Streamline spends with a business prepaid credit card

Choosing the right financial tools is crucial for smooth business operations. Among various options, a business prepaid credit card stands out for its control, transparency, and ease of use.

This blog explores why this solution is gaining popularity across US companies and what makes it the best fit for managing expenses efficiently and securely.

What is a prepaid business credit card?

A prepaid business credit card allows companies to load funds in advance, enabling teams to spend within limits without affecting credit scores. Unlike traditional cards, it offers real-time tracking and budget control.

Businesses prefer this model to reduce overspending risks and simplify employee expense management while maintaining accountability across departments.

Why choose a prepaid business credit card?

You need financial tools that offer both flexibility and control. A business prepaid credit card helps you streamline expenses without the risk of debt. It’s ideal for managing employee purchases, improving accountability, and keeping budgets in check—making it a smart choice for growing businesses in the US.

Budget control

You can preload specific amounts onto each card, helping you set and enforce clear spending limits. This prevents overspending and ensures that every dollar is used as planned. With predefined budgets, your team knows exactly how much they can spend—keeping finances aligned with your company’s goals.

Tax compliance

Maintaining accurate financial records is key during tax season. Prepaid cards automatically log every transaction, helping you keep IRS-ready documentation.

You’ll save time on paperwork, avoid missed deductions, and simplify audits with organized, exportable expense reports available whenever you need them.

Operational ease

You’ll save time by reducing the need for reimbursement requests and manual approvals. Funds can be loaded instantly, and employees can use their cards without delays. This helps your team stay focused on their work while you maintain full visibility over company spending from one central dashboard.

Secure transactions

Prepaid cards reduce risk by limiting exposure—only the loaded amount is at stake. You can lock or disable cards instantly, monitor spending in real time, and avoid sharing sensitive banking information. It’s a secure, controlled way to handle company expenses with confidence.

Benefits of prepaid business credit cards

Asset protection

Business prepaid credit cards help safeguard company funds by limiting access to only preloaded amounts. This separation reduces the risk of unauthorized spending or exposure to your primary business account.

Keeping personal and business transactions distinct also enhances financial clarity and strengthens overall asset security.

Tax efficiency

All transactions made using prepaid cards are automatically recorded and categorized, making it easier to prepare IRS-compliant reports. You can export records quickly during tax filing or audits.

This minimizes errors, maximizes eligible deductions, and saves time for your accounting team. It also ensures transparency and consistency in financial documentation year-round.

Spending oversight

With business prepaid credit cards, you can monitor every purchase in real time through an online dashboard. This provides clear visibility into how funds are being used across departments.

It enables you to adjust limits, approve spending, and maintain full control over business expenses. These insights can also inform future budgeting and resource allocation strategies.

Fraud prevention

Only preloaded amounts are available on prepaid cards, reducing your financial exposure. You can instantly freeze or deactivate any card showing unusual activity.

Real-time alerts and secure access help detect and prevent unauthorized transactions before they escalate. Plus, limited card access and role-based permissions enhance overall transaction security.

Find the ideal prepaid card packed with features for your business!

How prepaid business credit cards work

Fund loading

You can preload funds onto the card from your company’s business account using an online dashboard or mobile app. This gives you full control over spending limits and ensures employees access only what you’ve approved. Scheduled or instant transfers also help keep operational workflows smooth and uninterrupted.

Debt-free use

Unlike traditional credit cards, prepaid cards don’t involve borrowing or credit checks. You spend only what’s loaded, eliminating interest charges and reducing financial risk.

This makes it easier to maintain cash flow discipline and operate without the stress of accruing business debt. It also encourages more thoughtful, budget-conscious spending by all cardholders.

Transaction tracking

Every transaction is logged automatically and categorized within the platform for easy reference. You can view real-time activity, generate reports, and ensure compliance with spending policies.

This level of transparency simplifies auditing and improves accountability across teams. Over time, these records can help inform smarter financial planning and forecasting.

