Top 5 hidden costs of manual expense management

Many businesses across the US continue to rely on traditional paper-based and manual systems for tracking expenses, believing these methods save money on software costs. However, what appears as a budget-friendly approach actually conceals significant financial drains.

These hidden costs of manual expense management accumulate silently, affecting your operational efficiency, employee morale, and bottom line. From lost receipts to compliance risks, the true price of outdated expense processes extends far beyond what meets the eye, ultimately hindering your business growth and competitive edge.

Understanding the hidden costs of traditional expense systems

Traditional expense management approaches carry financial burdens that rarely appear on balance sheets. Paper-based expense systems and manual processes create inefficiencies through time-consuming workflows, increased error rates, and missed opportunities for cost control.

These hidden expenses manifest in delayed reimbursements, administrative overhead, and compliance vulnerabilities that can expose your business to penalties. Understanding these concealed costs helps you recognize why your current system may be draining resources without providing adequate visibility, control, or scalability for your organization's financial operations.

Hidden costs of paper-based expense systems

Paper-dependent expense management creates substantial financial drains that extend well beyond printing supplies. These costs of paper-based expense systems accumulate through storage requirements, document handling, and the inherent risks of physical record-keeping.

Storage and retrieval costs

Physical expense records demand dedicated office space for filing cabinets, storage rooms, and archival systems. You incur ongoing costs for maintaining organized filing structures, while staff spend valuable time locating specific documents during audits or budget reviews.

Off-site storage facilities add recurring monthly expenses, and document retrieval from archives can take days, disrupting financial operations when immediate access becomes necessary.

Lost or damaged receipts

Paper receipts fade, tear, or disappear entirely, creating gaps in your expense documentation. Employees misplace physical receipts before submission, forcing you to reject legitimate reimbursement claims or accept expenses without proper verification.

Damaged documents become illegible over time, compromising your audit trail and potentially invalidating expense records during tax examinations or financial reviews by regulatory authorities.

Compliance and audit risks

Paper-based systems struggle to maintain the consistent documentation standards required by IRS regulations and industry compliance frameworks. You face increased audit risk when expense records lack proper categorization, approval trails, or supporting documentation.

Manual filing systems make it difficult to produce complete audit trails quickly, potentially resulting in failed audits, tax penalties, and damaged relationships with regulatory bodies.

Printing and handling expenses

Your business continuously purchases paper, ink cartridges, and printing supplies to maintain expense documentation. Staff spend time photocopying receipts, printing reports, and distributing physical expense forms throughout your organization.

These seemingly minor costs compound monthly, while equipment maintenance, printer repairs, and supply inventory management add hidden administrative burdens that divert resources from value-generating activities.

Workflow inefficiencies

Paper-based processes require physical document transfer between employees, approvers, and accounting departments, creating bottlenecks and delays. Expense reports sit on desks waiting for signatures, slowing reimbursement cycles and frustrating your team.

Manual routing prevents parallel processing, forcing sequential approvals that extend processing times and reduce your finance team's ability to focus on strategic financial planning and analysis.

Hidden costs of manual expense systems

Even when businesses move beyond paper to digital spreadsheets, manual expense systems still generate substantial hidden costs. These systems require extensive human intervention for data entry, verification, and processing, creating opportunities for errors and inefficiencies. Your finance team spends countless hours on repetitive tasks that automated solutions handle instantly.

The costs of manual expense systems include not just wasted time but also the strategic disadvantages from delayed insights, undetected fraud, and employee dissatisfaction that impacts retention and productivity.

1. Data entry errors and reconciliation mismatches

Manual data entry introduces typos, transposed numbers, and incorrect categorizations that corrupt your financial data. Your accounting team wastes hours tracking down discrepancies between expense reports and bank statements, trying to reconcile mismatched amounts.

These errors cascade through your financial systems, affecting budget accuracy, tax calculations, and financial reporting, while creating compliance risks that could trigger audits or penalties.

2. Time wasted on manual processing

Finance staff spend hours each week manually reviewing expense submissions, cross-checking receipts against reports, and entering data into accounting systems. Employees repeatedly submit the same information through forms, emails, and conversations, creating redundant work across your organization.

