Seamlessly integrate Xero with your expense reporting software

Manually handling business expenses often leads to errors, delays, and lost productivity. Tracking receipts, entering data, and reconciling costs can drain valuable time. By connecting your expense reporting software with Xero, you can automate these repetitive processes. This integration ensures accuracy, speeds up approvals, and gives you complete visibility into spending.

With smoother workflows and fewer manual steps, your team can focus more on strategic financial decisions rather than tedious paperwork. Embracing digital automation through expense report integration helps your business save time, reduce mistakes, and streamline overall expense management operations effortlessly.

What is Xero integration?

Xero integration connects your expense management platform directly with Xero’s accounting system, enabling automatic syncing of transactions, reimbursements, and approvals. This ensures real-time visibility into every expense without manual data entry.

You can categorize costs, track spending by department, and reconcile accounts effortlessly. Through Xero accounting integration, businesses eliminate redundant work, enhance accuracy, and maintain organized financial records.

This seamless connection not only accelerates expense reporting but also empowers you to make data-driven financial decisions quickly. As a result, managing expenses becomes smoother, smarter, and more efficient across your entire organization.

Why should businesses integrate Xero with expense management software?

When you integrate Xero with expense reporting, all expense details flow automatically from your reporting system into Xero.

This eliminates the need to enter data manually, reducing duplicate efforts and costly mistakes.

Automated syncing ensures that every transaction is recorded accurately, saving you hours of tedious work each month.

By connecting expense software to Xero, you gain instant visibility into your company’s spending patterns.

Every approved expense reflects in your Xero dashboard immediately, helping you track budgets more effectively.

This real-time insight enables better forecasting and decision-making, ensuring complete financial transparency across all departments and projects.

Xero accounting integration simplifies reconciliation by automatically matching expenses, payments, and receipts.

Instead of manually reviewing entries, your finance team can confirm transactions with one click.

This faster process eliminates bottlenecks, ensuring month-end closings are smoother and error-free while maintaining accurate financial records that are always up to date.