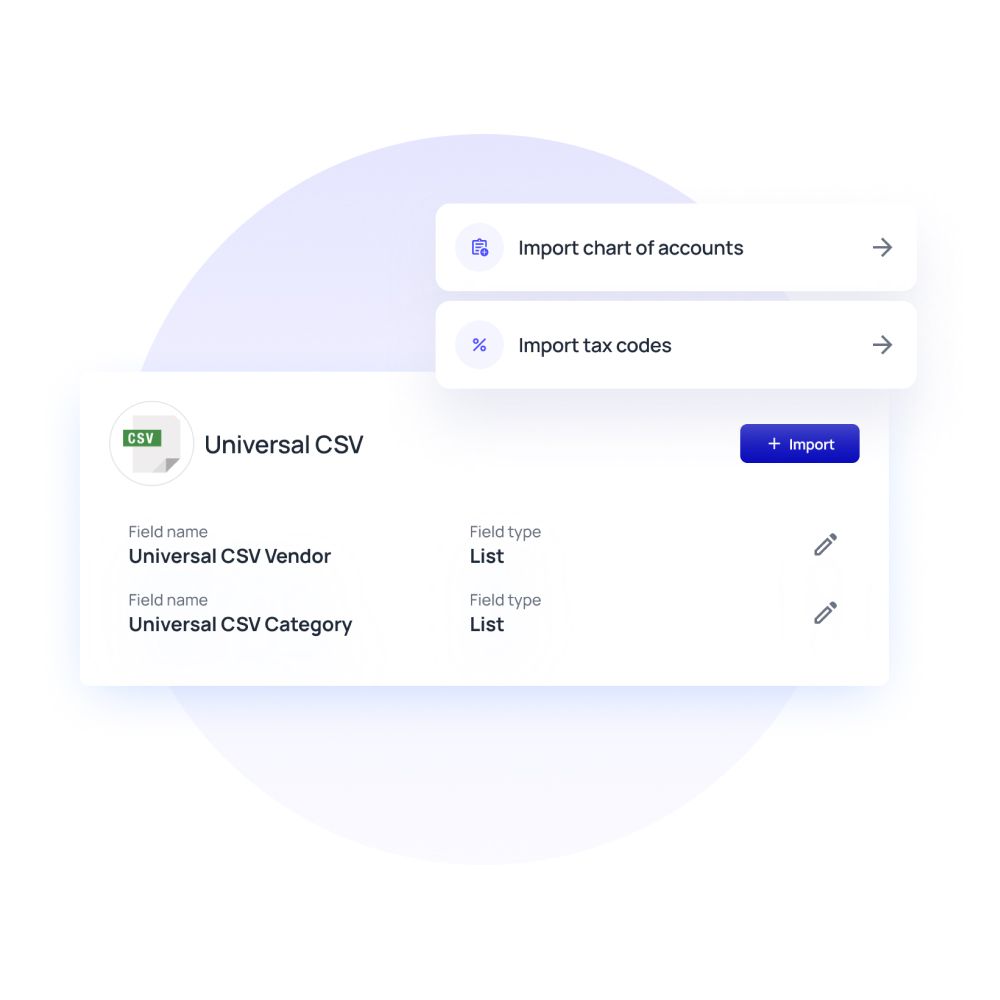

Software integration

These cards integrate easily with popular accounting and expense software such as QuickBooks, Xero, or NetSuite. Integration automates transaction syncing and categorization, reducing manual work for finance teams.

This enhances accuracy and keeps your financial systems aligned and up to date. It also minimizes human error and speeds up month-end reconciliations.