This time drain prevents your finance team from conducting strategic analysis, financial planning, or process improvements that could drive business growth and profitability.

3. Poor budgeting from lack of real-time insights

Manual systems provide expense visibility only after month-end closings, preventing proactive budget management. You discover overspending weeks after it occurs, eliminating opportunities for timely cost corrections.

Without real-time data, your department managers make spending decisions based on outdated information, leading to budget overruns that could have been prevented with immediate visibility into current expenditure patterns and trends.

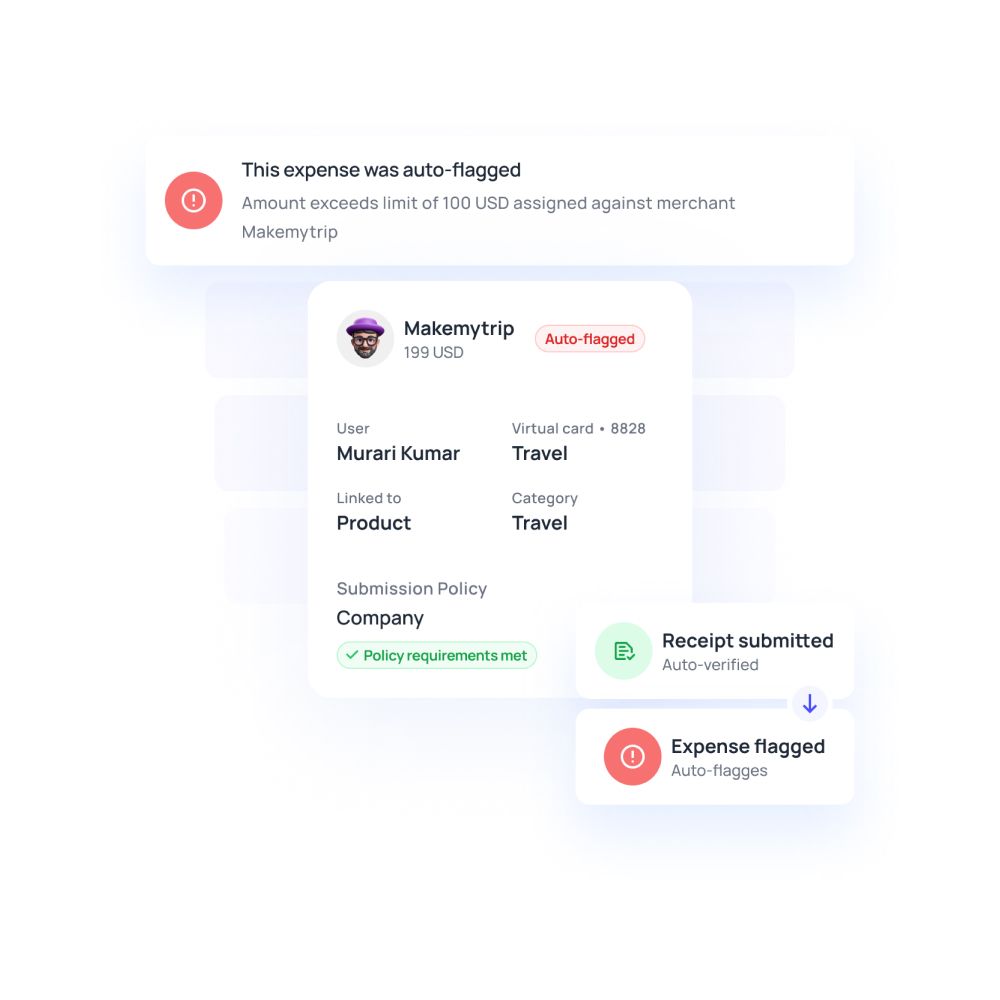

4. Fraud and duplicate claims slipping through

Manual review processes cannot effectively detect sophisticated fraud patterns or duplicate submissions across hundreds of expense claims. Dishonest employees exploit system weaknesses by submitting inflated amounts, personal expenses, or duplicate claims that overwhelm manual verification capabilities.

Your business loses money to fraudulent claims while lacking the analytical tools to identify patterns, repeat offenders, or unusual spending behaviors that automated systems flag instantly.

