Employee benefits of corporate travel expense management

Growing businesses are well aware of the travel requirements faced by employees across departments; from client meetings to expensive travel arrangements for events, each expense is crucial to a company's budget. Having a corporate travel expense management system in place is important to track, monitor, and control these costs so that budgets are used in the most efficient way possible.

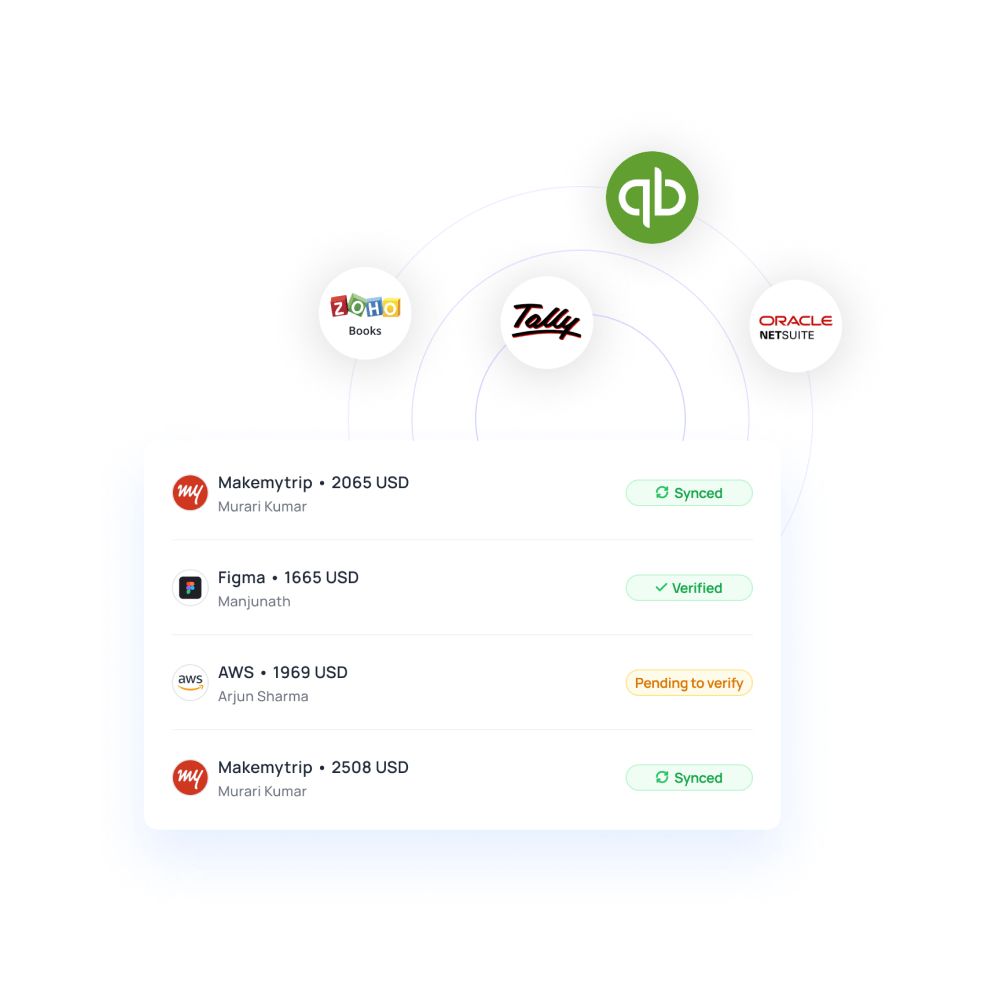

Volopay is one such expense management software that will help your business track and control every penny that goes out of the company budget. With smart financial tools like physical and virtual corporate cards, you can give your employees the flexibility to make travel expenses while still controlling the flow of money by setting limits and creating payment approval systems.

What aspects of corporate travel are employees responsible for?

While an organization might take up the responsibility to manage corporate travel expenses for their employees, the employees themselves are also responsible to comply with certain aspects of it:

