Smart employee expense cards for US businesses

Running a U.S. business sometimes means dealing with messy expense reports, delayed reimbursements, and unclear budget tracking. Traditional expense management—relying on manual receipts, personal card usage, or slow approval processes—wastes time and creates inefficiencies.

Employee expense cards offer a smarter, digital-first solution to streamline company spending. These cards empower your team to make purchases while maintaining control and visibility over expenses. Whether you're a startup or a large enterprise, expense cards for employees eliminate financial friction, reduce administrative burdens, and keep budgets in check. They provide real-time spending insights, automated expense tracking, and simplified approval workflows.

Ready to modernize your expense management? These innovative cards can transform your operations, making financial processes more efficient and transparent for businesses of all sizes.

What is an employee expense card?

An employee expense card is a company-issued payment tool preloaded with funds for business purchases. Unlike personal credit cards, these cards connect to your company account, providing spending control while eliminating employee out-of-pocket expenses.

Perfect for office supplies, travel, or software subscriptions, they offer customizable limits and real-time tracking for simplified budgeting.

How employee expense cards work for businesses

Employee expense cards are preloaded with funds from your U.S. bank account, requiring no credit checks. You set budgets, issue cards, and track transactions in real time.

Employees can't overspend allocated limits, and the system integrates with accounting tools for automated expense categorization and seamless financial reporting across your organization.

Works for in-office, remote, and travel expenses

Whether your team works in-office, remotely, or travels frequently, expense cards for employees adapt to their needs. Use them for client dinners, software subscriptions, or travel bookings.

Virtual cards handle online purchases while physical cards manage in-person expenses like meals or transportation, ensuring team access without delays or personal outlays.

Why businesses need employee expense cards

Stop relying on reimbursements

Reimbursements create a hassle; employees front costs, wait weeks for approval, and handle paperwork. Expense cards for employees let your team spend company funds directly, eliminating out-of-pocket expenses and speeding up processes.

This reduces friction, boosts employee satisfaction, and eliminates the traditional reimbursement cycle entirely.

