10 types of financial models explained with examples

Understanding the financial stability and possibilities of a company is important for managing business. That's where financial models come in. These models provide you with organized methods for predicting financial results and evaluating different company situations.

Financial modeling gives your decisions a data-supported basis, whether you're allocating resources, planning investments, or assessing a merger. Financial modeling comes in a variety of types, each with a specific function and use.

In this blog, you'll explore the most widely used financial modeling types and how you can use them to drive smarter business decisions using different types of financial models.

What is a financial model?

A financial model is an organized tool that you use with spreadsheets or specialist software to show the financial success of your business. It helps you make data-driven decisions by simulating real-world financial situations, from forecasting revenue and costs to evaluating investments and risk.

You can create a variety of financial models, including budget predictions, merger studies, and discounted cash flow models, depending on your company's objectives. Gaining knowledge of the numerous kinds of financial modeling enables you to evaluate profitability, make better plans, and get ready for shifting market situations.

Understanding the various forms of financial modeling guarantees more assured financial planning and stakeholder communication, regardless of the size of your company.

4 pillars of a financial model

To build a robust financial model, you rely on four key pillars. These components provide a comprehensive view of your business’s financial health, guiding strategic decisions and financial planning.

Business decisions on launching a startup, scaling operations, or evaluating investments, understanding different types of financial modeling, empower you to strategically plan and manage your finances with precision.

1. Income statement

Your income statement tracks revenue, expenses, and profits over a period. Over a certain time frame, it monitors sales, expenses, and net profits. This element aids in predicting future performance and evaluating operational efficiency in financial modeling types.

It serves as the foundation for the majority of financial model types. You calculate gross profit by subtracting the cost of goods sold from revenue, then deducting operating expenses to determine net income.

2. Cash flow statement

Your cash flow statement monitors cash inflows and outflows from operations, investing, and financing. The cash flow statement illustrates the flow and movement of funds for your company.

It aids in working capital management and liquidity comprehension. This kind is essential for assessing short-term financial health in financial modeling.

Having precise cash flow estimates helps guarantee that you never run out of money, whether you're forecasting or running scenarios. For internal planning and investor confidence, this is crucial in the majority of financial modeling types.

3. Balance sheet

Your balance sheet snapshots assets, liabilities, and equity at a specific point. You ensure assets (like cash or inventory) equal liabilities plus equity. Your equity, obligations, and assets are listed.

It enables you to monitor the changes in liabilities and investments in a variety of financial models. Important ratios that are essential for long-term strategic choices and firm valuation are supported by this pillar, including debt-to-equity and return on assets.

4. Debt schedule

Your debt schedule details all loans, including balances, interest rates, and repayment terms. You track principal and interest payments to forecast cash flow impacts. It assists you in keeping track of principal repayments, maturity dates, and interest payments.

This timetable is essential for financial modeling types in order to stress-test your model and prepare for changes in the capital structure. It guarantees that you comprehend how debt affects cash flow and profitability, which is a crucial component of many financial models.

Top 10 types of financial models

As you navigate financial planning, understanding the top financial models equips you to make informed business decisions. These models, from forecasting to valuation, help you analyze financial performance, optimize strategies, and drive business growth.

Whether you're learning about different types of financial modeling or exploring complex financial modeling types, these ten models provide a strong foundation for success.

1. Three-statement model

Definition

To create a coherent framework, you combine your cash flow statement, balance sheet, and income statement using the three-statement approach. The three-statement approach combines the income statement, balance sheet, and cash flow statement into a single, integrated projection.

It allows you to look into how changes in one area impact the business overall. This model serves as the foundation for most forms of financial modeling and helps forecast valuations and budgetary choices.

Example

● Gather historical data: Input at least 3–5 years of actual income statements, balance sheets, and cash flow statements.

● Set assumptions: Based on trends and business drivers, create assumptions for revenue growth, expenses, taxes, and capital expenditures.

● Build the income statement: Use the assumptions to forecast revenue, cost of goods sold, operating expenses, interest, and taxes.

● Construct the balance sheet: Project liabilities and assets include debt, inventory, and accounts receivable. Ensure the balance sheet includes things like net income and retained earnings.

● Develop the cash flow statement: Start with net income and apply the indirect technique. Link operating, investing, and financing operations to the balance sheet and account for non-cash items.

● Integrate statements: ensure net income feeds into retained earnings on the balance sheet, and cash flow updates the cash balance, maintaining consistency.

● Validate and test: check for sensitivity. Modify one assumption (growth rate, for example) and make sure that all financial statements reflect the change.

2. Budget model

Definition

Your budget model outlines planned revenues, expenses, and investments for a specific period. A budget model aids in the planning and distribution of funds across projects or departments over a given time frame.

It facilitates internal goal-setting and short-term planning. The budget model, one of several forms of financial modeling, helps you manage daily business operations and track performance against predetermined goals by concentrating on predicted income, expenses, and cash position.

Example

● Define budget period: set a one-year timeframe for your budget model, aligning with your fiscal year. Indicate if the budget is for a month, a quarter, or a year.

● Identify revenue streams: estimate sales based on historical data and market trends. To comprehend average revenue, expenses, and seasonal changes, use historical performance data.

● List expenses: categorize costs using past budgets. Make a list of all sources of income and project how much each will contribute throughout the selected period.

● Incorporate capital expenditures: plan investments to support business growth. Examine variable costs like commissions from sales as well as operating expenditures like rent, utilities, and payroll.

● Set assumptions: assume 10% revenue growth, 5% cost increase, and stable margins based on industry analysis.

● Get the budget statement ready: To create a predicted income statement, add up all of the estimated income and expenses.

● Build the model: use spreadsheets to input revenue, expenses, and capex, calculating net profit and cash reserves.

● Review and adjust: share with department heads, adjust based on feedback, and finalize for financial planning. Hold periodic reviews and make adjustments based on actual performance and market conditions.

3. Forecasting model

Definition

A forecasting model uses past data and future assumptions to project future financial performance. It is essential for resource management, investment analysis, and strategic planning.

In contrast to budget models, this model places more emphasis on "what-if" analysis than rigid goals. Forecasting is a component of several forms of financial modeling that aids in proactive decision-making and change anticipation.

Example

● Select the forecast horizon: Choose between short-term (3–12 months) or long-term (1–5 years).

● Collect historical financial data: Use at least three years of past income, expense, and cash flow records.

● Identify key business drivers: Determine the variables that influence revenue and costs, such as sales growth, conversion rates, or raw material prices.

● Develop forecast assumptions: Establish reasonable growth rates, margins, and operational inputs based on past patterns and market intelligence.

● Create the revenue projection: Start with the top line: use volume and pricing assumptions to predict sales for each category of goods or services.

