What are B2B payments? Methods, trends, and automation

B2B payments, or business-to-business payments, refer to financial transactions between companies rather than between a business and a consumer. In the United States, the demand for faster, more secure, and transparent B2B payment methods is growing rapidly due to increased digital transformation and global trade.

Traditional processes are giving way to automated solutions that streamline the B2B payment process, reduce manual effort, and improve accuracy. With evolving trends and technologies, businesses are adopting advanced tools to manage transactions efficiently.

Automation is no longer optional—it’s essential for enhancing financial workflows, reducing delays, and supporting scalability in today’s competitive business landscape.

What are B2B payments?

B2B payments, or business-to-business payments, are financial transactions made between two business entities for goods or services rendered. Unlike B2C (business-to-consumer) payments, which are usually instant and straightforward, B2B transactions often involve larger sums, extended payment terms, and a more complex B2B payment process.

These payments can be recurring, scheduled, or contract-based, and they typically include invoices, approvals, and reconciliation steps. B2B payment methods vary and include ACH transfers, wire transfers, checks, credit cards, and digital wallets.

In the US, companies are increasingly turning to automated systems to streamline B2B payments, improve cash flow management, and reduce human error. Efficient B2B payment systems are vital for maintaining strong supplier relationships, ensuring timely deliveries, and optimizing operational efficiency across industries.

Importance of B2B payments in modern business

In the fast-moving digital economy of the present time, B2B payments are the pillar of financial transactions between enterprises. As US businesses depend more on international vendors, efficient B2B payment mechanisms facilitate smooth operations.

Timely settlements, proper accounting, and vendor satisfaction depend on a well-organized B2B payment procedure. Automated processes are gaining popularity, companies are embracing streamlined business-to-business payments to enhance efficiency, increase visibility, and minimize hazards in their financial processes.

1. Facilitates efficient cash flow

Cash flow management is key to business stability. On-time B2B payments enable companies to have sound cash reserves and effectively plan for future outgoings.

Computerized payment systems monitor due dates and minimize late charges, maintaining the B2B payment system uninterrupted and free flowing. Effective cash flow management enables business continuity and facilitates long-term growth.

2. Builds supplier trust

Reliable supplier relationships are founded on reliability and trust. Consistent and timely business to business payments illustrate professionalism and fortify long-term relationships.

If vendors trust your payment methods, they will tend to provide favorable terms and prioritize your orders. An open B2B payment process aids in fostering reliable, mutually advantageous supplier relationships.

3. Improves financial visibility

Prompt and precise B2B payments reflect unambiguous visibility into a company's financial situation. Automation solutions facilitate monitoring each payment, which makes it possible to access financial information in real-time.

Increased visibility aids informed decision-making and strategic planning. An open B2B payment process enables finance teams to monitor cash outlays and track spending across departments with ease.

4. Reduces manual errors

Manual data entry in business-to-business payments can result in errors, like duplicate payments or wrong amounts. Automating the B2B payment process drastically minimizes such risks.

Automated checks, invoice matching, and rule-based workflows ensure accuracy and avoid expensive errors, allowing businesses to have error-free financial operations at scale.

5. Enables scalable operations

As the businesses expand, it becomes impossible to manage a growing number of vendors and transactions manually. Automating B2B payments enables firms to process more in volume without increased complexity.

Scalable solutions support growing payment requirements while keeping the process in line, ensuring that the B2B payment process is still efficient as the business grows across markets.

6. Supports faster reconciliation

Manual reconciliation of payments can hold up financial close procedures. Automated B2B payment solutions integrate with accounting applications to reconcile payments against invoices in real-time.

This shortens reconciliation time and offers accurate financials. Finance teams can close the month more quickly and with higher certainty with a simplified B2B payment process.

7. Drives operational efficiency

Streamlined business-to-business payments remove time-consuming tasks and cut processing time. Automation speeds up invoice approval, payment timing, and reporting. This reduces staff hours and lowers overhead expenses.

An optimized B2B payment process streamlines workflow, enabling businesses to concentrate on core activities instead of administrative bottlenecks and manual payment processing.

8. Strengthens compliance and control

Compliance with financial regulations needs to be sustained. Automated B2B payments facilitate audit trails, impose role-based access controls, and enable compliance with internal controls.

Protection of sensitive data is facilitated by features such as approval hierarchies and encryption. A secure and compliant B2B payment process reduces risks, facilitates regulatory compliance, and fosters confidence among stakeholders and auditors as well.

Methods of B2B payments

Modern businesses use various B2B payment means to facilitate seamless transactions between businesses. With the evolving financial transactions, US businesses are adopting traditional as well as new methods to process their business-to-business payments.

Proper business-to-business payment implies faster processing, improved cash flow, and stronger vendor relations. Choosing an optimal solution relies on transaction speed, expense, security, and global coverage.

1. Paper checks

Despite electronic alternatives, paper checks remain a favored B2B payment method, especially among old companies. They have tangible document and are easy to issue but experience delays, higher processing costs, and risk of fraud.

While checks are widely recognized, most businesses are shifting towards mechanized B2B payment methods in an attempt to save time, reduce errors, and increase efficiency in business-to-business financial transactions.