Saving and storing all receipts for expense report submission

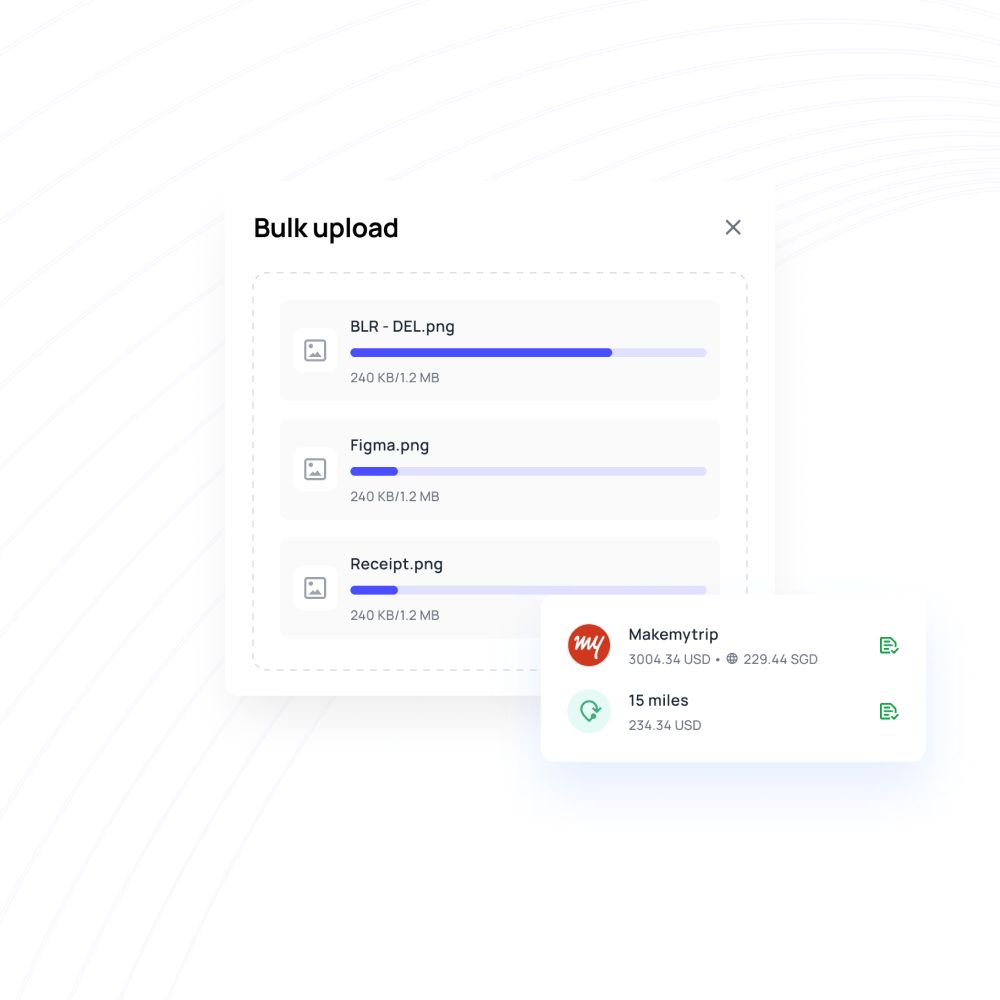

Another major responsibility that employees have is to ensure the safe storage of all their expense receipts as they have to submit them along with their expense reports to get reimbursements. This hassle is eliminated when you use a system like Volopay where you can simply attach an image of the receipt to the relevant expense through our mobile app and get reimbursed in real-time.

Following the expense policies

When making expenses, employees must know the rules regarding the type of business travel expenses they can make. Whether your organization uses an expense management software like Volopay or follows a traditional reimbursement system, adhering to these rules is very important. If an employee makes an expense that is not permitted as per the policy, they will not receive a reimbursement.

How can corporate travel become a burden for employees?

Paying with personal expenses

If proper travel allowances or a separate travel budget is not set for employees, then it means they will end up having to pay for necessary arrangements themselves. This is never really a good experience as it will make the employees conscious about their spending decisions. How much can they spend and what they can spend on would also be a troubling aspect if clear expense policies are not set by the organization.

Suggested read: How to reduce business travel expenses?

Delay in reimbursements

A delay in reimbursements can occur due to various reasons. If an accountant finds something fishy with your receipts, they might have to consult with team managers and clarify what the expenses were made for. There might also be issues that are not in anyone’s control such as the time taken for the money to be transferred from the company account to an employee’s personal bank account. Apart from this, the process of carrying out reimbursements in general for most companies is quite slow.

Time-consuming

Firstly, when employees use their personal funds in order to pay for business travel, they have to carefully save all relevant expense receipts so that they can submit them at the end of the month for bulk approval and get their reimbursements.

Secondly, this task of saving the receipts is quite tough as they are small paper slips that easily get misplaced. No proof of expense, no reimbursements. And finally, the time taken to get back your funds is quite lengthy. You have to wait the entire month to submit your expense reports, and even after that, you’ll have to wait for weeks or months for the finance team to verify and process the reimbursements.

Complex policies

To manage corporate travel expenses, businesses often set out rules for employee spending in the form of a corporate travel policy. More often than not, rather than providing clarity to all the employees, the documents are quite complex and not at all easy to decipher leading to more confusion.

How to streamline corporate travel for employees?

