How virtual corporate cards improve business efficiency?

Virtual payment cards are the most efficient, new-gen tools that make online payments a breeze for companies. With the help of virtual cards, you can control and monitor the way your company spends money online. You can have as many virtual cards as you want and allocate them to every online expenditure of your business.

A virtual card is a prepaid card that will come with a preset budget and carry a card number and CVV, just like a physical card, except that you won’t have a card here but only the particulars.

Let’s say that your company has an online subscription to a software tool. You can create a virtual card, assign a budget, and pay using this every month and it serves many other purposes like this.

Perks of using virtual cards for B2B payments

Better savings

While spending money online, overspending can sneak in ways you wouldn’t expect. Virtual cards let you set budgets for each one of them you create. Budget limits will make sure you never exceed the intended amount. Virtual payment cards are less expensive than other conventional payment methods like checks and physical cards and bear zero maintenance costs.

Budgetary benefits of virtual cards

Virtual cards let you set budgets for each card. Also, you can set approvers if you want to increase the budget or add more money to the account. Budget control is not just money-saving but also gives superior control to the finance team over budgeting and controlling expenses.

Accounts payable without physical touchpoints

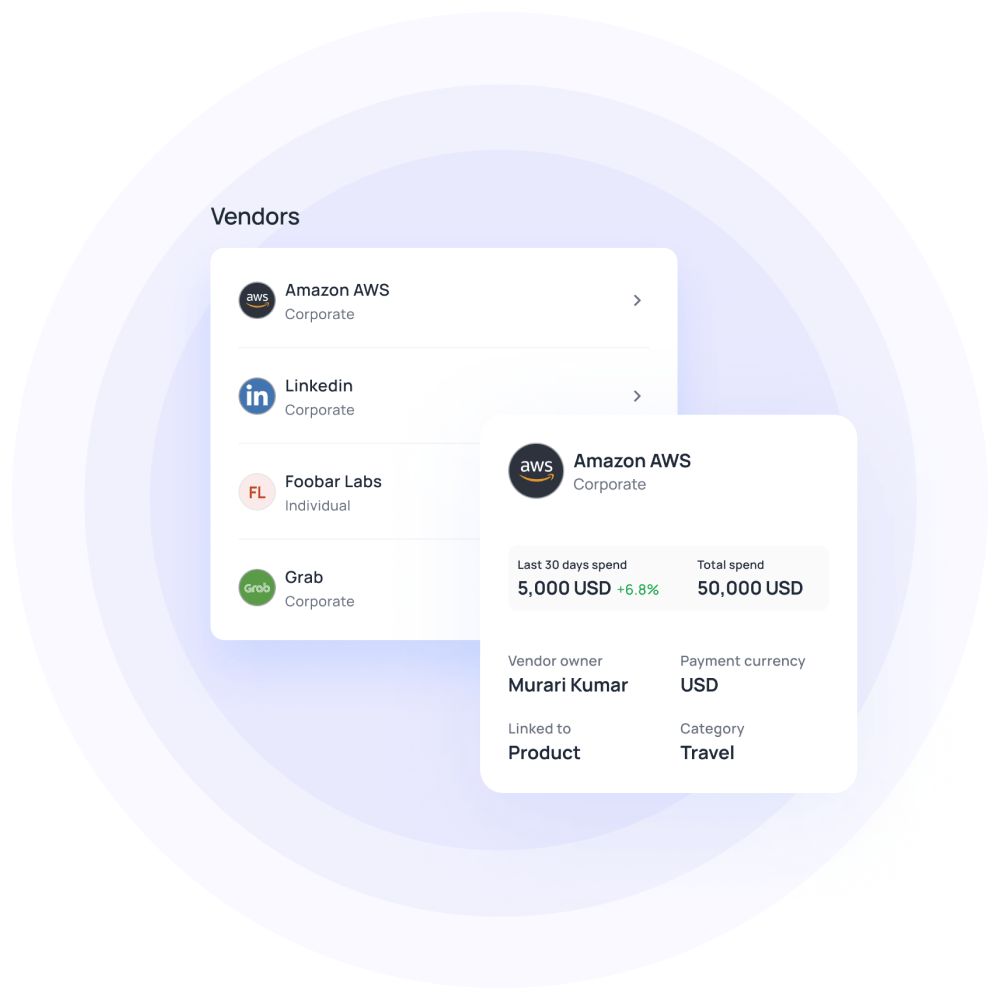

Your accounts payable team is going to love processing invoices without the presence of messy papers. Introducing digital solutions like a virtual card payment program will automate the whole accounts payable automation process end to end. Virtual cards streamline vendor and subscription payments and let them operate without interruption. Subscription management has never been this painless as you can use virtual cards to handle them, whether it’s one-time or recurring fees.

