Flexible reloadable debit cards for employees in Australia

In Australia’s fast-moving business landscape, reloadable debit cards offer a smarter way for startups and SMEs to manage employee expenses. They simplify tracking, reduce reimbursements, and give teams spending power—while finance teams maintain full visibility, control, and budget discipline in real time.

What are reloadable debit cards for employees?

Meaning and functionality

Reloadable debit cards for employees are financial tools preloaded with company funds and distributed to staff members for legitimate business expenditures, including travel costs, software subscriptions, and vendor payments. Unlike traditional credit cards, reloadable cards for employees eliminate debt accumulation since spending remains restricted to preloaded amounts.

Through Volopay's comprehensive platform, businesses can instantly reload these reloadable debit cards for employees using manual transfers or automated scheduled funding, guaranteeing continuous access to necessary funds for operations. Employees utilize these cards seamlessly across online platforms, retail stores, and ATM networks.

Why Australian businesses need them

Australian small-to-medium enterprises and emerging startups encounter distinctive operational challenges, including restricted budgetary constraints and complicated expense monitoring systems. Reloadable cards for employees deliver precise spending control mechanisms, completely eliminating overspending risks that plague traditional expense management approaches.

These innovative reloadable debit cards for employees significantly reduce dependency on cash transactions and personal reimbursement processes, which typically consume valuable administrative time.

With real-time expense tracking capabilities and seamless integrations with popular accounting platforms like Xero, these reloadable cards for employees help businesses maintain comprehensive financial visibility, making them absolutely essential tools for modern Australian enterprises. To make the most of them, it’s important to understand the difference between non-reloadable and reloadable prepaid cards, so you can choose the option that best fits your expense management strategy.

Benefits of reloadable debit cards for employees

Precise spending control

You can establish customized spending limitations on each reloadable card for employees, guaranteeing staff members remain within designated budgetary parameters. Modern cards enable real-time limit adjustments, effectively preventing unauthorized overspending incidents.

These reloadable debit cards for employees provide granular control over departmental expenses, ensuring financial accountability across your organization while maintaining operational flexibility for legitimate business expenditures.

Real-time expense visibility

A lot of card issuers today are providing real-time transaction update. Every transaction executed with reloadable debit cards for employees is automatically logged instantly within the dashboard system.

This feature provides transparency regarding expenditure patterns, revealing who is spending what amounts, where purchases occur, and when transactions happen. Such detailed visibility empowers businesses to optimize budgets effectively and make informed financial decisions based on actual spending data.

Streamlined reimbursements

With reloadable cards for employees, staff members eliminate out-of-pocket payments and lengthy reimbursement waiting periods entirely. Employees can submit expense claims in real-time through the software that the card is linked to, significantly reducing paperwork burdens and boosting operational efficiency.

This streamlined approach to expense management transforms traditional reimbursement processes, creating smoother workflows for both employees and finance teams throughout your organization.