5. Employee dissatisfaction due to delayed claims

Slow manual processing creates reimbursement delays that frustrate employees who effectively loan money to your company. Staff waste time following up on pending claims, contacting finance departments, and resubmitting lost documentation.

This dissatisfaction reduces morale, impacts employee retention, and damages your employer brand, particularly when competing for talent with companies offering faster, more transparent expense management experiences.

Challenges businesses face with paper-based and manual expense processes

Organizations maintaining traditional expense management approaches encounter numerous operational obstacles that impede financial efficiency and strategic decision-making.

These challenges extend beyond simple inconveniences, creating systemic problems that affect audit readiness, fraud detection, and employee engagement. Understanding these difficulties helps you recognize why modernizing expense management delivers value far exceeding implementation costs.

Difficulty retrieving and maintaining audit records

When auditors request expense documentation, manual systems force your team into frantic searches through filing cabinets, archived boxes, and email threads. You struggle to compile complete audit trails showing approval chains, policy compliance, and supporting documentation.

Missing or incomplete records create audit findings, while the time spent responding to information requests disrupts normal operations and delays audit completion.

Fragility and frequent misplacement of documents

Physical documents move through multiple hands during processing, creating numerous opportunities for loss or misfiling. Coffee spills damage receipts, papers slip behind filing cabinets, and documents get accidentally discarded during office cleanings.

Each lost document requires time-consuming reconstruction efforts, potentially forcing you to accept expenses without proper verification or deny legitimate claims, both of which create problems for your organization.

Time-consuming manual expense processing tasks

Your finance team manually performs repetitive tasks that consume hours weekly—typing expense details from receipts, calculating totals, checking policy compliance, and routing reports for approvals.

These labor-intensive processes prevent staff from analyzing spending patterns, negotiating vendor contracts, or developing cost-saving strategies. The opportunity cost of manual processing far exceeds the apparent savings from avoiding automation investments.

Month-end closings often delayed by errors

Manual expense processing extends month-end closing cycles as your accounting team reconciles discrepancies, corrects errors, and chases missing documentation. Late expense submissions compound problems, forcing you to either rush through reviews, risking oversight, or delay closings, affecting financial reporting timelines.

These delays impact decision-making speed, investor communications, and your ability to respond quickly to emerging financial trends or challenges.

No real-time visibility into company spending

Manual systems provide expense visibility only through periodic reports compiled days or weeks after spending occurs. You lack dashboards showing current spending trends, department budget status, or unusual expense patterns requiring immediate attention.

This delayed visibility prevents proactive financial management, forcing reactive responses to problems discovered too late for optimal intervention or course correction.

Hard to detect anomalies and fraud

Human reviewers cannot effectively analyze hundreds of expense claims monthly to identify subtle fraud patterns, policy violations, or spending anomalies. Manual checks miss duplicate submissions with slightly different amounts, personal expenses disguised as business costs, and expense patterns suggesting fraudulent behavior.

Your business loses money to undetected fraud while lacking the analytical capabilities to identify high-risk transactions or problematic spending behaviors.

Employee disengagement due to slow reimbursements

Lengthy reimbursement cycles damage employee trust and satisfaction as staff wait weeks for repayment of business expenses. Employees reduce business travel or avoid necessary purchases to prevent out-of-pocket costs, potentially impacting sales opportunities and customer relationships.

This frustration contributes to turnover, particularly among employees who travel frequently or incur substantial business expenses requiring personal funds during processing delays.

Strategies to mitigate hidden costs in manual expense management

Implement mobile receipt capture apps that allow employees to photograph receipts immediately after purchases, eliminating paper handling and storage costs.

Require digital expense submissions through email or basic digital forms rather than physical paperwork.

This shift reduces printing costs, accelerates document availability, and prevents receipt loss while creating digital records that support easier retrieval during audits or reviews.

Deploy optical character recognition technology that extracts expense details automatically from receipt images, reducing data entry time and transcription errors.

Integrate credit card feeds that import transaction data directly into expense tracking systems, eliminating manual typing.

These technologies free your finance team from repetitive data entry tasks, allowing focus on exception handling, policy enforcement, and strategic financial activities.

Adopt expense tracking dashboards that display current spending levels, budget consumption, and spending trends updated daily rather than monthly.