2. ACH payments

Automated Clearing House (ACH) payments are widely used in the US for low-cost and secure business-to-business payments. ACH transfers money directly between bank accounts, offering convenience and traceability.

This B2B payment is ideal for recurring payments, payroll, and vendor payments. ACH reduces processing fees compared to wire transfers and streamlines cash management for businesses of all sizes and sectors.

3. Wire transfers

Wire transfers are a safe B2B payment method for high-value or urgent payments. They enable fast settlement of domestic and foreign accounts. Wire transfers are expensive due to transaction fees.

They must be utilized for single or high-value business-to-business transactions where speed is essential. Wire transfers provide extra security and traceability via banks, and thus they are a safe method.

4. Credit card payments

Credit cards offer convenience and short-term financing for B2B transactions. They are used by businesses to manage cash flow, earn rewards, and track spending. Credit card purchases are especially convenient for e-commerce transactions and recurring services.

But they may be more expensive for merchants. Incorporated within the B2B payment system, credit cards allow instant processing and could make vendor management easier through centralized payments.

5. Virtual cards

Virtual cards are internet-only versions of actual credit cards used for secure and controlled B2B payments. Each purchase uses a unique card number, reducing the risk of fraud.

Virtual cards offer real-time tracking, budgeting, and easy reconciliation. This payment system for B2B is ideal for one-time purchasing and streamlining account payables processes with fewer manual touches or security concerns.

6. PayPal and digital wallets

Digital wallets like PayPal are being used more and more in business-to-business payment, especially among smaller sellers and freelancers. They have quick transfers, low setup costs, and global accessibility.

These sites are a great way of experiencing digital transactions but may charge a few transaction fees. Being a good B2B payment system, digital wallets facilitate businesses to adapt to a more digital, mobile economy.

7. Cross-border payment methods

Cross-border B2B payments require multiple currency support tools and regulatory compliance. SWIFT wire transfers, multi-currency accounts, and cross-border payment platforms are typical cross-border B2B payment tools.

They facilitate seamless global payments while managing exchange rates and charges. Automation and fintech innovations have improved cross-border business-to-business payment efficiency by reducing delays and facilitating global vendor payments.

8. Buy Now, Pay Later (BNPL) for B2B

BNPL solutions are evolving into a flexible B2B payment platform that allows customers to buy products and pay later in installments. The model fosters better management of cash flow and reduces the financial burden for small businesses.

BNPL for business-to-business transactions is gaining popularity due to ease of access, risk management capabilities, and ability to help grow through delayed payments.

9. Blockchain and cryptocurrency payments

Blockchain and cryptocurrencies are an open and secure means for B2B payment. Decentralized platforms reduce intermediaries, lower charges, and facilitate faster settlements. Bitcoin or stablecoins are increasingly being accepted as global business to business payments.

Adoption is low but blockchain offers traceability and security and is a forward-thinking alternative for global B2B payment systems.

B2B payment process: Step-by-step

Initiating payment request

The B2B payment process begins when a payment request is raised, either by a buyer or automatically through procurement software. This request typically includes invoice details, payment terms, and vendor information.

In automated business to business payments systems, this step is triggered upon invoice receipt, enabling quicker initiation, better compliance, and seamless integration with accounts payable workflows.

Invoice validation

Once the request is raised, the invoice undergoes validation to ensure accuracy and legitimacy. Key details like invoice number, PO match, due amount, and vendor credentials are verified. This step helps eliminate errors and fraud in the B2B payment process.

Automated systems streamline this by flagging discrepancies, reducing manual checks, and maintaining consistency in business to business payments.

Approval workflows

After validation, the invoice enters an approval workflow. Authorized personnel review and approve the invoice based on predefined rules or thresholds. For larger amounts, multiple layers of approval may be required.

Workflow automation in B2B payments ensures timely reviews, accountability, and transparency, preventing payment delays and enabling faster processing of inter-business financial transactions.

Payment scheduling

With approval granted, payments are scheduled based on vendor terms, cash flow priorities, or early payment discounts. This step allows businesses to optimize working capital while honoring commitments.

In modern business-to-business payments platforms, scheduling is automated, offering flexibility in selecting payment dates and methods to align with company policies and financial goals.

Payment execution

At the scheduled time, the payment is executed through the selected method—ACH, wire transfer, credit card, or digital wallet. Execution is carried out securely via integrated financial systems.

Automation enhances this step in the B2B payment process, ensuring timely disbursements and reducing reliance on manual transactions, which are more error-prone and slower.

Confirmation & reconciliation

Post-payment, both sender and recipient receive confirmation. Simultaneously, the transaction is reconciled with bank records and accounts payable systems. Automated B2B payments solutions reconcile in real-time, helping detect discrepancies early.

This ensures transparency, strengthens vendor relationships, and keeps financial data accurate and up to date in the general ledger.

Data recording & audit trail

Every step of the B2B payment process is recorded, creating an auditable trail. These records include timestamps, approvers, payment status, and communication logs. Having a comprehensive audit trail supports regulatory compliance, financial reporting, and internal reviews.

