How to reconcile expense reports efficiently with automation

Managing business expenses is a critical yet time-consuming task for finance teams across the United States. From small startups in Silicon Valley to established enterprises on Wall Street, organizations struggle with manual reconciliation processes that drain resources and introduce errors.

Expense reconciliation has traditionally been a tedious process involving spreadsheets, receipts, and countless hours of verification. However, modern automation technology is revolutionizing how to reconcile expense reports, delivering accuracy, speed, and compliance while freeing up valuable time for strategic work.

What is expense reconciliation?

Expense reconciliation is the process of verifying and matching business expenses recorded in financial systems with actual transactions, receipts, and supporting documentation.

This critical accounting function ensures that every dollar spent by employees, contractors, or through corporate cards is accurately tracked, properly categorized, and legitimately business-related.

The reconciliation process involves comparing expense reports submitted by employees against bank statements and credit card transactions to identify discrepancies, catch errors, and maintain financial integrity. When done correctly, it provides a clear, auditable trail of company spending.

Why reconcile expense reports: Importance for every business

Understanding how to reconcile expense reports effectively is fundamental to maintaining financial health and operational efficiency. Streamlining the expense report process goes far beyond simple bookkeeping; it's a strategic function that protects your organization from financial risks while enabling smarter business decisions.

Strengthens financial accuracy

Reconciliation ensures your books reflect actual spending, eliminating discrepancies between reported and actual expenses. This accuracy is essential for reliable financial statements, investor reporting, and budget forecasting.

Without proper expense reconciliation, your financial data becomes unreliable, leading to poor strategic decisions based on flawed information.

Prevents fraud and policy violations

Regular reconciliation acts as a deterrent and detection mechanism to prevent expense reimbursement fraud, duplicate submissions, and policy violations. By systematically reviewing expenses against receipts and company policies, you can identify suspicious patterns, unauthorized purchases, and attempts to circumvent spending limits before they become significant financial problems.

Supports cash flow management

Accurate expense report reconciliation, including knowing how to do petty cash reconciliation, helps you understand your true cash position by identifying outstanding reimbursements, pending payments, and actual versus budgeted spending. This visibility enables better cash flow forecasting and helps prevent unexpected shortfalls that could impact operations.

Simplifies audit and compliance

Well-reconciled expense records make audits smoother and less stressful. When every transaction has proper documentation and has been verified against bank records, you can quickly respond to auditor requests and demonstrate compliance with IRS regulations and GAAP standards.

Improves decision-making

Clean, reconciled expense data provides accurate insights into spending patterns, departmental costs, and vendor relationships. This information empowers leadership to make informed decisions about budget allocations, cost-cutting opportunities, and strategic investments based on reliable financial intelligence.

Different methods for expense report reconciliation

Finance teams manually match receipts to bank statements and expenses using spreadsheets. This traditional method involves physically matching each transaction, categorizing expenses by hand, and identifying discrepancies through visual inspection.

While offering complete control, it's extremely time-consuming and prone to human error.

The hybrid approach combines spreadsheet tools with basic software features, like automated data imports, formula-based matching, and reconciliation tracking.

Finance teams use Excel macros or simple accounting software to import bank feeds and expense data, then manually review flagged items and exceptions.

Advanced software platforms automatically match transactions, categorize expenses using machine learning, and flag anomalies without manual intervention.

These systems integrate directly with bank accounts, corporate cards, and accounting software to provide real-time reconciliation, drastically reducing processing time.

Common mistakes in expense reconciliation and how to avoid them

Even experienced finance professionals encounter challenges when managing expense reconciliation manually. The complexity of matching hundreds of transactions across multiple payment methods creates numerous opportunities for errors. Understanding these common pitfalls helps organizations recognize when automation of accounting processes becomes necessary.

1. Ignoring minor discrepancies until they pile up

Small unexplained differences often get overlooked because they seem insignificant. However, these minor discrepancies accumulate over time, creating substantial gaps in your financial records that become increasingly difficult to trace back to their origins.

Avoid it by: Investigating every discrepancy immediately, regardless of the amount. Set clear thresholds for acceptable differences and implement daily or weekly reconciliation cycles instead of monthly reviews to catch issues while transactions are still fresh.

2. Missing or incomplete documentation

Employees frequently submit expense reports without attaching receipts, or they provide photos that are illegible or missing critical information like dates and vendor names. This documentation gap makes verification impossible and creates compliance risks during audits.

