What is mileage reimbursement and how do you track it?

Do you find your employees spending more time behind the wheel for work-related trips rather than sitting at their desks?

If your employees are using their private automobiles for hopping between offices, meeting up clients, or bringing in office supplies, then they qualify for mileage reimbursement.

Mileage reimbursement benefits both the employer and the employee. While the employee receives payment for mileage expenses made on behalf of the company, it also provides business owners with tax-reduction incentives. But reporting business mileage is not an easy task.

What is mileage reimbursement?

Mileage reimbursement is compensation employers provide when employees use personal vehicles for business purposes.

The mileage reimbursement system ensures employees aren't financially burdened by work-related travel costs, promoting fairness and workplace motivation.

For employers, offering mileage reimbursement supports productivity while providing tax efficiency, as these payments typically qualify as deductible business expenses.

Understanding mileage reimbursement rates and policies helps both employers and employees manage transportation costs effectively.

What expenses are covered by mileage reimbursement

Mileage reimbursement covers the basic expenses associated with driving for business purposes, including fuel and maintenance.

Employees often bear costs for gasoline, oil changes, tire replacements, and routine vehicle servicing. Providing mileage reimbursement for employees ensures these recurring vehicle costs are fairly compensated.

When employees use personal cars for business, the vehicle’s value depreciates faster due to increased mileage and wear. Insurance premiums may also rise since higher usage elevates risk factors.

Employee mileage reimbursement helps offset these added expenses, ensuring workers don’t absorb business travel costs themselves.

While not always part of the standard mileage rate, parking fees and tolls regularly occur during business-related travel.

Employers can include these in their mileage reimbursement process when employees park at client sites or travel through toll roads. Covering these costs under employee mileage reimbursement encourages accurate reporting.

Mileage reimbursement for employees can extend beyond fuel and wear, often covering registration, taxes, and licensing fees linked to business-related vehicle use. Regular business driving increases administrative costs, such as renewals or road taxes.

Including all these costs in the mileage reimbursement process provides comprehensive coverage and ensures complete transparency of each business cost when personal vehicles are used for official business assignments.

Employee mileage reimbursement may include costs for necessary business-related vehicle accessories such as GPS devices, car chargers, or dash cameras. These tools enhance navigation, safety, and communication during work-related trips.

Incorporating such accessory-related expenses into the mileage reimbursement process demonstrates a comprehensive approach to cost management, ensuring employees are well-equipped when using their personal vehicles for professional duties.

Businesses maintain organized records of all employee mileage reimbursements for tax and auditing purposes. Documentation must include trip mileage, date, destination, and purpose. Proper record keeping ensures IRS compliance and supports financial accuracy.

By storing reimbursement data securely and consistently, employers strengthen policy transparency, reduce audit risks, and demonstrate adherence to the established mileage reimbursement process across departments or business units.

How does mileage reimbursement work?

Step 1: Logging business travel

The mileage reimbursement process begins when employees log their business travel accurately. They must record trip details like date, distance, and purpose using a mileage log or GPS-based digital app.

Proper logging ensures transparency and helps prove that the travel qualifies as work-related under company policy. Accurate documentation simplifies employee mileage reimbursement and enables faster review and approval by managers and finance teams.

Step 2: Submitting mileage claims

After logging their drives, employees must submit claims through a digital platform or expense portal. Submissions typically include mileage logs, receipts, and trip details. Following the deadlines outlined in the company’s mileage reimbursement policy ensures prompt processing.

This step in the mileage reimbursement process confirms that each claim is properly documented, promoting efficient and organized payment handling for both employees and employers handling travel reimbursements.

