Volopay - The best alternative to Happay

Looking for the best alternative to Happay? Meet Volopay—the all-in-one expense management solution.

With advanced AP automation, seamless vendor payments, unlimited virtual cards, and robust accounting controls, Volopay goes beyond Happay’s ‘almost-there’ features to deliver a truly powerful, all-in-one finance solution.

Trusted by finance teams at startups to enterprises.

Volopay vs Happay - in a nutshell

- International corporate cards

- Virtual cards

- UPI payments

- Merchant and category controls

- Advanced merchant identification

- AP automation

- Automated invoice processing

- Scheduled payments

- Recurring payments

- Robust accounting controls

- Accounting integration triggers

- Smart budgets

- Vendor payments

- Domestic transfers

- Flexible workflows

- TruTrip integration

What sets Volopay apart from Happay?

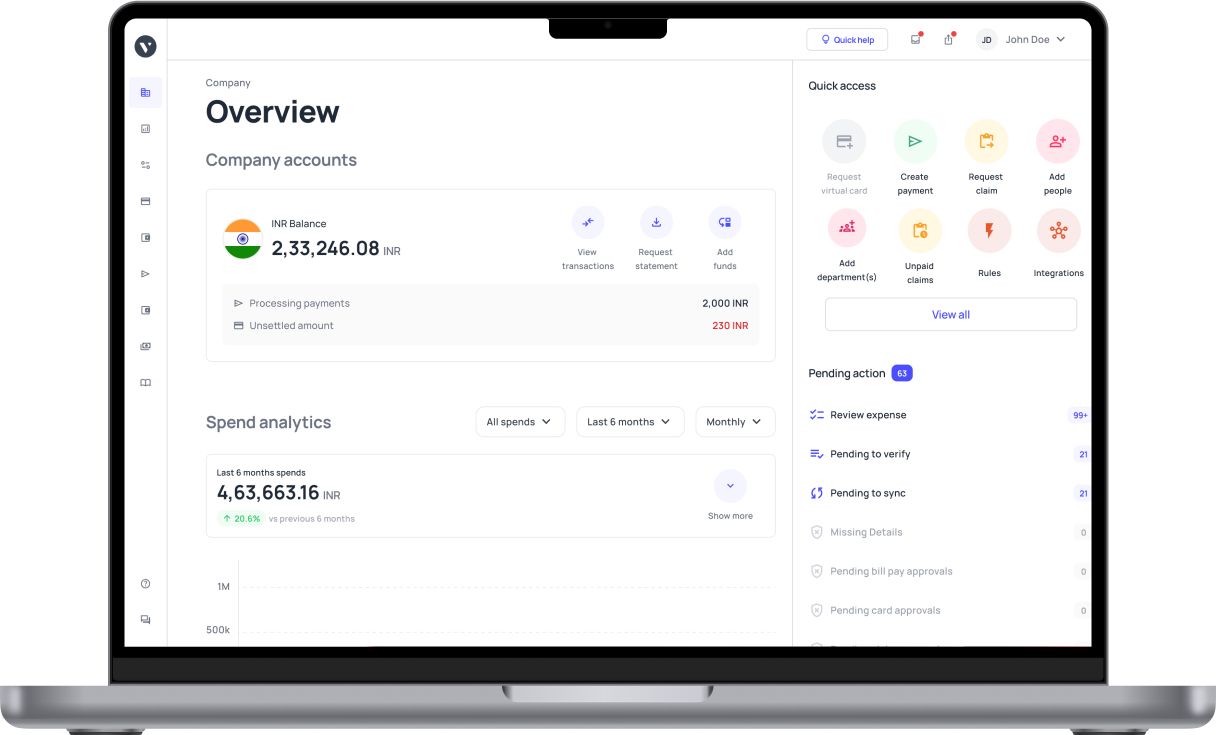

With Volopay you get the complete package - a comprehensive, fully integrated business accounting suite to manage all your accounts payables. Equipped with state-of-the-art expense management features, Volopay provides end-to-end support to help your company grow at a lightning-fast pace. It’s literally the only upgrade you’ll ever need for your accounting systems.

