12 benefits of virtual cards for Australian businesses

Virtual cards represent the future of business payment solutions in Australia's rapidly evolving digital economy. As companies across the country seek more secure and efficient payment methods, virtual cards offer unprecedented control over business expenses.

You can streamline your payment processes while maintaining robust security protocols. These digital payment tools eliminate traditional banking constraints and provide real-time visibility into your company's spending patterns.

Modern Australian businesses are discovering that the benefits of virtual cards deliver superior functionality compared to conventional payment methods, enabling smarter financial management and enhanced operational efficiency.

What is a virtual card?

A virtual card is a digitally generated payment card that exists only in electronic form. It provides unique card details number, expiry date, and CVV that work like traditional cards for online transactions.

Virtual cards can be configured for single-use transactions or ongoing payments, depending on your business requirements. These cards are typically issued instantly through your banking platform or specialized fintech providers.

They operate within existing payment networks like Visa and Mastercard, ensuring widespread acceptance across Australian and international merchants.

12 key benefits of virtual cards for businesses

Understanding how virtual cards transform business expense management and security will revolutionize your payment strategy.

1. Enhanced security

Virtual cards provide superior protection through advanced encryption and tokenization technologies that safeguard your business transactions. You can generate single-use card numbers for specific purchases, ensuring that even if payment details are compromised, they cannot be reused maliciously.

Each virtual card contains unique identifiers that are separate from your main business account, creating multiple layers of security. The digital nature eliminates physical theft risks associated with traditional corporate cards.

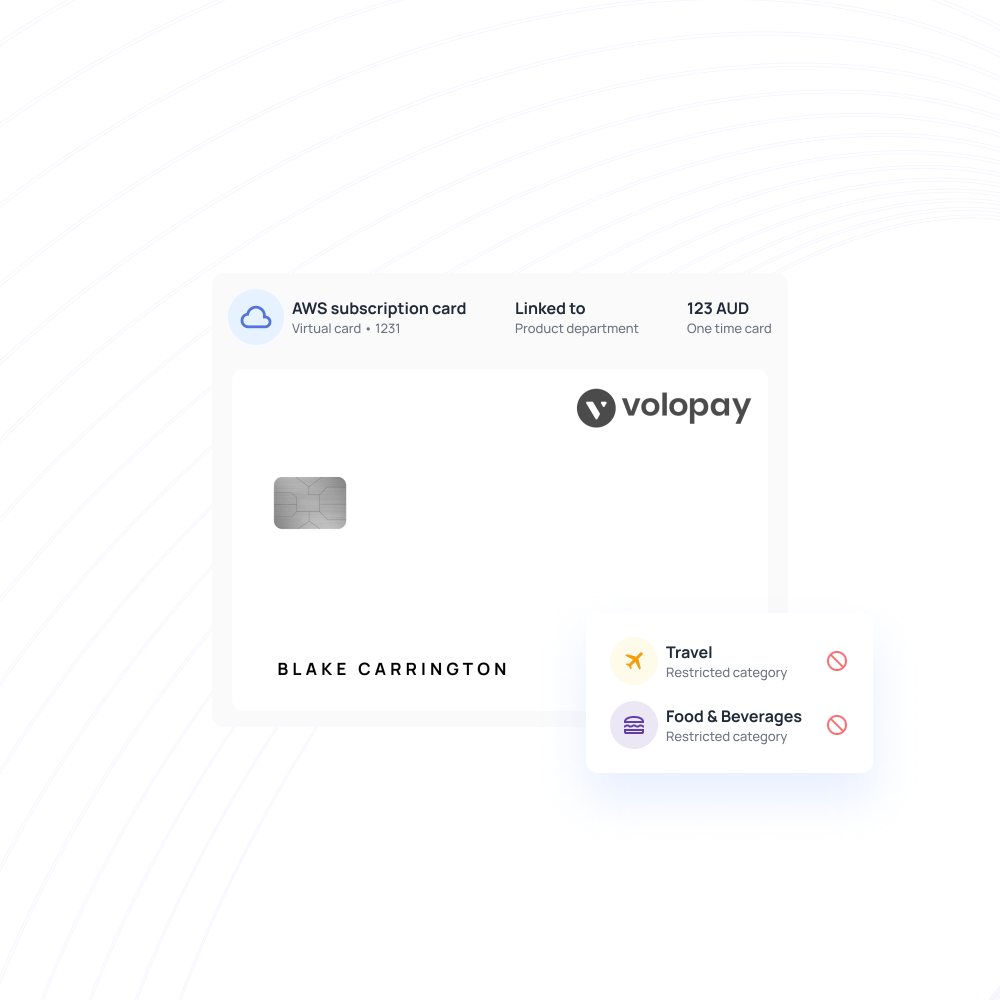

2. Spending controls

You gain unprecedented control over business expenses through customizable spending limits and transaction restrictions on virtual cards. Each card can be configured with specific dollar amounts, merchant categories, or time-based limitations that align with your budget requirements.

