Why integrate Xero with expense report software?

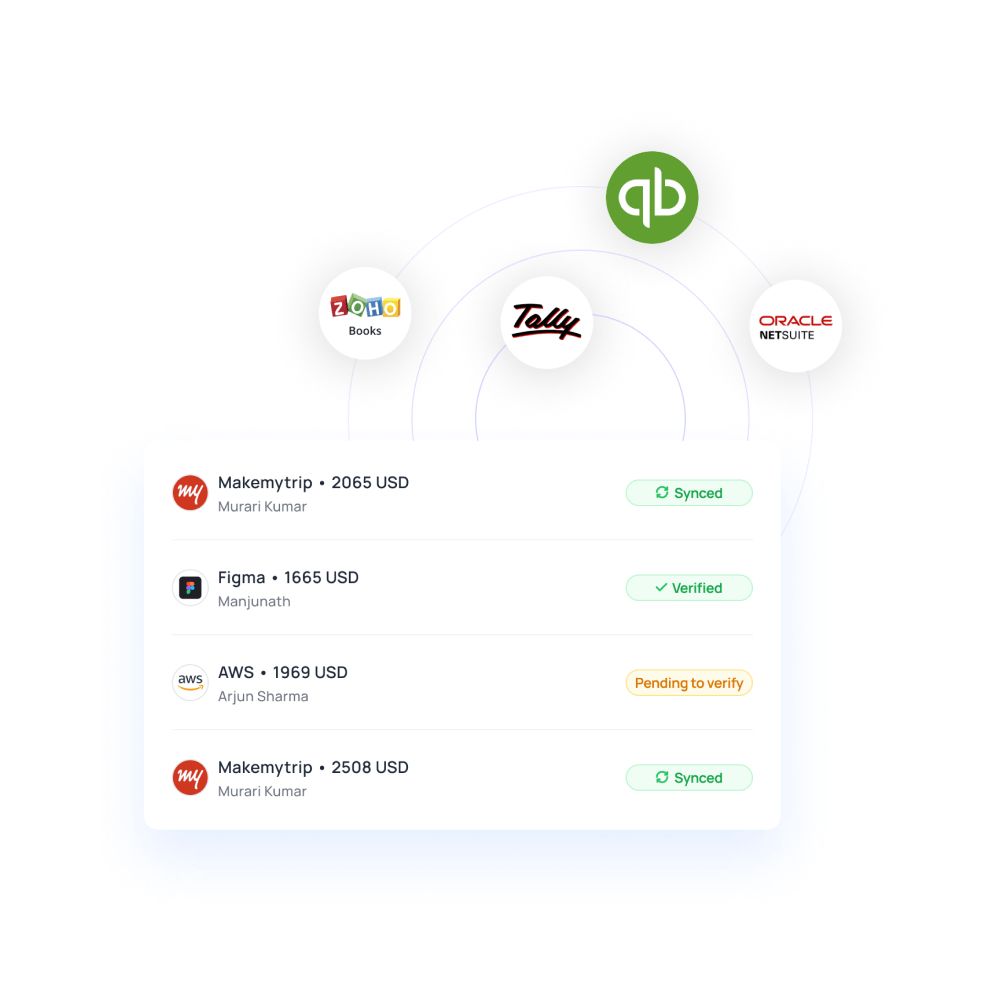

Your expense report and accounting process are symbiotic. They go hand-in-hand and affect one another. So, it would seem obvious that the two should be integrated together. Unfortunately, many people are still unaware of the benefits of Xero integration with their expense report automation. The days of doing manual data entry are over. Your expense report software can now be integrated with the Xero platform so that your data is already synced for accounting and reconciliation.

Xero accounting software is one of the most popular bookkeeping software in the world. It makes your records clean and accessible, easily analyzed by accountants. Integrating it with your expense tracker allows the data to be exported into Xero with the frequency of your choice (and on-demand!). It’s a swifter method, and less likely to be riddled with errors.

Benefits of Xero accounting software

Multi currency support

Xero supports multi-currency transactions and can process payments across 160 countries. International transactions are converted into your currency of choice within the application interface. This makes it possible for finance to take a look at reports in multiple currencies, as well as analyze currency markets/rates’ effects on cash flow and profits.