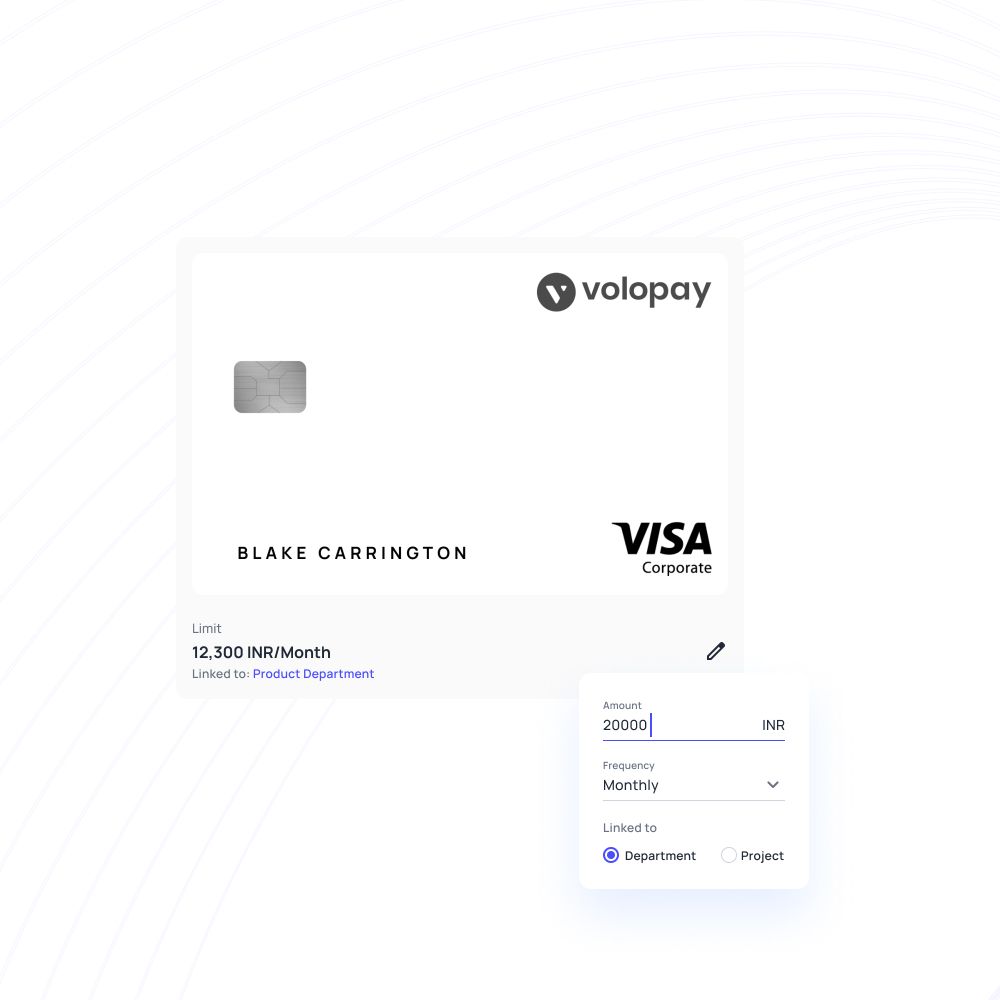

Easy-to-use, safe & highly powerful corporate cards

Volopay offers corporate cards equipped with cutting-edge technology that makes the payment and accounting experience fast and seamless.

