6 ways to manage employee expenses for remote teams

With changing times, we notice a paradigm shift in the way people want to work. Remote work and work from home (or anywhere) are on the rise. And as experts predict, this new working style has a rock-solid future. Remote work is a win-win as it helps both employees and employers at the same time. But the other side of the tunnel is not green yet because there is a rise in employee business expenses for setting up home offices.

It is crucial to consider the comfort of the employees who work from home. Yet, since this is all new, organizations struggle to find a way for managing employee expenses. And there are many other expenses involved besides home offices, like internet bills, new gadgets, and software. Small businesses suffer the most as they haven't explored remote accounting much.

5 expense management challenges

Less control over spending for finance team

Unexpected expenses can visit small businesses anytime and topple over their cash flow and capital. And with small businesses, the finance team has abysmal control over any expenses in general. There are two reasons for this:

1. They don’t take cost control and budgeting seriously.

2. They misestimate or underestimate the budgets due to the lack of experience.

With the focus to grow big, they tend to invest in new technologies, equipment, or amenities that bring in expense overload, leaving the finance team with little control over spending.

Lack of security

Breaches and ransomware attacks are a dime a dozen these days. Data protection and compliance issues are at their peak, giving a tough time to SMBs. Attackers majorly target SMBs as they don’t have an immensely secured network and are prone to cyber-attacks.

Accounting is the team that pays a heavy price, as they handle precious client and vendor banking information. A hefty sum has to be allocated only for the sake of digital security.

Slow reimbursement process

You never know where employee expenses come from when you own a small business. Small businesses are not used to corporate cards. The only way employees get their professional expenses back is through reimbursements.

But are these requests processed immediately? Mostly, No. The slow and tedious reimbursement process also accompanies panic-stricken follow-up calls from employees too. Upgrading to ingenious solutions like corporate credit cards can help in managing employee expenses expeditiously.

Inconsistent payroll management

Payroll processing and compliance daunt small businesses and their HR teams. And then, there are payroll taxes which is another complicated task. Tax code filling problems are a big headache to new employees.

They go through quite rough challenges with filling in positions, identifying vacancies, employee onboarding, and finding the right software for their payroll needs. It takes multiple rough patches for small businesses to set their HR records straight.

Managing cash flow

Cash flow refers to the total money businesses have in store to pay for expenses. Small businesses tend to spend a lot on investment and business expenses as beginners.

Though it is essential to do them, it shouldn’t be at the cost of affecting available resources and going broke. Reasonable control over the cash flow and prioritizing expenses is instead a great way to handle this problem.

6 easy ways to manage employee expenses for remote teams

Managing remote teams is quite a challenge itself, let alone their real-time expenses. But with clear guidelines and proper accounting and bookkeeping, you can turn this situation around.

Set up clear expense policy

The first step a small business should take to bring control while managing remote employees’ expenses is to set up rules and policies. The finance team should establish what is claimable and what is not. Based on the nature of the job and employees’ comfort level, you can decide on this.

Minimal eligible amounts for reimbursement and maximum limit should also be established and conveyed to avoid unnecessary hassles. Simply put, Employees should know the do’s and don’ts when it comes to employee business expenses.

