How corporate cards help manage small business credit line

A business credit line is a pay as you use type of loan rendered by financial institutions for businesses. It helps companies manage their monthly expenses and investment plans and maintain a positive cash flow without running out of funds.

Think of it as a short term loan paid back with a reasonable interest at the end of the payment cycle. Corporate cards are excellent sources to receive a line of credit and pay expenses online. It is similar to credit cards which have a specific range of funds available for online and offline payments.

How does credit facility offer credit line?

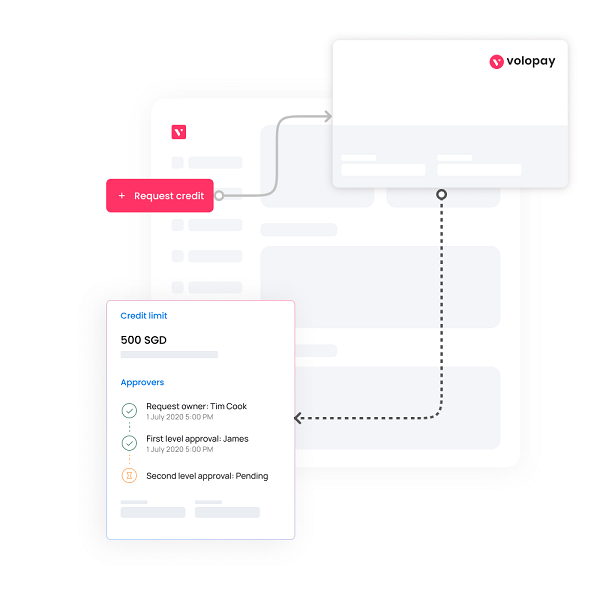

Typically, when applying for a small business credit line it involves documentation and submitting proof like bank statements and the business credit score. Score submission is to prove your ability to repay the liability. Companies attempts to keep the application and documentation process minimal for businesses to get business credit line services.

The credit team instantly processes credit requests up to USD 500k, which will be available for your physical and virtual card transactions. You can also use this credit for paying subscription fees and online purchases. The whole process is online and takes only minutes to apply.

How is business credit line processed ?

Credit line providers have their own sets of requirements, and upon meeting them, you will be allocated credit lines. One of the essential factors credit providers consider is how businesses manage credit scores. The amount of credit depends on these eligibility criteria and other factors affecting the score.

Here are the documents a company would request from the applicant. Bank statements, company credit score, cash flow statements, and other financial documents. Suppose you have a strong business credit score and good cash flow management. It won’t take long to see credits added to your account.

Once your application is processed and submitted documents are approved, you will receive the credit within two business days. You can use this for corporate credit cards payments and other local and foreign money transfers. Every month the credit gets recycled, and new credits will appear in the account.

Benefits of credit preloaded on corporate card

Easy to use

A business line of credit is easy to obtain and use and very effective for online payments. You can draw credits appearing in the account and use them any time, as long as the card's budget permits that. So, it’s a one-step process to pay liabilities without adding money from any wallet or account.

Higher spending limit

In the case of corporate credit cards preloaded with a credit line, spend limits are usually the budgets set by the administrator and not by the credit line provider. Credit availability is also high enough to manage your business's primary and odd expenses.

Highly secured

Volopay’s corporate credit cards are incredibly safe to use. These credit cards are not related to your bank account or the major expenses account you use (where you load money). So, even if your card is under the control of a predator, they cannot get close to your main account. And the admin can delete or freeze the account.

Avoid debts

Lack of funds can be a massive hindrance to your growth. Organizations make a blunder here by opting for loans and paying heavy interest. Why waste your money and pay penalties and claims when you can obtain business credit lines in a stress-free way. Credits are efficient in paying off sudden expenses.

