How can you financially empower your employees?

The startup and corporate world are evolving each day and so is the employee-employer relationship. Every business owner knows that if you take care of your employees, your employees will take care of your business. It is a perpetual cycle that truly is the reason for the success of most companies. And a major part of this dynamic is the aspect of financial empowerment.

In many industries, employees need access to company funds in order to carry out their day-to-day tasks. Managing the flow of money to your employees fluidly while still maintaining control and transparency of your company budget is a challenging task. This is where employee expense management and using modern financial tools come into the picture.

Why empower your employees financially?

Financial empowerment is not just something that looks good from an employee’s perspective but is actually something that affects business metrics. Anyone who has experience dealing with assigning budgets, monitoring, and controlling company expenses will tell you that there is a lot of friction between being granted company funds and actually being able to use or access them.

The more friction there is, the more time it takes for employees to carry out their functions. This leads to a lack of productivity. Thanks to modern tech solutions, companies have started to figure out how to manage employee expenses in a way that allows for easy and quick budget access to employees and at the same time control the funds.

5 ways to empower your employees financially with expense management software

By giving them easy ways to reimburse claims

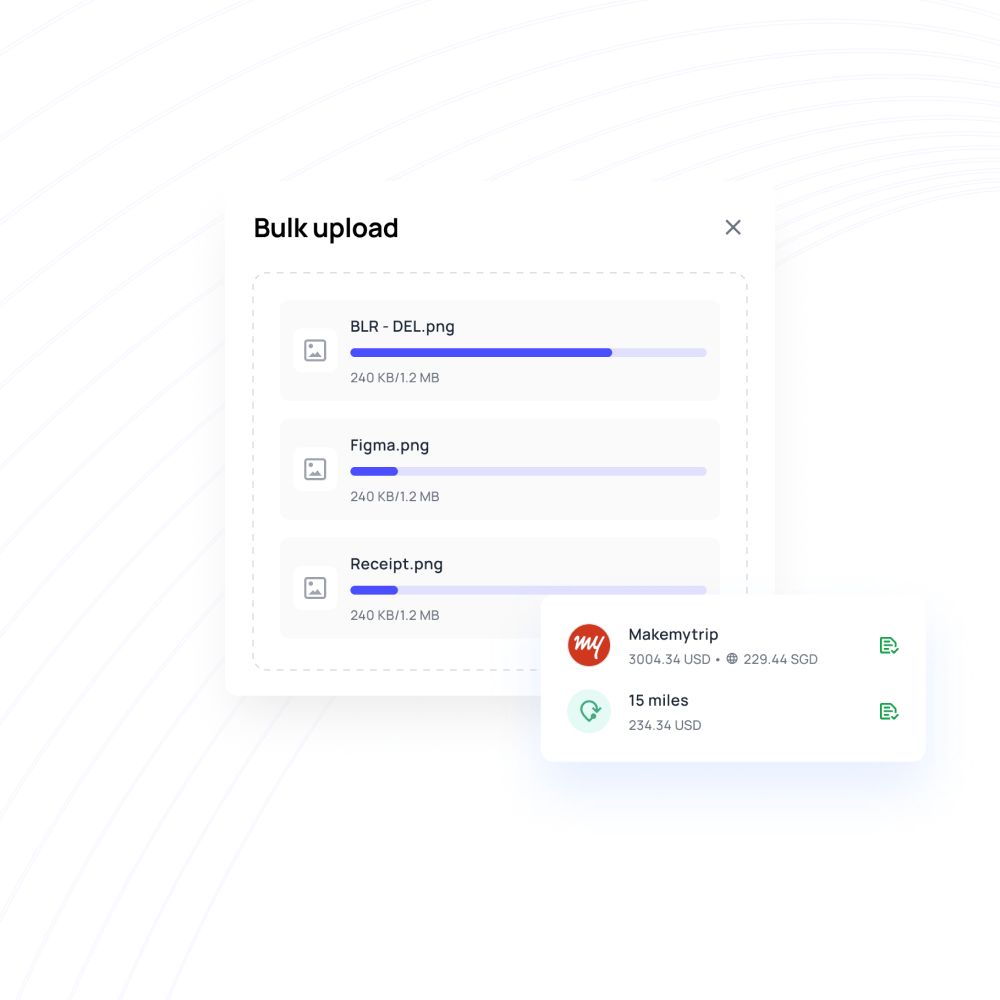

Employee expense reimbursement is probably one of the biggest pain points that employees face. If an employee does not have access to company funds, they have to make out-of-pocket expenses, save all the receipts till the end of the month, and then submit all of them along with an expense report to get reimbursed the next month.