Instant freezing capabilities allow you to immediately halt suspicious or unauthorized transactions without affecting other business operations. You can set recurring spending limits for different departments or employees, ensuring budget compliance across your organization.

3. Real-time tracking

Virtual card platforms provide comprehensive dashboards that offer instant visibility into all business transactions and spending patterns. You can monitor expenses as they occur, eliminating the delays associated with traditional expense reporting systems.

Detailed transaction data includes merchant information, purchase categories, and timestamps, giving you complete oversight of business spending. Budget tracking features allow you to compare actual expenses against allocated budgets across different projects or departments.

4. Generate single or multi-use cards

Virtual card platforms offer flexible card generation options that adapt to your specific business payment needs. You can create single-use cards for one-off purchases, ensuring maximum security for vendor payments or online subscriptions.

Multi-use cards provide ongoing payment solutions for recurring expenses like software subscriptions or utility bills. Instant card generation means you can issue new payment methods within seconds, eliminating waiting periods associated with physical card production.

5. Simplifies vendor management

Virtual cards streamline supplier relationships by providing dedicated payment methods for each vendor or contract arrangement. You can assign specific virtual cards to individual suppliers, making it easier to track expenses and manage vendor relationships.

Automated payment scheduling ensures timely settlements while maintaining detailed records of all vendor transactions. Each vendor receives their own secure payment channel, reducing the risk of payment disputes or processing errors.

6. Simplified reconciliation

Automated transaction recording eliminates manual expense tracking and significantly reduces bookkeeping workload for your accounting team. Virtual card platforms generate detailed expense reports automatically, categorizing transactions according to your business rules and accounting standards.

Integration with popular Australian accounting software like Xero, MYOB, or Quickbooks ensures seamless data transfer without manual intervention. Receipt matching capabilities link transaction records with supporting documentation, creating complete audit trails.

7. Cost savings

Virtual cards typically offer lower transaction fees compared to traditional corporate credit cards and banking products available in Australia. You eliminate expenses associated with physical card production, shipping, and replacement costs when cards are lost or stolen.

Reduced administrative overhead from automated expense management translates into significant cost savings for your finance team. Competitive foreign exchange rates on international transactions can reduce costs for businesses with global suppliers.

8. Employee empowerment

Instant virtual card issuance enables you to provide employees with immediate access to authorized business spending capabilities without waiting for physical cards. Each employee receives cards with predetermined spending limits that align with their role and responsibilities within your organization.

Self-service portals allow employees to request additional spending capacity or report issues without lengthy approval processes. Mobile applications provide convenient access to virtual card details and spending history.

9. Global usability

Virtual cards operate seamlessly across international markets, providing your business with worldwide payment capabilities for global expansion. Multi-currency support enables you to make payments in local currencies, often with competitive exchange rates that reduce transaction costs.

International merchant acceptance through major payment networks ensures your virtual cards work with suppliers and service providers globally. Time zone flexibility means you can make payments anytime.

10. Policy enforcement

Customizable spending controls ensure all employee purchases align with your company's financial policies and procurement guidelines automatically. You can configure virtual cards to only accept transactions from approved merchant categories, preventing unauthorized or policy-violating purchases.

Spending approval workflows can be integrated into virtual card systems, requiring management authorization for transactions exceeding predetermined amounts. Real-time policy violation alerts notify managers immediately when employees attempt unauthorized purchases.

11. Fraud prevention

Advanced tokenization technology replaces sensitive card information with unique digital tokens, making your payment data worthless to cybercriminals. Limited-use virtual cards minimize exposure to unauthorized transactions by restricting card validity to specific timeframes or transaction amounts.

Real-time fraud monitoring systems analyze transaction patterns and flag suspicious activities before they impact your business finances. Instant card deactivation capabilities allow you to immediately disable compromised cards.

12. Time efficiency

Streamlined payment processes eliminate time-consuming manual procedures associated with traditional business payment methods and expense management systems. Automated transaction categorization and reporting reduce the time your accounting team spends on monthly reconciliation and expense processing tasks.

Instant payment capabilities enable immediate supplier payments, improving vendor relationships and potentially securing better terms or discounts. Reduced administrative burden from automated expense tracking frees up valuable time for strategic activities.