Home office equipment for employees

With changing workforce styles and work-from-home becoming more prominent, offices are investing money to support their employees in setting up makeshift offices at their homes. But it ends up being a frustrating experience for employees to contact the HR and finance team back and forth for funds disbursement. Assigning a virtual card can smoothen the situation and allow employees to get an ergonomic and cozy work-from-home setup.

Employee perks

It’s an arduous task for employees to get reimbursements for professional trips and expenses. They have to submit their bills, wait for the team to approve, and get their money back. While this favors the company to keep track of their accounts payable, employees' burden increases by heaps. Providing virtual cards can avoid this never-ending process and let employees effortlessly enjoy perks and team lunches, not to mention business trips.

Scale your business efficiency to a new level with Volopay cards

Ensure business continuity with virtual cards

Buying defined preferences

When you process a payment to your vendor, The most common B2B payment modes are digital solutions like ACH wire transfer or payment through online applications like Google Pay, Swipe, or physical cards. They start moving towards digital payment solutions because of how transparent it is.

You can track everything here as you have a rock-solid proof of who received the payment, how much, and when. Virtual payments cards are also one of these sought-after solutions that vendors prefer. Rest assured your card solution will only promote business continuity.

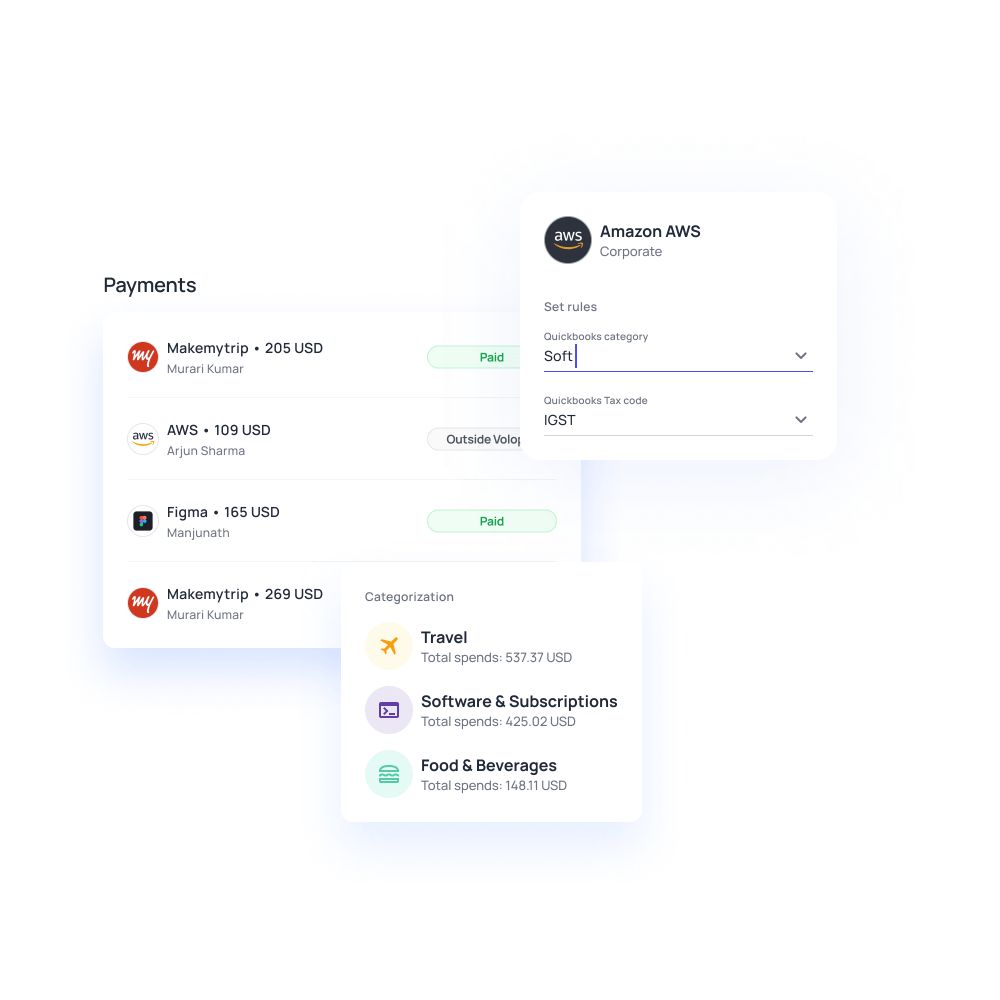

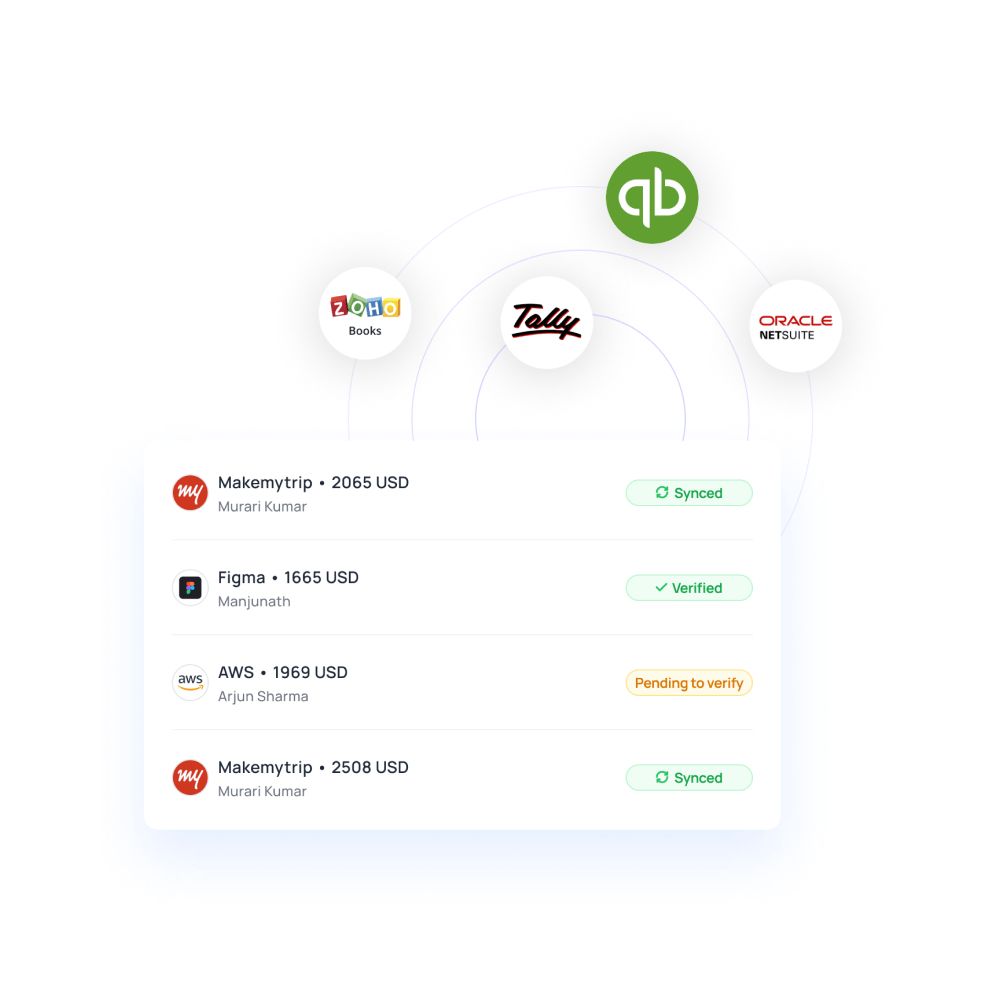

Easy connection with ERPs

In this fast-paced business world, you need accounting solutions that are end to end. Your software should do everything from pulling and extracting data right off the invoice to reconciling the settlement onto bank records. At the end of the day, the finance team has to compute the expenses and cross-verify receipts and invoices.

But if your card management system is smart enough to update manually or automatically with your bank records, you get the end-to-end solution you intended to pay and that’s how automation can set your business off like a well-oiled machine without any halts.

API access

Companies use bookkeeping software on a daily basis to take full advantage of automation, they like to use accounting software that can integrate well with other software. After making a card transaction through virtual cards, updating and balancing the records is required to avoid making wrong computations.

However, having a well-built virtual card payment program can do away with this extra load and automatically sync with APIs (application programming interface). Cross functionality between two different applications will reduce manual labor.

