Benefits of virtual credit cards for eCommerce startups

Thanks to new eCommerce startups, consumers have started moving to convenient options like online shopping. Businesses are also catching up with this trend, opening their very own online stores. It’s undeniable that eCommerce is here to stay. And from what we can see, we can expect businesses from all categories to give birth to their new eCommerce startups.

These are not just from the B2C space; B2B eCommerce startups are catching up too. What’s going to be a surprise for these new eCommerce startups is the unforeseen challenges in B2B e-commerce payment methods. B2B eCommerce payment is a far cry from other B2B payment worlds, as the former has a diverse set of buyers and sellers (including drop-shipping payments too).

Most common payment types

The payment methods these eCommerce startups follow are different from each other, too, and so far, it has not been standardized. While small companies use manual payment methods and checks, huge enterprises rely on wire and ACH transfers. But the need for a safe, secure and versatile payment method to pay off vendors and subscription fees is still open, out in the air. And virtual corporate cards are here to fill the gap.

Bank transfers

This one is a no-brainer as most B2B payments happen this way. They collect the account details of their vendors and unique IDs and send money through the company's bank account. It’s digital but not entirely safe and takes a massive load of manual work.

Reconciling that to the company record should also be done manually. Additionally, this method can lead to errors and delays, increasing the risk of financial discrepancies.

Check

Although checks are a thing of the past, eCommerce companies still rely on this B2B payment system for their vendor requirements. It's excruciating to fill in the check, send it in the mail, wait for the bank to process it, and rewrite another check if it fails.

And let’s not forget the money that gets wasted here on this incessant check processing., which delays transactions and affects cash flow management.

Corporate cards

Corporate cards make B2B payments quicker and safer compared to the rest. They use either physical cards or virtual corporate cards. Depending on the payment type, they can pick one card and use it. For online vendor payments, virtual cards are the better option.

