Remittance advice - Definition, types, and template

In today's interconnected global economy, financial transactions occur across borders with remarkable frequency. Among the myriad of financial tools facilitating these transactions, remittance advice stands out as a crucial component to help businesses keep track of payments made and for the reconciliation of accounts.

This comprehensive guide aims to elaborate on what is remittance advice, the importance it holds for an organization’s finance department, the different types of remittance advice, the information such a document must include, challenges faced when sending remittance advice, and its practical applications in business finance.

What is remittance advice?

As you manage your accounts payable in this day and age, remittance advice has become a critical tool for ensuring smooth, efficient, and accurate payment processes.

With automation reshaping financial operations, this document plays a pivotal role in streamlining workflows, strengthening supplier relationships, and adapting to digital payment trends. Below, we break down what remittance advice is, why it’s essential, and how it’s evolving.

Defining remittance advice

Remittance advice is a payment confirmation document you send to suppliers to verify that an invoice has been paid. It details critical information like the invoice number, payment amount, date, and method, enabling you to match payments to invoices accurately. Think of it as a receipt that ensures both you and your supplier are on the same page, reducing errors in your accounts payable process.

Importance for accounts payable

In your accounts payable department, remittance advice is a game-changer for invoice reconciliation. It bridges the gap between payments and invoices, allowing you to quickly confirm that payments align with outstanding balances.

By automating remittance advice, you can integrate it with accounting software, minimizing manual data entry, reducing errors, and speeding up the entire reconciliation process. This efficiency saves you time and resources while ensuring accuracy.

Impact on supplier relationships

Timely and clear remittance advice builds trust with your vendors. When you provide detailed, prompt confirmation of payments, suppliers gain confidence in your reliability, reducing disputes over unpaid or mismatched invoices.

Automated remittance systems allow you to instantly share advice via email or supplier portals, fostering transparency and strengthening partnerships critical to your supply chain.

Evolution in digital payments

The days of paper-based remittance slips are fading fast. Automation trends have shifted remittance advice to digital formats, integrated with cloud-based accounting platforms and digital payment systems.

You can now automate the creation and delivery of remittance advice, syncing it with electronic payments like ACH or wire transfers. This digital evolution cuts processing times, reduces paper waste, and aligns with the broader push toward fully automated accounts payable workflows.

Why is remittance advice important?

There is consistent evolution around accounting and payment methods. If you have observed, small and medium-sized businesses are moving from traditional payment methods like a check to digital payment solutions, ACH, wire transfer, and remittance transfers through online wallets.

As a rule, remittance advice has always been sent along with the check to the vendor. As we are leaning away from the check/cash payments, why is a remittance receipt still in the picture?

A remittance slip, often overlooked in its simplicity, holds significant importance in financial transactions. Here's a deeper dive into specific aspects of this document that outline why it's so crucial:

1. Act of courtesy

In the world of business, professionalism and courtesy go hand in hand. Including remittance advice with the payment signals to suppliers that you value transparency and clear communication.

It's like saying, "Here's your payment, and here's all the relevant information about it." This act of transparency fosters trust and goodwill between parties, laying the groundwork for enduring business relationships.

2. Improved vendor relationships

In any business relationship, trust is paramount. Timely and accurate remittance advice goes a long way in nurturing this trust. When suppliers receive prompt notification of payments along with detailed information, it demonstrates reliability and commitment on the part of the payer.

This, in turn, strengthens the bond between suppliers and customers, paving the way for smoother transactions and potentially more favorable terms in the future. The vendors themselves are more likely to support and help your business in ways they might not help others due to your professionalism.

3. Invoice matching

One of the practical functions of remittance advice is its role in invoice matching. By providing comprehensive payment details such as invoice numbers, payment amounts, and dates, remittance advice simplifies the process of reconciling payments with outstanding invoices.

It makes the task of reconciling payments for the finance teams of both businesses much easier. This reduces the likelihood of discrepancies or disputes, saving both parties time and effort in resolving payment-related issues.

4. Streamlines record-keeping

In today's complex business landscape, accurate record-keeping is non-negotiable. Remittance advice serves as a vital tool in this regard.

