Smarter spending with company debit cards for employees

Managing employee expenses through traditional reimbursement processes creates unnecessary friction in your business operations. Company debit cards for employees offer a modern solution that eliminates lengthy approval cycles, reduces administrative burden, and provides real-time visibility into your corporate spending.

These specialized debit cards for company use transform how you handle business expenses, giving you instant control over budgets while empowering your team with immediate access to funds.

Volopay delivers an intelligent corporate spend management platform that combines company cards with powerful expense tracking, automated workflows, and comprehensive reporting to help you optimize your financial operations.

Company debit cards for employees - What they are and why they matter

Company debit cards represent a modern financial solution that's transforming how businesses manage employee expenses and operational spending. As traditional expense reimbursement processes become increasingly cumbersome and inefficient, more organizations are turning to solution like company debit or prepaid debit cards as a streamlined alternative.

These corporate payment tools offer real-time expense tracking, enhanced financial control, and simplified accounting processes that benefit both employers and employees.

What are company debit cards?

Company debit cards are prepaid payment cards issued by businesses to their employees for approved corporate expenses.

Unlike traditional credit cards, these cards draw funds directly from a company's designated account or from preloaded amounts, ensuring spending stays within predetermined budgets. They function as controlled spending tools that eliminate the need for employees to use personal funds for business expenses.

How company debit cards for employees operate

The operational process begins with card issuance, where companies apply for corporate debit card programs through financial institutions or fintech providers. Once approved, individual cards are distributed to designated employees with personalized spending limits and usage parameters.

Companies can typically customize each card's restrictions based on the employee's role and spending needs. Regular reloads can be scheduled or triggered manually, ensuring cards maintain adequate balances for ongoing business needs while maintaining strict budgetary control.

Problems traditional expense management creates

Without employee debit cards, you encounter inefficiencies and risks that disrupt business operations. These pain points burden your team and jeopardize financial control.

Time-consuming reimbursements

You face frustrated employees covering company expenses upfront. Manual reimbursement processes drag on, generating piles of paperwork and frequent errors.

Delays in repaying staff, often taking weeks, erode trust and waste valuable time.

Poor spend visibility

You lack real-time insight into company spending. Finance teams scramble to track budgets as receipts pile up and reports lag.

Without centralized control, overspending slips through unnoticed, leaving you vulnerable to financial surprises and unable to make informed decisions about where and how your business’s money is being used.

Policy non-compliance and maverick spending

You struggle to enforce spending policies. Employees may ignore guidelines, making unauthorized purchases that drain budgets.

Manual oversight fails to catch out-of-policy spending consistently, leading to financial leaks. Without automated controls, maverick spending proliferates, undermining

Why modern businesses choose company debit cards for employees

Today's business landscape demands financial solutions that balance employee empowerment with fiscal responsibility. Company debit cards address the shortcomings of traditional expense systems by providing immediate access to funds without the complications of credit lines or reimbursement delays.

Forward-thinking companies recognize that empowering employees with direct access to approved funds accelerates decision-making, improves operational efficiency, and enhances overall business performance.

Instant access to funds for authorized teams

Your employees no longer need to wait for reimbursements or use personal credit cards for business expenses. Company debit cards provide immediate purchasing power for authorized team members, enabling them to make critical business decisions without financial delays.

This instant access accelerates project timelines, improves vendor relationships, and eliminates the frustration of out-of-pocket expenses. You maintain complete control through preset spending limits and merchant restrictions while empowering your teams to act quickly when opportunities arise.

Centralized control with decentralized execution

You can allocate specific budgets to individual employees or departments while maintaining real-time visibility into all spending activities. This approach allows your teams to execute purchases autonomously within their designated parameters, eliminating bottlenecks in the approval process.

Advanced management dashboards provide comprehensive oversight of all transactions, enabling you to monitor spending patterns, identify cost-saving opportunities, and ensure compliance with company policies. The result is faster execution combined with enhanced financial governance.

Safer and more transparent than corporate credit cards

Company debit cards eliminate the risk of accumulating corporate debt since employees can only spend available funds. This prepaid structure prevents overspending while providing complete transaction transparency through real-time reporting.

You'll never face surprise credit card bills or interest charges, and every purchase is immediately visible in your financial management system. Enhanced security features, including instant card freezing and transaction alerts, provide additional protection against fraud while maintaining the flexibility your business needs.

Get the perfect company debit card for your business

Core capabilities of Volopay's company debit cards

When selecting debit cards for company use, you need a solution that delivers both flexibility and control. Volopay's comprehensive platform transforms how you manage corporate spending by combining cutting-edge technology with intuitive design.

