Advanced prepaid travel cards for Australian businesses

Australian businesses are revolutionizing employee travel management with prepaid travel cards, moving beyond inefficient legacy methods like reimbursements, petty cash, or corporate credit cards. These modern financial tools eliminate post-trip paperwork, reduce unauthorized spending, and provide real-time visibility into travel expenses.

From mining operations to consulting firms, prepaid cards for travel offer a smarter, secure, and scalable solution built for Australia's diverse business landscape and global mobility requirements.

What is a prepaid travel card?

A prepaid travel card represents a fundamental shift in how businesses manage employee travel expenses. Unlike traditional corporate credit cards that extend credit lines, these cards operate on a preloaded fund system where you control exactly how much each employee can spend.

This approach eliminates the risk of overspending while maintaining compliance with Australian financial regulations and company travel policies.

The system works particularly well for companies operating across multiple states and territories. You preload funds based on trip requirements, set spending categories, and monitor usage in real-time.

This approach transforms travel expense management from reactive reporting to proactive budgeting, giving finance teams unprecedented visibility into travel spending patterns across your organization.

1. Preloaded for simplicity and control

The no-credit, prepaid model eliminates post-trip claims and unexpected charges completely. You load exact amounts based on trip requirements, preventing overspending while ensuring employees have adequate funds for approved expenses.

For growing businesses, these cards integrate seamlessly into existing travel frameworks. You can issue cards to individual employees, departments, or project teams, with customizable spending limits and merchant restrictions.

2. Travel-ready for domestic and global use

Cards work seamlessly across major cities and remote locations, plus internationally. Whether your team travels between Melbourne and Brisbane for client meetings or ventures internationally to Singapore and London. These cards provide the financial control and transparency modern businesses demand.

Key advantages of prepaid travel cards for Australian workforces

Businesses gain significant operational and financial benefits when implementing prepaid travel card for business solutions across their workforce.

The advantages extend beyond simple expense tracking to encompass strategic financial planning, compliance management, and operational efficiency improvements that directly impact your bottom line.

Budget in advance, spend with confidence

Pre-allocate travel spend by employee, department, or specific events with zero ambiguity about spending limits. You set exact amounts based on trip duration, destination costs, and per diem requirements, eliminating guesswork and preventing budget overruns that commonly plague traditional expense management systems.

Reduce admin and claim cycles

Eliminate the endless cycle of chasing receipts, processing expense reports, and reconciling post-trip claims. Your finance team focuses on strategic activities instead of administrative paperwork, while employees avoid the hassle of advancing personal funds and waiting for reimbursements.

Live monitoring for every swipe

Access instant alerts and comprehensive dashboards tracking travel spend per team member, department, or project. You see transactions as they happen, enabling immediate intervention if spending patterns deviate from approved budgets or policies, particularly valuable for remote operations.

Better rates, lower international fees

Avoid hidden banking fees and enjoy competitive foreign exchange rates across multiple currencies. Australian businesses save significantly on international travel costs, particularly important given the frequency of Asia-Pacific business travel and the distance-related expenses of overseas trips.