● Calculate operating costs and the cost of products sold. To keep things consistent, tie these to income or other factors.

● Projected net income and operational income: To determine the bottom line, add taxes, interest, and depreciation.

● Include cyclical and seasonal patterns: Forecasts should be modified to take into consideration recurring patterns, such as market slowdowns or holiday peaks.

● Examine against benchmarks: Contrast estimates with performance from competitors and industry norms.

● See the result: To monitor trends, deviations, and growth routes, use graphs and charts.

4. Discounted Cash Flow (DCF) model

Definition

Through adjusting for the time value of money, the DCF model assists you in estimating the value of a business based on its projected cash flows. This approach is crucial for business appraisal and investment analysis.

The DCF model, one of the fundamental forms of financial modeling, incorporates future cash flow predictions and discounts them to present value to provide a more accurate depiction of a company's intrinsic worth.

Example

● Project free cash flows: Start with operating profit (EBIT), adjust for taxes, add depreciation/amortization, and subtract capital expenditures and changes in working capital.

● Determine discount rate: Typically, you forecast 5–10 years of FCF based on growth assumptions.

● Estimate terminal value: Use either the perpetuity growth method or the exit multiple method to calculate value beyond the forecast period.

● Determine the discount rate: Use the weighted average cost of capital (WACC) as the discount rate.

● Discount cash flows: apply WACC to discount cash flows and terminal value to present value.

● Sum present values: add discounted cash flows and terminal value to estimate enterprise value.

● Validate assumptions: compare WACC and growth rates to industry standards for accuracy.

● Sensitivity analysis: Compare the calculated equity value with current market valuations to determine if the company is over- or undervalued.

5. Scenario analysis model

Definition

Financial experts utilize it as a comprehensive tool to guide high-impact outcomes; it's not just a simple spreadsheet. You use a scenario analysis model to evaluate financial outcomes under different conditions (best, worst, base cases).

They also include different types of financial models tailored to specific needs, like LBO models for acquisitions or sensitivity models for risk testing. It helps you assess risks and plan strategies, ensuring resilience in your financial planning.

Example

● Define scenarios: Create best (10% revenue growth), base (5%), and worst (0%) cases for your business.

● Collect historical data: Use past financial statements to set baseline revenue and costs.

● Set assumptions: Vary drivers like sales growth, COGS (50-60%), and expenses per scenario.

● Build financial projections: Model income statement, balance sheet, and cash flow for each scenario.

● Analyze impacts: Calculate net income and cash flow differences (e.g., $100K vs. $50K profit).

● Incorporate risks: Include external factors (e.g., market downturn) in worst-case projections.

● Review results: Use outcomes to adjust strategic plans, like cutting costs in worst-case scenarios.

6. Merger & Acquisition (M&A) model

Definition

Usually employed in M&A situations, a merger model assesses the financial effects of combining two businesses. It assists you in determining if a transaction will increase or decrease earnings.

This sort of strategic financial modeling comprises financing structure, acquisition price allocation, synergy estimation, and buyer and seller predictions to assess deal viability. It analyzes synergies, costs, and valuation, helping you assess deals and plan integration for business growth.

Example

● Input financials of both companies: Start with historical financial statements and forecasts for the acquirer and target.

● Estimate synergies: Identify cost savings or revenue enhancements resulting from the merger.

● Decide purchase consideration: Determine if the deal will be paid in cash, stock, or a mix.

● Allocate purchase price: Account for goodwill, intangible assets, and adjustments to book value.

● Adjust combined financials: Incorporate synergies and deal financing to reflect the new entity.

● Calculate accretion/dilution: Compare earnings per share (EPS) before and after the deal.

● Analyze sensitivity: Test how changes in assumptions, like synergy realization or purchase price, impact the outcome.

7. Comparable Company Analysis (CCA) model

Definition

A business's worth is assessed using the comparable company analysis (CCA) approach by contrasting it with other businesses in the same industry. This method makes use of valuation multiples and financial measures such as EV/EBITDA, P/E, and EV/Revenue.

This model is the most commonly utilized type of financial modeling in equities research and investment banking. Employing relative benchmarks from peer companies, it assists you in determining a company's market value.

Example

● Identify peers: Identify firms of similar size, industry, geography, and growth profile.

● Collect financial data: Gather key metrics such as revenue, EBITDA, net income, market capitalization, debt, and cash.

● Calculate multiples: Derive ratios like EV/EBITDA, EV/Revenue, and P/E for each peer company.

● Apply to your business: Use the median or average of these multiples and apply them to the target company’s financials

● Estimate valuation: Multiply the target company’s EBITDA or revenue by the chosen multiple

● Adjust for differences: account for unique factors in your valuation.

● Validate results: cross-check with industry reports to ensure valuation accuracy.

8. Leveraged Buyout (LBO) model

Definition

Your leveraged buyout (LBO) model evaluates acquiring a company using significant debt. An LBO model evaluates the purchase of a business mostly with borrowed money. It is one of the more sophisticated forms of financial modeling and a mainstay in private equity.

To ascertain whether the deal is financially feasible, you project returns, anticipate the company's financials, and arrange the financing (equity/debt). It assists you in assessing purchase scenarios' risk, return, and debt capacity.

Example

● Input acquisition assumptions: Enter purchase price, debt-to-equity ratio, interest rates, and fees.

● Forecast operating performance: Build projections for revenue, EBITDA, and free cash flow over 5–7 years.

● Structure the deal: Allocate financing between different debt tranches (senior, mezzanine) and equity.

● Build debt schedule: Track principal repayments, interest expense, and covenant compliance.

● Estimate exit strategy: Assume an exit multiple and a year for selling the business.

● Calculate internal rate of return (IRR): Measure return on equity using cash flows and the projected exit value.

● Test sensitivities: Run scenarios by adjusting leverage, growth, and exit multiples to test investment viability.

9. Precedent Transaction Analysis (PTA) model

Definition

A company's worth is determined by previous M&A transactions involving comparable enterprises, according to the precedent transaction analysis approach. To determine the target's valuation range, you examine the multiples paid in those transactions.

This approach is helpful for fairness opinions and merger negotiations. It provides real-world valuation benchmarks by taking control premiums and synergies into consideration among the different kinds of financial models.

Example

● Identify transactions: find 5-10 recent deals in your industry (e.g., retail acquisitions).

● Collect deal data: gather transaction values, revenue, and EBITDA from public records.

● Calculate multiples: compute EV/revenue (e.g., 2x) and EV/ebitda (e.g., 8x) for each deal.

● Apply multiples: multiply your revenue ($2m) or EBITDA ($400k) by median multiples.

● Estimate valuation: derive a valuation range (e.g., $3 3.2 m-$4 ) based on multiples.