Improves cash flow

No matter how many predictions you make, unprecedented and random costs arise here and there. Such dips make your cash flow wobble and induce anxiety. Never panic anymore as credit lines bring stability to this process. Negative or zero cash flow will take months to fix and can even bring your work to a halt. Let Volopay boost your cash flow so that you never see the rock bottom of the cash flow curve.

Maintaining credit score

Maintaining credit scores at positive levels is an arduous task even for well-established companies. All credits go to insufficient funds maintenance, late due payments, and poor payment habits. By obtaining credit, you can manage cash flow to pay dues and loans at the earliest. Also, Volopay allows the lender to pay back the acquired credit ten days from the end of the payment cycle. So, it’s easy for small businesses to manage credit scores.

Easy accessibility

Make payments at ease even from your home with the help of Volopay’s mobile app. It has every activity that the desktop application carries regarding the business credit line and other functions. Apply for a business line of credit from anywhere, and make lightning-fast payments from desktop and mobile software.

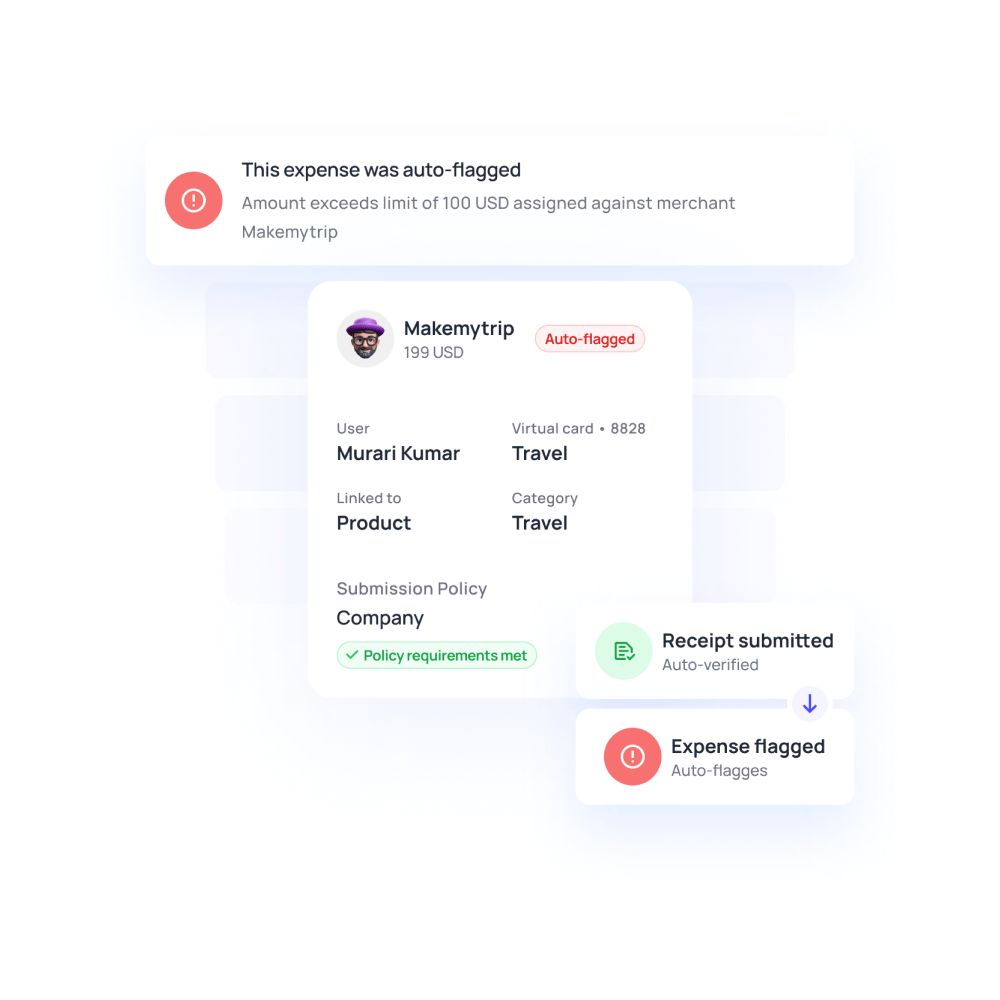

Reduce expense fraud

Expense frauds still exist both internally and externally. Human errors are also a part of this too, as the consequences of mistaken entries are the same as fraud. To avoid losing money over this, get your hands on Volopay which has built in security protection to protect your credit from frauds.

