Employee payroll card - Benefits and how to get one

If you’re looking for a faster, more convenient way to pay your employees, payroll cards might be the solution. These cards work like prepaid debit cards and allow you to load wages directly onto them, eliminating the need for paper checks or bank transfers.

Many businesses are switching to employee payroll cards as a practical alternative to traditional payroll methods, especially when dealing with unbanked employees. Whether you're managing a small startup or scaling up, business payroll cards can simplify payment processing and reduce administrative overhead.

In this guide, you’ll learn how payroll cards for employees work, why they’re growing in popularity, and how they can streamline your payroll system.

What is a payroll card?

A payroll card is a prepaid card issued by employers to pay employee wages. Instead of transferring salaries to a bank account, businesses load funds directly onto the card. This offers a practical solution for employees who don’t use traditional banking services and gives employers a streamlined way to manage payroll.

Employee payroll cards function much like debit cards, allowing cardholders to withdraw cash, make purchases, or pay bills. For businesses in Australia, these pay cards for employees are becoming an increasingly popular payroll method.

Payroll cards for business are especially useful for industries with high contractor or casual labor use, providing a flexible payment method that works without the administrative burden of direct deposit or paper checks.

How do payroll cards work?

Payroll cards are prepaid cards utilized by employers to disburse employee wages on each payday. Employees can access their funds through cash withdrawals, purchases, or bill payments. Unlike direct deposits, these cards do not necessitate a linked bank account, offering an accessible and flexible payment solution for numerous Australian workers.

1. Issue payroll card

The first step is selecting a payroll card provider that fits your business needs. Once chosen, you’ll receive physical or virtual payroll cards for distribution. Each card is tied to an individual employee account, making it easy to manage payments securely. Business payroll cards are typically activated online and can be branded with company details for a professional touch.

2. Enroll employees in the system

After issuing the card, the employee must be enrolled in the payroll system. This involves capturing essential data like name, contact details, tax information, and card number. Many platforms offer digital onboarding to simplify this step.

By registering employees properly, businesses ensure accurate salary transfers and legal compliance with Australian labor regulations tied to employee payroll cards.

3. Load employee wages

On each payday, the employer transfers wages onto the payroll card using a connected payroll platform or banking tool. These transactions can be automated for consistency and efficiency. Whether paying weekly, biweekly, or monthly, pay cards for employees allow businesses to deposit salaries quickly, reducing delays and making funds instantly accessible to the employee once the transaction is processed.

4. Access available funds

Once wages are deposited, employees can immediately use their payroll cards. These cards function like standard debit cards, enabling ATM withdrawals, in-store or online purchases, and bill payments.

Because they aren’t linked to a personal bank account, employee payroll cards offer added flexibility. Many payroll card providers also support mobile payments, giving workers multiple ways to access their earnings securely.

5. Track card usage

Employers and employees can monitor card activity in real time. Most payroll card systems offer dashboards or apps that show transaction history, balance updates, and card usage reports.

For businesses, this helps maintain accurate records and track payroll spending. Employees benefit by staying informed about their pay and managing their personal finances more effectively through such payroll cards.

6. Reload on payday

With each pay cycle, the card is reloaded with the employee’s earnings. This process can be scheduled automatically through the payroll system to avoid missed payments.

Business payroll cards are designed for repeat use, so there’s no need to replace the card every cycle. Funds appear on the card shortly after processing, ready for immediate use.

7. Replace if lost

At each scheduled pay cycle, the employer transfers wages directly to the payroll card. This process can be automated through payroll software, minimizing errors and delays.

Since business payroll cards are reusable, there’s no need to issue a new one each time. Employees receive timely payments, and employers maintain efficiency and consistency across all salary disbursements using this method.

8. Maintain legal compliance

Using pay cards for employees must comply with Australian labor laws, including Fair Work requirements. Employees should have the option to choose this payment method freely and must not be charged unfair fees.

Clear communication and written consent are essential. By ensuring payroll cards for employees meet regulatory standards, businesses can avoid legal issues and foster ethical payroll practices.

What are the common use cases of payroll cards for businesses?

Payroll cards are versatile tools that can handle a wide range of payment needs in Australian businesses. Beyond regular wages, they simplify the distribution of bonuses, commissions, and contractor payments.

Business payroll cards also reduce the hassle of reimbursing expenses or paying temporary staff, offering a flexible alternative to traditional banking systems.