● Adjust for context: account for deal-specific factors (e.g., synergies) in your valuation.

● Validate results: compare with CCA to ensure valuation consistency.

10. Sum of the parts (SOTP) model

Definition

Your sum of the parts model values your business by assessing each division separately. A multi-segment company is valued using the sum of the parts (SOTP) model, which evaluates each component independently.

When examining a conglomerate or diverse company, it's perfect. This model, which is one of the more sophisticated forms of financial modeling, identifies underperforming or hidden value. It allows you to deconstruct complicated organizations into their constituent parts and value each one separately before putting them together.

Example

● Identify business units: segment your company (e.g., retail, manufacturing, services).

● Collect financials: gather revenue, EBITDA, and assets for each unit.

● Value unit: Use dDC for multiples (e.g., 5xEBITDA) to estimate unit values.

● Adjust for synergies: account for shared costs or benefits across units.

● Sum valuations: add individual unit values to calculate the total enterprise value.

● Test assumptions: vary growth rates or multiples to assess valuation range.

● Strategic review: Use results to decide on selling or investing in specific units.

Applications of financial models in a business

Financial modeling equips you to make informed business decisions by projecting financial performance. Various types of financial models, from valuation to forecasting, help you optimize strategies, allocate resources, and enhance financial planning for business growth.

Business valuation

You use financial modeling types like DCF or comparable company analysis to determine your business’s value.

Discounted cash flow (DCF) assists you in determining value based on future cash flows, whether you're trying to sell your business, issue shares, or draw in investors. out of all the different kinds of financial models, valuation modeling provides you with a solid basis on which to negotiate agreements and comprehend the actual financial potential of your business in the marketplace.

Strategic budgeting

Budgeting models, a key type of financial modeling, help you plan revenues, expenses, and capital expenditures. You can anticipate future periods' income, expenses, and cash flow with the use of these models.

Effective resource allocation, deviation tracking, and necessary course adjustments are all made possible by budgeting models. One of the most popular forms of financial modeling is this one, particularly for financial planning and control in both new and existing companies.

Financial forecasting

You leverage financial forecasting models, one of the critical types of financial models, to predict revenue, expenses, and cash flow. You may model different growth scenarios and modify your plan as necessary.

These types of financial models assist you in projecting future income, profit, and expenses, allowing you to make proactive decisions whether you're planning an expansion or releasing a product. Because of this, forecasting models are a crucial component of your strategic toolbox.

Capital expenditure planning

Financial models for capital expenditure planning enable you to evaluate investments in assets like equipment. Before making a choice, you can weigh the costs and anticipated returns of every capital investment.

Financial modeling types such as payback period, NPV, and IRR help ensure that your investments are in line with your company's objectives. This strategy maximizes long-term earnings while assisting you in prudent money management.

M&A opportunity evaluation

You use M&A models, a specialized type of financial model, to assess deals by analyzing synergies, costs, and valuation. When contemplating a merger or acquisition, financial models enable you to assess how the transaction will affect your organization.

Profitability, cash flow variations, and possible synergies can all be evaluated. Models assist in ensuring that your investment is sound, from revenue effect to asset appraisal. These financial modeling types evaluate accretion/dilution and financial impact, guiding your merger or acquisition strategy to maximize business value.

Resource distribution

Financial modeling types, like budget or forecasting models, help you allocate resources effectively. Allocating resources is essential to the expansion of a firm. Financial models assist you in deciding how effectively to deploy goods, labor, and capital to maximize profits.

You can rank the departments or projects with the highest return on investment by examining different scenarios. This kind of financial modeling, out of all the others, enables you to maximize your operational effectiveness and steer clear of under- or over-investment in any given sector.

Analysis of financial statements

Your cash flow, balance sheet, and income statement can all be examined using financial models. This aids in your comprehension of your performance and financial well-being over time.

Here, financial modeling types include trend analysis, vertical/horizontal analysis, and ratio analysis. in order to manage development and maintain financial stability, these models help you identify your strengths, shortcomings, and opportunities for progress.

Investment analysis

Investment analysis models, among key types of financial models, help you evaluate opportunities like new projects or stocks. allow you to assess the value of an investment opportunity.

You may make wise investment choices by weighing expenses, risks, and expected rewards. This type of financial modeling includes tools such as roi, IRR, and NPV.

These models provide you with a clear picture of profitability and help you make decisions that will maximize your return, whether you're investing in a new product, market, or business.

Scenario analysis

You can evaluate how your company would function in the best-case, worst-case, and most likely scenarios with the aid of scenario models. You can better plan for unforeseen events like market booms and economic downturns by using this kind of financial model.

You may strengthen your planning process's resilience and make sure that unforeseen circumstances or shifts in the business environment won't catch you off guard by testing different hypotheses.

Assessing potential risks

Risk assessment models, an essential type of financial model, identify financial risks like cash flow shortages or market volatility. When it comes to recognizing and reducing risks, financial models are essential.

They can be used to examine the effects of regulatory changes, model financial shocks, or assess how sensitive important variables are. You can create plans that protect your company from future interruptions by measuring risk and its possible effects.

Benefits of a financial model for a company

You rely on financial models to guide your business strategy, offering clarity and precision in financial planning. These tools enhance decision-making, risk management, and stakeholder communication, driving business growth and ensuring long-term financial success. By using different types of financial modeling, you gain the insights you need to make informed, strategic decisions every step of the way.

Better decision making

Financial models empower you to make informed business decisions by projecting revenue, costs, and cash flows. Using financial models allows you to make decisions based on estimates and facts rather than conjecture.

The appropriate financial modeling types aid in comparing possible outcomes, whether you're assessing expansion plans or selecting between investment prospects. Utilizing various financial models can help you choose the best course of action and lower the likelihood of expensive errors, resulting in more intelligent and well-informed business decisions.

Increased financial insight

You gain enhanced financial insight through financial models that analyze income statements, balance sheets, and cash flow statements. Among other things, you can evaluate profit margins, costs, and revenue sources.

You can identify inefficiencies and growth possibilities with the aid of this deeper information. You can investigate the financial dynamics of your firm and make adjustments that support your overarching objectives by using several forms of financial modeling, such as trend models or ratio analysis.

Adaptability to market changes

Financial modeling equips you to adapt to market changes by forecasting financial performance under varying conditions. Financial models that are scenario-based allow you to model average, worst-case, and best-case scenarios.

In this manner, you'll constantly be prepared to modify your tactics when the market changes. The strategic agility made possible by several forms of financial modeling will let you keep ahead of trends, foresee obstacles, and boldly change course when necessary.