Provide department managers with visibility into their team's expenses as they occur, enabling proactive budget management.

Real-time tracking prevents budget overruns through immediate alerts when spending approaches limits, supporting better financial decision-making and resource allocation.

Issue corporate cards with built-in spending limits and category restrictions that enforce expense policies automatically at transaction time.

Card transactions create automatic expense records, eliminating manual reporting for most purchases.

Smart cards provide transaction-level visibility without manual data collection, reducing processing workload while giving you better control over company spending through automated policy enforcement.

Design clear approval routing rules based on expense amount, category, and department, ensuring consistent processing across your organization.

Document approval authority levels and implement email-based approval systems that accelerate decision-making compared to physical document routing.

Standardization reduces processing confusion, prevents approval bottlenecks, and creates audit trails documenting who approved each expense and when decisions occurred.

Implement expense management automation to match receipts to transactions, verify that required documentation exists, and flag missing receipts for follow-up.

Use automated storage systems that organize receipts by date, employee, category, and amount, enabling instant retrieval during audits.

Automation ensures complete documentation compliance while eliminating manual filing tasks and reducing storage costs associated with physical receipt archives.

Comparing paper-based, manual, and automated expense management

Understanding the differences between expense management approaches helps you evaluate upgrade options effectively. Each system type offers distinct characteristics affecting efficiency, accuracy, and cost.

Why automation is the smarter alternative for businesses

Automated expense management systems eliminate the hidden costs of manual expense management while delivering strategic advantages impossible with traditional approaches. You gain capabilities that transform expense management from an administrative burden into a strategic financial tool supporting business growth and efficiency.

Real-time visibility and control

Automated systems provide instant dashboards displaying current spending across departments, categories, and projects, enabling proactive financial management. You monitor budget consumption continuously rather than discovering overspending during month-end reviews.

Real-time visibility allows immediate responses to spending anomalies, supporting better cash flow management and helping you maintain tighter control over your company's financial resources throughout each reporting period.

