Accounts payable automation best practices and benefits

Undertaking a more strategic approach for efficient accounts payable management goes a long way in improvising the cash cycles, establishing cordial relationships with suppliers, earning rebates or early-payment discounts, and making the processes simpler for employees. Therefore, optimizing the accounts payable workflow process helps determine the future course of action.

What is accounts payable automation?

Accounts payable automation is the contemporary method of paying bills through more advanced and error-free software. Using accounts payable management software eliminates the possibility of human error, wrong data entry, and any double-dealing. However, the accounts payable process is seen as a secondary function of the finance and accounting departments.

Regarded as a back-office task, AP automation never gets the spotlight, resulting in poor working capital management and cluttered cash flow. Adverse effects of this can be seen through declining goodwill of the company, damaging relationships with the stakeholders, and slower response and delivery time.

Benefits of automate accounts payable process

Below are the reasons why having accounts payable automation is the need for your organization. Manage your payments better, bring together all financial activity, and maximize the output with a focused platform towards accounts payable management.

Eliminates duplicate task

Automated software carefully examines every transaction before letting in any entry. Any similar value with the exact details is immediately discarded. This way, no same transaction is fed into the software, and no damage is caused to the financial statements.

Saves time and efforts

Having paperless reporting helps in saving time and efforts in juggling between different paper receipts and invoices. AP automation brings together all the touchpoints and makes recording, storing, interpreting, and reconciling the data more accessible.

Scales productivity

AP automation helps employees escape the never-ending cycle of paper receipt matching. These repetitive tasks give a hard time to employees, preventing them from focusing on high-value jobs. Automation in the accounting process eases the burden of the finance team and helps them dedicate time for strategizing KPIs.

Early payment discounts

AP software has built-in reminders for scheduled invoice payments. Timely payments to suppliers help companies earn substantial discounts, which helps save money, establishes good faith among stakeholders, increases possibilities of new orders, and stabilizes the entire supply chain workflow.

Data-driven analytics

The accounts payable software gives insightful data about the gross spending of the organization. Granular details regarding each purchase order, the total value of the invoice, and vendor name are displayed to give a clear picture of all the trades payable. The analytics provided thereon can help formulate future planning and devising new work processes.

Risks of not adopting to accounts payable automation

Working with the paper and spreadsheets method clutters all the information. Manual entry everywhere burdens the finance team by switching between multiple sheets and piles of paper and finding out records from previous data files. Moreover, generating reports or statistics can also be difficult due to scattered data.

It is essential to have their records stored in one place and be able to access them anytime. Managing invoices, contract notes, purchase orders, inventory bill becomes a back-breaking task. Non-payment of dues damages the vendor's faith. A digital tool that oversees all such tasks stands indispensable.

Repeated delayed payments or under-payments can shake up the investor confidence in the company. This showcases the company’s inability to manage the cash cycle and working capital. Also, companies let slip chances of getting discounts or upcoming orders. Situations like these can erode a company's good standing.

Best practices for accounts payable automation

The accounts payable process differs from company to company. However, there are some general guidelines for extracting the best from the accounts payable invoice automation.

Shifting to paperless accounting

Paper is the enemy of efficiency. Having a paper-based accounting system slows down the accounting and communication process. Shifting towards paperless systems allows better workflow, accessible communication, and healthy working capital and cash flow management figures.

The tasks, right from creating purchase orders to confirming their payment, can be done through an electronic system through the software. Communication through a single platform results in uniformity of records and leads to seamless reconciliation.

Set a clear policy

Adopting more robust policies can help strengthen the internal processes, pave a way out of the traditional systems and advance towards a more secure and reliable platform.

The policies should favor the workforce, and it's important they find it easy to apply them in any given situation. Having pre-decided policies and procedures acts as a guiding light to every person in the organization.

Streamlining workflow

Using an automated system helps identify the previous system's bottlenecks. A computerized system is an investment for the business and not an expense. Suppliers can be reached directly for any queries through the accounts payable system. The invoice processing is much swifter and easier to account for in the system.

The method of capturing receipts is as easy as clicking a picture. All in one, automation in processes gives them a direction where the organization can take full advantage of the software's capabilities and leverage it into the software.