Improved risk mitigation

Financial models improve risk mitigation by identifying financial risks like cash flow shortages or market volatility. Although risk is inevitable in business, financial models can help you better manage it. You can find possible financial risks and create backup plans by testing various factors and hypotheses.

Financial model types that are frequently used for risk assessment include scenario and sensitivity studies. With this foresight, you may proactively fix vulnerabilities before they affect your business operations or financial results.

Facilitating financial reporting

You streamline financial reporting with financial models that integrate financial data into clear, accurate reports. Consolidating data and presenting it understandably are made easier with the use of financial models.

You may create precise balance sheets, cash flow projections, and income statements with the use of many forms of financial modeling. This guarantees uniformity and clarity when sharing data with lenders, auditors, and investors, in addition to streamlining internal reporting.

Accuracy in budgeting

You achieve accuracy in budgeting with financial models that forecast revenues and expenses precisely. Using past data and patterns, you may anticipate income, estimate expenses, and establish spending caps.

One of the most popular forms of financial modeling in the company is budgeting. This methodology lowers the possibility of overspending or underfunding important efforts by assuring you that your budget accurately represents performance objectives.

Streamlined planning process

You simplify your planning process using financial models, like a budget or forecasting models. Financial models make planning much more effective. You may create realistic timetables and budgets, distribute resources more skillfully, and model various tactics.

You can break down your objectives into manageable segments and make sure that reliable data supports all of your planning by using the appropriate financial modeling types. This improves coordination, expedites departmental decision-making, and streamlines procedures.

Communication with stakeholders

Financial models enhance communication with stakeholders by presenting financial projections in an accessible format. Presenting data-backed insights from different forms of financial modeling to partners, investors, or board members fosters trust.

Models convert complicated data into more understandable charts, forecasts, and visual representations. This degree of openness strengthens your commercial relationships and increases your trustworthiness.

Increased investor confidence

Financial models boost investor confidence by demonstrating your business’s potential through valuation or cash flow projections. They demonstrate your grasp of your industry and your well-defined plan for success.

A variety of financial models can be used to show future revenue, cash flow, and growth possibilities. When investors see well-organized, data-driven estimates supported by reliable financial modeling types, they are more likely to support your enterprise.

Enhanced operational efficiency

You enhance operational efficiency with financial models that optimize resource allocation. Models like cost-volume-profit analysis can identify opportunities for improvement, whether they are related to production bottlenecks, workforce concerns, or supply chain expenses.

You may streamline operations and allocate resources as efficiently as possible using this information. You can enhance overall business performance and take prompt action when you know where resources are being misallocated or underutilized.

Increased flexibility & adaptiveness

Financial models assist you in making quick plans and adjustments in the event of a supply chain interruption or an abrupt decline in demand. You can assess several strategies and react adaptably to opportunities and problems by using scenario planning and dynamic forecasting, two essential forms of financial models.

Scenario analysis models, a vital type of financial model, prepare you for uncertainties, enabling quick strategy adjustments to capitalize on opportunities or mitigate market risks.

Increased compliance & accountability

You improve compliance and accountability using financial models that track financial data against regulatory standards. They guarantee that your financial reporting complies with legal requirements and is accurate and transparent.

Additionally, you can monitor KPIs and record performance for auditing purposes. using structured financial modeling techniques, which provide uniform frameworks for analysis, reporting, and governance, makes this kind of accountability simpler to accomplish.

Key components of financial modeling

To create effective financial models, you must understand their core components. These elements, from financial statements to assumptions, ensure your financial modelling is accurate, reliable, and aligned with business goals. These components ensure that your model reflects reality and enables informed business decisions across different types of financial modeling.

1. Financial statements

Your financial model starts with the core statements—income statement, balance sheet, and cash flow statement. These reflect your company’s performance and are foundational to all types of financial models.

By linking these statements correctly, you create a dynamic model that updates across all areas with any input change. Understanding this interconnectivity is key when exploring different financial modeling types for forecasting, valuation, or strategic planning.

2. Working capital

Your working capital, calculated as current assets minus current liabilities, is critical in financial modelling. Working capital is the daily liquidity required for your business to run. It is the distinction between current liabilities and current assets.

You may effectively manage short-term obligations and predict cash requirements by tracking working capital in your financial model. monitoring working capital guarantees that you keep a healthy cash flow and prevent operational problems, regardless of the kind of financial modeling you employ.

3. Assumptions

You rely on assumptions to drive your financial models. Define growth rates (e.g., 5% revenue increase), cost ratios, or market trends based on data. Clear, realistic assumptions ensure your financial modelling types, like forecasting, remain credible and actionable.

Well-considered assumptions underpin all financial models, including interest rates, growth rates, and cost estimates. These presumptions direct your work and are essential for creating different kinds of financial modeling, such as budget templates or forecasting models.

4. Supporting schedules

You use supporting schedules in financial modelling to detail components like debt, capex, or depreciation. These could be payroll, capital expenditures, depreciation, or debt schedules. You can improve accuracy and tweak your model by using these schedules.

Different schedules will be required to account for the distinct cost structures or revenue drivers of the company, depending on the type of financial modeling you choose. These timetables provide your model with the depth it needs to be dependable.

5. Historical data

You analyze trends to inform assumptions and validate financial modelling types, ensuring projections reflect your business’s performance and market realities. For the majority of financial modeling types, historical data serves as the baseline.

You can establish well-informed benchmarks for your future estimates by examining historical sales, expenses, margins, and trends. Historical insights assist you in creating precise and reliable estimates for the many financial models you use, whether you're creating forecasting models or business valuation models.

6. Growth margins

You incorporate a margin of growth in financial modelling to project profitability improvements. estimate gross or operating margins based on cost efficiencies or pricing strategies. Growth margins aid in the prediction of investment returns and business expansion.

This element is essential to many financial model types, particularly capital investment analysis and startup estimates. Using the right financial modeling types, you may model aggressive, moderate, and conservative growth scenarios to evaluate how your company might grow over time.

7. Investments

Your investments, such as capex or equity stakes, are modeled to assess roi and cash flow impacts. Your current or planned investments should be represented in any financial model.

Understanding how investments affect cash flow and profitability is made easier with proper modeling. This element is crucial whether you're using financial modeling for fundraising or long-term strategy. Your financial models turn into instruments for astute, scalable expansion by assessing the risks and returns associated with investments.

What is the process of building a financial model?

Creating a financial model is a structured and strategic process that gives you a clear view of your company’s financial future. You create financial models to guide business decisions, projecting financial performance with precision.

Following a structured process ensures your types of financial modeling are accurate, reliable, and aligned with business goals, driving effective financial planning.

1. Set your goal

Start by defining the purpose of your financial model. Are you valuing a business, forecasting cash flows, or planning a budget? The structure and degree of detail are determined by your objective.

