Recurring billing issues and how to overcome these issues?

Are you worried about the missing recurring payments? we’ve all been there. But you don’t have to worry anymore when you have virtual cards. With the help of virtual cards, recurring payments might not seem very tedious to handle for businesses.

3 common challenges in traditional recurring payments

Time consuming

It is needless to say, but you can probably imagine how tough and time-consuming it would be for one individual to sit and renew each subscription service that is being used by the employees of the organization. Rather than assigning a person to do all these repetitive tasks, a business is better off automating these so that they can focus on actual work.

Billing errors

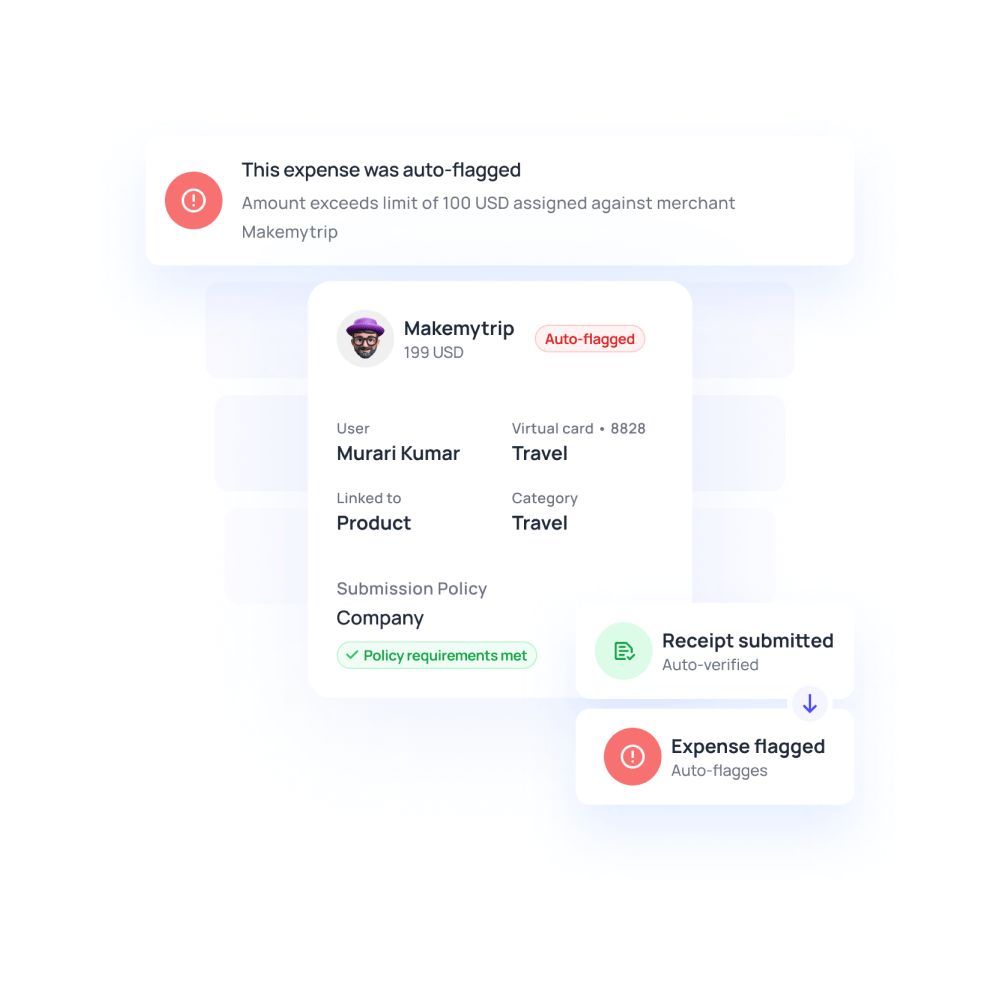

In the traditional format of making recurring payments where things are not automated, the company would receive bills based on which they would have to make payments. Sometimes, the amount that was sent across turns out to be incorrect and hence the payment cannot be made. If the payment is not made on time, the users of the service also get denied to use it as the system stops them from doing so.