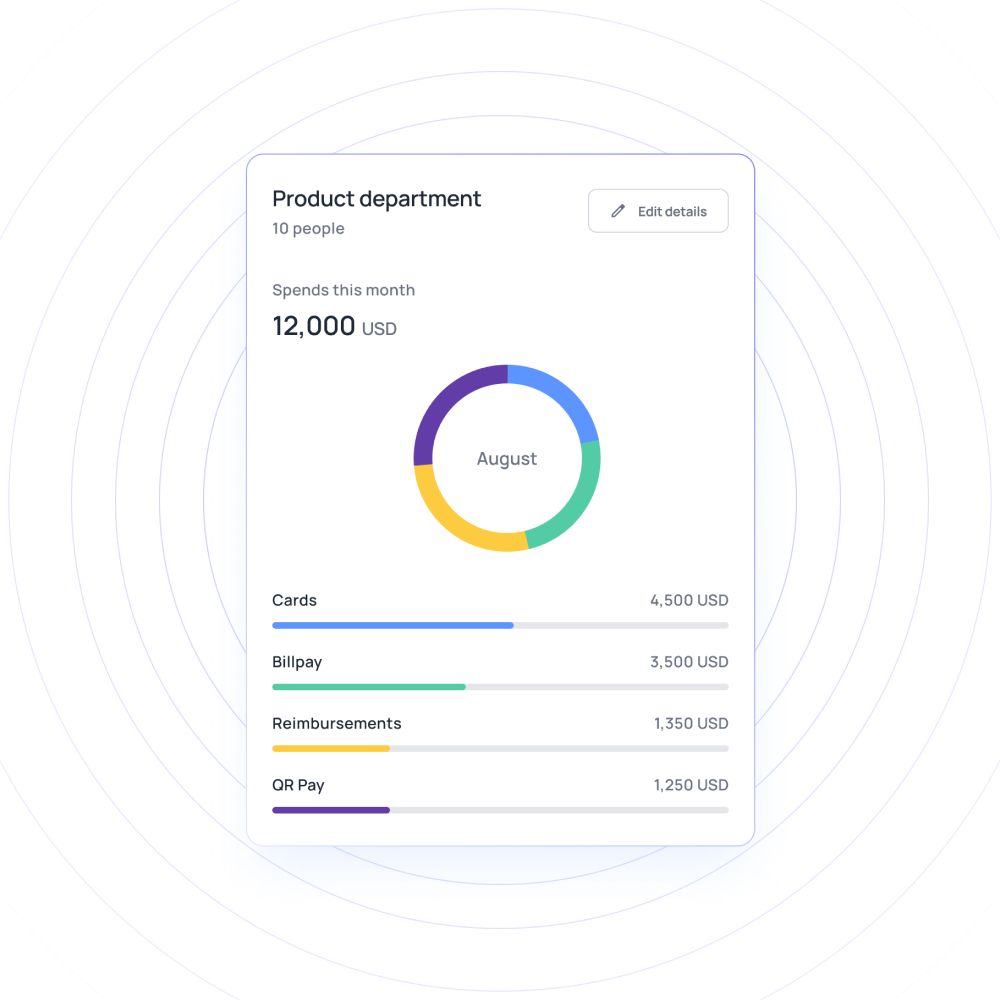

Connected ecosystem

You cannot solely rely on one payment solution like virtual payment cards when you run a business. Having an automated payment solution along with your card management platform will be the right way to set up a solid and foolproof accounts payable system that’s how you build a connected ecosystem

Every solution is interrelated and offers you more freedom and flexibility while choosing a payment mode. Locating a suite carrying every accounting and spend management function you need is the right way to build a connected ecosystem.

How Volopay virtual corporate cards improve business productivity?

Change the way your company pays online with Volopay virtual payment cards. Volopay offers both physical and virtual cards to business users. With virtual cards, you can create and assign as many cards as possible, assign budgets and make payments. You can either pay once or have a monthly payment option with this virtual card payment program.

This card will carry a number, expiration date, and CVV, which your employees can use while making online payments. The admin can oversee the transactions, approve if needed, freeze and block cards after usage.

The administrator also gets an overview of the total amount spent, cash back earned, and how much money is saved. There is no need to share the same card information for every usage, as you can have different cards for different purposes. Your employees can safely enjoy company benefits and perks with Volopay virtual cards while the company can still control and monitor their expenses. Never compromise on safety when you set the seal on business continuity.

FAQs

Keeping the budgets under control is essential for any business to run smoothly without worrying about working capital. Virtual cards help you achieve that. At the same time, they also minimize the workload of the accounting team so that they can focus on other essential tasks.

Each virtual payable card gets assigned to a specific vendor or employee expenses. And the account details of the card are used while processing the payment concerning the vendor. It’s almost the same as any online payment mode, except no physical card is involved.

B2B companies always welcome and habituate themselves to new innovative technologies. Digital payments are a part of their everyday accounting activities. Be it SaaS subscriptions, vendor payments, or employee benefits; virtual card payments help them. They create virtual cards and budgets for each one and wire the payment when it's due.

Virtual card for payments is the same as that of credit card payment, where the AP team will use the virtual card details to process the payment on time. You can use virtual cards to pay monthly bills like subscription costs. Money gets withdrawn from the budget allocated to the particular card, and the transaction is recorded.

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free