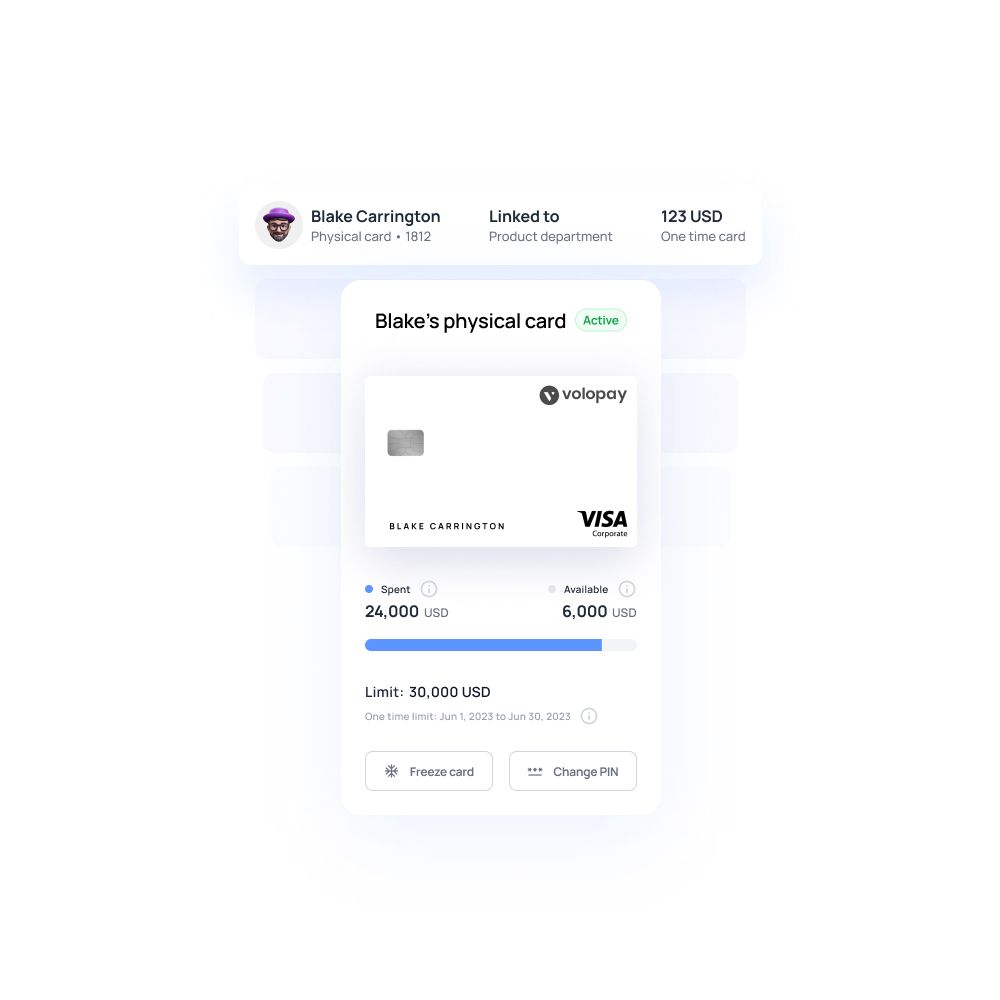

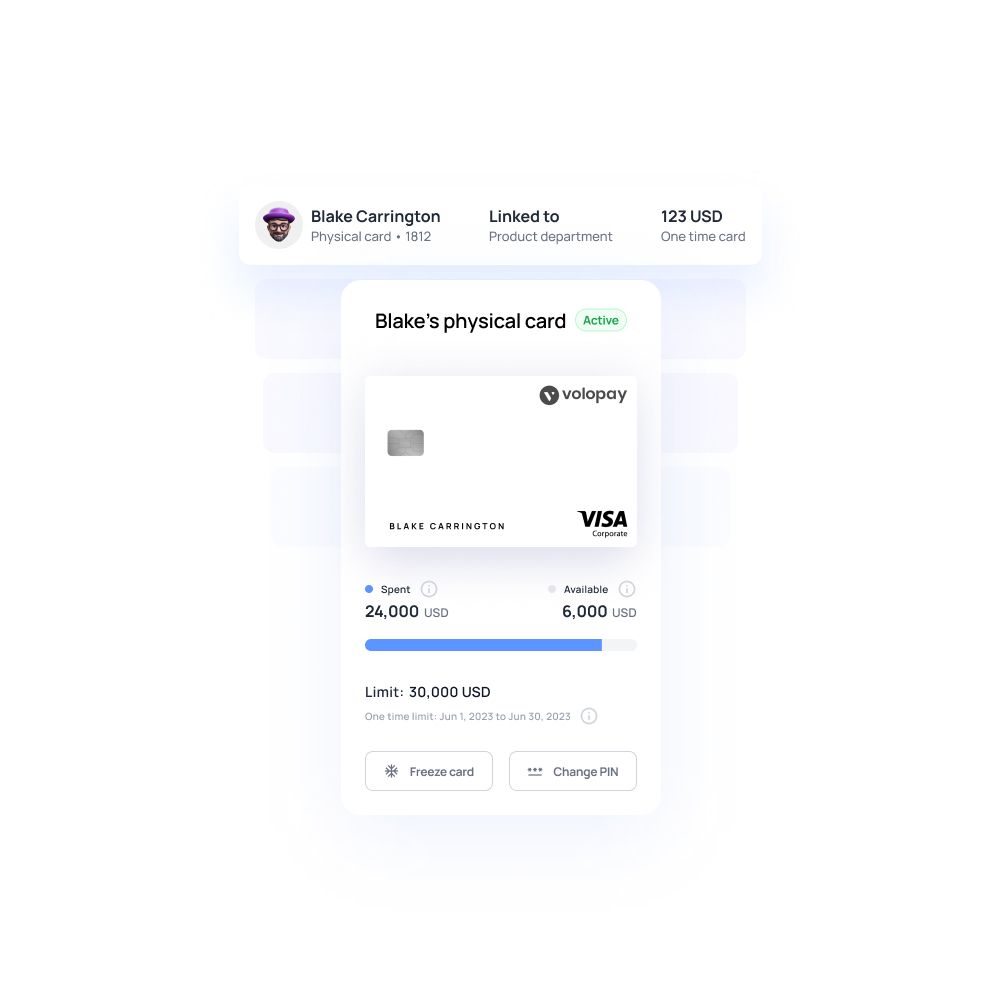

Physical and virtual cards with instant setup

You can issue both physical and virtual cards immediately to meet your team's diverse working arrangements. Physical cards serve your in-office employees and those requiring point-of-sale transactions, while virtual cards provide instant access for remote workers and online purchases.

Setup takes minutes, not days, allowing you to onboard new employees or launch projects without payment delays.