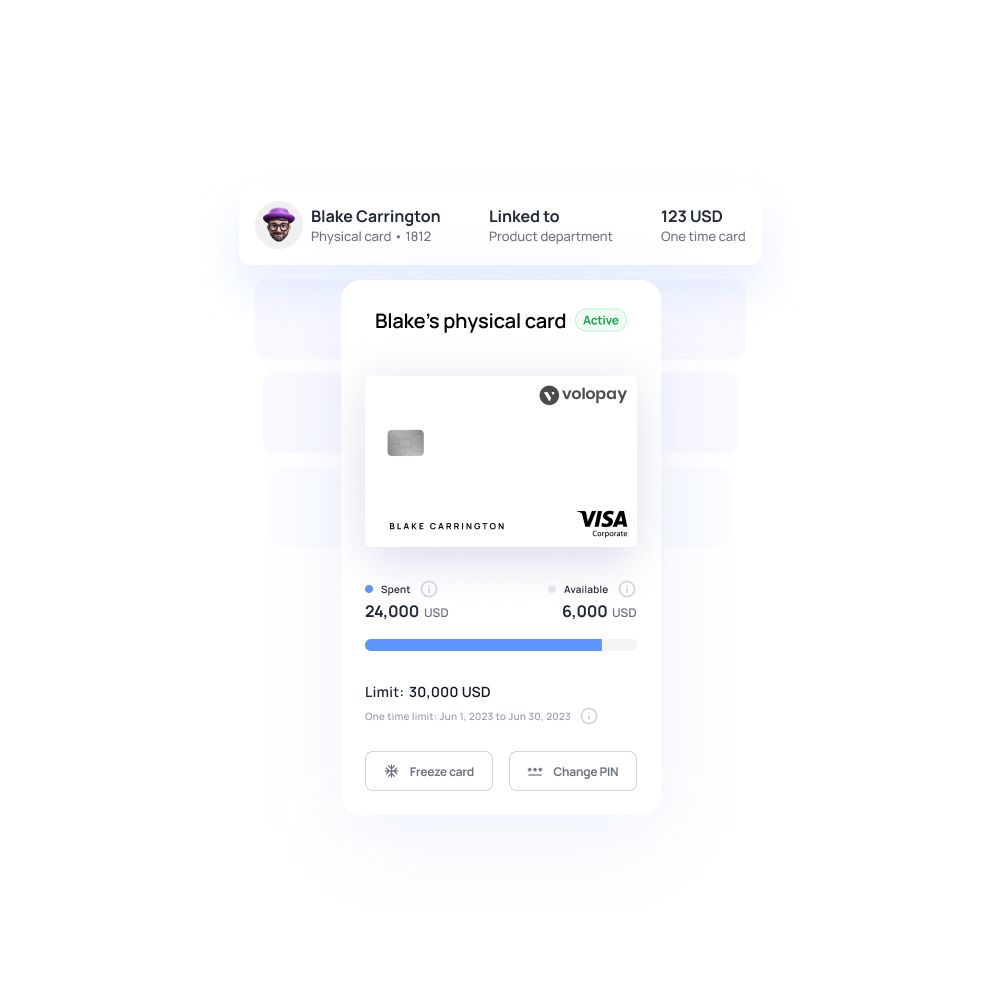

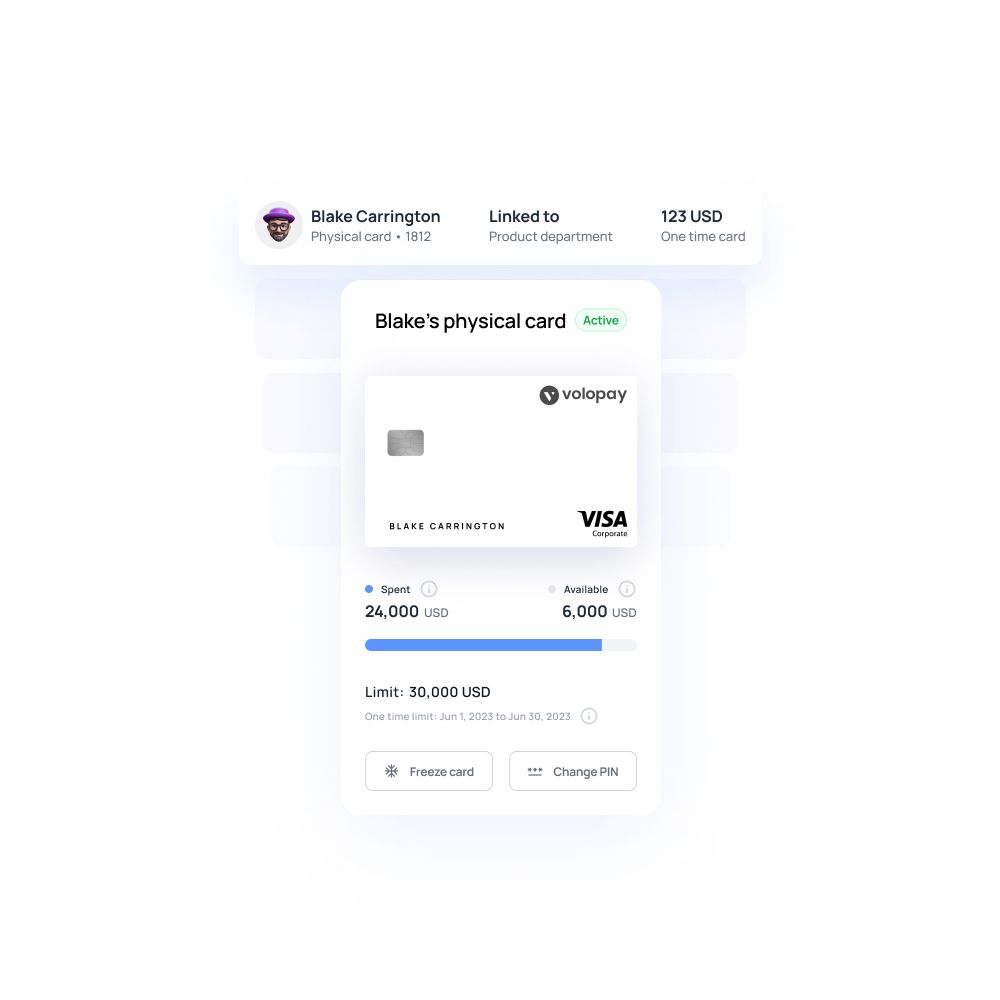

Flexible payments

You can issue individual cards with custom limits to employees or departments based on their roles and responsibilities. This enables quick, policy-based payments without central approvals every time.

Card settings can be adjusted in real time, making it easy to respond to changing business needs. Whether it’s for travel, subscriptions, or vendor payments, you stay in full control.

When to use a prepaid business credit card

Business startup

In the early days of launching a business, using a prepaid card helps you manage limited capital more effectively. You can avoid unnecessary debt while building financial discipline.

This setup gives you spend control from day one and protects your primary funds from unauthorized or unexpected charges. It helps establish organized financial practices that scale with your business.

Early expenses

Prepaid cards are ideal for covering initial costs like marketing, software subscriptions, or office supplies. With preset limits, you avoid overspending and stay aligned with your launch budget.

Plus, every transaction is automatically recorded, making expense tracking and categorization easier from the start. This transparency gives you a clear picture of where your startup funds are going.

Team management

When employees begin making business purchases, prepaid cards allow you to issue individual cards with specific spending limits. This avoids the hassle of reimbursements and reduces misuse.

You gain visibility over team spending while empowering staff to make approved purchases independently. Custom settings also let you control when and where each card can be used.

Growth readiness

As your business scales, prepaid cards offer the flexibility to manage multiple departments or projects without losing control. You can assign budgets, adjust limits, and monitor usage in real time.

This ensures financial oversight while keeping your operations agile and well-organized. It also helps enforce company-wide spending policies across all levels of your organization.

Choosing the right prepaid business card

Digital tools

Choose platforms that offer user-friendly mobile apps and dashboards with real-time transaction tracking. These features make it easier to manage business expenses on the go.

Quick card management, easy loading, and instant alerts boost control. Integrating with accounting software streamlines expense tracking and reporting.

Cost efficiency

Evaluate monthly fees, reload charges, and hidden costs before selecting a card. A cost-effective solution should offer transparent pricing with no surprise deductions.

Lower operational expenses mean more funds stay within your business, contributing to long-term financial health. Compare providers to find the best value for your business.

Spending limits

Select cards that allow customizable spending limits per employee or department. This helps enforce company policies and prevents overspending.

Having control over daily, weekly, or category-specific limits adds an extra layer of financial discipline. It also ensures that spending aligns with your operational and budgetary goals.

Support availability

Opt for providers that offer reliable customer support, including live chat, phone, or email. Timely assistance is critical when issues arise with card access or transactions.

A responsive customer support team helps avoid workflow disruptions and ensures smooth operations. Look for 24/7 availability if your business operates across time zones or on weekends.