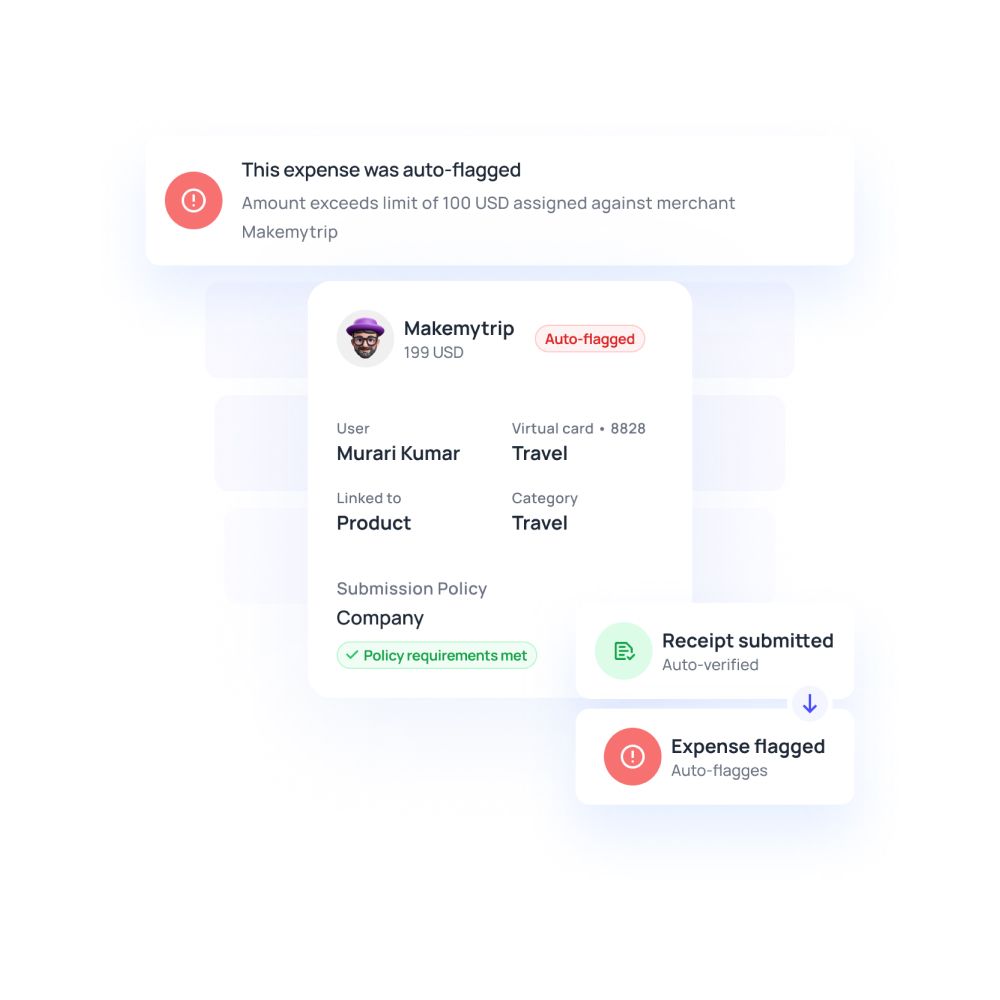

When integrating expense management with Xero, your records stay accurate, traceable, and compliant.

Each expense links directly to its corresponding receipt, ensuring a clear audit trail.

This reduces the risk of noncompliance, simplifies auditing, and provides transparency, helping your business remain prepared for internal and external financial reviews anytime

With expense report integration, employees can submit and track reimbursements effortlessly. Finance teams benefit from streamlined approvals and automated entries, minimizing repetitive tasks.

The integration encourages accountability and accuracy, while employees experience faster reimbursements and clear communication.

Together, this improves morale, productivity, and overall efficiency for your organization.

As your business expands, Xero integration easily scales to handle higher expense volumes and new departments.

It adapts to increasing transaction data without overwhelming your systems.

This scalability ensures consistent performance and reliability, allowing your financial operations to grow seamlessly while maintaining accuracy, visibility, and control across all processes.

Challenges businesses face without Xero-expense software integration

Manual data entry errors

Without integration, expense data must be manually entered into separate systems, increasing the likelihood of mistakes. Human errors, such as duplicate entries or missed receipts, disrupt financial accuracy.

Over time, these inaccuracies affect budgeting and reporting, making it harder for your team to maintain reliable and consistent expense records.

Delayed financial reporting

Manual workflows slow down report generation and approvals. When expenses are submitted, processed, and recorded in separate platforms, delays are inevitable.

Without automation, your finance team spends hours reconciling data before creating reports, which leads to outdated insights and reduced responsiveness to real-time spending trends.

Reconciliation issues across systems

Managing multiple platforms without synchronization leads to mismatched entries and reconciliation delays. Finance teams must manually verify each transaction between systems, wasting valuable time.

Without unified data, your records may show discrepancies that cause confusion during audits or closings, ultimately impacting your company’s financial clarity and operational efficiency.

Lack of transparency and control

Operating without integration means limited visibility into spending patterns and budget adherence. Finance teams cannot track expenses in real time, making it difficult to enforce policies or detect overspending.

This lack of transparency reduces control over financial operations, weakening accountability and decision-making across various departments and projects.

How the benefits of Xero integration solve expense reporting challenges

Using Xero accounting integration helps you overcome common expense reporting obstacles by automating data entry, reducing errors, and providing real-time insights. Multi-department spending becomes transparent, reconciliation is faster, and compliance is easier to maintain. The combination of automation and analytics ensures your business manages expenses efficiently while improving accuracy and financial control.