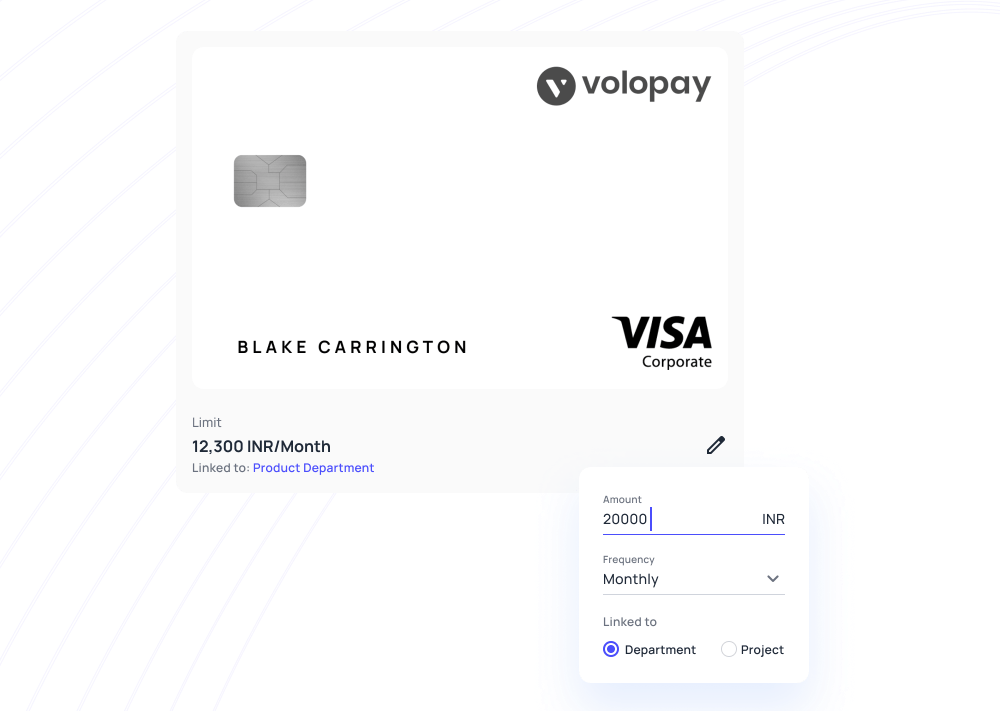

You can issue cards in both physical and virtual cards. In fact, you can issue an unlimited number of virtual cards with Volopay.

With Volopay’s international corporate cards, you can spend globally without hidden fees and enjoy seamless transactions in multiple currencies. Say goodbye to high FX charges and manage international expenses effortlessly!

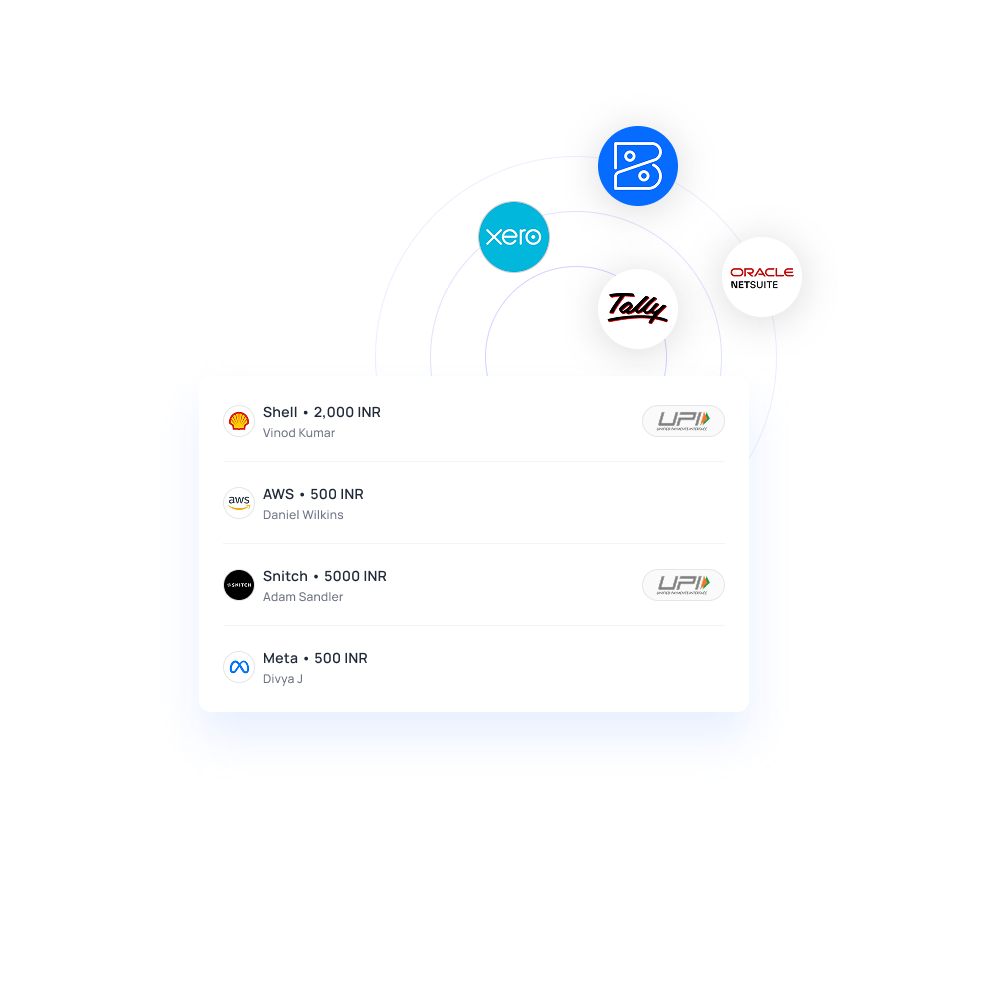

Make effortless business payments with UPI

Make quick, secure, and hassle-free business payments with Volopay’s UPI-enabled virtual cards. Instantly activate UPI, make real-time payments from your mobile, and track every transaction on an intuitive dashboard.

