Manage PPC marketing spends with automation

In the world of digital marketing, it is increasingly becoming standard for marketers to use potential strategies like PPC marketing. Pay-per-click marketing is any kind of online display marketing where the ad owner has to pay for every click it receives. Common advertising B2B platforms are Google, Facebook, LinkedIn, Twitter, and Pinterest.

It’s predicted that PPC marketing will blow up even more in the future, given the never-stoppable growth of internet users. Whether you are new to this Pay per click advertising or planning to implement it any time soon, make plans to include an expense automation solution in your strategy.

While you can conveniently use your current payment methods, PPC spend can be challenging to track, and soon you will understand the need for a much more transparent platform.

Types of PPC marketing spend business deal with

Subscription management

There is a subscription fee for digital marketing and advertising hosting applications like Google, Facebook, Instagram, and other social media applications. They are either paid as one-time payments or fixed or pay-as-per-use monthly fees.

There are various factors that decide how much the advertiser should pay and in what terms they pay. The majority of the display advertising is monetized through the pay-per-click or cost-per-click method. For every customer your advertisement attracts, you end up paying the Pay per click advertising platform based on your plan.

Another popularly used PPC spend term is visibility-based pricing. It can be an ad video or a large banner with your current deals or products. The advertiser is charged monthly based on the views and impressions (not clicks).

In a nutshell, subscription management includes the PPC marketing bills of every advertisement your marketing team runs on different platforms.

Vendor payouts

Handling ads, creating banners, churning out ad copies can sound like climbing Everest for a small business. So, they prefer hiring marketing agencies with a ready-made professional team ready to take over your PPC marketing needs. Vendor payouts occupy a significant share of the marketing expenses as it encompasses every marketing activity within.

They understand your business, find the best advertising and cost-effective platforms and make your ads go live. They monitor the performance of these ads and send you a monthly invoice that includes the PPC spend, agency charges for writing, design, SEO services, and subscription charges of marketing applications.

Some agencies have price-per-hour plans as well. If the budget doesn’t allow hiring a marketing agency, it can be achieved by hiring a group of freelancers you will pay based on the dedicated hours or number of projects they work on.

Small businesses are thrilled about the tangible results marketing agencies produce, that too, at a competitive price. They save time and effort by avoiding setting up their marketing team with every designation, paying their salaries, benefits, etc.

Hiring PPC personnel

Marketing teams use a wide range of applications for their writing, SEO, and outreach requisites; to name a few, Hubspot, CRMs like Pipedrive, SEMrush, Canva, keyword analyzers, and so on. With their paid versions, they can enjoy more features than what is offered with the basic, free module. This type of PPC marketing expense includes the subscription charges of applications they use.

If you decide to go for team expansion instead of getting help from private marketing agents or freelancers, then payroll expenses, salaries, and employee perks are counted in here as well.

When you go for an in-house team, you will have to bear the expenses of paying marketing professionals like SEO experts, content writers, copywriters, PR, market research analysts, social media management experts, etc.

Why should you use corporate cards for your PPC marketing spending?

Is it worth using corporate cards to manage PPC and cover marketing expenses? Can it handle payments sent to vendors and service providers?

Avoid delay in the payment transaction

Payment delays cause embarrassment and provoke unnecessary explanations and interrogations all over. As a typical delay occurs between 2 hours to 2 days, you genuinely wonder if you have sent the money to the right person. International payments are worse than this. Corporate cards are the ultimate solution to put an end to delays in settling marketing costs. You are sorted with one click, and the receiver gets the money.