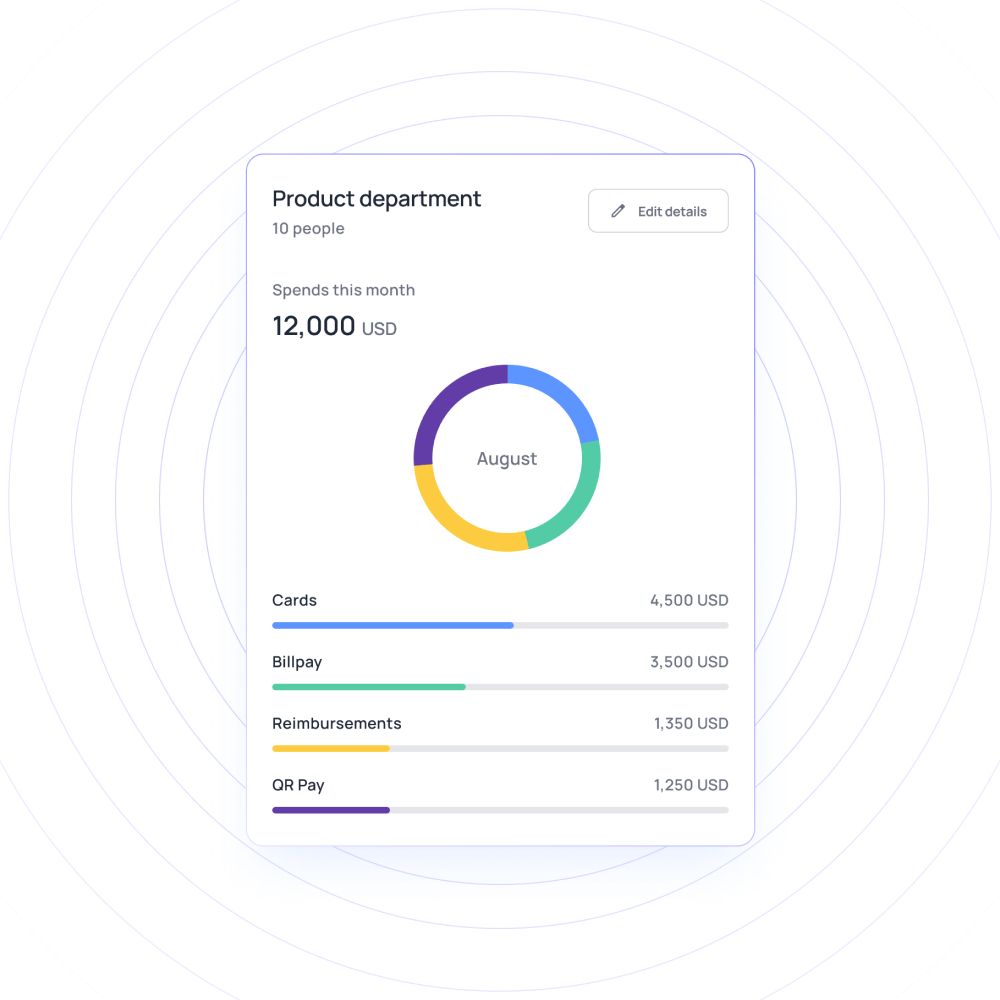

Set a clear budget

The very first thing that a business should do to streamline travel expense management is to set up a separate budget to manage corporate travel. If the company does not have past travel expense data, the finance team should definitely discuss with other department heads and create a forecast for estimated travel budget requirements. Doing this will at least avoid unprecedented costs to the overall company budget.

Flexibility to the employees

Last but not the least, a business should allow the employees to choose the mode of transportation and accommodation that they’re comfortable with rather than enforcing a particular way of traveling. This will make the overall experience of corporate travel much better. Volopay’s integration with TruTrip allows your employees to view many transport and hotel options to choose from.

Accessible on a mobile app

A lot of corporate business travel expenses occur on the go and it is not possible for an employee to always open their laptop to check how much funds are left in their digital expense wallet. This makes it important for you to choose an expense management platform that has a mobile app. Using the Volopay app, employees can not only view their expenses and see available funds, but also request funds and file expense receipts.

Make travel policy easier

Employees should be able to understand the policies easily without any complexity. The whole point of creating an expense policy is to ensure that all employees know about all expenses they are allowed to make so they can be confident in their purchasing decisions.