This entire process is quite tedious. Since expense receipts are small pieces of paper, the chances of losing them are high, making it tougher for them to claim a reimbursement for expenses without any receipts. To solve all of this, an organization should use financial tools that allow for instant reimbursements.

Instead of having to save and store all receipts physically, employees can use an app to scan and directly attach the receipts to relevant expenses and submit their claims at any time rather than waiting till the end of the month. Using OCR technology, the app automatically scans the receipt, matches it with the expenses, and verifies whether it is correct or not.

After this, the financial admin on the platform can directly approve the claim and reimburse the employee within seconds. This simple and intuitive ecosystem for employee expense management assures your workers that even if they make expenses using their personal funds, they will get back their money easily.

Related page: Benefits of rule-based expense reimbursement policy

By helping them manage corporate travel expenses & mileage tracking easily

Travel expense accounts for a major portion of employee expenses within a company. But for many companies, it isn’t the most well-organized system. Giving your employees the power to make their own choice regarding travel and staying arrangements within a budget is not financially empowering but also shows that you respect their personal preferences.

Instead of enforcing a way of travel and pre-booking everything for your employees, you can allow them to use an expense management system to manage their corporate travel and track mileage for city commute to get reimbursed easily. It’s a win-win situation as your employees get the freedom to choose while still following the budget guidelines of the company.

Easy access to funds through corporate cards

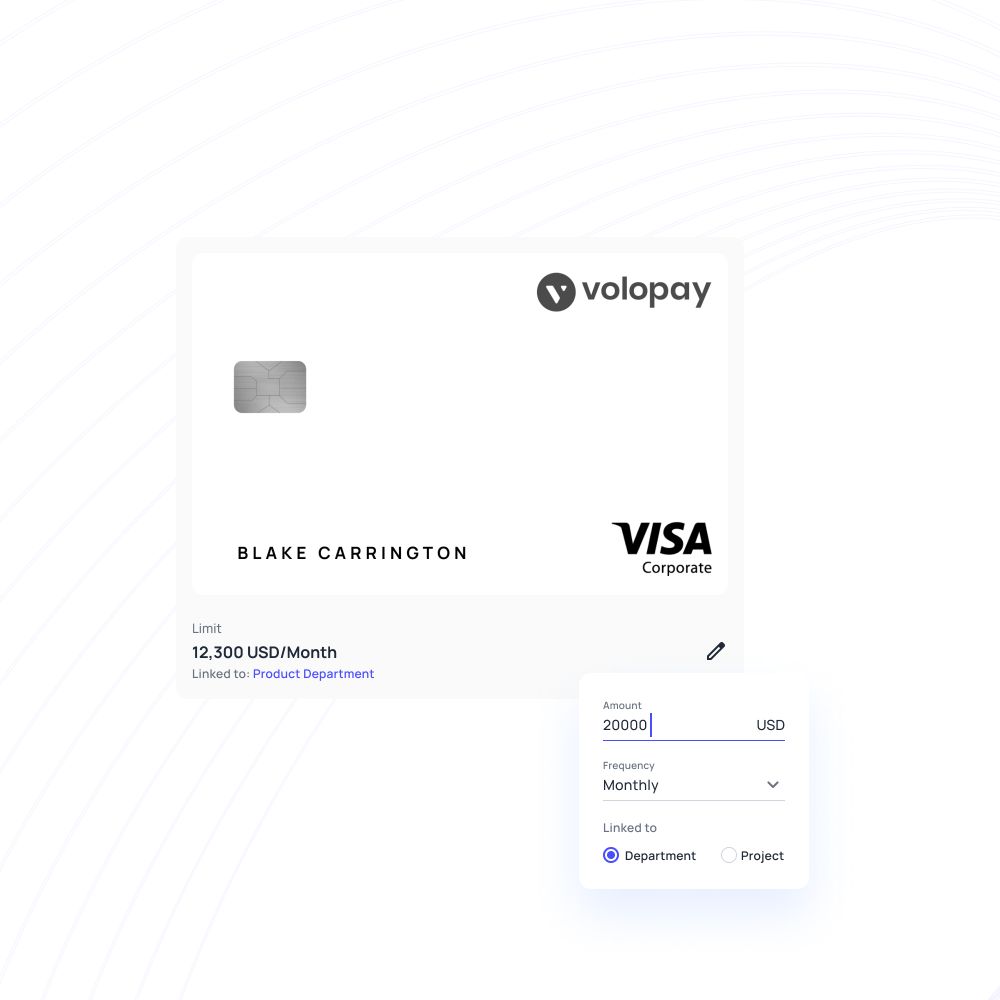

When a salesperson goes on a client visit, they can use the company’s corporate cards easily without paying from their own pocket for entertainment, fuel, dining, etc. All of this is possible thanks to physical and virtual corporate credit cards.