Not deactivating subscription

With so many people using so many different services across the company, it’s tough to track and monitor whether everyone is using their service or not. In some cases, even after an employee has finished using a subscription service, they forget to deactivate the subscription. Due to this the card used to make the payments is constantly being charged without the service even being used. If this is not checked regularly, it can cost the company a lot of money over time.

How do recurring payments work?

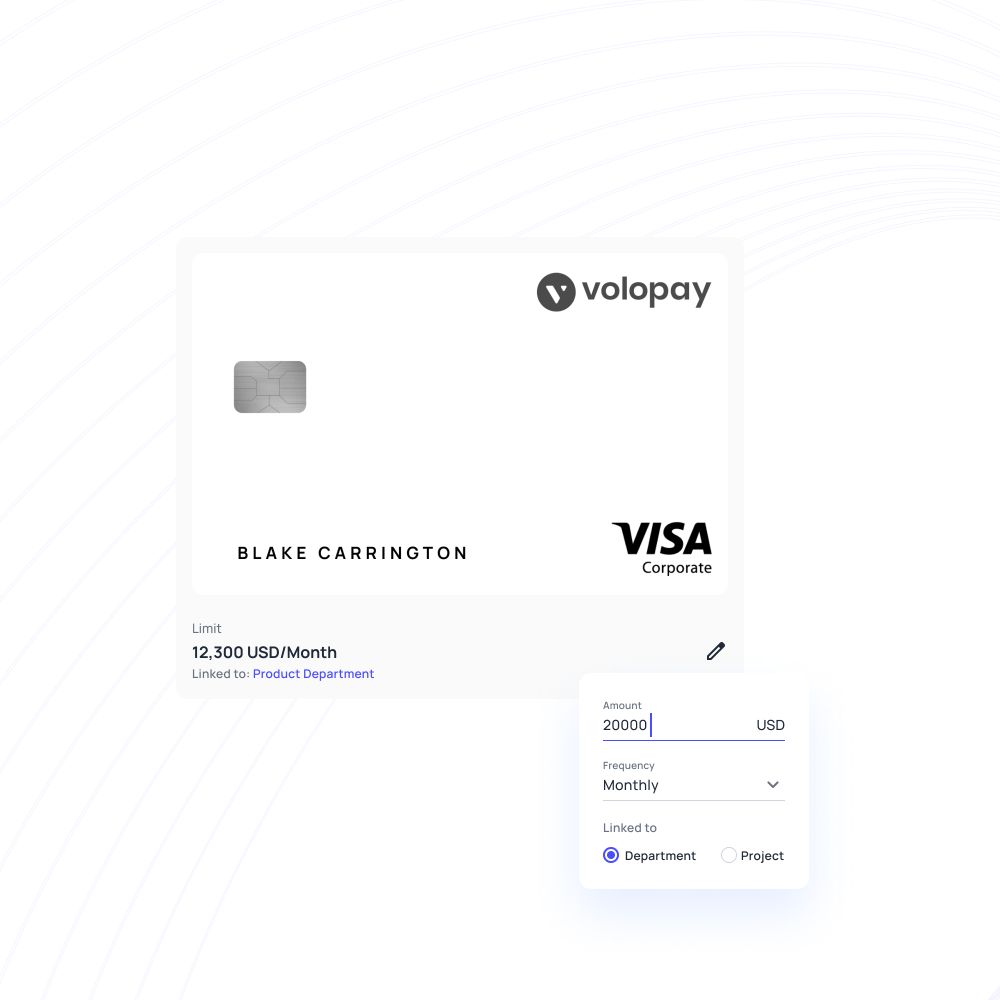

Any subscription that you choose will have different plans (monthly, quarterly or annually) according to which you will have to make recurring payments. As your business and team expand, it is always better to look for an automated subscription billing solution that will take care of your SaaS payments without your interference after setting it up for the first time. To start, you should create a virtual card from your Volopay dashboard for a particular subscription.