Align spend with travel policy

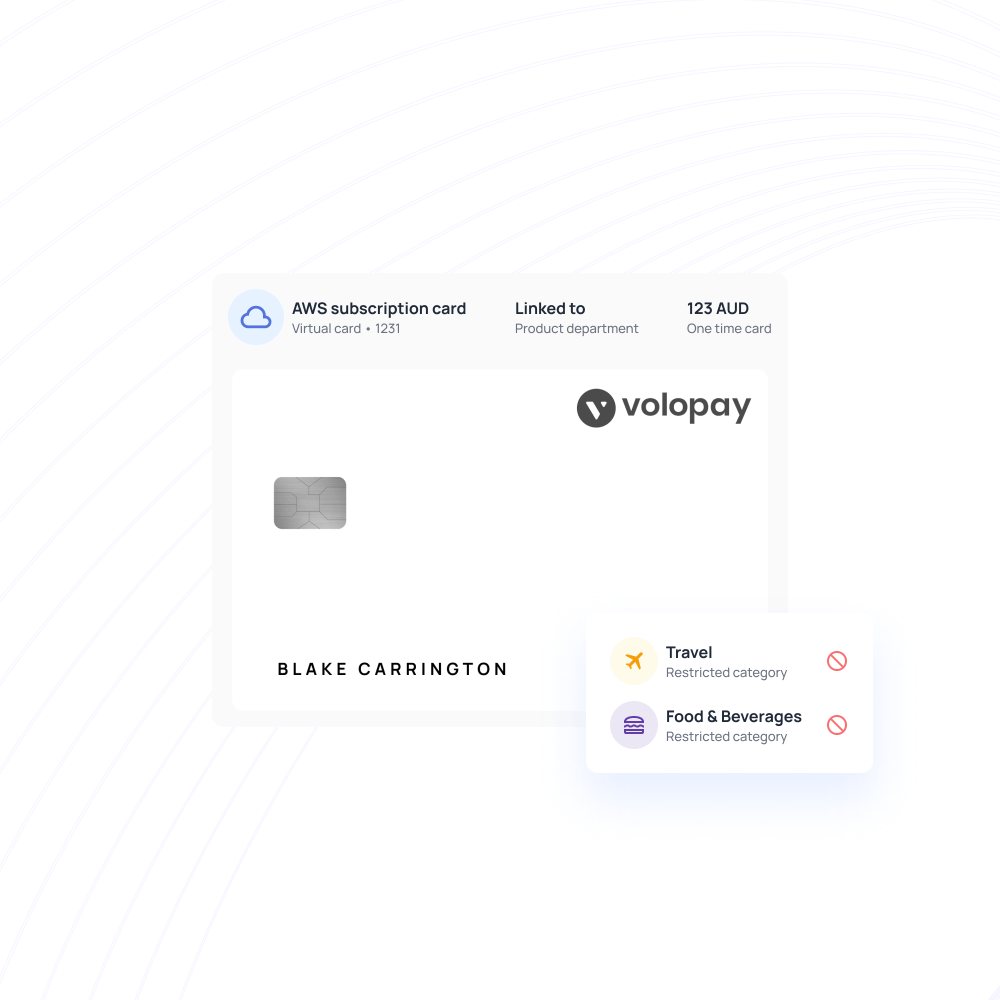

Custom rules prevent policy breaches and unauthorized transactions automatically. You program cards to block non-compliant purchases, restrict spending to approved merchant categories, and enforce daily or weekly limits, ensuring policy adherence without constant supervision or post-trip auditing.

Where Australian teams use prepaid travel cards

Businesses across diverse industries and geographical locations leverage business prepaid travel card solutions to address specific operational challenges. From resource-rich Western Australia to the financial centers of Melbourne and Sydney, these cards adapt to unique industry requirements and travel patterns.

1. Fly-in/fly-out (FIFO) and mining crews

Issue cards with daily limits for remote operations and worksite needs. FIFO workers traveling to iron ore mines or coal operations receive cards loaded with accommodation, meal, and incidental allowances, eliminating cash handling in remote locations.

2. Sales reps & consultants nationwide

Support agile, on-the-go teams without risking financial control. Representatives covering territories from Cairns to Hobart receive cards with flexible limits, enabling spontaneous client visits while maintaining strict spending oversight and eliminating personal expense advances.

3. Event and project-based teams

Provide card access for short-term campaigns without long-term account exposure. Teams attending trade shows or managing temporary projects receive purpose-built cards with event-specific limits and automatic expiration dates.

4. International business development trips

Enable safe, compliant spend during client visits and global conferences. Australian companies expanding into Asian markets or attending European trade shows issue cards with multi-currency capabilities and international merchant acceptance, ensuring seamless transactions abroad.

5. Government contractors and NPO staff

Maintain strict audit trails for grant-based or public funding travel. Organizations requiring detailed expense documentation for compliance purposes benefit from automated transaction categorization and comprehensive reporting features that satisfy auditing requirements.

Looking to streamline how your team handles travel expenses across Australia and beyond? Explore the Best prepaid travel cards in Australia—designed to give businesses full control, flexibility, and transparency, whether you're managing business events, sales teams, or international trips.

