What is financial accounting and why is it important?

Financial accounting serves as the foundation for Australian business operations, providing systematic tracking and reporting of all monetary transactions within your organization. What is financial accounting exactly? It encompasses the methodical recording, measuring, and communication of financial information to external parties, including investors, creditors, and regulatory bodies.

Understanding the financial accounting meaning is crucial for business owners who need to demonstrate fiscal responsibility and maintain compliance with Australian accounting standards. This system enables accurate financial representation, informed decision-making, and regulatory compliance.

What is financial accounting?

Financial accounting represents a structured approach to documenting and analyzing your business's monetary activities through standardized methodologies and reporting frameworks. It captures every transaction, categorizes them per established principles, and presents consolidated information via balance sheets, income statements, and cash flow statements.

In practical terms, financial accounting turns raw data into insights revealing your company's financial health and efficiency. By producing reliable information meeting Australian Accounting Standards Board requirements, businesses demonstrate accountability, attract investment, remain compliant, and build stakeholder confidence.

Why financial accounting matters for Australian businesses

Financial accounting plays an indispensable role in modern business operations by providing the analytical foundation necessary for strategic planning and regulatory compliance. Effective financial accounting systems enable business owners to monitor performance metrics, identify operational inefficiencies, and implement corrective measures that enhance profitability and long-term viability.

The practice ensures compliance with Australian Securities and Investments Commission (ASIC) regulations while facilitating smooth interactions with the Australian Taxation Office (ATO) during audits and assessments. It also provides documentation that banks and investors require when evaluating loan applications or investment opportunities.

Objectives of financial accounting

Providing reliable financial information

Financial accounting delivers an accurate representation of your business's financial position, operational performance, and cash flow through standardized reporting. By implementing accounting principles, you ensure that stakeholders like investors, creditors, and regulators rely on your documentation.

This transparency communicates your economic reality, giving stakeholders essential insights to evaluate business health, stability, and make informed decisions about investments, lending, or partnerships.

Assessing solvency and liquidity

Financial statements evaluate your business's ability to meet financial obligations. Liquidity assessment examines short-term commitments like accounts payable and expenses using current assets.

Solvency focuses on long-term obligations such as loans through ratios like debt-to-equity. These insights give lenders and investors confidence in your business's consistent ability to honor commitments and maintain financial health over time.

Facilitating informed decision-making

Financial accounting enables strategic decisions using accurate data and indicators. Investors evaluate profitability and ROI before investing. Creditors assess creditworthiness for lending. Partners and suppliers review financial health for partnerships.

Standardized financial data supports strategic decisions like investments, expansions, or loans. It provides clear documentation to guide stakeholders and business leaders toward well-informed, growth-oriented actions.

Ensuring compliance and accountability

Financial accounting maintains compliance with the Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO) regulations. Adhering to Australian Accounting Standards promotes transparency and ethics.

Accurate financial reporting prevents penalties and enhances governance. This ensures ethical operations and builds trust with investors, regulators, and partners, protecting stakeholder interests and upholding professional accountability across all business operations.

Reporting to external stakeholders

Financial accounting serves external users like investors, creditors, and regulators without internal access. Standardized financial statements offer reliable, verifiable data to assess your business’s stability and performance.

This focus builds stakeholder trust in your integrity and transparency. It supports ethical practices, ensuring confidence in your financial documentation and sustaining long-term stakeholder relationships essential for business credibility.

Supporting strategic growth

By analyzing financial data and performance metrics, businesses can identify trends, optimize resources, and plan for growth. Financial accounting reveals cost-saving areas, revenue opportunities, and investment prospects.

It enables detailed budgeting, forecasting, and strategic planning. This positions your business for competitiveness and long-term success while maximizing profitability and stakeholder value within Australia’s evolving market environment.

Principles and concepts guiding financial accounting

1. Accrual concept

The accrual concept represents a cornerstone principle requiring you to systematically record revenues and expenses precisely when they are earned or incurred, rather than when actual cash transactions occur.

If you deliver services during December but receive payment in January, financial accounting mandates recording that revenue in December’s statements. This approach ensures your financial records reflect true economic activity, providing stakeholders with realistic insights into your company’s performance and financial position.

2. Going concern concept

This essential principle operates under the assumption that your business will continue operating indefinitely without requiring asset liquidation or closure. Financial accounting’s approach allows you to allocate major costs like depreciation across multiple periods, enabling long-term planning.

However, if your business faces closure or significant distress, the assumption must be revised, requiring substantial changes in financial reporting and disclosure to maintain accuracy and inform stakeholders and regulatory authorities accordingly.