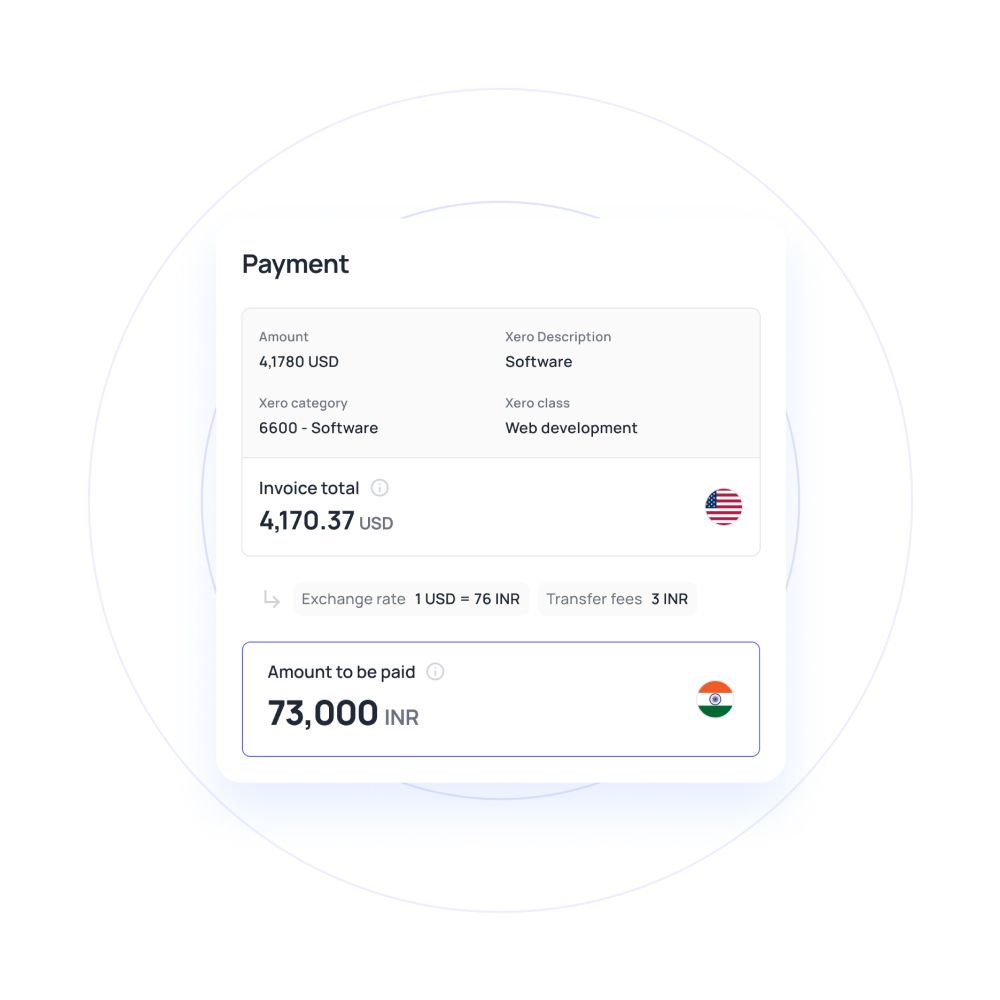

Multi-currency support

With Xero, you can manage expenses in multiple currencies without manual conversions. Exchange rates update automatically, allowing you to track global spending accurately.

This capability reduces errors, simplifies reporting for international teams, and ensures financial consistency across locations. Multi-currency support is essential for businesses expanding globally and managing overseas expenses seamlessly.

Cloud-based security and accessibility

Xero’s cloud-based system keeps your financial data secure while offering accessibility anytime, anywhere. You can access expense reports, receipts, and approvals remotely without compromising safety.

This flexibility allows your finance team and employees to work efficiently from multiple locations while maintaining strong security standards and protecting sensitive financial information.

Advanced reporting for efficiency

Xero provides detailed analytics and customizable reports, enabling you to monitor spending trends and identify inefficiencies. Automated dashboards consolidate data from all departments, making it easier to make informed decisions.

By leveraging advanced reporting, you can detect anomalies quickly, improve budgeting accuracy, and optimize overall expense management processes effectively.

Enhanced collaboration across teams

By using Xero, employees, finance teams, and management can collaborate seamlessly on expense submissions and approvals. Shared access reduces communication delays and ensures everyone stays aligned with company policies.

This collaborative approach accelerates reimbursement cycles, improves accountability, and enhances overall organizational efficiency in managing expenses across departments.

