Best Wise (Transferwise) alternative

Choosing the best expense management solution for your business isn’t the easiest task. There is a multitude of comparisons, factors that are part and parcel of making such an important decision. In this day and age, the market is full of options – one of the most popular ones being Wise (formerly known as Transferwise).

However, have you stopped to consider if, perhaps, there might be a better expense management software option out there? A cheaper way to manage business money transfers at lower FX rates? Look no further. Volopay has quickly become one of the fastest-growing and valued expense management and business account ecosystems that companies globally rely on.

Trusted by finance teams at startups to enterprises.

Should you choose Volopay or Wise – compare the two platforms

Features Volopay Transferwise |

|---|

Business accounts |

Lowest possible FX Rates |

Quick and easy set up |

Large money transfers |

Global currency options |

Cards with credit |

Prepaid corporate cards |

Virtual cards |

Credit line up to $500K |

Wider merchant coverage |

Accounting integrations |

Flat fees on remittance |

Payment approval workflows |

Account dashboard |

Department expenses |

Dedicated account managers |

What are you missing on with Transferwise?

Volopay is a one-stop solution that helps you to automate your accounts payable by combining corporate cards, money transfers, and accounting automation. With Transferwise, you miss on corporate cards, cashback, budgeting, real-time tracking, and cheap FX rates.

1. Business accounts

Volopay is not a bank – but we definitely offer more bank-like services in comparison to Wise. The latter is, at its core, a money transfer service that has expanded to add-ons for larger businesses and entities. But users find themselves unable to access general business account facilities such as ledgers, accounting, card management, comprehensive payment processes, or even diversity in vendor networks and currencies.

We have all of that and more. Opening a business account with Volopay is more well-rounded. For starters, all your payments are managed on a single dashboard – not just specific invoices or foreign transfers. You can issue cards as per your need, hold multiple currency wallets, and even generate analytics. Departmental allowances can be set based on forecasts, and reimbursements handled from the same place.

The Wise business account is, essentially, a personal money transfer portal plan expanded for businesses. It generates a local bank account number, similar to a unique ID on Stripe or PayPal. Volopay is not a payment business plan, nor for personal use. It is a powerful enterprise-level tool for companies to create and manage sophisticated financial processes from the same platform. The accounts function just as bank accounts would, with the same level of security, accessibility, and speed.

2. Approval workflows

If you were to open a Wise business account, you’d have the option to onboard certain employees and assign them roles (such as payer, accountant, and more). However, these roles can sometimes be limiting in their functionality. Unless an employee has a role pre-designated, they are unable to access some of Wise’s functions. Conversely, an employee with a higher-level role could bypass accountability. In response, Wise has tightened its security, leading to multiple blockages in payments for their clients.

Volopay uses a different method of accountability. Following the philosophy of maker-checker, our platform has multiple levels of approvals. These approvers are unique to cards, wallets, reimbursements, and departments (meaning the decision-maker of the department or employee gives the seal of approval instead of an assigned payer). You can delegate up to five levels of approval, and also create workflows to bypass approvals in cases of absences so that no payment is stopped.

These approval policies can also be designed to auto-approve certain vendor payments or amounts, or even employees who are approvers within the same workflow. As for compliance, your company and department expense policies get automatically applied! Timely payments without any loopholes or monopoly over cash movement.

2. Corporate cards

Wise’s debit card options are limited to certain countries, and can only be utilized when the amount is loaded into the account. In contrast, Volopay’s corporate card facilities are much wider.

Available to all clients in all markets, Volopay offers a range of physical cards, virtual cards, and corporate cards with credit. All of these cards can be linked to a specific employee, and follow the expense policies of the company. Transactions are recorded in real-time and added to the company’s General Ledger (GL), also accessible from the Volopay platform.

Whether you need a one-time use card for a gift or that one SaaS subscription, or a recurring card for your star salesperson, Volopay has you covered.

4. Accounting integrations

Yes, it’s true. Wise’s business account definitely comes with accounting integrations. However, it is notable that these integrations only account for transactions made on the Wise platform (primarily foreign transactions). With Wise being limited in its vendor network and its card offerings, this means that a good chunk of your cash flow does not get recorded.

On the other hand, the accounting integrations with Volopay fully become part of your financial ecosystem. Bookkeeping is automated to include not just foreign payments and receivables, but also corporate cards, credit line utilization, travel mileage, reimbursements, corporate travel bookings, allowances, and even employee reimbursements!

No part of your expense management journey is missing, or riddled with manual entry errors. Instead, your ledgers are neat, clean, and audit-ready with all the information you need for your financial statements.

5. Dedicated customer service team

Perhaps one of the biggest gems in the Volopay crown is our customer service. Trained to focus on your success, our service executives are available around the clock to handle any kind of issue. Want to change your plan? Facing trouble with onboarding? Is a feature not working? Our team addresses concerns within hours and irons them out at lightning speed.

In fact, we take pride in our response time and how we incorporate feedback to improve our product. Additionally, each client gets a dedicated customer service manager and account executive for individualized support.