Suggested read: Complete guide on company expense policy

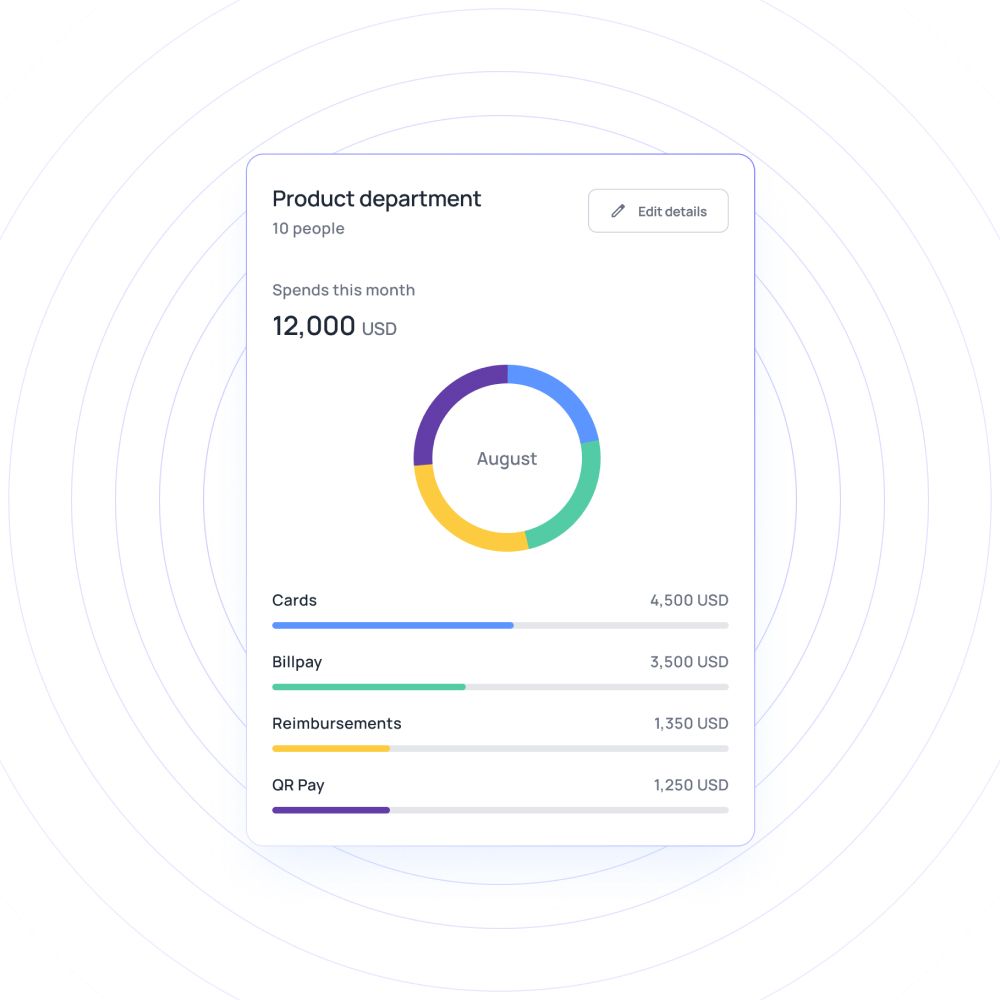

Track and enforce set budgets

Sometimes expenses get out of hand when you initiate your role in managing remote employees’ expenses. It becomes worse to the extent that it affects its cash flow.

Keeping this in mind, the accounts team should track the average expense of an employee and set distinct budgets for each expenditure. This budget constraint is not to become all stingy. It is to find out and provide the ballpark your employee needs to manage remote working.

