Sunk cost vs. opportunity cost: Detailed comparison with examples

Understanding the sunk cost vs opportunity cost dynamic is crucial for small and medium-sized enterprises (SMEs) aiming to make sound financial decisions. Sunk costs refer to past expenses that can no longer be recovered—think of spending INR 5 lakh on a failed software implementation. Despite the loss, continuing to invest just because money was already spent can lead to poor judgment.

On the other hand, opportunity costs are future-focused and represent the potential benefits missed when choosing one option over another. For example, if you decide against investing $50,000 in a promising new venture, the potential return from that venture is your opportunity cost.

These two concepts often get overlooked, yet they carry significant weight in financial planning and resource allocation. SMEs especially must be aware of these costs to avoid irrational commitment to unproductive choices and to stay agile in a competitive market.

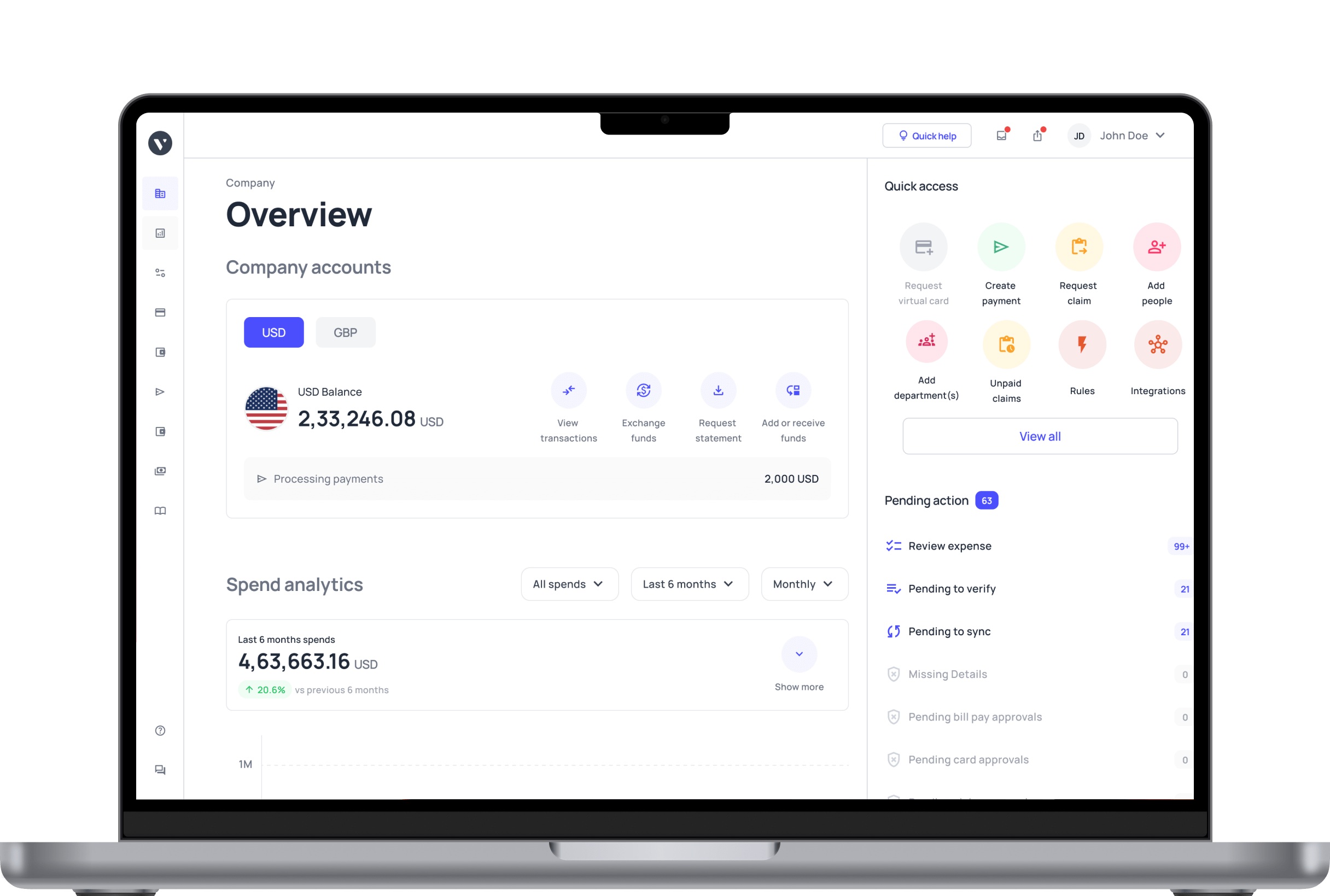

With Volopay’s real-time expense tracking and financial analytics, businesses can effectively weigh sunk and opportunity costs. This not only aids in recognizing when to pivot strategies but also ensures that every rupee or dollar spent delivers the maximum possible value, helping avoid costly financial traps and missed opportunities.

What is a sunk cost?

A sunk cost is a financial outlay that has already been made and cannot be recovered, no matter the future outcome. These are past expenses that should not influence current or future business decisions.

For instance, if a company spends INR 2 lakh on a marketing campaign that doesn’t deliver results, that money is a sunk cost—it’s gone and cannot be recovered. Even if the campaign failed, many businesses feel pressured to keep investing to try and salvage results. This can lead to poor allocation of financial resources and increased losses.

Sunk costs come in many forms, including investments in software, equipment, product development, or even employee training programs. A common mistake businesses make is allowing these past expenses to influence their future decisions.

For example, continuing to spend money on a failing product simply because a lot has already been invested is known as the “sunk cost fallacy.” It’s a cognitive bias that leads companies to irrationally allocate more resources instead of cutting losses. When not addressed, this mindset can drag down profitability and impair long-term growth potential.

For SMEs, recognizing sunk costs is vital for strategic agility. It allows teams to assess situations based solely on potential future returns rather than emotional attachment to past spending. In a fast-changing business landscape, the ability to walk away from unrecoverable investments can save valuable time and money.