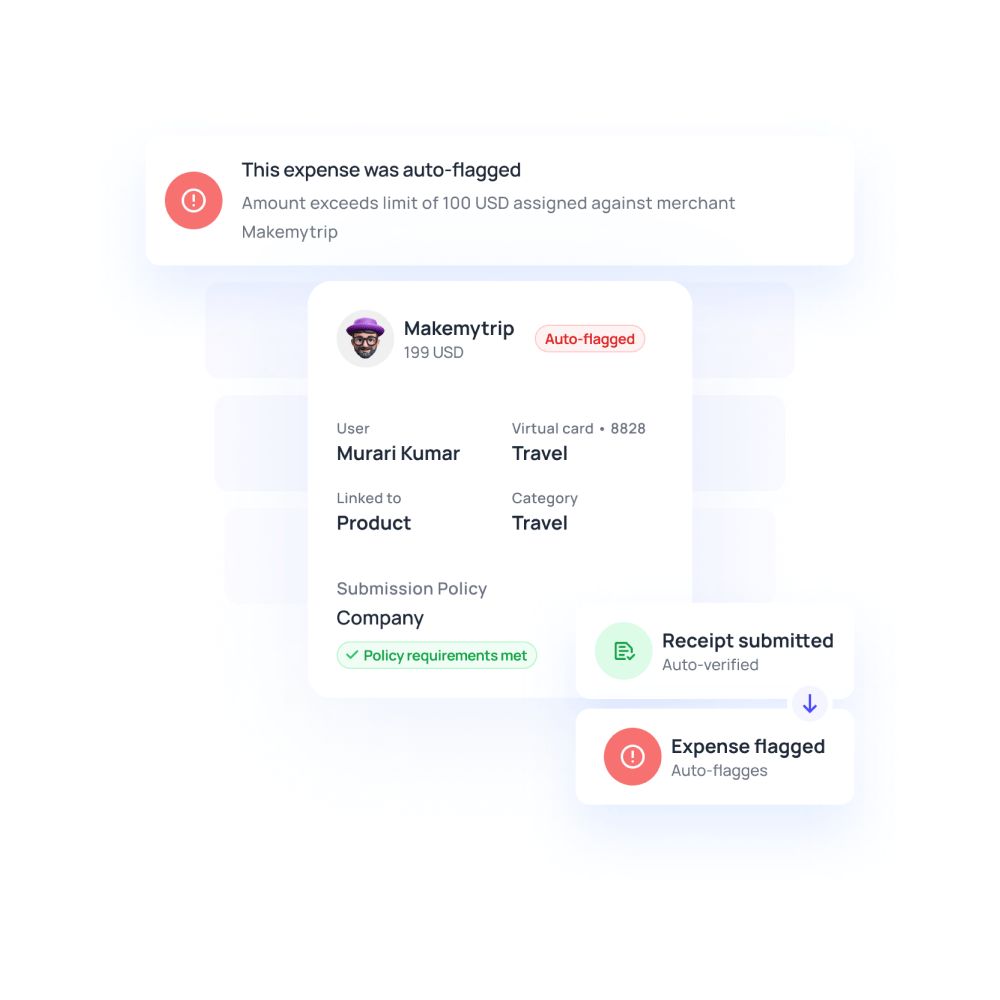

They have an expense management platform, the accounting team will have more control over it, preventing misuse and fraudulent activities.

Virtual credit cards- eCommerce B2B payment method

Virtual credit cards don’t need much introduction as they are already here for a while. Let’s see how suitable and advantageous are virtual cards for B2B eCommerce businesses.

Security

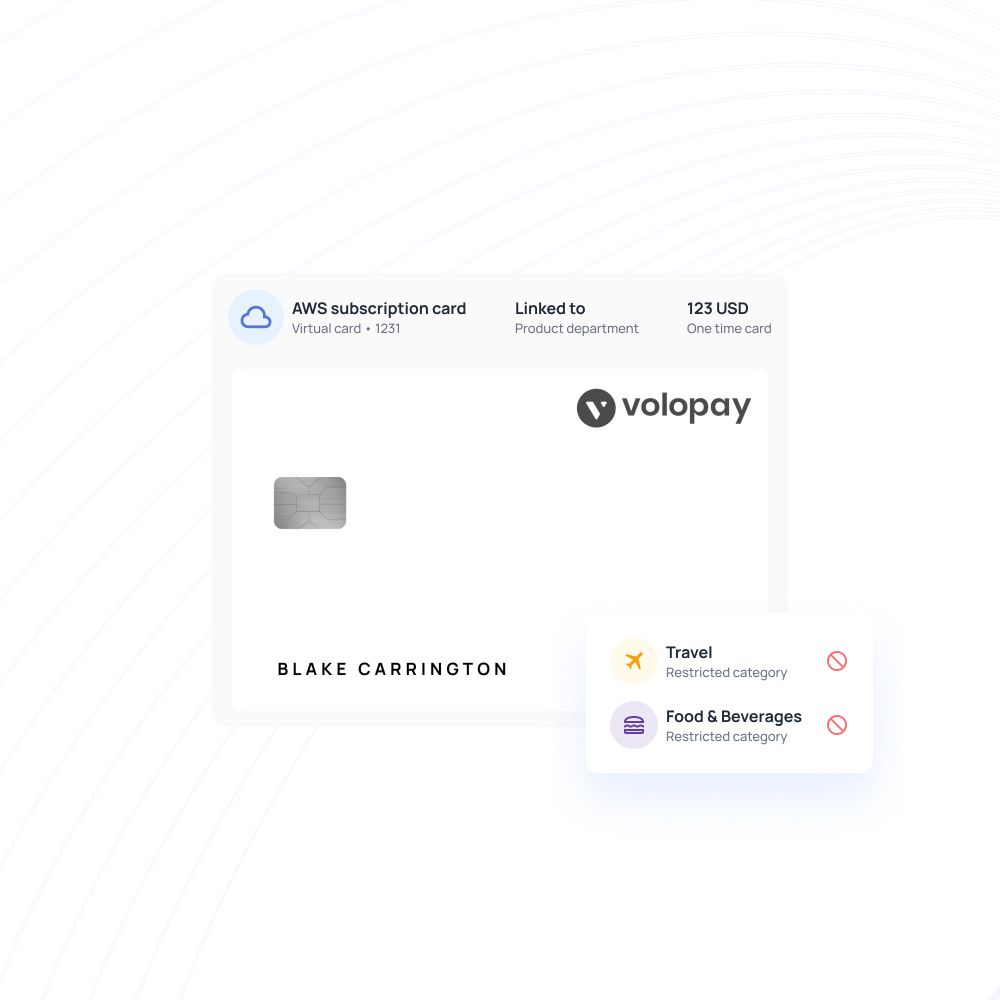

Virtual credit card payment is the safest compared to any other B2B eCommerce payment method used. As you see, you can have as many cards as possible for different vendors. And each card has its unique number.