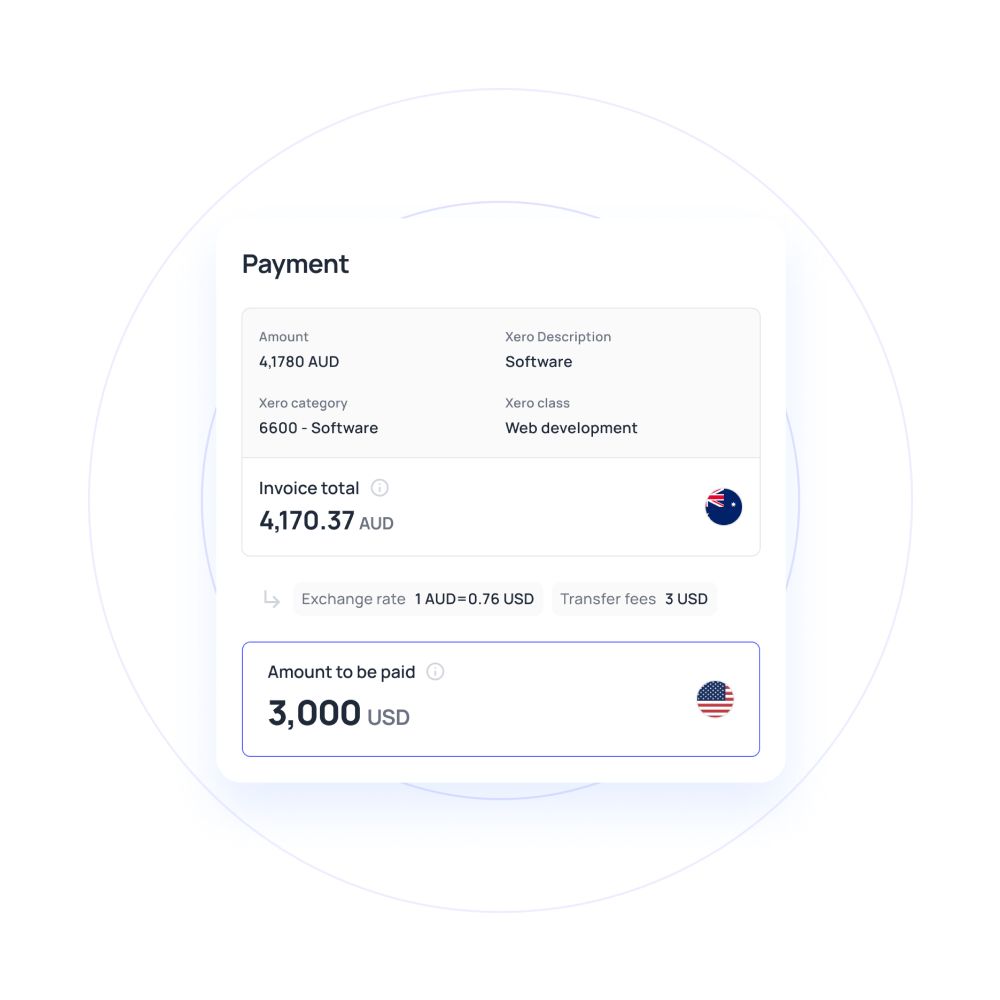

Multi-currency flexibility

Reloadable debit cards for employees provide comprehensive multi-currency transaction support, making them ideal solutions for businesses managing international vendors or frequent travel requirements.

You can process payments across the world with highly competitive exchange rates, substantially saving on foreign transaction fees. This global flexibility ensures seamless international business operations while maintaining cost-effective financial management practices.

Reduced administrative load

Reloadable cards for employees significantly minimize manual data entry requirements by automating comprehensive expense tracking and integrating seamlessly with popular accounting software platforms.

This automation frees your finance team from tedious administrative tasks, allowing them to focus on strategic business initiatives rather than chasing receipts. The result is improved productivity and a more valuable use of human resources.