By documenting payment details in a clear and structured manner, it streamlines the task of maintaining financial records. Whether for internal audits, regulatory compliance, or strategic financial analysis, having well-documented remittance advice facilitates accurate and efficient record-keeping practices.

5. Reduces errors

Errors in payment processing can have costly repercussions for businesses. However, detailed remittance advice serves as a safeguard against such errors.

By providing a clear breakdown of payment information, including the purpose of the payment and any relevant reference numbers or codes, remittance advice minimizes the likelihood of misunderstandings or misallocations. This not only saves time and resources but also helps maintain the integrity of financial data.

6. Supports efficient accounting

Efficiency is the lifeblood of any accounting department. Remittance advice plays a crucial role in supporting this efficiency by expediting the reconciliation process. With all the necessary payment details readily available, accountants can quickly match payments to invoices, verify transactions, and update records accordingly.

It aids even if you use an expense management system for your business. This frees up valuable time and resources that can be redirected towards more strategic financial tasks, ultimately contributing to better financial management and decision-making.

How does remittance advice work in accounts payable?

As you manage your accounts payable (AP), remittance advice is a critical tool that streamlines payment processes and ensures accuracy. It serves as a bridge between your payments and supplier invoices, integrating seamlessly into modern, automated workflows. Below, we outline how remittance advice works, from creation to reconciliation, with a focus on automation trends.

Generating remittance advice

You can generate remittance advice either manually or through AP software. Manually, you create a document detailing payment specifics—invoice number, amount, date, and method (e.g., ACH, check)—using templates in spreadsheets or word processors.

However, as we move into the future, most businesses use AP software like QuickBooks, Xero, or SAP to automate this process. These platforms pull invoice data directly from your system, generating advice with a few clicks, ensuring accuracy, and saving time compared to manual methods.

Sending to suppliers

Once generated, you send remittance advice to suppliers to confirm payment. This can be done via email, supplier portals, or integrated digital payment platforms. Automated systems dominate, allowing you to deliver advice instantly through cloud-based portals or email integrations.

Some platforms even embed advice within payment transactions (e.g., wire transfer notes), ensuring suppliers receive clear, timely confirmation, which reduces follow-up inquiries and strengthens vendor relationships.

Matching with invoices

Remittance advice is essential for reconciling payments with invoices. When you receive a supplier’s invoice, the advice details—invoice number, amount, and payment date—are used to match the payment to the correct invoice in your AP system.

This ensures your records align with the supplier’s, preventing discrepancies. In manual setups, you cross-check these details yourself, but modern AP software automates matching, flagging mismatches for review, which keeps your payment records accurate and audit-ready.

Role of automation

Automation, particularly AI-driven tools, has transformed remittance advice in the new era of finance. AI-powered AP systems automatically generate, send, and match remittance advice with invoices, reducing manual effort. Machine learning algorithms detect errors, such as duplicate payments or incorrect amounts, before they cause issues.

By integrating with digital payment platforms, automation ensures real-time updates and seamless data flow, cutting processing time and errors while enabling you to scale AP operations efficiently.

What are the different types of remittance advice?

As you navigate accounts payable, understanding the various types of remittance advice is key to optimizing your payment processes. With automation and digital transformation driving efficiency, remittance advice comes in multiple formats, from traditional notes to cutting-edge automated solutions. Below, we explore the main types, updated to reflect modern formats and automation-driven options.

Basic remittance advice

Basic remittance advice is a straightforward document you send to confirm payment. It includes essential details like the invoice number, payment amount, date, and method (e.g., check, ACH).

Typically sent via email or mail, this type is simple but effective for small businesses or low-volume transactions. In today's world, even a basic advice can be generated through accounting software, ensuring accuracy without complex integrations.

Removable invoice advice

Removable invoice advice is a detachable slip included with the invoice, often as a perforated section. You fill in payment details, such as the amount paid and date & return it to the supplier.

This format is still used in some industries but is declining due to digital alternatives. It’s practical for businesses with hybrid workflows, though it requires manual handling, which can slow down your accounts payable process.

Scannable remittance advice

Scannable remittance advice has evolved with technology, incorporating Optical Character Recognition (OCR)-enabled scans. Sent or received as physical or PDF documents designed for easy scanning, OCR extracts key data like invoice numbers & payment details.

