Prepaid corporate card to streamline spending

Managing business expenses can be a headache, but prepaid corporate cards offer a powerful solution to streamline spending, automate expense controls, and simplify accounting. With Volopay’s prepaid corporate cards, you gain unparalleled control over your company’s finances, whether you’re a startup or a large enterprise.

These cards eliminate overspending risks, enhance transparency, and integrate seamlessly with your accounting systems, saving you time and resources. Discover how Volopay’s innovative platform transforms spend management for US businesses, ensuring compliance, security, and efficiency.

Understanding prepaid corporate cards

What is a prepaid corporate card?

A prepaid corporate card, often referred to as a reloadable prepaid cards, is a payment tool preloaded with funds, designed for controlled employee spending. Unlike traditional credit cards, you load only what you authorize, ensuring departments marketing, IT, or operations spend within budget.

Issue cards instantly via a digital platform like Volopay, assign them to employees or projects, and track every transaction in real time for seamless budget management.

Fund flow vs credit exposure

Prepaid corporate cards carry zero debt risk. You preload funds, so spending is limited to the available balance no interest, no credit exposure. This structure protects your business from unexpected liabilities and simplifies financial oversight, making it ideal for teams managing travel, subscriptions, or vendor payments without the complexities of credit-based systems.

Real-world use cases

From business travel to vendor payments, prepaid corporate cards shine. Equip your sales team with cards for client dinners, marketing for ad campaigns, or IT for software subscriptions.

For example, a marketing manager can allocate $5,000 for a trade show, ensuring no overspending while tracking every expense in real time, simplifying reconciliations.

Key benefits of a prepaid corporate card for companies

Corporate prepaid cards eliminate surprise charges by restricting spending to preloaded amounts.

Set custom limits per card to prevent overspending. Advanced fraud protection, like instant card freezing, ensures security if a card is lost or misused, safeguarding your business finances from unauthorized transactions.

Unlike credit cards, corporate prepaid cards don't accrue debt. You fund them in advance, so there's no risk of interest charges or unpaid balances, giving you peace of mind and predictable budgeting.

This approach eliminates financial uncertainty and helps maintain healthy cash flow management.

Prepaid corporate cards are linked to advanced dashboards that provide real-time visibility into budget allocations and transactions. As soon as a card is used to make a payment, alerts allow managers and admins to gain insight into the spend without needing to wait for a statement.

This granular oversight prevents overspending, out-of-policy spending, as well as duplicate payments.