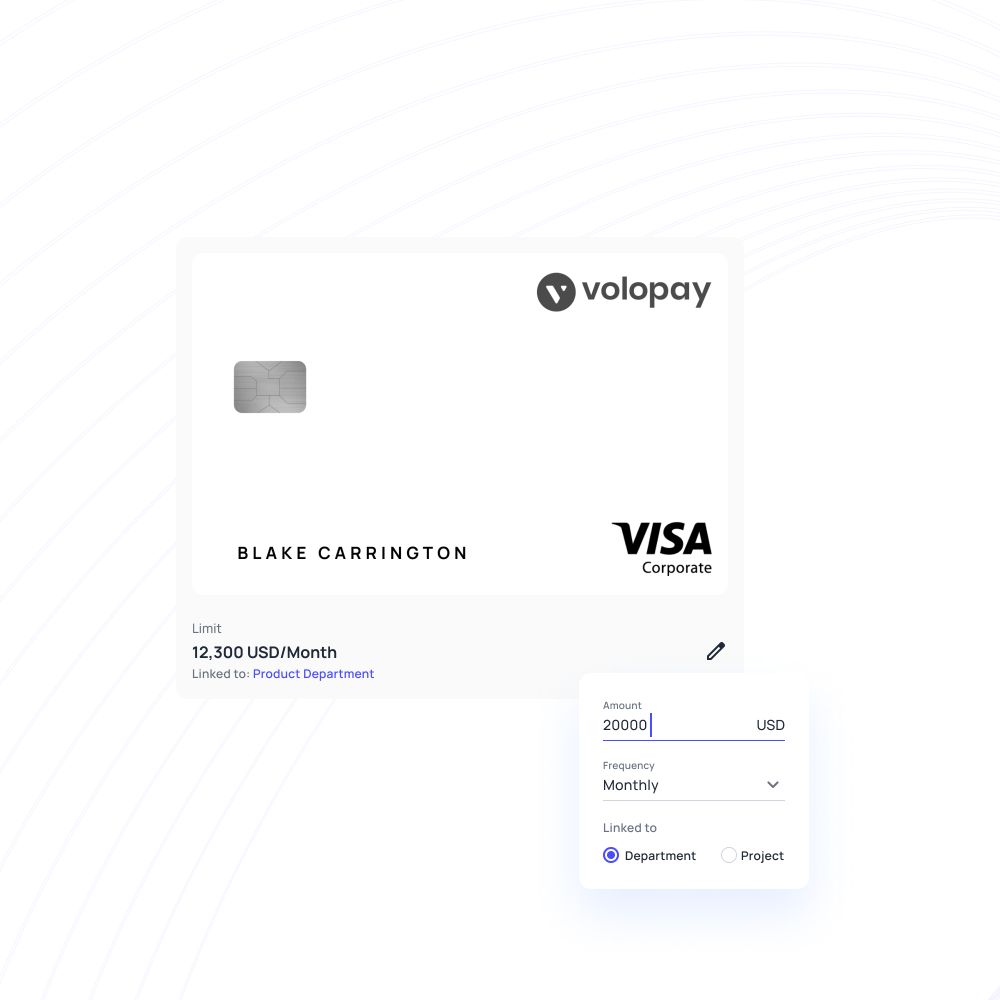

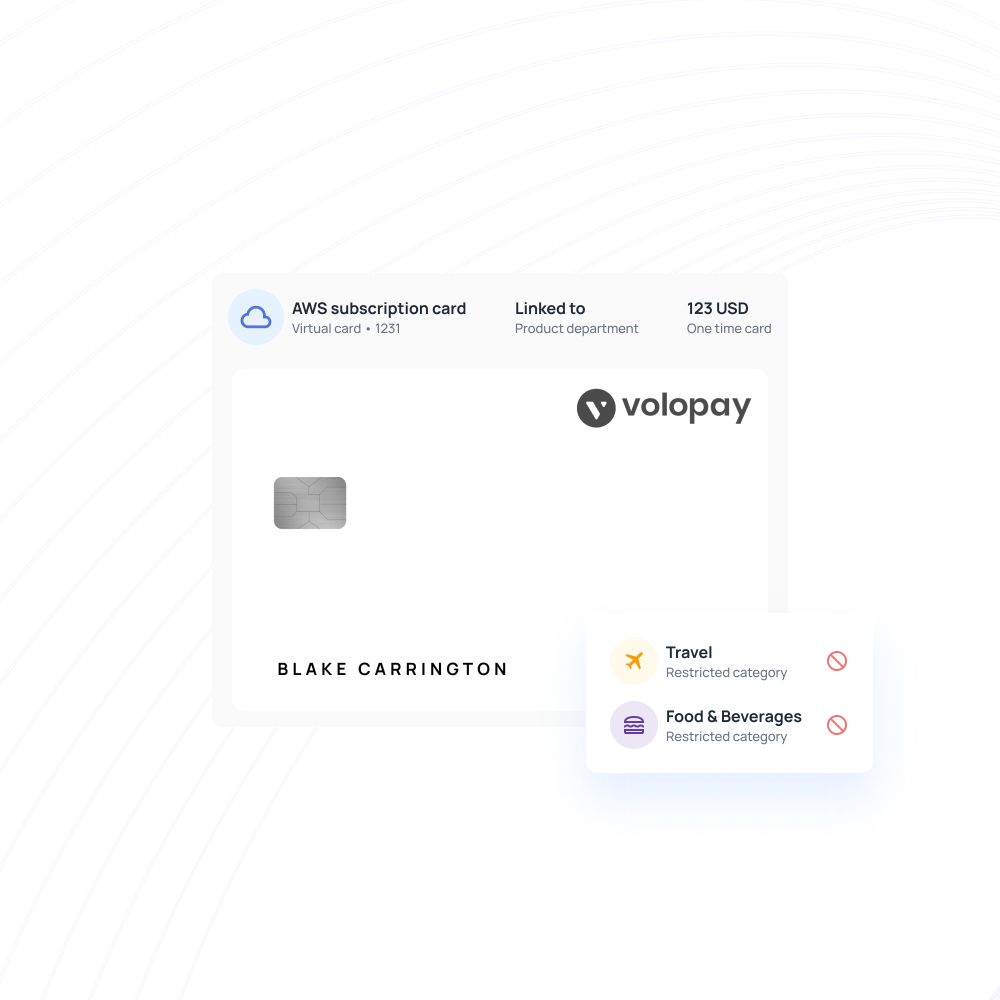

Custom spending rules by user, vendor, or category

Your company policies automatically enforce themselves through configurable spending controls. Set specific limits for individual users, restrict purchases to approved vendors, or limit spending by merchant category.

These intelligent rules prevent policy violations before they occur, eliminating the need for after-the-fact corrections while ensuring compliance across your entire organization.