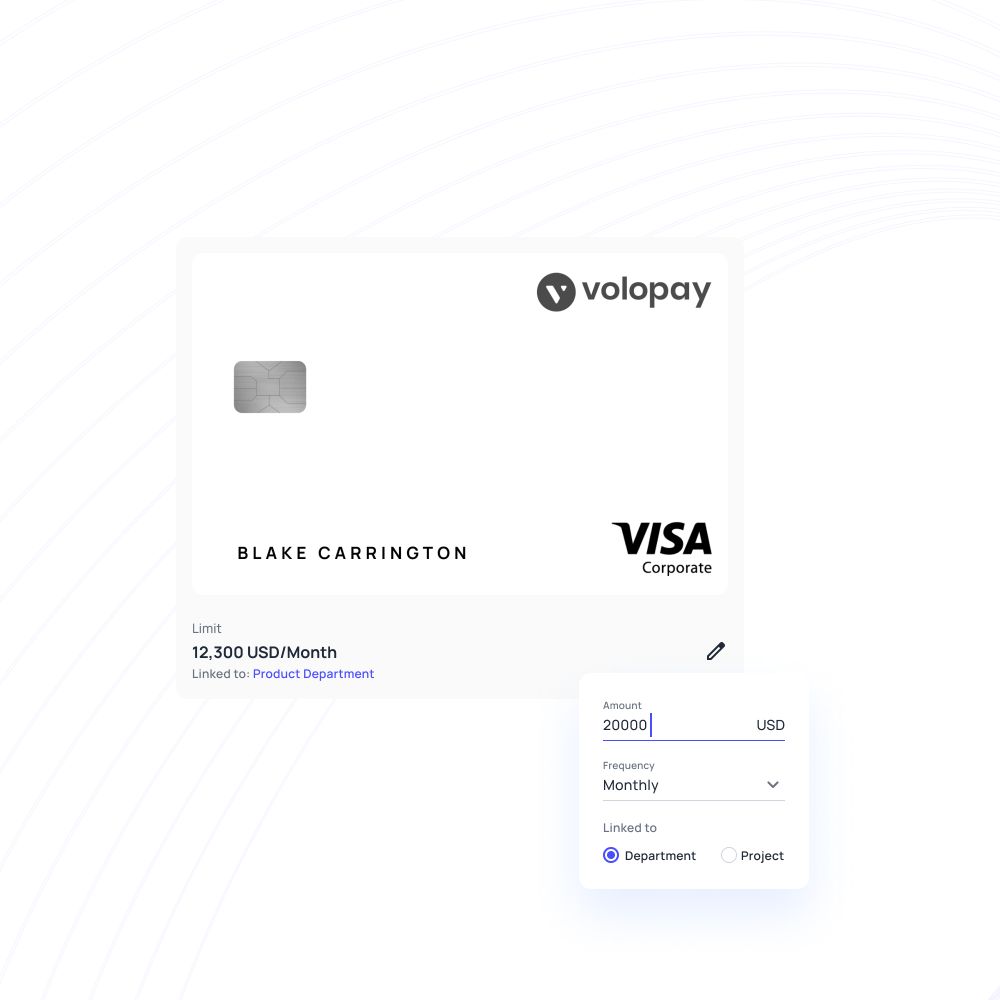

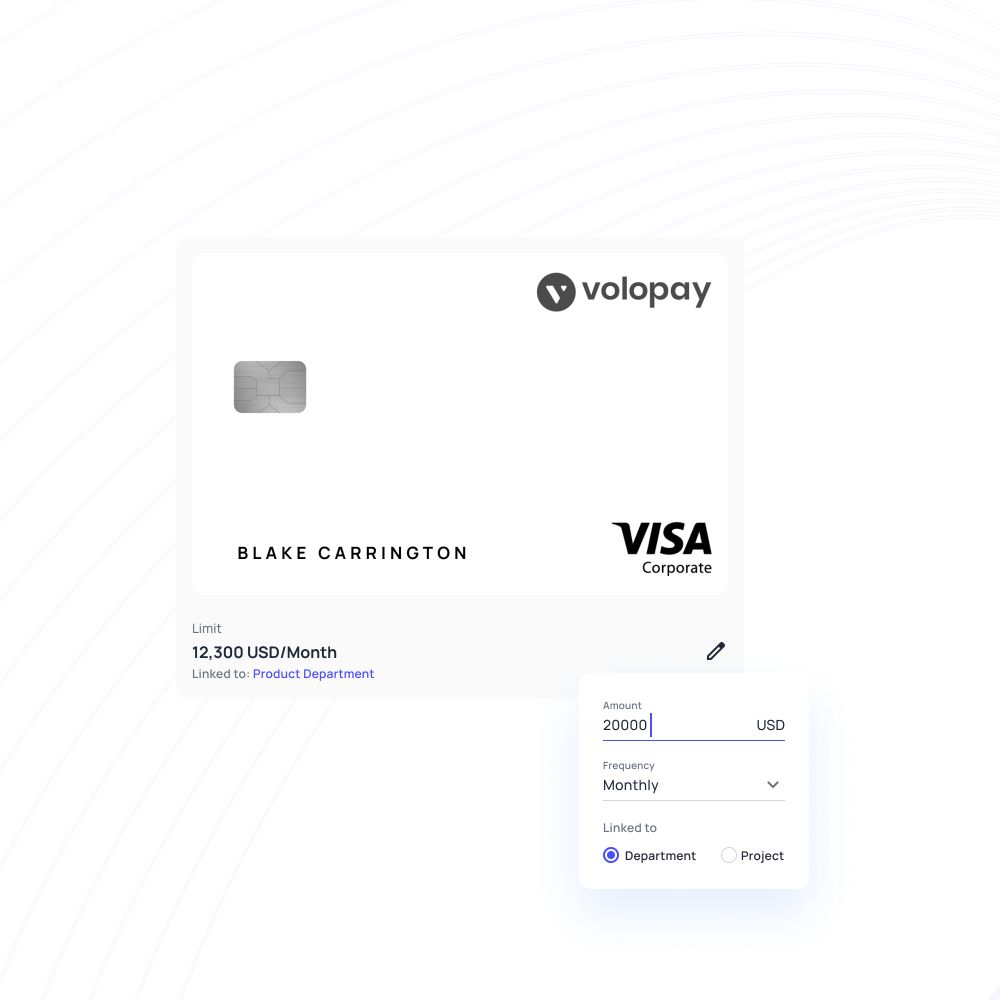

Set clear spending limits

With employee expense cards, you can set daily or monthly spending caps for each employee or department. This ensures budgets stay on track and prevents overspending.