Volopay’s prepaid corporate card - The modern choice

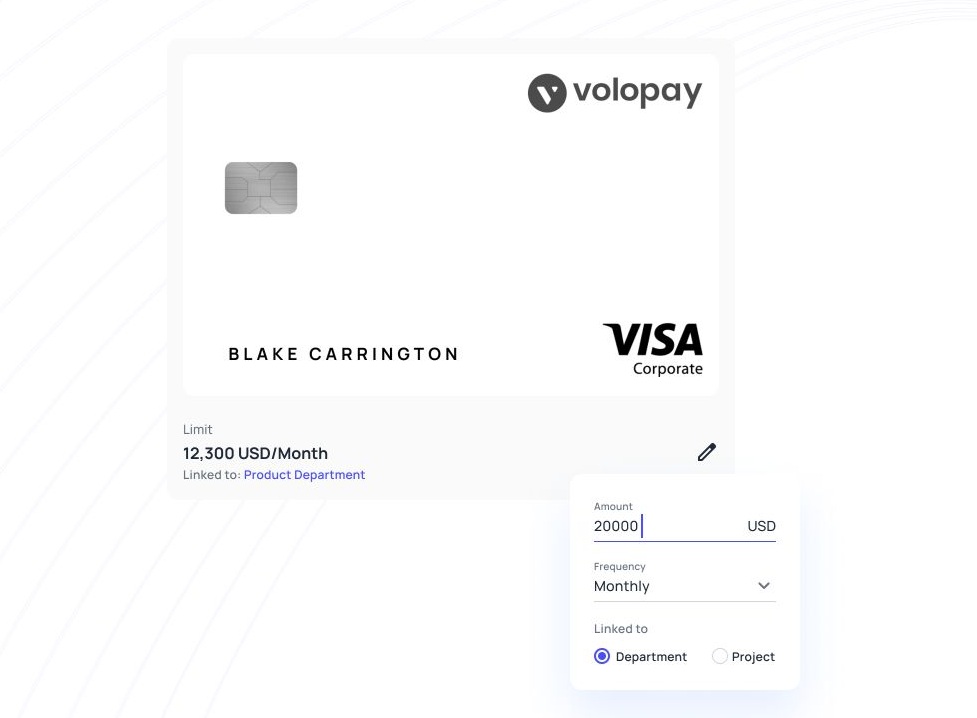

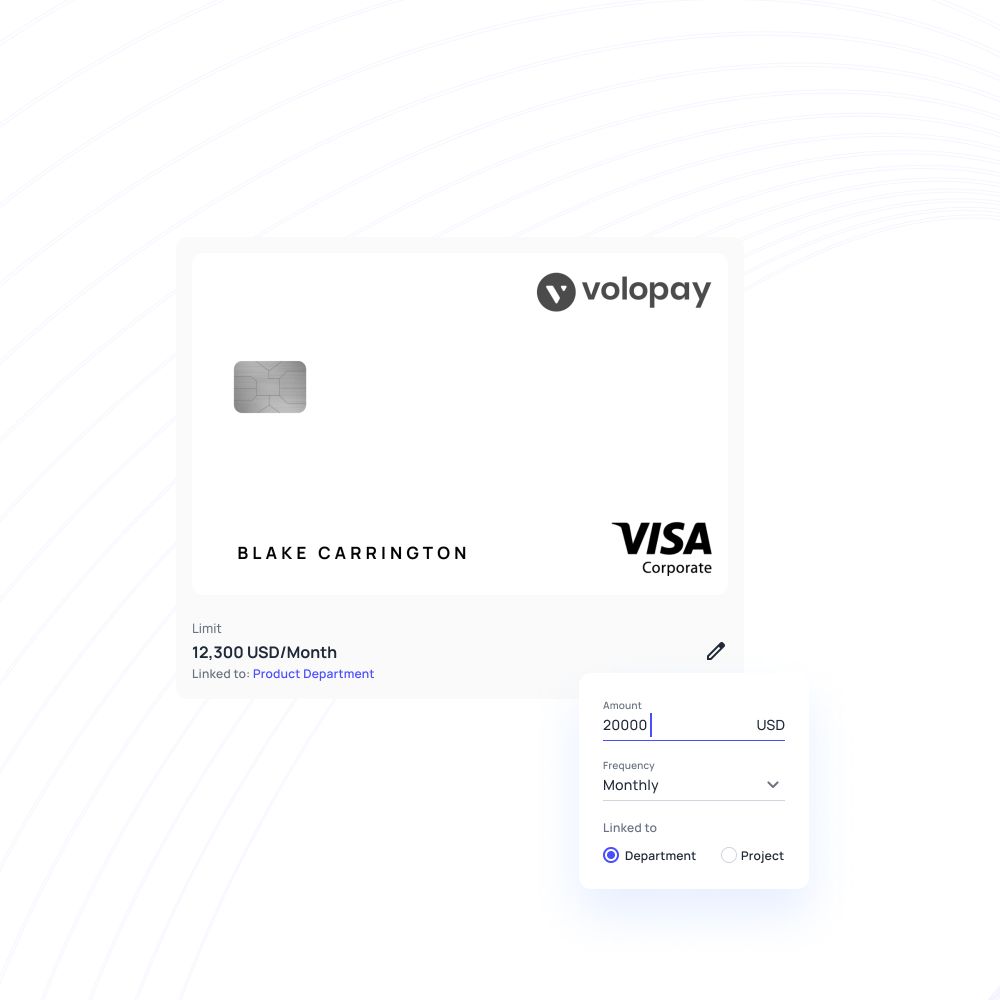

Custom spend limits and merchant controls

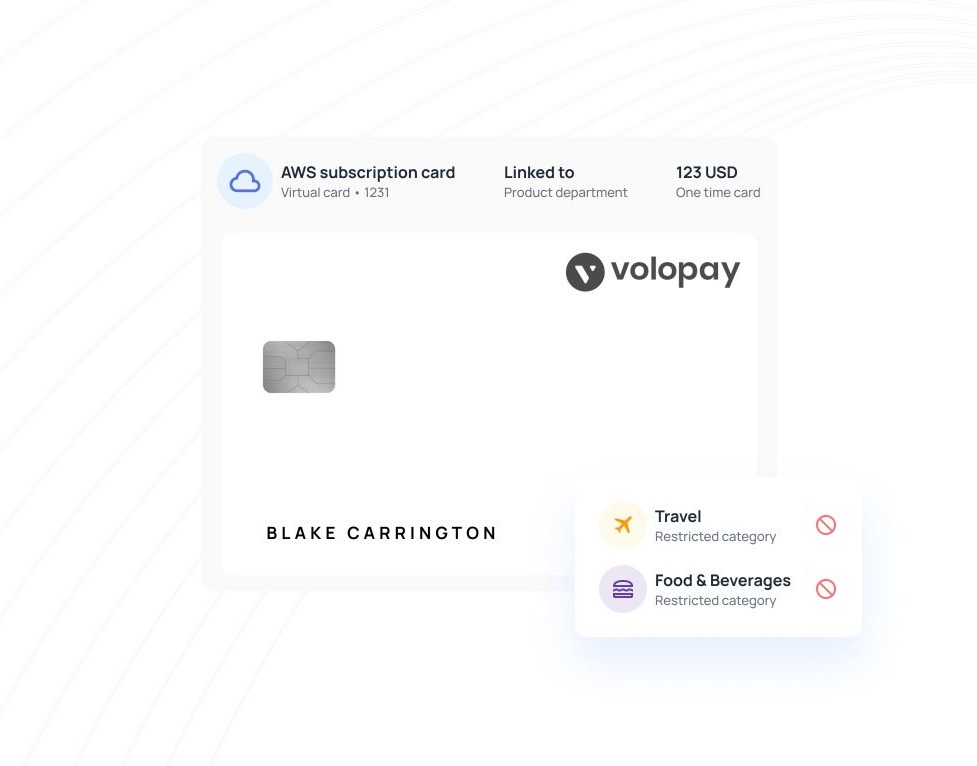

Set per-card or per-merchant spending limits to enforce budgets effectively. Restrict corporate prepaid cards to specific vendors or categories like software or travel ensuring compliance with your financial policies without micromanaging employees.