FDIC security

Ensure the card issuer partners with an FDIC-insured bank to protect your funds. This adds a layer of federal protection in case of issuer failure.

Security-backed cards offer peace of mind while handling your daily business transactions. Verifying regulatory compliance helps ensure your business stays protected from financial instability.

How to get a prepaid business credit card

1. Provider selection

Start by researching reputable providers that offer company prepaid credit cards tailored to your business needs. Compare features like mobile access, spending controls, fees, and integration options. Choose a provider that aligns with your budget, team size, and operational goals for the best long-term fit.

2. Document submission

Once you’ve selected a provider, complete the application and submit the required business documents. These typically include your EIN, business license, and identification for the account owner.

Accurate documentation speeds up approval and ensures compliance with federal regulations. Be sure to double-check document accuracy to avoid processing delays.

3. Fund allocation

After approval, transfer funds from your business account to the prepaid card account. You can set an initial budget and define allocation rules for departments or teams.

This upfront funding allows immediate control over how much is available for use. Many platforms also offer the option to automate recurring fund transfers.

4. Platform setup

Set up your account dashboard to manage cards, assign user roles, and define spending permissions. Link the platform to your accounting tools if integration is available.

This setup ensures efficient control and real-time tracking from day one. Customizing notifications and approval workflows can further streamline financial oversight.

5. Card distribution

Once the platform is configured, distribute physical or virtual cards to your team members. Assign custom limits based on job functions or departments.

Employees can begin using the cards immediately within the pre-approved guidelines. Regular training or onboarding can help ensure users follow company spending policies correctly.