Make business travel seamless with prepaid travel cards

Why Volopay is built for Australian business travel

Volopay's prepaid travel cards are purpose-built for Australia's unique geographical challenges, diverse industries, and stringent compliance requirements.

Unlike generic international solutions,Volopay understands the specific needs of Australian businesses operating across vast distances and multiple regulatory environments.

Local account, global acceptance

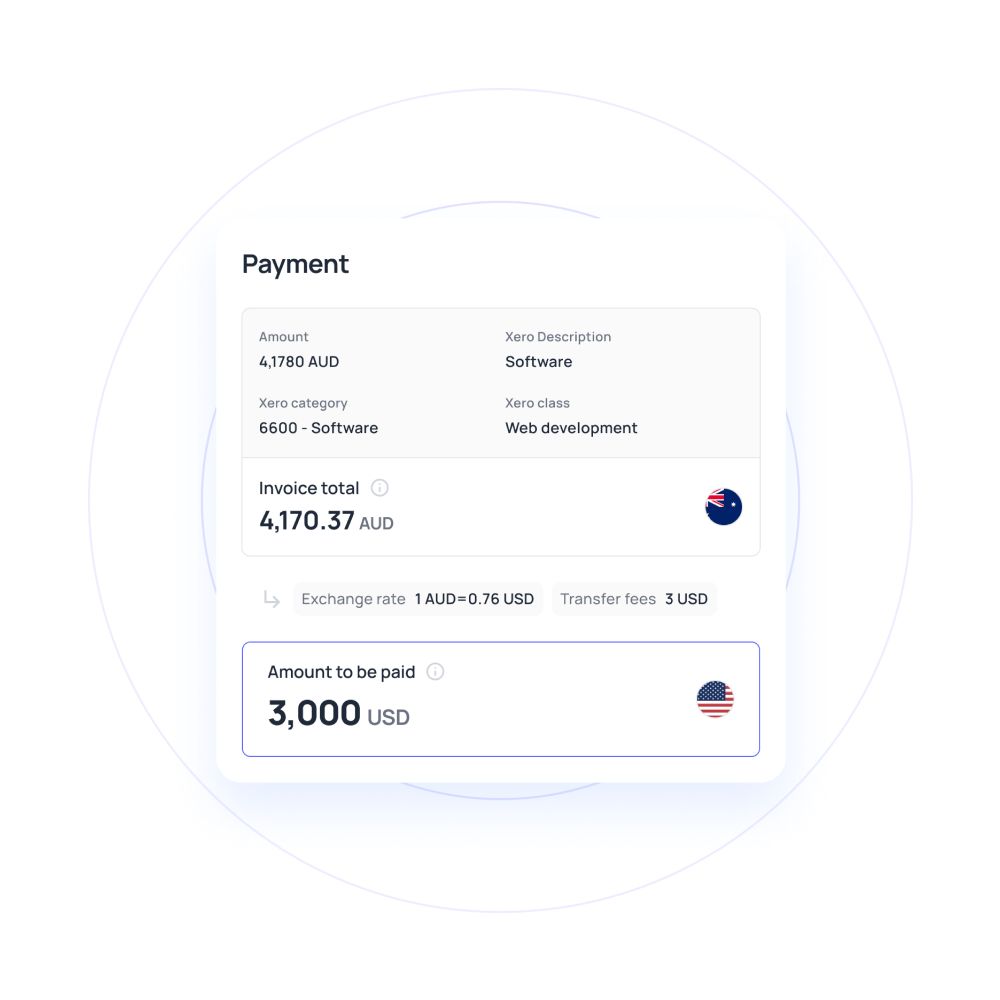

Multi-currency support combined with local banking integrations ensures seamless transactions whether employees travel domestically or internationally. You benefit from competitive exchange rates and reduced international transaction fees while maintaining compliance with financial regulations.