Modern business to business payments platforms maintain centralized, searchable logs for enhanced control and accountability.

Reporting & analytics

The final step involves generating payment reports and analyzing data to identify spending trends, bottlenecks, or policy gaps. These insights help finance teams optimize the B2B payment process and improve future planning.

With built-in analytics tools, business to business payments platforms enable real-time visibility into cash flow, vendor performance, and overall operational efficiency.

Dispute handling

If discrepancies arise—such as overcharges, late payments, or duplicate entries—a structured dispute resolution process is triggered. This step ensures transparent communication and resolution between businesses.

Automation helps track disputes, assign responsibilities, and maintain resolution timelines. Efficient dispute handling is vital to maintaining vendor trust and integrity in the B2B payments ecosystem.

Security and compliance in B2B transactions

1. Regulatory compliance (SOX, AML, KYC, etc.)

What are B2B payments without regulatory oversight? Regulatory compliance in B2B transactions includes adhering to laws like SOX (Sarbanes-Oxley Act), AML (Anti-Money Laundering), and KYC (Know Your Customer).

These frameworks prevent illicit activities and enforce corporate accountability. Companies using business-to-business payments must implement policies and verification steps that align with these regulations, ensuring transparency and reducing financial and reputational risks.

2. PCI DSS and data security standards

To protect sensitive payment data, businesses must follow PCI DSS (Payment Card Industry Data Security Standards) when processing B2B payments. These standards safeguard cardholder information and minimize breach risks.

Data encryption, tokenization, and secure servers are essential for any business to business payments system, ensuring secure transactions and reducing vulnerabilities across digital payment networks.

3. Fraud prevention tools and practices

Combating fraud in B2B payment systems requires a proactive approach. Tools like multi-factor authentication, real-time monitoring, AI-based anomaly detection, and IP whitelisting help flag suspicious activity.

These fraud prevention practices not only secure business-to-business payments but also build confidence in financial workflows, allowing organizations to mitigate risk and avoid unauthorized transactions.

4. Importance of role-based access and audit trails

Implementing role-based access ensures that only authorized users can perform critical actions in B2B payment systems. This reduces insider threats and maintains transaction integrity.

Audit trails further enhance B2B payments security by tracking every action—from approvals to disbursements—ensuring accountability, facilitating internal audits, and helping companies comply with financial regulations and corporate governance standards effectively.

Challenges in B2B payments

1. Manual processes and delays

Most organizations continue to use manual processes in their B2B payment systems, resulting in delays and inefficiencies. Entering details of invoices, approvals, and disbursements manually heightens the risk of human errors.

This decelerates the B2B payment process, leading to late payments, compromised supplier relations, and disrupted cash flow—underscoring the importance of automating business to business payments.

2. High processing costs

Older B2B payment instruments such as paper checks and wire transfers are extremely costly to process. Labor, printing, postage, and transaction fees all factor into the overall cost. These costs can be prohibitive for expanding businesses.

Automating B2B payments and moving online reduce overhead, increase efficiency, and make business to business payments more affordable.

3. Fraud and security risks

Fraud is one of the serious issues in B2B payments, especially considering the volume involved. Insider threats, phishing, and business email compromise are the typical risks involved. Poor authentication and a lack of adequate security protocols leave B2B payment systems vulnerable to fraud.

Integration of fraud detection capabilities and strong access controls is the key to guarding business to business payments.

4. Lack of payment visibility

Fraudulent behavior is a serious issue in B2B transactions, especially because of the high amounts involved. Business email compromise (BEC), phishing, and insider threats are typical risks.

Poor authentication and inadequate security measures leave B2B payment systems vulnerable to breaches. Installing fraud detection software and secure access controls is critical to safeguarding business-to-business payments.

5. Cross-border complexities

Cross-border B2B payments bring with them issues such as volatile exchange rates, diverse banking systems, and regulatory variations. International transactions tend to be delayed, more expensive, and fraught with compliance challenges.

Companies require payment solutions that make business-to-business payments easier across the world, provide real-time FX conversion, and ease compliance with the financial regulations of various countries.

6. Supplier payment preferences

Suppliers and providers have varied tastes for acquiring B2B payments, from ACH to virtual cards. Not addressing these can result in delays and dissatisfaction.

Companies need to embrace agile B2B payment systems that accommodate various business payment methods to ensure timely business to business payments among various stakeholders.

7. Data silos across systems

Isolated financial systems cause data silos, which interfere with the B2B payment process. Without integrated solutions, data has to be manually copied, resulting in inconsistencies and inefficiencies.

Integrated platforms enhance data flow, eliminate duplication, and facilitate more seamless B2B payments, ensuring accuracy and cohesion in financial reporting and transaction management.

8. Compliance with financial regulations

It is challenging for B2B payment systems to navigate changing regulations such as KYC, AML, and taxation laws. Non-compliance will lead to fines and brand damage.

Companies need to remain abreast of legal requirements and establish compliance screening to protect business-to-business payments, make audits easier, and establish trust with partners and regulating agencies.

9. Difficulty in reconciliation

Matching B2B payments with related invoices and records is cumbersome, particularly in the case of large volumes. Manual matching results in mismatches, delayed closures, and report inaccuracies.

