Employee debit cards to eliminate reimbursement hassles

Managing corporate spending doesn't have to drain your finance team's resources or compromise your budget controls. Modern businesses across the US are discovering how employee debit cards revolutionize expense management by automating controls, eliminating reimbursement hassles, and providing real-time visibility into every transaction.

Volopay's comprehensive platform transforms how your business handles employee spending, delivering the control you need with the flexibility your team demands.

Understanding employee debit cards

Employee debit cards represent a fundamental shift from traditional corporate spending methods, offering businesses unprecedented control over their financial operations while empowering employees with the spending flexibility they need to perform their roles effectively. A prime example of this innovative solution is the reloadable debit card for employees.

What is an employee debit card?

An employee debit card functions as a company-issued payment card that draws directly from pre-allocated business funds rather than extending credit.

Unlike personal debit cards linked to individual bank accounts, these cards connect to your company's designated spending accounts with built-in controls and restrictions.

Key benefits of employee debit cards for modern US teams

Your business gains immediate visibility into every transaction as it happens, eliminating the typical delays associated with expense reporting. Policy compliance becomes automatic rather than reactive, as the system prevents unauthorized spending before it occurs rather than flagging it afterward.

Employees enjoy greater spending flexibility without the burden of submitting receipts and waiting for reimbursements.

Why your US business needs employee debit cards

Traditional corporate spending methods create unnecessary friction, expose your business to financial risks, and consume valuable administrative resources. The modern business environment demands more sophisticated solutions that protect your bottom line while enabling operational efficiency.

Expense fraud and overspending risks

Shared corporate cards create accountability nightmares where tracking individual spending becomes impossible, leading to unauthorized purchases and policy violations. Cash advances eliminate spending controls entirely, making it difficult to track expenses or ensure compliance with company policies.

Personal reimbursements rely on employee honesty and accurate record-keeping, creating opportunities for inflated claims and fraudulent submissions. Employee debit cards eliminate these vulnerabilities by assigning individual spending responsibility while maintaining corporate oversight over every transaction.

Time drain on reimbursement

Your accounting team spends countless hours processing expense reports, matching receipts, and chasing employees for missing documentation. Reimbursement cycles typically take weeks, creating cash flow challenges for employees and administrative backlogs for your finance department.

Manual data entry introduces errors that require additional time to identify and correct. Debit cards for employees automate the entire process, capturing transaction data in real-time and eliminating the need for manual expense report processing.

Empower employees without losing control

Employees need spending flexibility to handle unexpected business expenses, client entertainment, and operational purchases without bureaucratic delays. Traditional approval processes slow down business operations and create frustration for both employees and managers.

Employee debit cards provide immediate spending access within predetermined parameters, ensuring employees can make necessary purchases while maintaining corporate financial controls.

Modernize employee spending with Volopay prepaid cards

Traditional banking solutions weren't designed for modern business expense management needs. Volopay's platform addresses the specific challenges US businesses face when managing employee spending, offering features that traditional financial institutions simply cannot provide.

Issue cards instantly to your team

Your employees receive both virtual and physical prepaid cards immediately through Volopay's dashboard, eliminating the typical waiting periods associated with traditional bank card issuance.

Virtual cards activate instantly for online purchases and subscriptions, while physical cards arrive within days rather than weeks. The entire process happens without bank visits, paperwork, or lengthy approval processes that slow down business operations.