Multiple virtual cards

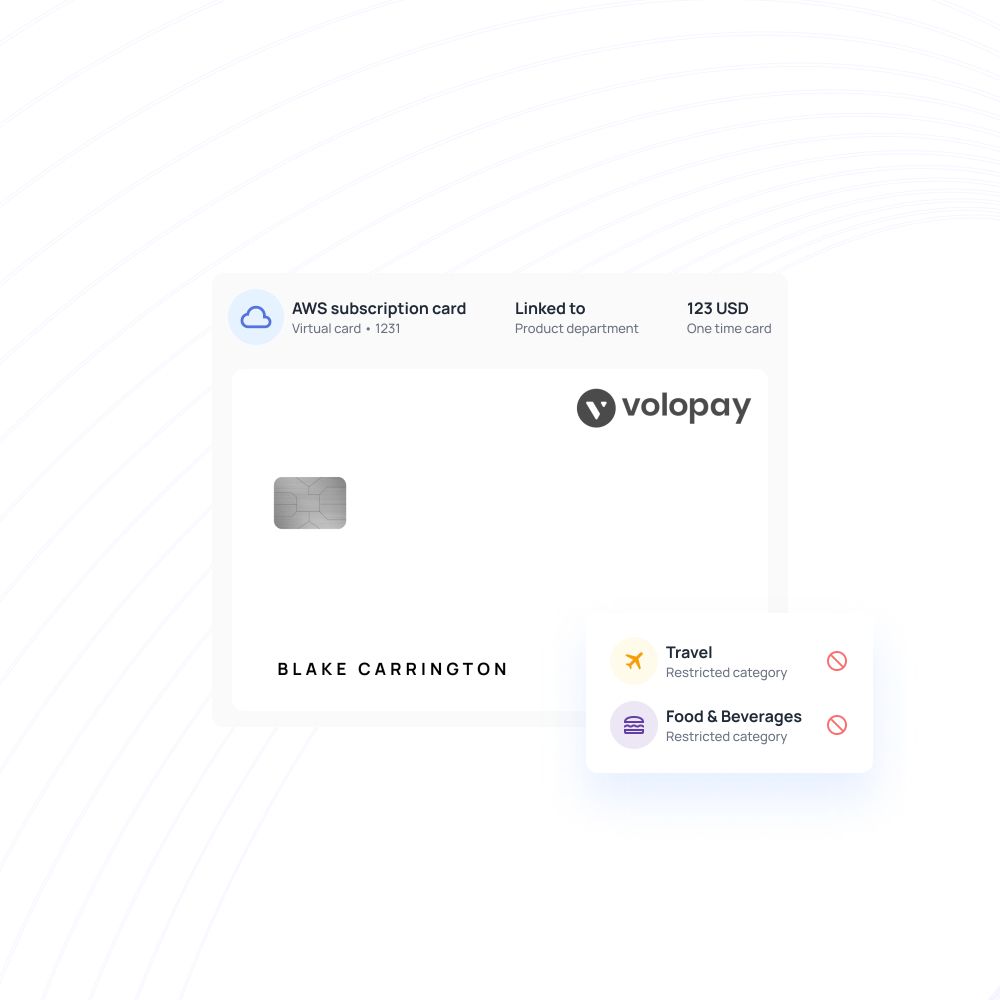

When there is an issue with one of the cards, or the security has been compromised due to some reason, you can simply block it and create or move to another card. Virtual cards function the same way as physical cards, except that they don’t exist in the real world. Due to this very reason, you can create multiple virtual cards in the card management system, and if one card isn’t working, you have an alternative card to use.

Set different cards for different campaigns

You can easily mix up your payments when you have a single card or an account. It can be hard to track down which payment has been made how much has been spent unless you don’t spend an hour going back and forth the records. As you get to create multiple cards with virtual corporate cards, you can have one card assigned to each vendor or campaign.

Avoid fraudulent activity

When a card gets stolen, it opens the door for multiple security issues. Your whole financial system is in danger, and anyone can access your client’s data. You need a robust and secure payment system that holds your main account details in the dark to avert these issues and uses powerful encryption techniques. When a card gets stolen, only that card will be affected. The rest of the cards and your central account are safe from the eyes of people with malicious intent.

Managing campaigns gets easier

Corporate cards can be a great help to reduce the load off the marketing team’s shoulder. They make your campaign management more manageable and more straightforward with the use of automation. You can run multiple campaigns through multiple tools and still not worry about paying them on time. Corporate cards have your back as you can schedule auto payments that would require approvals to get fulfilled.

Track and manage your PPC marketing spend with ease

Benefits of automating your PPC spend with expense management solution

You might still wonder if expense management automation is the right solution for streamlining your PPC spending. Here is how expense management automation software proves beneficial for marketing teams all over the world.