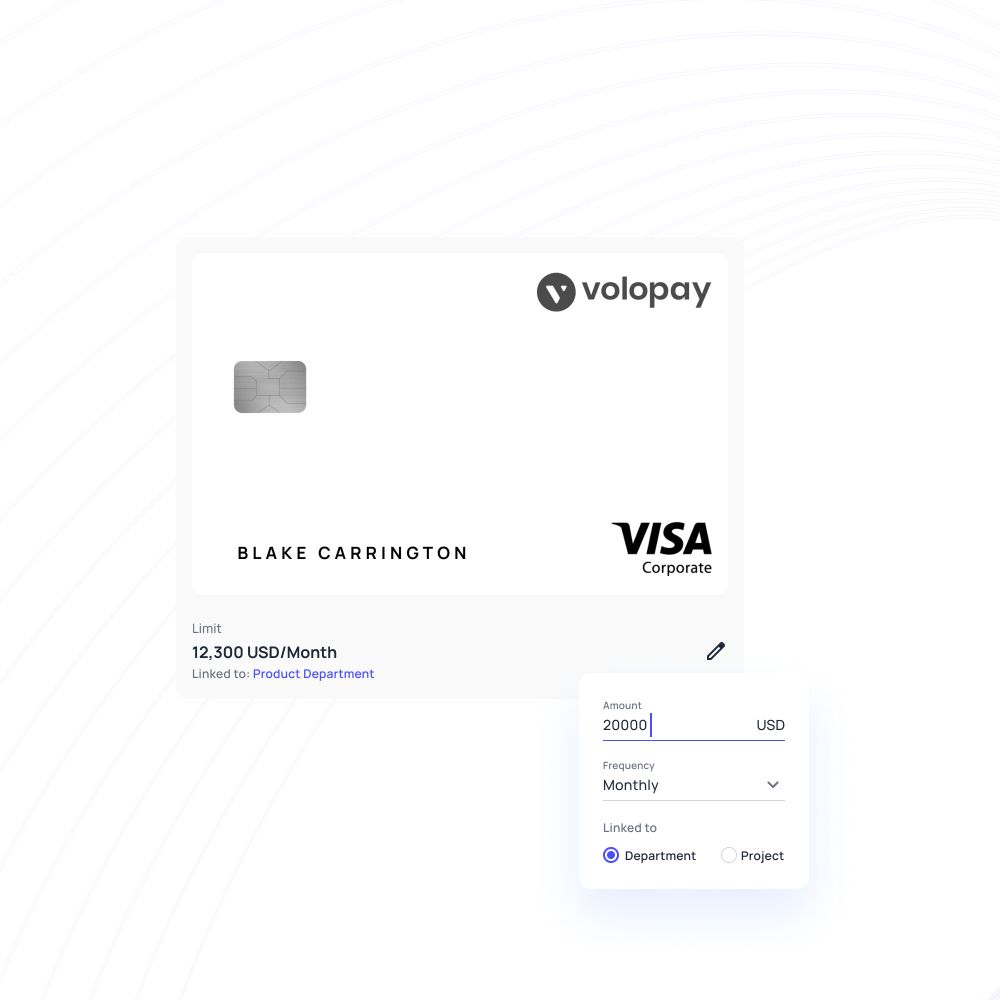

Why Volopay’s prepaid cards stand out

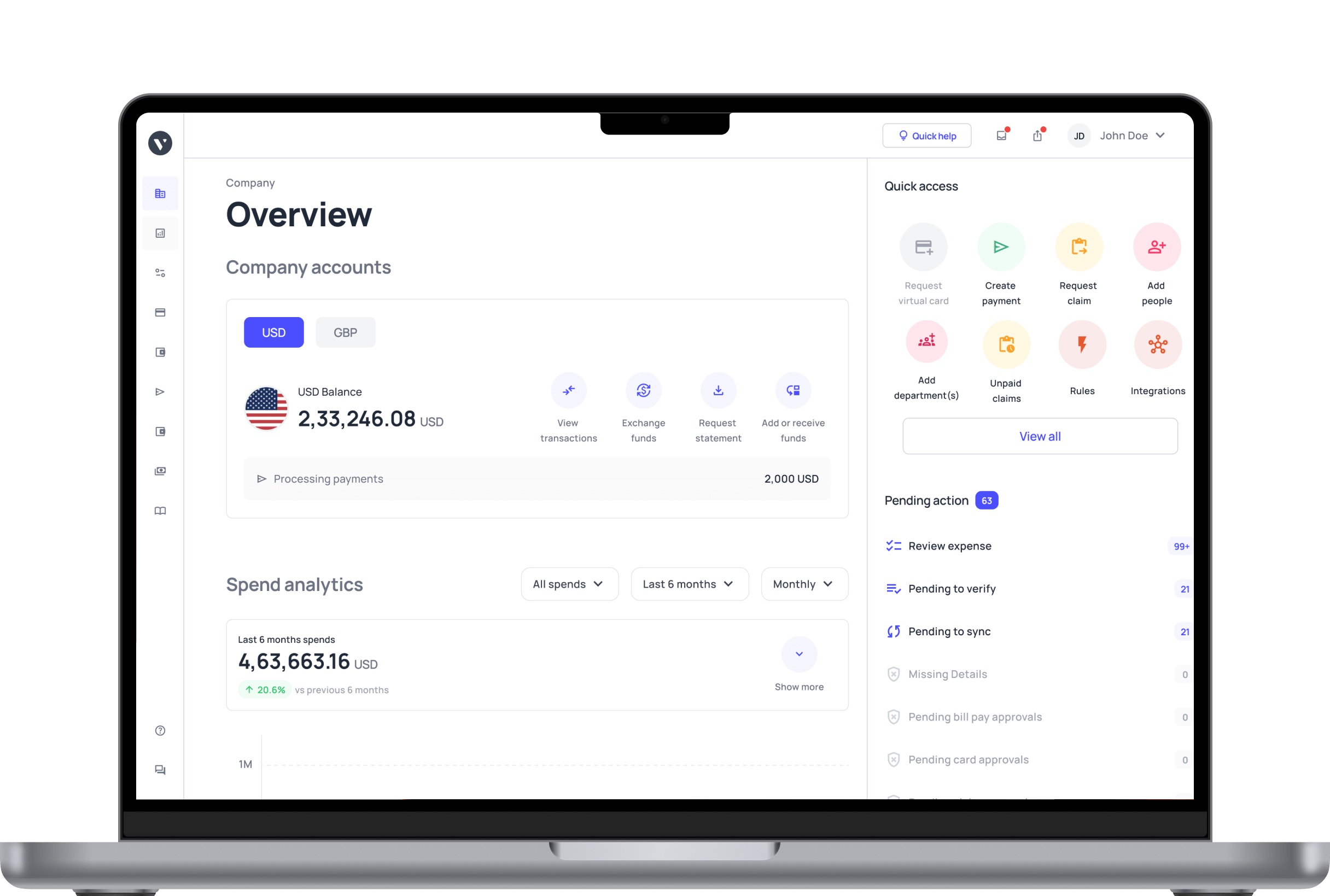

Volopay’s prepaid cards offer unmatched control, speed, and transparency for modern businesses. From instant top-ups to seamless software integration, these cards are designed to simplify expense management at every level.

Companies benefit from automated processes, real-time tracking, and better compliance—all in one centralized platform that scales with growing teams. With built-in tools for approval workflows and spend limits, businesses can confidently manage expenses without compromising flexibility.

Instant card top-ups

Volopay allows you to instantly load funds onto prepaid cards through an intuitive online dashboard. Whether funding individual employees or departments, transfers are immediate and hassle-free.

This ensures teams using Volopay’s corporate cards always have access to the resources they need, without waiting for lengthy approvals or manual bank processes. You can also schedule recurring top-ups, making it easier to support regular operational needs.