Adjust limits instantly to accommodate project needs or unexpected expenses, maintaining financial control while providing flexibility for business operations.

Accelerate team autonomy

Empower your employees to make real-time purchases without waiting for finance approvals. Whether booking flights or buying office supplies, expense cards give your team freedom to act quickly while staying within policy.

This autonomy increases productivity and eliminates delays that slow down business operations.

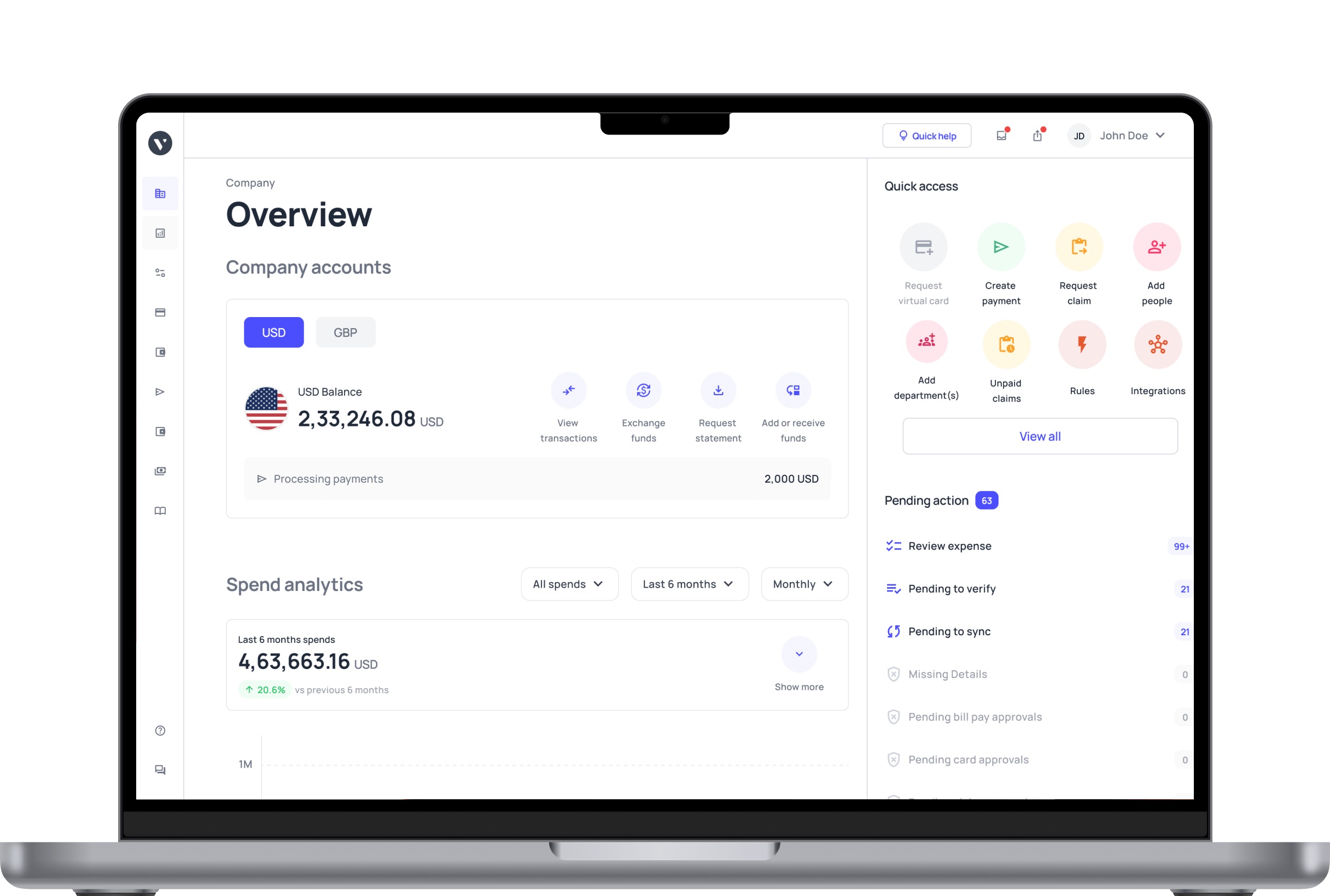

Real-time visibility and alerts

Track every transaction as it happens with real-time dashboards and instant alerts. See who's spending, where, and on what with employee expense cards.

Automated categorization organizes expenses by vendor or type, giving you clear insights into spending patterns and enabling better financial decision-making across your organization.

Streamline month-end reconciliation

Forget manual receipt collection and error-prone spreadsheets. Expense cards for employees automate categorization and sync with accounting software, making month-end reconciliation fast and accurate.

This saves your finance team hours, reduces discrepancies, and creates a more efficient financial management process for your business.

Get the best employee expense card for your business!

What makes Volopay the ideal choice for managing employee expenses?

Volopay is an expense management platform designed to simplify spend control for businesses of all sizes. With its intuitive interface, robust features, and seamless integrations. Volopay empowers you to manage employee expense cards efficiently while ensuring compliance and transparency throughout your organization.

Centralised control for all employee expense cards

Volopay's unified dashboard lets you issue, pause, reload, or restrict cards with a few clicks. Monitor all employee spending from one place, whether for a single team or multiple departments.

This centralized approach ensures complete oversight and control over all expense cards for employees.