High level of security

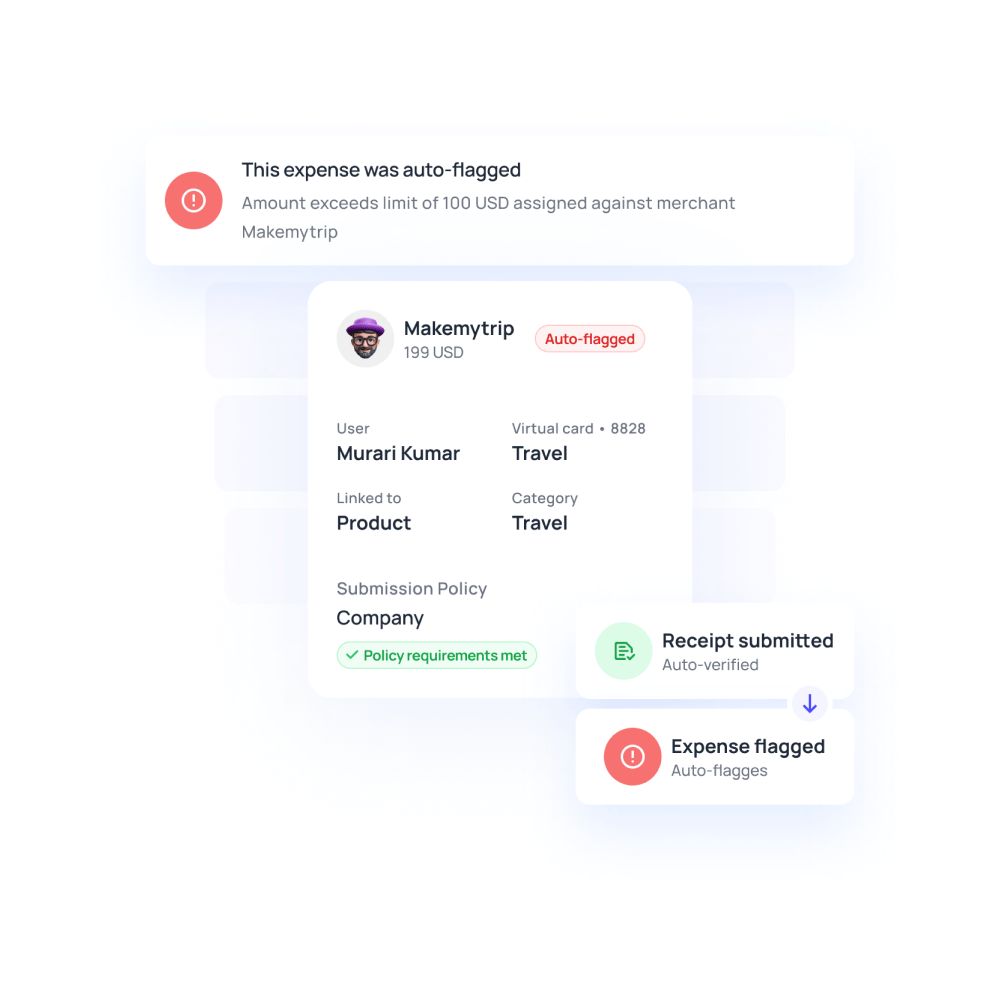

Credit card management platforms are highly encrypted and safe to use for business transactions. When fraudulent activity is detected in any one of the cards, you can cut it out of your system by blocking it for future use.

Better visibility

Visibility is the factor that management constantly worries about as they cannot keep popping in for expense updates. When they have a platform that offers a complete, transparent view of up-to-date payment information, they can sit back & not bother anyone with futile questions.

Reduce risks

Expense management automation takes away the risk of exposing your account to the eyes of scammers. Manage your subscriptions and vendor payouts with cards automatically without involving your original account information. So, you reduce the chances of getting blocked.

It saves time and money

Think of the time you waste when you note down every PPC marketing cost and its payment information and the efforts spent finishing the payment while constantly reporting to the accounting team. An intelligent assistant like expense management software can turn this into a cakewalk and shift your focus to marketing activities that warrant your attention.