How do Volopay's corporate cards work?

Individual cards for employees

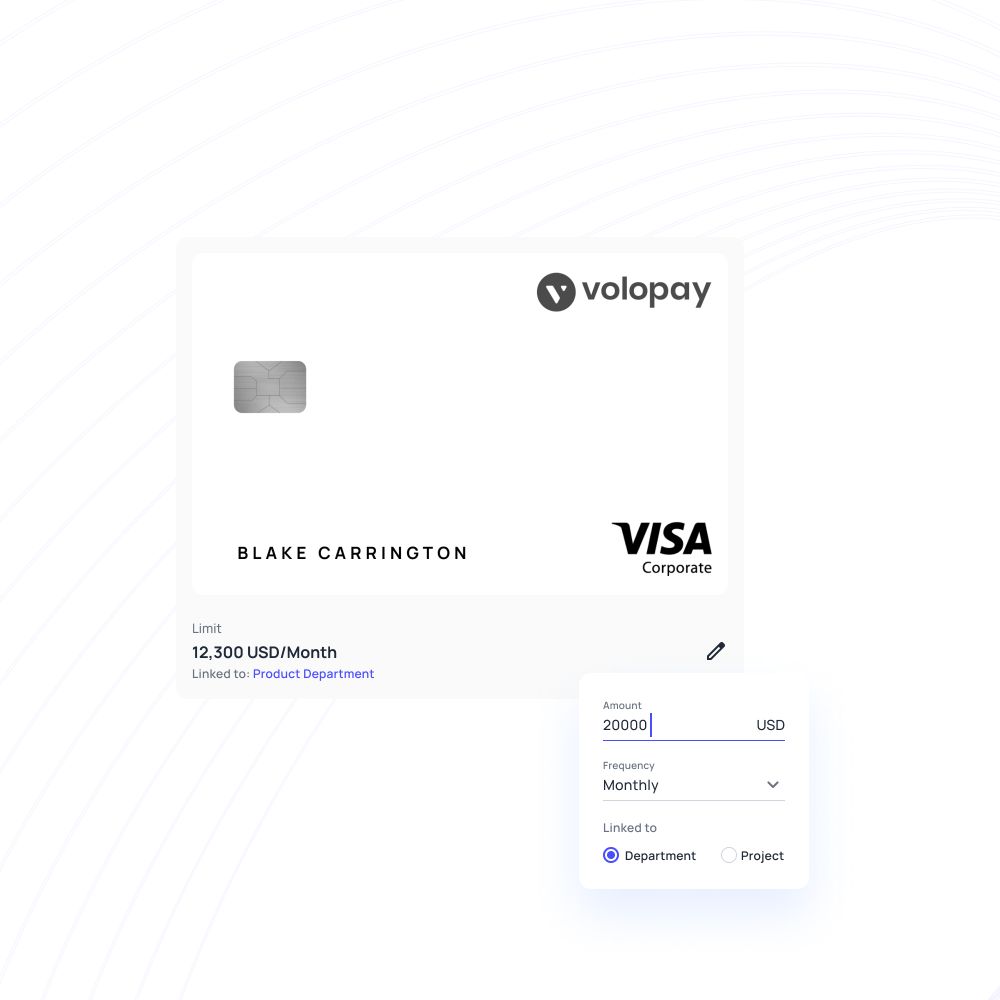

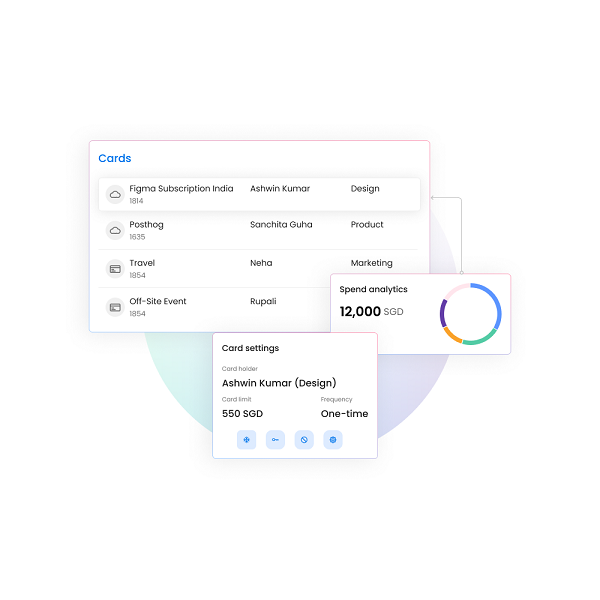

There has been a time when employees carried bags full of receipts, transaction slips, airline tickets, restaurant bills, and whatnot. The time has arrived when you can render each of your employees with individual corporate credit cards. The admin can distribute a virtual credit card to the employee within seconds and set limits. Employees can enjoy the liberty of having their card to cover business trip expenses, and admins don’t have to micromanage.

Add money from credit to bill pay

Most credit line providers make the credit line available only to card users. But what if you have to send money to your vendors? In Volopay, you can transfer the credit instantly to the bill pay feature. Bill pay is designed to make vendor payouts and other business transactions quick and painless. Contact your account manager to begin using this feature. It’s a two-step process afterward, where you add money to the bill pay account by drawing from the credit.

Allocate budgets to the team