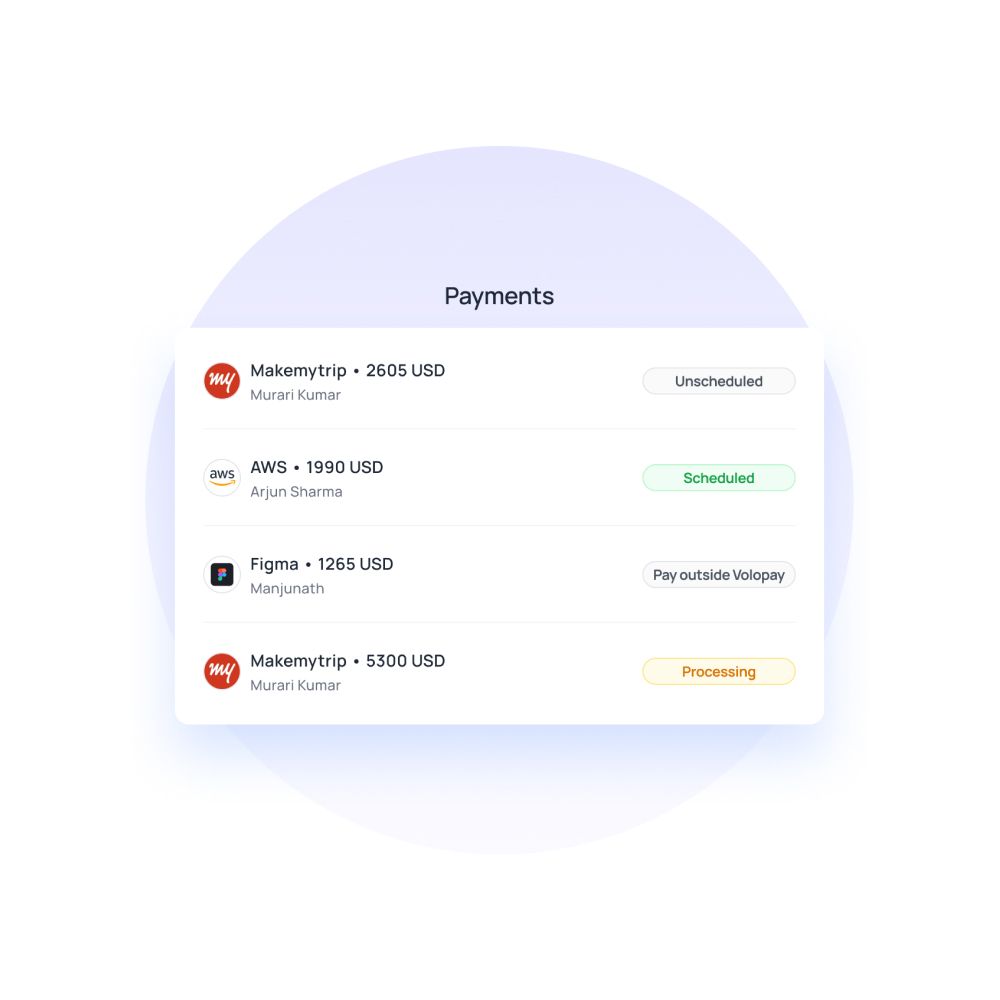

Use modern payment methods

Traditional methods are easy to learn but strenuous to proceed with. On the contrary, modern payment methods take some getting used to but are incredibly efficient and time-saving.

Modern payment methods like virtual cards are cut out to manage remote teams' expenses and make the most of current resources. It’s easy to track, assign budgets and approve payment requests. And employees find the process stress-free, too, as they are given cards with preset budgets.