This type integrates with accounting platforms, allowing you to automate data entry and reduce errors, making it ideal for businesses transitioning to fully digital systems while improving accuracy, saving time, enhancing compliance, and supporting scalable financial growth effortlessly across teams and regions.

Automated digital advice

Automated digital remittance advice is the cornerstone of modern accounts payable. Generated and delivered through cloud-based accounting software or supplier portals, this type syncs directly with digital payment systems like ACH, wire transfers, or blockchain-based platforms.

You can automate the entire process creation, delivery, and reconciliation using tools like QuickBooks, SAP, or specialized AP platforms. This format minimizes manual work, enhances real-time tracking, and supports seamless integration with your financial ecosystem, making it the gold standard for efficiency and scalability.

Who uses remittance advice?

A remittance slip serves as a vital tool in the financial ecosystem, utilized by many to facilitate transparent and efficient transactions. Let's explore the key users of remittance advice:

Businesses

Businesses of all sizes and sectors, no matter how big or small, and across every industry, consistently and effectively rely on remittance advice to streamline their payment processes.

Whether paying suppliers, vendors, or service providers, businesses utilize remittance advice to communicate essential payment details accurately. By providing clarity regarding payment amounts, invoice references, and transaction dates, businesses ensure smooth financial transactions and maintain healthy supplier relationships.

Banks

Banks play a pivotal role in the processing and verification of payments. Remittance advice serves as a crucial tool for banks to reconcile incoming payments with customer accounts.

By cross-referencing the information provided in remittance advice with transaction records, banks verify the authenticity of payments, detect potential discrepancies, and allocate funds promptly and accurately. This enhances the efficiency of fund management and fosters trust between banks and their customers.

Insurance companies

Remittance advice plays a pivotal role in premium collection and claims settlement processes. Insurance companies rely on remittance advice to track and verify premium payments from policyholders. Additionally, when processing claims, insurers utilize remittance advice to reconcile payments with policy terms and coverage details.

Ensuring timely and accurate disbursement of funds is crucial when it comes to claiming your insurance policy. This transparency in financial transactions enhances customer satisfaction and promotes trust in insurance providers.

Government agencies

Government entities, entrusted with public funds, leverage remittance advice to facilitate revenue collection and expenditure management. Tax authorities utilize remittance advice to track tax payments from individuals and businesses, ensuring compliance with tax regulations.

Similarly, social service agencies use remittance advice to disburse benefits and subsidies, maintaining transparency and accountability. By leveraging remittance advice, government agencies can track and manage public funds effectively and build trust in their institutions.

What information should remittance advice include?

As you manage accounts payable, ensuring your remittance advice contains the right information is critical for smooth transactions, strong supplier relationships, and compliance with modern standards.

A well-structured remittance advice aligns with digital workflows and regulatory requirements, making payment tracking and audits seamless. Below, we detail the key components your remittance advice should include.

1. Essential payment details

Your remittance advice must include core payment details to confirm the transaction. These are the invoice number, payment amount, and payment date.

The invoice number links the payment to the specific supplier invoice, the amount confirms what was paid, and the date clarifies when the payment was made. Including the payment method (e.g., ACH, wire, or digital wallet) is also standard, as it helps suppliers match payments in their systems quickly.

2. Supplier and payer information

Clear identification of both parties is essential. Include your business’s details—company name, address, and contact information (email or phone) and the supplier’s details, such as their legal business name, address, and accounts receivable contact.

Many AP platforms automatically populate this information from supplier profiles in cloud-based systems, ensuring accuracy and consistency across transactions.

3. Transaction references

To enable precise tracking, include transaction references like bank transaction IDs, payment reference numbers, or digital payment confirmation codes. These are critical for tracing payments through modern systems, especially with the rise of blockchain-based payments and instant transfer platforms.

Including these references helps you and your supplier resolve disputes or discrepancies quickly, particularly in high-volume or cross-border transactions.

4. Compliance notes

For audit trails and regulatory compliance, your remittance advice should include details required by the IRS or other authorities. This may include tax identification numbers (TINs) for both parties, especially for U.S.-based transactions, and any specific tax-related notes (e.g., withholding details for international payments).