Employee payroll distribution

The most common use of employee payroll cards is for regular salary payments. Instead of transferring wages through direct deposit, employers load pay onto each employee’s card.

This is especially useful for businesses with a diverse workforce that may include staff without bank accounts, enabling seamless and secure distribution of wages every pay cycle.

Employee bonus disbursements

Payroll cards provide a fast and traceable way to issue employee bonuses. Whether it’s a quarterly incentive or a holiday reward, funds can be loaded directly onto the card.

This approach ensures employees receive their bonuses on time and reduces the administrative burden of processing separate payments through traditional bank transfers.

Commission-based payments

For sales teams or roles with performance-based earnings, business payroll cards are a practical solution. Employers can issue commissions separately from base pay without altering payroll cycles.

Employees get immediate access to their commissions, which can boost motivation and satisfaction. This setup also simplifies record-keeping for finance teams by keeping earnings segmented and transparent.

Temporary staff compensation

Hiring temporary or seasonal workers often creates extra paperwork. Payroll cards for employees eliminate that complexity by allowing employers to quickly pay temp staff without setting up traditional payroll accounts.

This is ideal for industries like retail, hospitality, or agriculture in Australia, where short-term labor is common and speed of payment is critical.

Travel expense reimbursements

Instead of asking employees to wait for reimbursement through accounts payable, employers can use pay cards to immediately transfer approved travel expenses.

This speeds up the reimbursement process and gives employees faster access to their funds. It’s a smart option for teams that travel frequently and require reliable, quick compensation for out-of-pocket spending.

Overtime pay distribution

Managing overtime payments can add complexity to payroll. With business payroll cards, employers can load overtime earnings separately or as part of a scheduled deposit.

This method helps ensure accurate, on-time payouts and keeps financial records organized. Employees benefit by having fast access to the extra income they’ve earned through extended work hours.

Remote worker payments

Payroll cards are highly effective for businesses with distributed or remote teams. Whether employees are working from home or in another region, you can ensure timely payments without relying on bank transfers.

These cards eliminate location-based delays, making them perfect for Australia’s growing remote workforce. Employees can access wages instantly from anywhere.

Employee incentive payouts

When running performance-based incentive programs, payroll cards offer a quick and efficient way to reward staff. Whether it’s a monthly goal achievement or a special milestone, employers can load incentive funds onto the employee’s card.

This boosts morale while simplifying the payment process, removing the need for cash bonuses or manual transfers.

Contractor wage settlements

For businesses that hire freelancers or contract workers, employee payroll cards can simplify payouts. There’s no need to issue checks or manage one-time bank transfers. Instead, contractors receive their earnings directly onto the card.

It’s an efficient solution that supports compliance, provides proof of payment, and helps streamline temporary workforce management in Australia.

What are the different types of payroll cards?

Payroll cards come in various formats to meet different business needs. From reusable cards for regular staff to one-time cards for contractors or travel, employers in Australia can choose the most suitable type of employee payroll card based on usage, security, and integration features.

1. Branded payroll cards

These cards feature your company’s branding, offering a professional look and a sense of ownership for employees. Branded payroll cards enhance trust and brand visibility while functioning like standard employee payroll cards.

For businesses aiming to reinforce their identity with staff, this type of card delivers both utility and marketing value.

2. Personalized cards

Personalized cards incorporate employee-specific information such as names or employee IDs, enhancing security and minimizing the risk of misuse or loss.

These personalized business payroll cards also facilitate streamlined internal tracking. They are particularly suited for organizations that emphasize individual accountability while ensuring flexibility in their payroll processes.

3. General-purpose cards

General-purpose payroll cards can be used widely, including at ATMs, retail stores, and online. These are the most common type of pay cards for employees, offering flexibility and ease of access to wages.

For Australian businesses with diverse teams, this option provides a simple, scalable solution for distributing funds.

4. Reloadable cards

Reloadable payroll cards are designed for repeated use. Employers can deposit wages every pay cycle without needing to issue new cards. This type is ideal for long-term employees and reduces the overhead associated with card management.

Reloadable employee payroll cards promote sustainability and are commonly used in ongoing workforce arrangements.

5. Non-reloadable cards

Non-reloadable cards are preloaded once and discarded after use. These are useful for paying short-term contractors, issuing one-time bonuses, or reimbursing isolated expenses.

Since they can’t be reused, non-reloadable business payroll cards help maintain clear boundaries between different types of payments and minimize long-term tracking or administrative requirements.