So, even if any of the card information gets stolen, no one will be able to trace it back to the main account or the other virtual cards that you have. Virtual corporate cards can be frozen, locked, and deleted any time after their distribution.

Subscription management

Being a new eCommerce startup, paying for a few applications and software that are subscription-based; every month right on time before you get cut off can be a bit of a task. Virtual cards take care of your monthly payments once the approval gets released from your side.

You can also see how much subscription-based software your team uses, how many times you have paid, who approves them etc. And, there is absolutely no chance to have a double payment or missed payment.

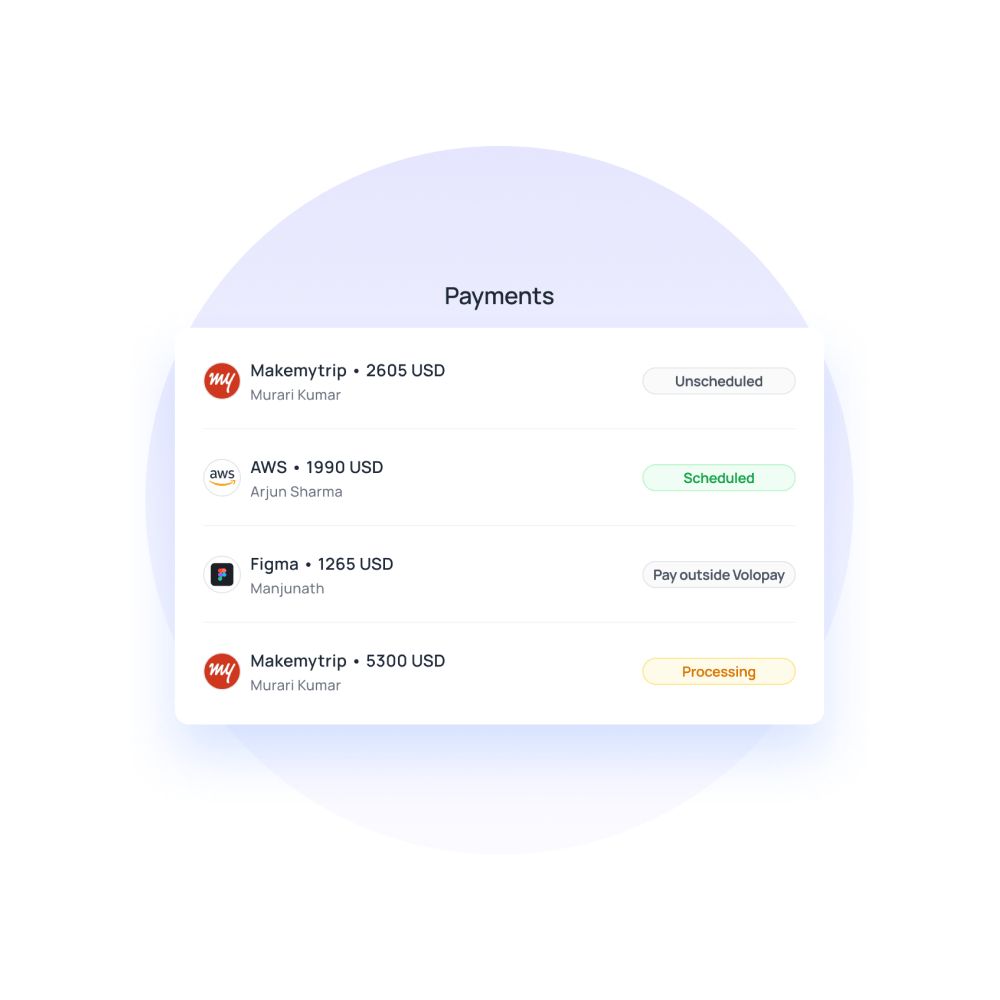

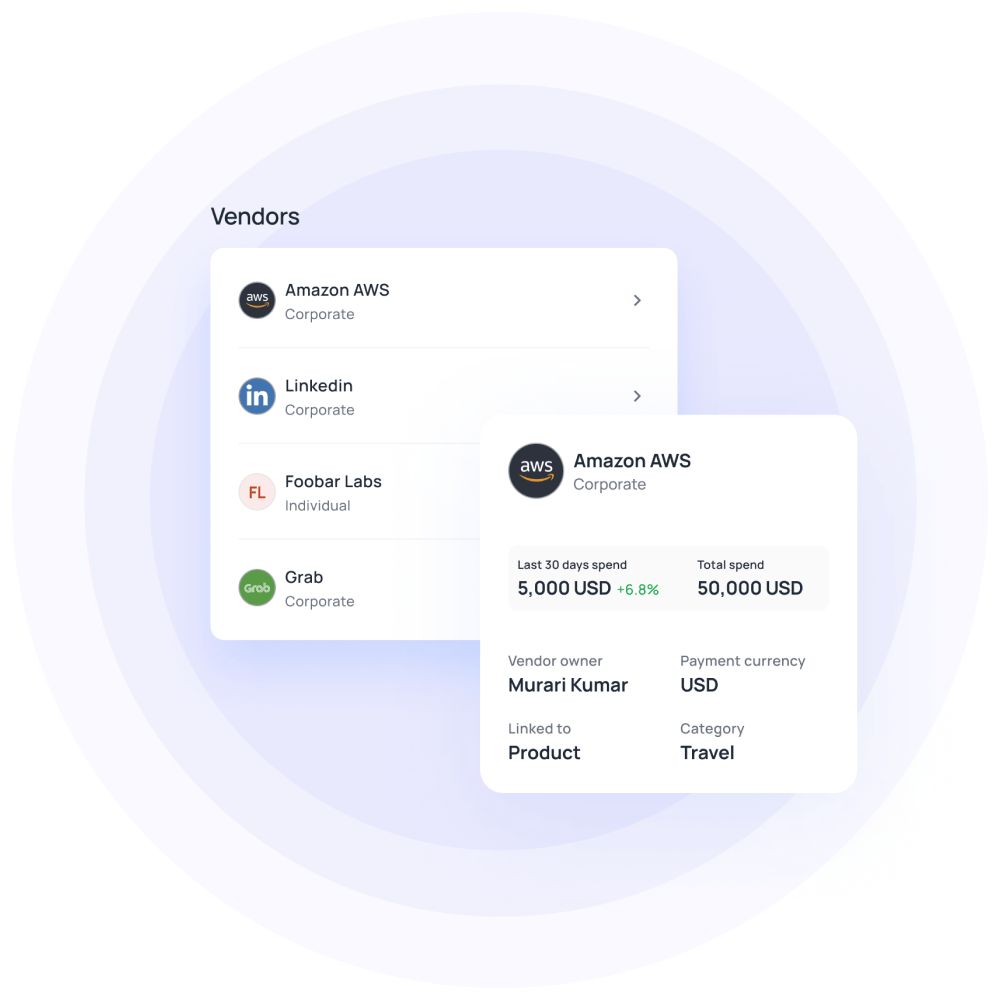

Easy supplier payment

As an eCommerce business owner, you highly rely on your suppliers to send stocks to your clients on time. With virtual cards, you can pay your suppliers on time and receive your consignments.

The sooner you receive your consignment, the faster you can deliver them to your customers. And for that to happen, there shouldn’t be any delay or interruption in your transactions. Missed or late payments can affect your business that easily.

Expense management

When you pay a lot of vendors and all through a different mode, it will be mind-boggling to track and tally. Virtual cards make the job simpler for accountants as they have the overall accounts payable in one place.

Having a platform where you can categorize, have separate cards for each vendor, set automated workflows, and pay vendors on time is what you need in streamlined expense management software.

Ready to make the switch to virtual cards?

Introducing Volopay virtual corporate cards where you can see all the above-discussed features and many more! Revolutionize your expense management by opting for one of the best B2B eCommerce payment methods. With the Volopay card management system, you can make subscription management and vendor payment seamless, as you can create as many cards as you want.

The administrator gets access to a neat and user-friendly interface, where they can see all the cards being handled and every virtual card payment made. The admin can also set limits or budgets for each of them, and if you need more money to be added, that goes on a level of approvals.

These sync with other accounting software happens automatically, and you wouldn’t even realize it's happening. So, no manual keying in! You can have physical cards, too, if your business process needs them. But most new eCommerce startups are cool with just having virtual cards alone.

Virtual cards are beneficial for employees too. You can issue a one-time virtual card if they have any work-related expenses coming up! Show them that you care and trust while safeguarding your accounting information.

Trusted by finance teams at startups to enterprises.