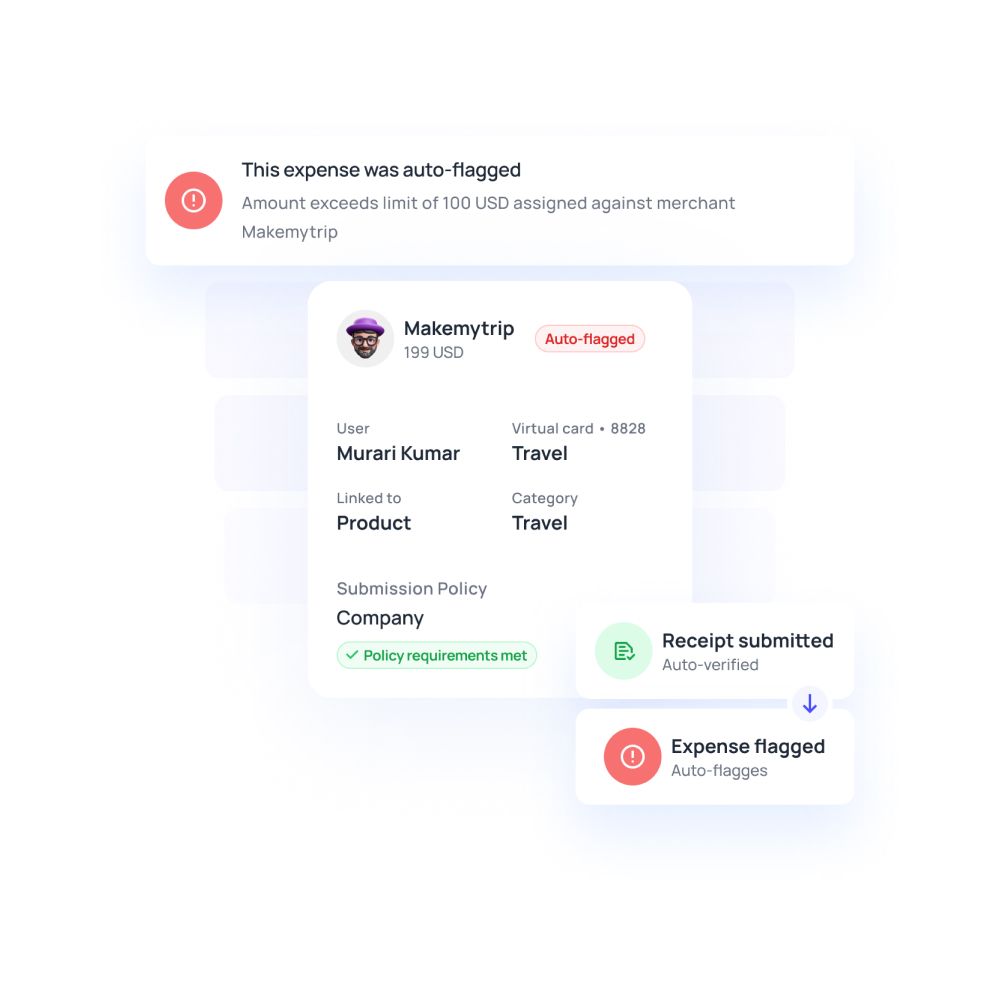

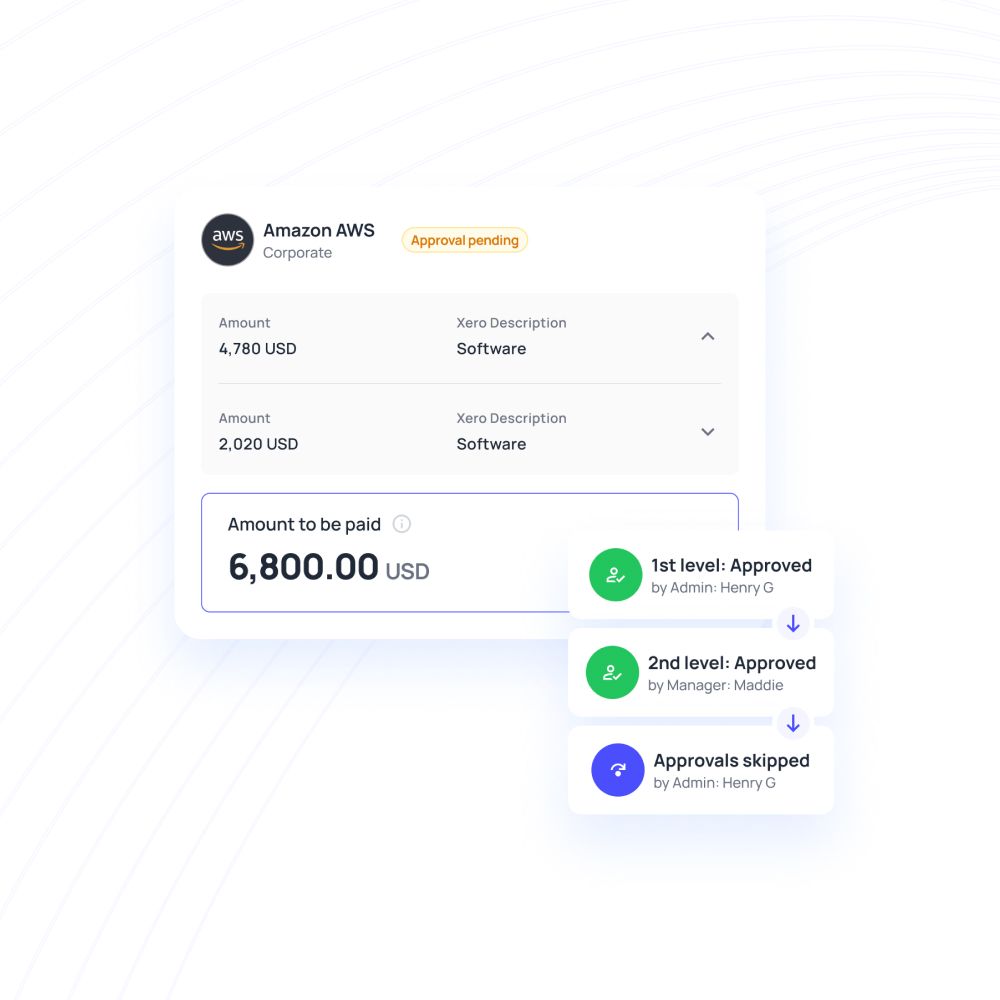

Set up automatic approval processes

The finance team cannot go over every bill and approval request on top of their heavy-loaded work. Enabling an auto-approval policy for predetermined employee expenses can prevent this.