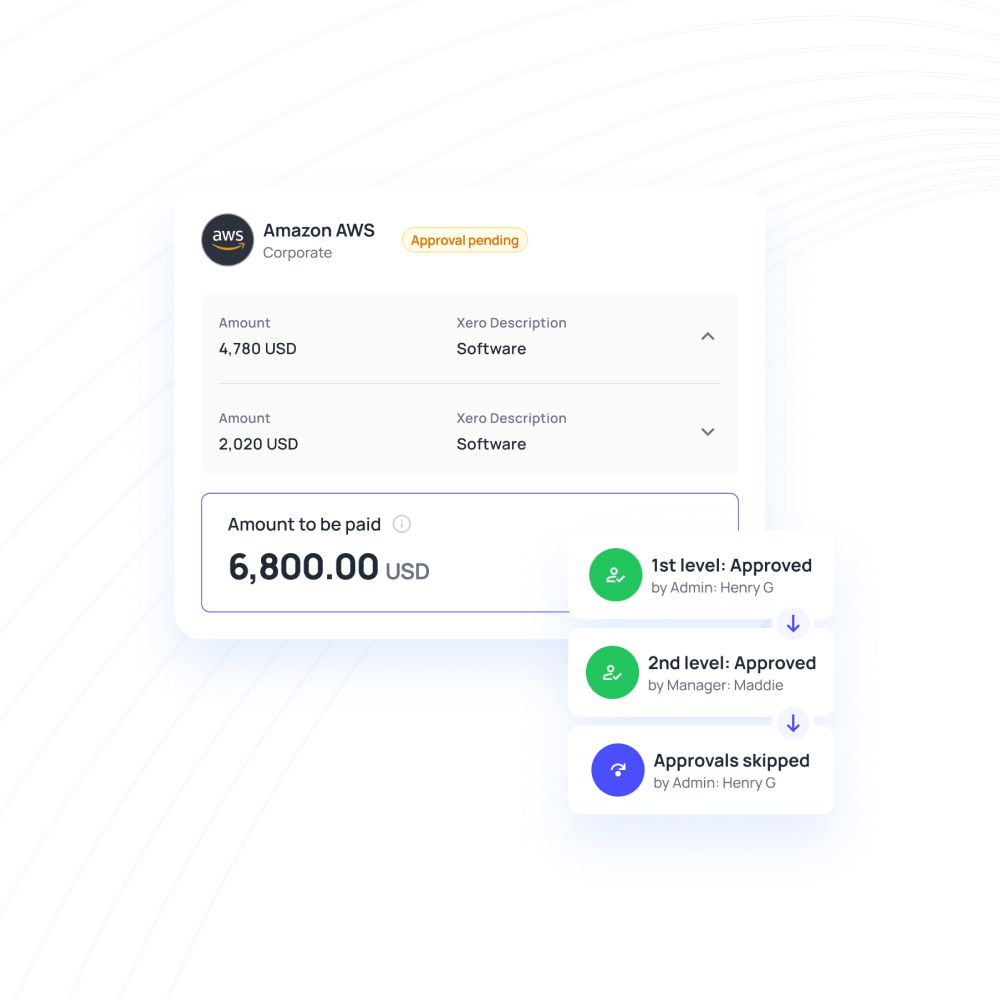

Step 3: Manager review and policy validation

Once claims are submitted, managers review them to confirm they meet the company’s mileage reimbursement policy. Each business trip is verified for authenticity and relevance to work duties. This validation step prevents false or redundant claims.

Supervisory approval ensures transparency and compliance with company rules, supporting a fair and accurate employee mileage reimbursement process that aligns with internal controls and financial accountability.

Step 4: Reimbursement calculation

After verification, the reimbursement amount is calculated by multiplying approved business miles by the applicable reimbursement rate, such as the IRS standard rate. This formula ensures fair compensation while maintaining consistency across departments.

By using standard or custom rates, employers manage travel expenses effectively. This step within the mileage reimbursement process ensures equitable payment of driving costs for all employees.

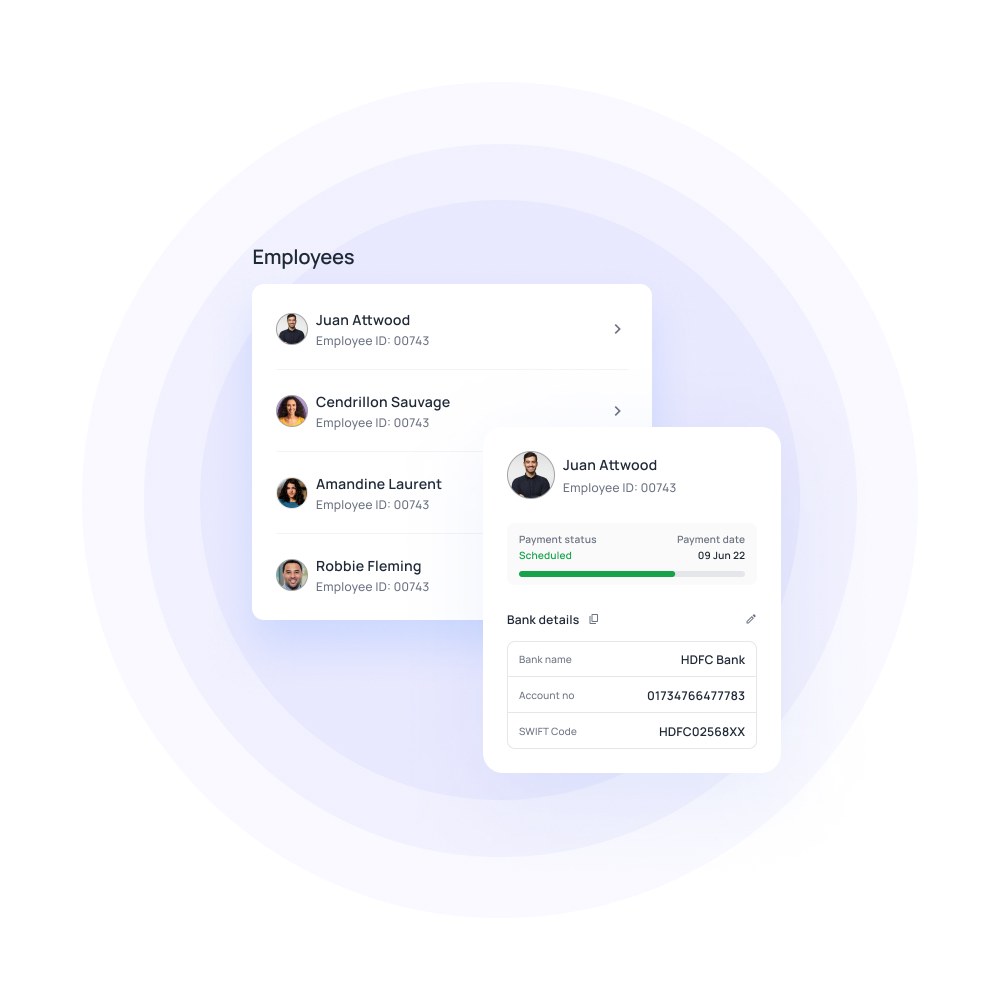

Step 5: Payment processing

Approved mileage reimbursement claims move to the finance department for payment processing. Reimbursements may be issued with payroll or as separate transactions. Using automated systems accelerates approval and reduces errors.

Prompt payment reflects an efficient mileage reimbursement process, assuring employees that their business travel expenses are covered quickly. This timely reimbursement reinforces trust and transparency between employees and employers in expense management.

Step 6: Record keeping and compliance

Businesses maintain organized records of all employee mileage reimbursements for tax and auditing purposes. Documentation must include trip mileage, date, destination, and purpose. Proper record keeping ensures IRS compliance and supports financial accuracy.

By storing reimbursement data securely and consistently, employers strengthen policy transparency, reduce audit risks, and demonstrate adherence to the established mileage reimbursement process across departments or business units.

Benefits of mileage reimbursement

Mileage reimbursement provides significant advantages for both your employees and your business. By compensating employees fairly for using their personal vehicles for work, you enhance job satisfaction and foster loyalty. When employees feel their travel expenses are recognized and covered, they are more motivated, which positively impacts productivity.

For your business, employee mileage reimbursement simplifies financial management by offering a structured and predictable system for compensating travel expenses. Additionally, it helps you stay compliant with legal and tax regulations, avoiding potential fines or disputes.