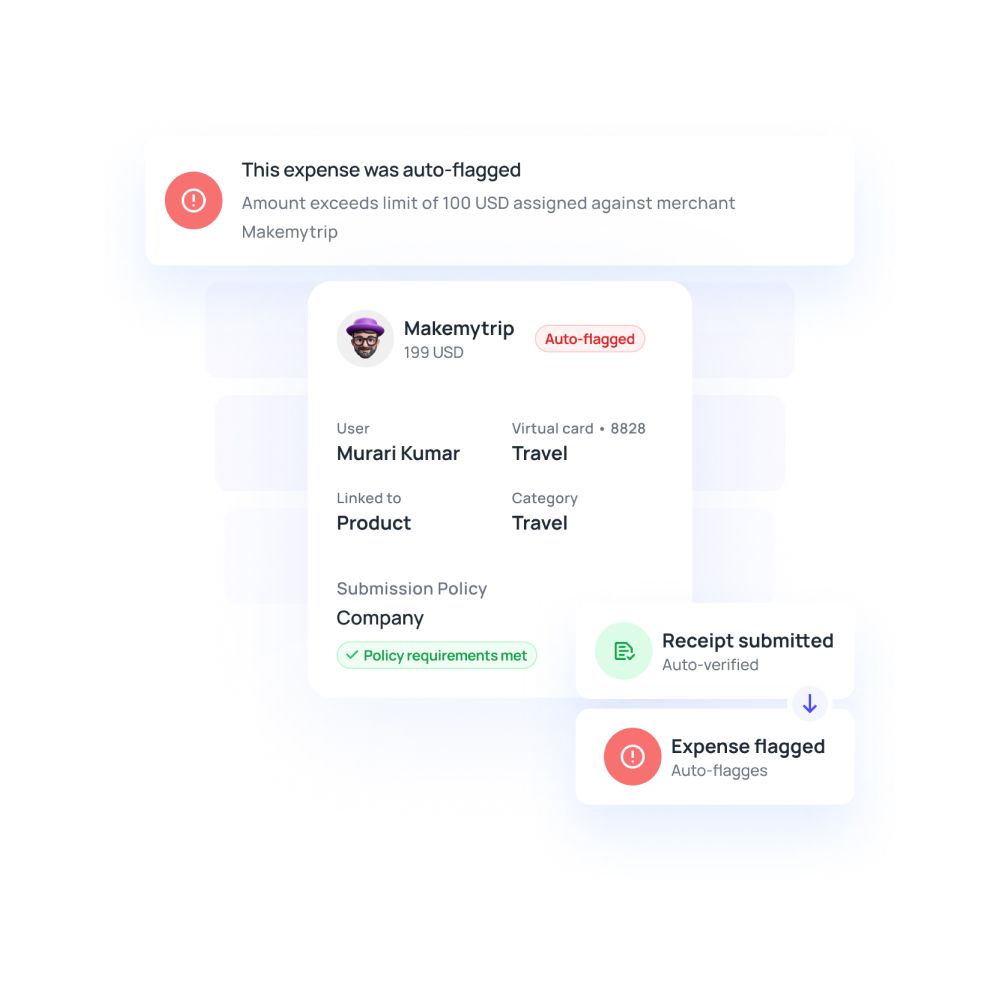

Real-time transaction monitoring

Every card transaction is instantly reflected in Volopay’s built-in ledger, offering complete transparency. This real-time visibility helps finance teams monitor spend as it happens.

It also allows for quick detection of unusual activity, keeping business expenses aligned with budgets and policies. Managers can set alerts and approval rules to maintain tighter control over spending.

