How to simplify vendor payments with prepaid cards?

In today's fast-paced business world, delayed or inaccurate vendor payments can strain cash flow and damage supplier relationships. Managing these payments manually—without the support of tools like expense management cards, often leads to errors, missed deadlines, and a lack of visibility into spending. This can impact trust and future collaboration with key vendors.

Efficient vendor payment processes not only help maintain strong supplier ties but also support better budgeting and operational control. Businesses looking to stay competitive need streamlined, tech-driven solutions like petty cash cards that deliver prepaid card benefits like real-time tracking, controlled spending, and reduced administrative effort.

That’s where Volopay prepaid cards come in—offering a smarter way to simplify vendor payments while improving financial efficiency and boosting vendor satisfaction.

Challenges of traditional vendor payments

Time-consuming manual work

Traditional vendor payments involve manual invoice entry, data matching, and approval routing—all of which consume valuable time and resources.

Finance teams often struggle to keep up with high volumes, leading to bottlenecks. These outdated, manual processes reduce productivity and prevent businesses from focusing on more strategic initiatives that drive growth and efficiency.

Payment delays and late fees

Late vendor payments can damage business credibility and strain supplier relationships. Missed due dates often result in late fees and loss of early payment discounts.

Vendors may prioritize clients with faster processing, making delays a competitive disadvantage. Timely payments are essential for maintaining trust and uninterrupted supply chains.

Fraud and error risks

Manual payment methods expose businesses to human errors and fraud. Duplicate payments, incorrect amounts, or unauthorized approvals can go unnoticed without automated checks.

These risks can lead to financial losses and audit issues. A secure, automated solution like Volopay prepaid cards helps safeguard business transactions with better controls.

Lack of spending visibility

Without real-time tracking, businesses face difficulty monitoring vendor payments and overall cash outflow. Fragmented records and paper-based systems limit insight into spending patterns.

This lack of visibility hinders informed decision-making. Companies aiming to simplify vendor payments need transparent systems that offer clear data on every transaction.