3. Monetary unit concept

Financial accounting systematically records and reports transactions using a consistent currency framework—exclusively the Australian Dollar (AUD) for reporting in Australia. This concept ensures that only quantifiable, monetary data enters financial statements, excluding elements like employee morale or brand reputation.

Its core meaning lies in supporting consistent, objective, and comparable reporting across businesses and time periods, allowing stakeholders to evaluate performance using verified financial information free from non-quantifiable influences.

4. Business entity concept

Your business organization is treated as a legally separate entity from you as an individual owner, maintaining clear financial boundaries between personal and business affairs. Personal expenses mortgage payments, private travel, or personal vehicle costs must not be recorded in business accounts.

This principle guarantees transparency in your business's financial position and obligations while upholding regulatory standards, supporting accurate performance assessments, and promoting professional integrity in financial documentation and reporting.

5. Cost concept (Historical cost)

Business assets are recorded at their original acquisition cost rather than changing market value, ensuring consistent and objective reporting. For example, a $10,000 equipment purchase remains listed at that amount regardless of later price changes.

This approach eliminates subjective valuations, promotes comparability, and supports verifiable reporting standards across time periods. It provides a solid foundation for financial analysis that enhances stakeholder confidence in the reliability of your financial statements.

6. Full disclosure principle

You must fully disclose all financial details that may influence stakeholder decisions about your business. This includes explanatory notes detailing accounting policies, contingent liabilities, post-reporting events, and operational changes.

The full disclosure principle builds trust with investors, lenders, and regulators by ensuring transparency and ethical financial communication. Stakeholders rely on this complete information for accurate business evaluations, strategic planning, and risk assessment aligned with professional accounting standards and expectations.

7. Consistency principle

You must apply the same accounting methods and procedures across reporting periods to ensure comparable financial data. For instance, if you use straight-line depreciation, maintain it consistently unless a justified change arises.

Financial accounting’s approach to consistency enables stakeholders to track trends, assess business performance over time, and make accurate comparisons. It enhances credibility in financial documentation and supports meaningful analysis across various timeframes and operational stages.

8. Prudent reporting

Prudence in financial reporting requires cautious judgment and conservative estimates, especially to prevent inflating income or assets. For instance, probable losses such as bad debts must be recorded promptly, while gains are recognized only once realized.

This protective approach prevents over-optimism in reporting, ensuring stakeholders receive trustworthy, risk-aware financial documentation. It promotes financial credibility, reduces exposure to regulatory scrutiny, and enables accurate, informed decision-making by external and internal users.

9. Matching principle

Expenses should be recorded in the same period as the revenues they help generate, ensuring accurate profitability analysis. If you spend $5,000 on advertising in June to boost July sales, record the expense in July. This principle aligns costs with associated income, providing clarity on returns from investments.

Accurate matching supports realistic profit evaluation and enhances stakeholders’ understanding of your business’s operational efficiency and financial cause-and-effect relationships.

10. Revenue recognition principle

Revenue must be recorded when earned through completed obligations, not when payment is received. For instance, if you finish a consulting project in March but get paid in April, record the revenue in March. This aligns with the accrual concept, reflecting when value is delivered.

It ensures your financial records match economic activity and business performance, helping stakeholders evaluate the timing, efficiency, and reliability of income generation.

The financial accounting cycle: A step-by-step process

Transaction identification

You begin the comprehensive financial accounting cycle by analyzing business transactions to identify those with measurable financial impact on your organization, including sales, purchases, loans, and assets.

Only recordable events those affecting assets, liabilities, or equity are included in formal records. For instance, signing a contract may not be recorded until actual service delivery fulfills performance obligations, ensuring accurate timing of transaction recognition in your financial documentation.

Journal entries

Systematically record identified business transactions in chronological order within a detailed journal, documenting both debit and credit entries for every transaction. For instance, if you sell merchandise for $1,000 cash, debit the cash account and credit the sales revenue account.

This foundational double-entry bookkeeping ensures mathematical accuracy and preserves accounting equation balance while offering complete transaction documentation necessary for internal audits and regulatory financial reporting compliance.

Ledger posting

Transfer all recorded journal entries to a general ledger system, organized by specific accounts like cash, revenue, accounts receivable, and expense classifications. This organized classification allows for efficient data retrieval, tracking, and analysis, while preparing essential details for generating financial statements.

The ledger posting process consolidates transaction data into summarized account views that enable accurate monitoring of balances and transaction histories throughout the accounting period.

Unadjusted trial balance

Prepare an unadjusted trial balance to confirm mathematical accuracy and completeness of your general ledger before adjusting entries. This report lists all ledger accounts with debit or credit balances, confirming that total debits equal total credits.

If any imbalance exists, investigate and correct it by identifying arithmetic errors, recording omissions, or incorrect postings. This step ensures foundational accuracy before making necessary period-end financial adjustments to align reporting.