Simplify business payments with one smart solution

Virtual cards’ edge over legacy payment methods

Discover why virtual cards consistently outperform traditional cash, physical cards, and conventional payment methods for modern business operations. The benefits of virtual cards become evident when compared to legacy payment systems.

Cash hassles

Traditional cash payments create significant administrative burdens through manual tracking requirements and limited visibility into business spending patterns.

You face challenges with receipt management, as cash transactions often lack proper documentation, making expense reconciliation difficult and time-consuming.

Cash payments provide no automatic integration with accounting systems, requiring manual data entry that increases the risk of errors. Security concerns arise from storing and transporting cash, especially for larger transactions.

Physical card flaws

Physical corporate cards are quite vulnerable to theft, loss, and unauthorized use, creating security risks and administrative overhead for your business.

You must deal with card replacement procedures that can take several days, disrupting business operations and employee productivity.

Shared physical cards create accountability issues, making it difficult to track individual spending and enforce personal responsibility for expenses.

Physical cards require manual expense reporting processes, increasing the likelihood of errors.

Credit card pitfalls

Traditional credit cards often lack granular spending controls, leading to budget overruns and unauthorized purchases that can negatively impact your business finances.

You face challenges with high credit limits that may encourage overspending beyond approved budgets, creating cash flow difficulties and financial management problems.

Interest charges on carried balances can significantly increase business expenses, especially when employees make large purchases near the end of a billing cycle.

Workflow gains

Virtual card automation reduces payment processing time by eliminating manual approval workflows and streamlining expense management procedures.

You benefit from instant payment capabilities that enable immediate vendor payments and faster business transactions without waiting for traditional banking processes.

Automated reconciliation processes reduce month-end closing time by providing real-time transaction data that integrates seamlessly with your accounting systems.

Virtual cards for smarter business spending decisions

See how virtual cards enable precise, informed business spending that aligns with your strategic objectives and budget requirements.

Subscription control

Managing SaaS subscriptions and recurring services becomes effortless when you use dedicated virtual cards for each service provider or software platform. You can set specific spending limits that align with subscription costs, preventing unexpected charges or service upgrades without authorization.

Single-use cards for trial subscriptions ensure you're not charged after trial periods end, eliminating unwanted recurring expenses that can drain your budget.

Travel spending

Business travel expenses become manageable and transparent when you issue virtual cards with predetermined budgets for flights, accommodation, and other travel-related expenses. You can create cards with geographic restrictions and spending categories that align with your travel policy, ensuring employees stay within approved limits. Real-time expense tracking during business trips provides immediate visibility into travel costs, allowing for budget adjustments as needed.

Vendor efficiency

Supplier payments become faster and more secure when you assign dedicated virtual cards to each vendor relationship or contract arrangement. You can establish spending limits that match contract values, preventing overpayment and ensuring budget compliance for all vendor relationships.

Automated payment scheduling ensures timely supplier payments while maintaining detailed transaction records for audit and compliance purposes. Virtual cards eliminate the need for complex banking procedures.

Ad budgets

Digital marketing spend becomes precise and trackable when you allocate specific virtual cards for different advertising platforms and marketing campaigns. You can set daily or monthly spending limits that prevent budget overruns while ensuring continuous campaign performance across various marketing channels.

Real-time spending data enables quick budget adjustments based on campaign performance, allowing you to optimize marketing spend for better return on investment.

Scaling business growth with virtual card solutions

Learn how virtual cards support your business's expansion goals by providing flexible, scalable payment solutions that grow with your organization. The benefits of virtual cards become particularly valuable during periods of business growth.

Rapid issuance

Instant virtual card generation enables you to quickly provide payment solutions for new employees, contractors, or project requirements without traditional banking delays. You can create multiple cards simultaneously for large team expansions or new project launches, ensuring everyone has immediate access to necessary business payment capabilities.

Emergency card replacement takes seconds rather than days, minimizing business disruption when payment methods are compromised or lost.

Flexible budgets

Dynamic budget allocation allows you to adjust spending limits across different virtual cards based on changing business needs and project requirements. You can redistribute budgets between departments or projects in real-time, ensuring optimal resource allocation without rigid banking constraints or lengthy approval processes.

Seasonal budget adjustments accommodate business cycles and changing cash flow requirements, providing flexibility that traditional payment methods cannot match.

Global reach

Multi-currency virtual cards enable seamless international expansion by providing payment capabilities in local currencies across different markets and regions. You can establish payment infrastructure in new countries without opening local bank accounts or dealing with complex international banking procedures. Competitive exchange rates reduce the cost of international transactions, making global expansion more economically viable for your business.