How Volopay prepaid cards simplify vendor payments

Virtual cards for instant payments

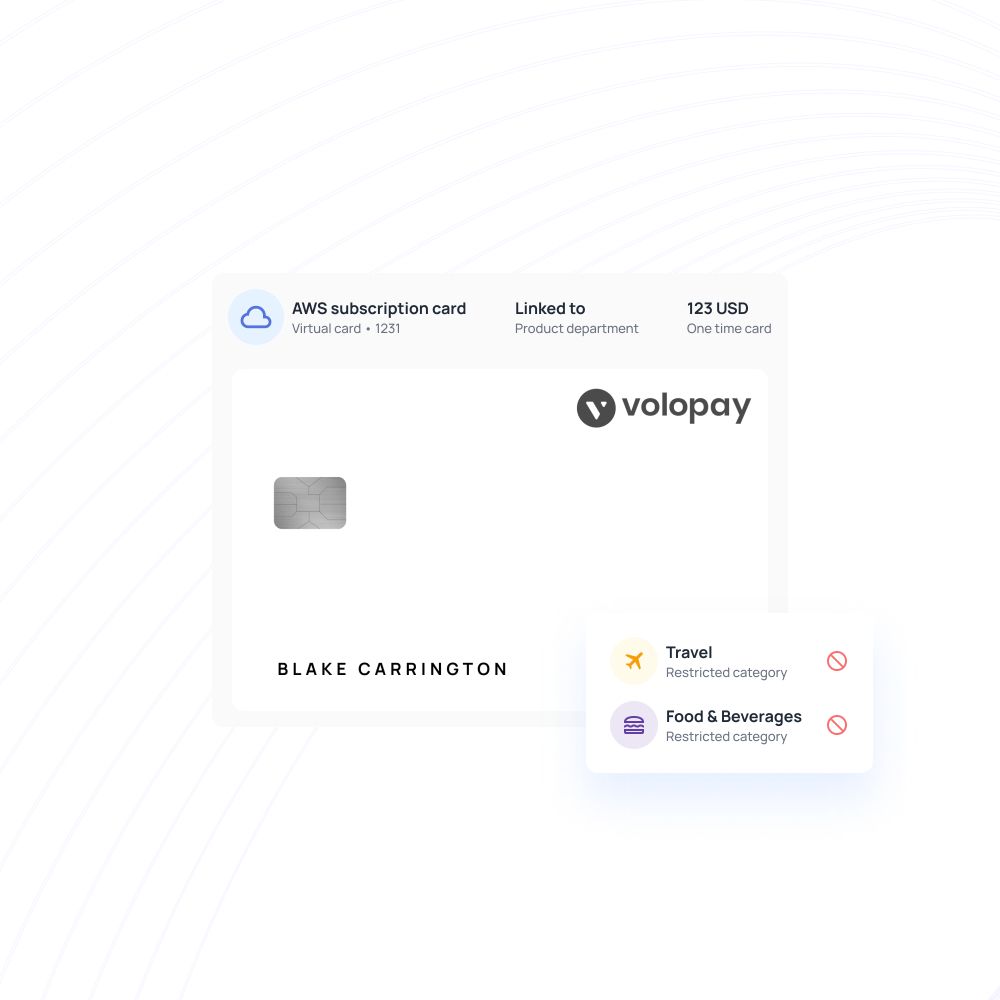

With Volopay prepaid cards, businesses can instantly create virtual cards for each vendor, ensuring secure and dedicated payment channels. These cards eliminate the need for sharing company-wide card details, reducing risk.

Vendor-specific cards streamline vendor payments while enabling faster processing, improving vendor relationships and operational efficiency across all departments handling procurement and finance.

Custom spending limits

Companies can assign customized budgets to each virtual card, ensuring better control over vendor-related expenses. These limits help prevent overspending and keep procurement aligned with financial plans.

By setting defined thresholds per vendor, businesses can optimize cost management and avoid unapproved purchases, creating a smarter way to manage and monitor outgoing payments. It also enforces internal compliance policies, reducing the likelihood of maverick spending.