Avoid it by: Implementing mandatory receipt capture at the point of purchase through mobile apps. Create clear policies requiring documentation within 24-48 hours of expense occurrence and use technology that prevents submission of incomplete reports.

3. Not accounting for timing differences

Credit card charges often appear on statements before employees submit their expense reports, or they clear days after the transaction date. Foreign currency transactions may post at different exchange rates than expected, creating apparent discrepancies when comparing reports to bank statements.

Avoid it by: Understanding your payment processors' typical settlement times and building these into your reconciliation process. Use transaction dates rather than posting dates for matching and implement systems that automatically account for pending transactions.

4. Manual categorization errors

Human judgment in assigning expense categories leads to inconsistency across reports and departments. One employee categorizes client meals as "entertainment" while another uses "business development." These inconsistencies make budget tracking impossible and create tax reporting problems.

Avoid it by: Creating detailed categorization guidelines with specific examples for common gray areas. Implement drop-down menus with predefined categories that align with your chart of accounts and use automated categorization based on merchant codes.

5. Lack of multi-level review

Single-person review processes create blind spots where errors go undetected and fraudulent claims slip through. Without proper segregation of duties, the same person can submit, approve, and reconcile expenses, creating opportunities for manipulation.

Avoid it by: Establishing multi-tier approval workflows where managers review for business necessity and policy compliance while finance verifies accuracy and supporting documentation. Implement random spot-checks by senior finance staff.

6. Using disconnected systems

When expense data lives in one system, bank transactions in another, and accounting records in a third, finance teams must manually export, reformat, and compare data across platforms. This disconnected infrastructure makes real-time expense reconciliation impossible.

Avoid it by: Investing in integrated platforms that automatically sync expense data with accounting systems and bank feeds. Implement APIs or native integrations that eliminate manual data transfer and serve as a single source of truth.

7. Duplicate or overlapping expense entrie

Employees sometimes submit the same expense multiple times through different channels—once as a card transaction and again as a manual reimbursement request. Split payments across multiple cards create confusion about who should claim which portion.

Avoid it by: Implementing duplicate detection algorithms that flag similar amounts, dates, and vendors before reimbursement. Clearly define policies for split expenses and use systems that automatically match card transactions to submitted reports.

8. Delayed submission of receipts and reports

When weeks or months pass between expense occurrence and submission, details become fuzzy, receipts get lost, and reconciliation becomes exponentially harder. Finance teams struggle to match old transactions to bank statements.

Avoid it by: Enforcing strict submission deadlines with clear consequences for non-compliance. Send automated reminders immediately after card transactions occur and consider closing expense periods after a reasonable window.

A 4-step framework to transition from manual to automated expense reconciliation

Shifting from spreadsheets to automated expense reconciliation doesn't require a complete operational overhaul. This practical framework helps US businesses implement automation systematically, minimizing disruption while delivering immediate benefits.

Centralize expense data

Consolidate all expense information into a single platform that captures corporate card transactions, employee reimbursement requests, vendor payments, and subscription charges.

Replace scattered spreadsheets with a unified system where every expense automatically flows into one database.

Automate matching rules

Configure intelligent algorithms that automatically match transactions to expense reports based on amount, date, merchant, and employee.

Set up rules that automatically handle common scenarios like recurring subscriptions, standard vendor invoices, and other routine transactions efficiently.