Adjusting entries

Make period-end adjusting entries for accruals like unpaid wages and deferrals like prepaid rent to reflect accurate financial positions. For example, if $2,000 in utility expenses is owed but unbilled, record it as both an expense and a liability.

These adjustments align with accrual accounting principles and ensure that your financial statements provide a realistic representation of your business’s obligations, revenues, and expenses at period-end.

Adjusted trial balance

Compile an adjusted trial balance after all accruals, deferrals, and necessary adjustments are recorded, ensuring accurate, complete account balances. This report reflects your business’s actual financial standing and confirms that total debits equal credits, validating all adjustments made.

The adjusted trial balance acts as the final verification step before preparing formal financial statements, maintaining alignment with accounting principles, and preserving equation balance across all account categories.

Financial statements

Create formal financial statements including profit and loss statements, cash flow statements, and balance sheets using data from your adjusted trial balance. These reports give stakeholders a full view of financial health, operational efficiency, and liquidity.

Following Australian Accounting Standards, these accurate reports guide strategic decisions, attract investment, and reflect compliance, providing insight into profitability and financial status at the close of each accounting period.

Closing entries

Close temporary accounts revenue and expenses by transferring balances to retained earnings after each period. For example, with $50,000 revenue and $30,000 expenses, move the $20,000 net profit into retained earnings.

This resets temporary accounts to zero and ensures they’re ready for the next cycle. The closing process secures proper financial continuity by maintaining permanent account balances while concluding the current accounting period efficiently.

Post-closing trial balance

Prepare a post-closing trial balance confirming that only permanent accounts assets, liabilities, and equity retain balances after closing entries. This ensures temporary accounts have been reset and validates accounting accuracy.

The report also verifies that the accounting equation remains balanced. It serves as the final checkpoint before a new accounting period begins, ensuring all financial statements and closing procedures have been completed appropriately.

Reversing entries

Optionally record reversing entries for prior period adjustments, like accrued expenses, to simplify current period accounting. For instance, if accrued wages were recorded in December, reverse the entry in January to avoid duplicate recording.

This optional method streamlines financial processes, minimizes confusion, and reduces errors, while ensuring financial accuracy across periods. Reversing entries support consistency and make regular accounting tasks easier to perform.

Key financial statements: The output and analytical tools of financial accounting

The balance sheet

● Purpose and structure

The balance sheet provides a comprehensive snapshot of your business's complete financial position at a specific point in time, systematically detailing all assets, liabilities, and equity components. This fundamental financial statement follows the essential accounting equation: Assets = Liabilities + Equity, ensuring mathematical balance and accuracy.

What is financial accounting's role in balance sheet preparation? It ensures that all financial transactions are properly recorded, classified, and summarized to present a true and fair view of your business's financial standing to stakeholders, investors, and regulatory authorities.

● Assets

Assets include everything your business owns or controls, categorized into current and non-current. Current assets cash, receivables, and inventory are liquidated within a year. Non-current assets property, equipment, long-term investments provide extended value.

For instance, a delivery van is non-current, while cash deposits are current. This classification provides a clear picture of your company’s liquidity, asset usability, and readiness to meet both short-term and long-term financial obligations efficiently.

● Liabilities

Liabilities reflect your business's financial obligations, classified into current and non-current. Current liabilities accounts payable, short-term loans, and accrued expenses—are due within one year. Non-current liabilities mortgages, long-term loans, deferred taxes extend beyond one year.

For example, a mortgage is non-current; a supplier payment due in 30 days is current. This classification helps stakeholders evaluate debt levels, repayment timelines, and overall financial risk and funding structure.

● Equity (Shareholders' funds)

Equity represents ownership interest and comprises share capital and retained earnings. Share capital refers to invested funds, while retained earnings are accumulated profits minus dividends. For example, if you invest $50,000 and retain $20,000 in profit, total equity equals $70,000.

Equity showcases the owner’s commitment and the business’s ability to generate value over time, reinforcing investor confidence and measuring performance through accumulated financial growth.

● Interpretation for stakeholders

The balance sheet helps stakeholders assess financial strength by analyzing solvency, liquidity, and capital structure. Key ratios like the current ratio (current assets ÷ current liabilities) indicate short-term financial health. Debt-to-equity and other ratios reveal long-term sustainability.

These metrics help investors, creditors, and management make informed decisions on business viability, risk, profitability, and future investment or financing strategies based on sound financial insight.

The profit & loss statement (Income statement)

● Purpose and structure

The profit and loss statement systematically summarizes your business's revenues, expenses, gains, and losses over a specific accounting period, clearly demonstrating operational profitability and efficiency. This comprehensive financial statement covers defined timeframes, such as quarterly or annual periods, highlighting your business's ability to generate profits through core operations.