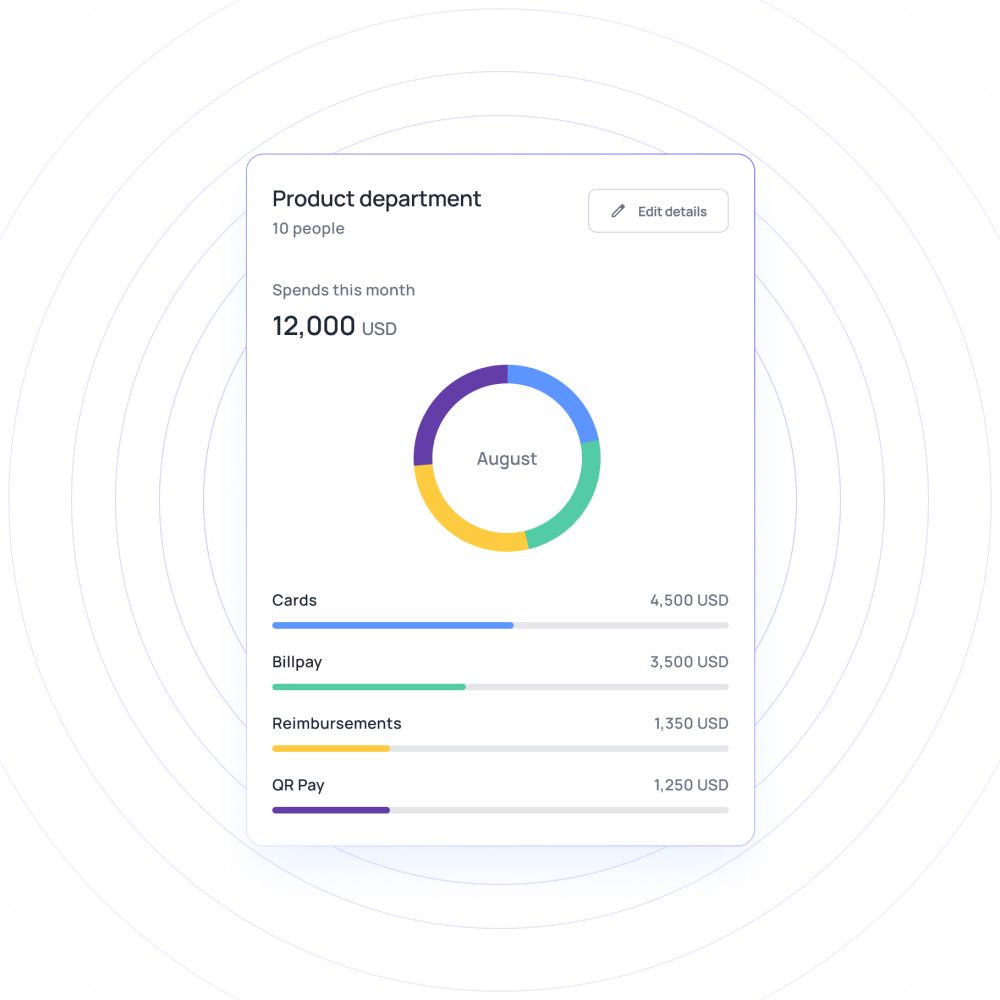

Real-time transaction tracking

Volopay prepaid cards offer complete real-time visibility into every transaction, providing live updates on vendor payments. This transparency empowers finance teams to monitor spending patterns, verify charges instantly, and resolve discrepancies faster.

Enhanced tracking reduces the risk of errors and supports better forecasting, helping businesses maintain tighter control over their budgets. With centralized dashboards, teams can generate audit-ready reports effortlessly for financial reviews.

