Upgrade your subscription management with virtual cards

Tired of chasing down recurring payments and reconciling messy invoices every month? If managing subscriptions feels like a never-ending task, it’s time for a smarter approach. By upgrading your subscription management with virtual cards, you can finally take control of every charge with clarity and ease.

Assigning a unique card to each subscription allows you to track spend, prevent billing errors, and stop unwanted renewals. With virtual cards for subscription management, you get precision, transparency, and automation—without the chaos. Ready to simplify your processes and safeguard your budget? This blog will show you exactly how.

What are virtual card payments?

In short, virtual card payments are any kind of payment made using a 16-digit card number without needing the physical form of a payment token. The transaction happens entirely digitally from one account to another.

Unlike physical card payments, which are payments made from one account to another that still require a tangible card to make, virtual card payments are cardless.

All you need is a device like your computer, tablet, or mobile phone that can generate your virtual card details. This includes your 16-digit card number, CVV, as well as the card expiry date.

When you have these details on hand, you can make online payments using your virtual cards in a similar way you would with a physical card.

Common challenges in managing business subscriptions

As your business scales, so does the complexity of subscription billing. Without the right tools, managing payments becomes error-prone and time-consuming. From duplicate charges to unclear ownership, these issues can drain budgets and waste valuable resources. Understanding these common pain points is the first step to effectively managing SaaS subscriptions and optimizing spend.

1. Forgotten renewals or duplicate subscriptions

Recurring payments often fly under the radar until they appear on your statement. When teams subscribe independently, duplicate tools or missed cancellations become common.

This leads to unnecessary expenses and wasted budget. Without proactive tracking or controls, forgotten renewals can continue silently, eating into company funds without delivering real value or visibility.

2. Lack of visibility into recurring charges

It’s challenging to get a clear view of what your company is paying for each month. Subscription costs are often scattered across departments and accounts, making it hard to consolidate or analyze them.

Without centralized oversight, budgeting becomes guesswork, and decisions are delayed. This lack of transparency ultimately weakens your financial control and planning.

3. Difficulty tracking who owns each subscription

When subscriptions are spread across teams, it’s unclear who manages or needs them. This confusion results in active subscriptions with no responsible owner or business case.

Without accountability, renewals continue unchecked, and cancellations are missed. Clear ownership is critical for streamlining approvals, budgeting accurately, and aligning tools with actual business use.

4. Security risks with shared corporate cards

Many companies use one corporate card for multiple subscriptions. While convenient, it opens the door to misuse, data breaches, or payment fraud. Lost cards or employee exits further complicate matters.

Without controlled access, your sensitive financial data is at risk. Reducing these risks requires a more secure, role-specific payment approach.

5. Manual effort to cancel or manage payments

Canceling or adjusting subscriptions is rarely a smooth process. It often involves chasing vendors, verifying charges, and digging through records.

When handled manually, it eats into finance teams' time and increases the chance of human error. Automating these processes can free up resources and improve overall financial efficiency.

How virtual cards solve subscription management challenges for U.S. businesses

To overcome inefficiencies, you need a smarter, more secure way to manage subscriptions. This section outlines how using virtual cards for subscription management provides a structured solution—improving control, reducing risk, and eliminating manual work tied to recurring business expenses.