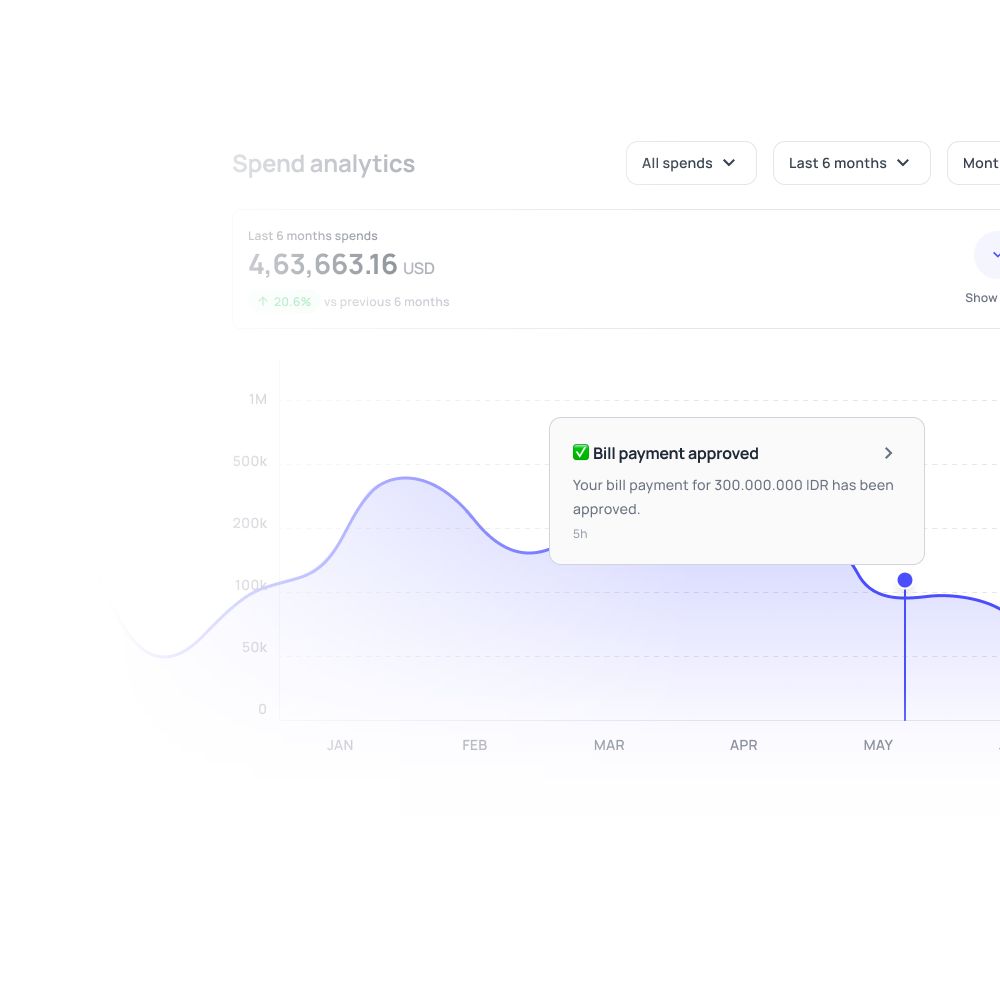

Real-time tracking and smart dashboards

You gain instant visibility into all company spending through comprehensive dashboards that update in real-time. Track individual transactions, monitor departmental budgets, and analyze spending patterns as they happen.

Smart categorization and detailed reporting provide the insights you need to make informed financial decisions and optimize your company's expense management strategy.

Seamless reloads and role-based access

Your cards maintain optimal balances through automated reload features and intelligent funding controls. Configure different access levels based on employee roles, ensuring appropriate spending authority while maintaining security.

This streamlined approach eliminates manual card management tasks while providing the flexibility your diverse teams require for efficient operations.