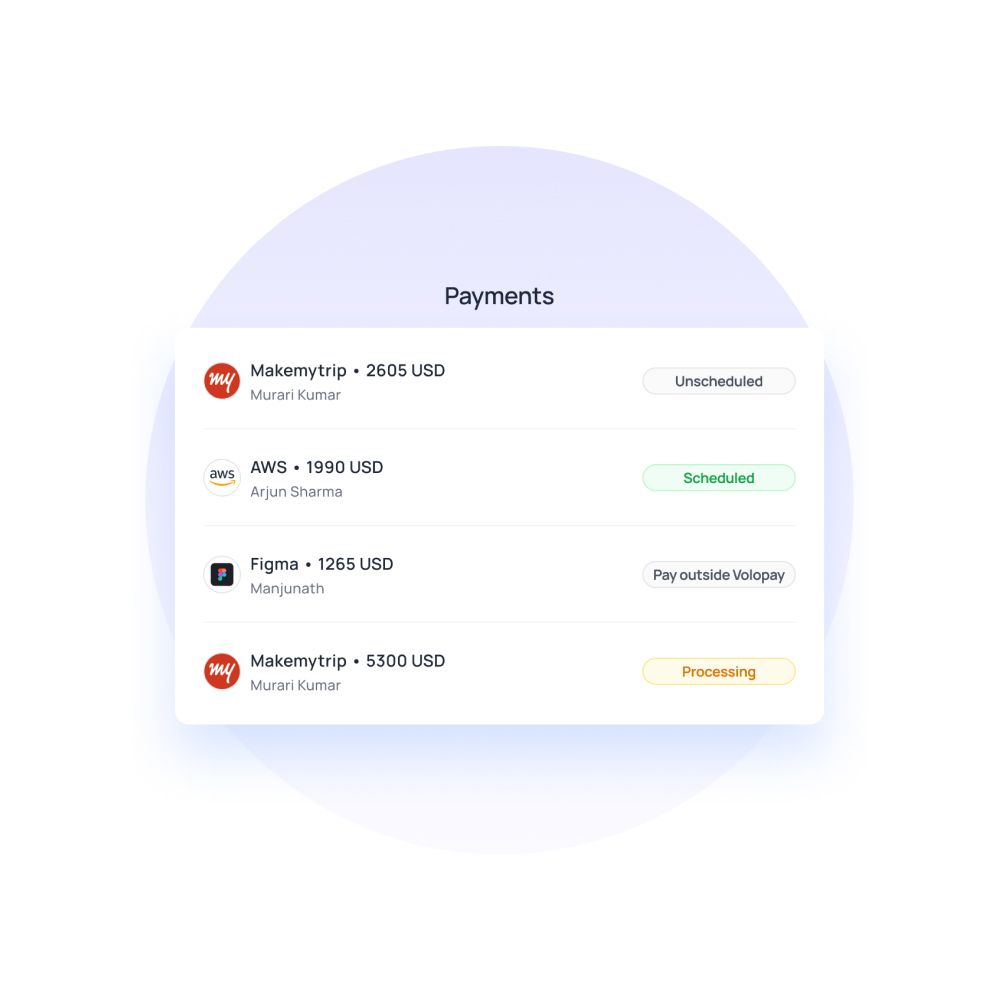

Automated payment scheduling

Recurring vendor payments can be scheduled automatically with Volopay, reducing manual effort and eliminating missed deadlines. Businesses can set specific dates for payments, ensuring consistency and reliability.

This automation not only saves time but also boosts vendor trust by delivering payments on schedule, every time—helping to simplify vendor payments effectively. It also reduces late payment penalties and improves the accuracy of cash flow planning.

Multi-currency support

Volopay's corporate cards support payments in multiple currencies, making it easier to pay international vendors without conversion hassles. Businesses can manage vendor payments globally while avoiding hidden fees and delays.

This feature is especially useful for companies working with overseas suppliers, helping maintain smooth operations and strong relationships across borders. It simplifies global procurement by consolidating all transactions within a single, unified platform.

Benefits of using Volopay prepaid cards for vendor payments

Faster payment processing

Volopay prepaid cards enable immediate payments, eliminating the delays of traditional banking methods. Transactions are processed in real time, allowing vendors to receive funds quickly.

This speeds up order fulfillment and project execution. Fast processing also helps businesses respond swiftly to urgent procurement needs and maintain uninterrupted supply chains.

Enhanced security

Each card comes with built-in controls like spending limits, usage restrictions, and instant deactivation. These features help prevent unauthorized access and reduce the risk of fraud.

Sensitive financial data stays protected through encryption and tokenization. Businesses gain peace of mind knowing their vendor payments are secure and compliant.

Improved vendor relationships

Timely and reliable payments show vendors that your business values their service. This strengthens trust and encourages long-term partnerships.

Consistent payment behavior also increases your credibility as a preferred client. Better relationships can lead to more favorable contract terms and priority service from vendors.

Reduced administrative work

Automated workflows cut down on time spent approving, recording, and reconciling payments. Finance teams no longer need to handle paper invoices or chase down payment confirmations.

This streamlining allows staff to focus on higher-value tasks. The result is increased productivity and fewer chances of manual errors.

Cost savings

Volopay prepaid cards help businesses save through reduced transaction fees and fewer penalties from late payments. Automated payments also unlock early payment discounts offered by vendors.

By avoiding currency conversion charges on international transactions, global operations become more cost-efficient. Every dollar saved supports healthier financial performance.

Step-by-step guide to paying vendors with Volopay prepaid cards

Set up a Volopay account

To start, sign up for a Volopay business account by submitting all the required basic company information and completing the necessary steps to verify your official business credentials.

Once approved, your account will be activated, and you can begin issuing Volopay prepaid cards instantly.

The onboarding process is fast and secure, allowing your business to begin managing vendor payments more efficiently from day one.

Create vendor-specific cards

After setup, generate virtual prepaid cards for each vendor to ensure secure, purpose-specific transactions.

Assigning unique cards to individual vendors improves tracking and reduces the risk of fraud. These cards can be reused or paused anytime, giving you full control.

It also simplifies audits by keeping vendor-related expenses separate and clearly identifiable. You can add custom labels or notes to each card, making vendor management more organized.

Load funds and set limits

Add funds to your Volopay wallet via linked bank accounts, and allocate budgets to individual virtual cards.

Set spending limits based on vendor contracts or project needs. These controls prevent overspending and ensure financial discipline.

Limits can be adjusted instantly as business priorities change, offering complete flexibility. Notifications alert you when limits are reached, ensuring proactive budget control.

Make and schedule payments

Use the virtual cards to pay vendors directly through their portals or by entering card details in payment links.

Schedule recurring vendor payments for ongoing contracts to avoid delays. This automated system improves payment consistency.

It also frees up finance teams from repetitive tasks, reducing the chances of human error. Vendors benefit from prompt payments, strengthening long-term partnerships.