Additionally, note any compliance-specific codes or references, such as those tied to anti-money laundering (AML) or know-your-customer (KYC) requirements, to ensure your records are audit-ready and aligned with global financial regulations.

How to send remittance advice?

In today's digital age, businesses have a multitude of options to send remittance advice to their counterparts. Here's a detailed look at the various methods available:

Send as a slip

A traditional yet effective method involves physically attaching a remittance advice slip to the payment. This slip accompanies the payment when delivered to the recipient.

This method is very helpful when there is a delivery of physical goods by transporters through whom the remittance advice can be sent back.

Send by fax

While somewhat antiquated compared to modern digital methods, faxing remains a viable option for transmitting remittance advice.

This method involves using a fax machine to send a copy of the remittance advice document to the recipient's fax number. This method is not very common in the modern era.

Send by post

For those who prefer a more tangible approach, remittance advice can be sent via traditional mail services. The sender prints out the remittance advice document and dispatches it to the recipient's postal address.

This is also a similar method to sending a slip but is a little more costly or time-consuming depending on the courier method.

Send by email

Email has become a preferred mode of communication for its speed and convenience. Sending remittance advice via email allows for rapid delivery, instant access by the recipient, and easy archiving for future reference.

There probably isn’t any other method that can beat the speed and convenience of sending a remittance advice document through email.

Electronic Data Interchange

Electronic data interchange (EDI) systems enable the electronic exchange of business documents, including remittance advice, between trading partners.

This method ensures secure and standardized transmission of payment details, eliminating the need for manual intervention and reducing the risk of errors.

Let the software do it for you

With advancements in technology, businesses can automate remittance advice generation and delivery using specialized accounting or payment processing software, which integrates seamlessly with payment workflows.

This saves time and effort while ensuring consistency and accurate payment information delivery of the remittance advice.

Remittance advice template

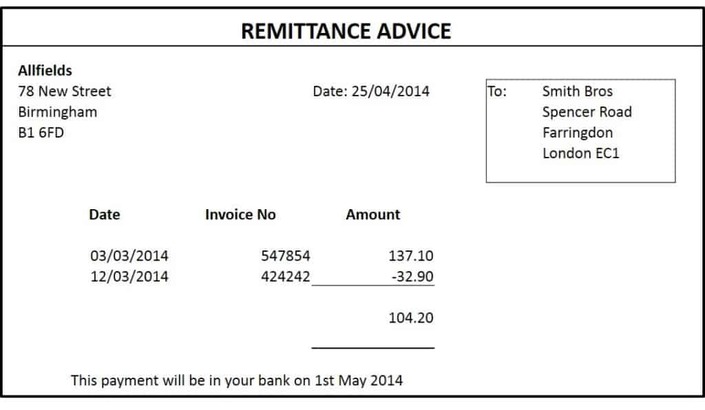

Here is an example of a simple remittance advice:

As you can see in the example above, the remittance advice contains important information such as the date it was generated, the name and address of the payee, the invoice number, the amount paid, and the date on which payment will be credited to the payee’s bank account.

Differentiating remittance advice from proof of payment and payment remittance

Remittance advice, often abbreviated as "RA," is a document sent by a payer to a payee, providing detailed and concise information about a transaction that has been made or is being made. Remittance advice typically includes important details such as the payment amount, invoice number, payment date, and any additional notes or messages related to the transaction.

It is an essential communication tool, facilitating reconciliation of payments and ensuring documentation accuracy. It also promotes transparency between all parties involved in financial transactions, which is crucial for maintaining trust and clarity throughout the payment process.

Proof of payment

Proof of payment refers to documentation that serves to verify the completion of a financial transaction, providing a tangible record that confirms the transfer of funds. This documentation can take various forms, such as a receipt, bank statement, or confirmation email, depending on the payment method used.

Unlike remittance advice, which primarily serves to communicate payment details to the recipient, proof of payment serves as a tangible evidence that a payment has been made. Hence, it can be used for record-keeping, auditing, and resolving disputes effectively between parties involved in financial transactions.

Payment remittance

Payment remittance, also known simply as remittance, refers to the transfer of funds and a proof of payment from one party to another as part of a payment transaction. It encompasses the entire process of initiating, authorizing, and executing a payment, from the point of initiation by the payer to the receipt of funds by the payee.