Digitize and attach documentation

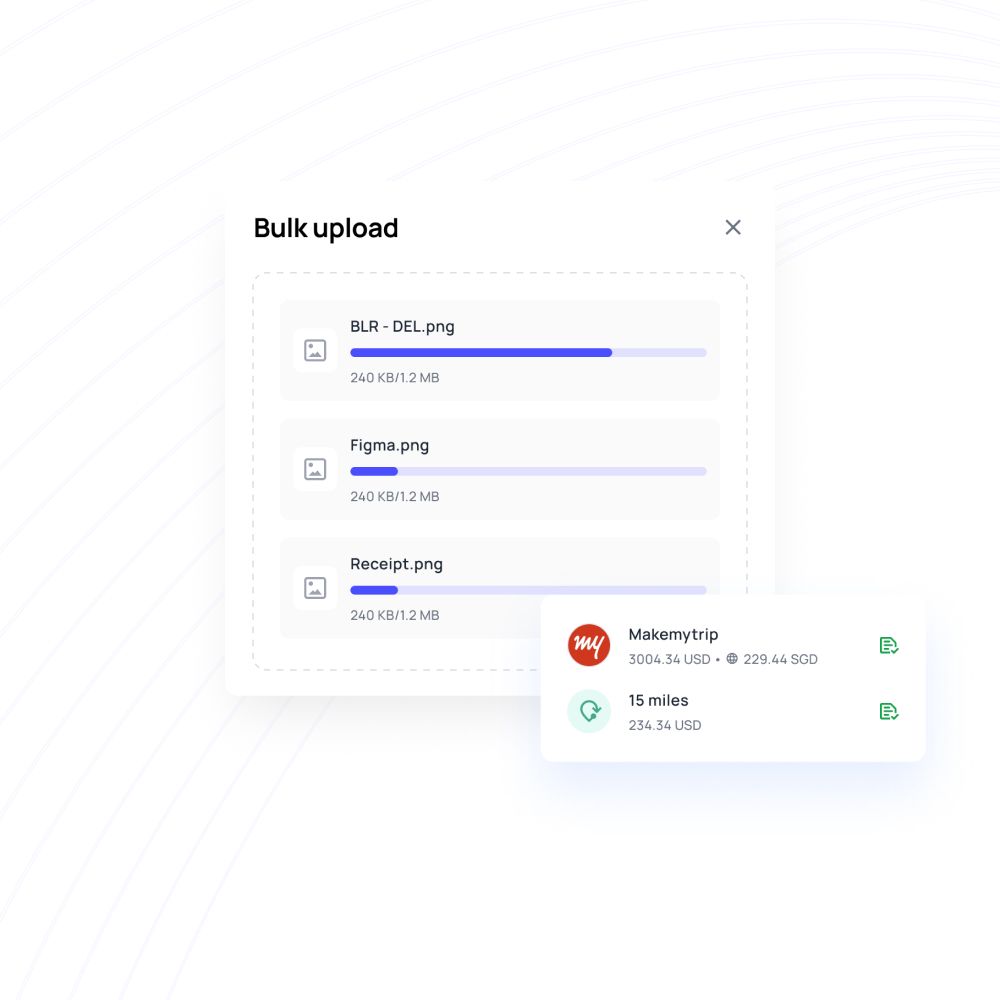

Implement mobile receipt capture that allows employees to photograph and upload documentation instantly after purchases.

Use OCR technology to extract key data from receipts automatically, eliminating manual data entry.

