limits, category restrictions, and merchant controls. A production manager can purchase replacement parts but not office supplies.

Transactions sync in real-time with all details captured automatically. Employees upload receipts directly from their phones, eliminating lost receipts and missing documentation. Your finance team spends less time chasing receipts and more time analyzing spending patterns.

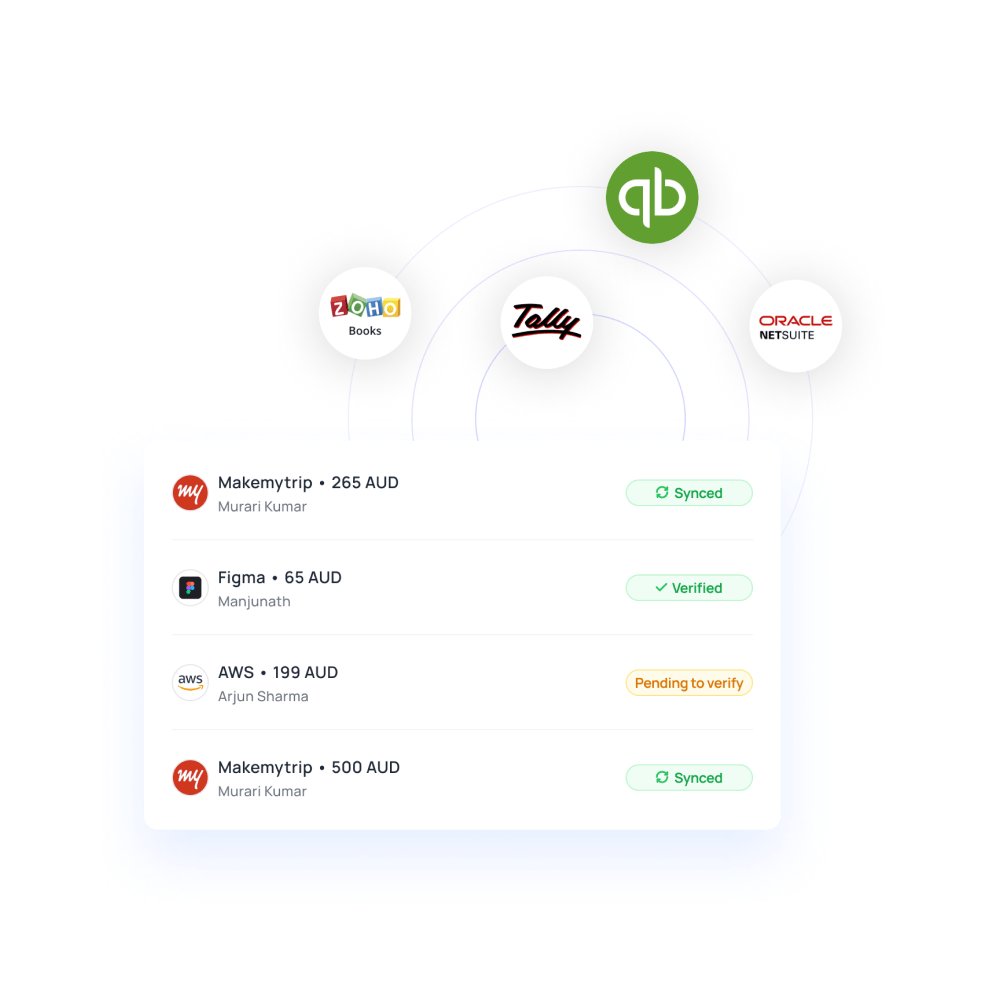

Manufacturing ERP & accounting integration

Your ERP system is the source of truth for financial data, vendor relationships, and general ledger structure. Any expense management solution that doesn't integrate creates duplicate data entry and reconciliation nightmares.

Volopay's native integrations with major manufacturing ERP platforms like QuickBooks, Xero, MYOB, Oracle NetSuite, and Microsoft Dynamics ensure expense data flows automatically into your existing workflows. Transactions sync in real-time with proper GL coding, cost center allocation, and project tracking.

You leverage your existing chart of accounts, approval hierarchies, and vendor databases rather than recreating them. When you close the books at month-end, expense data is already reconciled and categorized correctly, making BAS lodgement significantly easier.

Manage cash flow and cost analysis with ease

Manufacturing operates on tight margins where cash flow timing can mean the difference between taking on new orders or passing on opportunities. When you lack visibility into upcoming payments and spending trends, you make financial decisions reactively.

Unified expense management provides real-time financial intelligence for proactive decisions. You see all pending payments, scheduled disbursements, and current cash positions in a single dashboard. You forecast cash requirements based on approved but unpaid invoices and adjust payment timing accordingly.

Cost analysis tools help you identify opportunities to reduce spending without sacrificing operational efficiency. You compare costs across facilities, analyze spending trends over time, and benchmark expenses against industry standards to identify areas where you're overspending.

Bring Volopay to your business

Get started now

FAQs

Volopay centralizes all supplier payments in one platform with automated three-way matching between POs, receipts, and invoices to ensure you only pay for materials.

Yes, Volopay handles everything from large supplier invoices through accounts payable to small employee reimbursements via corporate cards or expense submissions.

Invoices get matched automatically to purchase orders, routed to appropriate approvers based on your workflows, and scheduled for payment on optimal dates to maximize cash flow.

Yes, Volopay's Bill Pay feature captures all recurring operational expenses with automated payments and budget tracking for each expense category.

Volopay offers native integrations with several accounting platforms, such as Xero, QuickBooks, NetSuite, and Microsoft Dynamics that sync transaction data, vendor information, and GL codes bidirectionally.

You can issue corporate cards for fleet expenses with controls restricting spending to fuel and maintenance while tracking real-time costs per vehicle.

Yes, you can create custom approval workflows, spending limits, and category restrictions for each department or cost center that are enforced automatically.

Volopay provides real-time visibility into all pending payments, scheduled disbursements, and current cash positions in a single dashboard for better forecasting.

Volopay offers customizable reports by department, vendor, category, or time period to analyze trends, compare costs across facilities, and track budget utilization.

Implementation typically takes 2-4 weeks, including ERP integration setup, employee onboarding, card issuance, and workflow configuration.