Automated matching applications and integrated systems assist companies in achieving higher accuracy, minimizing workload, and facilitating seamless financial reconciliation across all business-to-business payments.

Enhance B2B payment efficiency with Volopay

Strategies to streamline the B2B payment process

Adopt automation tools

Automation is key to modernizing the B2B payment process. By using automation tools, businesses can reduce manual data entry, eliminate human errors, and speed up approvals.

This not only improves accuracy but also ensures timely B2B payments, ultimately boosting supplier relationships and cash flow management in all types of business-to-business payments.

Digitize invoice workflows

Integrating B2B payment systems with accounting software consolidates financial data, making reconciliation faster and more accurate. This integration reduces duplication, enhances reporting, and gives businesses a complete view of their business-to-business payments.

Seamless connectivity between systems ensures smoother workflows, fewer errors, and improved compliance with internal and external standards.

Integrate accounting software

Integrating B2B payment systems with accounting software consolidates financial data, making reconciliation faster and more accurate. This integration reduces duplication, enhances reporting, and gives businesses a complete view of their business-to-business payments.

Seamless connectivity between systems ensures smoother workflows, fewer errors, and improved compliance with internal and external standards.

Leverage real-time data and insights

Access to real-time data helps businesses monitor and manage B2B payments proactively. Insights into cash flow, outstanding invoices, and payment trends support better financial planning.

With real-time analytics, businesses can optimize the B2B payment process, improve decision-making, and address bottlenecks in business-to-business payments before they become major issues.

Implement dynamic discounting

Dynamic discounting allows buyers to make early B2B payments in exchange for discounts from suppliers. This strategy improves supplier cash flow while reducing procurement costs.

Integrating dynamic discounting into the B2B payment process supports mutually beneficial terms and strengthens vendor relationships, creating long-term savings and enhancing the value of business-to-business payments.

Educate staff on payment compliance

Well-informed employees play a critical role in maintaining secure and compliant B2B payment systems. Regular training on compliance standards like KYC, AML, and PCI-DSS reduces risks and promotes best practices.

A knowledgeable team ensures the B2B payment process runs smoothly and aligns with legal and regulatory frameworks for business-to-business payments.

Standardize payment policies

Creating consistent internal policies for B2B payments improves control and accountability. Standardizing procedures across departments ensures uniformity in approvals, scheduling, and documentation.

This helps prevent errors, streamlines the B2B payment process, and promotes faster, more predictable business-to-business payments, reducing operational friction and enhancing financial governance.

Establish clear vendor agreements

Clear vendor agreements outline payment terms, responsibilities, and dispute resolution methods. Having well-defined contracts ensures both parties understand expectations, which helps streamline B2B payments.

These agreements support timely business-to-business payments, minimize miscommunication, and create a solid foundation for strong, long-term supplier relationships within the B2B payment process.

Emerging trends in B2B payments

1. AI-driven payment automation

Artificial intelligence is revolutionizing B2B payments through intelligent automation. AI-powered tools help detect anomalies, automate invoice processing, and streamline approval workflows. These solutions enhance accuracy in the B2B payment process while reducing human errors and manual effort.

Businesses benefit from faster payment cycles and better forecasting capabilities. AI also supports compliance by monitoring patterns and flagging suspicious transactions, making business-to-business payments more efficient and secure.

2. Increased use of virtual cards

Virtual cards are gaining traction as a secure, flexible option for B2B payments. They offer enhanced control, limited-use credentials, and real-time tracking. Companies prefer virtual cards in the B2B payment process for online vendor transactions, recurring payments, or temporary spending needs.

Their use reduces fraud risk and simplifies reconciliation, making virtual cards a valuable tool for streamlining business-to-business payments across departments and supplier networks.

3. Blockchain-based payment solutions

Blockchain technology is driving transparency and security in B2B payments. With distributed ledger systems, companies can verify transactions instantly, reducing delays and mitigating fraud. Blockchain enables seamless cross-border business-to-business payments, cutting out intermediaries and lowering transaction fees.

Smart contracts are automating parts of the B2B payment process, ensuring terms are fulfilled before payments are released, offering greater trust and accountability in B2B transactions.

4. Integrated payment platforms

Businesses are increasingly adopting integrated platforms that unify multiple B2B payment methods into one dashboard. These platforms consolidate invoices, payment schedules, and approval workflows, creating a single source of truth.

Integrated systems enhance visibility across the B2B payment process, improve collaboration among finance teams, and speed up reconciliation. By centralizing business to business payments, organizations gain control, reduce errors, and optimize cash flow more effectively.

5. Faster payment expectations (e.g., RTP)

Real-time payments (RTP) are becoming the norm in B2B payments, fueled by growing demand for speed and agility. Businesses expect instant processing and confirmation across the B2B payment process, particularly for time-sensitive transactions.

RTP systems reduce working capital delays and support better vendor relationships. As business-to-business payments evolve, real-time capabilities will become essential for meeting operational needs and maintaining a competitive edge.

6. BNPL models for B2B

Buy Now, Pay Later (BNPL) is expanding into the B2B payment space, offering businesses greater flexibility in managing cash flow. BNPL allows buyers to acquire goods and services while deferring payments over time.