Proper mileage tracking and reimbursement also ensure transparency, reducing the risk of overpayments or errors. By implementing a fair and efficient mileage reimbursement process, you maintain a positive work environment while optimizing your expense management.

Compensates employees for their costs

You ensure your employees are fairly compensated for the expenses they incur while driving for work, covering fuel, maintenance, and wear and tear.

Employee mileage reimbursement helps offset these costs, ensuring your employees aren’t financially burdened by out-of-pocket expenses when using their personal vehicles for business tasks.

By providing fair compensation, you foster a positive relationship between your business needs and your employees’ contributions, maintaining their satisfaction while fulfilling your goals.

Simplifies travel expense management

Employee mileage reimbursement simplifies travel expense management for you and your employees.

Implementing automated systems and clear reimbursement policies allows you to easily track and manage expenses without unnecessary administrative burdens.

Your employees benefit from a straightforward method for reporting travel and expense costs, while you maintain effective control over expenses.

A mileage reimbursement system enhances financial oversight and streamlines operations.

Boosts employee motivation

Fair and consistent employee mileage reimbursement directly boosts your employees' job satisfaction and motivation.

When you recognize and compensate them for business-related travel expenses, you contribute to a more positive work environment.

This acknowledgment of their efforts enhances morale, making employees feel valued and appreciated.

By covering their costs, you are not only supporting their financial well-being but also strengthening their loyalty and commitment to your company, ultimately leading to better employee productivity and job performance.

Ensures regulatory compliance

Properly managing employee mileage reimbursement helps you stay compliant with legal and policy requirements.

By following consistent procedures, you ensure adherence to labor laws, tax regulations, and company policies.

Corporate travel policy compliance protects you from legal risks and penalties while demonstrating fairness in compensating your employees.

Ensuring that reimbursements are handled correctly not only safeguards your business but also fosters trust and transparency with your employees, who see that their work-related expenses are being fairly addressed.

Avoids capital costs

You avoid the significant capital costs associated with maintaining a company fleet by reimbursing employees for using their personal vehicles for business purposes.

Employee mileage reimbursement eliminates the need for vehicle purchases, insurance, and ongoing maintenance, allowing you to focus resources on more critical aspects of your operations.

This cost-effective strategy supports your employees’ work-related travel needs without imposing unnecessary financial strain on your business, ultimately leading to more efficient budget management and long-term savings.

Facilitates easy bookkeeping

Mileage reimbursement simplifies bookkeeping by providing clear, detailed records of travel expenses.

Streamlined expense reporting and tracking makes it easy for you to manage financial documentation and meet regulatory requirements.

Organized records reduce the risk of errors, ensuring smoother audits and compliance checks.

Straightforward knowledge of what is mileage reimbursement expense management, enhances control over your financial processes, leading to efficient operations and better oversight of your company’s expenses.

Lowers extra expenses

Relying on employee mileage reimbursement helps you avoid the extra expenses linked to managing a company fleet.

By compensating employees for using their own vehicles, you eliminate the costs of fleet maintenance, insurance, and fuel.

This approach keeps your travel-related expenses low while still meeting your operational needs.

Your employees also benefit from this arrangement, as it provides them with additional flexibility in managing their transportation needs, while simultaneously ensuring that they receive fair compensation for any business-related travel trips they undertake.

Reduces tax liability

Structuring your mileage reimbursement program effectively can reduce tax liability for both your business and your employees.

By treating employee mileage reimbursement as a tax-deductible expense, you reduce operational costs.

When reimbursements are handled correctly, they remain non-taxable income for your employees.

This dual benefit supports your financial strategy while ensuring your employees aren’t burdened with additional taxes.

It’s a win-win approach that balances cost management with employee satisfaction.

Common methods for calculating mileage reimbursement

Calculating mileage reimbursement accurately is crucial for businesses to ensure fair employee compensation and maintain compliance with tax regulations. Here, we explore the most common methods used to determine mileage reimbursements efficiently.

Standard mileage rate method

The standard mileage rate method is the most common approach to calculating mileage reimbursement. The IRS updates this rate annually to cover average expenses like fuel, insurance, and vehicle depreciation.

To determine employee mileage reimbursement, multiply business miles driven by the standard rate. This method simplifies the mileage reimbursement process, reduces record-keeping, and ensures consistent compensation for employees across all departments and travel purposes.

Actual expense method

The actual expense method calculates employee mileage reimbursement based on real vehicle costs. Employees record all work-related expenses such as fuel, maintenance, insurance, and repairs. Reimbursement is then provided in proportion to business use.

While this approach offers precise results, it requires thorough record-keeping. Businesses use it when they need accurate cost reflection rather than standardized rates, ensuring transparency in their mileage reimbursement process.

Fixed and Variable Rate Method (FAVR)

The Fixed and Variable Rate (FAVR) method combines both consistent and flexible elements to calculate mileage reimbursement. Employees receive a fixed payment for predictable costs like insurance and depreciation, plus a variable rate for fuel and wear based on actual miles driven.

This personalized employee mileage reimbursement option provides flexibility and fairness, reflecting the true costs of vehicle operation and usage for business needs.

Business mileage allowance method

Under the mileage allowance method, employees receive a set rate per mile or a periodic allowance to cover expected vehicle expenses. This simplified model helps businesses streamline reimbursement administration while maintaining fairness.

Though less precise than actual expenses, it’s popular for consistent travel. The mileage reimbursement process under this method balances budget predictability, and equitable compensation for work-related vehicle use.

Manual mileage tracking challenges and their solutions for businesses

IRS standard mileage reimbursement rate

The IRS standard mileage reimbursement rate is a guideline set by the Internal Revenue Service (IRS) in the U.S. for reimbursing employees for business-related travel. This rate covers expenses related to fuel, maintenance, and vehicle depreciation.

This rate is designed to fairly compensate you for the costs incurred while using your personal vehicle for work. There are variations in the rate depending on the type of vehicle and specific situations. For instance, different rates may apply for business versus medical or charitable driving.

