Best Revolut alternative in 2025

Looking for an easy-to-use, scalable expense management application for your growing business in the US? If you already have Revolut in mind and want to go for a better alternative, then look no further. Volopay is here to help you with managing your business finances better than its competitors, particularly Revolut. Volopay has robust accounting tools like cards, bill pay, budgets, and AP integrations to simplify your accounts payable. While Revolut is curated more for single owners and traders, Volopay is for thriving startups that grows an inch every day.

Trusted by finance teams at startups to enterprises.

Here’s why companies choose Volopay over Revolut

- Unlimited virtual cards

- Free, unlimited local transactions

- Unlimited virtual cards

- AP Automation

- Vendor management

- Mobile app

- Reimbursement

- Multi-currency wallets

- In-app integrations

- In-house credit facility

- Spend insights

What are you missing with Revolut?

Volopay is a one-stop solution that helps you to automate your accounts payable by combining corporate cards, money transfers, and accounting automation. With Revolut, you miss on cashback, budgeting, real-time tracking, multi-level approval flows, and cheap FX rates.

Unlimited virtual cards

Volopay promises unlimited number of corporate cards (both virtual and physical). You can create as many cards as you need and have it dedicated to your employees, departments, or any particular monthly expense category. You can unlock its true potential to fuel your employee business expenses and monthly subscription fees. The same way, assigning budgets for each card and setting spending limits is also feasible. When not in use, you can easily delete or froze it.

On the other hand, Revolut only lets you have a maximum of 200 virtual cards and 3 physical cards at a time which is subjected to change based on selected plans. This limited setup can work for a business owner if they have lesser number of employees and fixed expense categories – not for companies looking to scale.

International transfers at nominal prices

Volopay allows free local and foreign transactions at the lowest possible current fx charges. Simple and transparent.

Revolut promises a certain number of free local and international payments depending on the plans you choose. Great! What’s the catch here? There is a limit on the free number of transactions set for each pricing scheme. So you will be charged £0.2 for every local and £3 for every international payment when the payment crosses the chosen limit. Though their exchange rates are better than what traditional banks dictate, you are either forced to limit your transactions or incur the transaction fees.

Spend lesser with smart budgeting tools

Volopay has departments, which makes it more ideal and desirable for small and medium sized businesses who needs to keep a tab on their expenses. With these departments, you can create categories, set maximum limits, and tag them under every related expenses. So, it automatically counts every expense made under that category and lets you know if you are on the right track or about to exceed.

This feature is crucial for growing businesses because they can never predict when they go overboard on spending or what item/category causes them to break the budgeting rules. Volopay demonstrates visually whether you stick to an organizational-wide annual budget which Revolut doesn’t.

Strong and robust AP automation

Accounts payable involves a series of steps like onboarding a vendor, receiving and uploading invoices, scheduling payments, and sending it out on time. Volopay is designed to favor the accountants in this process and reduce the complexity of it by automating it all the way through.

Though Revolut can help you make and schedule business transactions, it isn’t fully automated and you cannot track a payment by its vendor. So, when it comes to vendor management, the support you receive from Revolut is diminutive. Contrastingly, Volopay makes the payment process simpler for accountants while effortlessly managing vendors.

Align your spending with your company’s expense policies

Volopay gives full control to accountants in updating expense policies and creating rules. This way, the application knows how to route any payment and who its approvers are. It is also applicable to payment limits for different expense categories too. And there can be multiple approvers too.

The whole job is transparent, letting anyone track and know where the payment stands. The same applies to when an employee applies for reimbursement too. Volopay does expense reporting and controls better than Revolut by the control options understandable and easily accessible in one place.

Integrations to nullify manual work

Both Volopay and Revolut stand at the same level as both offer solid integrations with other accounting software like Xero, Netsuite. Volopay allows both automated and manual synchronization facilities. So accountants have the liberty to choose which has to be synced right away and which can be done later.

Volopay also permits API integrations with business tools like TruTrip and Talenox. These applications are used in HRMS and business travel booking. You can connect with these applications within the Volopay dashboard and make the payment straight away.