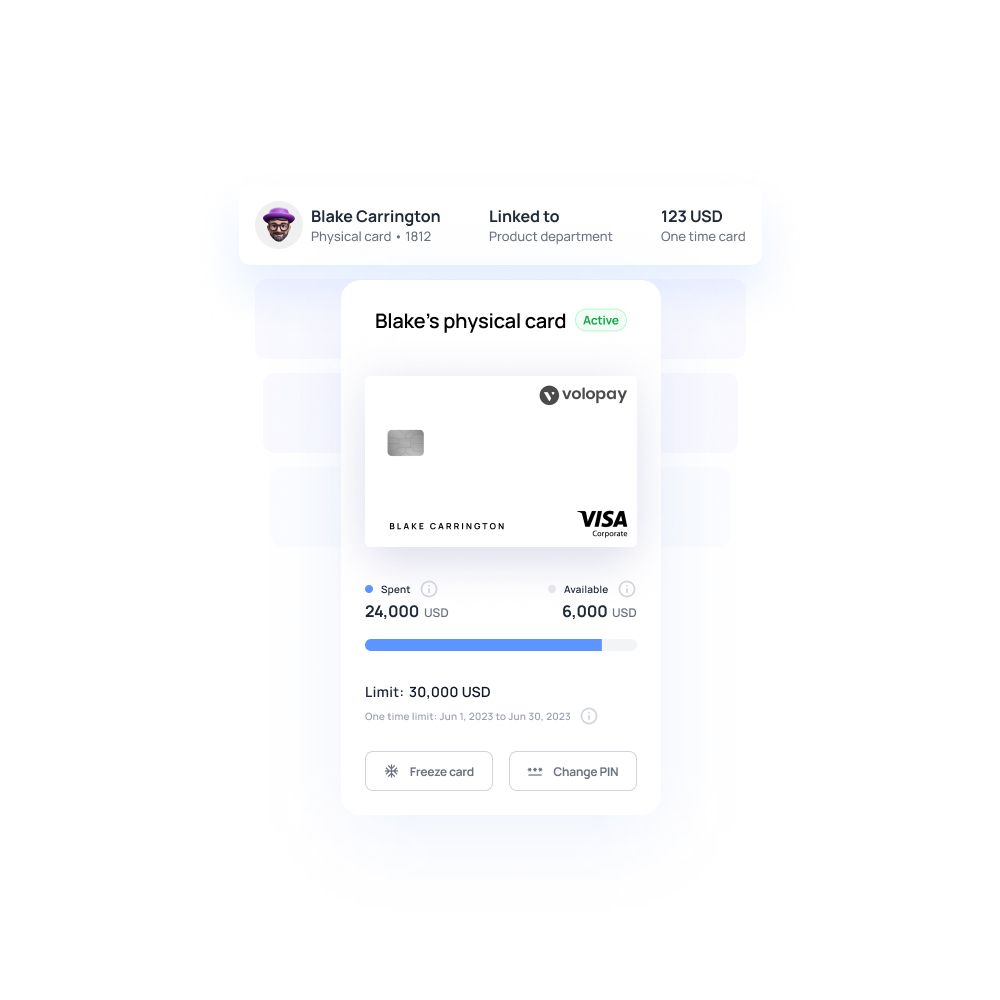

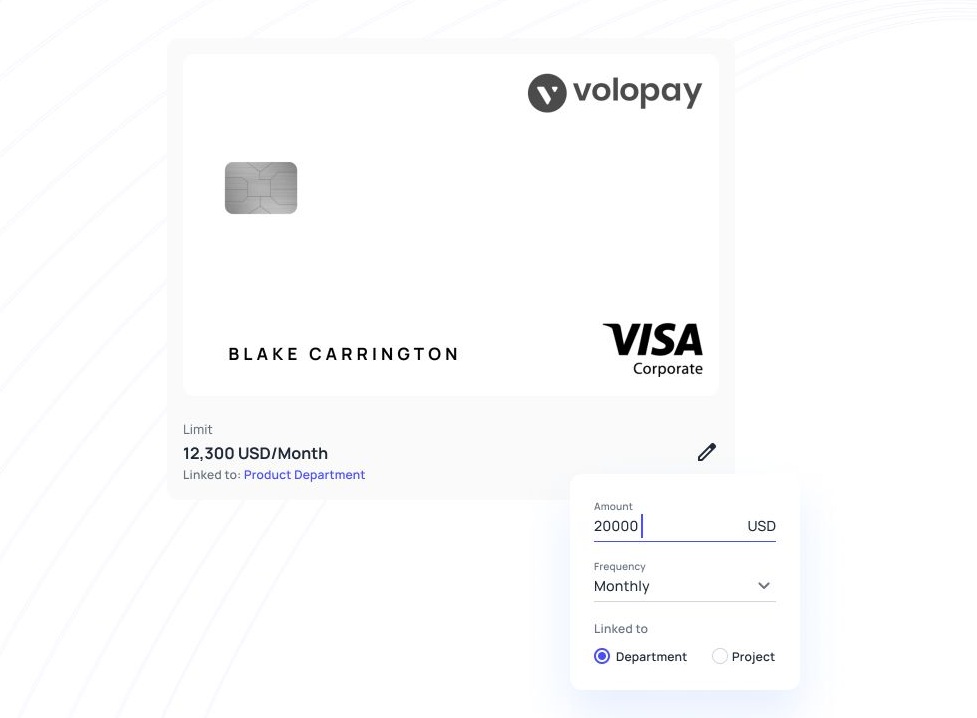

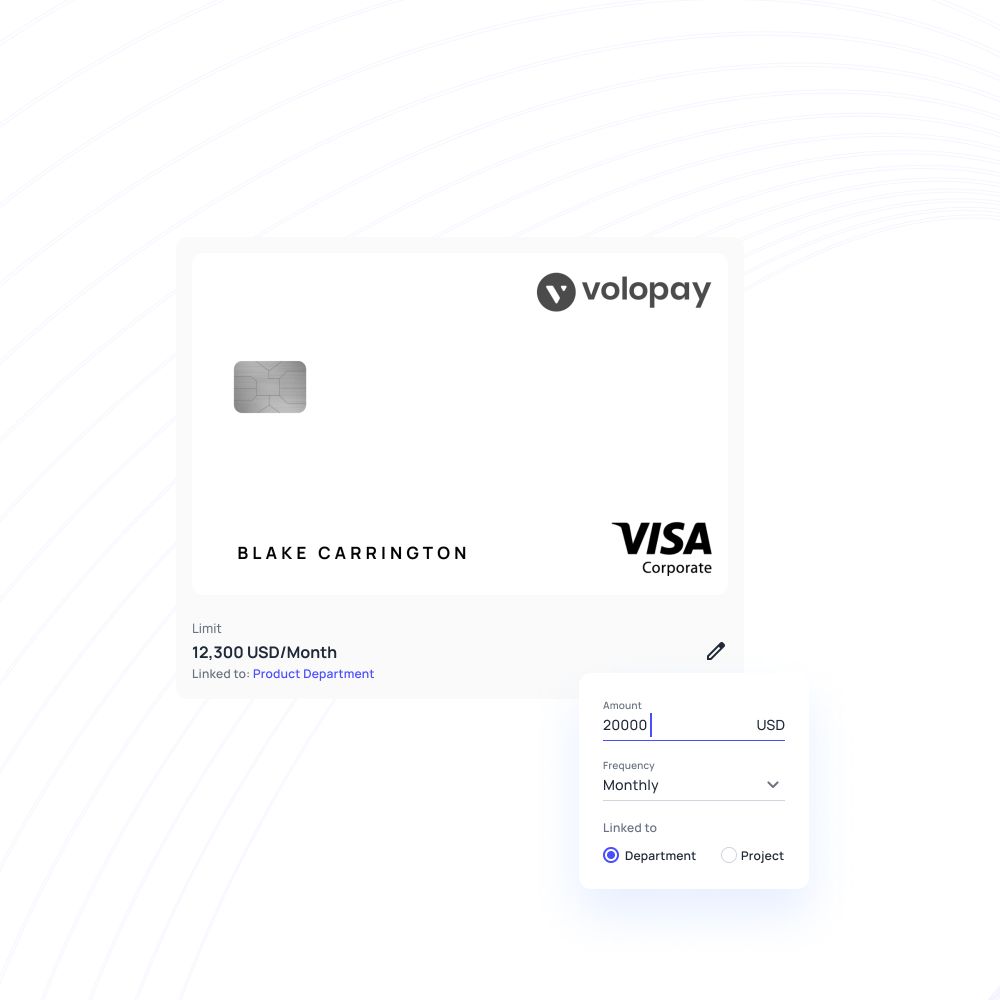

Customize spend limits, categories, and controls

You set specific spending limits based on employee roles, project requirements, or departmental budgets. Merchant category restrictions ensure funds are used only for approved business purposes, preventing unauthorized purchases.

Daily, weekly, and monthly spending limits provide multiple layers of control. Purpose-based restrictions allow you to create cards for specific projects or expenses, ensuring budget adherence across different business initiatives.