Since different financial models have diverse uses, establishing your goal early on aids in choosing the best kinds of financial models and maintains the project's focus and success throughout. Clarifying the objective shapes the type of financial model, like DCF or three-statement, ensuring it meets your strategic needs and supports decision-making.

2. Gather historical data

You collect historical data, including income statements, balance sheets, and cash flow statements from the past 3-5 years. gather precise historical financial information for the previous three years or more, including cash flow reports, balance sheets, and income statements.

This information establishes trends and gives context. The majority of financial modeling models use this data to predict future performance, therefore, it's an essential starting point for any model you create.

3. Pinpoint key drivers

Pinpoint key drivers influencing your business performance, such as revenue growth, COGS, or customer acquisition rates. by recognizing and implementing these, you can better capture the factors that influence results.

These levers are fundamental to financial modeling of all kinds. By concentrating on them, you may make your model more accurate and make it simpler to update when internal or market conditions change.

4. Identify assumptions

Assumptions such as growth rate, inflation, interest rates, and costs form the foundation of your financial model. To keep the model grounded, these should be precisely defined and supported by good reasoning or market research.

It's crucial to match the assumptions made by various financial model types with the objectives and setting of your company. Clear, realistic assumptions anchor your financial modeling types, ensuring projections in budget or forecasting models are credible and actionable for planning.

5. Plan the structure

Plan your financial model’s layout to ensure clarity and functionality. Your model is easier to read and manage when it has a clear, organized layout. assumptions, calculations, and output should all be on different sheets. color-code formulas and inputs.

Professional financial modeling types are distinguished by their well-designed layouts, which make it simple for others to explore and comprehend your reasoning.

6. Build the income statement

You construct the income statement by projecting revenue, COGS, and operating expenses. Create an income statement to begin building your model. Add in revenue, operational costs, net income, gross profit, and cost of goods sold.

This claim demonstrates profitability over time and forms the foundation of numerous financial model types, particularly those that emphasize growth and performance indicators. Calculate EBITDA, then subtract taxes and interest to derive net income.

7. Build the balance sheet

The balance sheet should then be constructed to show your equity, liabilities, and assets. Connect pertinent elements to the assumptions and the income statement. All forms of financial modeling require balance sheets, particularly for evaluating capital structure and financial health.

Making sure it always balances and takes operational decision changes into account is your aim. Create your balance sheet, forecasting assets (e.g., cash, receivables), liabilities (e.g., payables, debt), and equity.

8. Build the model

Integrate your financial statements and supporting schedules (e.g., debt, capex) into a cohesive financial model. Bring everything together now. connect schedules (depreciation, debt, and working capital), link assumptions to computations, and combine the cash flow, balance sheet, and income statement.

All of the components are combined into a single dynamic tool at this step. Depending on the type of financial modeling you employ, the structure may change, but functionality and clarity are important.

9. Validate the financial model

After the build, test the integrity of the model. Do totals match? Are the financial statements balanced? Check formula consistency and remove circular references.

Different types of financial models may introduce unique complexities, so validation ensures your logic holds up across scenarios and outputs reflect reality. You validate your financial model by checking for errors, such as circular references or unbalanced balance sheets. Compare projections to historical data and industry benchmarks.

10. Document the model

The assumptions, sources, formulas, and structure of your model are explained in the documentation. It facilitates later review and makes your model more comprehensible to others. This is especially crucial when working with various financial modeling types and in collaborative settings.

Professionalism is demonstrated by thorough documentation, which also makes the model auditable and scalable. Document your financial model by noting assumptions, formulas, and data sources in a separate guide or comments.

11. Test the model

You test your financial model by running sensitivity analyses, adjusting assumptions like revenue growth and costs. Applying various scenarios—realistic, cautious, and optimistic—to test your model's performance is known as testing.

Many forms of financial modeling include sensitivity and scenario analysis as essential components that assist you in comprehending how changes in variables impact your results. This gives you the confidence to use the model while making decisions.

12. Present the findings

Provide a concise executive summary or dashboard that summarizes your findings. To convey the financial narrative, use tables, charts, and important KPIs. The results of even the most intricate financial models should be presented in an easy-to-understand visual style for stakeholders.

Adapt your presentation to the audience, whether they are executives, internal teams, or investors. Present your financial model’s outputs, such as net income, cash flow, or valuation, in clear charts or dashboards.

13. Review and revise regularly

You review and revise your financial model regularly to reflect new financial data, market changes, or business strategies. Models of finance are dynamic. assumptions alter, markets shift, and your company changes as well. develop the practice of routinely reviewing and updating the model.

This guarantees the continued relevance and utility of the financial modeling types you have selected. By keeping the model updated, you may have precise, up-to-date insights for strategic choices, fundraising conversations, and performance evaluations.

Who builds financial models in a business?

You’ll find various professionals building financial models to support business decisions. Each role leverages types of financial modeling to address specific needs, from valuation to risk assessment, ensuring financial planning aligns with business goals. Here’s a breakdown of who typically builds financial models in a business.

Accountants

As an accountant, you create financial models to ensure accurate financial reporting and budgeting. Creating the basic data that financial models use is frequently the responsibility of accountants.

They guarantee the accuracy and regulatory compliance of past financial data. Their work serves as the foundation for several financial model types, such as cost analysis, forecasting, and budgeting.

Private equity professionals

Professionals in private equity create financial models to forecast future returns, analyze risks, and evaluate possible investments. They evaluate how an acquisition may affect a target company's financials using these models. These types of financial models assess returns, debt structures, and exit valuations, helping you make informed acquisition or divestiture decisions to maximize portfolio value.

In the realm of financial modeling types, private equity professionals typically build models for mergers, acquisitions, and valuations, often incorporating discounted cash flow (DCF) and other investment-focused metrics to determine potential growth and profitability.

Finance managers

In your role as a finance manager, you develop financial models for forecasting and resource allocation. For internal planning and strategic decision-making, finance managers frequently create and update financial models. They are in charge of cash flow analysis, forecasting, and budgeting, coordinating financial models with corporate objectives.

Finance managers may concentrate on capital planning, profitability analysis, and operational performance as components of several financial model types. Their efforts are essential to ensuring that company goals are in line with available funds and market dynamics.

Chief Financial Officers (CFOs)

As a CFO, you oversee financial modeling to guide strategic planning. From high-level strategic modeling to in-depth financial planning, Chief Financial Officers (CFOs) are in charge of the entire financial modeling process. They guarantee that the models are in line with the long-term objectives of the company and offer guidance for important financial choices.

You use types of financial models like M&A or the sum of the parts to evaluate growth opportunities, ensuring financial decisions enhance business value and support long-term financial health.