6. Virtual payroll cards

Virtual payroll cards are issued digitally and can be accessed through mobile apps or secure portals. They’re useful for remote or hybrid teams that don’t require physical cards.

Employers can load funds instantly, and employees can use them for online payments or digital wallets, supporting quick, contactless transactions across Australia.

7. Prepaid debit cards

Prepaid debit payroll cards allow employers to load a fixed amount for employee use. These cards aren’t linked to personal bank accounts and work for both in-person and online transactions.

For businesses in Australia, they provide a secure, easy-to-manage alternative for paying employees who prefer not to use traditional banking systems.

8. Instant issue cards

These cards can be activated and used immediately upon distribution. Perfect for onboarding new hires or covering urgent payments, instant-issue business payroll cards allow for rapid access to funds.

This is especially valuable in fast-paced sectors like hospitality, retail, or staffing agencies dealing with frequent employee turnover.

9. Travel expense cards

Designed specifically for handling business travel costs, these payroll cards separate salary payments from reimbursable expenses. Employees can use them for flights, accommodation, or meals while traveling for work.

By issuing travel expense payroll cards, businesses in Australia simplify accounting and ensure that travel funds are clearly tracked and compliant.

What are the benefits of payroll cards for employers?

These cards give employers a smarter way to handle wage distribution. By replacing paper checks and reducing reliance on traditional bank transfers, business payroll cards improve efficiency, reduce processing costs, and simplify record-keeping.

They also enhance security and flexibility, especially for Australian businesses with diverse teams, contractors, or remote employees.

Cost-effective payroll management

Payroll cards reduce administrative costs by streamlining wage disbursements. Employers save on printing, processing, and banking fees associated with checks or manual transfers.

By automating payments through business payroll cards, companies can cut down on payroll processing time and lower operational expenses, making payroll card systems a cost-effective choice for growing businesses in Australia.

Simplified compliance tracking

Staying compliant with Australian wage laws and reporting standards is easier with payroll cards. Transaction histories are automatically logged and accessible, supporting audits and regulatory checks.

Business payroll cards reduce the risk of manual errors and offer better transparency. This helps businesses maintain accurate financial records while staying aligned with Fair Work requirements.

Improved employee satisfaction

Fast, reliable access to wages boosts employee morale. Payroll cards for employees eliminate delays caused by bank processing or lost checks. Workers appreciate the convenience, especially those without traditional bank accounts.

Providing a flexible payment option shows that your business values accessibility and is willing to accommodate diverse employee needs in a practical way.

Enhanced company reputation

Offering modern payment methods like payroll cards reflects positively on your company’s image. It signals that your business is tech-savvy, efficient, and responsive to employee preferences.

In industries with high turnover or seasonal workforces, using business payroll cards can help attract talent and position your brand as forward-thinking and worker-friendly in the Australian market.

Reduced administrative burden

Payroll cards eliminate the need for printing, mailing, and reconciling physical checks. This lightens the workload on your HR and finance teams.

Automated wage loading through employee payroll cards also cuts down on repetitive manual tasks. The result is a faster, leaner payroll process that frees staff to focus on more strategic activities.

Modernized payment processes

Using payroll cards moves your business away from outdated payroll systems. Funds are transferred digitally, and employees receive instant notifications, improving overall transparency.

Business payroll cards integrate easily with most payroll software used in Australia, making it easy to adopt without major disruption. This modern approach fits the pace of today’s work environments.

Efficient financial record-keeping

Efficient financial record-keeping: Every payroll card transaction is automatically tracked, helping you maintain accurate payment records. This simplifies end-of-month reconciliations and reduces the chances of errors or disputes.

Business payroll cards also provide real-time visibility into payroll outflows, making it easier to plan, budget, and report financial data with clarity and confidence.

What are the benefits of payroll cards for employees?

Payroll cards give employees convenient, flexible access to their earnings. Without needing a traditional bank account, workers can receive wages, make purchases, or withdraw cash with ease.

For many in Australia, especially casual or contract workers, employee payroll cards simplify how they get paid and offer faster access to their money.

Instant access to funds

Employees don’t have to wait for bank processing times. With payroll cards, wages are available immediately after the employer loads them. This is particularly helpful for workers who rely on timely payments.

Business payroll cards reduce payment delays and provide employees with direct access to their income through ATMs, EFTPOS machines, or digital purchases.