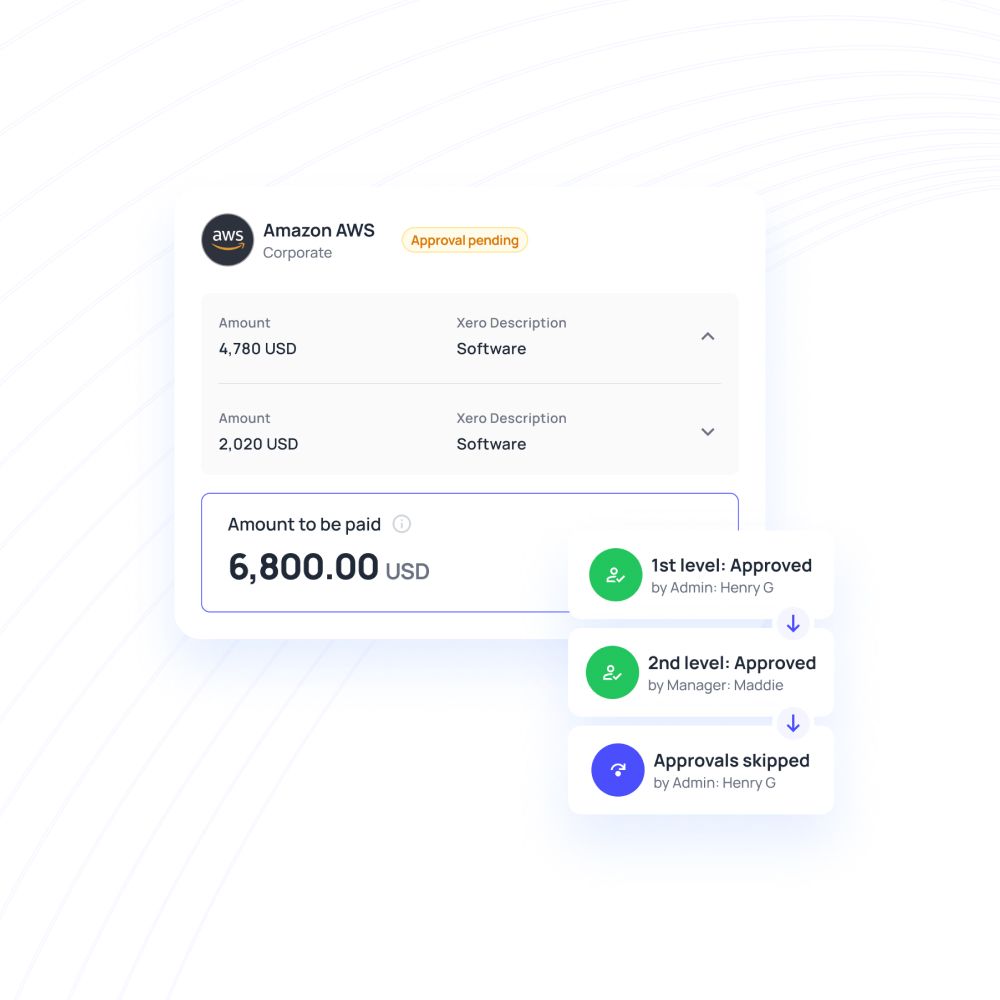

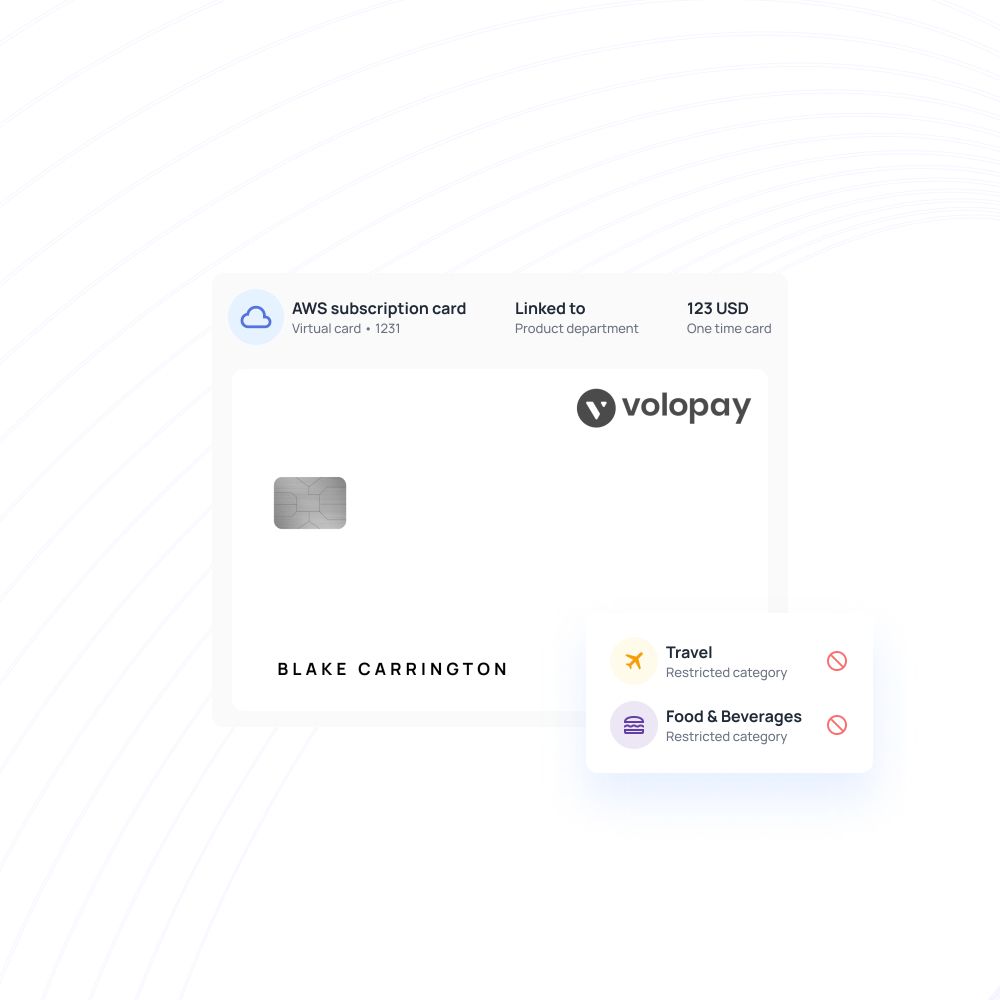

Smart controls for better compliance

Set merchant- or category-specific rules to align spending with company policies. For example, restrict cards to only allow travel or software purchases.