How to integrate expense management with Xero seamlessly

To connect expense software to Xero effectively, follow a structured setup process. Each step ensures smooth integration, proper mapping of accounts, and automated workflows.

By preparing your account, selecting the right tools, and training your team, you can implement a system that streamlines expense reporting, improves accuracy, and enhances overall financial control.

1. Prepare your Xero account

Ensure your Xero account is fully set up with active users, permissions, and updated financial data. Review existing expense categories and the chart of accounts.

Preparing your account minimizes errors during integration and provides a solid foundation. This step ensures all expense data will sync correctly once the connection is established.

2. Choose the right expense management tool

Select an expense management software that aligns with your business needs, integrates seamlessly with Xero, and supports automation features. Evaluate functionality, reporting options, and user experience.

Choosing the right tool ensures efficiency, accuracy, and a smooth workflow for your employees while maximizing the benefits of Xero integration.

3. Connect expense management software to Xero

Follow the software instructions to seamlessly connect expense software to Xero. This usually involves authenticating accounts and granting necessary permissions. Once connected, your expenses, receipts, and approvals will sync automatically.

Proper connection ensures real-time updates, reduces manual data entry, and lays the groundwork for automated reconciliation and reporting.

4. Map expense categories and accounts

Align your expense categories in the management software with your Xero chart of accounts. Correct mapping ensures transactions post accurately, and reporting remains consistent.

This step prevents misclassification, improves financial transparency, and allows your team to generate accurate expense reports without extra manual adjustments or reconciliations.

5. Automate expense workflows

Set up automated workflows for approvals, notifications, and reimbursements. Automation ensures every expense follows the correct process, reduces delays, and maintains compliance.

This setup allows your finance team to focus on analysis rather than manual approvals, while employees benefit from faster processing and accurate reimbursements.

6. Test the integration

Run sample transactions to confirm that data flows correctly between your expense software and Xero. Verify categories, amounts, approvals, and reporting.

Testing ensures that issues are identified early, avoiding discrepancies and delays. It guarantees that your integrated system functions smoothly before going live for all employees.

7. Train your team & monitor performance

Educate employees and finance staff on the integrated system, workflows, and reporting features. Monitor usage, track efficiency gains, and resolve any issues promptly.

Proper training ensures high adoption, accurate expense reporting, and maximized benefits from the Xero integration, supporting continuous improvement in your financial processes.

Ensuring compliance and data security in Xero integration

Strengthening audit readiness

Xero integration ensures all business expense data is accurately recorded and easily traceable. Each transaction is linked to receipts, approvals, and relevant accounts, creating a clear audit trail.

This level of financial transparency simplifies internal and external audits, reduces the risk of any potential errors, and ensures your business maintains regulatory compliance efficiently.

Role-based employee access

Integration allows you to assign specific access levels to employees based on their roles. Finance teams, managers, and staff can access only the information necessary for their responsibilities.

This prevents unauthorized data changes, safeguards sensitive financial information, and ensures accountability while maintaining operational efficiency across departments.

Encryption and secure data transfers

All data transmitted between expense management software and Xero is encrypted using secure protocols. This protects sensitive financial information from cyber threats and unauthorized access.

Secure data transfers guarantee confidentiality, integrity, and compliance with industry standards, giving your business peace of mind while managing digital workflows.

Best practices for a smooth integration

Preparing expense categories and chart of accounts

Before integration, review and standardize your expense categories and chart of accounts. Clear organization ensures transactions are accurately classified and mapped during syncing.

Proper preparation prevents misallocation, improves reporting accuracy, and streamlines workflow, providing a solid foundation for a secure and efficient Xero integration.

Training employees for easy adoption

Educate your employees on the integrated system, workflows, and reporting tools. Proper training reduces mistakes, increases adoption, and ensures smooth operations.

Employees familiar with the system submit accurate expenses and follow approval processes correctly, enhancing overall efficiency and contributing to a successful integration outcome.

Reviewing mappings before syncing

Verify that all categories, accounts, and expense codes are correctly mapped between systems. This step prevents misclassified transactions and reconciliation errors.