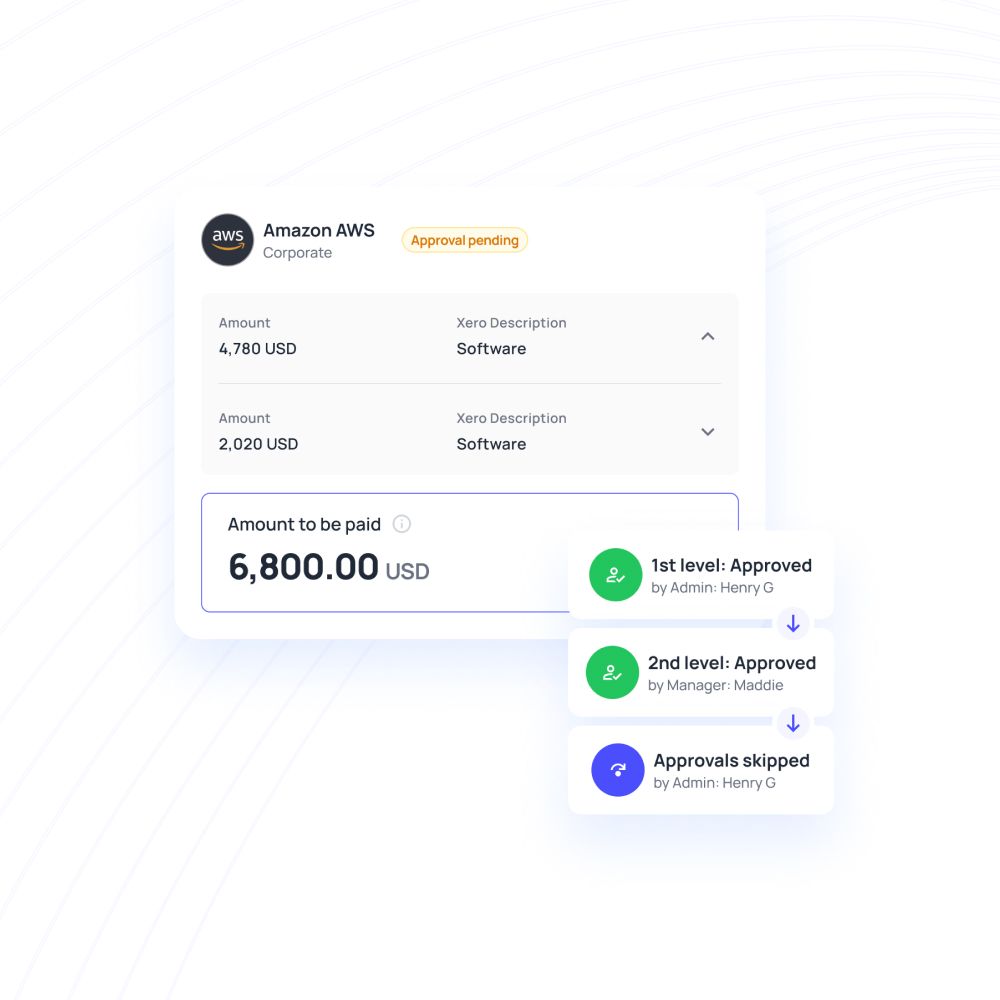

Faster reimbursements and approvals

Automation accelerates expense workflows through instant routing to appropriate approvers based on predefined rules and automatic notifications, preventing approval bottlenecks.

Employees receive reimbursements within days rather than weeks, improving satisfaction and eliminating the frustration associated with traditional processing delays.

Faster cycles reduce employee inquiries to finance teams, freeing staff time for higher-value activities while strengthening employee trust and engagement.

Error reduction through automation

Automated data capture eliminates transcription errors, while built-in validation rules prevent common mistakes like missing receipts, incorrect categorizations, or math errors.

System-enforced policy checks ensure compliance before submission rather than discovering violations during review.

Reduced errors accelerate processing, improve financial data accuracy, and minimize reconciliation work, allowing your accounting team to trust expense data and close books faster.

Fraud prevention with policy controls

Automated systems detect duplicate submissions, flag unusual spending patterns, and enforce policy limits automatically at transaction time.

You configure rules identifying high-risk transactions requiring additional scrutiny, while analytics highlight employees with suspicious expense patterns.

Proactive fraud prevention protects your company from losses while creating deterrence effects that reduce fraudulent behavior across your organization.

Audit-ready records

Automation maintains complete digital audit trails documenting every expense submission, approval decision, policy check, and system action.

You generate comprehensive audit reports instantly, providing auditors with organized documentation meeting regulatory requirements.

Automated record-keeping ensures nothing gets lost, supports rapid audit responses, and reduces audit findings, protecting your business from penalties while minimizing the operational disruption associated with audit processes.