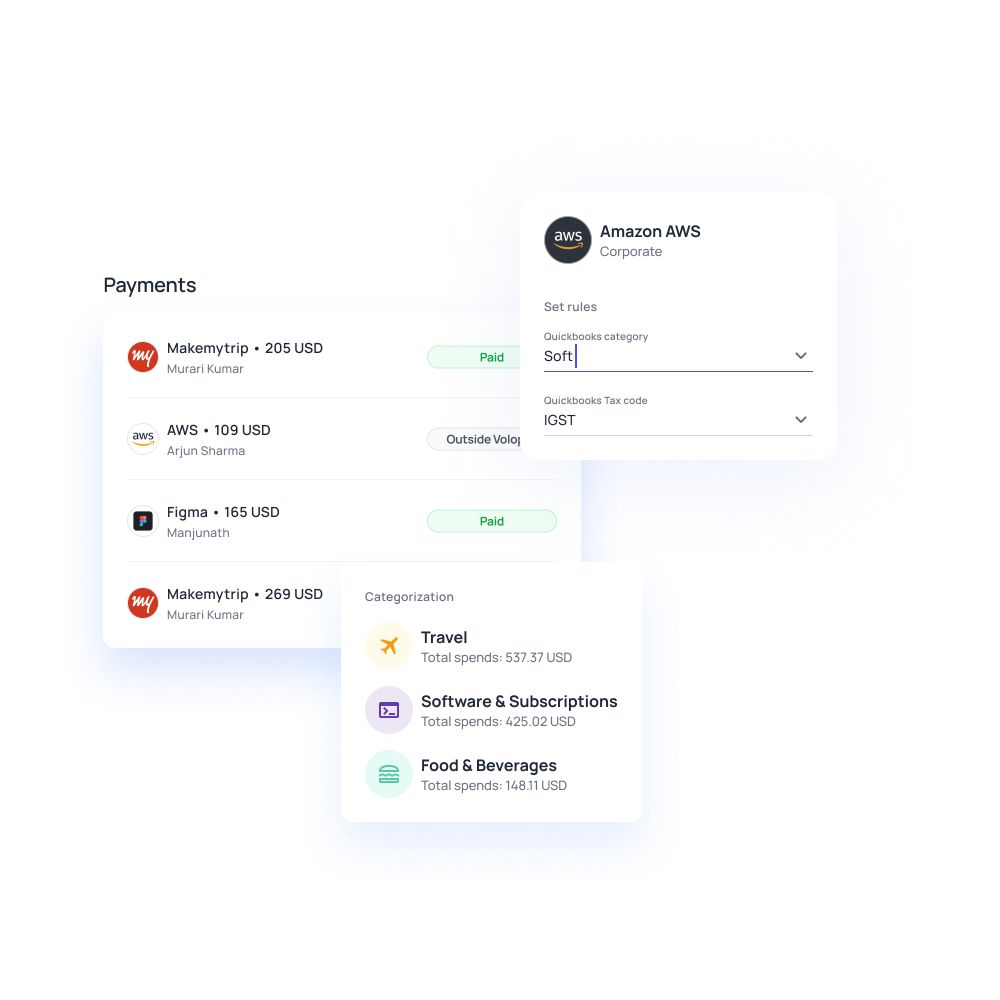

Track and reconcile payments

Monitor every transaction through Volopay’s real-time dashboard, which provides detailed visibility into card usage. Export data for accounting and reconciliation without manual effort.

Each payment is recorded with timestamps and vendor tags. This centralized platform helps maintain accurate financial records and supports faster month-end closing.

It also reduces the need for back-and-forth communication between the members of the finance and procurement teams.

Analyze budgets and spends

Leverage Volopay’s analytics and reporting tools to review vendor spending trends over time.

Identify high-cost vendors, underutilized services, or areas for cost savings. Use these insights to renegotiate contracts, reallocate budgets, or consolidate vendors.

This data-driven approach enhances business financial strategy and improves ROI on vendor relationships. It empowers key decision-makers with actionable intelligence to support long-term business growth.