Reviewing mappings before live syncing ensures data accuracy, reduces the need for corrections, and guarantees that reporting and financial records remain precise and trustworthy.

Monitoring integration logs regularly

Regularly check integration logs to identify errors, failed transactions, or syncing issues. Continuous monitoring allows your team to address problems promptly and maintain system reliability.

By keeping a close eye on integration performance, you ensure consistent accuracy, prevent data loss, and sustain smooth expense reporting operations over time.

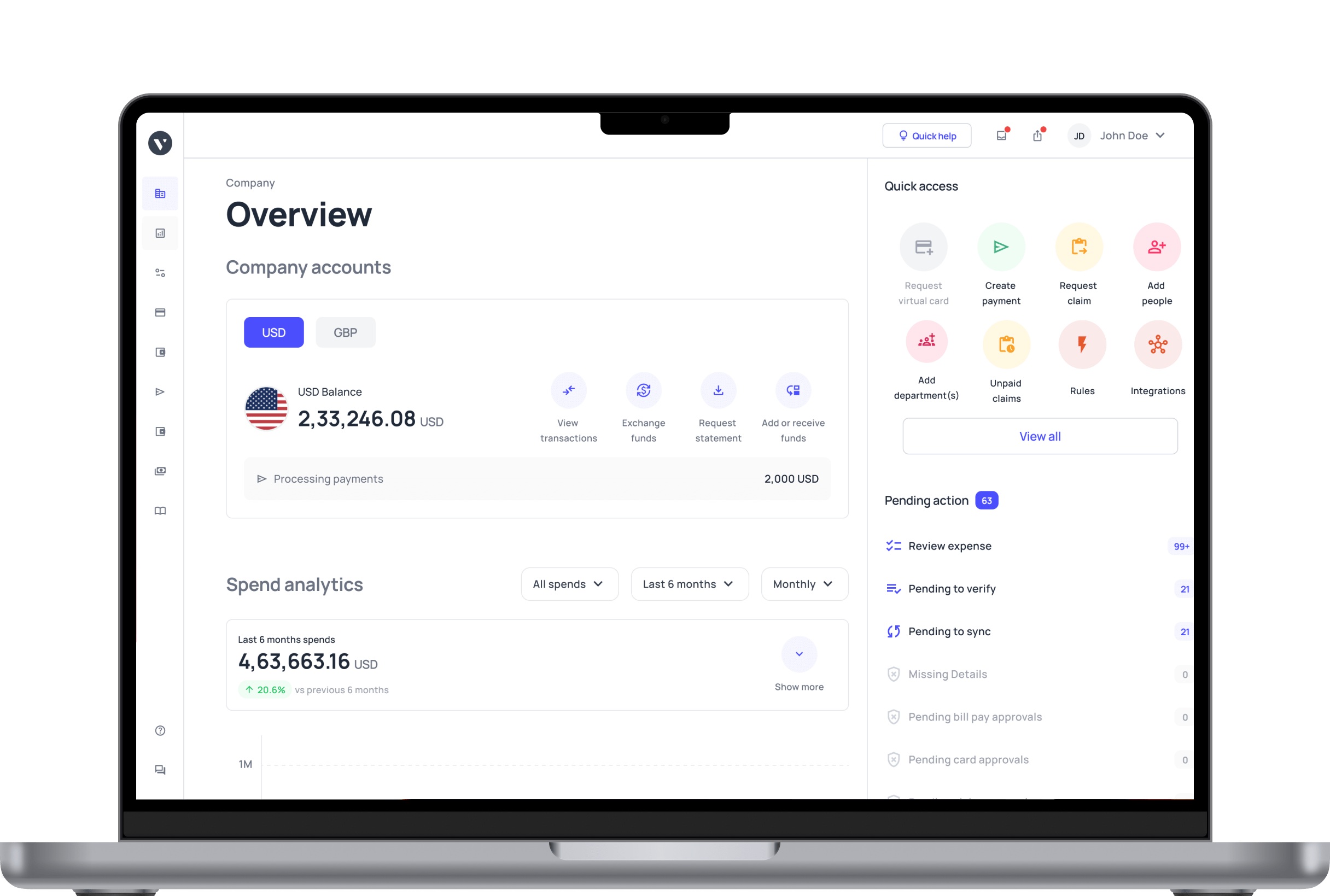

How Volopay and Xero work together for smarter expense management