Customize based on your needs

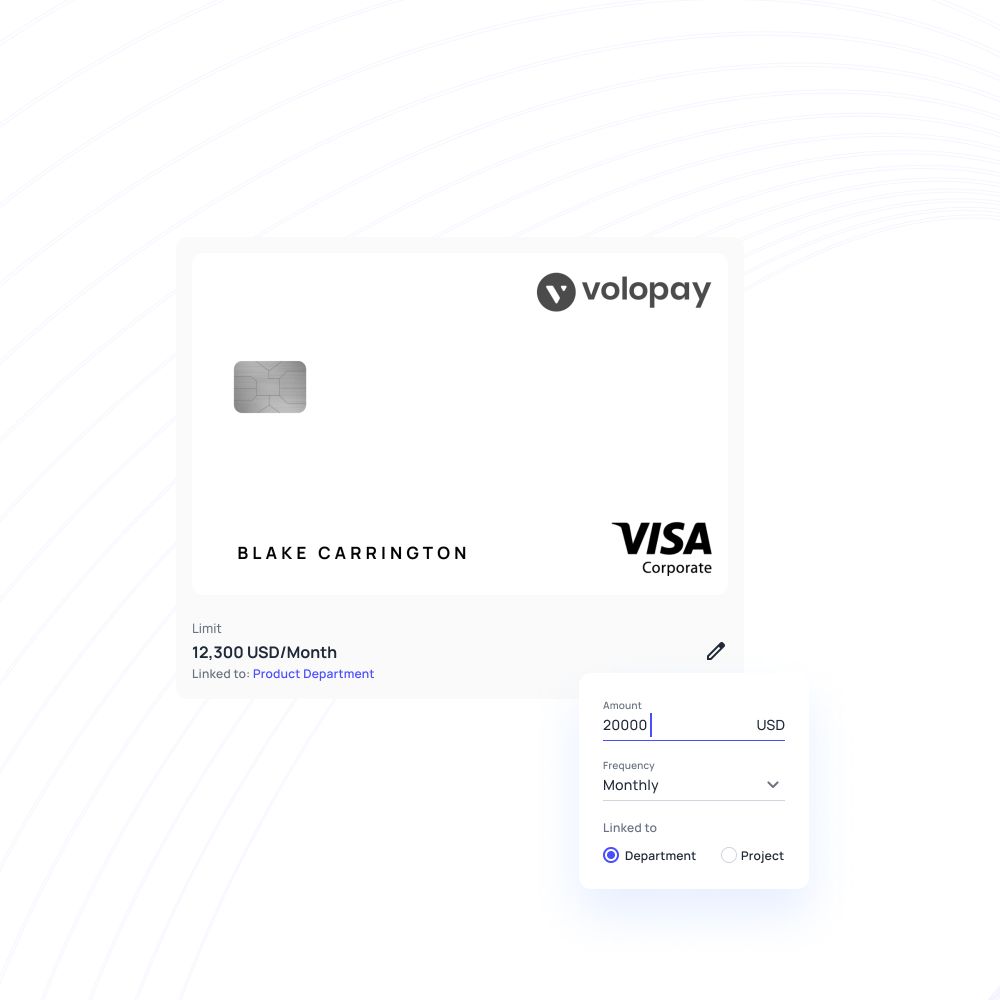

Play around with the application to modify it to suit your team’s requirements. For example, you can change the approval settings based on the campaign or the payment amount. You can set payment limits for a few categories, and if it exceeds, you can select appropriate levels of approvals. Customize it in a way that makes you spend less time monitoring while still getting the work done on time.

Faster payments

Swift payments promise instant access to the applications you subscribe to. Corporate cards empower you to make instant payments that are not delayed due to banking reasons. While maintaining manual records, one or two things can slip off your attention which can cause delays. Bid goodbye to these last-minute payments, unprofessional, and delays by letting in an innovative payment automation system.

Manage marketing and PPC spends with Volopay

A busy department with complex functionalities like marketing deserves an organized and automated expense management software that makes instant, automatic payments, keeps meticulous records, and simplifies the overall PPC marketing spend process.

Volopay’s payment platform can be that expense management automation partner for you to achieve the marketing expense management goals and overall marketing budget. Here is what Volopay is capable of taking over your marketing expense management.