You can also establish a quick and hassle-free process where an employee would request funds and a checker would approve it. This checker can be their direct manager. You could avoid unnecessary steps by creating an effective approval workflow for each employee expense.

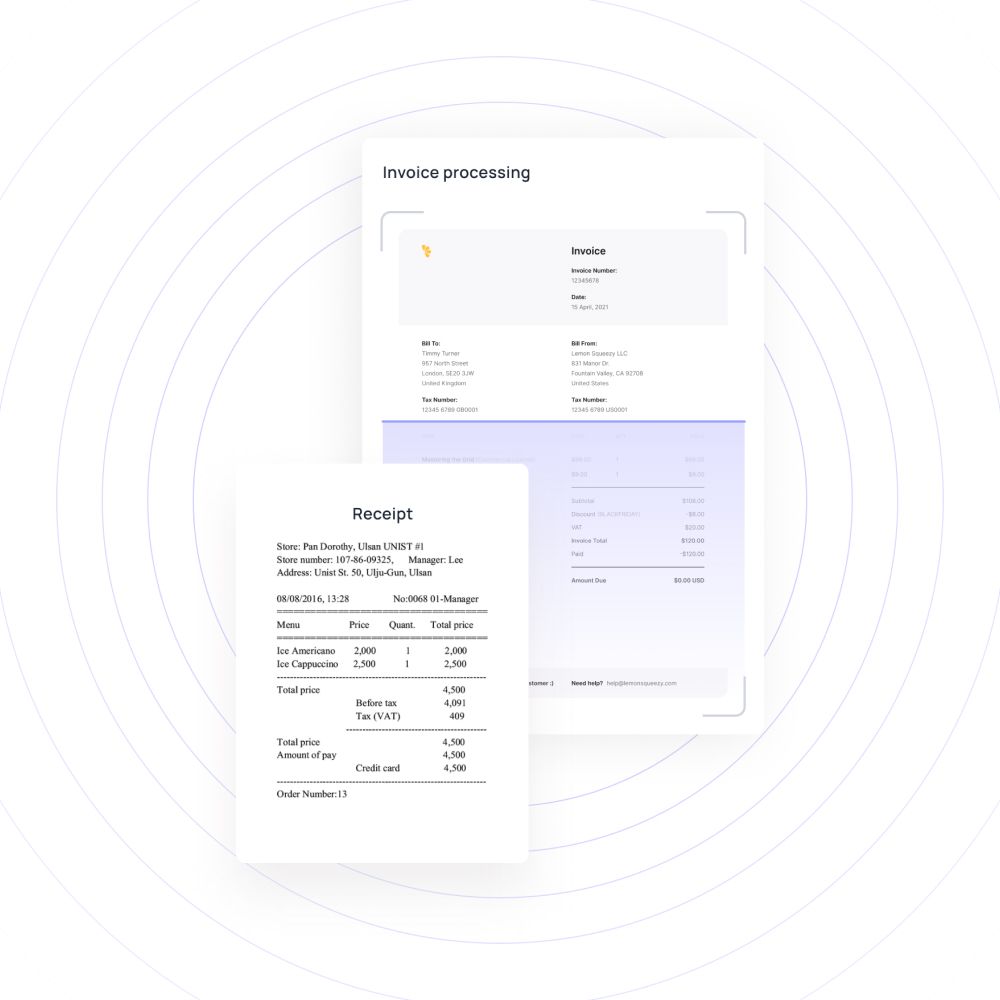

Automate invoice processing to save time and money

Companies who are ahead of their time in technologies take accounting issues in stride, while outdated ones still struggle to get through the manual workload. Doing invoice processing manually through pen and paper is passe as we can now rely on accounting and bookkeeping applications.