This model supports growth without compromising liquidity and can be integrated into the B2B payment process through digital platforms. BNPL solutions are reshaping how business-to-business payments are financed and structured.

7. Data-led decision-making in payments

Data analytics is transforming how companies handle B2B payments. By leveraging payment data, businesses gain insights into spending patterns, payment cycles, and vendor performance. This intelligence drives smarter decision-making and risk management in the B2B payment process.

Data-driven strategies enhance forecasting, optimize working capital, and support compliance. In the future, real-time data will become a critical asset for managing business-to-business payments efficiently and proactively.

8. Sustainability in payment methods

Sustainability is emerging as a priority in B2B payments, with businesses favoring eco-friendly and paperless methods. Digital invoicing, virtual cards, and electronic fund transfers reduce environmental impact.

Companies are aligning their B2B payment process with ESG goals, improving both efficiency and reputation. As sustainability becomes a key business metric, business-to-business payments will continue shifting toward greener alternatives, reducing reliance on physical documents and minimizing waste.

9. Decentralized finance (DeFi) adoption

Decentralized finance is entering the B2B payments ecosystem, offering borderless, peer-to-peer financial services. DeFi platforms eliminate intermediaries, lower costs, and provide programmable transaction capabilities.

This decentralized approach enhances security and control in the B2B payment process, especially for global businesses. As trust in blockchain technology grows, DeFi will gain traction as a disruptive force, redefining how business to business payments are executed, tracked, and governed.

Benefits of automating your B2B payment process

In the evolving world of B2B payments, automation is a game-changer. By implementing automation tools, businesses can streamline their business-to-business payment processes, reduce operational inefficiencies, and achieve greater financial control.

Reduces human error

Manual B2B payment processes are prone to errors, from incorrect invoice amounts to misplaced data. Automating these tasks significantly reduces the risk of human error. With automated systems, businesses ensure that invoices are processed accurately and payments are made on time, minimizing costly mistakes.

This precision contributes to smoother financial operations, boosting overall efficiency in the business-to-business payment process.

Speeds up processing time

Automating B2B payments can drastically reduce processing time. Manual tasks like data entry, invoice matching, and approval workflows take valuable time, slowing down the payment cycle.

With automated tools, businesses can instantly verify invoices, obtain approvals, and execute payments, significantly improving the speed of transactions. This enables businesses to pay suppliers quickly and ensures timely financial operations.

Improves supplier relationships

Prompt payments foster trust and positive relationships with suppliers. By automating the B2B payment process, businesses can ensure timely and accurate payments, avoiding late fees and enhancing supplier satisfaction.

Strong supplier relationships improve collaboration and negotiation terms, ensuring smooth operations. Suppliers appreciate the reliability of automated systems, and businesses benefit from improved supply chain efficiency and vendor loyalty.

Enhances financial accuracy

Financial accuracy is crucial in B2B payments, and automation significantly enhances it. Automated systems reduce errors in calculations, data entry, and reconciliation. With accurate payment records, businesses can avoid discrepancies that could affect cash flow and tax reporting.

Automation ensures that financial data aligns perfectly with the company’s books, reducing discrepancies and improving overall financial health.

Boosts real-time reporting

Automating your B2B payment process provides access to real-time financial reporting. Automated systems allow businesses to track payments, approvals, and balances instantaneously. This capability provides actionable insights into cash flow, payment cycles, and outstanding liabilities.

With accurate and up-to-date reporting, businesses can make informed decisions, adjust strategies quickly, and optimize cash management for better financial stability.

Lowers transaction costs

Manual payment processing incurs costs due to inefficiencies and human labor. Automating B2B payments helps reduce these costs by eliminating paper-based transactions, postage, and manual data entry.

Automated systems streamline the entire process, reducing overhead expenses associated with traditional payment methods. Lower transaction costs contribute to improved profitability and make the business to business payment process more cost-effective.

Supports regulatory compliance

Automation enhances B2B payments compliance by ensuring that transactions meet industry standards and regulatory requirements. Automated systems can be programmed to comply with laws such as SOX, AML, and KYC, reducing the risk of non-compliance.

This feature helps businesses avoid fines and penalties while keeping their financial processes transparent and secure. Automation supports efficient compliance monitoring and reporting.

Integrates with ERP systems

Automated B2B payment systems can seamlessly integrate with existing ERP (Enterprise Resource Planning) systems. This integration ensures a smooth flow of data across various business functions, including finance, procurement, and accounting.

By connecting payment systems with ERP tools, businesses can improve data accuracy, streamline processes, and reduce the complexity of managing multiple financial platforms, making operations more cohesive and efficient.

Enables audit readiness

With automated B2B payment solutions, businesses can maintain a detailed audit trail for all transactions. Every action, from payment initiation to final execution, is recorded in real-time. This transparency ensures that companies are always prepared for internal or external audits.

Automation simplifies the auditing process, reduces the risk of non-compliance, and provides businesses with a clear and accessible history of their financial activities.

Provides better cash flow control

Automating B2B payments gives businesses better control over their cash flow. With automated systems, companies can schedule payments, track outstanding invoices, and forecast future cash flow more accurately.