Secure payment method

Payroll cards offer strong security features, including PIN protection and transaction monitoring. Unlike cash payments, lost or stolen cards can be blocked and replaced. This gives employees peace of mind, knowing their wages are safe.

Employee payroll cards also reduce the risk of paycheck theft or fraud, making them a safer alternative to physical payment methods.

No bank account needed

Not every worker has or wants a bank account. Payroll cards let employees receive and use wages without needing one. This increases accessibility for unbanked or underbanked individuals in Australia.

For businesses, offering pay cards for employees eliminates banking barriers and makes it easier to pay staff who might otherwise face challenges with traditional payroll systems.

Reward and cashback programs

Some payroll card providers offer built-in perks such as rewards points or cashback on purchases. Employees benefit from earning bonuses while using their card for everyday spending.

These features can improve financial wellbeing and create a more engaging experience. Business payroll cards that include these extras can also help employers boost retention and satisfaction without increasing wages.

Safe and quick card replacement

If a payroll card is lost, damaged, or stolen, employees can request a replacement without delay. Many providers offer fast card reissuance and support transferring the remaining balance.

This ensures employees continue to access their pay without disruption. Employee payroll cards with reliable replacement options offer a smoother, more secure experience than waiting on bank-issued replacements.

What are the limitations of payroll cards?

Although payroll cards provide numerous advantages, they also present certain limitations. Employers and employees must consider potential fees, usage restrictions, and fraud risks.

Recognizing these challenges enables businesses in Australia to select the most suitable payroll card solution, ensuring their teams are safeguarded and well-supported in all transactions.

Associated fees

Some payroll cards charge fees for ATM withdrawals, balance inquiries, or inactivity. These small charges can add up over time, especially for lower-income workers.

Employers should select business payroll cards with low or no fees and clearly communicate any potential costs to employees. Transparency and cost awareness are essential for maintaining trust and satisfaction.

Limited merchant acceptance

Not all merchants accept payroll cards, especially in rural or cash-preferred areas. Employees may face challenges using their cards for certain purchases.

It’s important to choose employee payroll cards backed by widely accepted payment networks. This ensures workers can use their cards in more locations across Australia, both in-store and online.

Withdrawal limits

Certain payroll card programs impose daily or per-transaction withdrawal limits, which can be inconvenient for employees requiring access to substantial amounts of cash.

Employers should carefully consider these limitations when selecting payroll card options to ensure they meet the needs of their workforce. Providing clear information about these restrictions can help minimize confusion and dissatisfaction among employees.

Risk of fraud or theft

Like any financial product, payroll cards can be vulnerable to fraud, skimming, or theft. If card details are compromised, employees may lose access to their wages temporarily.

Choosing employee payroll cards with strong security features, fraud monitoring, and 24/7 customer support is critical to protecting both company funds and employee trust.

Difficulties with disputes

Resolving disputes or transaction errors can take time, especially with lower-tier payroll card providers. Employees may find it harder to get support compared to traditional banks.

Employers should partner with reputable business payroll card providers that offer responsive customer service and clear dispute resolution processes to reduce frustration and ensure timely issue handling.

What features to look for when getting payroll cards for your business?

Choosing the right payroll card provider is about more than just convenience, it’s about ensuring long-term reliability, security, and compatibility with your existing payroll processes. For businesses in Australia, the ideal payroll card solution should support easy rollout, secure payment handling, regulatory compliance, and seamless integration with your finance systems.

A great payroll card program doesn’t just make it easier to pay employees, it helps create a more efficient, transparent, and employee-friendly payroll experience. Here are nine essential features to prioritize when evaluating payroll card providers for your business.

1. Low or no fees

Look for payroll cards that offer minimal fees for loading, ATM withdrawals, or monthly maintenance. Reducing costs makes the solution more attractive for employees and simplifies budgeting for employers.

Transparent fee structures also help avoid employee dissatisfaction or confusion around hidden charges related to card use.

2. Easy employee enrollment

The onboarding process should be quick and straightforward. Look for providers that support digital self-enrollment, bulk registration, and minimal paperwork. This reduces administrative strain on your HR team and ensures faster card issuance for new employees.

Seamless enrollment means your business can get payroll cards up and running without delays or unnecessary friction.

3. Multiple withdrawal options

Employees should be able to access their wages conveniently. A good payroll card allows withdrawals via ATMs, EFTPOS machines, or digital wallets. Some providers even offer free or subsidized ATM access.