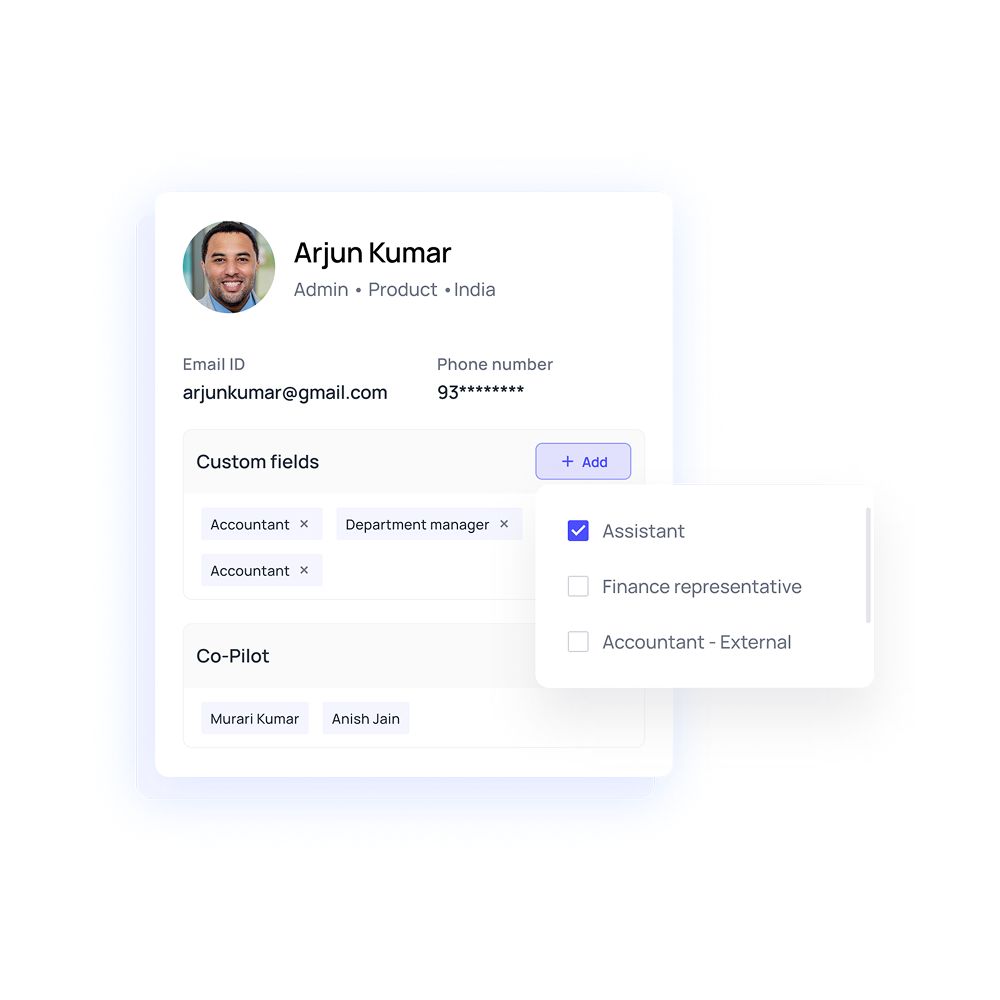

Role-based access and approvals

Your finance team, department managers, and employees receive appropriate access levels based on their responsibilities within the organization. Multi-level approval workflows ensure larger purchases receive proper authorization before processing.

Administrative controls prevent unauthorized card creation or limit modifications. This systematic approach maintains compliance while streamlining the approval process for legitimate business expenses.