Consultants & financial advisors

Financial models are used by consultants and financial advisors to give their customers strategic insights. They might assist companies in maximizing their financial performance or determining whether new initiatives are feasible.

Consultants create customized models for a variety of financial models, including capital budgeting and business valuation, based on the needs of each client. They frequently provide scenario analysis or stress testing to help inform choices. Their knowledge guarantees that the models are relevant to the goals of the clients.

Equity research analysts

As an equity research analyst, you build financial models to value companies for investment recommendations. To evaluate the worth of companies and investment prospects, equity research experts create financial models.

To estimate a company's future earnings and assess if the stock is overpriced or underpriced, they use financial models such as relative valuation models and discounted cash flow (DCF). Using DCF or precedent transaction models, prominent types of financial modeling, you analyze financial performance, guiding investors with accurate market insights and valuation estimates.

Risk analysts

They use several kinds of financial modeling to evaluate different situations and predict how possible risks may affect a business's performance.

By estimating potential losses or benefits from market swings, credit risk, and operational difficulties, risk models assist firms in preparing for unforeseen circumstances and enable them to put measures into place to effectively reduce or manage those risks.

Scenario analysis models, a vital type of financial modeling, help you quantify risk impacts, ensuring mitigation strategies protect your business’s stability.

Educators and researchers

As an educator or researcher, you develop financial models to teach or study financial concepts. Financial models or simulations, which are used to examine market behavior, financial rules, or the effects of macroeconomic variables, may be included in the category of financial modeling types. By offering fresh methods and perspectives, their work advances the discipline of financial modeling.

Mistakes to avoid while making a financial model

You must steer clear of common pitfalls when building financial models to ensure accuracy and reliability. Avoiding these mistakes in types of financial modeling enhances financial planning and supports sound business decisions. To help you avoid common pitfalls, here are some mistakes to watch out for when building your financial model.

Using outdated information

You risk inaccurate projections by using outdated data in your financial model. Old revenue, expense, or market data can skew types of financial models, like forecasting models. Poor strategic choices and inaccurate estimates may result from this.

When building your model, make sure to utilize the most recent financial data, market trends, and assumptions. Forecasting and budgeting are two examples of financial models that can be distorted by outdated data, producing predictions that are out of step with the state of the market.

Not involving key stakeholders

Failing to involve key stakeholders, like finance or operations teams, can lead to misaligned financial models. Although finance teams frequently create models, to obtain the most accurate insights, cooperation with departments such as sales, operations, and marketing is crucial.

For instance, including feedback from people who will be directly affected by the model's results might increase the effectiveness of financial modeling techniques like budgeting and scenario analysis.

Weak scenario planning

You weaken your financial model with poor scenario planning. Neglecting best, worst, and base cases in scenario analysis models, a critical type of financial modeling, limits risk assessment. Ignoring many situations in your financial model is a common mistake.

Your model might not adequately prepare you for unforeseen circumstances if it does not take into account the best-case, worst-case, and likely-case situations. Scenario planning enables you to assess risk and opportunity more methodically and proactively, whether you're creating financial models, such as forecasting or a business assessment.

Ignoring seasonal changes

Seasonal variations can have a big impact on revenue and expenses, yet they are often overlooked by financial models. For instance, holidays or other special occasions may generate increases in sales for a retail business.

You run the danger of making irrational assumptions if you ignore these variations. Adjust assumptions for seasonality to ensure projections align with business cycles and financial planning.

Integrating seasonal data into financial modeling types such as cash flow analysis or revenue forecasting will help you build a more accurate and actionable model that reflects the true nature of your business’s performance.

Not updating the model on a regular basis

Ensure to periodically examine and update your model because critical assumptions, financial performance, and market conditions can all change over time. This is especially crucial for financial model types like forecasting and budgeting, where making bad decisions might result from using out-of-date assumptions.

Changes in market conditions or business strategies require revisions to types of financial modeling, such as three-statement models. Schedule periodic updates to keep projections accurate and aligned with your financial goals.

Skipping validation

Skipping validation risks errors in your financial model. Unchecked formulas or unbalanced balance sheets undermine types of financial models like DCF models. Your model may produce inaccurate results if you don't test it for accuracy, consistency, and dependability.

Always verify that the assumptions and calculations in your model are accurate. Testing several hypotheses and contrasting the model's results with actual data should be part of the validation process.

Neglecting external factors

You weaken your financial model by overlooking external factors like economic shifts or regulatory changes. When creating a model, ignoring these factors may lead to wildly inaccurate projections.

Always include pertinent financial model types, such as scenario analysis, to consider changes in the outside world. Your model will be more responsive to changes in the market and offer superior strategic insights if it takes the larger context into account. These impact types of financial modeling, such as forecasting models.

Challenges in building a financial model for your business

You face several challenges when building financial models for your business, from data quality to regulatory shifts. Overcoming these hurdles ensures your types of financial modeling are accurate, reliable, and aligned with business goals for effective financial planning.

Complex architecture of the model

Developing different types of financial models for your company sometimes entails complex interdependent variables and financial structures. Making certain your model is adaptable, scalable, and capable of integrating many financial scenarios is crucial as you develop it.

As you add more components, such as cash flow estimates, balance sheets, and income statements, the architecture becomes more complex. Making the model manageable and helpful requires striking a balance between complexity and clarity.

Availability of quality data

You struggle with the availability of quality data for your financial model. Inaccurate or incomplete historical data, such as revenue or expense records, undermines types of financial models like forecasting models.

Your financial modeling techniques, such as forecasting or budgeting, may be distorted and produce false results if you don't have accurate data. Particularly when discussing past performance, industry trends, or competition insights, you must make sure that your data sources are reliable and comprehensive.

Integration with existing systems

Integrating your financial model with existing systems, like ERP or accounting software, poses a challenge. Updating and maintaining your various financial model types is made simpler by seamless data flow throughout your company, which is ensured by effective integration. To make the process go more smoothly, pick platforms and technologies that make synchronization simple.

Regulatory changes

You face regulatory shifts that impact your financial model. Changes in tax laws, accounting standards, or industry regulations affect types of financial models like compliance-focused models. Maintaining compliance and avoiding fines requires keeping abreast of legislative changes and modifying your model appropriately.

Ignoring regulatory changes could lead to inaccurate projections and unforeseen expenses. Staying updated and adjusting assumptions ensures your model remains compliant and supports business operations without penalties.

Aligning stakeholder expectations with results

Achieving a consensus can be difficult since different teams or departments may have different goals and expectations. It's crucial to make sure that all important stakeholders agree with the goals, schedules, and assumptions when working on financial model types like forecasting or budgeting.

Frustration and a lack of confidence in the model's results can result from misalignment. Engaging stakeholders early ensures your model meets diverse business needs and supports strategic goals.