These granular controls provide flexibility while maintaining strict oversight over company expenditures and preventing unauthorized spending.

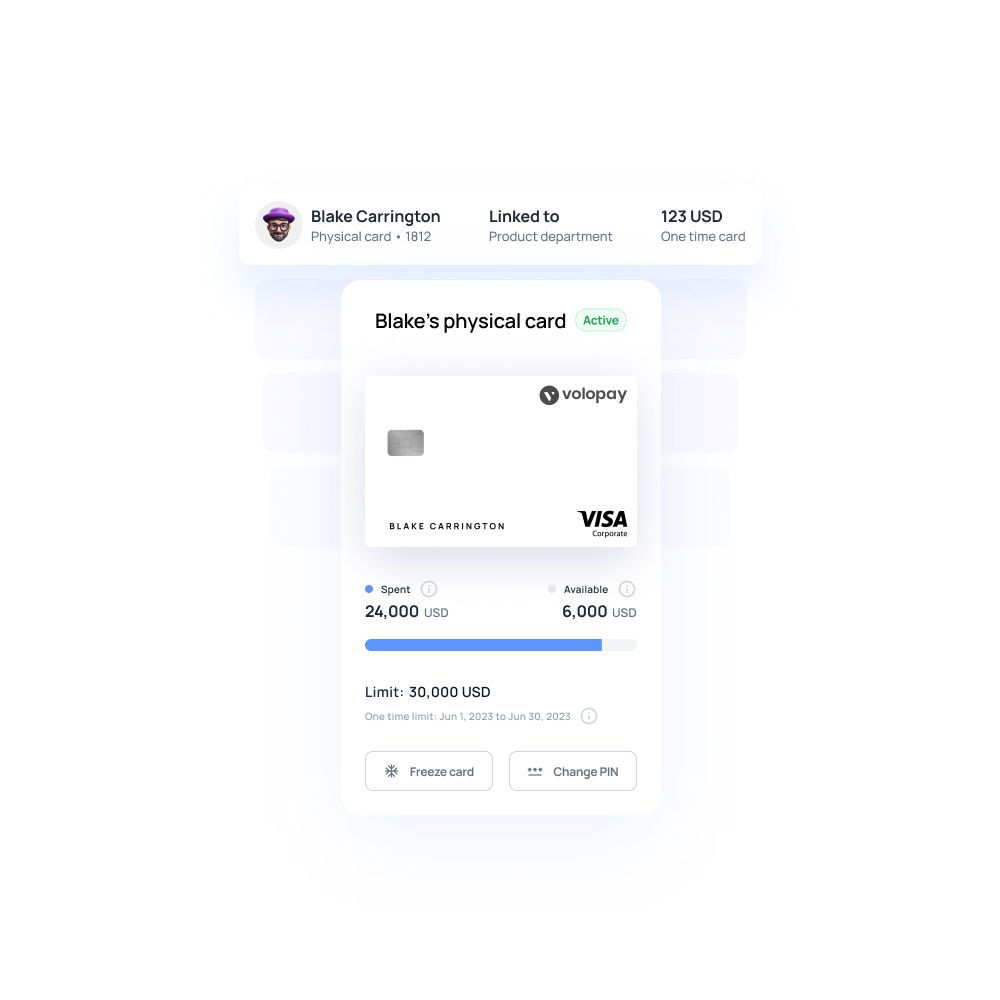

Instant virtual & physical card issuance

Issue virtual or physical prepaid corporate cards directly from Volopay's dashboard in minutes. Assign them to employees, vendors, or specific projects, enabling immediate use for online subscriptions or in-person purchases like travel expenses.