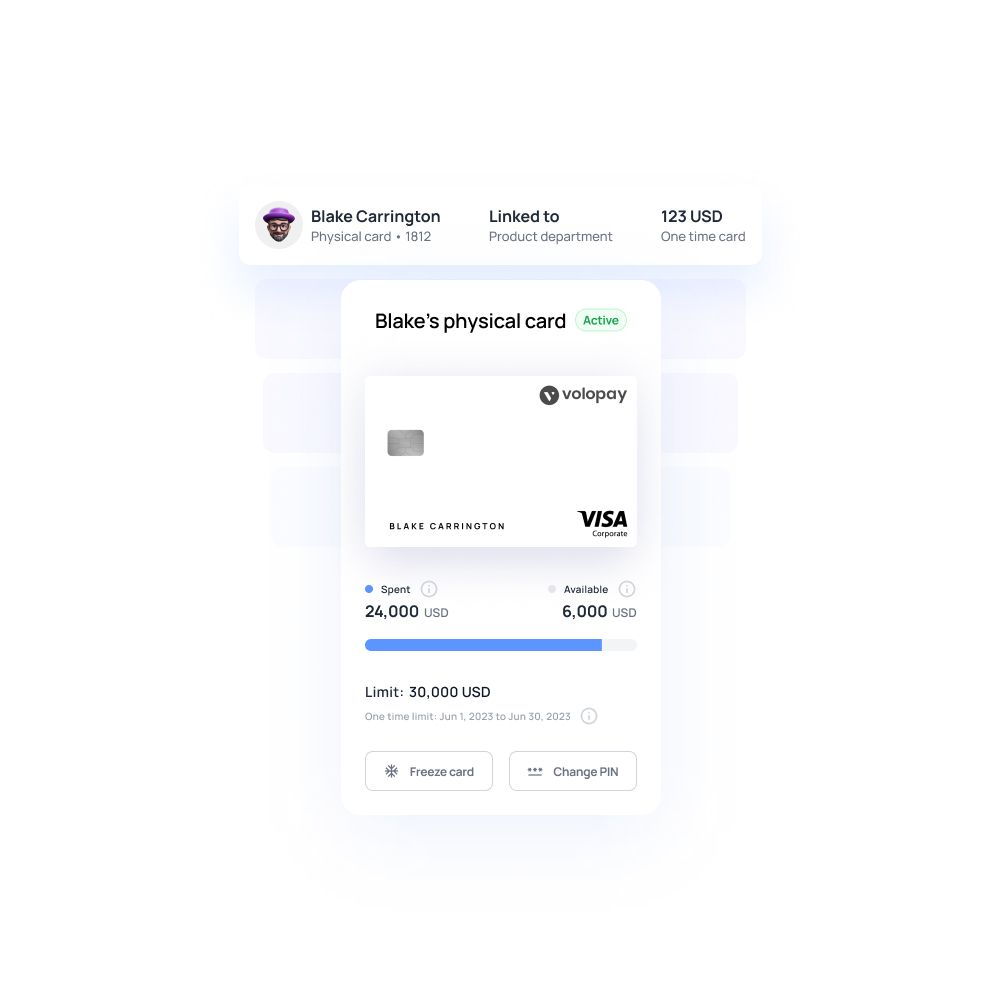

Revoke or freeze cards instantly

When employees change roles, leave the company, or report lost cards, you can freeze or revoke access immediately through the platform. This instant control prevents unauthorized usage and protects your business from potential losses.

Temporary freezes allow you to investigate suspicious activity without permanently disabling cards. The ability to reactivate cards quickly ensures minimal disruption to legitimate business operations.

End reimbursements - Switch to Volopay employee cards

Real-time visibility with Volopay's employee debit cards

Financial visibility drives better business decisions and ensures compliance with corporate policies. Volopay's platform provides comprehensive oversight tools that give you complete control over your corporate spending patterns.

Ledger sync for every swipe

Every transaction automatically synchronizes with your accounting system in real-time, eliminating manual data entry and reducing the risk of errors. Transaction details include merchant information, purchase categories, and employee identification, providing complete audit trails.

This immediate synchronization ensures your financial records remain current and accurate without additional administrative effort.

Mobile and web access for managers

Managers monitor team spending patterns through both mobile applications and web-based dashboards, providing flexibility for oversight regardless of location. Real-time alerts notify supervisors of unusual spending patterns or policy violations.

Detailed transaction histories enable managers to identify spending trends and make informed budget decisions. The platform's accessibility ensures managers can maintain oversight without being tied to their desks.

Alert systems for budget overspend

Automated notifications alert you when spending approaches or exceeds predetermined thresholds, enabling proactive budget management. Policy breach alerts identify unauthorized purchases or spending pattern anomalies immediately.

Customizable alert parameters ensure you receive relevant notifications without being overwhelmed by minor variations. These systems enable rapid response to potential issues before they impact your bottom line.