Corporate cards for employees are made in such a way that they allow individuals to make liberal spending decisions while still letting the company be in control of the funds through approval systems and real-time expense tracking. This makes it super simple to manage employee expenses.

Real time visibility

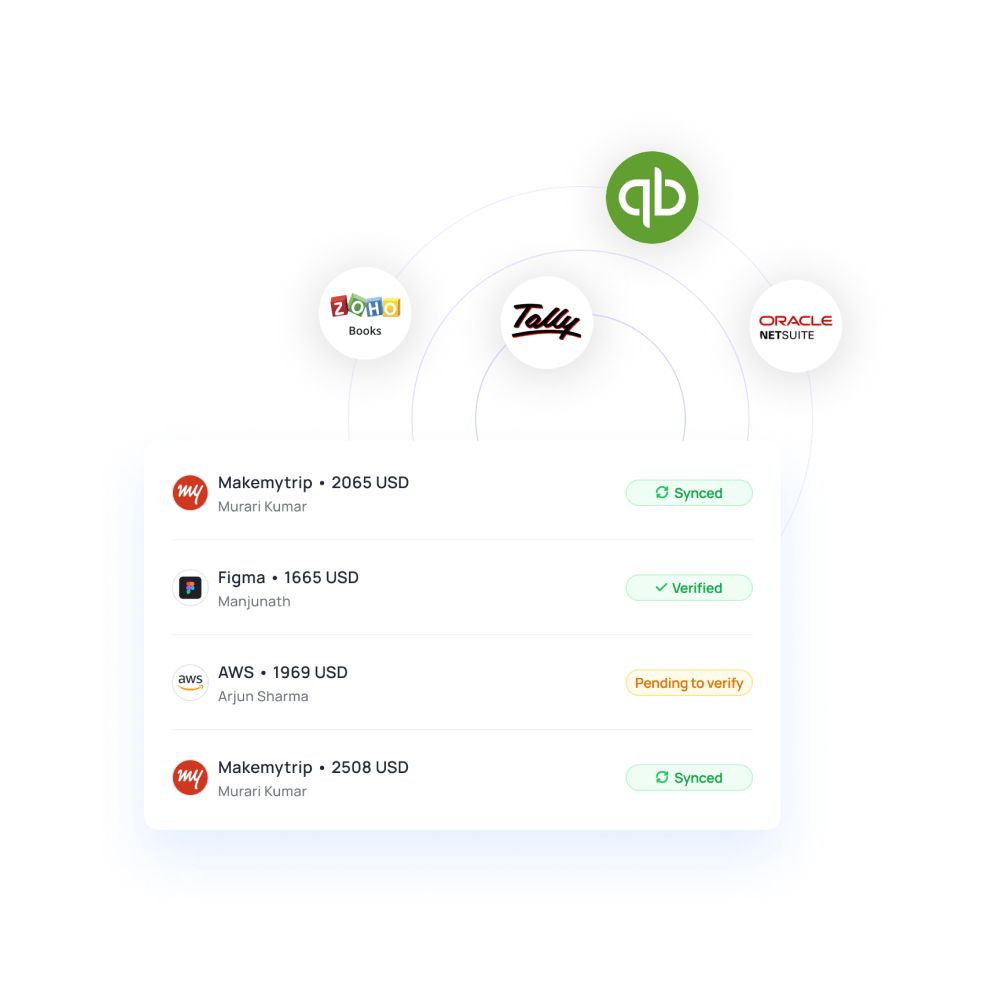

Employees and the financial admins get to see everything related to corporate card expenses, expense reports, analytics, and tracking the status of their reimbursement, all in one dashboard. Every time an expense is made using a financial tool from the expense management ecosystem such as a corporate card, the transaction is automatically recorded in an expense tab that is visible to the employee and the admins of the software system. This ensures that there is complete transparency of the money that is being spent by employees and no chance for any manipulation.

Subscription management system for departments

There are many companies operating with the help of internet subscription services. Different departments in the organization use different SaaS services to execute their tasks. These services have become an irreplaceable part of the modern digital business. Marketing teams use automation and advertising tools while the sales department uses CRM systems to manage leads.

Every department has its own software requirements and allowing your team members to choose the right tool to get the job done while still maintaining complete control and tracking over budgets is important for business efficiency. To do this, you can let your employees use virtual corporate credit cards and manage all their subscriptions in one place, i.e. your expense management system.

Managing your employee expenses is easy now with Volopay

Get started today with all-in-one financial tool

Volopay is the best employee expense management software that makes tracking and controlling budgets less of a headache and helps your finance team to manage business expenses.