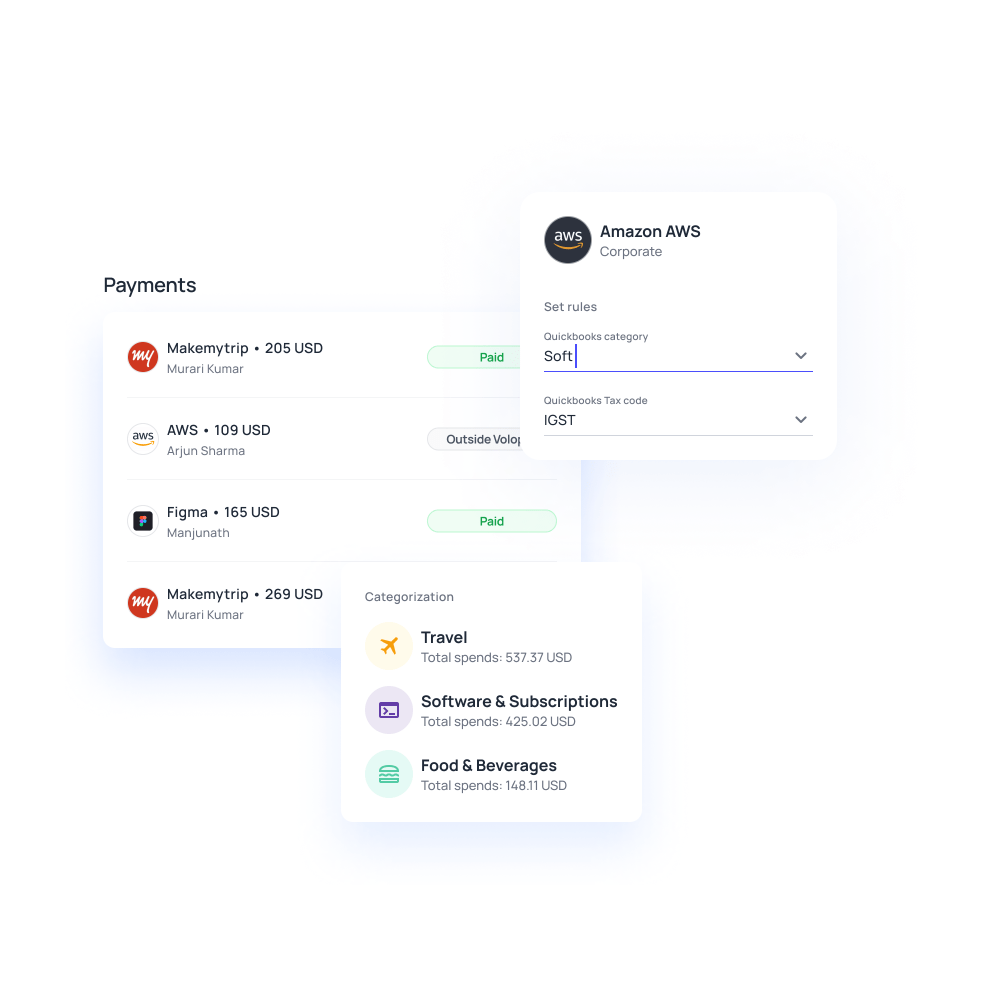

Look into your spending habits

Volopay provides an elaborate overview of your spending habits by displaying your entire payment history visually. You can see the payment trends based on different categories, vendors, departments or campaigns. This advantage helps you in monitoring your money management and alter spending habits. Since every payment you have made is included, you don’t have to go anywhere to see how much money is handled.

All-in-one solution for accounts payable

On the whole, Volopay acts like a suite for financial and accounting control and supports you in all phases of your company’s growth. Revolut can be a great tool for sending and receiving business payments. but when you are in need of an all-in-one solution for accounts payable, Volopay stands first. Though Revolut has accounts receivable and personal accounting tools, SMBs would prefer Volopay for its transparent and robust accounting features.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards.

Manage and track every dollar that leaves your company.

Open a global account with multi-currency payments.

Manage vendors, approve invoices and automate payments.

Save hours daily, and close your books faster every month.

Integrate with the all the tools and software that you use daily.