Real-time updates and automated alerts allow businesses to anticipate cash shortages and take proactive measures. This level of control enables more efficient financial planning, reducing the risk of cash flow issues.

Discover how Volopay simplifies your B2B payments efficiently!

How to choose the right B2B payment automation software

Security and encryption features

Security is a top priority when choosing B2B payment automation software. Ensure that the software offers robust encryption features to protect sensitive payment data. Look for encryption protocols like SSL/TLS, and end-to-end encryption to safeguard transactions.

This will protect your business and customers from cyber threats, maintaining trust and confidentiality throughout the business-to-business payment process.

Integration with existing tools

For seamless B2B payment processing, the software should integrate smoothly with your existing tools, such as ERP systems, accounting software, and CRM platforms. Integration reduces manual work, minimizes errors, and enhances data consistency across systems.

Look for B2B payment automation software that supports a variety of integrations to streamline your business operations and improve efficiency.

Scalability and flexibility

The right B2B payment automation software should grow with your business. Choose software that is scalable and flexible to accommodate your evolving payment needs.

Whether you're expanding globally or increasing transaction volume, the software should be able to handle more users, payments, and currencies without compromising performance. Scalability ensures that your business remains agile and future-ready.

User access control

Effective B2B payment automation software should provide customizable user access controls. This feature ensures that only authorized personnel can access sensitive payment information.

By setting different permission levels based on roles, you can minimize the risk of internal fraud and improve security. Proper user access control protects both your financial data and business from unauthorized access or errors.

Real-time payment tracking

Real-time payment tracking is an essential feature of B2B payment automation software. It enables businesses to track payments and transactions as they happen, providing greater visibility and control.

This feature helps to identify issues quickly, resolve disputes efficiently, and manage cash flow effectively. Real-time tracking improves financial decision-making and ensures timely payments to vendors and suppliers.

Multi-currency and cross-border support

If your business operates globally, selecting B2B payment automation software with multi-currency and cross-border payment support is vital. The software should allow you to make payments in different currencies, streamline international transactions, and handle foreign exchange fluctuations.

This feature simplifies cross-border transactions, reduces the complexities of currency conversion, and ensures that you can easily manage global payments.

Customization options

Choose B2B payment automation software that offers customization options to suit your specific business needs. Whether it’s configuring workflows, designing payment approval processes, or tailoring reporting formats, customization gives you the flexibility to adapt the software to your business operations.

Customizable software enhances efficiency and ensures that your business-to-business payment system works exactly how you need it to.

Customer support and service

Good customer support is crucial when selecting B2B payment automation software. Ensure that the software provider offers reliable and responsive customer service to address any issues or technical difficulties you may encounter.

Look for support options such as phone, email, or live chat, and check the availability of resources like documentation, FAQs, and user guides to help you troubleshoot problems efficiently.

Compliance and audit trail

Ensure that the B2B payment automation software complies with relevant regulations such as SOX, PCI DSS, and GDPR. The software should also maintain a detailed audit trail of all transactions, providing transparency and accountability.

This feature is vital for ensuring compliance with financial regulations, conducting audits, and maintaining the integrity of your business-to-business payment system.

Customer reviews and reliability

Before finalizing your decision, check customer reviews and testimonials for insights into the reliability and effectiveness of the B2B payment automation software. Reliable software should have a proven track record of performance, scalability, and security.

Reviews from other businesses can provide valuable information on the software’s usability, customer support quality, and overall satisfaction with the product.