How Volopay's reloadable debit cards work

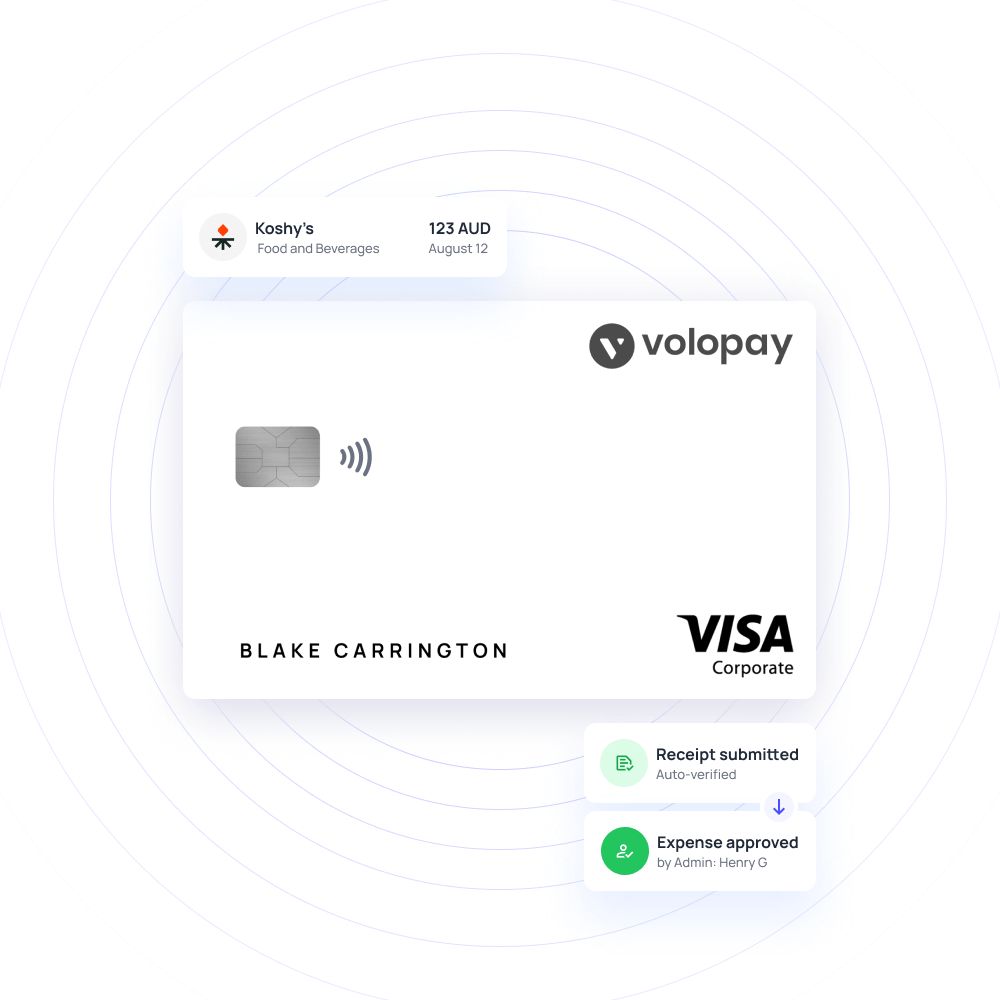

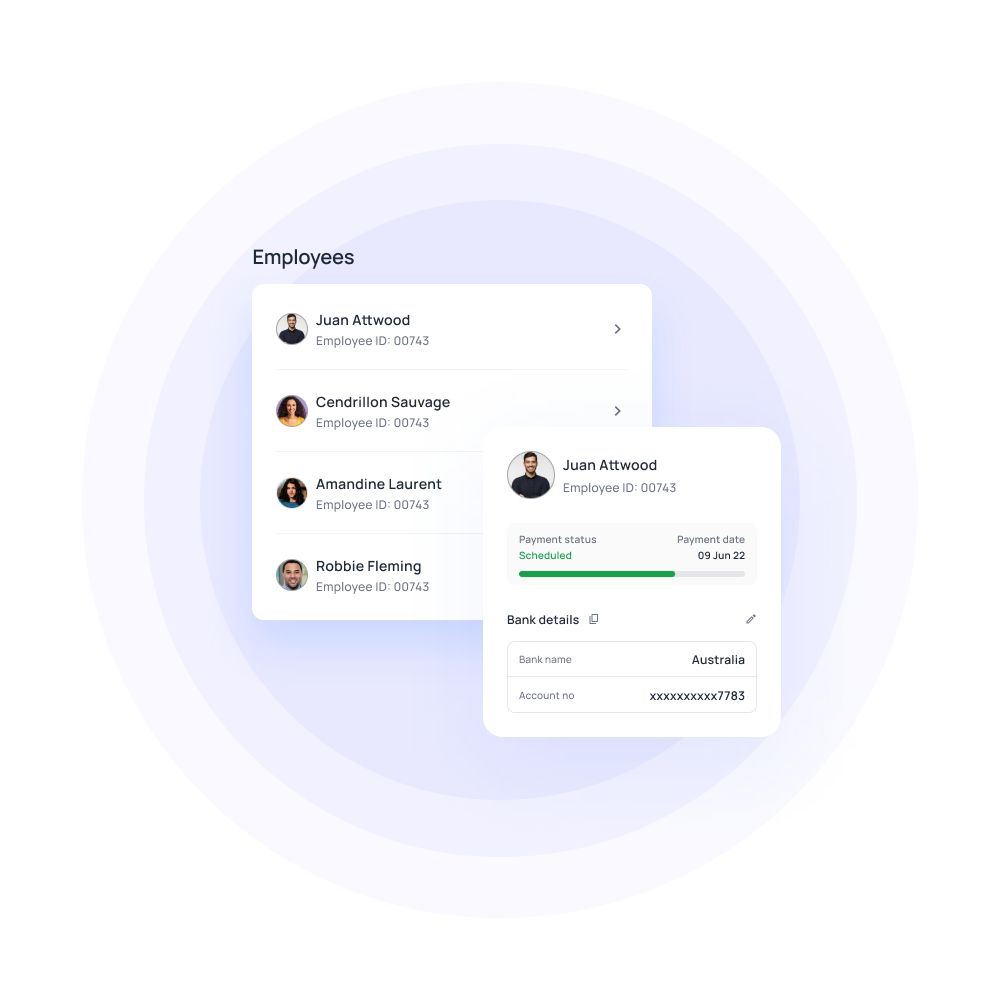

Issuing cards

You can issue both physical and virtual reloadable cards for employees through Volopay's user-friendly platform with just a few simple clicks. Physical cards work perfectly for in-person payment scenarios, while virtual cards ideally suit online expense requirements.

You can assign these cards to specific employees, departments, or individual projects, ensuring proper expense allocation and tracking throughout your organizational structure.

Reloading funds

Topping up reloadable debit cards for employees is completely seamless and user-friendly. You can manually add funds through the Volopay dashboard interface or configure automatic reload schedules based on your predetermined budget parameters.

Funds become available instantly upon transfer, ensuring employees maintain consistent access to necessary financial resources for business operations without delays or interruptions.

Setting spending limits

Volopay enables you to establish custom spending limits on each reloadable card for employees according to your specific business requirements. You can define daily, weekly, or monthly spending caps and adjust them dynamically as business needs evolve.

Employees can request additional funding, when necessary, which requires proper manager approval to ensure maintained financial control and accountability.

Monitoring transactions

All transactions are automatically recorded in real-time within Volopay's centralized ledger system for comprehensive tracking. You can filter expenses by card, employee, or project categories to review detailed spending patterns and trends.

Push notifications alert you immediately to every transaction, enhancing transparency and enabling proactive financial management across your organization.

Securing cards

Volopay's reloadable debit cards for employees incorporate robust security features, including instant card freezing and blocking capabilities if cards are lost or stolen.

PCI DSS compliance ensures all transactions are encrypted and protected against fraud, effectively safeguarding your business funds. These comprehensive security measures provide peace of mind while maintaining operational efficiency for daily business expenses.

Issue reloadable cards instantly for every employees

Why choose Volopay's reloadable debit cards?