Connecting employee debit card spend to your books: Volopay's integrations

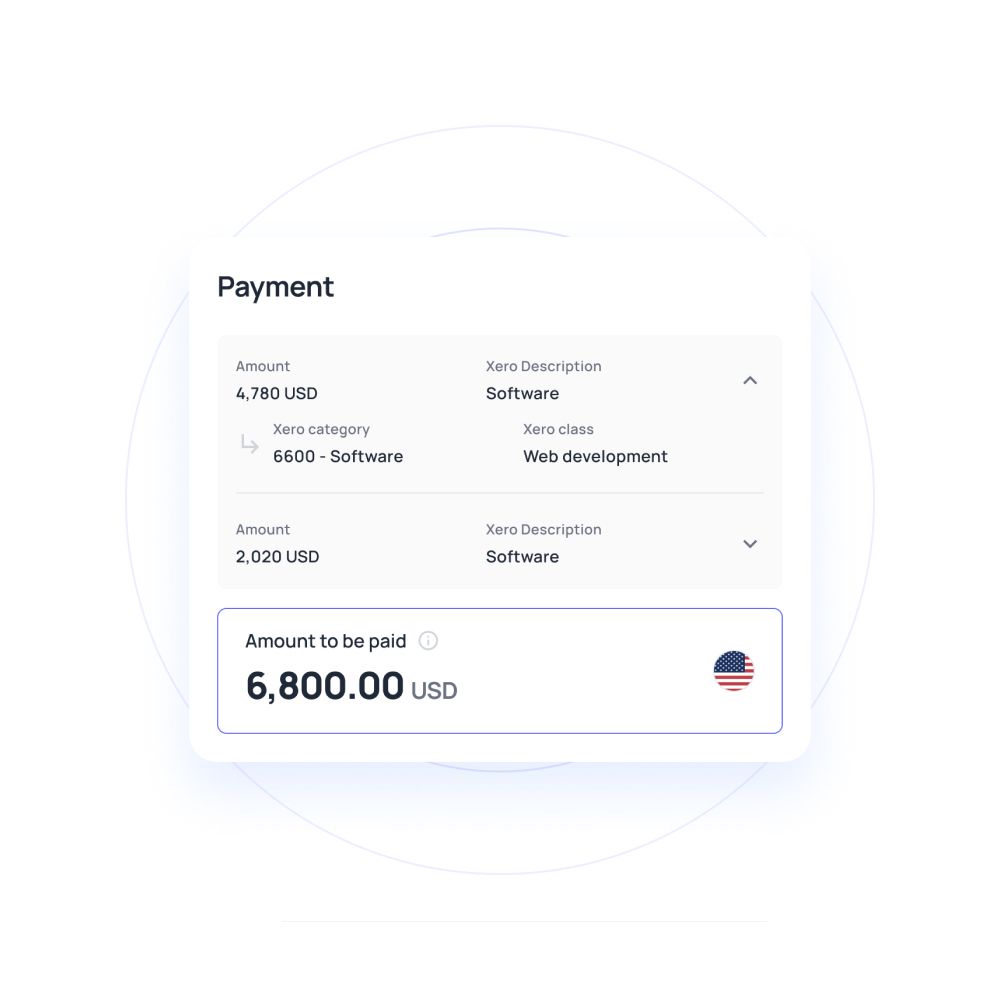

Native integrations with QuickBooks, Xero, and NetSuite

Transaction data flows automatically into your existing accounting workflows without manual intervention. A chart of accounts mapping ensures expenses are categorized correctly from the moment they occur.

Real-time synchronization keeps your financial records current and eliminates month-end reconciliation headaches. These integrations work with the accounting platforms most US businesses already use, minimizing implementation complexity.

Automated receipt capture via OCR

Optical character recognition technology automatically extracts relevant information from receipts, eliminating manual data entry requirements. Receipt matching pairs transaction records with supporting documentation automatically.

Digital receipt storage ensures compliance with record-keeping requirements while reducing physical storage needs. This automation saves hours of manual work while improving accuracy and compliance.

One-click export for audits

Generate comprehensive audit reports covering all employee debit card transactions with a single click. Reports include transaction details, receipt images, and approval workflows necessary for compliance reviews.

Customizable date ranges and filtering options ensure you can produce exactly the information auditors require. This streamlined reporting capability reduces audit preparation time and demonstrates strong internal controls.

Track team spending in real-time: Get Volopay cards

Volopay's built-in security and compliance controls

Enterprise-level security protects your business and employee data while ensuring compliance with financial regulations. Volopay's platform meets the security standards that US businesses require for financial transactions.

PCI DSS & SOC 2 certified

Enterprise-grade data protection safeguards every transaction processed through the platform. Regular security audits ensure ongoing compliance with industry standards.

Data encryption protects sensitive information both in transit and at rest. These certifications demonstrate Volopay's commitment to maintaining the security standards your business requires.