Avoid manually estimating budgets or capping expenses, as you can set up budgets and tag each card with one of them. Associating this card with a budget adds up expenses to the particular budget category so that you can track if you don’t over exceed the allocated budget. When you use this card, you are drawing from the allocated funds of the budget category added to this card.

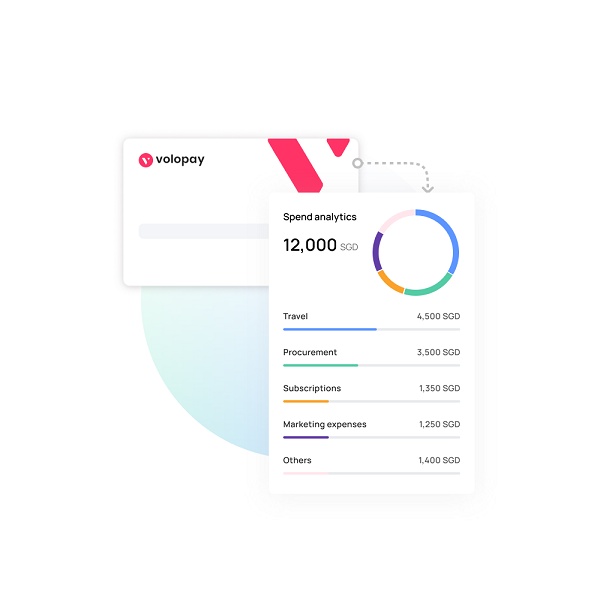

Real-time visibility on card spending

Know where you stand and how many business expenses you make on average without effort. Volopay promises real-time visibility, which means you can view and monitor expenditures as they happen. Improper tracking and negligent accounting management can cause havoc on your cash flow because you are not up-to-date with what goes in and out of the spends

Trusted by finance teams at startups to enterprises.

Get Volopay for your business

Get started free

Related pages

Building your business credit is crucial for small businesses, find out the techniques to build business credit here.

Learn about how you can get the flexible credit line with minimum documentation and a two-day approval process.