Agile financial thinking promotes better risk management and faster reallocation of capital to more promising opportunities. Letting go of past losses helps companies reset their strategy with a fresh perspective.

Volopay’s platform helps SMEs avoid the trap of overcommitting to sunk costs by offering clear visibility into past spending. With detailed reporting and analytics, decision-makers can more easily identify which costs are sunk and focus on future profitability rather than past losses. This enables smarter planning and discourages irrational spending habits that stem from earlier financial commitments.

What is an opportunity cost?

Opportunity cost is the value of the next best alternative that is given up when a decision is made. Unlike sunk costs, which are rooted in the past, opportunity costs are forward-looking and based on potential benefits.

They help evaluate what you might be missing out on by choosing one option over another. This concept encourages comparison between possible paths before making commitments. It highlights the real trade-offs businesses must consider when allocating limited resources.

Consider a business with $50,000 in surplus cash. If the company chooses to invest in a new warehouse instead of a high-yield mutual fund, the potential earnings from the mutual fund represent the opportunity cost.

In simpler terms, opportunity cost is about understanding what you’re sacrificing when you make a choice. That forgone benefit may have long-term implications on cash flow, profitability, or growth. Recognizing it early helps prevent misaligned financial decisions.

For SMEs, this concept is essential for maximizing returns on limited resources. Every decision—from hiring talent to expanding product lines—has an opportunity cost. Allocating team members to one project means they can’t contribute to another, potentially more profitable one.

Failing to consider these costs can result in underutilized potential and missed business milestones. Businesses that routinely weigh opportunity costs tend to make more strategic and outcome-focused decisions. Comparing expected returns and strategic alignment, companies can make smarter choices. The clearer you are about what you’re potentially giving up, the better your overall decision-making will be.

Tools like Volopay allow SMEs to track real-time spending and assess resource utilization, which helps in identifying opportunity costs more accurately. When evaluating opportunity cost vs sunk cost, Volopay’s data insights empower users to focus on value creation rather than past mistakes.

In this way, the software supports a more rational, cost-conscious approach to business management—helping navigate the complex trade-offs in the opportunity vs sunk cost debate.

Key differences between sunk cost and opportunity cost

Nature of costs

Sunk costs are expenses already incurred and cannot be recovered, such as a failed marketing campaign. They remain constant regardless of future outcomes.