This streamlined process eliminates waiting periods and administrative delays, ensuring your team can make necessary purchases without disruption to business operations.

Immediate freeze, reload, or revoke

Lost card? Freeze or revoke prepaid corporate cards instantly via Volopay's platform.

Reload funds as needed to keep operations running smoothly, all while maintaining complete control over every card's activity and transaction history for enhanced security management.

Get the perfect prepaid card for your business!

Built-in security & compliance for prepaid corporate cards

PCI‑DSS & SOC 2 certified infrastructure

Volopay's platform is PCI-DSS and SOC 2 compliant, ensuring secure data storage and transactions for corporate prepaid cards.

Your financial data is protected with industry-standard encryption and rigorous security protocols that meet the highest compliance standards. This comprehensive security framework safeguards sensitive payment information and maintains data integrity across all card transactions.

Instant fraud alerts & card locks

Receive real-time alerts for suspicious activity on your prepaid corporate cards. If a card is compromised, lock or freeze it instantly from the Volopay dashboard, preventing unauthorized use and protecting your funds.

Advanced monitoring systems detect unusual spending patterns and immediately notify administrators of potential security threats.

Role-based permissions

Assign role-based access to control who can issue, load, or spend on corporate prepaid cards. Admins can set specific permissions for finance teams or department leads, ensuring compliance and accountability across your organization while maintaining operational efficiency.

Approval roles can also be created to determine who has the authority to approve payments and issue cards.

Scale from startups to enterprise with prepaid corporate cards

Startups stay agile and in control

Startups can issue corporate prepaid cards without credit checks, enabling quick setup and controlled spending. Volopay's platform lets you allocate budgets for ad campaigns or travel without bureaucratic delays.

This streamlined approach allows emerging businesses to maintain financial control while moving at the pace their growth demands, ensuring cash flow remains predictable.

SMEs gain budget visibility & efficiencies

Small businesses benefit from real-time tracking and automated reporting with prepaid corporate cards. Monitor team spending per project or department, reducing administrative overhead and ensuring every expense aligns with your budget.

Enhanced visibility eliminates manual expense reporting while providing actionable insights for better financial planning.

Enterprises need control and audit trails

For large enterprises, Volopay offers multi-level approval workflows and detailed analytics for corporate prepaid cards.

This infrastructure allows companies to support hundreds of users with compliance-ready audit trails, ensuring transparency and regulatory adherence across complex organizational structures.

Volopay's prepaid corporate cards: Redefining company spend management

Tailored prepaid cards for every use case

Issue corporate prepaid cards for specific teams, projects, or vendors with custom limits, expiry dates, and merchant controls. For example, create a card for a marketing campaign with a $10,000 limit, restricted to ad platforms, ensuring precise budget adherence.

These tailored solutions eliminate overspending while providing teams the autonomy they need to execute projects efficiently and maintain operational momentum.

Subscription & vendor payment automation

Automate recurring vendor or subscription payments with Volopay's prepaid corporate cards. Schedule payments for SaaS tools or suppliers, eliminating missed invoices and late fees while streamlining accounts payable processes.

This automation reduces administrative burden and ensures consistent cash flow management while maintaining complete visibility over recurring expenses.

Unlimited virtual cards for team autonomy

Generate unlimited virtual corporate prepaid cards for specific vendors, tools, or campaigns. Each card has unique rules and balances, empowering teams while maintaining strict control over online spending.

Virtual cards offer enhanced security for digital transactions and can be instantly created or deactivated as business needs change.

Approval workflows built for compliance

Set up multi-step approval chains with up to five levels of approvers for prepaid corporate cards. Policy triggers ensure every top-up or spend complies with your financial standards, reducing fraud and errors while maintaining regulatory compliance across all departments.

Approvals can also be made on the go, which prevents delays in making payments.

Real-time analytics on prepaid spend

Volopay's live dashboards provide comprehensive spend trends, card usage, and budget variance data.

These dashboards allow teams to make data-driven decisions without manual updates, optimizing financial strategies across departments with actionable insights.

Bring Volopay to your business

Get started now

FAQs about reloadable prepaid cards

Yes, Volopay lets you set per-card spending limits, merchant restrictions, and category rules to align with your budget and policies.

Absolutely, schedule recurring payments for vendors or subscriptions, automating accounts payable and avoiding late fees.

Volopay offers both virtual cards for online payments and physical cards for in-person transactions like travel or client meetings.

Volopay’s cards are PCI-DSS and SOC 2 compliant, with real-time fraud alerts and instant freeze options for maximum security.

Load funds instantly via Volopay’s dashboard or set auto-reload triggers to ensure uninterrupted spending for employees or projects.