The statement structure follows a logical flow from gross revenue through various expense categories to arrive at net profit or loss, providing stakeholders with detailed insights into operational performance and management effectiveness.

● Revenue recognition

Revenue encompasses all income streams, including product sales, service income, and other operating income, systematically recognized when performance obligations are satisfied and earnings are realized. For practical application, if you sell $10,000 worth of goods to customers, you record this revenue when the sale transaction occurs and ownership transfers, following established revenue recognition principles.

This approach ensures that financial statements accurately reflect the timing and substance of business activities, providing stakeholders with reliable information about your business's income-generating capacity and operational performance

● Cost of goods sold (COGS)

Cost of Goods Sold represents direct costs specifically attributable to producing goods or services sold during the reporting period, including raw materials, direct labor, and manufacturing overhead expenses. If you manufacture furniture, timber costs and wages paid to carpenters constitute COGS directly related to production activities.

Subtracting COGS from total revenue yields gross profit, a crucial metric demonstrating your business's production efficiency and pricing strategy effectiveness. This calculation helps stakeholders understand your business's fundamental profitability before considering operating expenses and other indirect costs.

● Operating expenses

Operating expenses include all costs necessary for running your business operations, encompassing rent payments, utilities, marketing expenditures, administrative salaries, and depreciation expenses. For example, $5,000 spent on advertising campaigns or $2,000 monthly office rent represent typical operating expenses that directly impact your operating profit calculations.

These expenses reflect your business's operational efficiency and management's ability to control costs while maintaining service quality. Understanding operating expense patterns helps stakeholders evaluate management performance and operational sustainability over time.

● Non-operating income and expenses

Non-operating items encompass financial activities separate from core business operations, including interest income from investments, gains or losses from asset sales, and other extraordinary items. For instance, earning $1,000 from investment portfolios or paying $2,000 in loan interest affects your net profit but doesn't reflect core operational performance.

What is financial accounting's treatment of these items? It separates them from operating results to provide stakeholders with clear insights into core business performance versus financial management activities, enabling more accurate business evaluation and strategic planning.

● Net profit/loss

Net profit or loss represents the final financial result after subtracting all expenses, including operating and non-operating items, from total revenues earned during the reporting period. A practical example would be $50,000 in total revenue minus $40,000 in total expenses, yielding a $10,000 net profit that reflects your business's overall efficiency and profitability.

This bottom-line figure demonstrates management's effectiveness in generating shareholder value and provides a comprehensive measure of business performance that stakeholders use for investment and lending decisions.

● Earnings per share (EPS)

For publicly traded companies, Earnings Per Share divides net profit by the number of outstanding shares, providing investors with a standardized profitability metric. If your company generates $100,000 in net profit with 10,000 outstanding shares, the EPS equals $10 per share, representing a key performance indicator for potential investors.

This metric enables shareholders to compare profitability across different companies and time periods, supporting informed investment decisions and portfolio management strategies while reflecting management's ability to generate returns for shareholders.

The cash flow statement

● Purpose and structure

The cash flow statement systematically tracks actual cash inflows and outflows during specific reporting periods, focusing specifically on liquidity and cash management rather than accrual-based accounting. Unlike the profit and loss statement, which records transactions when they occur regardless of cash timing, this statement shows actual cash movements across operating, investing, and financing activities.

This comprehensive approach provides stakeholders with crucial insights into your business's ability to generate cash, meet obligations, and fund growth initiatives through effective cash management strategies.

● Operating activities

Operating activities reflect cash flows directly related to core business operations, including cash receipts from customer sales, cash payments to suppliers, salary payments to employees, and other routine operational transactions. For example, receiving $20,000 from customers or paying $15,000 in employee wages directly affects operating cash flow calculations.

These activities demonstrate your business's ability to generate positive cash flow from core operations, which is essential for long-term sustainability and growth. Strong operating cash flow indicates effective management of working capital and operational efficiency.

● Investing activities

Investing activities encompass cash flows related to long-term asset acquisitions and disposals, including purchasing manufacturing equipment, selling property, or making strategic investments in other businesses. For example, buying new equipment for $50,000 represents a cash outflow, while selling excess property for $30,000 generates a cash inflow.

These activities reflect your business's growth investments and strategic asset management decisions. Stakeholders analyze investing activities to understand management's capital allocation strategies and long-term growth commitments.

● Financing activities

Financing activities include cash flows from interactions with owners and creditors, encompassing issuing new shares, repaying loans, paying dividends, or securing additional financing. For example, raising $100,000 through share issuance creates a cash inflow, while repaying $40,000 in loans or paying $10,000 in dividends generates cash outflows.