By giving employees more flexibility in how they retrieve their funds, you make the card more practical and worker-friendly.

4. Strong fraud protection features

Security is non-negotiable. Prioritize providers offering fraud monitoring, PIN protection, card freezing, and real-time alerts. These tools help prevent unauthorized use and protect employee earnings.

Australian businesses must ensure that payroll cards comply with financial data security standards to avoid exposing staff to preventable risks.

5. Real-time transaction tracking

Employees benefit from being able to instantly view their balances and recent activity. A payroll card should include an online portal or mobile app that displays transactions in real time.

This kind of visibility empowers workers to monitor their finances closely and helps resolve disputes or questions faster.

6. Compatibility with payroll software

Make sure the payroll card platform integrates smoothly with your existing payroll or HR software, such as Xero, MYOB, or KeyPay.

Integration automates wage disbursement, reduces manual data entry, and ensures accurate, on-time payments. It also simplifies record-keeping and improves payroll processing speed.

7. Customizable card controls

Being able to set spending limits, restrict merchant categories, or block certain transaction types is a valuable feature. This helps employers reduce misuse and tailor payroll cards to specific employee roles or requirements.

Custom controls add a layer of operational security and financial governance.

8. Nationwide or global usability

Payroll cards should work seamlessly across Australia, and globally if you manage international staff or remote workers. Choose a provider with wide acceptance across ATM networks and retailers.

Some cards also support international use and multicurrency access, which is a plus for businesses with distributed teams.

9. Regulatory compliance support

Australian businesses must comply with Fair Work regulations and financial reporting requirements. Look for payroll card providers that offer compliance support, including audit trails, employee consent documentation, and proper wage statement formatting.

This reduces legal risk and ensures your payroll practices meet government standards.

10. 24/7 customer service

Issues can arise at any time. A provider with round-the-clock support ensures both your business and employees can get help when needed.

Whether it’s a lost card, a technical issue, or a pay-related question, access to responsive customer service prevents payroll disruptions and maintains trust.

How to implement payroll cards in your organization?

Implementing payroll cards requires careful planning to ensure a smooth rollout and strong adoption. From provider selection to training and compliance, businesses must follow a structured approach that supports both operational efficiency and employee satisfaction.

1. Research payroll card providers

Start by evaluating payroll card providers that serve businesses in Australia. Look for features like fraud protection, real-time transaction tracking, low fees, and integration with your existing payroll system.

Comparing providers helps ensure you choose one that aligns with your business needs and gives employees a secure and user-friendly way to receive their pay.

2. Choose a suitable card plan

Select a payroll card plan that fits the size and structure of your workforce. Some plans offer more flexibility for part-time or remote workers, while others focus on enterprise-scale features.

Pay attention to card fees, usability, and scalability to ensure long-term value and support as your company grows.

3. Communicate with employees

Clear communication is key to successful adoption. Explain what payroll cards are, how they work, and the benefits they offer. Reassure employees about security, accessibility, and fee structures.

Providing an FAQ or help guide can ease any confusion and ensure that employees feel confident using their new payroll cards.

4. Integrate with your payroll system

Your payroll card solution should work seamlessly with your existing payroll software, such as Xero, MYOB, or KeyPay. Integration allows automatic wage transfers, reduces manual work, and lowers the risk of payroll errors.

Ensuring compatibility from the start will save time and streamline your payroll process moving forward.

5. Set up employee enrollment

Make the enrollment process as simple as possible. Some providers offer bulk upload options or secure digital sign-up portals.

Whether employees are onboarded individually or in groups, the process should be fast, intuitive, and require minimal manual intervention. Smooth enrollment increases participation and minimizes disruptions during the transition.

6. Train HR and payroll teams

Your HR and payroll teams should understand how to administer payroll cards, manage employee queries, and resolve common issues.

Provide basic training on the platform interface, card settings, and troubleshooting procedures. This ensures the teams behind payroll can confidently support staff and maintain system efficiency.

7. Ensure legal compliance

Make sure your payroll card system complies with Australian labor laws and Fair Work regulations. Employees must be able to access their full pay without unfair restrictions or fees.

Compliance also includes obtaining proper consent from employees and ensuring that wage statements and tax reporting remain accurate and accessible.

8. Monitor card usage and feedback

Once the program is live, track how employees are using their payroll cards. Look for trends in usage, transaction issues, or service requests. Encourage employees to provide feedback on their experience.