This software can capture information from a digital copy of an invoice, verify the information, generate a bill and send it for approval. All of this happens digitally and automatically, and the admin has complete control over it.

Related read: A complete guide to OCR invoice processing in accounts payable

Digital documentation

Storing paper records and finding something you need out of it is a herculean task. It’s not possible while working remotely too. Digital documentation is recording everything in electronic form rather than doing paperwork and maintaining paper bills and invoices.

You get an option to be eco-friendly while saving your data neatly and guardedly. Modern expense management software aids you to go entirely paperless. You can safely access it whenever you need it.

Struggling with managing employees expenses for remote teams?

How can Volopay help in managing employee expenses for remote teams?

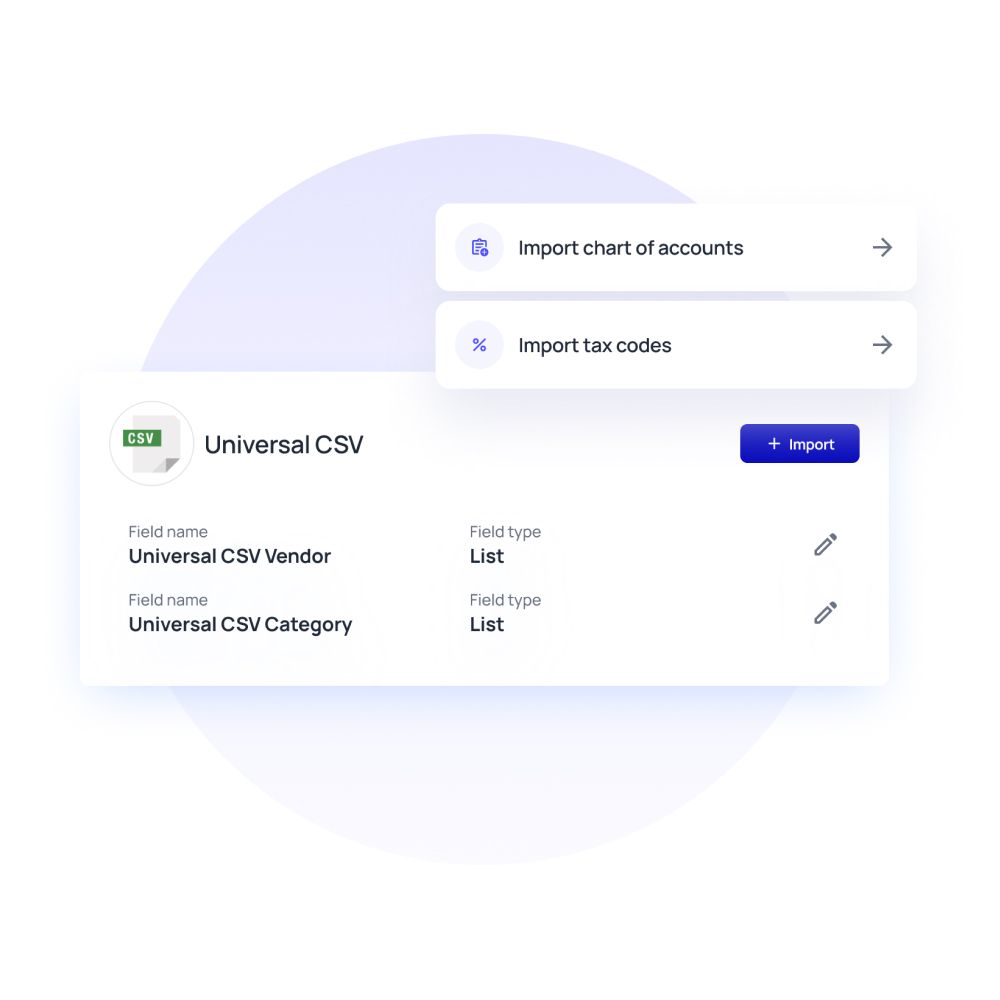

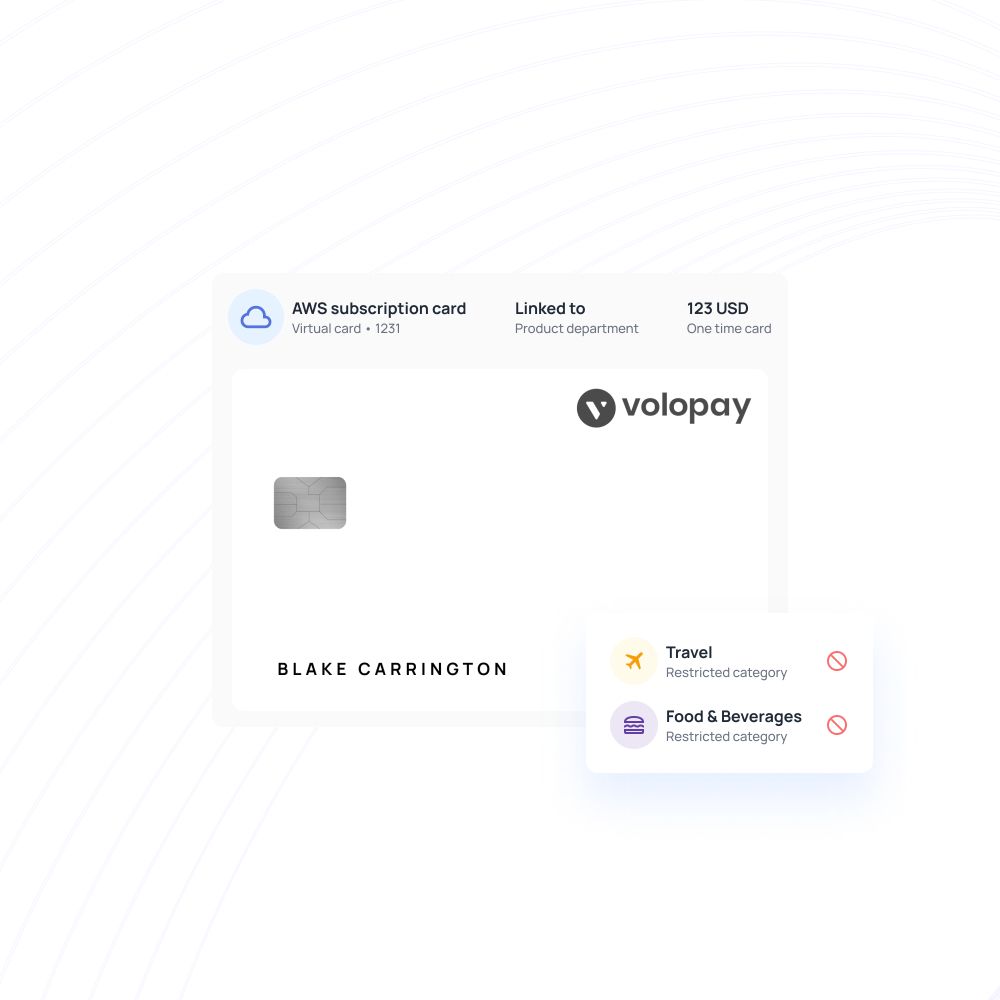

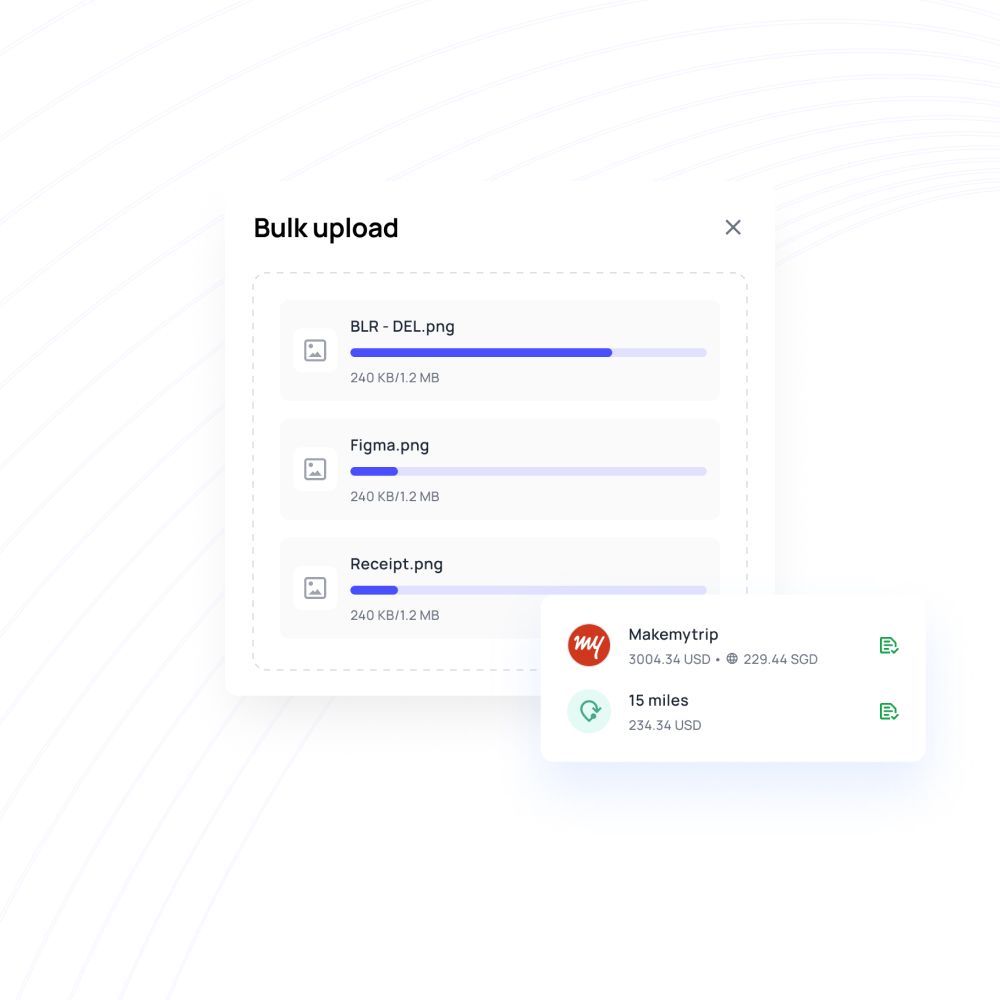