Keeping up with the IRS updates ensures that you fairly compensate your employees according to the current standards. By adhering to these rates, you provide clear and consistent employee mileage reimbursement for their work-related driving, simplifying financial compliance and corporate travel management.

How to calculate mileage reimbursement?

To calculate mileage reimbursement, multiply the total miles driven for business reasons by the reimbursement rate. The formula is:

Reimbursement = Miles Driven × Reimbursement Rate

For example, if an employee drives 120 miles for business and the IRS rate is $0.655 per mile:

120×0.655=78.60

The employee should be reimbursed $78.60.

This straightforward calculation forms the basis of the mileage reimbursement process. Accurate mileage tracking and using the correct reimbursement rate are essential for compliance and transparency.

Industry-specific mileage reimbursement examples

Sales and client-facing roles

Sales professionals regularly travel to meet clients for presentations and demos. Mileage reimbursement enables them to recover expenses (like fuel and vehicle maintenance) incurred during these trips.

This process not only ensures fair compensation but also motivates employees by covering travel costs. Businesses benefit as reimbursement for employees helps maintain transparency and aligns with tax regulations concerning business-related travel expenses.

Remote and hybrid employee travel

Remote and hybrid workers occasionally travel to company offices for meetings or collaboration. Mileage reimbursement for these employees compensates for travel costs when commuting on business days between home and the workplace.

This tailored approach ensures that employees engaged in flexible working arrangements are fairly covered for mileage expenses while supporting business continuity and adherence to reimbursement policies.

Delivery and logistics businesses

Drivers in the delivery and logistics industries use personal vehicles frequently, accumulating significant operational costs. Mileage reimbursement compensates these employees, ensuring that essential delivery operations continue without imposing financial burdens on staff.

The mileage reimbursement process effectively supports smooth business logistics while maintaining full compliance with regulatory and tax guidelines.

Public sector travel policies

Employees in government or nonprofit sectors typically follow standardized mileage reimbursement policies based on federal or state reimbursement rates.

These policies ensure employees receive equitable compensation when using personal vehicles for official business travel.

Adhering to these guidelines maintains compliance with legal requirements, promotes transparency, and supports budget management within public service or nonprofit organizations that prioritize fair and consistent mileage reimbursement for employees.

Independent consultants

Consultants and freelancers often travel to client sites, incurring vehicle expenses related to business activities.

Mileage reimbursement offers a transparent and legitimate way to cover these essential business travel costs, including fuel, maintenance, and insurance.

Proper documentation as part of the mileage reimbursement process is crucial for tax deductions and ensuring compliance. This encourages accurate expense tracking and legitimizes travel costs tied to independent work or consulting.

Tracking mileage for reimbursement: Standard and remote workflows

Standard mileage tracking

Standard mileage tracking involves employees manually recording trip details such as start and end odometer readings, trip dates, destinations, and purpose. This method suits smaller teams or occasional business travelers who prefer traditional pen-and-paper or spreadsheet logs.

Though simple, it requires diligence for accuracy and compliance with mileage reimbursement policies, forming a foundational step in the employee mileage reimbursement process for many businesses.

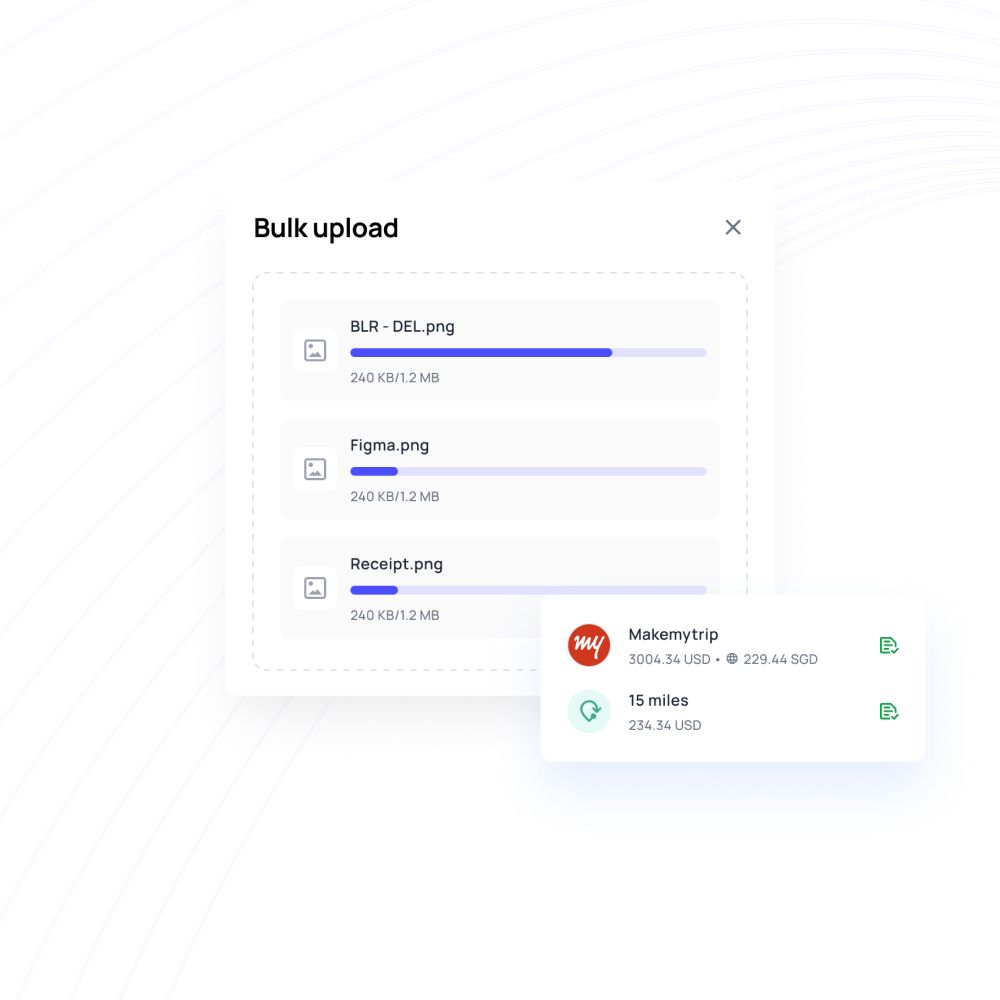

Mobile and app-based tracking

Mobile and app-based tracking tools use GPS readings to automatically record business miles driven. These apps enhance accuracy by eliminating manual entry errors and provide detailed trip logs that meet audit requirements.