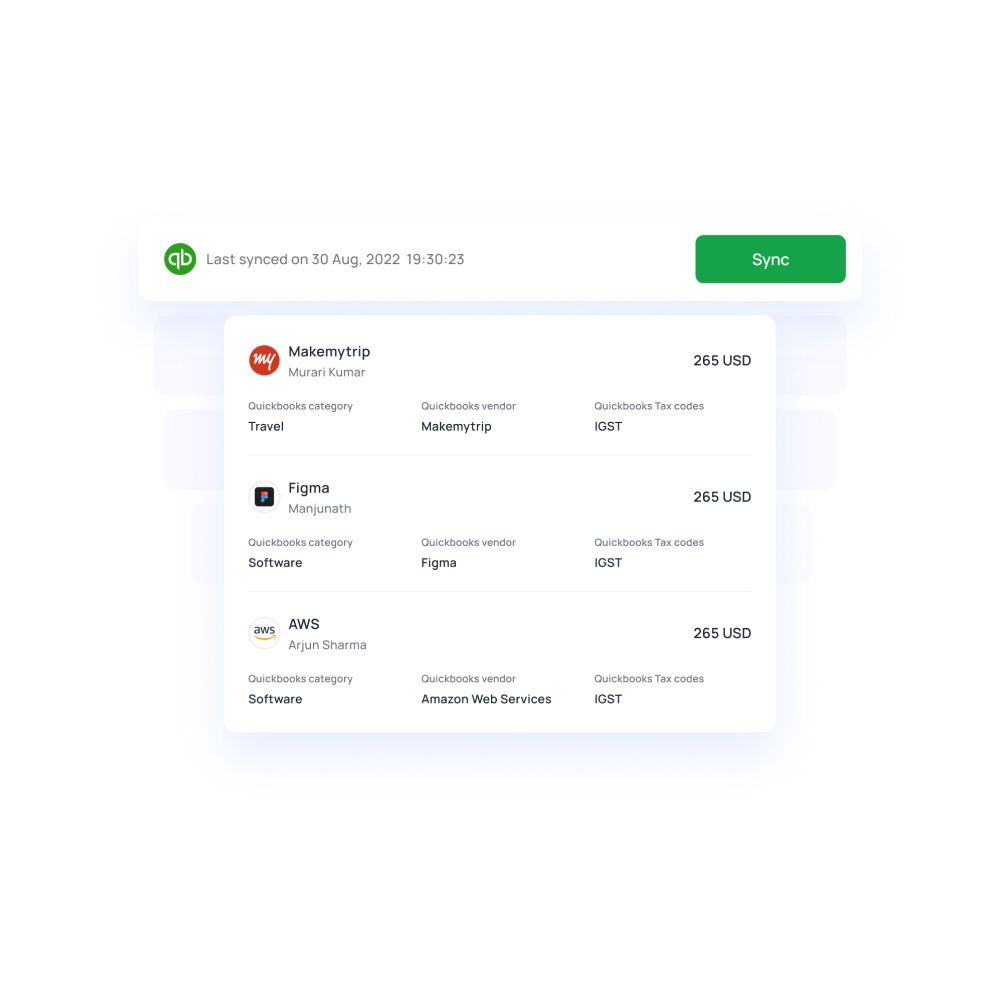

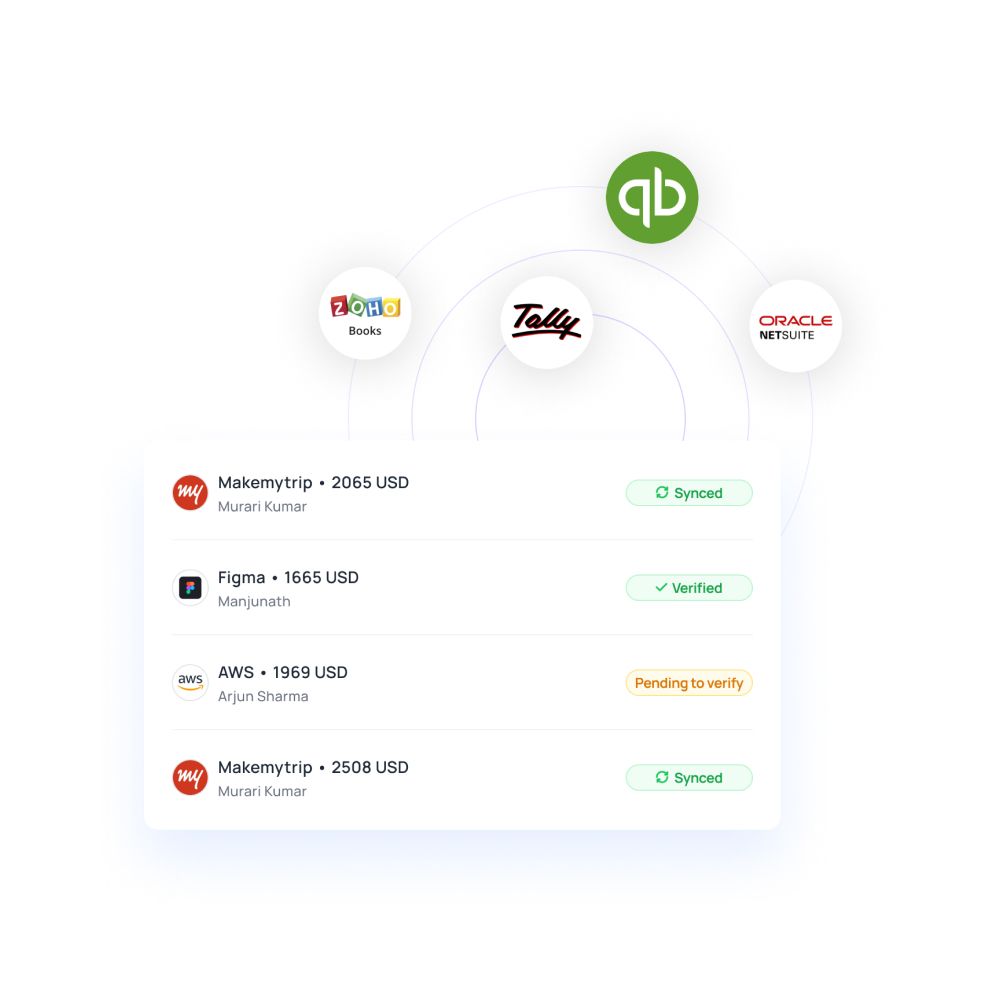

Simplified accounting integration

Volopay connects directly with accounting tools like QuickBooks, Xero, and NetSuite to streamline expense reporting. Each transaction is automatically categorized and synced with your ledgers.

This automation reduces manual entry, minimizes errors, and makes month-end reconciliation significantly faster and easier. It also ensures financial records stay up-to-date and audit-ready at all times.