When creating a virtual card, you must fill in the following details:

Name of the card - For easy identification of what expense/subscription you are using this card for.

Frequency - You get two options to select from: ‘None’ which means that the amount you decide as the spending limit of the card is just for one-time use and not a recurring card; and ‘Monthly’ which means that the amount you decide as the spending limit for this card will be renewed every month from the date of its creation.

Amount - Type in the amount of money that you want to be able to spend using this card.

Budget - Select any one of the budgets that your company has created from which the card will have access to the amount of money being requested.

Card owner - Select the employee who would be using the card for the monthly recurring subscription.

Expiry date - Set a custom expiry date for this card based on your requirements.

Finally, add any additional informational notes and set other default values.

Once your recurring virtual card is ready, simply use it to make the payment for the subscription service. Ensure that the monthly refresh date of your virtual card is a day or two before the recurring payment date of your subscription.

Looking for software that automates your recurring payments?

Benefits of virtual cards for recurring payments

Speed up transactions

Using Volopay virtual cards, you’ll be able to quickly make various subscription payments without having to wait for another person to finish using a company corporate card.

Save time

An accountant or finance member will no longer have to sit and manually renew every subscription each month. Since you’ve already added the card details once in the merchant’s purchase site.

More reliable while purchasing software

When using virtual cards from Volopay, you get enhanced security because of the way we have built them. Each virtual card that you create on our platform is not linked to any bank account. So even if in the rare occasion where someone hacks your browser to get your card details, they won’t be able to cause any further damage as they will not be able to trace back the card to any bank account.

Furthermore, if such a scenario happens and you are aware of it, you can instantly go to the dashboard and freeze the card temporarily or block it permanently. This way, even if some amount was left from the spending limit of your card, the hacker will not be able to use it to make any payments or withdrawals.

Cut down unaccounted expenses

When you use virtual cards, the challenge of money silently leaking away from your budget because an employee forgot to close a subscription after their work was done will no longer exist.

The simple reason behind this is that when you create a virtual card on Volopay, we allow you set a custom expiry date for it. So let’s say someone in your sales team wants to use the LinkedIn sales navigator for just 3 months, they can create a virtual card that expires exactly 3 months from their purchase date of the subscription.

This way, your employee will have a monthly recurring subscription to the service they need and they won’t have to worry about manually going and canceling the subscription as the card will automatically deactivate itself as per the set expiry date.