This modern approach streamlines the mileage reimbursement process, saving employees time and boosting transparency, making employee mileage reimbursement faster and more efficient.

Remote and hybrid employee tracking

Cloud-based mileage tracking solutions support remote and hybrid employees by enabling them to log business travel from any location. This flexibility promotes inclusion and transparency for decentralized teams, ensuring mileage reimbursement for employees regardless of geographical location.

Such systems integrate easily into broader expense management platforms, easing the reimbursement process across varied work arrangements.

Integration with reimbursement systems

Mileage tracking data often integrates seamlessly with payroll or accounting software, automating reimbursement calculations and payments. This integration reduces manual workload and administrative errors while improving financial accuracy.

By linking mileage data directly to reimbursement systems, businesses can streamline the employee mileage reimbursement process, ensuring timely and precise compensation for business travel.

Audit and compliance considerations

Digital mileage logs simplify audits by providing timestamped, detailed records of business trips, including dates, distances, locations, and purposes. This robust documentation ensures that the mileage reimbursement process complies with IRS regulations and company policies.

Accurate record keeping minimizes risks of non-compliance and facilitates transparent expense reporting, critical for maintaining trust between employees and employers.

Reimbursing employees for mileage

To effectively manage employee mileage reimbursement, follow these steps:

● Establish a reimbursement policy

Define the reimbursement rates, acceptable mileage documentation, and procedures. Clearly communicate these guidelines to your employees to ensure consistency.

● Collect mileage records

Require employees to maintain accurate mileage logs, detailing the date, purpose, and distance of each trip. Use digital tools or manual logs to track this information.

● Review and approve

Verify the submitted mileage reports for accuracy and compliance with your policy. Approve the amounts for reimbursement once verified.

● Process payment

Use your accounting system to process the approved mileage reimbursements. Ensure that payments are made promptly, adhering to your company's payment schedule.

Documentation requirements

You need detailed mileage logs from employees, including trip dates, destinations, and distances traveled. Depending on your policy, you may also require receipts for fuel and maintenance.

This documentation ensures accurate and fair employee mileage reimbursement and helps maintain transparency in the employee expense reimbursement process.

Submission process

Employees should submit their mileage logs and any required receipts through a designated platform or directly to your accounting department.

Ensure the submission process is clear, accessible, and straightforward to avoid delays and confusion in processing their reimbursements.

Timelines

Establish and communicate a timeline for submitting mileage reports and processing reimbursements. Typically, employees should submit their mileage reports monthly, and you should process reimbursements within 10–15 business days. Clear timelines help manage expectations and ensure timely compensation for your employees.

Best practices for creating a mileage reimbursement policy for your business

Define all eligible business trips clearly

A clear mileage reimbursement policy defines which trips qualify for reimbursement, such as client visits or inter-office travel. It explicitly excludes personal errands or non-business-related travel.

This clarity prevents confusion and ensures fairness in employee mileage reimbursement. Clear definitions help employees understand what constitutes reimbursable mileage, saving future headache or trouble for both employers and employees.

Set mileage rates and submission deadlines

Policies should set mileage reimbursement rates based on current IRS standards or company-specific criteria. Employees need clear deadlines for mileage log submissions, typically monthly, to ensure timely processing.

Adopting a consistent schedule within the mileage reimbursement process limits delays and improves financial planning. Regular submission deadlines help maintain accuracy and organizational efficiency.

Ensure documentation standards

Establishing firm documentation standards is crucial for effective employee mileage reimbursement. Policies require comprehensive mileage logs, including trip dates, start and end locations, and travel purpose details.

This prevents disputes and ensures IRS compliance. By setting these documentation requirements, companies uphold the integrity of the mileage reimbursement process and facilitate audit-ready reporting to avoid errors or misunderstandings.

Monitor, review and audit regularly

Regular policy audits and reviews ensure data accuracy and adherence to company mileage reimbursement policies. Periodic checks detect discrepancies, identify fraudulent claims, and improve overall process integrity.

Continuous reviews reinforce compliance with tax laws and internal controls, securing the fairness and reliability of employee mileage reimbursement. This practice strengthens financial oversight and promotes trust between employees and management regarding reimbursement processes.

Tax and compliance considerations

1. Classifying mileage reimbursements correctly

Mileage reimbursement that follows IRS guidelines is typically non-taxable, as long as you keep proper records and classify them under the correct plan. Knowing what is mileage reimbursement and classifying it correctly means you won’t be taxed on these payments (subject to certain limits and conditions).

This protects both employees and employers with a clear, compliant mileage reimbursement process that follows government rules and avoids any unexpected tax issues.

2. Maintaining accurate records

Accurate record-keeping is key in the mileage reimbursement process. Make sure you log every trip’s date, purpose, and miles driven. These details help during audits and prove compliance with tax laws.

Proper documentation ensures your employee mileage reimbursement claims are clear and accepted, avoiding delays or complications in getting reimbursed quickly and fairly.

3. Following local and regional regulations

It’s important that mileage reimbursement for employees complies with state and federal regulations. Laws can vary by region, so staying updated on these rules helps your business avoid penalties.

Understanding the local definitions and conditions on what is mileage reimbursement and ensuring your filing and disbursal process meets local laws is part of maintaining a transparent and compliant reimbursement process that benefits both employees and employers.

4. Ensuring compliance across the organization

Keeping all mileage reimbursements consistent across your organization is easier with centralized expense reporting. Digital tools help standardize how mileage is tracked and reimbursed for employees.