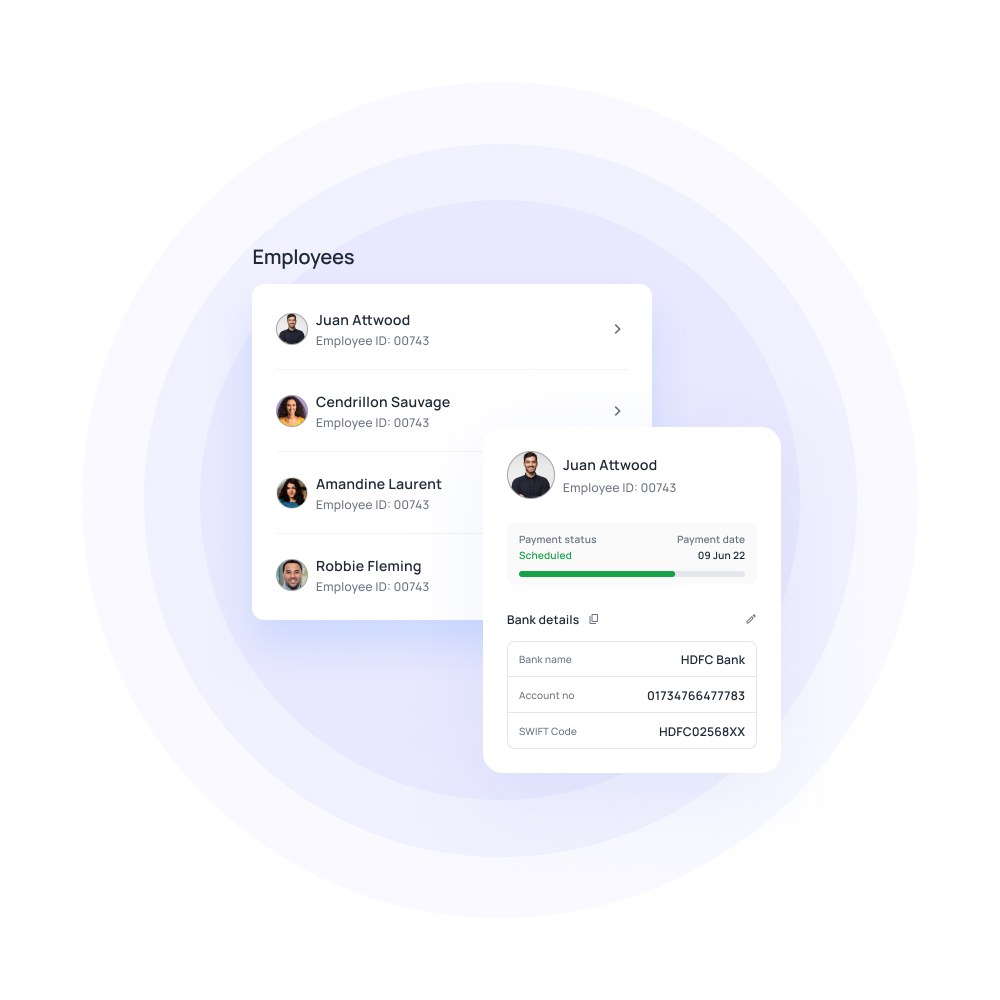

Volopay integrates seamlessly with Xero to simplify expense management. Automating workflows reduces manual entry, improves reporting accuracy, and streamlines approvals.

Businesses can manage spending efficiently across departments and global teams while maintaining compliance, visibility, and control. This combination provides a complete solution for smarter, faster, and more reliable financial operations.

Automated expense reporting

Volopay automatically captures employee expenses, card transactions, and receipts, syncing them directly with Xero. This eliminates manual data entry, reduces errors, and ensures real-time tracking.