No backups needed

Since Xero is a web-based software, all your data is always protected. You don’t need to worry about files getting lost, corrupted, or mislabeled. All documents are stored in your account. Xero allows you to share emails, document scans, bank information, and all transactional/invoice data. All bills and receipts are also stored online.

Financial reporting

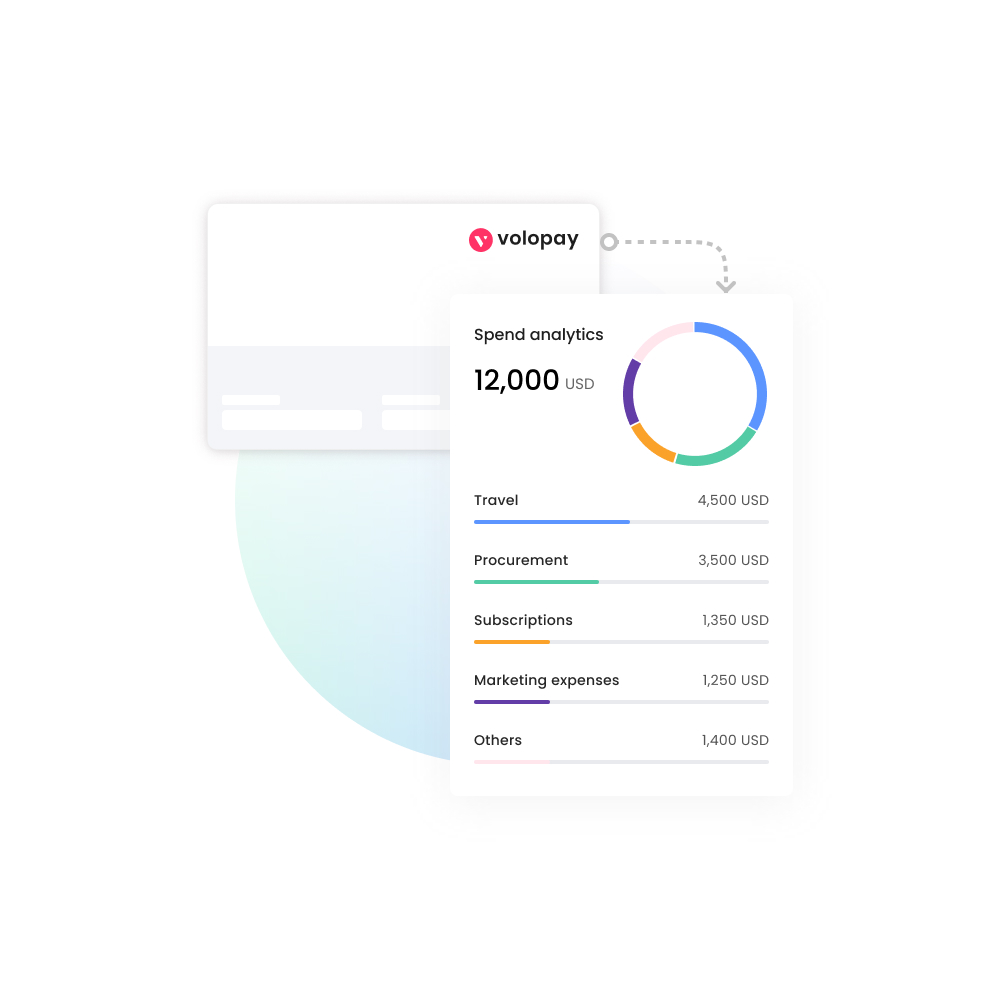

Xero accounting software makes expense reporting a streamlined process. You can choose which information to include in reports, and generate them according to necessity. Business performance records are visible wherever needed. Xero allows you to apply custom formulae to the data for analysis. Integrated data from your expense report automation is plugged into reports directly.

Safe and secure

Xero accounting software has a secure platform for all your transactional data. Invoices and bills are generated within the system to prevent fraudulent claims. Banking information can be directly linked to your reports for a live feed of transactions. Additionally, multiple integrations allow you to securely transfer payment data onto the platform without having to worry about data theft or loss.