Separate virtual cards for each subscription

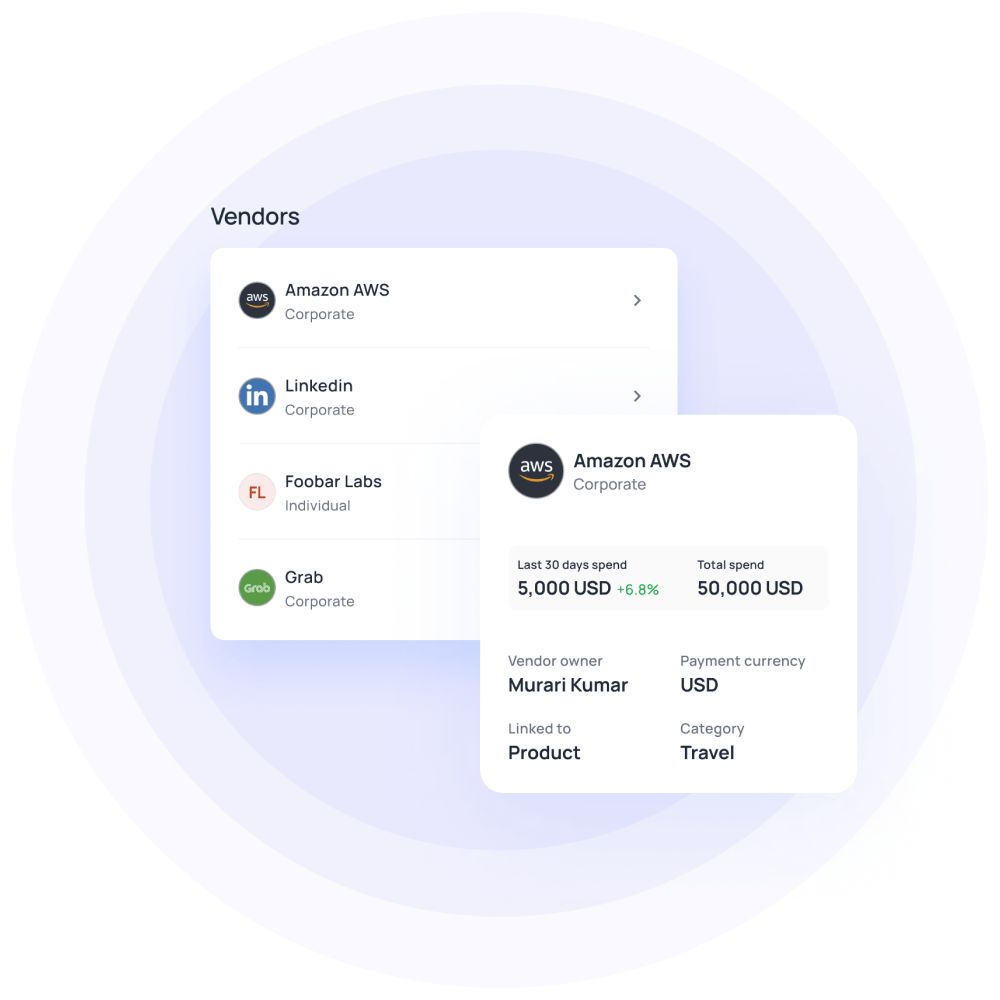

Probably the biggest benefit of using Volopay virtual cards is that you can create an unlimited number of them at no extra cost at all. The reason why this function is so useful is that it allows you to create separate cards for each subscription.

This way, you know exactly how much is being spent on what and who is spending it. Your employees also won’t have to wait to use the same card. Using the same card for many different SaaS services can make it difficult to keep track of who is making which payment.

Using virtual cards, employees in departments can automate separate cards for separate services. For example, the marketing team can create unique virtual cards for tools SEMrush, Hootsuite, etc. The sales team can do the same for tools like Mailchimp, Linkedin Sales Navigator, etc., and so forth for other teams.