Unlike Happay, Volopay ensures universal merchant compatibility, so you never face payment restrictions.

With advanced security features, set spending limits, monitor transactions, and manage approvals effortlessly. Every payment is recorded instantly, giving you complete financial transparency and control over your business expenses.

Extensive corporate card features

Volopay lets you proactively set and customize controls on corporate cards to help track every single penny that leaves your company, in real-time.

You can set up complex, customizable approval workflows on these cards to fit your company’s needs and requirements.

You can use Volopay cards to instantly send money anywhere, pay for subscriptions, recurring payments, or just as single-use, gift or burner cards.

Upgrade to an advanced expense management solution today!

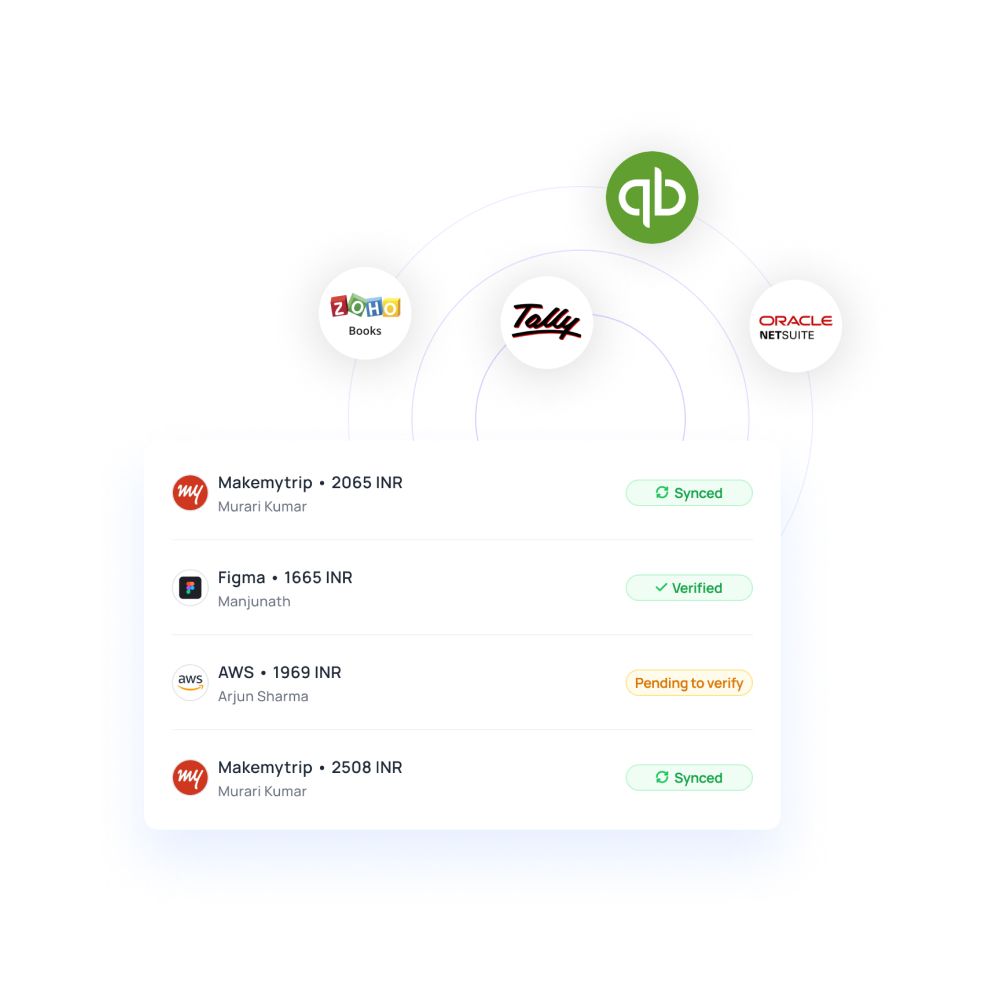

Seamless accounting integrations with triggers

With companies using multiple software at once the need for smooth integration capabilities has become a necessity.

Accounting integrations usually require a step where transaction category, codes etc. have to be selected manually before the integration can happen. This is how it works with most expense management platforms, including Happay.

In contrast, Volopay has introduced the unique feature of accounting triggers. You can use this feature to set a trigger for a particular vendor, card, user or budget and let the software do the auto-filling for you for all future transactions.