6. Low FX rates and multi-currency wallets

Everyone uses Wise for their easy foreign transactions. But what if we told you there’s a way to do it that is cheaper, allows bulk amounts, and accounts for every transaction. While Wise has enabled a business account feature to make international payments, their platform still blocks and flags larger sums. A security feature that has disrupted thousands of payments to vendors. Moreover, larger sums also invite larger fees, due to Wise’s usage of mid-market values.

At Volopay, you can transfer the same amount for a much lower cost. In addition, if you make or receive payments to a particular country more frequently, you can establish a wallet in that currency to minimize charges. The best part? Volopay offers you the ability to send and receive payments in over 130 currencies (much higher than Wise’s 80 currency threshold).

Additional Volopay features that can help your business

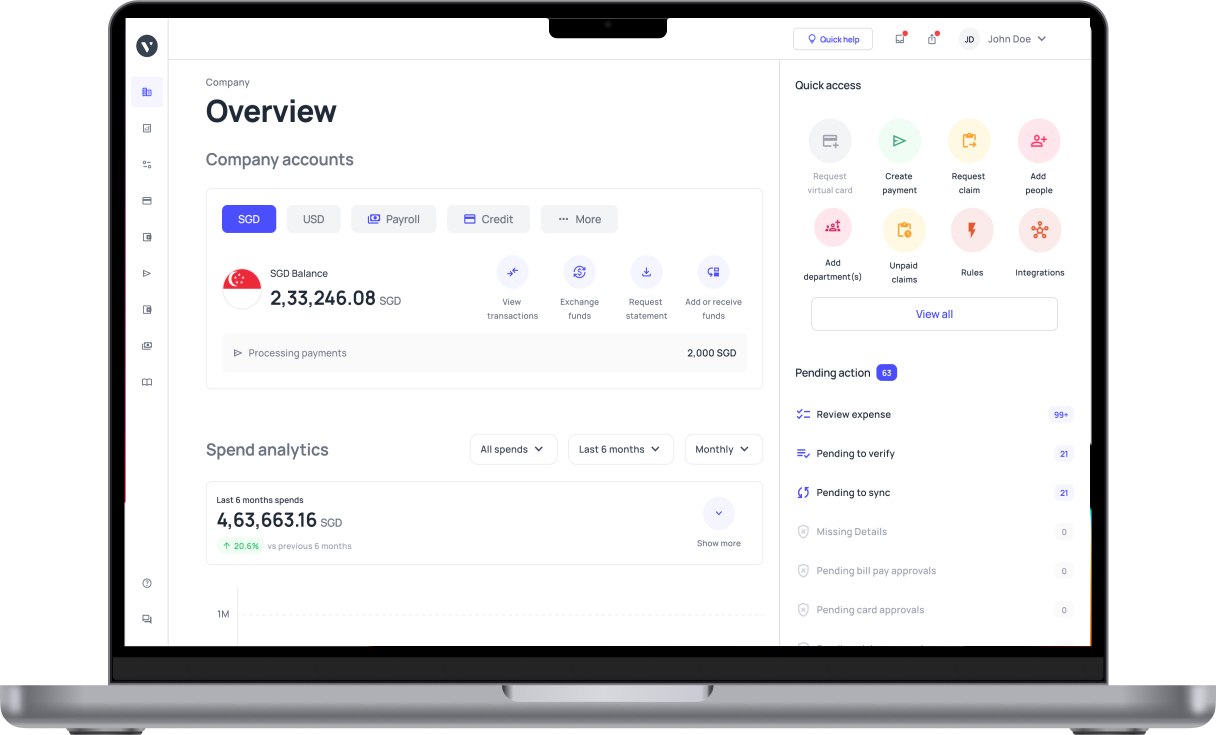

Dynamic account dashboard

The Volopay expense management dashboard is an easy-to-navigate, user-friendly interface that allows employees and managers to manage their business finances. Instead of simply being a portal to make payments, it lets administrators access account balances (across wallets), analyzes card transactions, and even set up invoices and receipts for a smooth accounts payable process.

This dashboard is a one-in-all centralized way of looking after all company finances, and not just international payments or transfers. The real-time updates let the finance department account for every transaction made within the company.

Reimbursements for employees

Volopay offers clients flexibility in terms of how they manage employee expenses. After all, it’s not possible to equip every employee with a card (particularly if they’re unlikely to make frequent spending decisions). But reimbursements can be so daunting – so much paperwork & hassle.

Not with Volopay. Our reimbursement dashboard allows any employee to submit a reimbursement claim, along with matching receipts and information. The approval workflows make it possible for this to be checked and sanctioned within a few hours, preventing the headache of late payouts. Employees can even get mileage reimbursed for their corporate travel!

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Get the best expense management platform

All of this sounds pretty neat, huh? The bottom line is that Wise remains a dynamic money transfer platform. However, it lacks multiple functionalities required by a business account. It also lacks coverage of all its features in various countries and also charges exorbitant fees for larger transactions (a commonplace occurrence for businesses).

But you don’t have to simply take our word for it. Explore our Volopay dashboard by signing up for a demo, and get started on your smarter, wiser financial journey.