Payment remittance involves various intermediaries, such as banks or payment processors, depending on the payment method used. Unlike remittance advice, which is a communication tool, payment remittance facilitates and executes the actual transfer of funds between parties.

What are the challenges of managing remittance advice?

As you manage remittance advice in your accounts payable processes, you face several challenges that can complicate workflows, especially with the rise of global payments and digital systems. From inconsistent formats to data security concerns, addressing these issues is critical for efficiency and compliance. Below, we explore the key challenges and how they impact your operations.

Lack of standardization

One major hurdle is the lack of standardized formats across suppliers. Each vendor may prefer different details or delivery methods for remittance advice, such as specific invoice number formats or unique data fields.

While platforms offer templates, smaller suppliers may still use custom formats, forcing you to adapt manually. This inconsistency slows down reconciliation and increases the risk of miscommunication, requiring you to negotiate uniform standards or use flexible AP software to accommodate variations.

Manual processing errors

Manual remittance advice processes are prone to errors and delays. If you rely on spreadsheets or paper-based systems, data entry mistakes like incorrect numbers or payments can lead to mismatched records and disputes.

Non-automated systems also cause unnecessary delays in sending advice, frustrating suppliers awaiting timely payment confirmation. Transitioning to automated AP tools significantly reduces these recurring errors, but businesses still using outdated legacy methods often struggle to keep up with high-volume or time-sensitive transactions.

International payment complexities

Managing remittance advice for global payments introduces additional challenges. Cross-border transactions involve foreign exchange (FX) fluctuations, requiring you to include accurate currency conversion details in the advice.

Compliance with international regulations, such as anti-money laundering (AML) or tax reporting (e.g., FATCA), adds complexity, as you must include specific details like tax IDs or withholding information. These factors make it harder to ensure timely, accurate remittance advice, especially without software that supports multi-currency and compliance features.

Data security risks

In the digital age, sending remittance advice, particularly via email, poses significant data security risks. Emails containing sensitive details like bank transaction IDs or supplier information are vulnerable to phishing attacks or data breaches.

As cyber threats grow more sophisticated, unencrypted email-based advice can easily expose your business to fraud or severe non-compliance with data protection laws (e.g., GDPR, CCPA). Using secure supplier portals or encrypted digital platforms is absolutely critical to fully safeguard your data and maintain trust with vendors.

How can you implement remittance advice effectively?

Choose the right AP software

Selecting the right AP software is the foundation of effective remittance advice implementation. Tools like Volopay, QuickBooks, or SAP Concur offer automation features that generate, send, and track remittance advice with minimal manual effort.

You should also prioritize platforms that integrate with digital payment systems (e.g., ACH, wire transfers) and supplier portals, ensuring real-time delivery and compatibility with your existing financial ecosystem. Evaluate software based on scalability, user-friendliness, and support for compliance requirements to match your business needs.

Set clear policies

Establish clear policies for remittance advice to ensure consistency. Define the format, including essential details like invoice numbers, payment amounts, dates, and transaction references, aligning with modern standards.

Specify delivery methods email, supplier portals, or embedded in payment systems—and set timelines for sending advice (e.g., within 24 hours of payment). Document these policies in your AP guidelines to ensure all stakeholders, from your team to suppliers, understand expectations, reducing confusion and errors.

Train your team

Effective implementation requires a well-trained team. Educate your AP staff on generating and sending remittance advice using your chosen software. Provide training on entering accurate data, verifying supplier details, and troubleshooting common issues, such as mismatched invoices.

Leverage online training modules or vendor-provided tutorials from platforms like Volopay to keep your team updated on automation features. Regular refresher sessions ensure your staff stays proficient, especially as digital tools evolve.

Monitor and optimize

Continuously monitor and refine your remittance advice process using analytics. Most AP software offer dashboards to track metrics like delivery times, error rates, or supplier feedback. Use these insights to identify bottlenecks, such as delayed advice or frequent mismatches, and address them promptly.

For example, if analytics show suppliers prefer portal-based advice, shift away from email delivery. Regularly review your processes to incorporate new automation features or compliance updates, ensuring your AP operations remain efficient and scalable.

How does remittance advice support global payments?