Opportunity costs, on the other hand, represent the benefits a business misses out on when choosing one option over another. These are not actual outflows but rather the value of a forgone opportunity.

Understanding the nature of these costs is critical in evaluating sunk cost vs opportunity cost decisions effectively.

Decision-making impact

Sunk costs often distort decision-making due to the sunk cost fallacy, where businesses continue investing just to justify past expenses. This can lead to poor financial outcomes.

Opportunity costs, however, help leaders make informed and rational choices by highlighting potential benefits lost.

Acknowledging these trade-offs improves clarity and strategic direction. Unlike sunk costs, opportunity costs promote forward-thinking behavior and support optimal resource allocation when deciding between competing business initiatives.

Timing

Sunk costs are tied to past actions and are already reflected in previous financial decisions. These historical costs remain fixed regardless of future choices.

In contrast, opportunity costs are future-oriented, based on what could be gained from alternative actions. Their value lies in their predictive nature, allowing businesses to forecast and weigh options proactively.

This distinction in timing is key when comparing opportunity cost vs sunk cost in strategic planning.

Financial reporting

Sunk costs are recorded in financial statements as part of a company’s expenditure history. They can be tracked, audited, and reviewed, even if they no longer influence future decisions.

Opportunity costs, however, are theoretical and do not appear in formal financial reports. Since they represent potential gains rather than actual outflows, they are used more in analysis than accounting. This makes sunk costs vs opportunity costs distinct in their role in financial reporting.

Quantifiability

Sunk costs are easy to quantify as they involve specific, known expenses, such as $10,000 spent on software development. Their exact amounts are clearly documented.

Opportunity costs are less tangible and based on projections or comparisons between alternatives. Estimating them often requires assumptions and market data, making them more subjective. Despite this, opportunity costs are crucial for forward planning and resource optimization, especially when weighing opportunity vs sunk cost trade-offs.

Psychological influence

Sunk costs tend to create emotional bias, causing business owners to irrationally stick with failing projects due to prior investment. This is known as loss aversion.

Opportunity costs, by contrast, demand strategic foresight and objective thinking. Recognizing what’s being sacrificed helps leaders avoid emotional traps and make smarter, growth-driven decisions.

Common sunk costs in SMEs

1. Capital investments

Small and medium enterprises (SMEs) often invest heavily in machinery, equipment, or software to support their operations. Once these assets are purchased, the money spent becomes a sunk cost, regardless of whether the investment yields the desired outcomes.

For example, spending $25,000 on machinery that later becomes obsolete or underutilized is a classic case. Businesses may continue using it simply because of the initial expense, even when better options are available.

This mindset reflects the sunk cost vs opportunity cost dilemma that affects operational efficiency. It’s important for SMEs to evaluate whether continuing to use such assets adds value or if switching to newer solutions is more beneficial.

2. Marketing expenses

Marketing campaigns that fail to produce results are another common sunk cost for SMEs. Money spent on digital ads, brochures, or influencer promotions cannot be recovered once deployed, even if the campaign does not increase sales. Companies often hesitate to pivot or stop these efforts because of prior investment.

However, holding onto ineffective strategies drains resources. Recognizing the opportunity cost vs sunk cost issue early helps businesses shift focus to more promising alternatives.

This flexibility allows SMEs to allocate funds more efficiently and avoid throwing good money after bad. In a fast-changing market, timely decisions about marketing spend are crucial to staying relevant.

3. R&D costs

Research and development efforts frequently lead to sunk costs, especially when outcomes are uncertain. SMEs may develop new product prototypes or solutions that never reach the market or fail regulatory standards. The funds allocated to these projects cannot be recouped, even if the product isn’t viable. Many firms persist with flawed ideas due to prior spending.

This illustrates how sunk costs vs opportunity costs must be weighed realistically to avoid further loss. Instead, businesses should consider potential returns and market demand before committing additional resources.

Continuously evaluating R&D projects against business priorities can minimize wasted investment. This proactive approach also encourages innovation without risking excessive financial exposure.

4. Training costs

Training new hires is essential, but the expense becomes a sunk cost when employees leave shortly afterward. SMEs spend significantly on onboarding, upskilling, and role-specific training. If turnover is high, that investment offers little to no return.