Volopay's multi-level approval workflows ensure high-value transactions are vetted, reducing misuse and maintaining strict compliance with your employee expense cards policies.

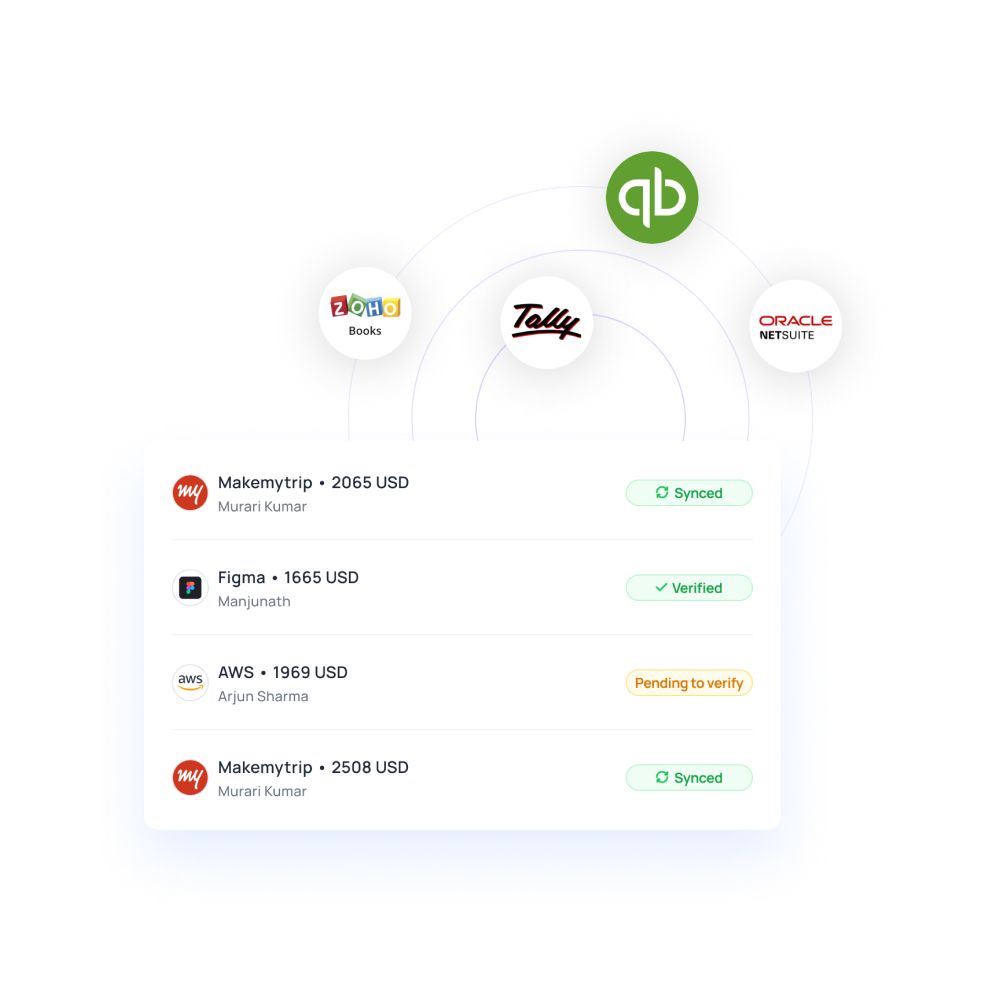

Integrates with U.S. accounting tools

Volopay syncs seamlessly with popular U.S. accounting software like QuickBooks, NetSuite, and Xero.