As you handle cross-border transactions in today's world, remittance advice is a vital tool for ensuring clarity, compliance, and efficiency in global payments. Inspired by platforms that emphasize multi-currency support, remittance advice streamlines international accounts payable processes by addressing currency complexities and regulatory demands. Below, we explore how it supports your global payment operations.

Facilitating cross-border clarity

Remittance advice ensures accurate invoice matching in global transactions by providing suppliers clear payment details number, amount, and date regardless of location. For cross-border payments, this clarity is critical, as suppliers in different countries may use varied formats.

By including standardized details, remittance advice helps you and your suppliers align records accurately, reducing costly disputes and ensuring smooth, efficient reconciliation across borders, even in complex, high-volume, or multi-party financial transactions handled daily worldwide.

Managing currency conversions

When dealing with multiple currencies, remittance advice enhances transparency by including foreign exchange (FX) details. You can specify the payment amount in both your currency and the supplier’s, along with the exchange rate applied and the date of conversion.

This is especially important in the digital age, as platforms like Volopay offer competitive FX rates and multi-currency support, enabling you to provide precise conversion data. This transparency prevents confusion over payment amounts and builds trust with international vendors.

Compliance with regulations

Global payments come with diverse banking and tax regulations, such as anti-money laundering (AML) rules, know-your-customer (KYC) requirements, or tax reporting like FATCA or GST, making compliance complex and requiring businesses to stay vigilant and constantly updated with evolving standards.

Remittance advice supports compliance by including critical details like tax identification numbers, withholding tax information, or country-specific payment references.

AP tools help you embed these details automatically, ensuring adherence to regulations across jurisdictions and maintaining audit-ready records for international transactions.

Automation for speed

Automation is key to speeding up global payment processing, and remittance advice plays a central role. Using AP tools like Volopay, you can automate the generation, delivery, and matching of remittance advice, even for multi-currency transactions.

These platforms integrate with digital payment systems (e.g., wire transfers, international ACH) to send advice instantly via supplier portals or email, reducing delays and manual errors.

In the new era of finance, this automation ensures faster processing, enabling you to handle high-volume global payments efficiently while maintaining accuracy and compliance.

Why integrate remittance advice with corporate card solutions?

Integrating remittance advice with corporate card solutions, like those offered by Volopay, transforms expense management. By connecting card payments to remittance advice, you gain efficiency, accuracy, and control over your financial operations.

This integration aligns with modern platforms that combine multi-currency cards and automated AP workflows. Below, we explore why this integration is essential for your business.

Streamlining card payments

Integrating remittance advice with corporate card solutions links card transactions directly to payment confirmations. When you use corporate cards for supplier payments, platforms automatically generate remittance advice with details like invoice number, payment amount, and transaction date.

This eliminates the need to manually create advice for card payments, ensuring suppliers receive clear confirmation and your AP process remains seamless, even for high-volume card transactions.

Real-time expense tracking

Corporate card integration allows you to sync card spends with AP records in real time. Each card transaction generates a remittance advice that is instantly recorded in your AP system, providing a clear trail of expenses.

With Volopay’s dashboard, you can track these expenses as they occur, matching them to invoices without delays. As your business evolves, this real-time visibility helps you monitor cash flow and maintain accurate financial records across departments or global operations.

Reducing reconciliation errors

Manual reconciliation of card payments can lead to errors, such as mismatched invoices or untracked expenses. By integrating remittance advice with corporate card solutions, you automate the matching process.

Platforms like Volopay use AI to align card transactions with invoice data in the remittance advice, flagging discrepancies for review. This automation minimizes errors, ensures accurate AP records, and saves time, especially for businesses with frequent card-based payments.

Enhancing budget control

Integrating remittance advice with corporate cards strengthens budget control by tying card limits to AP processes. With tools like Volopay, you can set spending limits on corporate cards and link each transaction to remittance advice, ensuring all payments align with approved budgets.

The advice provides a clear record of card spending, helping you enforce limits and prevent overspending. This integration gives you granular control over expenses, supporting financial discipline across your organization.

Why choose Volopay for remittance advice and accounts payable automation?

As you streamline your accounts payable in the digital age, Volopay stands out as a powerful solution, combining corporate cards with advanced AP automation to simplify remittance advice and payment processes.