Your finance team can generate accurate expense reports quickly, making approvals faster and simplifying budgeting and compliance while maintaining full transparency across all organizational spending.

Hassle-free reimbursements

Employees submit expenses through Volopay, and reimbursements are processed automatically. Integration with Xero ensures approvals and payments align with financial records.

This speeds up reimbursement cycles, reduces administrative burden, and ensures employees are compensated accurately and promptly, creating a more efficient and satisfying experience for both staff and finance teams.

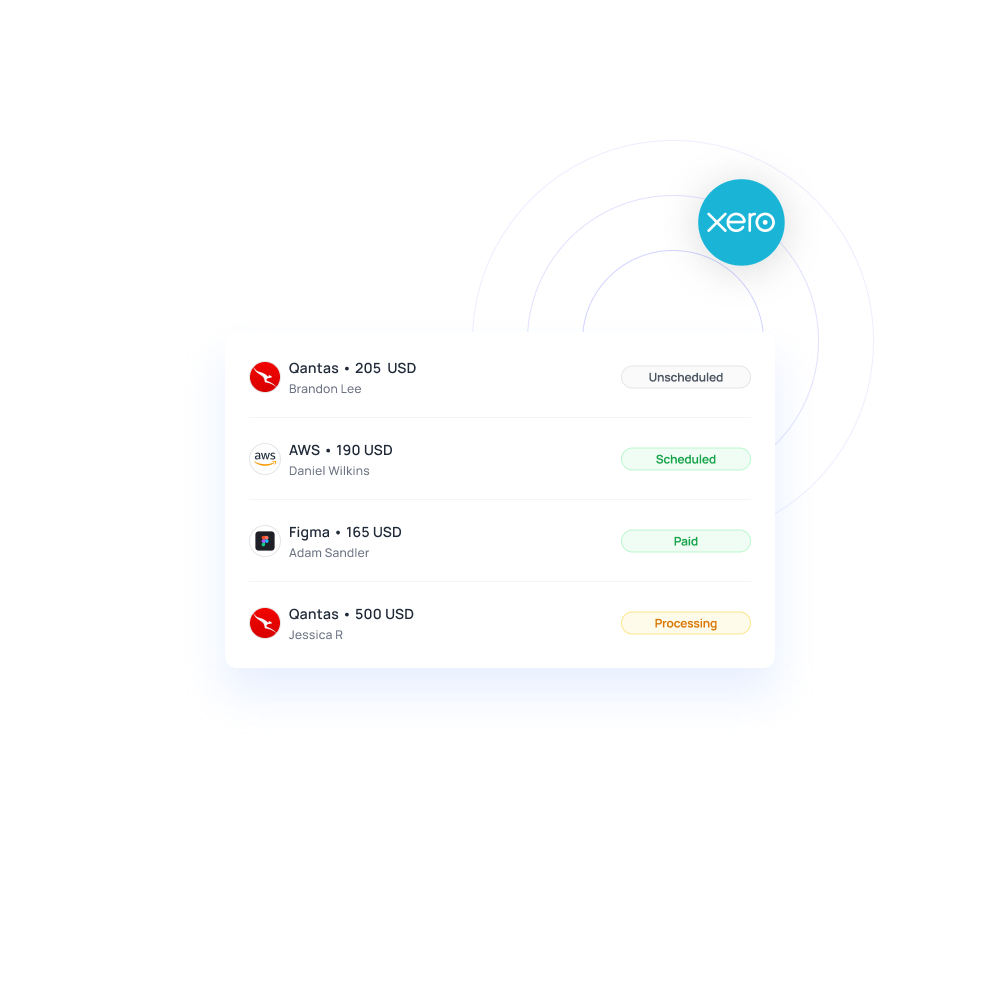

Streamlined vendor and card payments

Volopay simplifies vendor payments and corporate card management by syncing transactions with Xero automatically. This reduces manual reconciliation, prevents missed payments, and provides a unified view of all outgoing funds. Businesses can track spend across multiple cards and suppliers efficiently while maintaining accurate and up-to-date financial records.