Boost business efficiency

Xero automation can boost business efficiency on an unexpected scale. When redundant tasks are eliminated from employee to-do lists, then more time is spent on productive operations. Moreover, Xero’s analytics abilities allow you to analyze revenue, cash flow, profit margins with ease. Instead of tallying costs at the end of the quarter, Xero accounting software gives you continuous access to your expense report and progress (consequently, aiding smarter business decisions).

Makes collaboration easy

Xero accounting has made remote work better and removed the distance between departmental communication. The platform keeps a tight lock on all your financial documentation, while also bringing together data in a single spot. Controlled visibility and access lets inter-departmental collaborations easier. The effort of multiple employees is in a single place, with lesser time wasted on revised report editions, corrections, or error mapping for the expense tracker.

Accessible

Since Xero brings all your accounting information to one platform, your expense tracker is easily accessible for all relevant departments. Advisors and managers can collaborate with accountants in real-time, and analyze reports together. All billing and invoicing information is also gathered on the same platform, to ensure that all data can be verified quickly.

Why do organizations prefer Xero integration for spend management?

Real-time view of your cash flow

Xero is a one-stop solution for all your financial analytical needs. The integration of this application makes analytical reporting as smooth as butter. Xero’s analytics tool is a powerful one. Bank balances and cash flow have real-time visibility for accountants and administrators.

A compact view of your financial health is readily available for you to assess. AI-powered predictions, scenario planning, and transactional impact can help you better manage your future financial decisions.

Run your business on the go

Integrating Xero into your business is one step closer to having a mobile business. The web app and the mobile app allow you to have full flexibility and control while being on the go. It is an end-to-end business processing solution.

You can submit and manage expenses, track inventory, and also get a view of ongoing projects. Invoices can be paid, and quotes generated without having to stop and conduct any kind of manual labor. Xero integration even lets you manage your payroll virtually, creating a seamless workflow.

Get paid faster with online invoicing

Spend management with systems like Xero becomes easier when you can generate invoices and receipts on the platform. There is no need for manually generating invoices and then uploading them, or sending them to vendors. Xero allows you to create custom invoices through their web service (and app).

These invoices come with an immediate payment button, so any money received is automatically accounted for, as well. Systematic reminders to vendors and employees make follow-up easier, too. If you haven’t reached the invoicing stage yet, Xero also lets you generate quotes for clients and vendors.

Reconcile in seconds

One of the benefits of using Xero automation is the ease of reconciliation. What used to be a long-drawn process can now occur within seconds. Xero tracks all your expenses and suggests matching data to reconcile expenses. Your records will always reflect the latest and current data.

Additionally, Xero also allows accounts to reconcile information in bulk. If a certain set of transactions come under a specific category of reconciliation, you can also use Xero to create and apply “Bank rules” to transactions.

Reimburse expenses promptly

Reimbursements are one of the trickier aspects of financial accounting. With a Xero integration, they don’t have to become a headache anymore.

Receipts and claims can be attached for transparency, while transactions are easy to search and verify. Any paybacks to employees are recorded on the same platform to prevent accidental or fraudulent double-claims. Online processing takes lesser time than writing cheques or making physical claims, so your employees are never strapped for cash.

Spend less time on closing books & more time on growing your business

How do Xero & Volopay help with better expense reporting?

Account management with Xero becomes ten times more efficient and accurate when a spend management system like Volopay is used to track your records and transactions. In fact, Volopay lets accountants directly maintain data records and request information before it is transferred to Xero so that there is no chance of error.