Meeting deadlines

You deal with time constraints when building financial models. Types of financial modeling, like m&a models, require detailed projections and sensitivity analysis, which are time-intensive. Due to time constraints, you can feel pressured to complete the modeling process quickly, which could result in errors or omissions.

Effective project management abilities are necessary to balance various financial models, such as forecasting and company value, with strict timelines. Set aside time for extensive stakeholder reviews, testing, and validation to guarantee the accuracy and dependability of the finished model.

Understanding user capability

You must consider user capability when building financial models. Stakeholders could find it difficult to understand the outcomes if your model is overly complicated or calls for in-depth financial knowledge.

When creating financial models such as cash flow analysis or budgeting, it is crucial to take the user's capabilities into account. to guarantee that everyone can comprehend and apply the concept efficiently, provide sufficient training or condensed versions. Complex types of financial modeling, such as scenario analysis models, may overwhelm users with limited financial expertise.

Capacity for error detection

Financial models are susceptible to errors, whether from data entry mistakes, formula inaccuracies, or logical flaws. Without robust error detection mechanisms, these issues can go unnoticed, leading to flawed analyses.

Implementing comprehensive validation procedures, such as cross-checks, sensitivity analyses, and independent reviews, is vital. Utilizing error-checking tools and maintaining a culture of meticulousness can significantly reduce the risk of undetected errors.

Forecasting accuracy

Achieving forecasting accuracy is one of the biggest obstacles in developing a financial model. Accurate forecasting can be challenging, even with the best data, due to outside variables including consumer behavior, market conditions, and economic trends.

Consider assumptions and how they affect estimates when developing financial models such as capital expenditure planning or revenue forecasting. Misjudging these can lead to unreliable projections, requiring you to refine data sources and test scenarios to align with business outcomes.

Strategies to overcome the challenges in building a financial model

You can enhance financial planning by following best practices when building financial models. These strategies ensure your types of financial modeling are accurate, user-friendly, and aligned with business goals, driving effective decision-making and business growth.

1. Make use of standardized templates

Use standardized templates for your financial models to ensure consistency across types of financial modeling, like three-statement or DCF models. The modeling process can be streamlined and consistency between models can be ensured by using standardized templates for your sorts of financial models.

For cash flows, financial statements, and other crucial elements, templates offer an organized framework. They make it simple to compare models and offer a point of reference for upcoming modeling assignments.

2. Keep a record of everything

For anyone examining the model, it offers clarity and transparency, particularly when working on intricate financial models like budgeting or forecasting. It's important to record each assumption, computation, and choice made in your financial model.

Having clear documentation makes it easier to change or revise your model over time without creating misunderstandings. Troubleshooting, auditing, and handoff to other team members as needed are made easier with a well-documented model.

3. Set benchmarks

Set benchmarks against industry standards to validate your financial model. You may determine whether your model is realistic by contrasting your assumptions and projections with those of other firms that are comparable to yours.

Financial models such as capital expenditure planning and business valuation must be in line with market developments. This guarantees that your model accurately captures the facts of the competition, enabling you to make data-driven, well-informed business decisions. This ensures your projections are realistic, boosting credibility and aligning with market expectations.

4. Maintain clarity

Keep your financial model simple and clear to enhance usability. Avoid overly complex formulas in types of financial models like budget models. Maintaining simplicity and clarity is essential when creating financial models, particularly those that involve cash flow analysis or budgeting.

Adding extraneous details to the model can cause confusion and mistakes. Make sure the model is easy to use and intuitive so that all stakeholders, regardless of financial expertise, can comprehend and apply it. For decision-makers, a simple model guarantees that important information is readily available and actionable.

5. Maintain version control

You must maintain version control to track changes in your financial model. Keep a record of every version of your model as you update or edit it so you can always refer to earlier iterations.

This is especially crucial for financial model types where assumptions and results can fluctuate over time, such as budgeting and financial forecasting. Version management makes it easier to see changes, evaluate their effects, and keep an accurate record of your modeling work across time.

6. Integrate visualization

Using visualization tools can improve your capacity to explain intricate financial concepts to stakeholders who are not in the financial industry. You may make important measurements, trends, and comparisons easier to understand by utilizing visual components.

Effective visuals enhance the overall impact of your financial model and make decision-making easier. Visuals for revenue trends or cash flow in types of financial models, such as scenario analysis, make insights accessible, aiding stakeholder understanding and decision-making.

7. Set up alerts for key metrics

Establishing alerts for important financial model parameters, like cash flow or profitability, guarantees that you can see any departures from expectations fast. When key performance indicators (KPIs) surpass or fall below preset levels, alerts deliver real-time notifications.

By taking a proactive stance, you can resolve possible problems before they become more serious, which makes your model more adaptable to changes in your company's environment.

8. Create a scenario library

A best practice for financial model types, such as scenario analysis and forecasting is to create a scenario library. Various sets of inputs and assumptions that reflect diverse business conditions are included in this collection.

You may rapidly assess the effects of modifications to cost structures, sales projections, or market conditions by using predefined scenarios. Develop a scenario library to test multiple outcomes in your financial model. This prepares you for market uncertainties and strengthens planning.

9. Set up a feedback loop with end users

Creating a feedback loop with your financial model's end users guarantees that it satisfies their requirements and expectations. Get feedback from stakeholders who use your financial model types for decision-making after you have deployed them.

Utilize their input to enhance results, modify presumptions, and make adjustments. A feedback loop encourages ongoing development, which will eventually assist you in building a more reliable and approachable financial model. Gather input on usability and accuracy for types of financial modeling, like budget models, ensuring your model meets business needs and drives adoption.

10. Leverage tools & technologies

Financial modeling software can increase efficiency, increase accuracy, and automate computations. Additionally, these technologies can support visualization, version control, and teamwork.

You may create and manage increasingly complex financial models more quickly and efficiently by utilizing the appropriate technology for your model types. Leverage technology and tools like Excel, Power BI, or financial modeling software (e.g., Adaptive Insights) to build robust financial models.