Enterprise-grade security

Volopay's seamless integrations ensure secure handling of financial data with multi-layered protection, user permissions, and encryption. Integration with Xero preserves this security while providing authorized access to finance teams.

Sensitive information remains protected from unauthorized access, and the business maintains compliance with regulatory standards and internal security policies.

Real-time sync for accuracy

Transactions, receipts, and approvals are instantly synced between Volopay and Xero. Real-time updates ensure that expense data is always accurate and up to date.

This continuous sync minimizes reconciliation errors, improves reporting reliability, and allows finance teams to make faster, data-driven decisions across departments and global operations.

All-in-one spend management

Volopay centralizes all expense types, including cards, invoices, and reimbursements, in a single platform. Integration with Xero ensures every transaction is recorded accurately in the accounting system.

Businesses gain full visibility, reduce manual work, and manage budgets effectively, creating a comprehensive and efficient approach to corporate spending.

Multi-entity and global support

For businesses that are operating across countries or multiple entities, Volopay provides automated tracking and reporting for each entity.

Integration with Xero ensures consolidated financial records while supporting multi-currency transactions. This enables seamless global operations, easier auditing, and accurate expense management across all teams and locations.

Practical use cases: Volopay Xero integration in action

Travel and employee reimbursements

Employees can submit travel expenses through Volopay, which syncs automatically with Xero. This streamlines approvals, ensures receipts are tracked, and allows reimbursements to be processed efficiently.

Finance teams gain real-time visibility into travel spend, improving budget control and reducing delays in reporting or reimbursements across the organization.

Subscription and SaaS expense tracking

Recurring subscription and SaaS costs are captured automatically through Volopay and recorded in Xero. This allows finance teams to monitor usage, prevent duplicate charges, and track spending across multiple services.

Automated tracking ensures accurate budgeting, simplifies renewals, and provides a complete overview of recurring expenses for better decision-making.

Automated vendor invoice payments

Volopay manages vendor invoices and ensures payments are scheduled correctly, syncing directly with Xero. This reduces missed payments, simplifies reconciliation, and provides a complete record of all vendor transactions.

Businesses benefit from improved cash flow management, faster processing, and accurate financial reporting for all supplier-related expenses.

Multi-entity accounting for global teams

For global organizations, Volopay tracks expenses for multiple entities and currencies, syncing them with Xero in real time. This ensures consolidated reporting, simplifies audits, and maintains accurate financial records for each location.

Multi-entity support allows teams worldwide to operate efficiently while finance maintains control and visibility across all operations.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs

Businesses can typically set up Xero integration within a few hours. With step-by-step guidance, proper account preparation, and selecting the right expense management tool, the integration process is fast, smooth, and requires minimal technical expertise.

If transactions fail to sync, review mapping settings, check for system errors, and ensure proper permissions. Troubleshooting common issues quickly resolves syncing problems, maintaining accurate and up-to-date financial records.

All types of expenses, including employee reimbursements, corporate card transactions, vendor invoices, subscriptions, and travel costs, can be synced into Xero. This ensures complete visibility and accurate financial reporting across all business expenditures.

Yes, Xero integration supports multi-entity organizations and departmental tracking. You can manage different teams, locations, and currencies while maintaining consolidated financial records and accurate reporting for each entity or department.

You can customize expense mappings to align with your chart of accounts and business categories. This ensures accurate classification, proper reporting, and smooth reconciliation of transactions in your accounting system.

Industries with frequent expense reporting, global teams, or high-volume transactions benefit most. Examples include technology, consulting, finance, retail, and travel sectors, where automation improves efficiency, accuracy, and compliance.

Volopay automatically captures transactions, approvals, and receipts, syncing them in real time with Xero. This automation streamlines manual tasks, ensures accuracy, and maintains consistently updated financial records for improved expense management.

Yes, multi-currency expenses are automatically converted and recorded accurately. Exchange rates are updated in real-time, allowing for seamless reconciliation and precise reporting of international transactions across multiple currencies.

The integration uses encryption, secure protocols, and role-based access to protect data. It ensures compliance with financial regulations, maintains confidentiality, audit readiness, and safeguards sensitive corporate financial information.