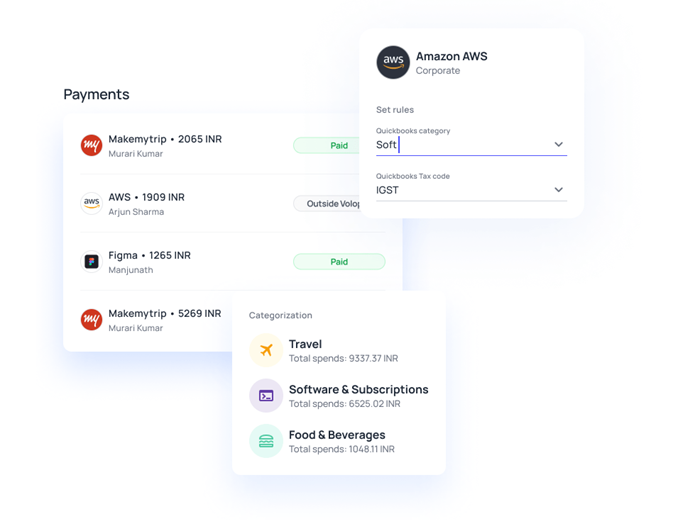

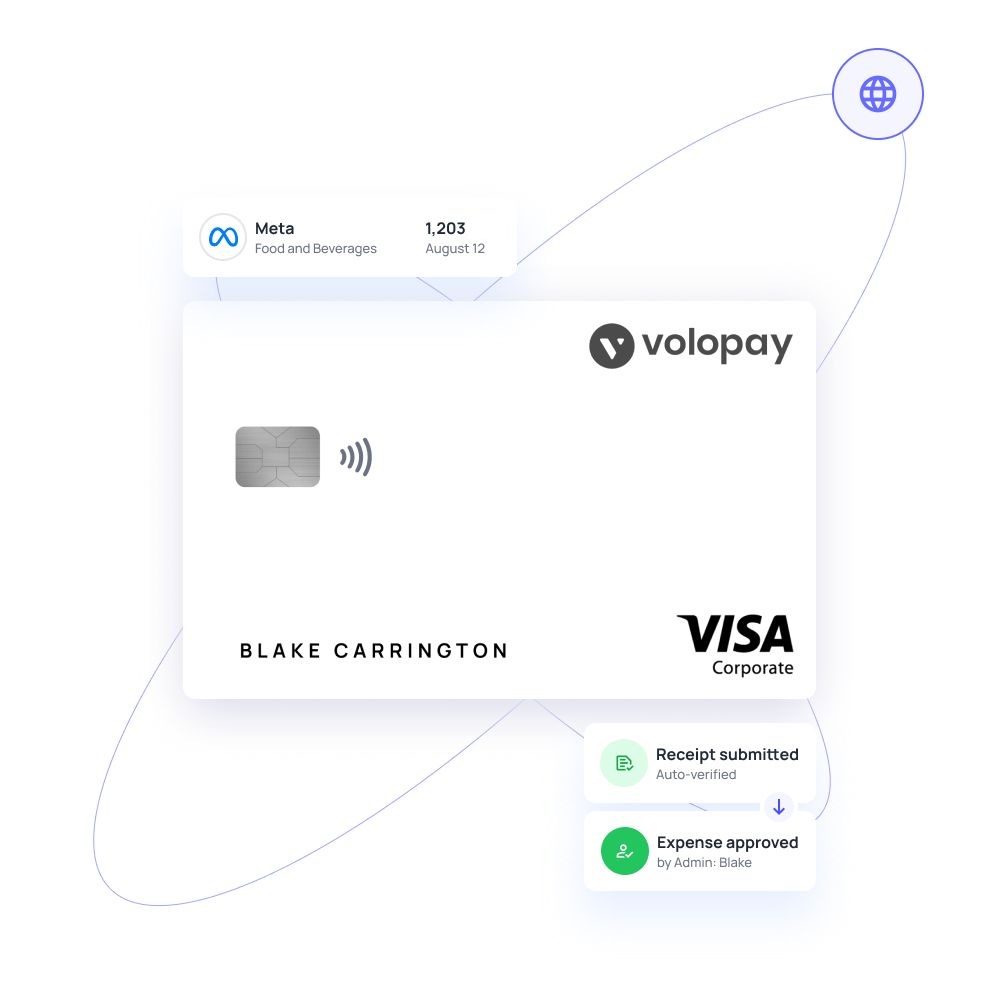

Built-in receipt capture and automated categorization

You'll never chase missing receipts again with integrated capture technology that automatically organizes expense documentation. Smart categorization systems sort transactions according to your accounting requirements, streamlining reconciliation processes and audit preparation.

This automation reduces administrative overhead while ensuring complete compliance with financial reporting standards.

How company debit cards for employees improve financial discipline

Enforce spend policies automatically

You set rules directly in the card systems. Limits on amounts, vendors, or categories ensure compliance. Unauthorized transactions are blocked instantly, reducing manual oversight and keeping spending aligned with your policies effortlessly.

Full audit trails and approval workflows

You meet compliance needs seamlessly. Every transaction is logged with detailed records, creating clear audit trails. Built-in approval workflows ensure oversight before spending occurs, simplifying regulatory adherence and giving you confidence that financial processes are transparent, traceable, and aligned with governance standards.

Reduce fraud and misuse with granular controls

You prevent abuse proactively. Cards feature controls like real-time monitoring, spending caps, and vendor restrictions. Suspicious activity triggers alerts, and unauthorized use is stopped before it escalates, safeguarding your funds and minimizing fraud risks without constant manual intervention.

Real-world use cases for company debit cards

When you implement company debit cards across your organization, you'll discover their transformative impact on financial operations. These practical applications demonstrate how strategic card deployment can streamline processes, enhance control, and empower your teams to operate more efficiently.

Travel and employee expenses

Equip your field teams with dedicated cards that eliminate expense report headaches and out-of-pocket spending. Your traveling employees can book flights, reserve hotels, and cover meal expenses instantly, while you maintain real-time visibility into spending patterns.

This approach reduces reimbursement delays, prevents cash flow issues for employees, and provides immediate transaction data for budget tracking. You'll appreciate how seamlessly expense management integrates with your accounting systems when every purchase is automatically categorized and recorded.

Recurring software or vendor subscriptions

Transform your subscription management by assigning specific cards to different software services and vendor relationships. You'll eliminate the risks associated with shared payment methods while gaining granular control over recurring expenses.