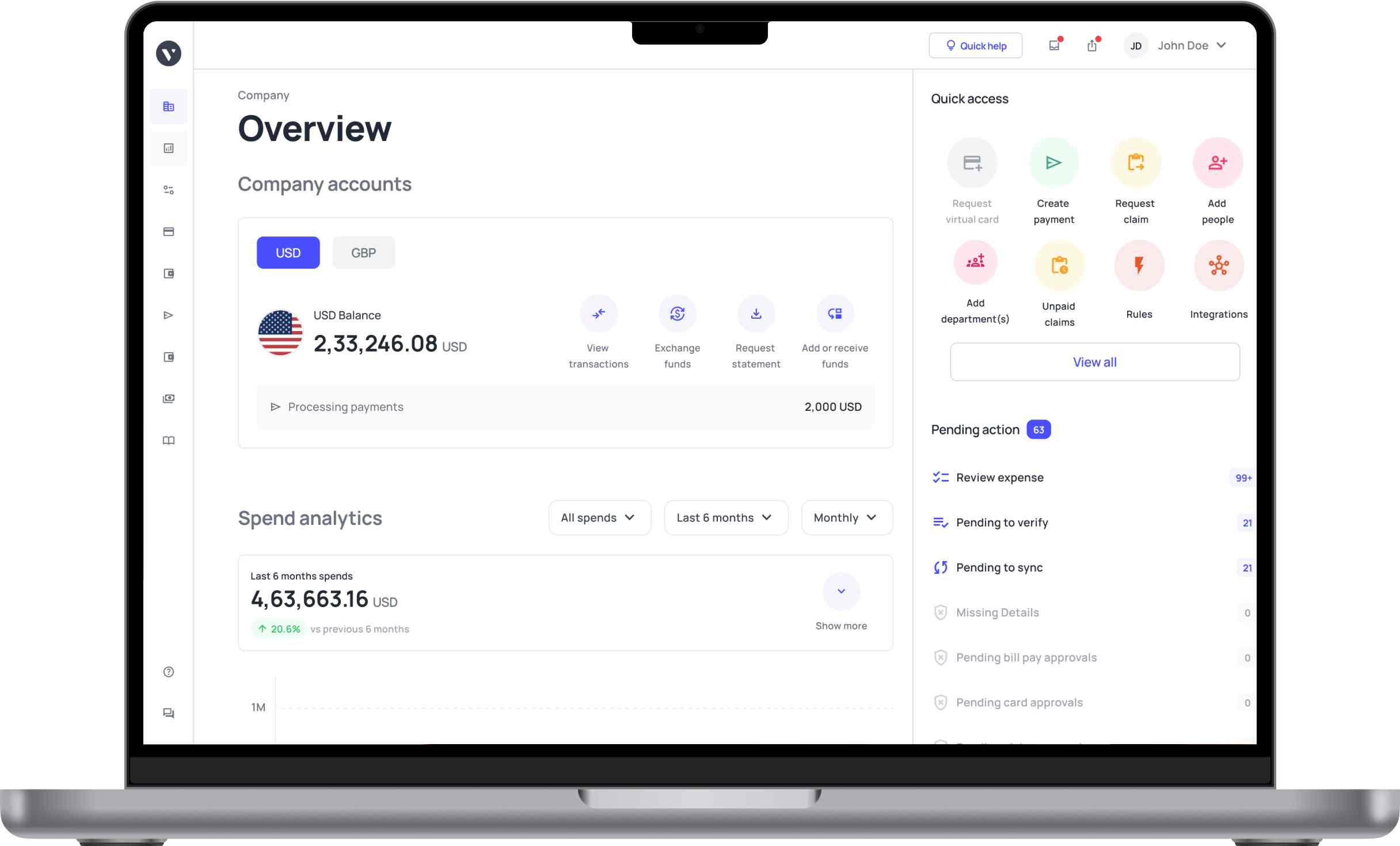

Simplify and improve financial tracking with Volopay

You can revolutionize financial expense tracking with Volopay, a leading expense management platform. Designed for businesses, it streamlines spend management, offering automation and real-time insights to optimize financial processes and drive business efficiency.

Whether you're a startup or a growing business, Volopay helps you automate, control, and optimize every aspect of your spending while aligning with different types of financial modeling and financial planning processes.

Streamlined expense management

You streamline business expenses with Volopay’s expense management software, a top type of financial model for spend control. Pre-approved budgets, spending caps, and policy enforcement are just a few of the clever features that give you total control over your finances.

Volopay's business budgeting capabilities help strengthen the various financial modeling types, particularly when creating predictions and budgets using real-time data. It automates expense reporting, approvals, and reimbursements, reducing manual work.

System integrations

Manual data entry can be avoided by syncing data straight to programs like Xero, QuickBooks, or NetSuite. Accurate insights and trustworthy predictions are provided by these integrations, which guarantee consistency across any financial model types you create.

Maintaining current data for planning, budgeting, and analysis is another way that being able to link with many systems improves your financial modeling methods. Volopay's system integrations, vital for types of financial models, sync expense data automatically, eliminating manual entries..

Automated reconciliation

You simplify reconciliation with Volopay’s automated reconciliation feature. You may stop manually matching receipts and transactions with Volopay. By connecting your spending to the appropriate invoices and accounting data, the platform automates reconciliation.

You guarantee accuracy and compliance while saving hours of manual labor. Maintaining reliable financial data is essential for all sorts of financial modeling, including variance analysis and cash flow models.

Real-time transaction visibility

You can track each transaction as soon as it occurs with Volopay. You can keep an eye on spending as it happens using approval workflows and real-time notifications. This real-time visibility enables more precise financial model types and facilitates proactive financial change adaptation.

Live tracking makes it simpler to match financial objectives with practical measures, whether you're handling payroll or vendor payments. You maintain budget control and make informed financial decisions effortlessly.

Customizable dashboard

You leverage Volopay’s customizable analytics dashboard to visualize spending patterns. The adaptable interface facilitates deeper insights into budget adherence, department-wise spending, and staff reimbursements.

These analytics facilitate better decision-making and performance assessment when working with various financial modeling types. Data presentation to stakeholders is made much simpler with the help of export-ready reports and graphic representations.

Mobile access

You manage expenses on the go with Volopay’s mobile access. With the help of the Volopay mobile app, you can manage your business spending from anywhere. From your phone, you may view reports, upload receipts, and accept or reject requests.

Mobile access ensures that your types of financial models are supported with real-time updates even when you’re away from your desk. This adaptability enhances responsiveness and keeps you consistently in line with your budgetary objectives.

FAQs

Yes, it does. By using assumptions and historical data, your financial model estimates future revenue. This is a key aspect across many types of financial modeling, including forecasting and business planning models.

Simplify visuals, highlight key takeaways, and avoid jargon. Use graphs and dashboards to present insights from various types of financial models in a digestible format for broader understanding.

The level of detail depends on the model’s purpose. Strategic models use broad assumptions, while operational ones need granular data. A well-balanced model stays accurate, manageable, and easy to interpret.

Match the model’s detail to its purpose. Simpler financial modeling types suit internal planning, while complex types of financial models work for investor presentations or strategic analysis.

Clarity, consistency, accuracy, and flexibility. Strong financial modeling types will allow you to test assumptions, visualize outcomes, and guide decision-making with confidence.