These activities demonstrate how you fund business operations and growth initiatives. The financial accounting meaning of financing activities lies in showing stakeholders how the business manages its capital structure and returns value to shareholders.

● Reconciliation of cash

The cash flow statement systematically reconciles opening and closing cash balances by summarizing net cash flows from operating, investing, and financing activities. If you begin with $20,000 in cash and experience a $10,000 net cash inflow during the period, your ending cash balance reaches $30,000, clearly demonstrating cash movement sources.

This reconciliation provides stakeholders with confidence in cash flow accuracy and helps identify potential cash management issues that require attention or strategic adjustments.

Statement of changes in equity

This comprehensive statement systematically tracks all changes in equity components during reporting periods, including issuing new shares, retaining profits, paying dividends, or other equity transactions. For example, if you add $50,000 in share capital and earn $20,000 in retained profits, this statement details these movements with complete transparency.

The statement ensures stakeholders understand how owners' equity changes over time, reflecting management's decisions regarding profit distribution, capital structure, and reinvestment strategies that affect shareholder value.

Notes to accounts

Notes provide essential additional context and detailed explanations supporting financial statement figures, including accounting policies, contingent liabilities, subsequent events, and other material information. For instance, notes might explain depreciation methods, pending litigation, or significant contracts that could impact future performance.

These explanatory notes ensure stakeholders have the comprehensive information necessary for informed decision-making, demonstrating transparency and compliance with disclosure requirements while building trust and credibility with investors and regulatory authorities.

Importance of financial accounting for Australian businesses

Ensuring regulatory compliance and avoiding penalties

Strict compliance with Australian Securities and Investments Commission (ASIC) and Australian Taxation Office (ATO) regulations represents a non-negotiable requirement for Australian businesses operating legally.

Accurate, timely financial reporting ensures your business consistently meets Australian Accounting Standards requirements, effectively avoiding costly fines, legal complications, or regulatory sanctions. For instance, the timely lodgment of annual financial statements with ASIC prevents automatic penalty assessments and maintains your business's good standing.

What is financial accounting's role in compliance? It provides systematic documentation and reporting frameworks that satisfy regulatory requirements while protecting your business from legal exposure.

Informed strategic decision-making and business planning

Comprehensive financial data serves as the analytical foundation guiding your most critical strategic choices, from expanding operations and entering new markets to implementing cost reduction initiatives and optimizing operational efficiency.

Systematic analysis of trends revealed in your profit and loss statements enables informed planning regarding capital investments, pricing strategy adjustments, and resource allocation decisions that directly impact long-term profitability.

The financial accounting meaning in strategic planning lies in transforming raw transaction data into actionable insights that support evidence-based decision-making processes, ensuring your business strategies align with actual financial performance and market realities.

Attracting investors and securing funding

Potential investors and financial institutions rely heavily on your comprehensive financial statements to systematically assess investment risks and evaluate potential returns before committing capital resources.

A robust balance sheet demonstrating healthy liquidity ratios, manageable debt levels, and consistent profitability patterns significantly enhances your ability to attract external funding for growth initiatives or expansion projects.

Professional financial accounting practices demonstrate management competence and operational transparency, increasing investor confidence while improving your negotiating position for favorable financing terms and conditions that support sustainable business growth strategies.

Performance measurement, analysis, and benchmarking

Financial accounting systems enable systematic performance measurement against established business goals and industry benchmarks, providing objective metrics for evaluating operational efficiency and competitive positioning.

For example, comparing your gross profit margins to industry competitors highlights specific areas requiring improvement while identifying competitive advantages worth leveraging. Regular financial analysis reveals performance trends, seasonal patterns, and operational inefficiencies that inform strategic adjustments.

This analytical capability supports continuous improvement initiatives while ensuring your business remains competitive within Australia's evolving market conditions.

Effective tax planning and management

Accurate, comprehensive financial records facilitate optimal tax obligation management, including Goods and Services Tax (GST) and corporate tax calculations, ensuring full regulatory compliance while strategically minimizing tax liabilities through legitimate deductions and credits.

Professional financial accounting enables proactive tax planning strategies that align with business objectives while maintaining ATO compliance requirements.

Systematic record-keeping supports efficient tax preparation processes, reduces audit risks, and ensures your business takes advantage of available tax incentives and concessions that can significantly impact bottom-line profitability and cash flow management.

Enhanced budgeting and future forecasting

Comprehensive financial data provides the analytical foundation supporting accurate budgeting processes and reliable future forecasting that guide strategic planning and resource allocation decisions.

By systematically analyzing historical performance patterns, seasonal variations, and growth trends, you can predict cash flow requirements, plan capital expenditures, and establish realistic financial targets.