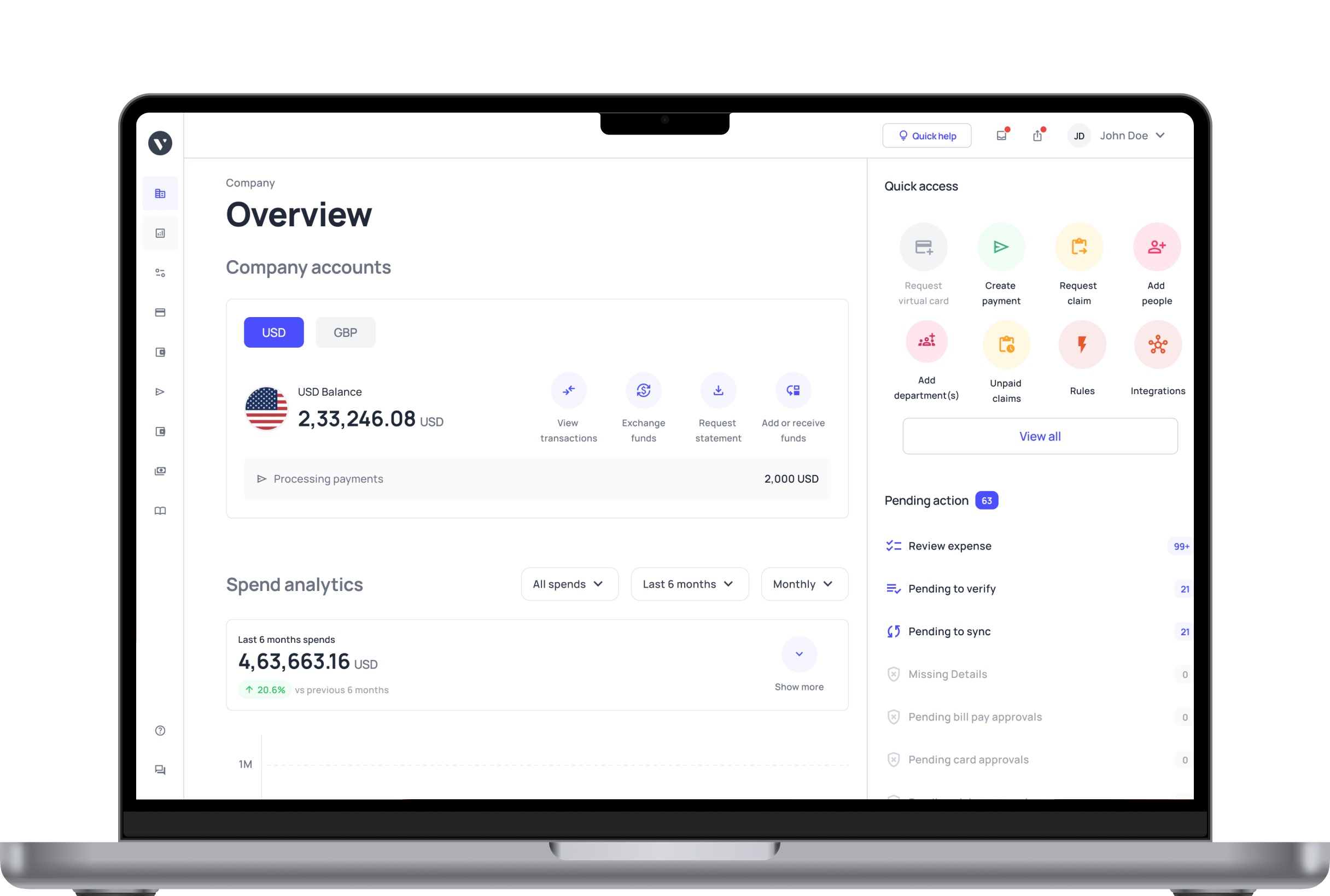

Boost financial efficiency using Volopay's automated expense management software

Volopay delivers comprehensive expense management automation specifically designed for businesses seeking to eliminate manual processing costs and gain better financial control. Our all-in-one expense management platform combines smart corporate cards, automated workflows, and real-time visibility tools that transform how you manage company spending.

You receive an integrated solution addressing every aspect of expense management from initial purchase through final accounting integration, supported by features that reduce administrative burden while strengthening policy compliance and fraud prevention.

Smart corporate cards

Volopay provides virtual and physical corporate cards with customizable spending limits, merchant category restrictions, and validity periods that enforce your expense policies automatically.

You issue corporate cards instantly to employees for specific projects or recurring expenses, maintaining complete control over spending parameters.

Each transaction creates automatic expense records, eliminating manual reporting, while real-time notifications keep you informed of company spending as it occurs across your organization.

Centralized expense dashboard

Your finance team accesses comprehensive dashboards displaying all company expenses across cards, reimbursements, and invoice payments in unified views.

You monitor spending trends by department, category, employee, or custom tags, gaining insights impossible with manual systems.

Real-time analytics help you identify cost-saving opportunities, track budget performance, and make data-driven decisions that optimize your company's financial efficiency and resource allocation.