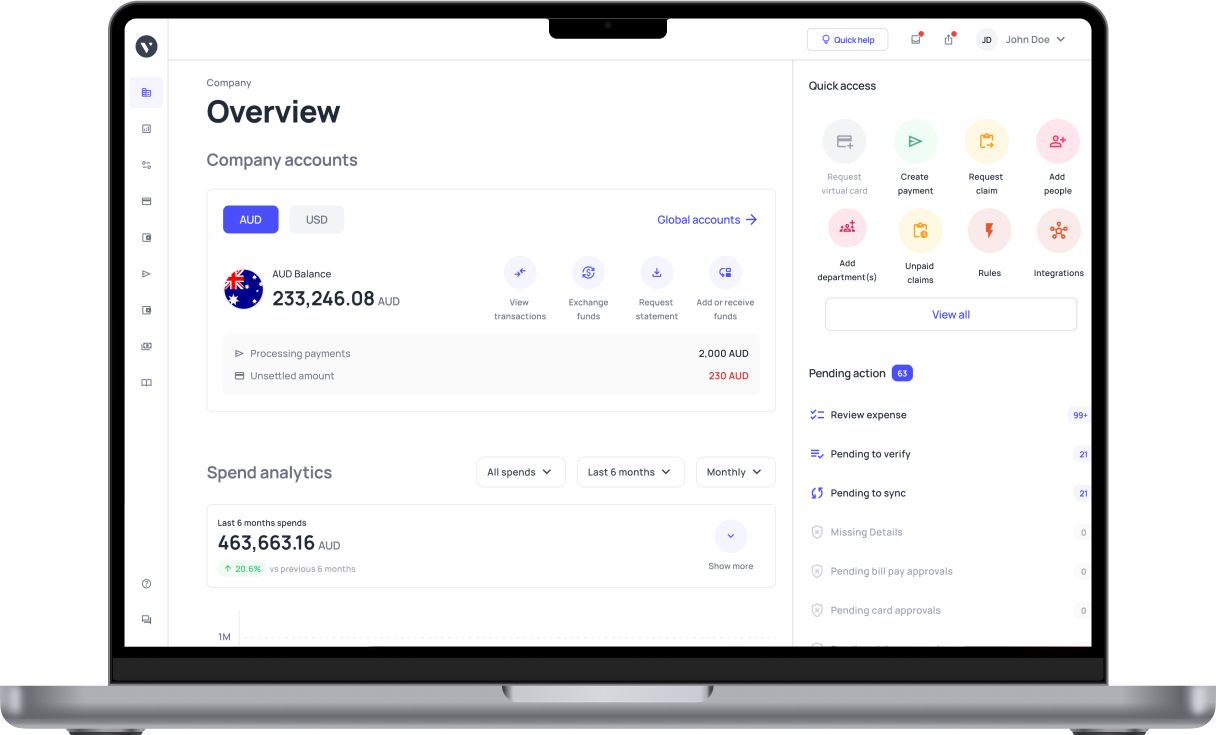

One dashboard, total visibility

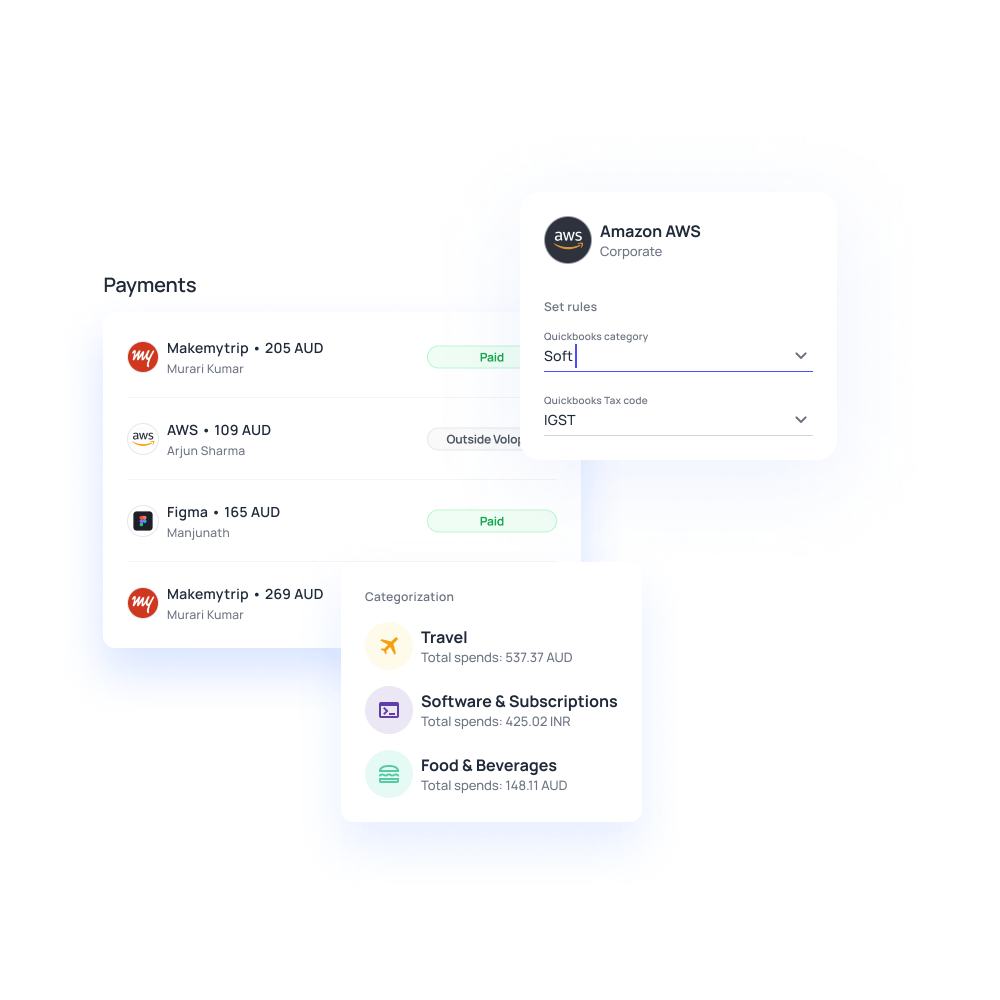

Finance teams control every issued card from a single, comprehensive platform. You monitor spending patterns, approve transactions, and generate reports without switching between multiple systems or reconciling data from various sources, streamlining financial management processes.

Virtual cards in minutes

Issue virtual cards instantly even if someone is already mid-trip. Emergency travel situations or last-minute business opportunities don't require waiting for physical card delivery, enabling immediate financial access through secure virtual card generation and mobile app integration.

Australia-based onboarding and support

Localized assistance from initial onboarding through ongoing expense reconciliation. Your team receives support during Australian business hours, with staff who understand local banking systems, tax requirements, and compliance obligations specific to Australian business operations.

Take control of your business travel spend today!

Trusted by finance leaders across Australia

Volopay serves as a strategic partner for forward-thinking CFOs and financial controllers across Australia's diverse business landscape. From startup technology companies in Sydney to established corporations in Perth, finance leaders trust Volopay to provide comprehensive expense management solutions that scale with business growth.

Built for strategic financial control

Identify company-wide spending patterns and trends, detect anomalies, and improve forecasting accuracy through comprehensive analytics.

You gain insights into travel patterns, cost optimization opportunities, and budget allocation effectiveness, enabling data-driven decisions that improve financial performance.

Scales from startup to enterprise

Proactively establish policies that evolve with your team size, office locations, and growing business complexity.

Whether you're a five-person consultancy or a multinational corporation, the system adapts to your businesses' changing requirements without requiring platform migration or extensive reconfiguration.

Policy compliance built-in

Prevent violations through automated enforcement instead of reporting them afterward.

You program cards to block non-compliant transactions, restrict spending to approved categories, and enforce approval workflows, ensuring policy adherence without constant manual oversight.

Smarter travel spend planning with Volopay

Volopay's comprehensive expense management platform transforms everything from reactive tracking to proactive planning, enabling finance teams and travel managers to control costs before trips begin. This strategic approach reduces financial surprises, improves budget accuracy, and eliminates the administrative burden of post-trip reconciliation.

Preload cards based on itineraries

Assign card limits based on trip duration, destination costs, and per diem requirements with precision.

You eliminate guesswork by calculating exact travel costs and loading appropriate amounts, preventing both overspending and the inconvenience of insufficient funds during business trips.