Financial accounting (meaning, in forecasting) encompasses the transformation of historical data into predictive models that support proactive business management, enabling early identification of potential challenges and opportunities that require strategic responses.

Fraud detection, prevention, and risk mitigation

Regular financial accounting procedures systematically identify unusual transactions, unexplained discrepancies, and potential fraudulent activities, including unauthorized expenditures or revenue manipulation attempts.

Strong internal control systems, supported by comprehensive financial accounting processes, effectively safeguard business assets while reducing operational risks. Systematic transaction monitoring, distribution of duties, and regular account reconciliations create multiple layers of protection against financial fraud while ensuring accurate reporting.

These protective measures build stakeholder confidence while preserving business reputation and financial integrity.

Facilitating mergers, acquisitions, and disposals

During complex business transactions such as mergers, acquisitions, or asset disposals, potential buyers and investors rely extensively on your audited financial statements to assess business value, identify risks, and determine fair market pricing.

Accurate, comprehensive financial records ensure smooth transaction processes, support professional due diligence activities, and facilitate fair business valuations that protect all parties' interests.

What is financial accounting's role in transactions? It provides verified documentation of business performance, asset values, and liabilities that enable informed decision-making throughout negotiation and completion processes.

Building stakeholder trust and credibility

Transparent, consistent financial reporting systematically builds trust and credibility with investors, creditors, customers, suppliers, and other stakeholders who depend on reliable information for decision-making purposes.

Regular publication of accurate financial statements demonstrates management accountability, operational transparency, and commitment to ethical business practices that enhance your reputation within Australia's business community.

Strong financial reporting practices support long-term stakeholder relationships while creating competitive advantages through enhanced credibility and trustworthiness that facilitate business growth and partnership opportunities.

Effective communication of financial health

Professional financial statements serve as universal communication tools that clearly convey your business's financial health, operational performance, and growth potential to diverse stakeholder groups with varying levels of financial expertise.

These standardized reports ensure a consistent understanding of your business's profitability, financial stability, and strategic direction across different audiences.

The financial accounting meaning in communication encompasses the translation of complex financial data into accessible formats that support informed stakeholder decision-making while building confidence in your business's management capabilities and future prospects.

Financial accounting vs. management accounting: Key distinctions

Primary purpose and target audience

Financial accounting primarily serves external stakeholders, including investors, creditors, regulatory authorities, and other third parties, by providing standardized, auditable financial reports that ensure transparency and compliance.

Conversely, management accounting focuses exclusively on internal users such as managers, executives, and decision-makers, delivering customized analytical data, performance metrics, and strategic insights that support operational planning and control.

The financial accounting meaning in this context emphasizes external accountability and regulatory compliance, while management accounting prioritizes internal decision-making support and operational efficiency enhancement through tailored reporting solutions.

Nature of information

Financial accounting utilizes historical, verifiable monetary data to create objective, standardized reports that accurately reflect past business performance and current financial position.

Management accounting incorporates diverse information types, including non-monetary data such as employee productivity metrics, customer satisfaction scores, and operational efficiency indicators, combined with forward-looking projections and scenario analyses.

This distinction enables financial accounting to provide reliable historical documentation while management accounting offers comprehensive analytical tools supporting strategic planning and performance optimization across multiple business dimensions.

Adherence to standards and regulations

Financial accounting operates under strict adherence to Australian Accounting Standards, Australian Securities and Investments Commission regulations, and other mandatory legal requirements that ensure consistency, comparability, and transparency across all business entities.

Management accounting enjoys a degree of flexibility in reporting formats, methodologies, and presentation styles, allowing organizations to customize analytical approaches based on specific operational needs, strategic objectives, and decision-making requirements.

What is financial accounting's regulatory framework compared to management accounting? Financial accounting must comply with external standards, while management accounting adapts to internal requirements.

Periodicity of reporting

Financial accounting follows standardized reporting periods, including quarterly and annual cycles, that align with regulatory requirements, taxation obligations, and stakeholder expectations for consistent information delivery.

Management accounting provides frequent, ad-hoc reporting capabilities that deliver real-time operational insights, daily performance metrics, and immediate analytical support for urgent decision-making requirements.

This timing distinction enables financial accounting to meet external compliance obligations while management accounting supports dynamic internal management processes that require immediate access to current operational data.

Focus and level of detail

Financial accounting maintains a comprehensive organizational focus, presenting standardized financial information that covers entire business operations using consistent detail levels that ensure comparability across different periods and organizations.

Management accounting provides granular insights into specific operational areas, departmental performance, product line profitability, and individual cost center analysis that enables targeted management interventions and optimization strategies.

This approach allows financial accounting to serve broad stakeholder needs while management accounting delivers precise analytical support for specific management decisions.