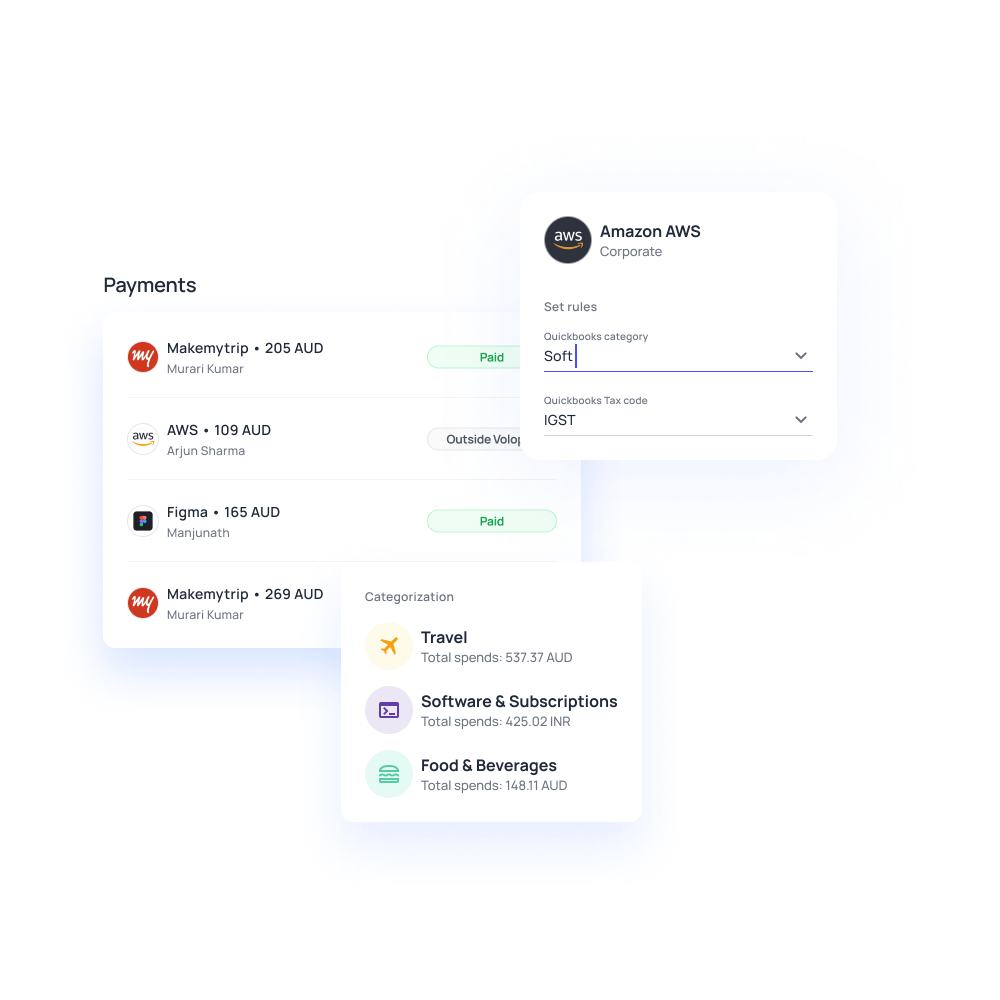

Seamless ERP integration

Volopay's reloadable cards for employees integrate effortlessly with leading accounting platforms, including Xero, QuickBooks, and MYOB, streamlining your financial workflow. All transactions sync automatically across systems, completely eliminating time-consuming manual reconciliation processes and ensuring accurate, up-to-date financial records.

This seamless integration reduces administrative overhead while maintaining comprehensive audit trails. Your finance team benefits from real-time data synchronization, enabling faster month-end closings and improved financial reporting accuracy across all business operations.

Robust security

Volopay's prepaid reloadable debit cards for employees maintain PCI DSS compliance standards, featuring advanced encryption protocols and sophisticated fraud detection systems. You can instantly freeze or block cards through the intuitive mobile application, providing immediate protection against unauthorized usage.

Multi-layered security measures include transaction monitoring, spending pattern analysis, and suspicious activity alerts. These comprehensive security features protect your business funds while ensuring employee confidence in using corporate payment solutions for legitimate business expenses.

Unlimited virtual cards

You can create unlimited virtual reloadable cards for employees at absolutely no additional cost, maximizing operational flexibility without budget constraints. These digital cards excel for online payments, subscription management, and vendor-specific expenses, enhancing security through advanced tokenization technology.

Virtual cards eliminate physical theft risks while providing granular control over online spending. Each virtual card can be customized with specific spending limits, expiration dates, and merchant restrictions, ensuring optimal security and expense management across diverse business requirements.

Multi-currency support

Volopay's reloadable debit cards for employees support transactions across multiple currencies, featuring dedicated multi-currency wallets for seamless international payment processing. This functionality significantly reduces foreign exchange costs for businesses managing global operations and international vendor relationships.

Competitive exchange rates ensure cost-effective international transactions while maintaining transparent fee structures. Real-time currency conversion capabilities enable accurate budget tracking across different markets, making these cards essential tools for businesses with international expansion plans or remote global teams.

Intuitive mobile app

Volopay's comprehensive mobile application enables complete management of reloadable cards for employees from anywhere, providing unparalleled convenience and control. Issue new corporate cards, reload funds instantly, adjust spending limits, and review detailed expense reports directly from your smartphone or tablet.