Monitoring helps you identify any issues early and allows for adjustments that improve satisfaction and system performance.

9. Address employee concerns

Be ready to support employees with card-related problems such as lost cards, transaction errors, or withdrawal questions. Fast, responsive support shows that the company takes their concerns seriously.

A reliable payroll card program should include access to help resources or direct support from your card provider when needed.

10. Review and adjust as needed

Payroll systems aren’t set-and-forget. Regularly assess your provider’s performance, employee satisfaction, and overall cost-efficiency. If issues persist or better options become available, be ready to change plans or providers.

Ongoing evaluation ensures your payroll process stays modern, compliant, and aligned with your business goals.

Best practices to follow when using payroll cards in a business

For the employer

● Introduce payroll cards gradually

When implementing payroll cards in your business, roll them out gradually. Start with a pilot group before expanding to the entire workforce.

This allows you to address any issues early on and make adjustments based on employee feedback. A phased introduction ensures smoother transitions and helps employees become comfortable with the new payment method.

● Create a dedicated payroll card team

Designate a team within HR or payroll to manage payroll cards for employees. This team should handle card enrollment, troubleshooting, and overseeing card distribution.

A dedicated team ensures all issues are addressed promptly and employees receive consistent support. It also allows for a focused effort on improving and maintaining your payroll card system.

● Set clear performance standards

Set clear expectations for the use and management of business payroll cards. Define performance standards such as timely payroll loading, card security, and proper enrollment procedures.

Communicate these standards to employees so they understand the importance of following the guidelines. Clear standards help ensure the success and efficiency of the payroll card program across your business.

● Train employees on card use

Provide training for employees on how to use their employee payroll cards effectively. This includes explaining card features, fees, and how to check balances.

Offering clear guidance ensures that employees understand the system and can maximize the benefits of their payroll cards. The better they understand their card, the fewer mistakes and issues will arise.

● Identify and manage inactive cards

Monitor for payroll cards that remain unused over extended periods. Inactive cards can be a sign of employee dissatisfaction or non-engagement.

Implement a process to deactivate or replace unused cards. Regularly review card activity to ensure that all issued cards are actively used and that employees are benefiting from the payroll card program as intended.

● Audit payroll card usage regularly

Conduct regular audits of payroll card transactions to ensure there are no discrepancies, fraudulent activity, or unauthorized use.

These audits also help you assess the program’s efficiency, identify areas for improvement, and ensure that cards are being used according to company policies. Regular checks also help maintain financial control and reduce the risk of errors or misuse.

● Analyze payroll card providers carefully

Before selecting a provider, thoroughly analyze different payroll card providers. Look for ones with transparent fee structures, solid customer support, and security features.

Compare their compatibility with your payroll system and review customer feedback. Carefully evaluating your options ensures that you choose a provider that can scale with your business and provide excellent service to your employees.

● Choose trusted payroll card providers

Work with reputable, well-established providers of business payroll cards. A trusted provider ensures that your employees have access to secure, reliable, and efficient card services.

Additionally, a reputable provider offers customer support, fraud protection, and legal compliance, which are essential for maintaining trust and security in your payroll program.

For the employee

● Follow payroll card rules strictly

Always adhere to the rules and guidelines associated with your payroll card. This includes understanding fee structures, spending limits, and card activation procedures.

By following the established rules, you ensure your card works as intended and avoid unnecessary issues. Staying compliant with the rules helps maintain a smooth, problem-free experience with your payroll card.

● Avoid overspending

Be mindful of your spending when using your employee payroll card. Since the card is preloaded with your wages, it’s important not to exceed your balance.

Overspending can result in declined transactions or unexpected fees. Keep track of your expenses to ensure you are within your budget and to avoid running out of funds before your next payday.

● Use the card responsibly

Treat your payroll card like a personal debit card. Use it for necessary purchases and manage your spending habits.

Avoid using it for non-essential or impulse buys, as this can affect your financial health. By using the card responsibly, you can make the most of your wages while keeping financial stress to a minimum.

● Keep track of receipts and expenses

Always keep receipts for purchases made with your payroll card. Tracking your expenses helps you stay within your budget and makes it easier to monitor how much of your earnings are being spent.

Keeping organized records can also be helpful when managing your finances and ensuring you’re using the card within its limitations.

● Report lost or stolen cards right away

If your payroll card is lost or stolen, report it to your provider immediately. Most providers offer 24/7 customer support and can freeze your card to prevent unauthorized transactions.