This improves compliance, simplifies audits, and makes the mileage reimbursement process smooth and fair all around. When everyone follows the same rules, employee mileage reimbursement becomes more transparent and reliable.

Why automate mileage tracking and reimbursement

Eliminate manual errors and inaccurate logs

Automating mileage reimbursement helps get rid of manual errors that often happen with handwritten logs. Apps automatically track your trips using GPS, ensuring every mile is recorded accurately.

This means you get reimbursed fairly without worrying about mistakes, lost receipts, or forgotten trips. Automation makes the mileage reimbursement process smoother and more reliable for everyone involved.

Save time for employees and finance teams

Using automated mileage tracking saves you and the finance team valuable time. Instead of filling out spreadsheets or paper logs, the app does the work of logging trips and calculating reimbursements.

It speeds up approval and payment, so you can spend less time on paperwork and more on your work. This efficient mileage reimbursement process benefits employees and payroll staff alike.

Maintains policy compliance effortlessly

Mileage reimbursement automation ensures your trips always follow company policies by running real-time checks as you log miles. This helps you avoid mistakes and out-of-policy claims.

Automation also keeps your records IRS-compliant automatically, reducing tax risks. Staying compliant has never been this easy, making the whole employee mileage reimbursement process worry-free.

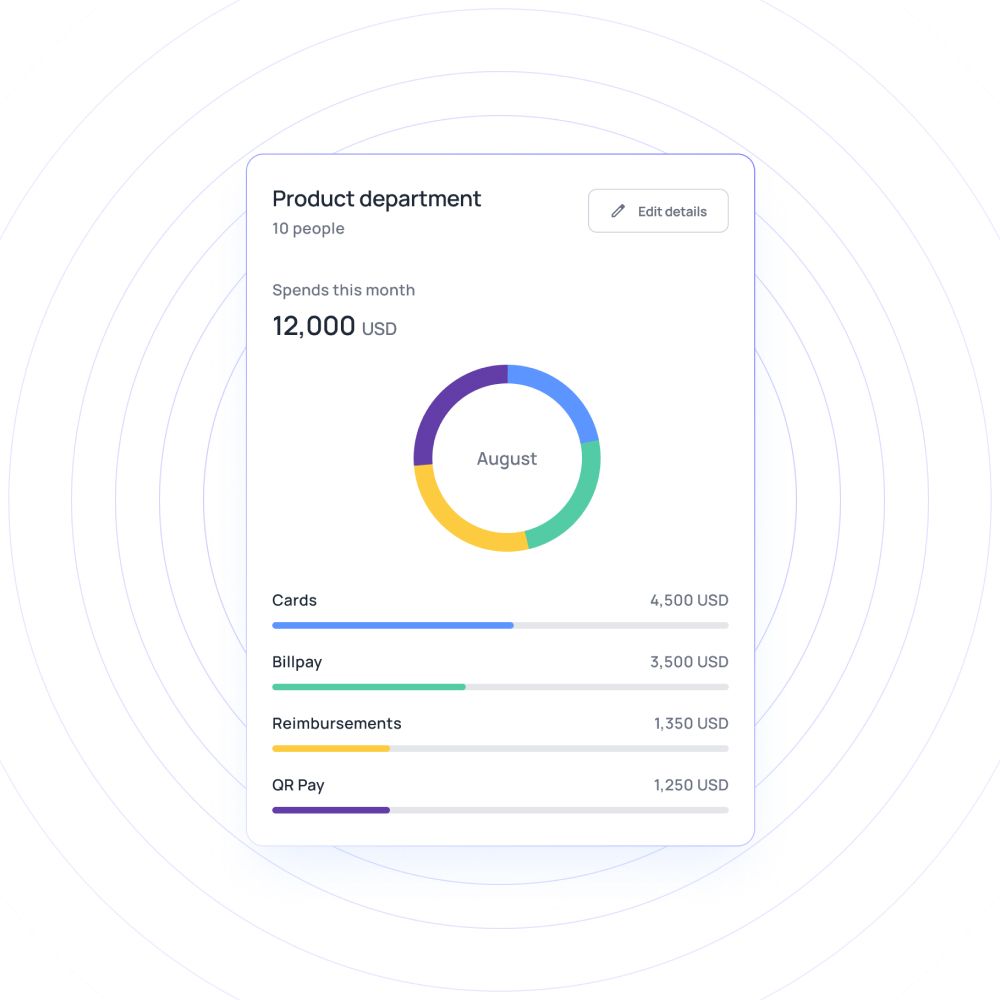

Gain complete visibility and control

With automated mileage tracking, both you and your managers get clear visibility into business travel expenses. You can see detailed reports and track reimbursements anytime, keeping everything transparent and organized.

This control helps you manage travel budgets better and ensures the mileage reimbursement process stays fair and accountable.