Transform B2B payments with Volopay’s automation platform

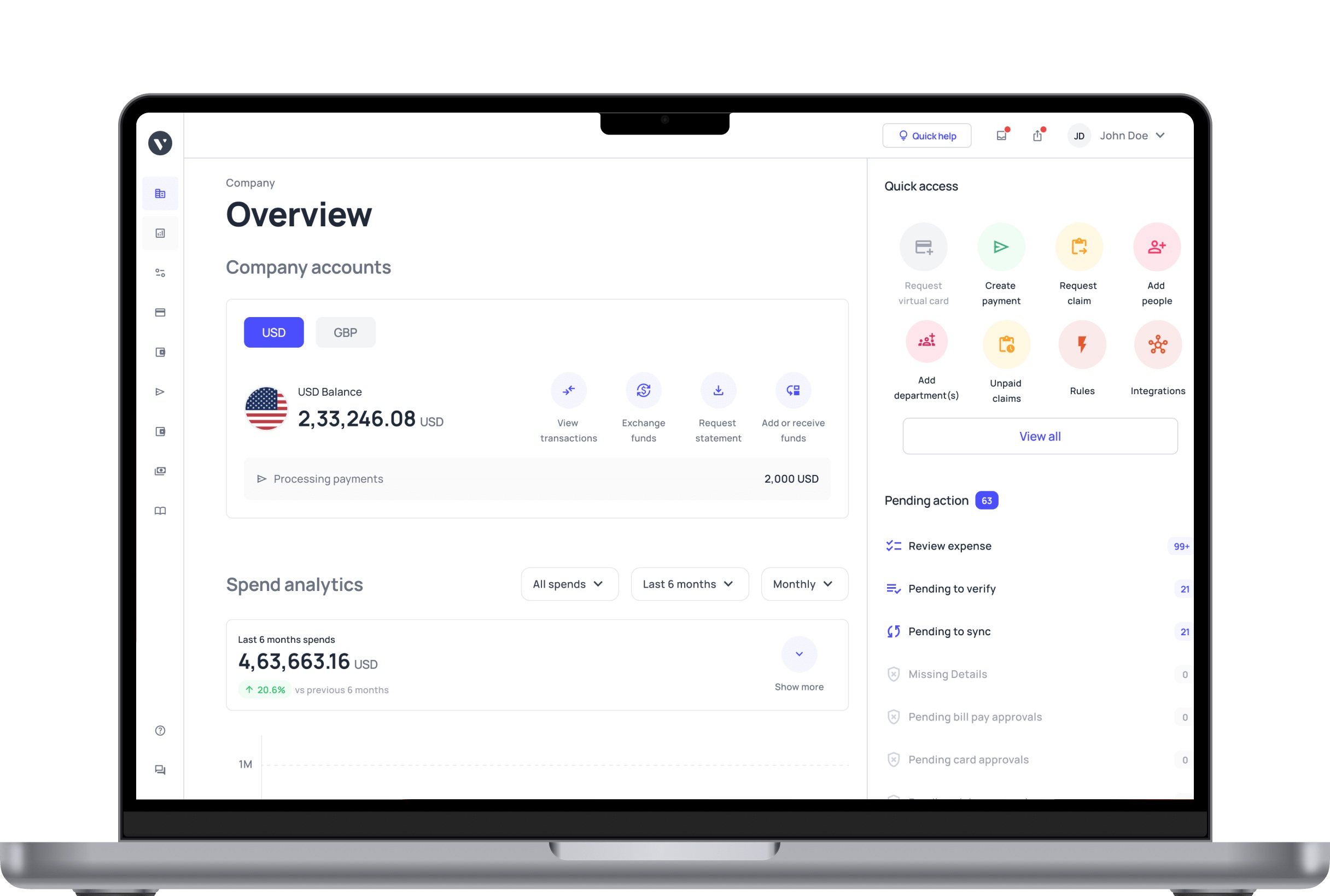

What are B2B payments in the modern world without automation? In today’s fast-paced business environment, managing B2B payments efficiently is crucial for maintaining smooth operations. Volopay’s B2B payment automation platform revolutionizes how businesses handle their payments, providing a seamless, secure, and scalable solution.

By automating the payment process, Volopay helps businesses save time, reduce errors, and improve cash flow management. This platform is designed to simplify the complexities of business-to-business payment systems, offering a range of tools to enhance productivity and control.

Automate recurring payments

Volopay’s platform allows businesses to automate recurring B2B payments, ensuring timely and consistent transactions without manual intervention. Whether it’s paying suppliers or settling subscription services, the automation reduces the risk of missed payments and late fees.

By automating regular payments, businesses can focus on strategic operations instead of spending time managing routine transactions.

Auto-approve based on smart rules

Volopay offers an intelligent approval system that auto-approves B2B payments based on predefined smart rules. This feature streamlines payment workflows, allowing businesses to automatically approve transactions that meet specific criteria.

By leveraging smart rules, businesses can eliminate bottlenecks, speed up the approval process, and ensure compliance with internal policies, all while minimizing human errors in decision-making.

Real-time expense tracking

With Volopay’s real-time expense tracking feature, businesses can gain immediate visibility into their B2B payment activities. The platform enables real-time monitoring of transactions, allowing businesses to stay on top of their financial health.

This feature ensures that any discrepancies or anomalies are detected quickly, reducing the chances of errors and enabling proactive management of cash flow.

Integrated invoice management

Volopay’s B2B payment automation platform integrates invoice management seamlessly into the payment process. The platform automatically matches invoices to payments, reducing the manual effort involved in matching and processing invoices.

This integration helps eliminate bottlenecks, streamline payment workflows, and ensure that no invoice is overlooked, enhancing overall operational efficiency and reducing administrative overhead.

Set multi-level payment approvals

Volopay allows businesses to set multi-level payment approvals, ensuring that every B2B payment goes through a structured review process. With customizable approval hierarchies, businesses can align the approval workflow with their organizational structure, providing greater control over large payments.

This feature promotes accountability, ensures proper authorization, and strengthens financial governance in the payment process.

Connect with major ERPs

Volopay seamlessly integrates with major ERP systems, ensuring that B2B payment automation aligns with existing business operations.

By connecting to ERP tools, businesses can sync financial data in real-time, simplifying processes such as invoicing, expense tracking, and reconciliation. This integration ensures consistency and accuracy across platforms, reducing the need for manual data entry and improving operational efficiency.

Send international payments easily

Volopay simplifies international B2B payments, allowing businesses to send payments across borders with ease. The platform supports multiple currencies, making it easier to manage payments to global suppliers.

With Volopay, businesses can avoid the complexities of currency conversion, manage foreign exchange rates, and ensure timely payments, all while streamlining their international payment processes.