When team members leave or subscriptions need updates, you can manage individual card access without disrupting other services. This systematic approach prevents surprise charges, simplifies vendor relationship management, and ensures subscription costs are properly allocated to the correct departments or projects.

Departmental budgets and project-based spending

Give your department heads and project managers the autonomy they need while maintaining strict budget controls. You can set spending limits, restrict merchant categories, and monitor real-time usage across different teams or initiatives.

This empowers your managers to make necessary purchases without lengthy approval processes, while you retain oversight through automated alerts and spending reports. Your teams will appreciate the flexibility, and you'll value the enhanced accountability and budget adherence.

Office operations, procurement, and petty cash

Digitize your everyday operational expenses with trackable card transactions. Your office managers can purchase supplies, pay for services, and handle unexpected expenses while creating an automatic audit trail. You'll eliminate the administrative burden of cash reconciliation and gain detailed insights into operational spending patterns.

You can learn more about how these cards specifically simplify business expenses by exploring our page on petty cash cards.

Unlock smarter expense management with Volopay cards

Volopay vs. traditional debit card issuers

While traditional debit card issuers focus on basic card functionality, you need a comprehensive solution that transforms how your business manages expenses.

Volopay doesn't just issue cards—it revolutionizes your entire spend management workflow with intelligent automation, real-time visibility, and seamless integrations that traditional providers simply can't match.

More than just cards: full spend management

Traditional card issuers stop at transactions, but you deserve complete spend visibility. Volopay automatically captures receipts, categorizes expenses, and generates detailed reports while your team spends. Set dynamic budgets, enforce approval workflows, and eliminate manual expense tracking.

Your finance team gains real-time insights into every dollar spent, turning expense management from a monthly headache into an automated advantage that drives better business decisions.

Integration-ready with your accounting tools

Stop wrestling with disconnected financial systems that create more work than they solve. Volopay seamlessly syncs with QuickBooks, Xero, NetSuite, and many other accounting platforms, automatically pushing transaction data where you need it.

Real-time synchronization eliminates manual data entry, reduces errors, and ensures your books stay current. While traditional card providers leave you copying and pasting transaction details, Volopay creates a unified financial ecosystem that works effortlessly.

Designed for global and growing teams

Traditional card issuers struggle with international operations and team scaling, but your ambitions shouldn't be limited by outdated infrastructure. Volopay supports 30+ currencies with competitive exchange rates, implements sophisticated role-based access controls, and scales spending limits dynamically as your business grows.

Whether you're managing remote teams across continents or expanding into new markets, Volopay adapts to your operational complexity while maintaining complete financial control and transparency.

Why Volopay is the smartest choice for company cards

When you're evaluating debit cards for company use, you need more than just payment functionality—you need a platform that transforms how your business manages employee spending.

Volopay delivers the most advanced corporate card solution, combining enterprise-grade controls with an intuitive user experience that scales seamlessly with your growth.