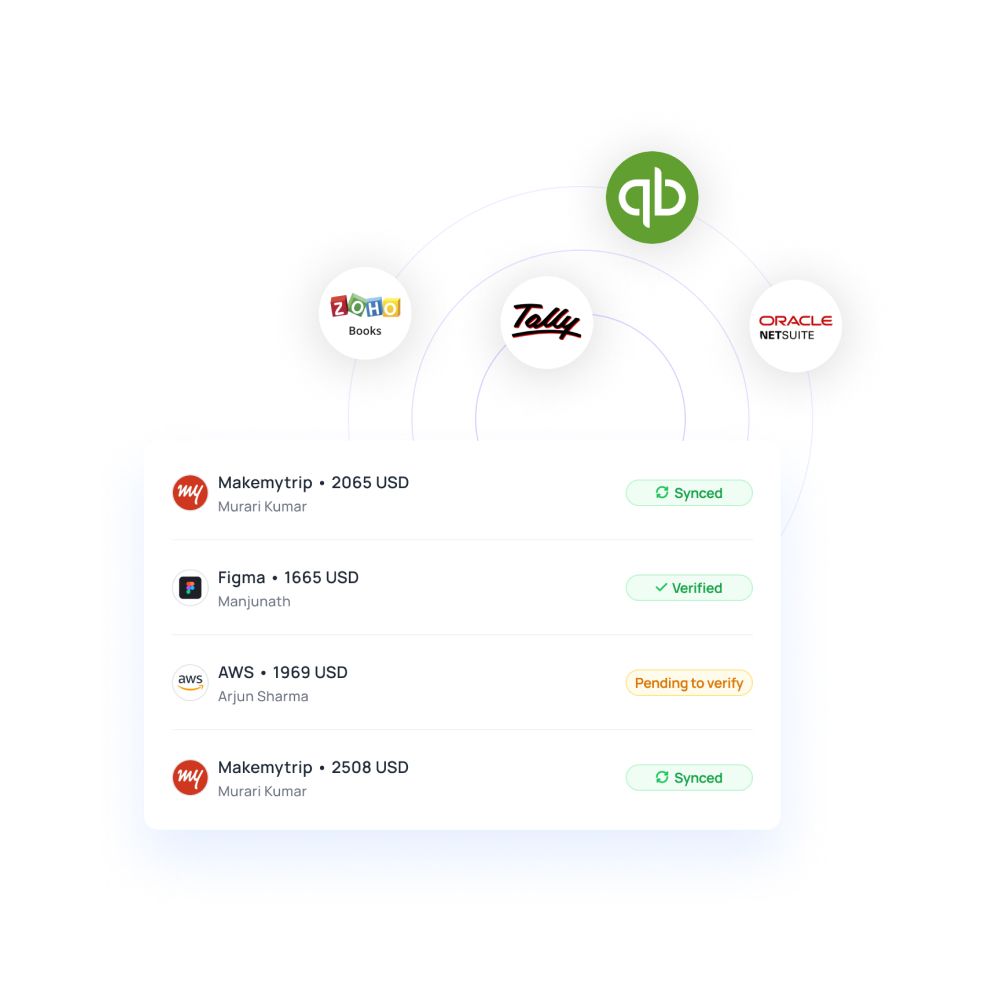

Seamless integration with expense management systems

Automated mileage tracking plugs right into your company’s expense management system and payroll software. This integration means your mileage reimbursements flow smoothly through the existing financial workflow without extra steps.

It simplifies reporting, speeds up payments, and reduces errors, making the entire mileage reimbursement process faster and hassle-free for employees and finance teams.

Tips to better mileage management

Effective mileage management helps businesses control travel expenses, ensure fair reimbursements, and maintain tax compliance. Implementing the right strategies and tools can reduce errors, save time, and provide clear visibility into employee travel costs and patterns.

Consider an equitable mileage rate - not the standard one

There are multiple inaccuracies when the standard rate is being calculated. It takes into account last year’s average vehicle cost, average insurance premiums, and average depreciation based on a certain number of miles. However, unless your employees are experiencing all the above factors, reimbursing them on the standard mileage rate is highly incorrect.

This can prompt high-mileage drivers to add in a few extra miles to earn more out of reimbursement, leaving you unable to control your mileage expenses. That’s why you should consider adopting an equitable mileage rate that doesn’t reward employees for driving more.

This means that the rate is adjusted for each employee based on the kind of traveling they do and the prevalent gas prices. Having a different mileage for each employee is a cumbersome process, however, this will ensure that each employee is paid fairly.

Standardize the vehicle instead of the mileage rate

As we previously said, the best way to compensate employees fairly is to create an equitable mileage rate for them. The best way to calculate this is by using a standard vehicle that can be utilized to conduct business operations.

An employer cannot control the distance and geographically-sensitive fuel and other additional costs, therefore they can control the type of car to ascertain the appropriate mileage reimbursement rate for the employee. Since reimbursing bigger and more expensive vehicles is more costly, you as an employer can ensure that vehicles are used for business purposes.

For example, this means that one cannot use an SUV truck to do business tasks such as meeting a client. Once you have chosen an appropriate vehicle such as a mid-range sedan, you can easily calculate the mileage rate by taking fuel, insurance, and wear and tear of the specific car segment into consideration.

Choose mileage tracking apps over manual employee reporting

Even if you have adopted the previous tips, you could still incur a heavy mileage cost without having a good mileage tracker in place. While employee reporting is a traditional form of mileage tracking, it is extremely time-consuming and prone to human error.

Sometimes employees do not mark it correctly and are later filling in the details with estimates, which could fiscally harm your company in the long run. If the employees think they are being paid unfairly, they’ll try to receive the compensation they think is fair by inflating the number of miles driven.

Instead of scrutinizing their every move, automate mileage tracking by using applications that use GPS and digital data entry to precisely record any business trip and capture mileage in real-time to bring down overall reimbursement costs.