Check this out: Best practices for effective marketing budget management

Track your expenses and SaaS subscription

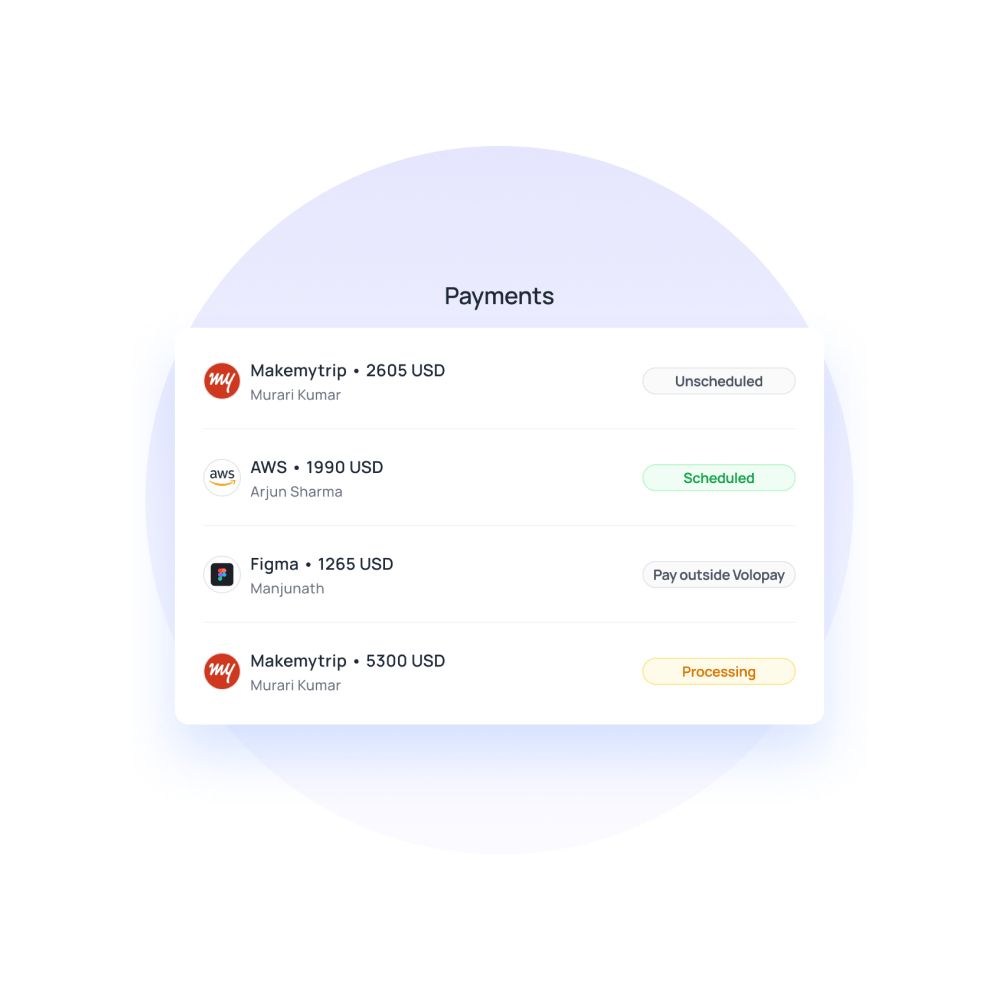

Volopay has a specific dashboard for virtual cards which gives you a comprehensive view of the amount spent through each card and the amount left. When you select a particular card, you get granular details such as the time the payment was made, who made it, and what the purchase was for. All of these together make a seamless tracking and monitoring experience for the financial controller to manage SaaS subscriptions and control the budget accordingly.

How can Volopay help in recurring payments?

Notify owners about balance limit

Some businesses may also decide to not create separate virtual cards for each subscription but rather a particular category. For example, you may create a card and name it ‘marketing subscriptions’ to carry out all your SaaS payments for the marketing department.

In this case, there are several recurring payments you would be making through the same card, and you’ll want to ensure that the card always has the necessary balance to purchase more SaaS subscriptions if needed. For this, users have to enable the ‘Notify owners about low card balance below a certain limit’ in the settings tab of that particular card. So, you’ll always know whether you have sufficient funds to make another subscription payment or not.