Reimbursements

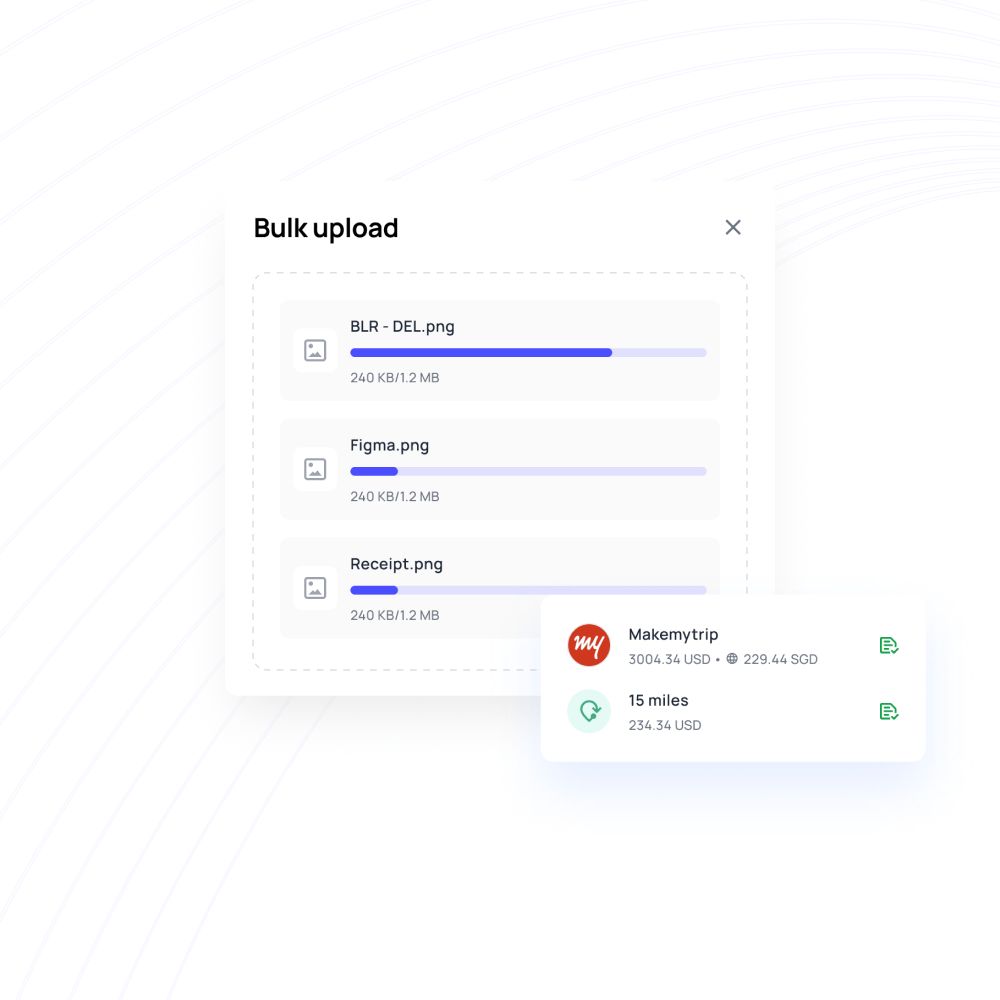

Reimbursements can be difficult to track in a company of hundreds of employees. Volopay handles reimbursements within the platform so that you don’t have to file long-winded claims. Employees can file a claim on the platform, and repayment can happen via Volopay’s Bill Pay.

Receipts and details can be requested by multi-level approvers before the transaction is authorized. All of this information is auto-coded for Xero to understand. As soon as you integrate your Xero account with Volopay, this reimbursement history - with all its details - is transferred automatically to your accounting report.