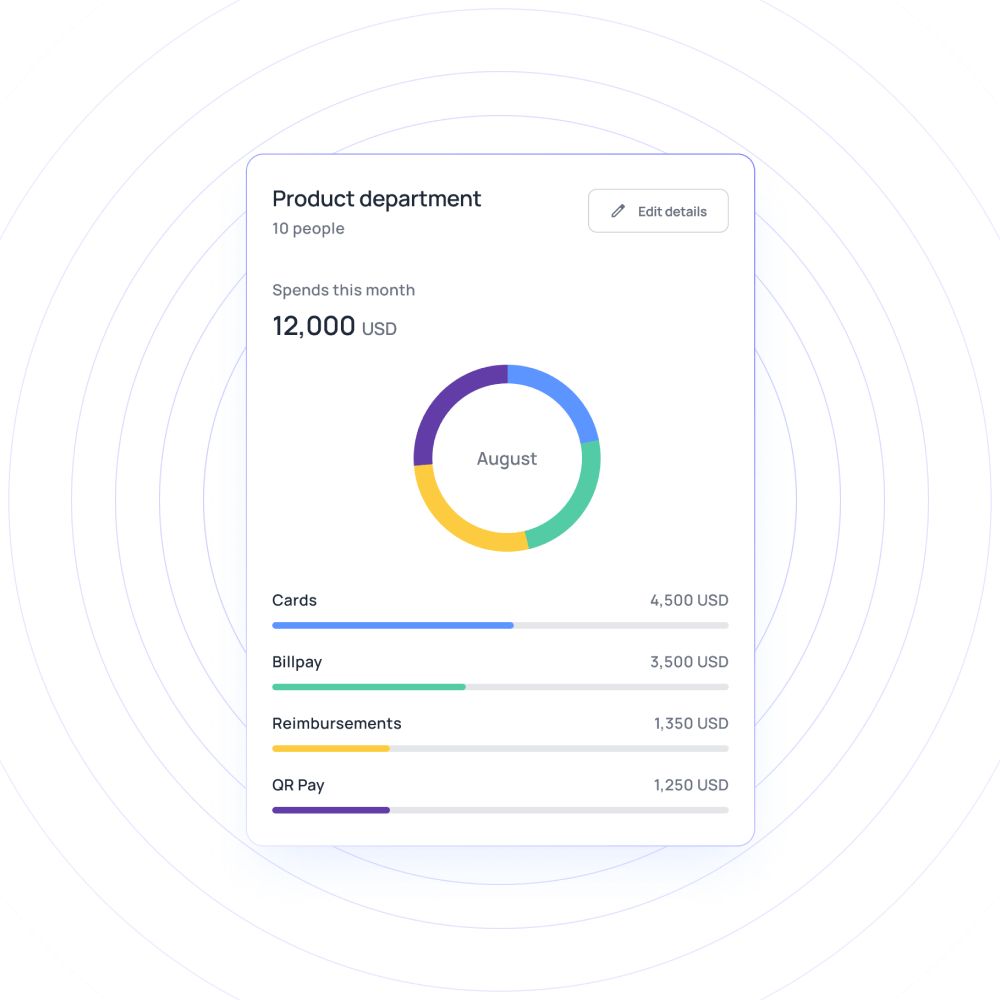

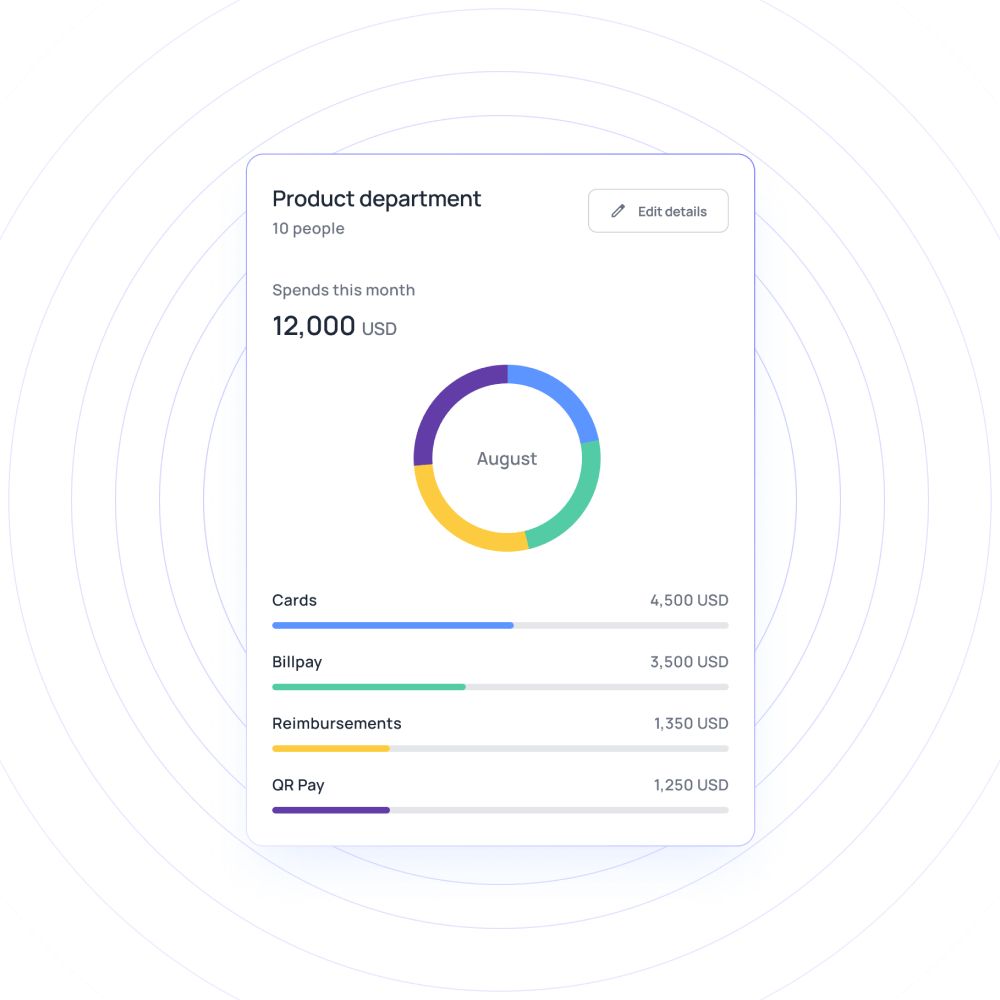

To talk about the card management system, Volopay has a centralized card management platform where every virtual credit card can be seen and tracked. You can create multiple number of cards for every campaign or application you possess and set customized limits and approvals as well to manage PPC expenses.