Instant lock & transaction alerts

Suspicious activity triggers immediate card locks and administrative notifications, preventing potential losses. Real-time monitoring identifies unusual spending patterns or unauthorized usage attempts.

Manual lock capabilities allow immediate response to lost cards or security concerns. These rapid response capabilities minimize potential exposure to fraudulent activity.

Customizable permissions

Finance teams receive administrative access appropriate for their oversight responsibilities. Managers get visibility into their team's spending without broader system access.

Employees can view their own transaction history while maintaining privacy for other users. This granular permission structure ensures appropriate access while maintaining security and privacy standards.

Use cases for employee debit cards

Employee debit cards adapt to virtually any business spending scenario, providing the flexibility your operations require while maintaining the controls your finance team demands.

Marketing and events

Marketing teams handle vendor payments, advertising platform charges, and event expenses without delays or approval bottlenecks. Campaign spending stays within budget through automated controls while enabling rapid response to market opportunities.

Event planners can make necessary purchases on-site without cash advances or reimbursement delays. Debit cards for employees in marketing roles ensure creative projects stay on track and within budget.

Sales and travel

Sales representatives cover client entertainment, travel expenses, and accommodation costs without personal financial exposure. Per diem spending stays within company guidelines through automated controls.

Travel booking becomes seamless with immediate payment capability. Commission-based sales teams benefit from consistent expense management regardless of travel frequency or client entertainment requirements.

Operations and procurement

Operations teams handle supplier payments, maintenance expenses, and equipment purchases with appropriate spending authority. Procurement specialists can make necessary purchases without lengthy approval processes.

Vendor payments process immediately, potentially qualifying for early-payment discounts. Supply chain management becomes more efficient when purchasing authority aligns with operational responsibility.

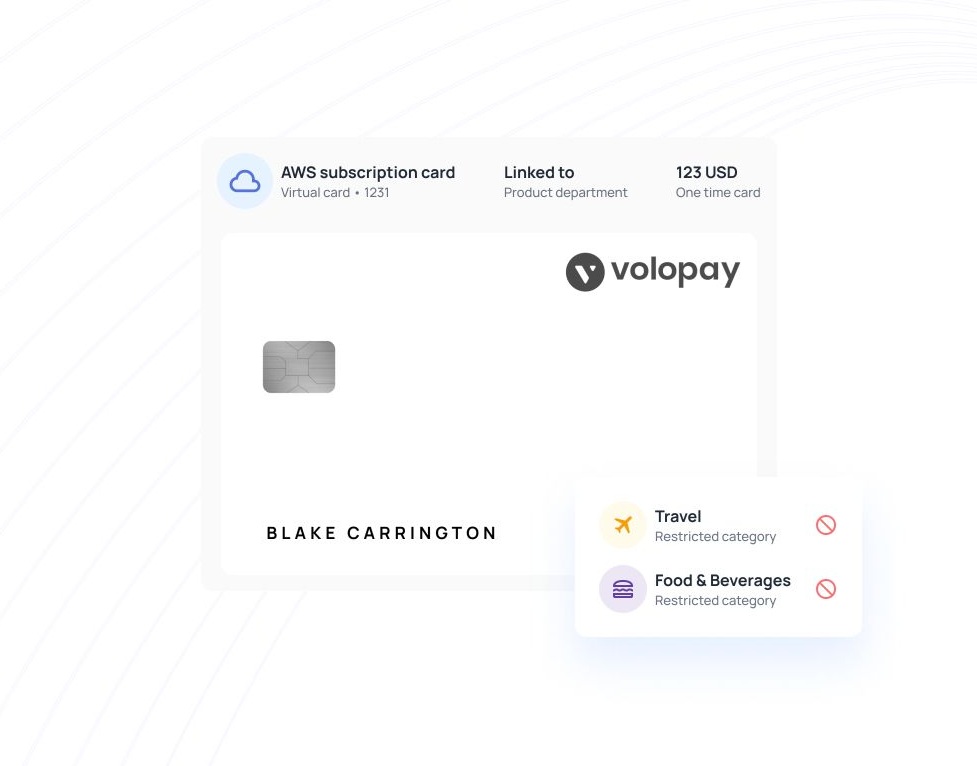

IT and SaaS tools

Technology teams manage software licenses, subscription renewals, and equipment purchases without administrative delays. SaaS subscription management becomes automated, preventing service interruptions due to payment issues.