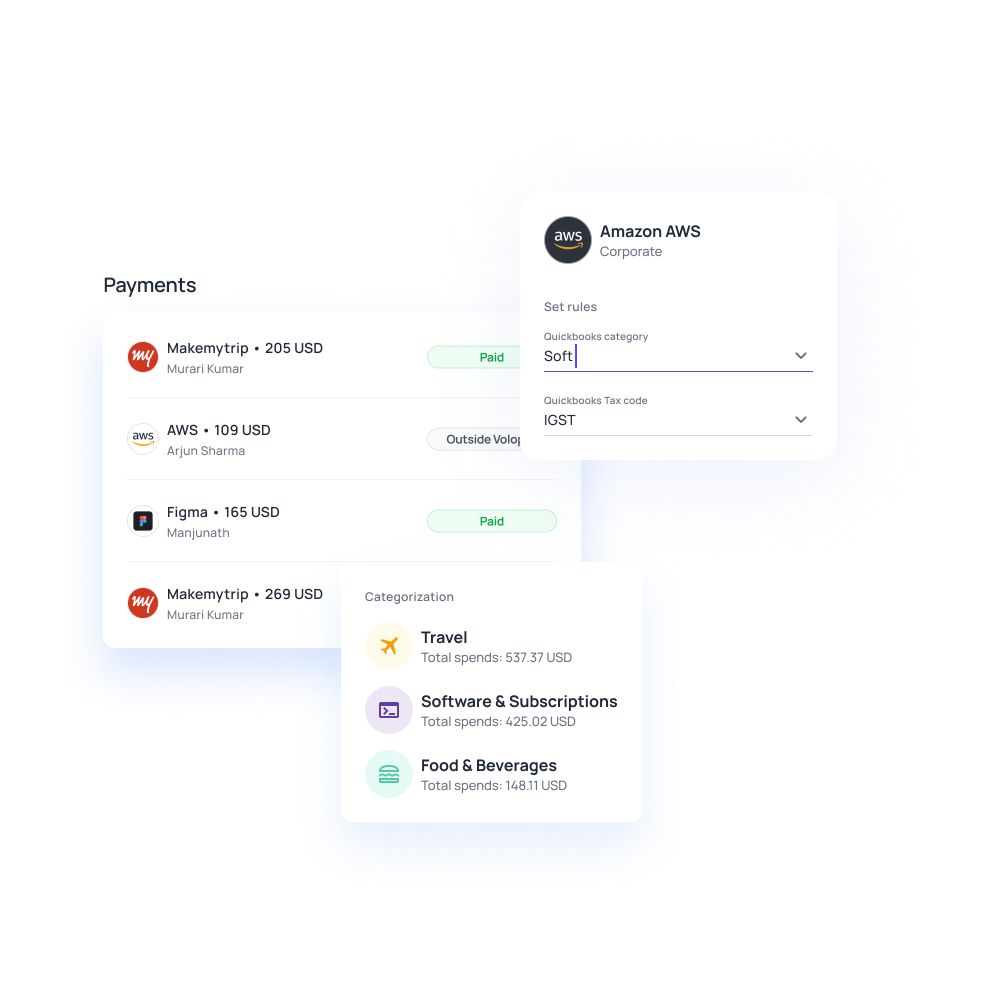

Integrate with accounting software

Connect your expense platform directly to QuickBooks, Xero, NetSuite, or your existing accounting system through native integrations.

Enable automatic data sync that pushes reconciled expenses into the correct general ledger accounts without manual exports.

How expense automation enhances accuracy and compliance for businesses

Once you've implemented expense reconciliation automation, the transformation extends far beyond simple time savings. Modern platforms fundamentally change how finance teams operate, shifting from reactive transaction processing to proactive management.

Real-time visibility into company spending

Automation provides instant dashboards showing current spending patterns, budget utilization, and emerging cost trends.

Finance leaders can monitor departmental expenses, identify overspending before it becomes problematic, and analyze vendor relationships before month-end reports.

Error-free and audit-ready reports

Automated systems eliminate the calculation mistakes, transposition errors, and categorization inconsistencies that plague manual processes.

Every transaction follows the same logic, every match meets consistent criteria, and every report reflects accurately reconciled data.

Reduced month-end closing time

Instead of scrambling through the last week of each month to reconcile expenses and close books, automated expense reconciliation maintains continuous reconciliation throughout the reporting period.

Many finance teams cut their closing time from days to hours.

Better fraud detection and policy compliance

Machine learning algorithms identify unusual patterns that humans might miss: duplicate submissions across different formats, split transactions designed to bypass approval limits, or expenses that violate company policy.

Automated policy enforcement prevents non-compliant expenses from entering the system.

Faster approvals and workflow efficiency

Automated routing sends expense reports to appropriate approvers based on amount, department, and expense type without manual intervention.

Managers receive notifications with all relevant information and can approve or reject claims from their mobile devices.

Reduced human intervention

By handling routine matching, categorization, and approval routing automatically, the system minimizes the manual touchpoints that create delays and introduce errors.

Finance teams shift from processing transactions to managing exceptions and analyzing spending patterns.

How Volopay automates expense report reconciliation

Volopay transforms how to reconcile expense reports by providing an all-in-one accounting automation platform that eliminates manual work while delivering complete visibility and control over business spending. Built specifically for modern businesses, Volopay addresses the unique challenges finance teams face.

Automated expense reporting

Employees capture receipts instantly through Volopay's mobile app, with OCR technology automatically extracting merchant names, amounts, dates, and tax information.

Our platform pre-fills expense reports using this data, eliminating tedious manual entry while ensuring accuracy.

Real-time sync for accuracy

Every corporate card transaction appears on your Volopay dashboard immediately, allowing instant matching with expense reports and receipts.

This real-time synchronization and visibility of financial data across all platforms eliminates the lag time that creates significant reconciliation challenges in traditional accounting systems.

All-in-one spend management

Beyond just expense reconciliation, Volopay consolidates corporate cards, bill payments, reimbursements, and vendor management into a single platform.

This comprehensive approach ensures every business expense flows through one system, creating complete spending visibility.