Promptly reporting a lost or stolen card ensures that your wages are protected and minimizes the risk of fraud or theft.

● Stay informed about card features

Stay up to date on any changes or updates to your employee payroll card. Familiarize yourself with new features, rewards programs, or fee adjustments.

Being informed about your card's capabilities helps you maximize its benefits and avoid unexpected fees or limitations. It also empowers you to make better financial decisions with your payroll card.

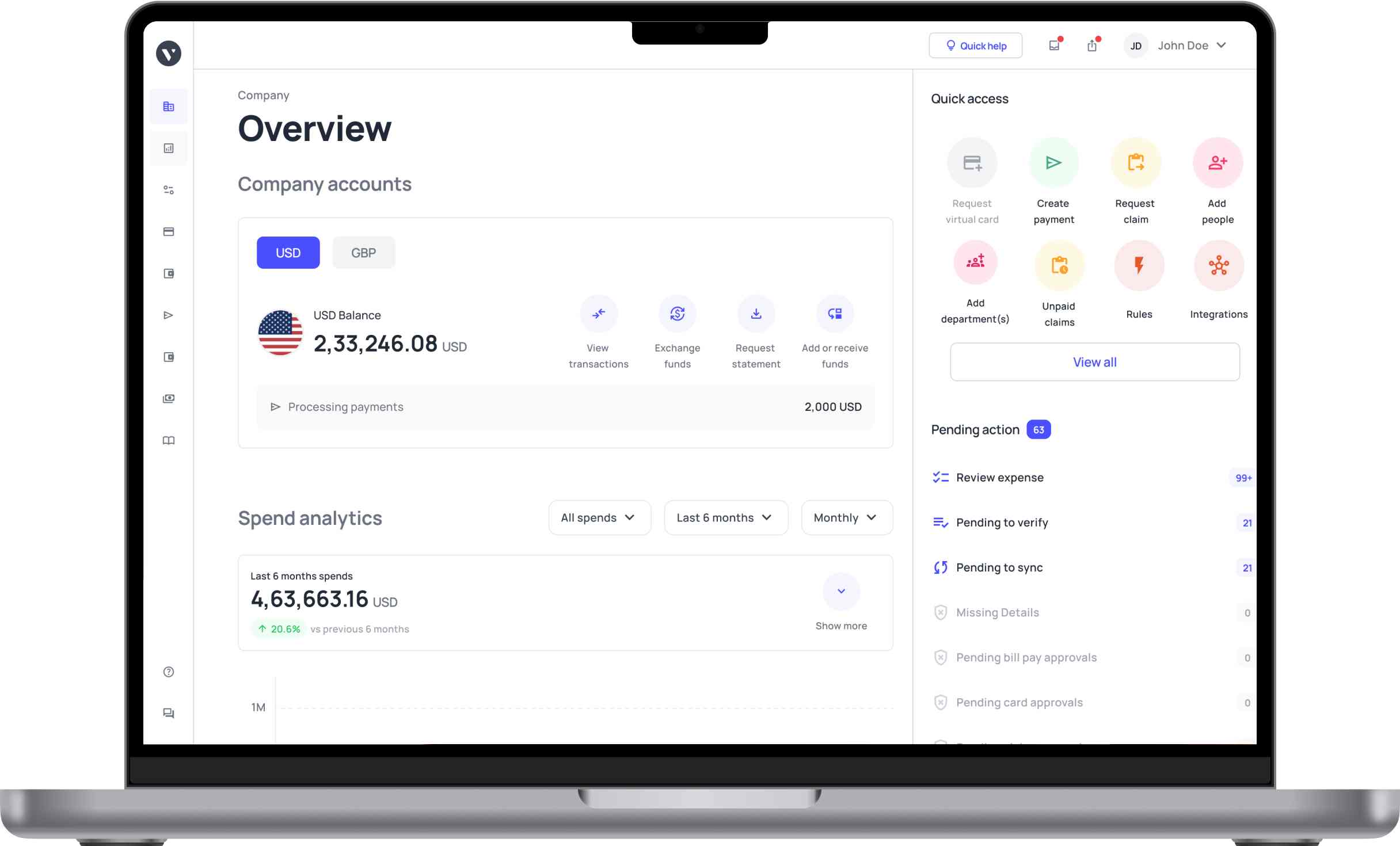

How does Volopay streamline payroll management for businesses?