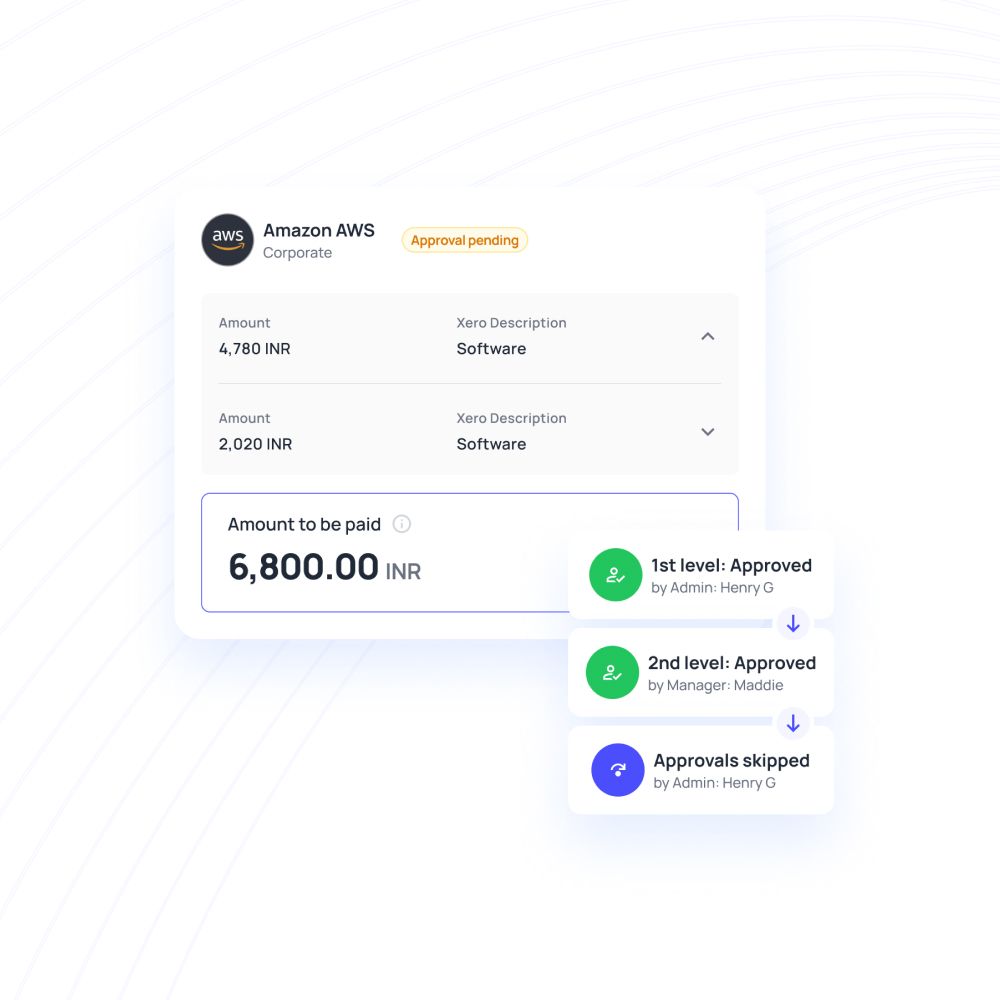

Comprehensive accounts payable management

Happay gives you a dashboard to control and track card expenditures. With Volopay, you get all that and more—a powerful accounts payable management dashboard equipped with bulk payments, AI-powered OCR technology (Magic Scan), and advanced vendor management.

This allows for easy and secure vendor payments across the globe while automating data entry, invoice matching, processing, expense reporting, and approval routing.

Another key difference is that Volopay lets you assign cards not only to employees but also to entire departments. Teams can track spending by vendor, organize expenditures efficiently, and assess ROI with greater clarity.

Highly competitive rates & 0 hidden costs

At Volopay we strongly believe in a no-fine print and no-markups policy. Our prices are crystal clear with no hidden costs whatsoever. Our remittance rates are best in the market, even better than the rates provided by banks.

To provide a more accessible service we also have different plans designed to fit the needs of all companies, regardless of their scale. This means that you save a lot more money and get the right value out of your investments.

Customer service that never lets you down

A common complaint businesses often have is with regard to the customer service they receive through the lifespan of their usage of a product or service. The case is the same for many expense management platforms, including Happay.

To ensure our clientele does not have the same experience we have assembled a customer service team that is at your service 24*7, 365 days of the year. We’ve received many accolades thanks to our customer service systems and are proud to boast one of the happiest clienteles in the industry.