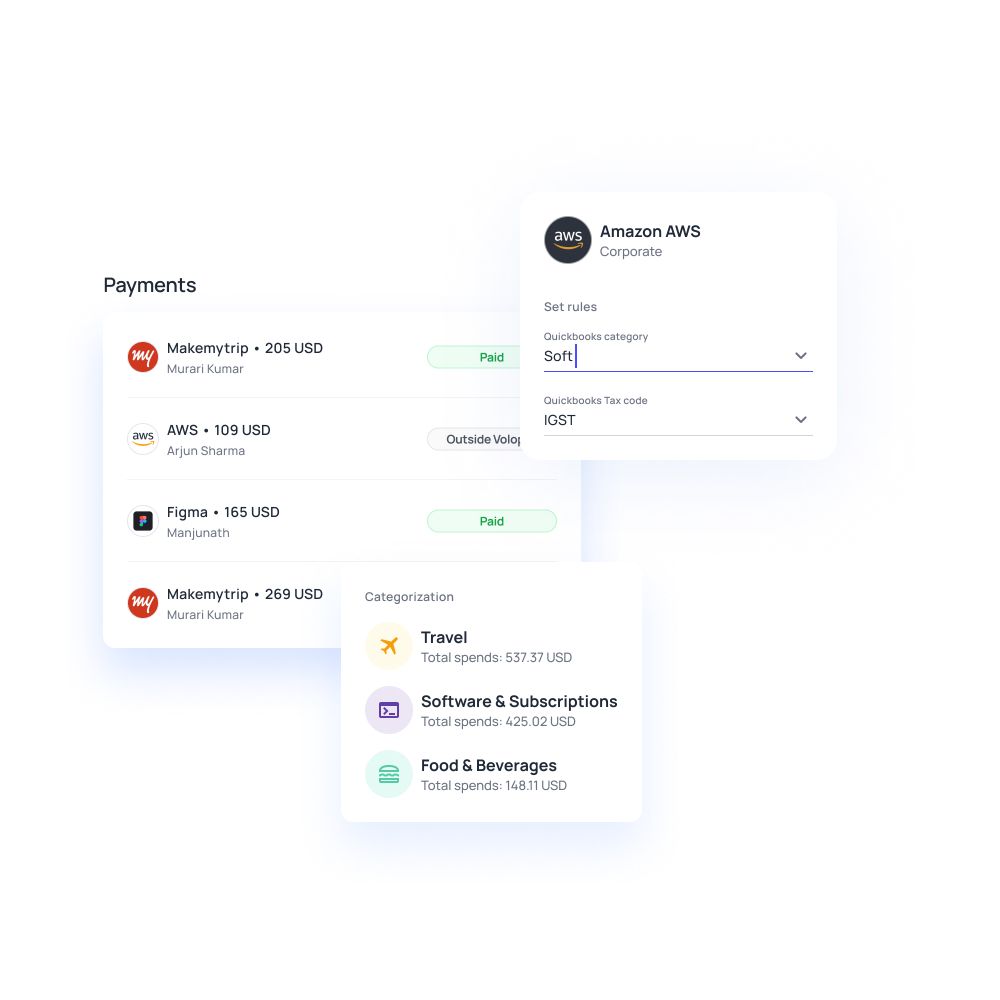

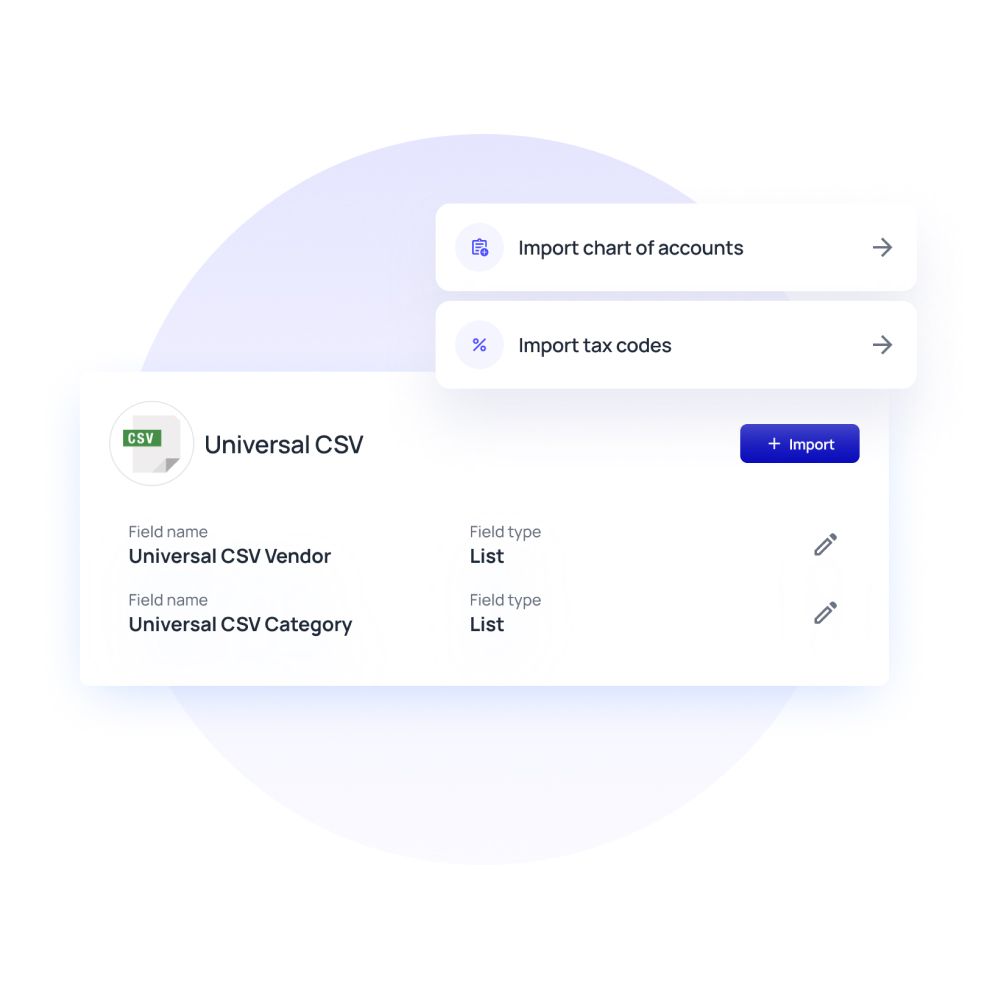

Automated accounting integrations

Volopay integrates seamlessly with QuickBooks, Xero, NetSuite, and other leading accounting platforms, automatically syncing expense data and eliminating manual data entry.

You configure custom mapping rules, ensuring expenses flow into the correct accounts, classes, and departments within your accounting system.

Automated synchronization maintains real-time accuracy between systems, accelerates month-end closings, and ensures your financial records remain current without manual reconciliation work.

Multi-currency and global expense support

Volopay supports international operations with multi-currency cards and automatic currency conversion at competitive exchange rates.

You track expenses in original currencies while viewing reports in your preferred base currency, simplifying international expense management.

Global capabilities support remote teams, international travel, and cross-border operations, providing consistent expense management experiences regardless of where your employees work or travel for business purposes.

Paperless receipt management

Employees capture receipt photos directly through Volopay's mobile app, automatically matching images to card transactions or reimbursement claims.

You eliminate physical receipt handling, storage costs, and lost documentation problems while maintaining complete audit trails.

Optical Character Recognition (OCR) extracts key details automatically, reducing manual data entry while creating searchable, organized receipt archives accessible instantly during audits or expense reviews.

Custom spend policies and approvals