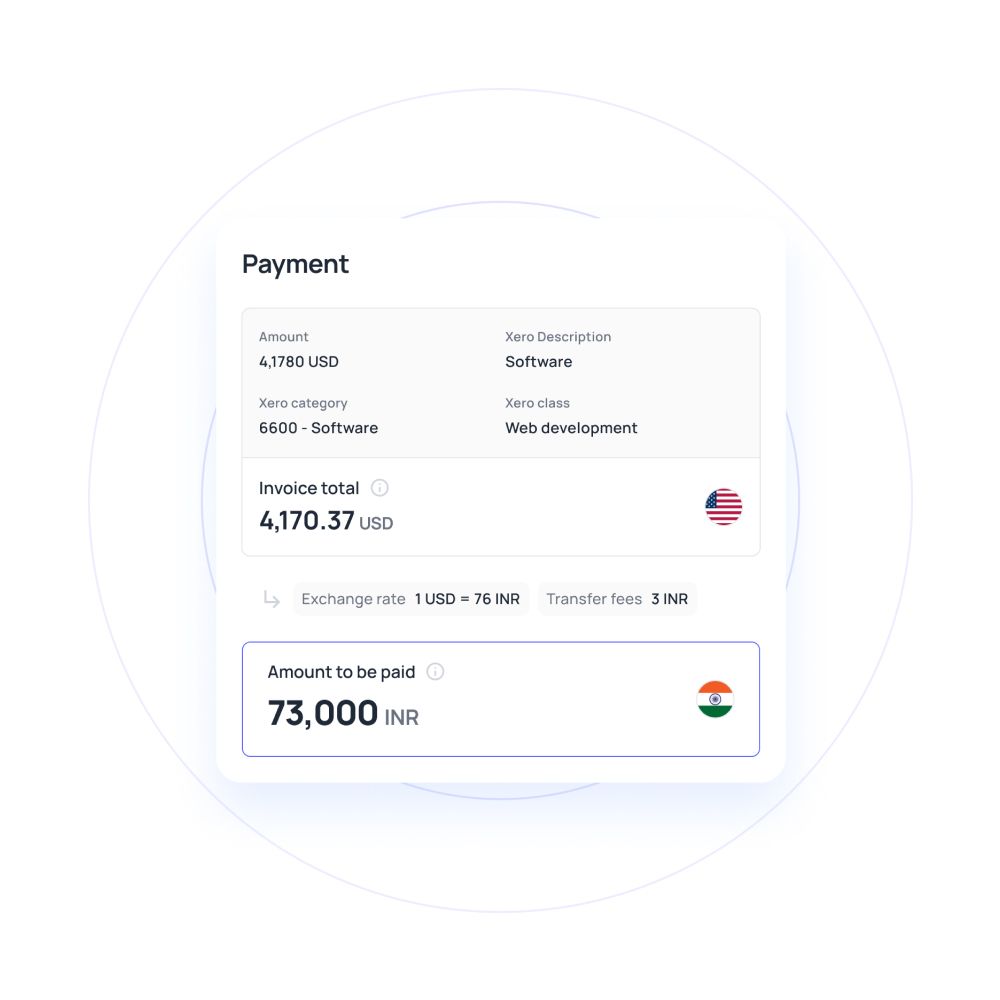

Multi-currency reconciliation

For businesses operating internationally or working with foreign vendors, Volopay automatically handles currency conversions and exchange rate fluctuations.

The platform tracks expenses in their original currencies while converting to USD for consolidated reporting.

Automated accounting integrations

Volopay connects directly with accounting platfroms like QuickBooks, Xero, NetSuite, and other accounting platforms used by US businesses.

Reconciled expenses automatically sync to your general ledger with correct coding, categorization, and supporting documentation attached.

Streamlined vendor and card payments

Volopay enables direct vendor payments through ACH transfers, international wires, and virtual cards, with every transaction automatically recorded and reconciled within the platform.

Issue virtual cards for specific purposes with preset spending limits.

Top use cases of Volopay's automated expense reconciliation

Different expense types present unique reconciliation challenges. Volopay's expense reconciliation automation capabilities address these specific scenarios, delivering tailored solutions that simplify previously complex workflows while maintaining rigorous financial controls.

Expense reports and employee reimbursements

Employees submit reimbursement requests directly through the mobile app with attached receipts, triggering automated approval workflows based on your policies.

Once approved, Volopay processes payments and automatically records the expense in your accounting system.