The user-friendly interface ensures quick access to essential features while maintaining robust security protocols. Push notifications keep you informed of all transactions, enabling proactive expense management and immediate response to any irregular spending patterns or security concerns.

Use cases for reloadable debit cards in Australian businesses

Equip traveling employees with reloadable cards for employees to cover essential business expenses, including flights, accommodation, meals, and ground transportation during official business trips.

Set travel-specific spending limits based on trip duration while tracking all expenses in real-time to maintain strict budget adherence.

These cards eliminate the need for expense advances or personal credit card usage, reducing reimbursement delays and administrative burden.

Transaction monitoring provides additional security and helps verify legitimate business expenses during travel periods.

Utilize virtual reloadable debit cards for employees to efficiently manage SaaS subscriptions.

Assign dedicated cards per subscription service to track individual costs accurately and prevent unexpected service interruptions due to payment failures.

This approach enables better budget allocation across different departments while maintaining clear visibility into recurring software expenses.

Automated renewal tracking helps prevent unnecessary subscriptions and ensures optimal software license utilization across your entire organization.

Process domestic and international vendor payments using reloadable cards for employees for timely settlement of invoices and maintaining strong supplier relationships.

Schedule recurring payments automatically to avoid late fees and streamline accounts payable processes while maintaining detailed transaction records.

Multi-currency support enables seamless international supplier payments without complex wire transfer procedures.

Real-time payment confirmation provides immediate verification of successful transactions, improving vendor communication throughout your supply chain operations.

Allocate dedicated reloadable debit cards for employees to marketing teams for advertising expenditures on platforms like Google Ads, Facebook, LinkedIn, and other digital marketing channels.

Set campaign-specific spending limits to maintain strict budget control while optimizing return on investment across different marketing initiatives. Real-time expense tracking enables immediate campaign performance analysis and budget reallocation when necessary.

This granular approach to marketing spend management ensures maximum advertising effectiveness while preventing budget overruns and maintaining clear accountability across marketing team members.

Provide reloadable cards for employees to remote staff members for essential home office supplies, high-speed internet connections, and workspace setup costs.

Virtual cards ensure secure online payments while eliminating the need for personal expense advances or complex reimbursement procedures.Real-time transaction tracking simplifies expense oversight and ensures compliance with remote work policies.

This approach supports remote employee productivity while maintaining financial control and transparency across distributed teams, making it easier to manage modern hybrid work arrangements effectively.

Comparing reloadable debit cards to other different payment methods

Reloadable debit cards vs traditional cash payments

Unlike traditional cash payments, reloadable cards for employees provide comprehensive security and complete transaction traceability for business expenses.

Lost or stolen cash cannot be recovered, while cards can be frozen instantly through mobile applications, protecting company funds.

Digital transaction records automatically simplify auditing processes and significantly reduce fraud risks.

Real-time spending notifications ensure immediate awareness of all transactions, enabling proactive expense management and enhanced control across your organization.

Reloadable debit cards vs traditional debit cards

Traditional debit cards connect directly to bank accounts, creating potential overspending risks and exposing primary business funds.

Reloadable debit cards for employees restrict spending strictly to preloaded amounts, offering superior budget control without debt accumulation risks.

This approach prevents accidental overdrafts while maintaining clear spending boundaries.

Businesses gain enhanced financial oversight through customizable spending limits and detailed transaction categorization, ensuring better expense management compared to conventional banking solutions.

Reloadable debit cards vs expense reimbursements

Traditional reimbursement systems require employees to pay business expenses out of pocket, causing cash flow delays and employee frustration.

Reloadable cards for employees eliminate these issues by providing immediate access to company funds for legitimate business expenses. This approach reduces administrative overhead while improving employee satisfaction.

Automatic transaction recording eliminates manual receipt submission processes, creating more efficient expense workflows and faster financial reporting across all departments within your organization.

Best practices for managing reloadable debit cards

Establish clear policies

Develop comprehensive guidelines for appropriate card usage, including detailed lists of permissible business expenses and specific spending limit parameters. Communicate these established policies clearly to all employees to ensure consistent compliance and maintain organizational accountability.