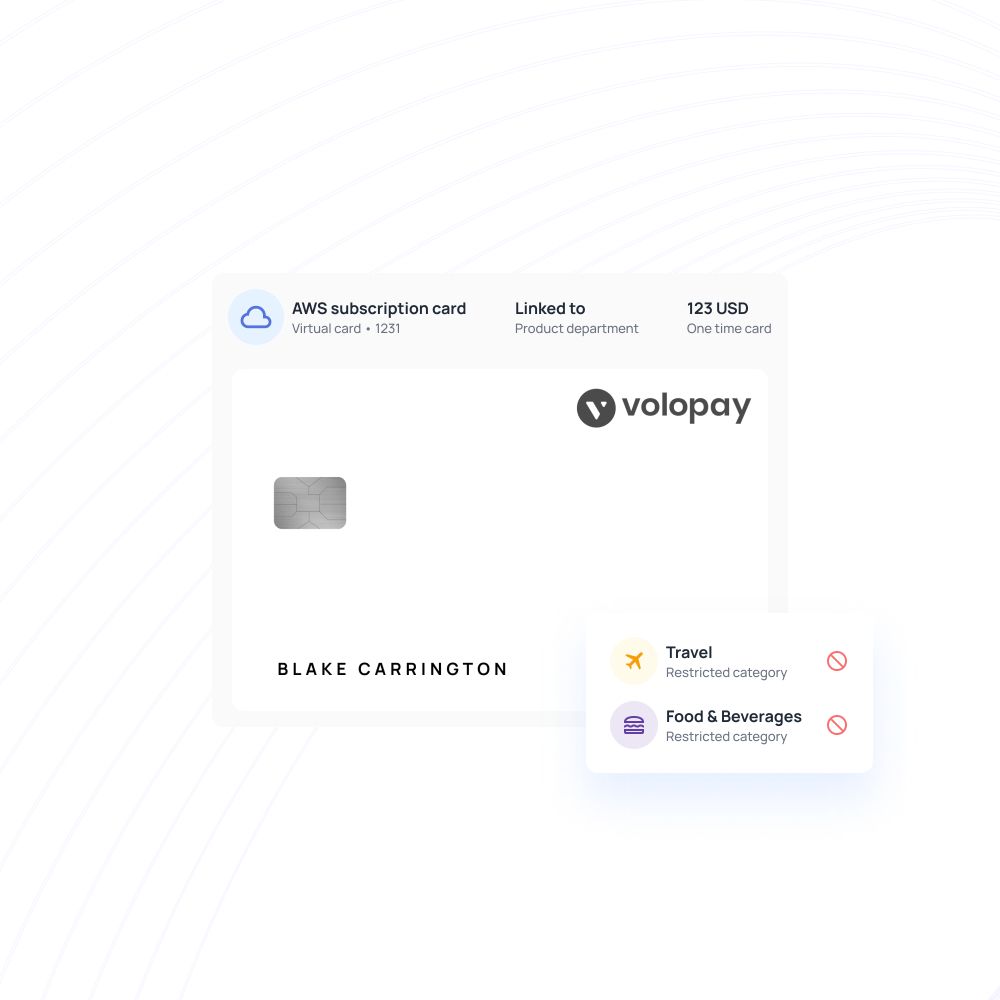

Assigning a unique card to each subscription

With virtual cards, you can issue a separate card for every vendor or service. This isolates payments, making it easier to track and control individual charges.

If suspicious activity occurs, you can act without disrupting other services. It also simplifies audits by linking each card directly to a specific subscription.

Easily cancel or suspend unused subscriptions

Unused or redundant subscriptions are easy to eliminate when each has a dedicated card. Instead of contacting multiple vendors, simply freeze or deactivate the associated virtual card.

This ensures no future charges go through, while giving your team time to review usage or assess the need for renewal.

Setting card spend limits and expiry dates

You can predefine limits for each virtual card to avoid unexpected charges or overbilling. Expiry dates ensure that cards automatically stop working when no longer needed.

This protects your budget while enforcing compliance across teams. Financial control becomes proactive, reducing overspending from forgotten or misused subscriptions.

Automating renewals while staying in control

Virtual cards simplify recurring payments by automating renewals, yet you retain full control. With clear visibility into each card’s activity, you know exactly what’s being billed and when.

This enables faster and secure approvals and accurate forecasting. You automate without losing oversight, ensuring payments align with actual business needs.

Benefits of using virtual cards for online subscriptions

Enhanced financial visibility

Virtual cards offer real-time insights into who is spending, how much, and on what services. You can easily track active subscriptions across teams without digging through bank statements. Each card maps directly to a service, making reconciliation simpler and faster. This clarity supports smarter budgeting and prevents hidden costs from accumulating unnoticed.

Quick response to fraud or billing errors

When a suspicious charge appears, you can immediately pause or cancel the associated virtual card without affecting other services. This instant response reduces exposure to fraud or accidental billing. Unlike traditional cards, you don’t need to replace everything. Virtual card systems isolate issues quickly, helping you protect your finances with minimal disruption.

Flexible control by department or user

Assigning virtual cards to specific users or departments gives you targeted control. You can customize access, set limits, and monitor usage without micromanaging. This structure encourages accountability while still supporting autonomy. Team leads gain flexibility, while finance retains control, ensuring subscriptions serve actual needs without bypassing company policies or overspending.

Streamlined budgeting and approvals

One of the major benefits of virtual cards for subscription management is their ability to simplify budget allocation. Cards can be issued with pre-set limits, allowing finance teams to enforce spending policies without delays. This removes the need for repeated approvals and manual tracking, speeding up decisions while maintaining full expense oversight.

How virtual cards simplify subscription payment tracking for businesses

Real-time alerts and notifications

Virtual cards send instant alerts for every transaction, keeping you informed of charges as they happen. These notifications help you detect unusual activity or unexpected billing immediately.

With real-time visibility, your finance team can respond faster, avoid surprises, and maintain better control over recurring payments without relying on delayed bank statements or reports.

Categorization by department, service, or owner

Each virtual card can be tagged by department, service, or individual owner, making it easier to organize and monitor payments. This categorization simplifies tracking and allows you to identify which teams are using which tools.

Over time, you gain valuable insights into subscription usage patterns, helping to reduce waste and optimize spend allocation.

Exportable reports for accounting and auditing

Transaction data from virtual cards can be exported in structured formats for accounting or audit purposes. These reports offer clear, itemized records tied to each subscription, making financial reconciliation faster and more accurate.

With centralized records, audits become smoother and less time-consuming, improving compliance while reducing reporting errors or oversight gaps.

Reduced admin time for finance teams

Using virtual cards for subscription management significantly lowers the manual effort required to track and verify recurring payments.