Team enablement

Departmental virtual cards provide each business unit with dedicated payment capabilities and spending controls that align with their specific operational requirements. You can empower team leaders with budget management tools that enable autonomous spending decisions within predetermined limits and policy guidelines. Role-based access controls ensure appropriate spending authority while maintaining overall financial oversight and control across your organization.

Optimizing payment workflows with virtual card analytics

Use virtual card analytics to streamline business payment processes and gain valuable insights into your organization's spending patterns and financial performance.

Spending insights

Comprehensive dashboards reveal detailed transaction patterns that help you understand where and how your business spends money across different categories and time periods.

You can identify peak spending periods, seasonal trends, and departmental variations that inform better budget planning and resource allocation decisions.

Vendor spending analysis highlights your most expensive suppliers and identifies opportunities for contract renegotiation or supplier consolidation to reduce costs.

Dynamic adjustments

Real-time spending data enables you to make immediate budget adjustments based on actual transaction patterns and changing business requirements throughout the month.

You can identify budget shortfalls early and reallocate resources between departments or projects to maintain operational efficiency and prevent spending disruptions.

Automated spending alerts trigger when predetermined thresholds are reached, enabling proactive budget management rather than reactive expense control measures.

Accounting integration

Seamless integration with popular Australian accounting software eliminates manual data entry and reduces reconciliation time significantly.

You benefit from automated transaction categorization that aligns with your chart of accounts, ensuring consistent and accurate financial reporting across all business expenses.

Real-time data synchronization means your accounting records are always current, improving the accuracy of financial statements.

Performance reports

Detailed performance analytics identify cost-saving opportunities by highlighting spending inefficiencies, duplicate expenses, or opportunities for vendor consolidation across your organization.

You can generate executive reports that provide spending summaries for board meetings, demonstrating financial discipline and efficiency.

Departmental performance comparisons identify which business units show excellent budget management and which areas need additional oversight.

Safeguarding business payments with the security of virtual cards

Ensure virtual card payments are secure, compliant, and protected according to Australian regulatory requirements, standards and industry best practices.

Fraud mitigation

Advanced tokenization technology replaces sensitive payment information with unique digital identifiers, making transaction data worthless to cybercriminals even if intercepted.

Single-use virtual cards provide maximum security for high-risk transactions by ensuring card details cannot be reused after the initial purchase.

Real-time fraud detection systems monitor transaction patterns and immediately flag suspicious activities that deviate from normal business spending behavior.

GST compliance

Automated transaction recording ensures accurate GST tracking for purchases, simplifying tax compliance and reducing the risk of errors in quarterly submissions.

You benefit from detailed transaction categorization that aligns with ATO requirements, making it easier to claim legitimate business expense deductions.

Integration with accounting software automatically calculates GST obligations and generates reports required for business activity statements.

Data protection

Bank-level encryption protects all virtual card data and transaction information according to Australian privacy legislation and international security standards.

You benefit from secure data transmission protocols that prevent unauthorized access to sensitive financial information during payment processing.

Compliance with Australian Privacy Principles ensures your business meets data protection obligations while using virtual card services and storing transaction records.

Transform your business payments with Volopay's virtual cards

Unlock seamless payment management with Volopay's virtual cards designed specifically for Australian businesses seeking advanced financial control and efficiency. Experience the benefits of virtual cards through Volopay.

Quick setup

Volopay's streamlined onboarding process enables you to start issuing virtual cards within hours of account approval, eliminating lengthy setup procedures associated with traditional banking products. You can create unlimited virtual cards instantly through the intuitive web interface or mobile application, providing immediate payment solutions for urgent business requirements.

Smart analytics

Comprehensive spending dashboards provide real-time insights into business expenses with customizable reporting that aligns with your expense management and accounting requirements.

You gain access to advanced analytics tools that identify spending trends, budget variances, and cost-saving opportunities across different departments and expense categories. Predictive forecasting capabilities help you anticipate future cash flow needs and budget requirements based on historical spending patterns.

Secure transactions

Bank-grade encryption and tokenization technology ensure all payment data remains protected throughout transaction processing and storage within Australian data centers. You benefit from multiple layers of security, including biometric authentication, device fingerprinting, and behavioral analysis that prevent unauthorized access to virtual card systems.

Compliance with Australian financial services regulations and international security standards provides confidence that your payment infrastructure meets requirements.

Easy integration

Seamless connectivity with accounting software, including Xero, MYOB, QuickBooks, and more, eliminates manual data entry and ensures accurate financial record-keeping. You can integrate virtual card data with expense management systems, travel booking platforms, and procurement software to create comprehensive financial workflows.

Open API architecture enables custom integrations with proprietary business systems or specialized industry software, providing flexibility for unique operational requirements.

Bring Volopay to your business

Get started now