Document policy updates regularly and provide accessible reference materials for ongoing employee consultation. Clear expectations prevent misuse while empowering employees to make confident spending decisions within established parameters.

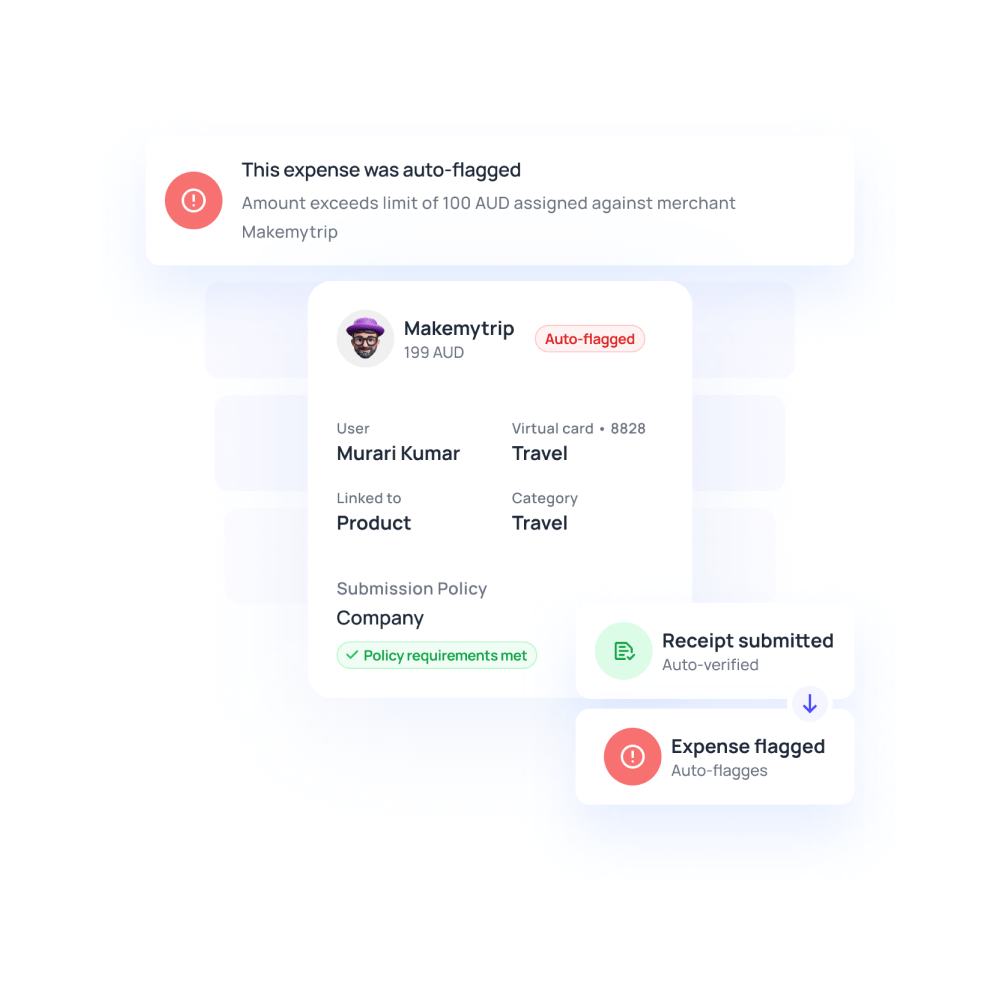

Monitor transactions regularly

Review all transactions systematically using Volopay's comprehensive dashboard to identify unauthorized or suspicious spending activity promptly. Regular monitoring enables proactive financial control and helps optimize overall spending patterns across departments.

Implement automated alerts for unusual transaction patterns and establish escalation procedures for questionable expenses. This vigilant approach maintains financial integrity while providing valuable insights into organizational spending trends and budget allocation effectiveness.

Train employees

Provide comprehensive training on effectively using reloadable cards for employees and navigating Volopay's platform features successfully. Ensure all employees understand established policies, proper receipt submission procedures, and appropriate support contact information.

Regular training updates keep staff informed about new features and policy changes. Well-trained employees maximize card benefits while minimizing compliance issues and administrative burden throughout your organization.