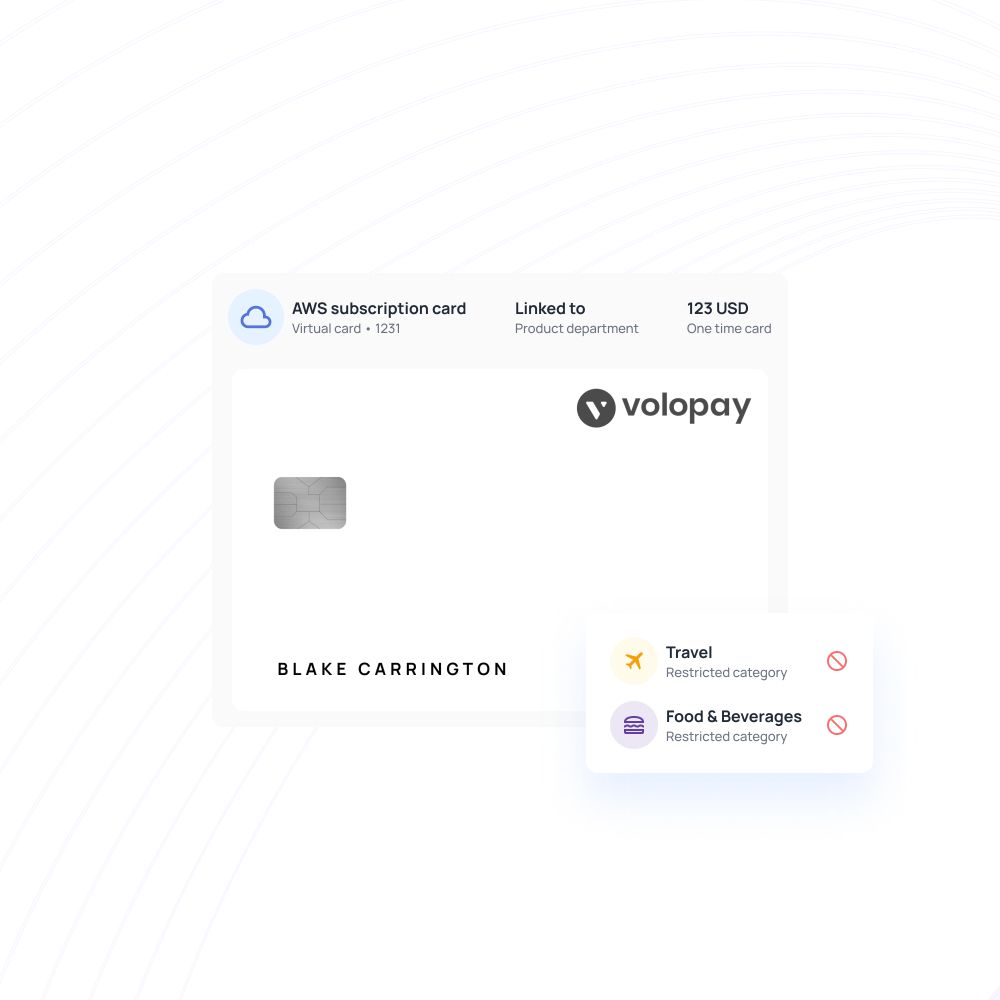

Burner card and recurring card

When dealing with recurring subscription billing, it is quite convenient to have a card that has a spending limit of exactly the amount of the subscription. This helps in avoiding any type of extra charges from the service without your notice and also safeguards the money in your budget from being stolen.

You might also come across a situation where you want to use a tool for just a month or even less than that. In such cases, you can also create a one-time or burner card that does not refresh the amount of money you select each month. Instead, you select a custom expiry date and it will automatically stop functioning after that date is passed.

Modify your budgets

Whenever you upgrade or downgrade a subscription plan, you can also make the necessary changes to the budget of the card so that it matches the exact amount of the new payment plan you set for your subscription service.

Sync with your accounting software

Another important function that your finance team will appreciate is the ability to directly sync these expenses from the Volopay ledger to the ledger of your accounting software through seamless integrations. Sync onto your existing accounting software - Netsuite, Quickbooks, Xero, Deskera, MYOB, Zoho, and Tally.

FAQs

It all depends on the requirements of your business. How long will a member or team need a SaaS service? This question should help in your decision. A practice that many SaaS businesses do is to provide their service at a lower rate if you choose an annual plan. So if you plan to use a service for a little over 7-8 months or more, then it would be a smart idea to choose the annual plan.

Every subscription billing is a recurring payment, but not every recurring payment is part of a subscription plan. While both the concepts are similar, they have subtle differences. A subscription billing cycle has a set period - quarterly and/or annually, where the user has to still pay monthly but they will be charged a cancellation fee if they decided to opt-out in between a quarterly or annual plan.

A recurring payment on the other hand is simply recurring every month and can be canceled at any time without any charges.

Yes, you can simply freeze or block the virtual card that you’re making the payments from and you will have stopped your recurring payments. Although this stops money from your budget from being used, we also suggest going and officially canceling from the merchant’s account, else it might keep showing as a payment incomplete error for the service you use.

The limitations on the Volopay virtual cards are the ones that you set. From spending limits, who can use the card, which budget it retrieves the money from, and whether it is a one-time or recurring card is all in your control. The only limitation is that you can’t use these cards for transactions in physical stores with card machines.

Trusted by finance teams at startups to enterprises.