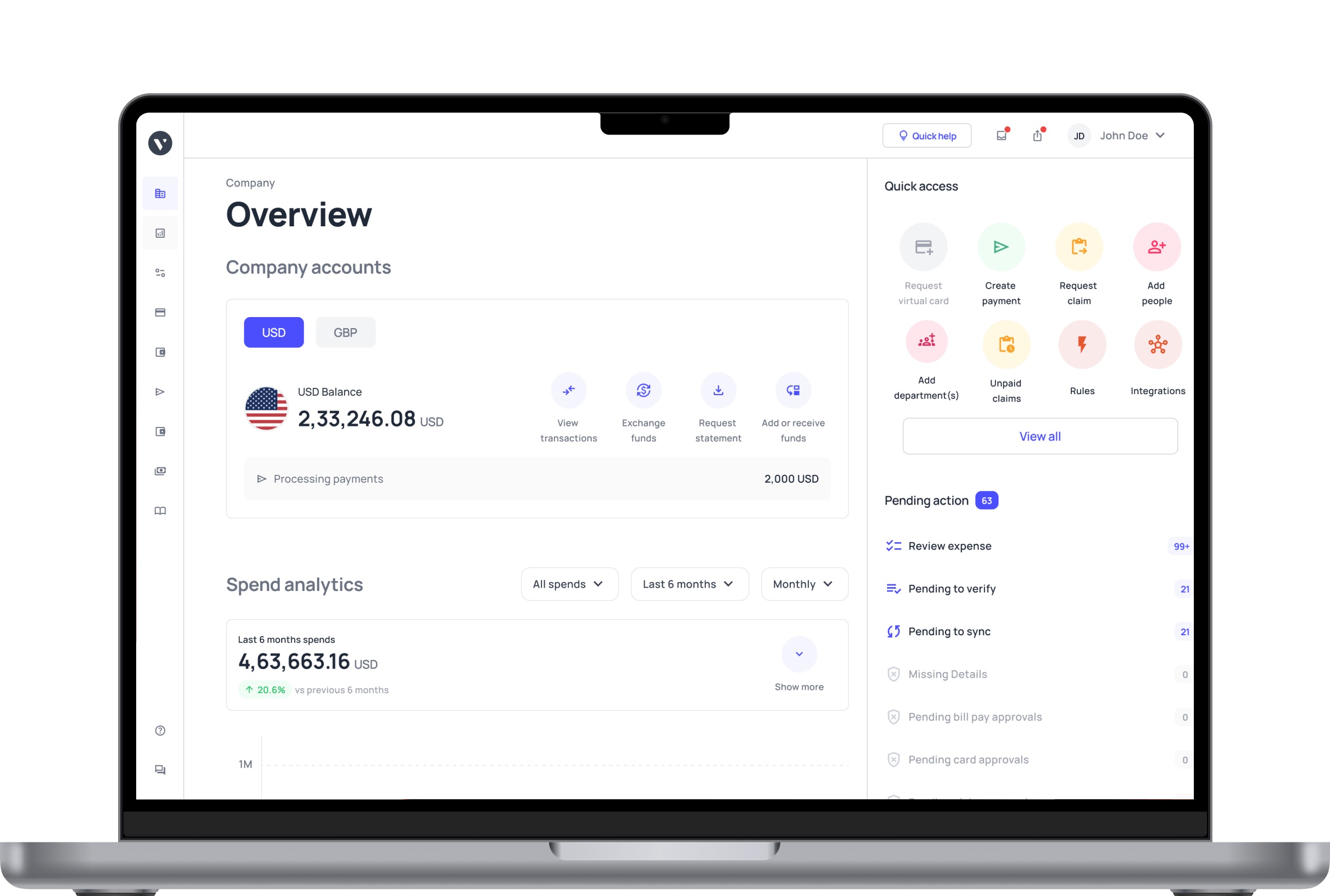

One dashboard for card control, compliance, and reporting

Stop juggling multiple platforms to manage your company cards. Volopay's unified dashboard puts complete control at your fingertips—issue prepaid cards instantly, set spending limits, track transactions, and generate compliance reports all from one interface.

Real-time notifications keep you informed while automated workflows handle routine approvals, transforming complex card management into streamlined operations that save hours weekly.

Instant scalability for growing businesses

Your card program should accelerate growth, not constrain it. Volopay scales effortlessly from startup to enterprise, issuing new cards in seconds as you hire. Dynamic spending controls adapt to changing team structures while bulk management tools handle hundreds of cards as easily as ten.

No lengthy approval processes or administrative bottlenecks—just instant access to payment tools that match your pace.

Centralized visibility across all company debit cards

Gain complete transparency over every employee transaction without the administrative burden. Volopay's centralized dashboard displays real-time spending across all cards, categorizes expenses automatically, and flags unusual activity instantly.

Advanced filtering and search capabilities help you locate any transaction in seconds, while detailed audit trails ensure compliance readiness and financial accuracy.

Finance-first controls built-in

Every feature serves your financial control objectives. Set granular spending limits by merchant category, geography, or time period.

Require receipt uploads before transactions clear, enforce multi-level approvals for large purchases, and automatically block non-compliant spending. These aren't add-on features—they're core capabilities designed by finance professionals who understand your operational requirements and regulatory obligations.

World-class support and onboarding

Your success is our priority from day one. Dedicated onboarding specialists guide your implementation, customizing workflows to match your existing processes. Ongoing support includes training sessions, best practice consultations, and 24/7 technical assistance.

Whether you're troubleshooting a transaction or scaling to new markets, our expert team ensures your card program operates flawlessly at every growth stage.

Bring Volopay to your business

Get started now

FAQs

If an employee loses their company debit card, you can immediately freeze or block it through the Volopay dashboard. A replacement card can be issued instantly to ensure continued access.

Yes, you can issue multiple cards with unique spending limits and category restrictions. This allows you to control budgets by role, department, or individual, and helps prevent overspending or misuse.

Yes, Volopay debit cards can be used for international transactions and recurring online subscriptions. They're perfect for global vendor payments, remote teams, and online tools like SaaS platforms or services.

Volopay company debit cards are highly secure, offering instant freeze, custom spend rules, real-time notifications, and virtual card options. These features reduce fraud risks and keep your company funds protected.

Volopay offers advanced features like real-time expense tracking, automated accounting integrations, and spend controls, unlike traditional bank-issued cards, which usually lack detailed visibility and control over employee-level transactions.

The requirement for minimum employees varies from provider to provider. If you’re unsure about how you qualify, sign up for a demo with our team and have a chat to see how your team could implement and benefit from Volopay’s debit cards.