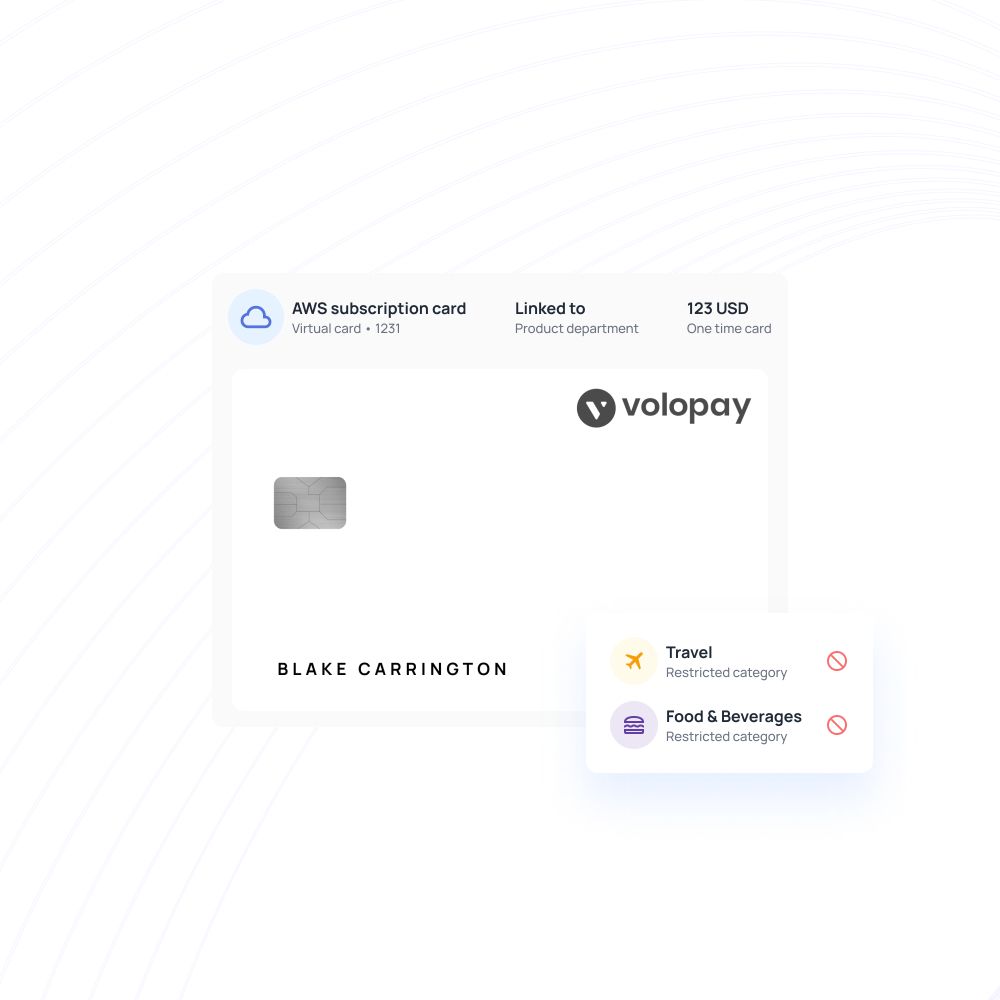

Unlimited virtual cards for online expenses

Volopay enables businesses to generate unlimited virtual prepaid cards for secure online transactions. Whether it’s managing SaaS subscriptions, vendor payments, or digital purchases, each card can be assigned unique limits and usage rules. This reduces risk, simplifies tracking, and eliminates the need to share sensitive card details across teams.

Industry-leading security protections

Volopay is ISO-certified and PCI DSS compliant, ensuring the highest standards of data and payment security. Businesses can instantly freeze or disable any card in response to suspicious activity.

These built-in safeguards protect against fraud and unauthorized transactions, keeping company finances secure at all times.

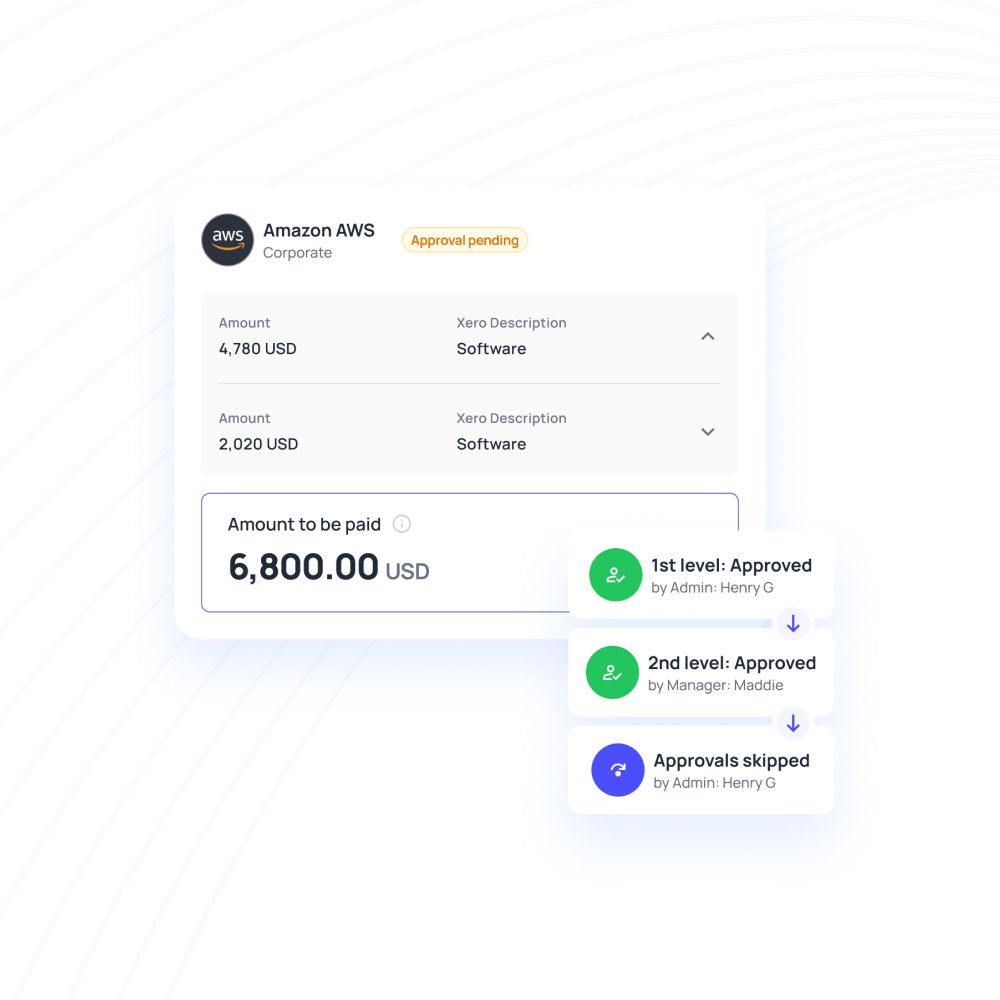

Multi-tier approval workflows

Volopay allows you to create custom approval workflows with up to five levels of review. Managers can pre-set spending rules and delegate review responsibilities based on hierarchy.

This ensures greater accountability while speeding up approvals and eliminating bottlenecks in the expense process.

Mobile app for on-the-go management

With Volopay’s mobile app, employees and managers can manage expenses from anywhere. Users can track spending, submit receipts, and request funds in real time.

The app also allows instant card control, enabling teams to stay productive and compliant while on the move.

Bring Volopay to your business

Get started now