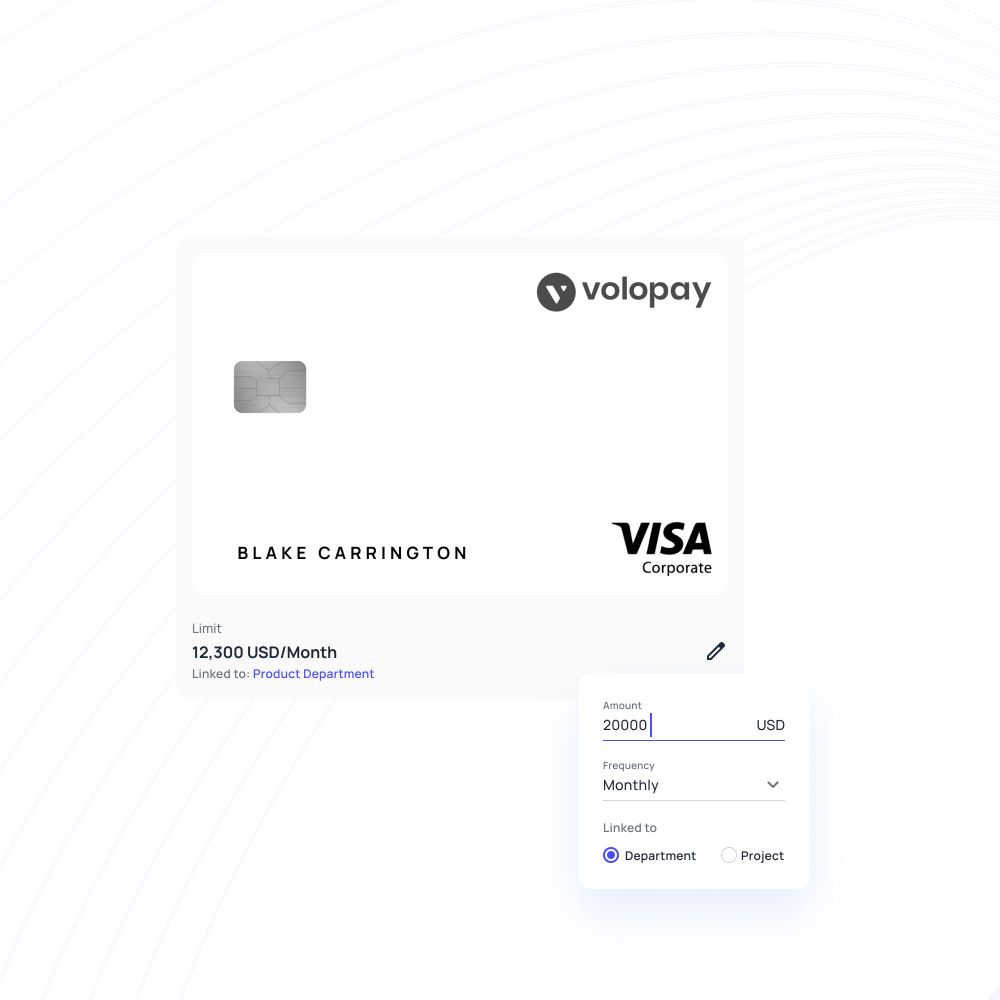

Corporate card spending

Volopay's corporate cards integrate seamlessly with the expense management platform, automatically matching every card transaction to its corresponding receipt and expense report.

Real-time spending notifications alerts the employees to capture their receipts immediately.

Subscription and SaaS expense tracking

Software subscriptions and recurring services create reconciliation challenges when charges appear unexpectedly.

Volopay identifies recurring transactions, tracks subscription expenses by department, and alerts finance teams to upcoming renewals.

Multi-currency and global reconciliation

International expenses involving foreign currencies, cross-border payments, and varying tax regulations complicate traditional reconciliation.

Volopay handles currency conversions automatically and maintains records in both transaction and reporting currencies.

Bring Volopay to your business

Get started now

FAQs

Monthly reconciliation is standard, but modern automated systems enable daily or weekly reconciliation cycles. More frequent expense reconciliation catches errors faster, prevents small issues from compounding, and reduces month-end workload significantly.

Prioritize automated transaction matching, receipt capture with OCR, direct accounting integrations, customizable approval workflows, and real-time reporting. Multi-currency support, corporate card integration, and policy enforcement are essential features.

Yes, quality platforms flag exceptions and route them to appropriate reviewers with relevant context for quick resolution. The system learns from these exceptions, improving future matching accuracy significantly.

Absolutely. Modern platforms like Volopay specifically address international business needs with multi-currency support, foreign exchange tracking, and compliance with various regional tax requirements for seamless global operations.

Volopay reconciles corporate card transactions, employee reimbursements, vendor payments, subscription services, international transfers, and virtual card purchases. Essentially, any business expense flowing through the platform undergoes automatic reconciliation.

Volopay employs bank-level encryption, multi-factor authentication, and role-based access controls to protect financial data. The platform complies with SOC 2, PCI-DSS, and other relevant security standards.

Yes, Volopay's scalable architecture serves businesses from seed-stage startups to established enterprises with thousands of employees. The platform grows with your business without requiring migration to new systems.