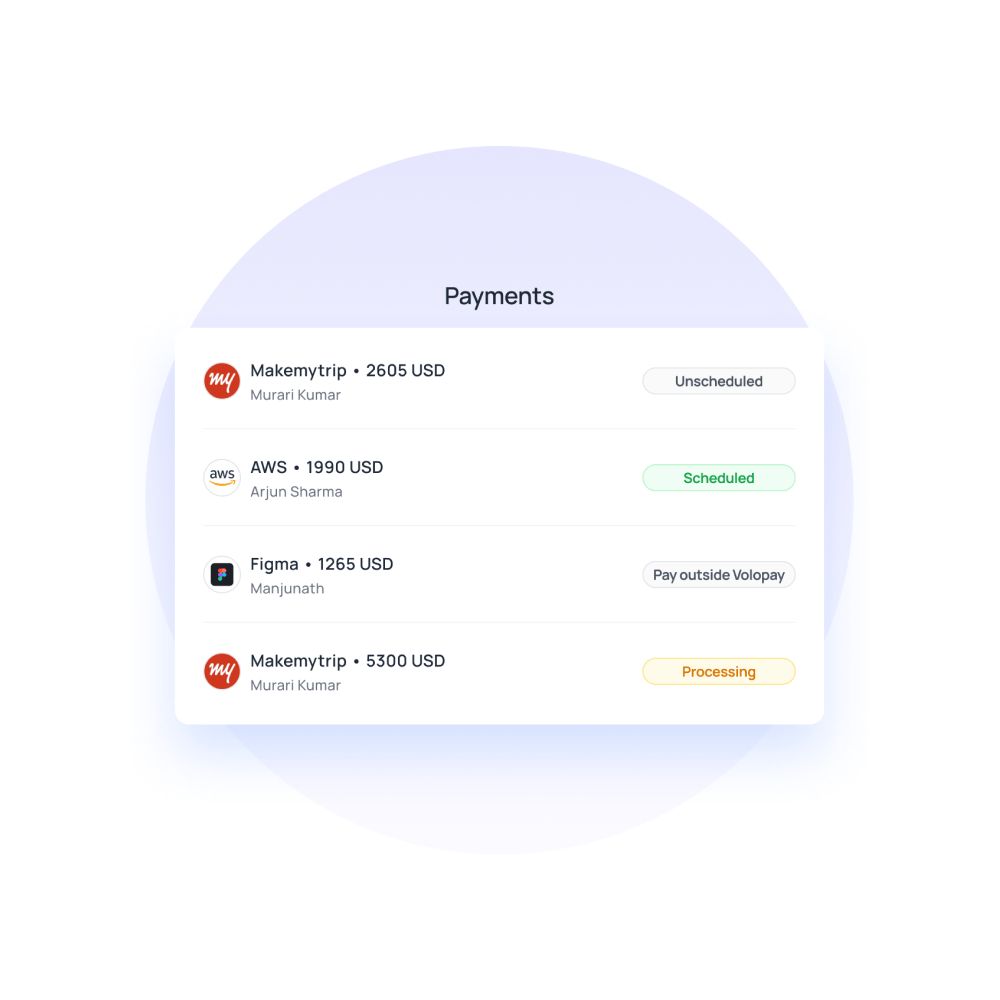

Make your payments with Bill Pay

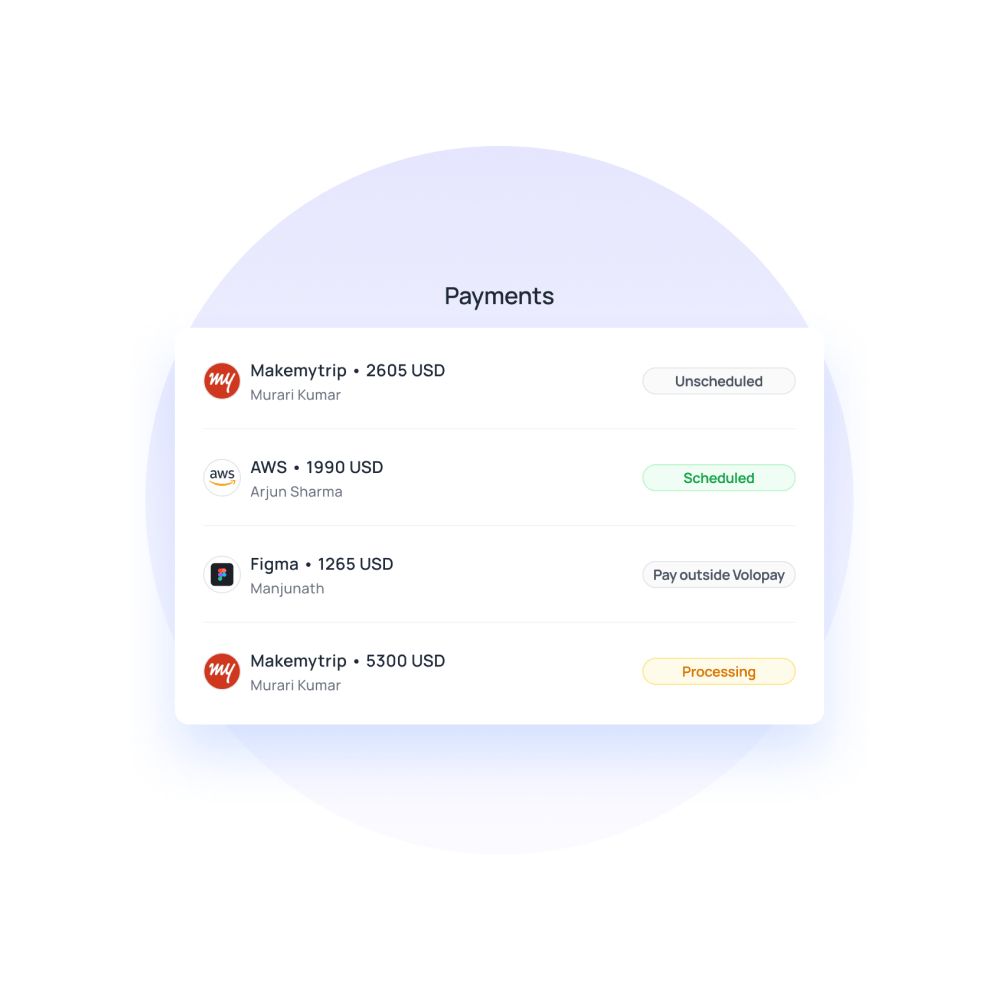

You can use the Bill Pay feature for vendor payments and invoice clearances to send money to the recipients' accounts. It is possible to schedule your payments beforehand and set approval workflows.