Volopay’s key features for vendor payments

Bill pay automation

Volopay allows businesses to schedule and automate recurring vendor payments, ensuring timely and hassle-free transactions. This feature reduces manual effort and eliminates the risk of missed or late payments.

By automating the payment process, businesses can maintain smooth cash flow and ensure consistency in managing Volopay prepaid cards.

Multi-level approvals

Volopay’s multi-level approval workflows ensure secure and compliant vendor payments. Payments go through customizable approval hierarchies, ensuring each transaction meets company policies and is authorized by the correct parties.

This adds a layer of oversight and control, preventing unauthorized or incorrect payments while also speeding up the approval process.

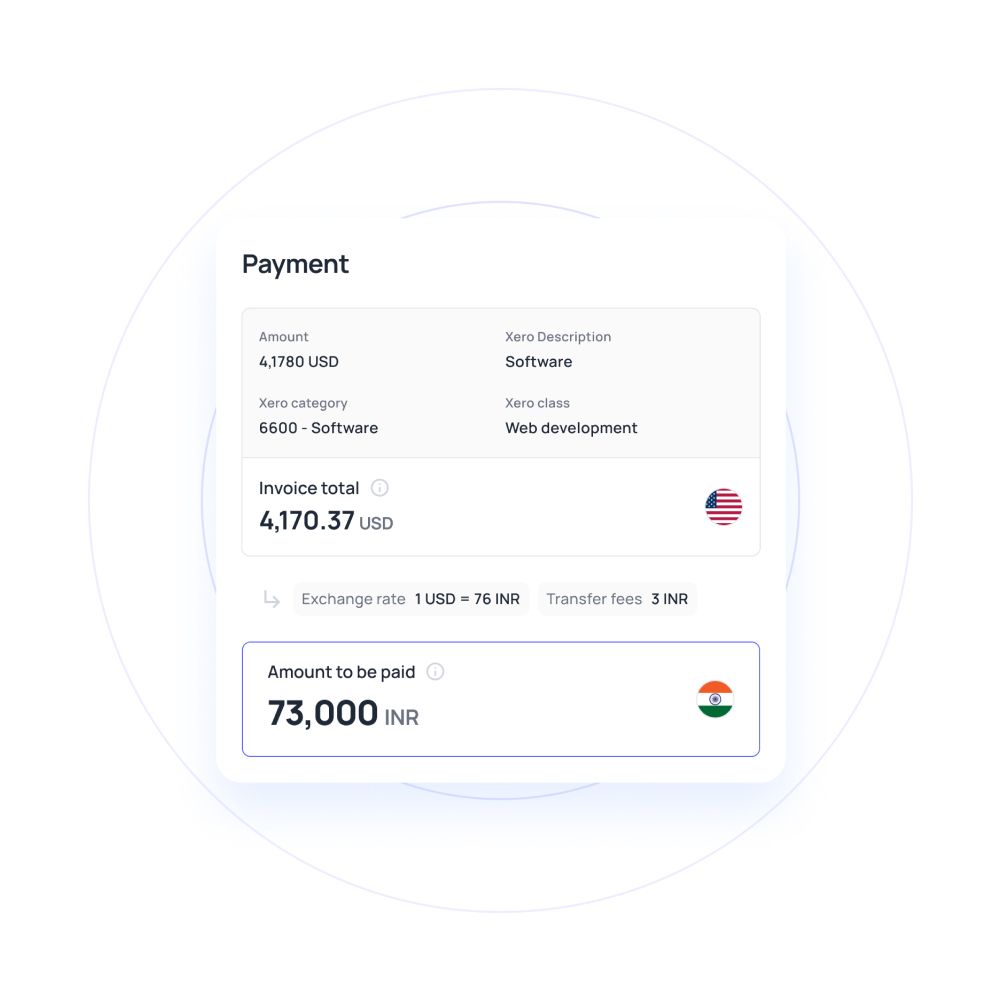

Accounting integrations

Volopay integrates seamlessly with popular accounting software like QuickBooks, Xero, and others, ensuring smooth syncing of transaction data. This integration allows businesses to keep their financial records up to date with ease.

It helps automate reconciliation processes, providing accurate reports for faster decision-making, and making it easier to track vendor payments.