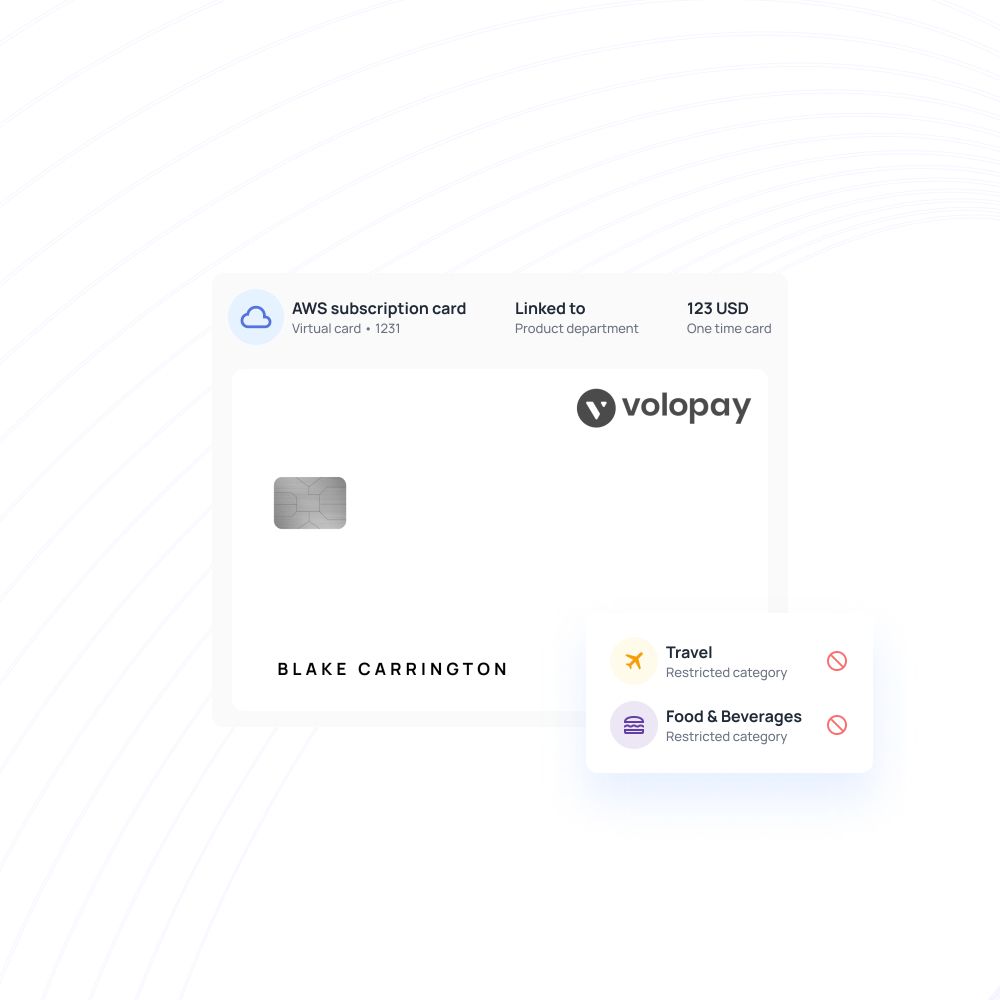

Virtual cards

Similarly, all virtual cards with Volopay also have real-time swipe records. Unlike cards taken from banks, these cards can be unlimited (with unlimited statements, budgets, and employees associated with them). Instead of hunting for data linked to these cards, Volopay maintains a ledger of card transactions which is then generated into a report for Xero to process.

Volopay, as a platform, strives to streamline all your financial transactions and budgeting needs. As Xero predicts future measures and offers budgeting advice, you can translate this by creating budgets on Volopay. Invoices, payments & cards can be associated with these budgets. Transactions will be automatically categorized to match the budget, reflecting on your analytical reports in Xero.

Integration

The beauty of integration is that you don’t have to do anything yourself. Xero and Volopay have already worked together to make your job easier. Integration is a quick process that doesn’t require you to code data or make it decipherable. Removing human redundancy, Volopay creates fields and labels that are understood and processed by Xero automatically. You no longer need to copy and paste the information in your expense tracker to your accounting tracker.

Additionally, using two automation software accounts adds an additional layer of security. All your invoices, receipts, and statements are available on Volopay, as well as Xero. Since Volopay does not require you to attach bank data for card creation, you can create cards without exposing your banking information to data theft. These card statements are then processed through a secure integration, which verifies your identity on both fronts before granting data exchange permissions.

How do Volopay expenses sync with Xero?

Volopay has inbuilt reminders for employees to make claims and upload expense data. This expense report can be reconciled and exported, or automatically transferred to Xero via the official integration. Companies can add accountants to their Volopay accounts for accounts-relevant information. Accountants can also take a look at ledgers and ensure that all data is reconciled before transferring to Xero.

Xero integration with Volopay

The Xero automation integration gives Volopay permissions to transfer the ledger, invoicing, and billing information into your Xero account. Similar to any other kind of account sync, your Xero transaction history will reflect all payments made through Volopay’s Bill Pay or corporate cards your employees have with Volopay.

Invoices and receipts will also be automatically added. You no longer need to do any kind of manual data entry. The integrated system takes care of all data value fields and makes your job as simple as a single click.

Trusted by finance teams at startups to enterprises.