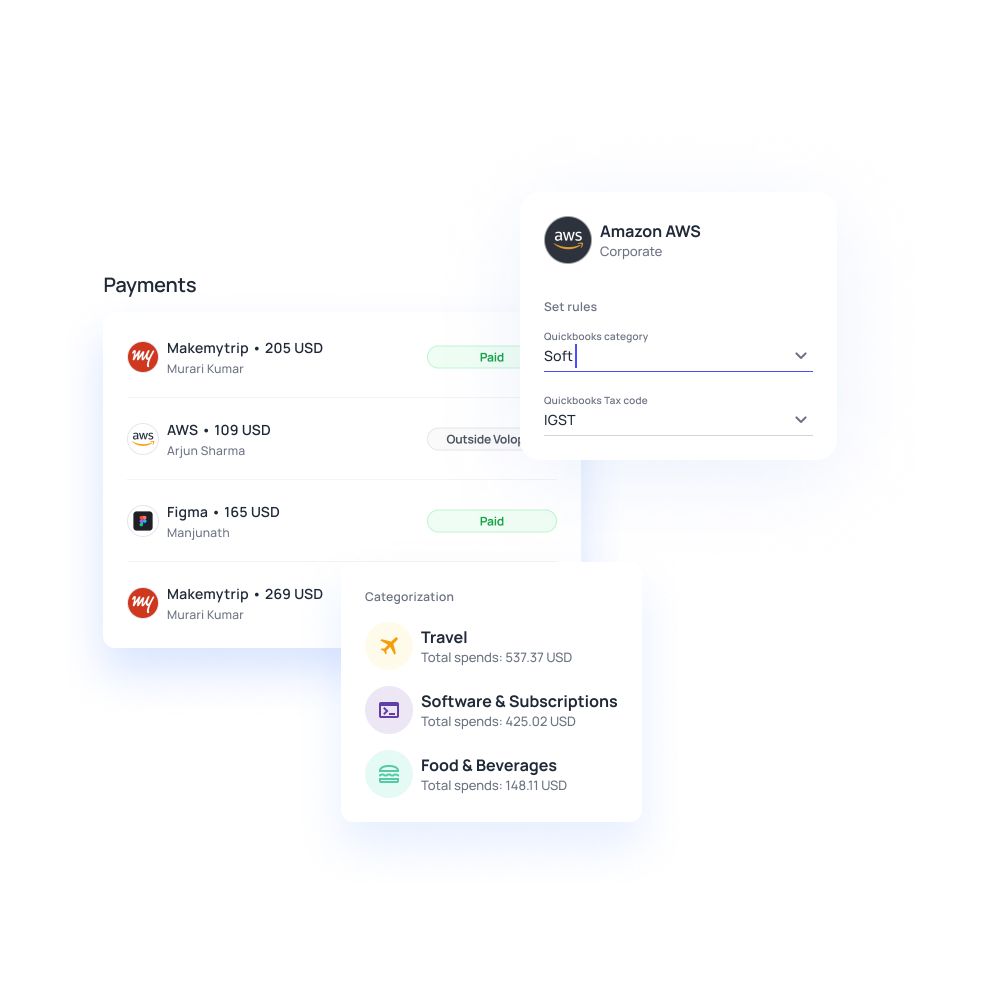

Enhance your mileage reimbursement with Volopay

Volopay revolutionizes what is mileage reimbursement for your business with its advanced expense management system, providing a seamless solution for both employees and employers. Its user-friendly interface simplifies the submission process, allowing employees to easily log their mileage and corporate travel related expenses.

Key features include real-time reporting and analytics, which offer instant insights into mileage expenses and reimbursement statuses. This capability ensures accurate tracking and timely adjustments, enhancing financial oversight.

Volopay also enforces policy compliance with built-in checks, ensuring that all submissions adhere to company guidelines and legal requirements, which helps mitigate errors and compliance issues.

The platform integrates smoothly with existing accounting systems, reducing manual data entry and improving accuracy. This integration allows for efficient reconciliation of mileage expenses and streamlines overall financial management.

Streamlined reimbursement process

Volopay transforms the mileage reimbursement process for your business by offering a streamlined employee expense reimbursement software.

Employees can easily submit mileage logs and related expenses through a user-friendly interface. This approach reduces the administrative burden, minimizes errors, and accelerates the reimbursement process.

By automating and simplifying submissions, Volopay ensures that you can handle mileage reimbursements efficiently, providing a smooth experience for both employees and employers.

Real-time reporting and analytics

Volopay’s expense management system features real-time reporting and analytics. You and your employees can access up-to-date information on mileage expenses and reimbursement statuses.

This feature allows for immediate tracking and adjustments, giving you insight into spending patterns and ensuring accurate and timely reimbursements. Real-time visibility enhance financial oversight and help you manage your budget more effectively.

Policy compliance and checks

With Volopay, compliance with employee mileage reimbursement policies is easier to maintain. The system includes built-in checks to ensure that all submissions adhere to company policies and legal requirements.

This reduces the risk of errors and ensures that reimbursements are processed according to established guidelines. By automating policy enforcement, Volopay helps you stay compliant and avoids potential issues with reimbursement claims.

Seamless integration with accounting systems

Volopay integrates seamlessly with your existing accounting systems, providing a unified approach to managing expenses. This integration streamlines the process of recording and reconciling mileage reimbursements, reducing manual data entry and improving accuracy.

By connecting expense data directly to your accounting system, Volopay simplifies financial management and enhances overall efficiency in handling reimbursements.

Speedy claims with centralized platform

Volopay’s centralized expense management platform enables speedy claims processing for mileage reimbursement. Employees can submit claims quickly, and you can review and approve them with ease.

The system consolidates all reimbursement requests in one place, allowing for faster processing and reduced turnaround times. This efficiency ensures that employees receive timely compensation, improving satisfaction and reducing administrative delays.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs on mileage reimbursement

There are better alternatives for the standard mileage rate. One approach is to separate the fixed costs (insurance, depreciation) from variable costs (gas, oil change, tires) and reimburse them accordingly. This is known as Fixed and Variable Rate Reimbursement (FAVR).

No, mileage reimbursement and reimbursing, in general, have nothing to do with income and refer to the compensation given to employees for carrying out business duties through out-of-pocket expenses.

Yes, an employer can refuse to pay mileage. However, this could lead to employee dissatisfaction. Therefore it’s recommended that business owners should offer mileage reimbursement as it also provides tax relief to the employees, wherever applicable.

Yes, mileage reimbursement can be used to negotiate a compensation package with an employee.

The Internal Revenue Service (IRS) issues a new standard mileage rate for employees using privately owned vehicles for business, medical, charitable, and moving purposes every year.

To ensure accurate mileage reporting, keep a detailed log of your trips, including dates, destinations, and distances. Use tracking tools or apps for precision in employee mileage reimbursement.

No, employee mileage reimbursement typically does not cover commuting miles to and from your regular workplace. It usually applies to travel that the business sends employees on or travel that makes up part of the business processes (client meetings, deliveries, conferences and conventions, etc).

If you have questions or disputes about employee mileage reimbursement, contact your HR or finance department for clarification. Review your mileage policy and provide detailed records.

No, employee mileage reimbursement covers only business-related travel. Personal errands during business trips are not eligible for reimbursement.

Mileage reimbursement is generally non-taxable if it follows IRS guidelines. Ensure compliance with tax regulations to avoid taxable income issues related to employee mileage reimbursement.