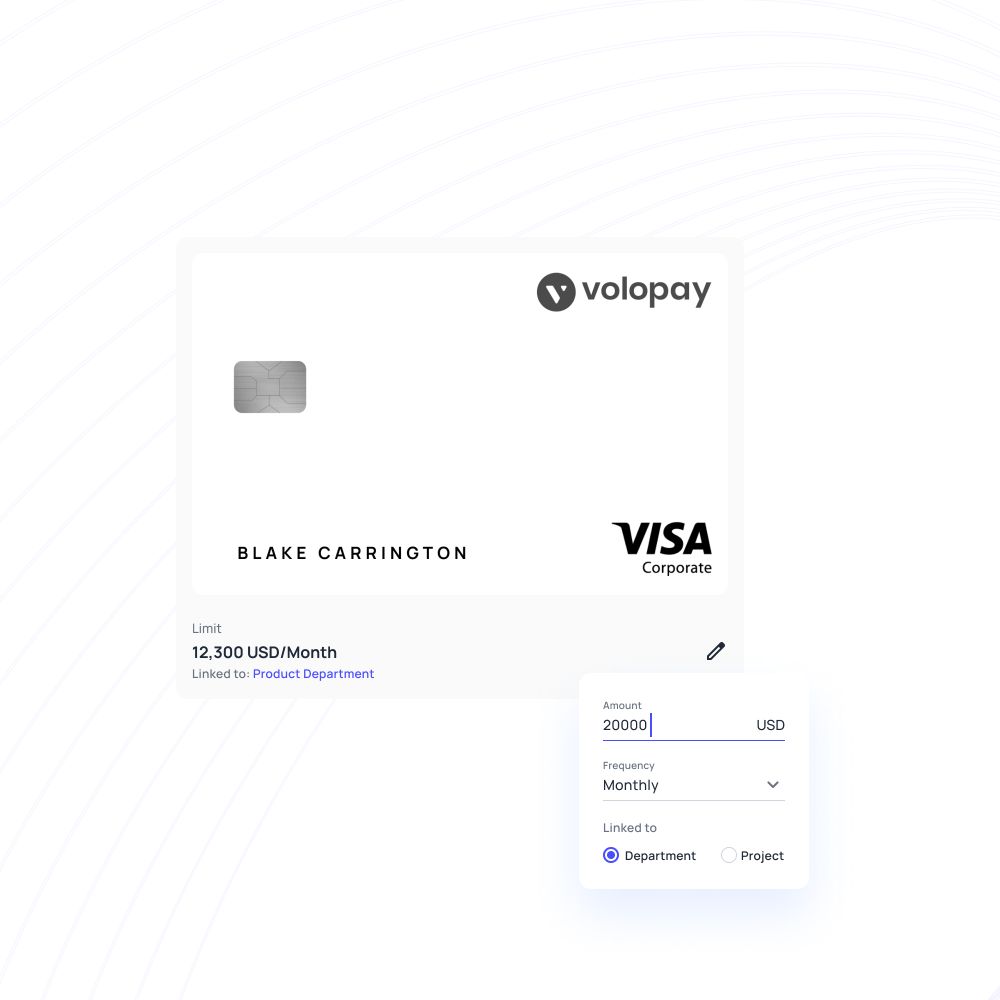

Volopay solves this problem by allowing businesses to create travel budgets and set pre-expense approval systems for them. So whenever an employee wants to make an expense for travel purposes using Volopay cards, a notification is sent to the approver of the budget in real-time to approve or reject the request. This way the company has control over the budgets while still giving their employees quick access to funds.

Automate your workflow

Some might ask, what if the approver is not available to approve the expense request and the employee is stuck in a situation without the funds. Good question! To solve this issue, you can automate certain expenses that are below a particular range without any approval system. This is done by setting a specific range within the approval policy.

For example, the travel policy that you create for your travel budget can parameters where any expense that is equal to or greater than $100 must be approved by the approver, but any expense lower than that does not require approval. The funds in this case can directly be accessed by the employee using their physical or virtual card.

How can Volopay make your employees’ travel smoother?

Corporate travel expense management doesn't have to be as hard as it seems. In fact, using Volopay is a pretty solid way to improve your business travel management systems, here's how:

Issue corporate travel cards for employees

When you use Volopay as your expense platform, you can easily create a separate budget for corporate travel management. So now, as an admin on the platform, whenever you create a virtual card for an employee, you can select the relevant budget for the card to pull funds from.

Each employee of yours on the platform also gets a physical card that they can use to make expenses.

Integrated with Trutrip

Due to our integration with TruTrip, you get the best of options for travel arrangements in terms of quality as well as flexible pricing. A travel management software integrated with expense management software means you get the best corporate travel expense management experience by monitoring all your company savings, spending, and travel trends.

Detailed insights on spending

The ability to track and monitor means that you will get deep spending insights. This will help in understanding travel patterns, frequency of travel budget requirements, and therefore help your entire team to forecast and plan for the future in a better way.

Reimbursements

While on a trip, in case a situation arrives where an employee forgets their physical card in a hotel or doesn’t have it on them at that moment, but urgently needs to make a payment, then they can use their personal funds to carry out the transaction, save the receipt, and file an expense claim right through their Volopay mobile app. This way they’ll get reimbursed sooner than later.