Understanding your expense policy and workflow is the first step you take towards effectively streamlining the remote team’s expenses. The second step is choosing the right accounting software that will be of good help throughout this process. Volopay expense management software lets you have both physical and virtual cards. In the case of virtual cards, you are not limited to only having a few. You can create them in endless amounts.

Corporate cards

Corporate cards are also helping businesses with managing their employees' business expenses and subscription tariffs. It’s convenient and hassle-free as accountants find it easy to distribute cards and track expenses. It simplifies the remote accounting process by providing each employee a safe way to handle employee business expenses within a limited budget.

There are no restrictions or approvals when using the card within its limits. Your employees feel valued as they are trusted with something noteworthy like this. And then, your accounting team feels empowered, too, as they can track down employee expenses, see if there is overuse, approve additional credit requests and delete card post use.

Out of pocket expenses

Reimbursement processes can sound like a tiring task, but with Volopay, it gets done in a jiff. Employees can raise one through the mobile app, and right after the approval, they will get their money back. While we are on that, you can assign one-time cards as well.

Typically, companies ask employees to buy things for their remote office on their own money and get it reimbursed later. That’s unfair, and employees might not have a vast stash ready. But virtual cards change the way topsy turvy gives equalized treatment to employees and those managing remote teams.

FAQs

Employee business expenses include furniture for the home office, office supplies, equipment costs, internet, and phone bills.

Volopay’s accounting software lets you assign limits to every card you create. That way, you know that each employee is only given the amount they are entitled to use. If they need additional money, they can request it and the concerned team has to approve it. And you have access to the dashboard where you can see what’s happening with the cards.

Yes, the admin can assign as many virtual cards as possible. So every team member can get their own virtual card with a posted limit.

Volopay uses bank-level encryption technology to keep the information safe and secure. Customer privacy is one of our top priorities, and you can be assured that your valuable data is safe with us.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now