Managing payroll can be a time-intensive and error-prone task, particularly as teams expand. Volopay streamlines this process through intelligent automation, seamless integrations, and real-time transparency.

Covering everything from employee payments to deductions and reconciliation, Volopay offers a comprehensive enabling Australian businesses to handle payroll with precision, efficiency, and scalability.

Automates complete payroll process

Volopay streamlines every aspect of payroll management, from calculating employee wages to executing transfers. It enables the scheduling of payments, application of deductions, and compliance with tax obligations, all without manual intervention.

This minimizes the risk of delays or compliance errors, enhancing efficiency and accuracy for businesses while allowing HR and finance teams to concentrate on strategic initiatives instead of routine payroll tasks.

Unlimited virtual cards for employees

Volopay allows businesses to issue unlimited virtual cards, giving employees secure, flexible access to company funds. These cards can be used for payroll disbursements, expense reimbursements, or project-specific budgets.

With individual limits and controls, companies can manage spending in real time. It’s a faster, more controlled alternative to traditional payment methods or payroll cards.

Customizable, multi-level approval workflows

Volopay supports multi-level approval chains tailored to your company structure. You can set up different workflows for salary payments, bonuses, or contractor payouts.

Managers and finance leads can review, approve, or reject transactions before they’re finalized. This control ensures that payroll disbursements follow company policy while maintaining transparency and preventing unauthorized or duplicate payments.

Ensures compliance and security

Compliance is critical in payroll, and Volopay helps businesses stay aligned with Australian tax laws and Fair Work regulations. The platform includes built-in controls that flag anomalies, enforce limits, and generate audit-ready records.

Data is encrypted end-to-end, and secure access controls keep sensitive payroll information protected from misuse or unauthorized access.

Simplifies payroll deductions handling

Handling superannuation, tax withholdings, and other deductions can be complex. Volopay simplifies this by allowing custom deduction rules tied to employee profiles.

These deductions are automatically applied during payroll runs, minimizing errors and ensuring each payment reflects accurate take-home pay. This saves time and improves compliance with Australian workplace obligations.

Automates payroll reconciliation

Volopay automatically matches payment records with payroll ledgers, eliminating the need for manual reconciliation. Any mismatches are flagged instantly, helping you resolve issues before they escalate.

By syncing bank transactions with payroll activity, you gain clear visibility into where funds went and why, supporting cleaner books and faster month-end closes.

Provides real-time payroll tracking

You can monitor payroll status live through Volopay’s dashboard. Know when payments are initiated, processed, and received. This transparency helps teams quickly spot and respond to payment issues or delays.

Real-time tracking keeps both employees and finance teams informed, reducing the number of follow-ups and building trust in the payroll process.

Integrates with accounting software

Volopay integrates smoothly with accounting platforms like Xero, QuickBooks, and MYOB. Payroll data syncs automatically, keeping your books updated without extra effort.

This tight integration reduces data entry errors and ensures financial reporting reflects accurate payroll figures. It also helps finance teams stay compliant and ready for audits or tax filings.

Offers advanced reporting and analytics

Track payroll trends, compare costs over time, and drill into team-level spending with Volopay’s analytics tools. Reports can be customized to show payroll by department, role, or location.

These insights help leadership make informed decisions about hiring, budgeting, and compensation planning. With everything in one place, payroll becomes more than a cost, it becomes a strategic asset.

Simplify global payroll in one platform

FAQs on payroll cards

Payroll cards function similarly to bank accounts, allowing employees to access and spend their wages. However, they don’t offer all bank services, such as savings or credit features.

Yes, some payroll cards may charge fees for transactions like ATM withdrawals or card maintenance. These fees vary depending on the card provider, so employees should review terms carefully.

Yes, payroll cards for employees can be used online for purchases, just like a regular debit card, as long as the merchant accepts prepaid cards. This provides flexibility for employees.

Unlike direct deposit, which transfers funds into a bank account, payroll cards provide a prepaid card that employees can use for purchases or ATM withdrawals, without needing a traditional bank account.

Yes, business payroll cards can often be customized with company branding, card designs, and specific spending restrictions, allowing for more control over how employees use their wages.

Businesses of all sizes, including startups, SMEs, and large enterprises, can benefit from Volopay’s corporate payroll cards by streamlining payroll processing and providing easy access to employee wages.

Yes, Volopay’s payroll software is highly customizable, allowing businesses to tailor workflows, approval processes, and reporting features to suit their specific payroll needs and operational requirements.