Equipment purchases can happen immediately when technology failures threaten business operations. IT spending aligns with departmental budgets while maintaining operational flexibility.

Employee debit cards built for all business sizes — from startups to enterprises

Early-stage businesses require immediate spending capability without complex approval hierarchies. Limited administrative resources mean expense management must be largely automated. Rapid growth demands scalable solutions that won't require replacement as the business expands.

Employee debit cards provide the control startups need while maintaining the operational speed that drives growth.

Mid-size businesses require departmental spending oversight without enterprise-level complexity. Multiple locations or remote teams need consistent expense management processes. Growth phases demand spending flexibility while maintaining budget discipline.

Department-specific controls ensure spending aligns with business priorities while providing managers with appropriate oversight tools.

Enterprise businesses require sophisticated approval workflows and comprehensive audit trails. Hundreds or thousands of employees need individual spending access with role-appropriate limitations. Complex organizational structures demand flexible permission systems and reporting capabilities.

Automated compliance ensures corporate policies are enforced consistently across all locations and departments.

Empower your team - Issue Volopay employee cards

Why Volopay beats traditional debit card systems

Traditional banking solutions were designed for personal banking rather than corporate expense management. Volopay addresses the specific needs of modern businesses with features that traditional banks cannot provide.

No delays, branch visits, or paperwork

Card issuance happens entirely online, eliminating bank visits and lengthy application processes. Account setup takes minutes rather than weeks. Policy changes are implemented immediately without requiring new paperwork or approval processes.

This streamlined approach ensures your business operations aren't delayed by administrative requirements.

More control and customization

Traditional bank cards offer basic spending limits with minimal customization options. Volopay provides granular controls over spending categories, merchant types, and approval workflows.

Integration capabilities connect your expense management with existing business systems. Reporting tools provide insights that traditional banking platforms cannot offer.

Built for modern business needs

Your card program scales automatically as your business grows without requiring system changes or migrations. Feature updates deploy automatically, ensuring your expense management capabilities improve over time.

Customer support understands business needs rather than treating corporate accounts like personal banking relationships. The platform evolves with your business rather than constraining your growth.

Get started with Volopay's employee debit cards in minutes

Volopay's streamlined setup process means you can start seeing benefits immediately rather than waiting for lengthy implementation periods.

Start your free trial or book a demo

Risk-free trials allow you to test the platform with real transactions before committing to full implementation. Personalized demonstrations show exactly how the system addresses your specific business challenges.

Implementation support ensures smooth transitions from your current expense management processes. No long-term contracts or commitments mean you can evaluate the platform thoroughly.

Issue your first card instantly

Your first employee debit card activates within minutes of account setup. Virtual cards work immediately for online purchases and subscriptions. Physical cards are delivered within days for in-person transactions.

Employees can begin using the system immediately without waiting for training or setup periods.

Trusted by finance leaders

Finance professionals across the US and the world rely on Volopay for expense management because the platform addresses real business challenges with practical solutions. Customer success stories demonstrate measurable improvements in efficiency and control.

The platform's reliability and feature set have earned trust from businesses ranging from startups to established enterprises.

FAQs

Yes, you can establish individual spending limits, merchant restrictions, and category-specific controls for each card. Daily, weekly, and monthly limits provide multiple control layers. Role-based restrictions ensure spending aligns with job responsibilities and company policies.

Virtual cards activate instantly upon account setup, while physical cards typically arrive within 2-3 business days. The entire process happens online without bank visits or lengthy approval procedures. Bulk card issuance for multiple employees processes simultaneously.

Every transaction synchronizes immediately with your accounting system, providing instant visibility into spending patterns. Transaction details include merchant information, employee identification, and expense categories. Mobile and web dashboards provide real-time access to spending data.

Native integrations work seamlessly with QuickBooks, Xero, NetSuite, and other popular US accounting platforms. API connections enable custom integrations with specialized accounting systems. Automated data sync eliminates manual entry and reduces reconciliation time.

Yes, cards work internationally with competitive exchange rates and transparent fee structures. International transaction controls allow you to enable or restrict overseas spending. Real-time notifications provide immediate visibility into international purchases.

Instantly freeze or revoke cards through the platform to prevent unauthorized usage. Temporary locks allow investigation of suspicious activity without permanent card cancellation. Replacement cards are issued immediately to minimize business disruption from lost or stolen cards.

Bring Volopay to your business

Get started now