Real-time analytics

Volopay’s real-time dashboards provide insights into vendor payments, enabling businesses to track spending and analyze payment patterns instantly. These analytics help businesses monitor their financial health and optimize vendor payment strategies.

By providing a clear overview of cash flow, companies can make informed decisions and improve their budgeting processes.

Global payment capabilities

With Volopay, businesses can make payments to international vendors using SWIFT and multi-currency options, enabling seamless business money transfers. This feature streamlines global transactions and reduces the complexity of cross-border payments.

By simplifying vendor payments across different currencies, businesses can ensure timely and efficient transactions without dealing with multiple payment gateways.

Comparing Volopay prepaid cards to traditional payment methods

Speed and efficiency

Volopay prepaid cards offer instant payments, providing immediate access to funds for vendors. In contrast, traditional methods like wire transfers can take days to process, delaying transactions.

This speed enables businesses to simplify vendor payments and maintain smoother operations, ensuring vendors are paid promptly without delay.

Security and control

Volopay cards come with built-in fraud protection, such as customizable spending limits and instant card freezing. Traditional methods like checks, on the other hand, are vulnerable to theft, alteration, and fraud.

With prepaid debit cards, businesses maintain more control over payments and reduce security risks that come with physical transactions.

Cost effectiveness

Volopay prepaid cards are more cost-effective, with lower transaction fees compared to expensive wire transfer charges. Wire transfers can incur high fees, especially for international payments, while prepaid cards streamline the process, reducing costs.

This helps businesses optimize financial efficiency and spend less on processing payments.

Ease of tracking

Volopay offers real-time dashboards to track every payment instantly, providing complete visibility into spending. Traditional methods require manual tracking and reconciling of checks or wire transfers, which can lead to errors and delays.

With real-time tracking, businesses can quickly identify discrepancies and ensure accurate financial records.

Best practices for managing vendor payments with Volopay

1. Automate recurring payments

Schedule regular vendor payouts using Volopay’s automated system and prepaid petty cash cards. This ensures timely payments, eliminates manual intervention, and reduces the risk of late fees. By combining automation with prepaid petty cash cards, you enhance efficiency, maintain tighter control over spending, and enable predictable cash flow management.

2. Set clear spending policies

Establish clear rules for using vendor-specific cards to avoid overspending. Define spending limits and usage guidelines to ensure compliance with your company’s financial goals. This policy helps maintain control over expenses while ensuring vendors are paid correctly.

3. Monitor transactions regularly

Review your Volopay dashboard weekly to track and manage vendor payments. Regular monitoring helps identify any discrepancies or unauthorized transactions early, ensuring financial accuracy and transparency. It also ensures payments align with budgets and business objectives.

4. Communicate with vendors

Keep vendors informed about payment schedules and any changes to payment terms. Effective communication builds trust and ensures that vendors are aware of when to expect payments, reducing the risk of misunderstandings or delays.

5. Leverage integrations

Sync Volopay with your accounting tools like QuickBooks or Xero to streamline financial operations. This integration automates data flow between platforms, reducing manual entry and ensuring accurate reporting. It simplifies financial management and helps maintain up-to-date records of all transactions.

FAQs about Volopay's prepaid cards

Volopay prepaid cards are created for each vendor, allowing businesses to load funds and set limits for payments. Payments can be made instantly via card details or through payment portals, simplifying the payment process for both businesses and vendors.

Yes, Volopay cards are highly secure, featuring encryption and robust fraud protection mechanisms. Cards can be frozen instantly, and spending limits can be customized, ensuring that vendor payments are protected from unauthorized transactions and fraud.

Volopay cards support multi-currency transactions and are compatible with SWIFT for global payments. This allows businesses to manage international vendor payments seamlessly, eliminating the complexity of cross-border transactions and ensuring timely payments in various currencies.

Volopay integrates with popular accounting software like QuickBooks, NetSuite, and Xero. This synchronization ensures that payment data flows directly into your accounting system, streamlining reconciliation and reducing manual data entry, making financial management more efficient.

Volopay offers competitive rates with no hidden fees. There are no charges for card issuance or account maintenance, making it a cost-effective solution for managing vendor payments while avoiding the high fees often associated with traditional payment methods.