Auto-categorize expenses

With Volopay’s B2B payment automation, businesses can auto-categorize expenses, making it easier to track spending and prepare for financial audits. The system automatically categorizes expenses based on predefined rules, ensuring that each transaction is correctly classified.

This feature helps maintain organized financial records, simplifies tax preparation, and provides businesses with better insights into their expenditure patterns.

Get instant insights and dashboards

Volopay provides real-time dashboards and instant insights into B2B payment activities, offering businesses a comprehensive view of their financial landscape. These insights include expenditure reports, cash flow analysis, and transaction history, all available at a glance.

The platform’s analytics tools help businesses make data-driven decisions, optimize payment strategies, and identify areas for cost savings or improvement.

Streamline entire AP process

Volopay streamlines the entire accounts payable (AP) process, automating each step from invoice receipt to payment execution. By centralizing and automating AP tasks, businesses can significantly reduce manual errors and processing time.

The platform enables quicker payments, better supplier relationships, and smoother financial workflows, enhancing operational efficiency and contributing to a more effective B2B payment system.

Future of B2B payments: What to expect in the near future

Predictions for further AI and blockchain integration

In the coming years, AI and blockchain integration in B2B payments will become more pervasive. AI will drive smarter automation, allowing businesses to optimize payment processing with predictive insights and fraud detection.

Blockchain will provide greater transparency, security, and real-time settlement, minimizing risks associated with cross-border transactions and ensuring faster, more reliable payments for businesses globally.

Central Bank Digital Currencies (CBDCs) in B2B

As governments explore Central Bank Digital Currencies (CBDCs), businesses can expect their integration into B2B payment systems. CBDCs will offer a safer, more efficient alternative to traditional currencies.

With faster settlement times, reduced transaction fees, and enhanced security, CBDCs will transform how businesses handle cross-border payments and facilitate global commerce seamlessly.

Rise of decentralized finance (DeFi) for businesses

The rise of decentralized finance (DeFi) will revolutionize B2B payments. DeFi platforms will enable businesses to make peer-to-peer transactions without intermediaries, reducing fees and improving payment speed.

With blockchain as a backbone, DeFi will provide decentralized lending, borrowing, and payment systems, allowing businesses greater control over their financial operations and enhancing their global reach.

The shift toward completely paperless and instant payments

The future of B2B payments will be dominated by paperless and instant transactions. Digital payment systems will replace traditional methods like checks, ensuring faster and more efficient transactions.

Businesses will increasingly rely on digital wallets, smart contracts, and secure payment gateways, allowing for instantaneous payments without delays or manual processing. This shift will streamline financial workflows and improve overall business agility.

FAQs

B2B payments refer to transactions between businesses for goods or services, unlike B2C payments, which occur between businesses and consumers. B2B payments typically involve larger amounts, longer payment terms, and more complex invoicing.

They often require greater accuracy, compliance, and integration with accounting systems to ensure smooth transactions between companies in various industries.

Automated B2B payment solutions are highly secure, leveraging advanced encryption, multi-factor authentication, and compliance with industry standards like PCI DSS. They minimize human error and fraud risk, ensuring data protection.

Many platforms, like Volopay, use secure payment gateways and real-time monitoring to protect transactions, safeguard sensitive financial information, and maintain regulatory compliance.

Yes, small businesses can significantly benefit from B2B payment automation. It streamlines payment processes, reduces manual errors, and enhances cash flow management. Automation helps small businesses save time, improve efficiency, and gain better control over their finances.

It also enables them to scale operations smoothly, even with limited resources, making them more competitive in the market.

Automation in B2B payments eliminates manual tasks, reducing the chances of errors and delays. By automating invoicing, approval workflows, and payment execution, businesses can ensure timely and accurate transactions.

Automated systems can trigger payments as soon as approval is received, facilitating faster processing times and minimizing the risk of delays, improving relationships with suppliers and partners.

Common B2B payment methods in the US include ACH payments, wire transfers, credit card payments, checks, and virtual cards. Each method offers different benefits, such as lower fees, faster processing, or greater security.

B2B businesses may also use PayPal or digital wallets, depending on transaction volume, security requirements, and cross-border needs.

Volopay simplifies cross-border B2B payments by providing an easy, secure platform for international transactions. With competitive exchange rates and fast processing times, businesses can pay vendors globally without hefty fees.

Volopay supports multiple currencies, enabling businesses to streamline their global financial operations. It also ensures compliance with international regulations, enhancing security for cross-border transactions.

Yes, B2B payments can be scheduled in advance with automated payment solutions. This feature helps businesses avoid late payments and ensures smooth cash flow management.

By automating and scheduling payments in advance, companies can improve supplier relationships, meet deadlines, and minimize the risk of missed or delayed payments, all while maintaining compliance with payment terms.

Volopay is ideal for mid-sized companies due to its scalable features, cost-effective pricing, and seamless integration with existing tools like accounting software and ERPs. It provides businesses with automated payment workflows, real-time expense tracking, and multi-level approval processes.

Volopay’s flexibility, coupled with its user-friendly platform, allows mid-sized companies to manage finances more efficiently, saving time and reducing administrative burden.