Plan multi-city or group travel with ease

Easily configure your employee cards by team, location, or trip type for conferences, client visits, or roadshows.

Complex travel arrangements with multiple destinations become manageable through centralized card management and coordinated spending limits aligned with overall travel budgets.

Avoid end-of-trip reconciliations

Front-load budgets and restrict usage categories so reconciliation becomes automatic.

You eliminate the administrative burden of processing expense reports and reconciling credit card statements, allowing finance teams to focus on strategic financial planning.

Forecast travel spend by role or department

Utilize historical data to plan future travel budgets more accurately across regions or functions.

You identify spending patterns and department-specific requirements, enabling more precise budget allocation and improved financial planning for upcoming fiscal periods.

Travel spend that's secure by design with Volopay

Volopay ensures safe, compliant, and fraud-proof usage of prepaid cards for travel for business travel across domestic and international destinations.

Security features protect both individual transactions and overall financial integrity, giving businesses confidence in their travel expense management systems.

1. Block fraud with merchant and location controls

Prevent misuse through granular controls by geography, category, and vendor type. You restrict card usage to approved merchant categories, specific geographical regions, and authorized vendor types, eliminating unauthorized transactions and reducing fraud risk significantly.

2. Instant card locking and custom alerts

Lost cards lock immediately from the dashboard, while custom alerts notify you of unusual spending patterns. You maintain complete control over card security even when employees travel to remote locations or different time zones, ensuring an immediate response to potential security issues.

3. PCI-DSS certified for payment security

All transactions are processed on secure, globally accepted infrastructure meeting international payment security standards. You benefit from bank-level security protocols without managing complex compliance requirements internally, ensuring transaction safety across all payment channels.

4. Secure mobile access for travellers

Employees view balances, upload receipts, and freeze cards without risking data leaks. The mobile application provides secure access to essential card functions while maintaining strict data protection protocols, enabling self-service capabilities without compromising security.

5. Compliant with Australian financial regulations

Built for ASIC and AUSTRAC compliance requirements, helping maintain audit-ready logs and tax records. You satisfy regulatory obligations through automated compliance features and comprehensive transaction documentation, reducing audit preparation time and regulatory risk.

Get started with Volopay prepaid cards in minutes

Starting with Volopay's business prepaid cards requires minimal setup time while providing maximum operational impact. The streamlined onboarding process gets your team access to advanced travel expense management within minutes, not days or weeks.

Register and complete digital KYC

Quick onboarding using your ABN and identification documentation. You complete the entire registration process online without visiting physical locations or submitting paper forms, enabling immediate access to card management features upon verification completion.

Load funds via bank transfer or BPAY

Top up cards securely from your business bank account using familiar Australian payment methods. You fund cards through established banking channels, ensuring secure transfers while maintaining existing banking relationships and internal financial controls.

Create cards with limits and tags

Assign corporate cards by employee, department, or project with unique rules for each. You customize spending limits, merchant restrictions, and usage categories for different team members, ensuring appropriate financial controls while enabling necessary business transactions.

Track, update, and pause cards anytime

Use your dashboard to make changes in real time, even mid-trip. You adjust spending limits, modify merchant restrictions, and pause cards immediately through the management interface, maintaining control over travel expenses regardless of employee location or timing.

Bring Volopay to your business

Get started now

FAQs about prepaid cards for business travel

Yes, you can issue unlimited cards for any department with individual spending limits and controls. Each card maintains separate tracking while rolling up to department-level reporting for comprehensive budget management.

Absolutely, cards work globally wherever global cards are accepted. You benefit from competitive foreign exchange rates and reduced international transaction fees, making overseas business travel more cost-effective than traditional banking solutions.

Yes, you can restrict cards to specific merchant categories like airlines, hotels, restaurants, and ground transportation. This ensures cards are used only for approved travel expenses while blocking unauthorized purchases automatically.

Card top-ups process instantly through bank transfer or BPAY. You can fund cards immediately when employees need additional travel funds, even if they're already traveling or in different time zones.

Yes, cards support multiple currencies with competitive exchange rates. You benefit from reduced foreign exchange fees and transparent pricing when employees travel internationally, making global business travel more cost-effective and predictable.