Corporate cards

As part of your plan with Volopay, every employee in your company can get a physical corporate card and create unlimited virtual cards through a software system.

Having a company card specifically for each employee allows them to use it without the worry of returning it to someone else. It also gives them easy access to company budgets without having to constantly make a request every time a purchase has to be made.

Mobile app for easy reimbursements

The Volopay app is available on Android and iOS smartphones. Employees can easily request funds on their corporate cards even while they are on the move.

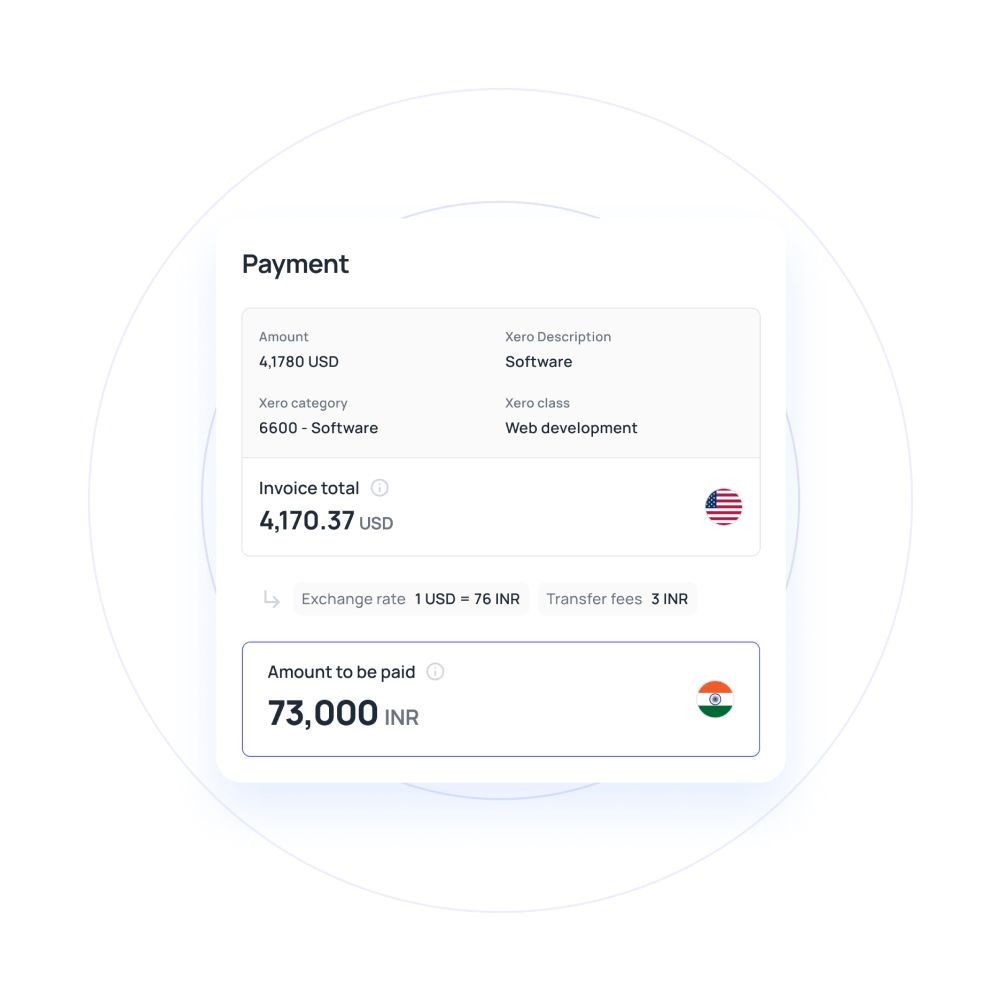

Money transfers

Rather than relying on the traditional banking systems, you also get a robust infrastructure to wire money domestically and internationally within minutes. This is especially useful for employees to pay multiple vendors that your business is dealing with. Using our system, you not only get to pay your suppliers at the lowest rates but also manage each vendor.

You can create separate vendor accounts on Volopay and manage all their invoices in one place. Once the accounts are created, you don’t have to manually enter their data, again and again, every time you need to make a payment.

The 3-way invoice sourcing feature automatically sources all vendor invoices from your email, accounting software, and the ones you directly upload on the platform. The cherry on top is the ability to schedule and create recurring payments so that you don’t miss out on any payments and face a penalty.

Expense management

No matter which expense tool you use through Volopay, all transactions are recorded in real-time giving the employee and the financial controllers complete visibility over their spending. This allows for transparency that goes both ways.

Trusted by finance teams at startups to enterprises.