Time orientation

Financial accounting predominantly adopts a backward-looking perspective, systematically summarizing completed transactions and historical performance data to create comprehensive records of past business activities and achievements.

Management accounting emphasizes future-oriented analysis, incorporating forecasting models, budgeting processes, strategic planning tools, and predictive analytics that support proactive decision-making and strategic positioning.

This temporal distinction enables financial accounting to provide reliable historical documentation while management accounting facilitates forward-thinking strategic planning and performance optimization initiatives.

Common challenges faced by businesses in financial accounting

Complexity of tax laws

Australia's comprehensive tax system, encompassing Goods and Services Tax (GST), Fringe Benefits Tax (FBT), corporate income tax, and numerous other taxation requirements, presents ongoing complexity challenges that require continuous monitoring and expert knowledge.

Frequent legislative changes, regulatory updates, and interpretation modifications demand constant attention to ensure full compliance and avoid costly penalties. You must invest in professional expertise, specialized software solutions, or comprehensive training programs to maintain current knowledge and ensure accurate tax compliance throughout evolving regulatory landscapes.

Data accuracy and integrity

High transaction volumes, complex business operations, and multiple data sources create significant challenges in maintaining absolute accuracy and integrity throughout financial accounting processes and systems. Manual data entry processes, system integration complexities, and human error risks require robust validation procedures, systematic reconciliation processes, and comprehensive quality control measures.

Ensuring accurate data capture, processing, and reporting demands significant attention to detail, systematic verification procedures, and comprehensive audit trails that support reliable financial statement preparation and stakeholder confidence.

Demand for skilled professionals

Finding qualified accounting professionals with comprehensive knowledge of Australian Accounting Standards, regulatory requirements, and industry-specific expertise presents ongoing challenges, particularly for small businesses operating with limited financial resources and competitive constraints.

The shortage of experienced professionals, increasing salary expectations, and specialized skill requirements create recruitment difficulties that impact financial reporting quality and compliance capabilities. Organizations must invest in professional development, competitive compensation packages, or outsourced accounting services to access necessary expertise and maintain operational standards.

Adherence to GAAP

While Australia implements its own Australian Accounting Standards (AAS), maintaining alignment with global Generally Accepted Accounting Principles (GAAP) for international stakeholder requirements, cross-border transactions, and multinational operations creates additional complexity in financial reporting processes.

Reconciling different accounting standards, ensuring consistent application across jurisdictions, and meeting diverse stakeholder expectations require comprehensive knowledge and systematic procedures. This dual compliance requirement demands additional resources, professional expertise, and systematic coordination to ensure accurate reporting that satisfies multiple regulatory frameworks.

Cybersecurity risks

Digital accounting systems, cloud-based platforms, and electronic data storage create significant cybersecurity vulnerabilities, including data breaches, ransomware attacks, and unauthorized access threats that could compromise sensitive financial information and business operations.

You must implement comprehensive security measures, including data encryption, access controls, backup systems, and disaster recovery procedures, to protect against evolving cyber threats. Investment in secure software solutions, professional security services, and employee training programs becomes essential for maintaining data integrity and operational continuity.

State-specific compliance

Operating across multiple Australian states introduces additional complexity through varying tax obligations, regulatory requirements, and compliance standards that differ significantly between jurisdictions and create administrative burdens.

For example, payroll tax rates, thresholds, and calculation methods vary substantially between states, requiring careful tracking and separate compliance procedures for each jurisdiction. This geographic complexity demands specialized knowledge, systematic coordination procedures, and potentially multiple professional relationships to ensure comprehensive compliance across all operational locations and regulatory requirements.

Role of technology and accounting software

Automation of processes

Modern accounting software solutions like Xero, MYOB, and QuickBooks systematically automate essential financial processes, including data entry, ledger posting, bank reconciliation, and comprehensive report generation, significantly reducing manual labor requirements and associated error risks.

These technological solutions enable you to redirect valuable time and resources from routine administrative tasks toward strategic analysis, business development, and value-added activities that drive growth and competitive advantage.

Automation capabilities ensure consistency, accuracy, and efficiency throughout financial accounting processes while supporting scalable operations and improved productivity.

Improved accuracy and compliance

Advanced accounting platforms incorporate built-in validation rules, automated calculations, and comprehensive compliance checks that ensure precise mathematical accuracy and strict adherence to Australian Accounting Standards throughout all financial processes.

These technological tools minimize human error risks, enforce consistent application of accounting principles, and provide systematic audit trails that support regulatory compliance and financial statement reliability.

Automated compliance features reduce the risk of costly penalties, enhance reporting accuracy, and build stakeholder confidence in financial documentation quality and professional standards.