Configure multi-level approval workflows based on amount thresholds, expense categories, departments, or custom criteria matching your organizational structure.

You establish policy rules that automatically check expense submissions for compliance, flagging violations before processing.

Customizable workflows ensure appropriate oversight while maintaining processing speed, giving you confidence that every expense receives proper review according to your company's governance requirements and financial controls.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs

Traditional systems become unmanageable with growth, causing delays, errors, and disproportionate administrative costs that force expensive emergency automation implementations.

Manual systems create fraud vulnerabilities through limited oversight, allowing inflated amounts, duplicate claims, and personal expenses to slip through undetected reviews.

Traditional processes frustrate employees through time-consuming submissions, slow reimbursements, and confusing workflows, damaging morale and weakening your employer brand.

Manual systems require time-consuming formatting and reconciliation work, creating compatibility challenges, integration failures, and delays that prevent real-time accounting accuracy.

Volopay combines smart cards, automated receipt capture, policy enforcement, approval workflows, and accounting integrations for complete automated expense management transformation.

Volopay reduces administrative labor, eliminates paper expenses, prevents fraud losses, minimizes compliance penalties, and decreases turnover costs from improved experiences.

Volopay maintains comprehensive audit trails, ensures policy enforcement, generates instant compliance reports, and guarantees complete documentation to prevent penalties.