You can see every transaction that has happened and will happen under the Bill Pay’s accounts section. You can take care of your payroll or pay per click advertising payments through this advanced, instant payment system.

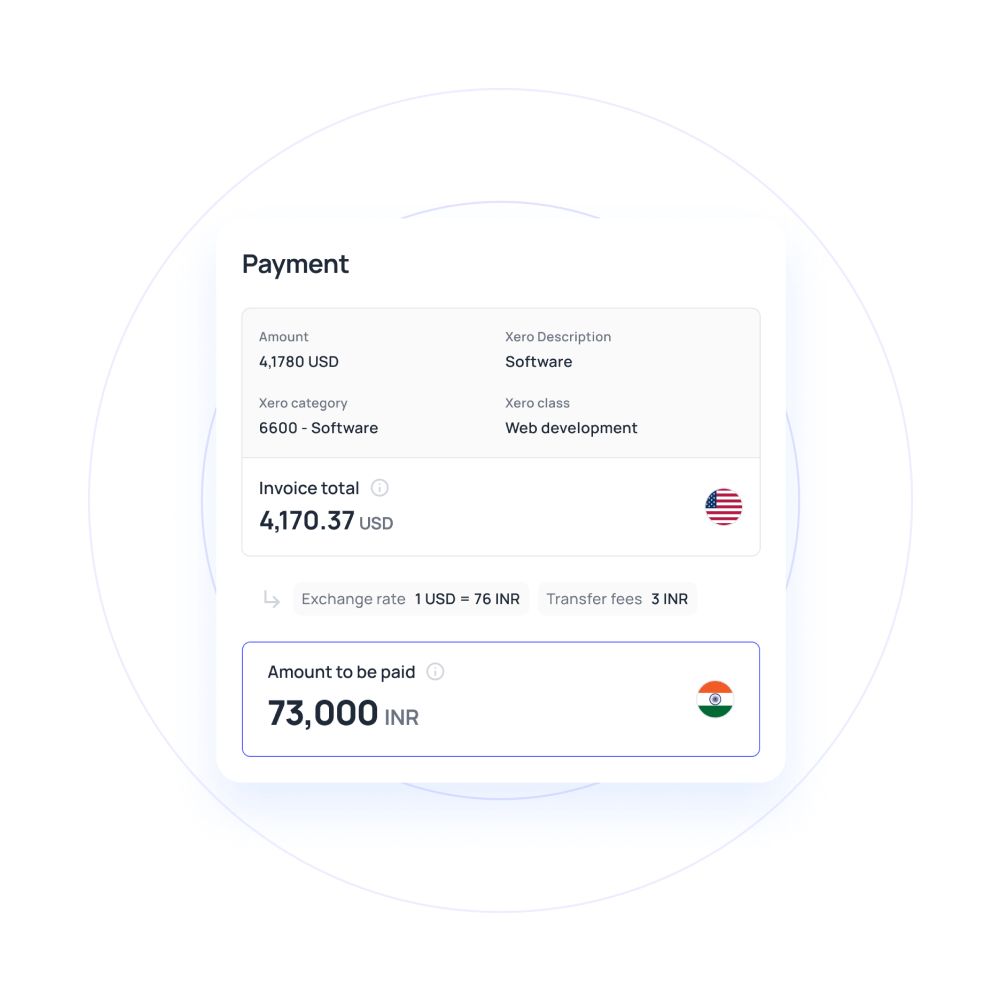

Send international and local payments

When you hire a freelancer from a different country, you can use this benefit very well and enjoy cashbacks. The PPC expense is majorly paid through monthly-based plans by most businesses.

Tracking this cost and delivering on time to use the marketing piece again can be carried out using Volopay’s credit cards as they allow online payments.

Set budget for marketing spend

Volopay also takes care of your budgeting by letting you add budgets to each card or category, for that matter. So managing your marketing budget will be a breeze.

Pay your PPC marketing costs quickly and smartly with Volopay’s expense management automation system.

Trusted by finance teams at startups to enterprises.