Real-time reporting

Contemporary accounting software delivers immediate access to current financial information, enabling real-time monitoring of cash flow positions, profitability trends, budget performance, and other critical metrics that support rapid decision-making and strategic responsiveness.

This instant availability of financial data allows you to identify emerging issues, capitalize on opportunities, and implement corrective actions without delays that could impact business performance.

Real-time reporting capabilities transform financial management from reactive to proactive, supporting agile business operations and competitive positioning in dynamic markets.

Data security and backup

Professional accounting platforms implement comprehensive security measures, including advanced encryption protocols, automated backup systems, secure access controls, and disaster recovery capabilities that protect sensitive financial information from loss, corruption, or unauthorized access.

These robust security features ensure business continuity, protect against cyber threats, and maintain data integrity throughout all operational scenarios.

Investment in secure technology solutions demonstrates professional responsibility, builds stakeholder confidence, and ensures compliance with privacy regulations while protecting valuable business assets and competitive information.

Streamline your Australian business finances with Volopay

Seamless accounting process automation

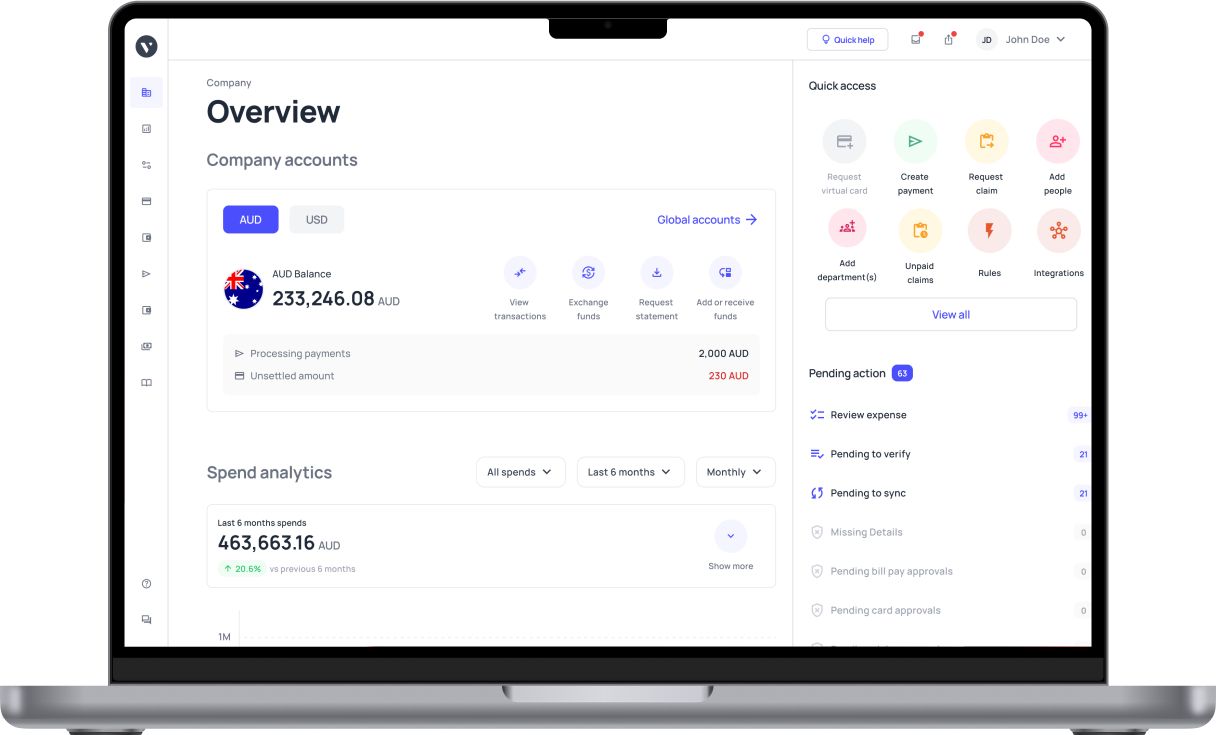

Volopay’s spend management platform revolutionizes financial accounting by integrating with tools like Xero. It automates expense recording, categorization, and reconciliation, delivering real-time financial accounting meaning.

This reduces manual tasks, enhances accuracy, and ensures compliance with Australian regulations. Streamline your financial accounting processes, save time, and minimize errors with Volopay’s efficient accounting automation solution. Discover what financial accounting is with seamless automation.

End-to-end financial visibility beyond expenses

Volopay transforms financial accounting with corporate cards, expense tracking, and budget controls. It simplifies financial accounting, seamlessly integrates with accounting systems for businesses.

This holistic solution enhances visibility, supports strategic decisions, and automates reconciliations. From employee expense management to ensuring compliance, Volopay empowers efficient financial management. Explore what is financial accounting with a platform designed for growth.