Get started with Volopay

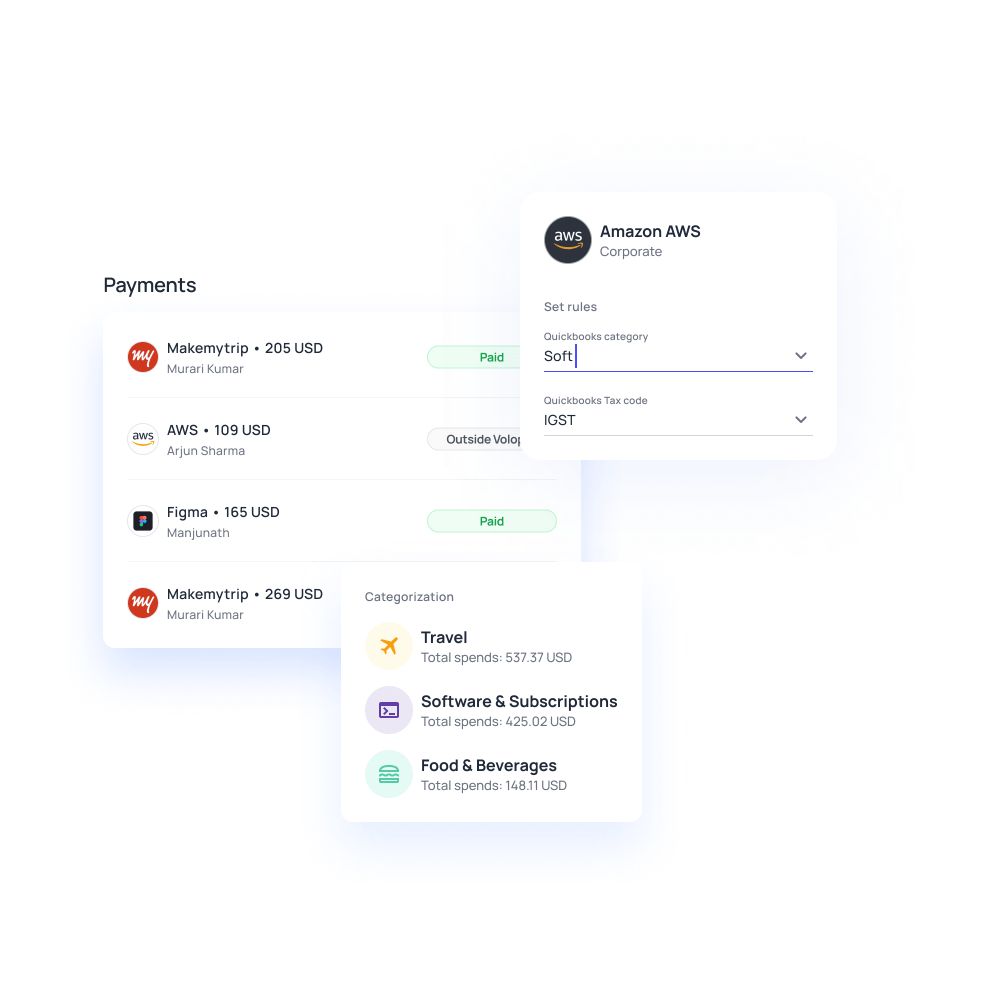

Volopay’s SaaS-driven accounts payable software provides solutions to scattered data entries, order management, vendor payments, and invoice processing.

• Scan, upload, and approve invoices in a single go. Schedule your invoice payment or any other wire transfer for a future date.

• Track the status of all your invoices and payments in real-time.

• The Bill Pay feature allows users to transfer money to over 130 countries with the lowest price and no surprise charges.

• Easy vendor management by making payments to their bank account directly through the software by matching against invoice number.

• Multi-level approvals to approve the payment from multiple people.

• Integrate your accounting system - Xero, Quickbooks, Netsuite - into the accounts payable management software for enhanced visibility.

• Easy reconciliation of all the entries added into the software.

• Schedule your invoice payment for a future date.

• With three-way invoice sourcing, the accounting department can directly upload invoices on our platform, mail them to us, or we directly sync unpaid invoices from your accounting system.