Transactions from expense cards for employees are automatically recorded and categorized, streamlining your bookkeeping and ensuring accurate financial records without manual data entry or reconciliation delays.

Physical and virtual card support

Issue physical cards for in-person expenses like client meetings or travel, and virtual cards for online purchases like SaaS subscriptions.

Both employee expense cards can be created instantly, tailored to specific roles or projects, providing maximum flexibility for your team's spending needs.

Responsive support

Volopay offers dedicated support during your business hours. Whether you need help with onboarding, troubleshooting expense cards for employees, or policy configuration, their responsive team ensures smooth operations and quick resolution of any issues that may arise with your platform.

Scalable for startups, mid-sized companies, and large enterprises

Startups need agility. Volopay's instant card issuance and simple budgeting tools let you assign expense cards for employees without delays.

Skip reimbursements and focus on growth while maintaining tight control over cash flow. Quick setup enables immediate spending control for your team.

Mid-sized companies benefit from department-level controls and real-time spend visibility with employee expense cards.

Automate expense tracking and approval workflows to reduce administrative burdens and keep your growing team aligned with budgets while scaling operations efficiently and maintaining financial oversight.

For large enterprises, Volopay offers robust integrations, detailed audit trails, and role-based controls for expense cards for employees.

Customize permissions by department or job function, ensuring compliance and scalability across complex operations while maintaining security and detailed financial reporting capabilities.

Secure, compliant, and audit-ready expense management

1. PCI DSS-compliant infrastructure

Volopay adheres to PCI DSS standards, using bank-grade encryption to protect card data and transactions from expense cards for employees.

This ensures your financial information is secure from fraud or breaches, providing peace of mind for businesses handling sensitive payment data.

2. Real-time expense logs

Every transaction from employee expense cards is automatically logged with details like location, vendor, and category.

This creates a transparent audit trail, making it easy to review spending or prepare for audits while maintaining complete visibility over all financial activities.

3. Receipt capture and matching

Employees can upload receipts via Volopay's mobile app, and its OCR technology automatically matches them to transactions from expense cards for employees.

This ensures IRS-compliant documentation and reduces manual errors while streamlining the expense reporting process for your entire organization.

4. Role-based card permissions

Assign permissions based on job roles or departments to limit employee expense cards usage.

For example, restrict a card to only marketing expenses or specific vendors, minimizing the risk of misuse while ensuring appropriate spending controls across your organization.

5. Downloadable reports for accounting and tax

Generate CSV or PDF reports with detailed transaction data from expense cards for employees for accounting, audits, or tax filings.

Volopay's reports are formatted to meet the U.S. tax requirements, saving your finance team time during compliance and reporting periods.

Get started with Volopay employee expense cards

Sign up for a Volopay account

Provide your company details and complete a simple onboarding process for employee expense management cards.

Our team guides you through setup to ensure a smooth transition, helping you establish proper controls and policies for your organization's spending management needs.

Fund your Volopay wallet

Securely transfer the funds from your U.S. business bank account to your Volopay wallet.

This serves as the source for all card transactions from expense cards for employees, keeping your finances organized and providing centralized control over company spending activities.

Create and issue cards instantly

Generate virtual or physical employee expense cards for employees based on their roles. Assign cards for specific projects, departments, or vendors in just a few clicks.

This flexibility ensures each team member has appropriate access to company funds.

Set rules and monitor spendings

Apply custom spending limits and merchant restrictions per card for expense cards for employees.

Track live spending through Volopay's web or mobile dashboard, ensuring real-time oversight and maintaining complete control over your organization's financial activities and budget compliance.

FAQs about expense cards for employees

Yes, you can set daily, weekly, or monthly spending limits for each card, adjustable in real time via Volopay’s dashboard.

You can instantly freeze or block the card through Volopay’s app or dashboard, ensuring no unauthorized transactions occur.

Virtual cards can be issued instantly, while physical cards are delivered within a few business days.

Absolutely, you can assign cards to specific departments or projects with tailored limits and rules.

Yes, employees can have multiple virtual or physical cards for different purposes, like travel or vendor payments.

Bring Volopay to your business

Get started now