Volopay empowers you to manage payments, ensure compliance, and scale effortlessly. Below, we highlight why Volopay is the ideal choice for your AP automation and remittance advice needs.

Seamless accounting sync

Volopay integrates seamlessly with leading accounting platforms like QuickBooks, Xero, and NetSuite, making remittance advice generation and reconciliation effortless.

When you process payments using Volopay’s prepaid corporate cards, the platform automatically generates remittance advice and syncs it with your accounting software, updating invoice records in real time. This eliminates manual data entry, reduces errors, and ensures your financial records are always accurate and up-to-date, saving you valuable time.

Multi-currency support

Volopay’s multi-currency support is a game-changer for managing global payments. With low foreign exchange (FX) fees, you can pay suppliers worldwide without worrying about high conversion costs.

Remittance advice generated through Volopay includes detailed FX information, such as exchange rates and payment amounts in both currencies, ensuring transparency for you and your suppliers. This feature simplifies cross-border transactions, making it easier to maintain strong vendor relationships globally.

Enhanced security and compliance

Volopay prioritizes secure, IRS-compliant processes for your peace of mind. Its platform uses encrypted channels for delivering remittance advice, protecting sensitive data like bank details and transaction IDs from cyber threats.

Additionally, Volopay ensures compliance with IRS requirements by including necessary details, such as tax identification numbers, in remittance advice, supporting audit-ready records. This focus on security and compliance minimizes risks and aligns with the stringent financial regulations of the U.S.

Scalable AP solutions

For growing businesses, Volopay’s scalable AP solutions are designed to evolve with your needs. Its automation features streamline the entire remittance advice process—from generation to delivery while integrating with corporate card payments for real-time expense tracking.

Whether you’re handling a few transactions or thousands, Volopay’s platform adapts, offering tools like multi level workflows and analytics to optimize AP efficiency. This scalability ensures you can manage increasing payment volumes without sacrificing accuracy or speed.

Supported by

We are proud to be supported by world's leading investors, founders and senior leadership of world's leading companies.

Related pages to remittance

Learn about remittance money transfer, its process, types, associated fees, risks and how to mitigate them. Read to know more.

Essential guide for small businesses on international money transfers, including transfer methods, advantages, security, and key considerations.

Learn about remittance in our comprehensive guide: what it is, how it works, and its benefits for international money transfers.

Bring Volopay to your business

Get started now

FAQs

Remittance advice is typically provided by the payer, whether it's an individual or a business entity. It serves as a notification to the payee about a payment made or to be made, along with relevant details.

No, remittance advice and invoices serve different purposes in financial transactions. While an invoice is a request for payment issued by the seller to the buyer, remittance advice accompanies the payment and provides details about the transaction, such as the payment amount, invoice number, and payment date.

Remittance advice is issued by the payer or their financial institution. It can be generated manually or automatically depending on the payment process and the systems used by the payer.

A remittance advice check is a payment instrument that includes remittance advice details along with the payment. It typically consists of a physical check accompanied by a detachable portion containing remittance advice information.

Yes, a remittance advice check can be cashed or deposited like any other check. The remittance advice portion of the check provides important details about the payment, such as the purpose, amount, and recipient.

The timing of remittance advice delivery depends on various factors, including the payer's internal processes, the chosen delivery method (e.g., mail, email), and the location of the recipient. It can range from immediate electronic delivery to several days for postal delivery.

Remittance advice is not mandatory for every transaction, but it is commonly used in business transactions to provide transparency and facilitate reconciliation between parties. Its usage may vary depending on the industry, payment method, and specific agreements between parties.

Inaccurate remittance advice can lead to payment disputes and may have legal implications depending on the specific circumstances and agreements between parties. It's essential for remittance advice to accurately reflect the details of the payment to avoid misunderstandings and disputes.

Yes, remittance advice can be sent electronically via email, Electronic Data Interchange (EDI), or other digital channels. Electronic delivery offers speed, convenience, and cost-effectiveness compared to traditional mail delivery.

While remittance advice is more common in business transactions, individuals can also use it for personal transactions if they want to provide clarity and documentation about a payment. It can be particularly useful when making significant payments or when clarity is needed for record-keeping purposes.