Automate reloads

Configure automatic reload schedules for reloadable debit cards for employees to ensure continuous access to necessary funds without manual intervention. Schedule systematic reloads based on departmental budgets and spending patterns to eliminate manual top-up requirements.

Automated funding prevents service interruptions while maintaining consistent cash flow for business operations. This approach reduces administrative overhead while ensuring employees always have access to required funds for legitimate business expenses.

Audit expense reports

Conduct periodic comprehensive audits of expense reports to verify strict compliance with established organizational policies. Utilize Volopay's advanced analytics features to identify spending trends and adjust budgets accordingly for optimal financial management.

Regular auditing ensures accountability while providing valuable insights into expense patterns and budget optimization opportunities. Systematic reviews help maintain financial control while improving future budget planning and resource allocation decisions.

Bring Volopay to your business

Get started now

FAQs: Reloadable debit cards for employees

You issue reloadable debit cards for employees directly through Volopay's intuitive platform, assigning them to specific staff members for legitimate business expenses. Reload funds either manually through the dashboard or automatically via scheduled transfers, while tracking all spending in real-time.

The platform provides comprehensive transaction visibility and expense categorization. Employees receive instant notifications for successful transactions, ensuring transparency and immediate awareness of card usage across your organization.

Yes, Volopay's reloadable cards for employees maintain strict PCI DSS compliance standards, featuring advanced encryption protocols and sophisticated fraud detection systems. Instant freeze and block capabilities protect against unauthorized usage through mobile applications.

Multi-layered security measures include transaction monitoring and suspicious activity alerts. These comprehensive security features ensure complete protection of business funds while maintaining employee confidence in corporate payment solutions for daily business operations.

You can establish custom daily, weekly, or monthly spending limits on each reloadable debit card for employees, easily adjustable through Volopay's user-friendly dashboard interface. This granular control ensures strict budget adherence while providing operational flexibility.

Spending limits can be modified instantly based on changing business requirements or specific project needs. Employees receive notifications when approaching limits, preventing overspending while maintaining productive business operations across all departments.

Yes, reloadable cards for employees support seamless transactions across multiple currencies, featuring dedicated multi-currency wallets for cost-effective international payments. Competitive exchange rates reduce foreign transaction costs while maintaining transparent fee structures.

Real-time currency conversion enables accurate budget tracking across different markets. This comprehensive multi-currency support makes these cards essential tools for businesses with global operations, international vendors, or remote teams working across various geographic locations.

Reload reloadable debit cards for employees manually through Volopay's platform or configure automatic transfers from linked business accounts for seamless funding. Manual reloads provide immediate fund availability, while automated systems ensure continuous access based on predetermined schedules.

Both options maintain detailed transaction records for accounting purposes. The flexible funding approach accommodates different business cash flow patterns while ensuring employees always have access to necessary funds for legitimate business expenses.

Yes, virtual reloadable cards for employees are specifically designed for Software-as-a-Service subscriptions, offering secure online payments and comprehensive expense tracking for recurring costs. These digital cards eliminate physical theft risks while providing granular control over subscription management.

Each virtual card can be assigned to specific services or departments for detailed cost allocation. Automated tracking helps prevent unnecessary subscriptions while ensuring optimal software license utilization across your entire organization.

Volopay's reloadable debit cards for employees sync seamlessly with major ERP systems, including Xero and QuickBooks, automating transaction categorization and reconciliation processes. Real-time data synchronization eliminates manual data entry while maintaining accurate financial records.

Advanced integration capabilities support custom expense categories and department-specific reporting requirements. This comprehensive integration streamlines accounting workflows while ensuring accurate financial reporting and simplified month-end closing procedures.

Volopay's reloadable cards for employees offer superior spending control, unlimited virtual card creation, comprehensive multi-currency support, and seamless ERP integrations, significantly exceeding traditional bank card capabilities. Advanced features include real-time expense tracking, customizable spending limits, and automated reconciliation processes.

Unlike conventional banking solutions with limited functionality, Volopay provides comprehensive expense management tools designed specifically for modern business requirements and operational efficiency across diverse organizational structures.