Since each card is linked to a specific service, there’s no need to sort through complex billing chains. This automation streamlines finance workflows, allowing your team to focus on strategic planning rather than routine follow-ups.

Why your business should switch to Volopay virtual cards for efficient subscription management

Assign virtual cards to individual subscriptions

Volopay’s virtual cards allow you to assign a separate card to each subscription, making it easier to isolate payments. This setup improves tracking, accountability, and budget clarity. It also helps reduce billing confusion by clearly mapping each charge to a specific tool, vendor, or department, eliminating guesswork and simplifying financial reviews.

Auto-lock cards after free trials or renewal dates

You can set virtual cards to automatically lock after a free trial ends or a renewal date passes. This prevents surprise charges from forgotten trials or tools no longer in use. It also ensures only reviewed and approved subscriptions continue, helping you control spending and reduce unnecessary renewals.

Eliminate subscription overlap and redundancies

With each card tied to a specific tool, Volopay makes it easy to identify duplicate services across teams. This helps you eliminate overlapping subscriptions and consolidate where possible. Reducing tool sprawl saves money and improves operational efficiency. It also ensures your teams only pay for what’s actually needed and actively used.

Centralized control panel for all recurring payments

Volopay provides a single dashboard to view and manage every recurring payment. This centralized panel offers real-time visibility into spending across departments and users. You can pause, cancel, or adjust cards as needed, all from one place—streamlining workflows and giving your finance team total control over monthly commitments.

Smart insights to flag underused tools

Volopay’s smart analytics identify tools with low or declining usage, helping you cut down on wasted spend. These insights allow you to evaluate whether a subscription is still needed before the next renewal. With this data, managing SaaS subscriptions becomes more strategic, supporting cost optimization without disrupting productivity.

Alerts for failed, unusual, or duplicate charges

With Volopay's corporate cards, you receive instant notifications if a payment fails, a charge seems suspicious, or a service bills twice. This proactive system reduces the risk of missed renewals or fraud. With faster alerts, you can resolve issues before they escalate, keeping your subscriptions running smoothly and your financial data accurate.

Simplified reconciliation for recurring expenses

Volopay makes reconciliation easier by automatically tagging and categorizing subscription charges. Since each card is tied to a specific service, transaction tracking becomes straightforward. This eliminates manual sorting and reduces errors in your records. Your finance team saves time and ensures that recurring expenses are matched accurately to the right budgets.

How Volopay keeps your subscription payments secure

Volopay issues a distinct virtual card for each subscription, which limits risk by isolating transactions. If one card is compromised, others remain unaffected.

This segmented structure prevents a single breach from impacting your entire payment system, offering an added layer of protection against fraud, misuse, or unauthorized recurring charges.

With Volopay, you can instantly block or cancel any virtual card from your dashboard. This rapid response feature is crucial during suspicious activity or vendor disputes.

Unlike traditional cards, you don’t need to replace everything—only the affected card—minimizing disruption while maintaining complete control over active subscriptions and future payments.

You can assign strict spending limits and usage rules for every virtual card. These controls ensure that no card exceeds its intended budget or duration.

By automatically enforcing restrictions, Volopay helps prevent misuse, accidental overcharges, and unauthorized renewals, safeguarding your financial resources and maintaining accountability at every level.

Volopay allows you to restrict each card to specific vendors or merchant categories. This prevents cards from being used for unrelated or suspicious purchases.

If a charge doesn't match the preset rules, it’s automatically blocked. This proactive control mechanism strengthens security while ensuring that payments stay aligned with business intent.

You receive real-time notifications for every transaction made through Volopay’s virtual cards. This live monitoring enables quick detection of unauthorized charges or billing errors.

This visibility helps you take immediate action when something looks unusual, reducing potential financial damage and enhancing oversight across all recurring payments.

Volopay uses bank-grade encryption protocols and complies with PCI DSS standards to ensure data protection. Every transaction and card detail is securely processed and stored.

These robust security measures prevent data breaches, support regulatory compliance, and provide peace of mind that your subscription payments are handled with the highest level of safety and security.

Bring Volopay to your business

Get started now

FAQs

Yes, Volopay allows you to define custom spending limits for each virtual card, helping you control costs, avoid budget overruns, and ensure every subscription charge stays within approved financial boundaries.

Absolutely. Virtual cards work seamlessly for both monthly and annual subscriptions, allowing you to manage various billing cycles with ease while maintaining full visibility and control over recurring payments.

Volopay instantly alerts you to any irregular charges. You can block or cancel the specific card, preventing further transactions while protecting your business from unexpected fees or vendor billing errors.

Yes, Volopay supports both domestic and international subscription payments, allowing you to manage global vendors, set controls per region, and track expenses centrally, all from one dashboard.

Volopay’s smart analytics identify low-usage and duplicate tools across departments. This helps you eliminate waste, consolidate services, and optimize your overall subscription spend more effectively.

Trusted by finance teams at startups to enterprises.