Replacing those employees requires repeating the process and incurring similar costs again. Understanding opportunity vs sunk cost helps improve hiring practices and training ROI. Focusing on employee retention strategies can reduce these costs and strengthen organizational stability.

Providing a positive work environment and career growth opportunities can lower turnover rates. By minimizing frequent training cycles, businesses save money and enhance team productivity.

Common opportunity costs in SMEs

1. Investment choices

Small and medium enterprises often face decisions where they must choose one project or investment over another. For example, allocating funds to expand a product line might mean missing out on investing in technology upgrades.

This trade-off is a classic example of sunk cost vs opportunity cost, where the benefit of the forgone alternative must be carefully considered. Choosing the right project can significantly impact future growth and profitability.

Ignoring potential returns from alternative investments can limit business success. Evaluating these choices ensures that capital is put to its best use. Making these decisions with clear insight helps prevent costly mistakes.

2. Resource allocation

SMEs must decide how to allocate limited resources, such as staff time or budget, across competing priorities. Assigning employees to one department may reduce support available elsewhere, affecting overall productivity.

Similarly, diverting funds to one initiative means other projects may remain underfunded. This situation highlights the importance of understanding opportunity cost vs sunk cost when distributing resources.

Proper resource allocation helps maximize efficiency and business outcomes. Without it, critical areas may be neglected, reducing competitive advantage. Careful planning ensures that high-impact areas receive adequate attention. It also encourages cross-functional collaboration to meet organizational goals.

3. Time management

Time is one of the most valuable assets for any SME, and focusing on low-value tasks can result in significant opportunity costs. Spending too much time on routine administrative work can prevent leaders from pursuing strategic activities that drive growth.

Prioritizing time effectively requires an awareness of what opportunities are being sacrificed. This reflects the broader challenge of sunk costs vs opportunity costs in managing daily operations. Efficient time management supports better decision-making and long-term success.

Businesses that optimize how they use time typically outperform their competitors. Delegating non-essential tasks can free up leadership for higher priorities. It also fosters a culture of productivity and accountability across teams.

4. Market opportunities

Failing to recognize emerging market trends or customer demands can result in missed chances for growth. For example, delaying entry into a new market segment means losing potential revenue and market share.

Such missed opportunities represent a key element of opportunity vs sunk cost decisions. SMEs that stay alert and responsive to market changes gain a competitive edge. Ignoring these signals can result in falling behind competitors and reduced profitability.

Proactive market analysis is essential for seizing new growth avenues. Regularly monitoring consumer behavior and industry shifts helps businesses adapt swiftly. This agility can make the difference between success and stagnation.

How sunk costs lead to the sunk cost fallacy

Psychological traps

Loss aversion often causes individuals and businesses to persist with failing investments simply to avoid admitting a loss. This natural tendency makes it hard to cut losses even when continuing causes more harm. The fear of wasting what has already been spent clouds objective decision-making.

This emotional bias frequently drives poor financial choices, illustrating the complexity of sunk cost vs opportunity cost decisions. Recognizing these psychological traps is critical to prevent repeating costly errors. Overcoming loss aversion allows better evaluation of future benefits without being anchored to past expenses. Being aware of this trap helps leaders make clearer, more rational financial decisions.

Commitment bias

Commitment bias leads people to stick to previous decisions despite evidence suggesting a change is needed. It can cause a reluctance to abandon projects or investments because of the time or money already spent. This behavior exemplifies the challenge in balancing opportunity cost vs sunk cost thinking.

Being overly committed to the past limits flexibility and adaptation to new information. Businesses that fail to break free from this bias often incur greater losses. Developing awareness and encouraging objective reassessment can reduce this costly error. Companies that cultivate a culture open to change are better positioned to avoid commitment bias.

Emotional investment

Emotional attachment to projects or assets can cloud judgment and decision-making in SMEs. Owners and managers may continue funding ventures due to personal pride or optimism rather than rational analysis. This emotional involvement is a key driver of the sunk costs vs opportunity costs dilemma.

Such attachment makes it harder to accept that cutting losses might be the better option. It prevents businesses from reallocating resources to more promising opportunities. Learning to separate emotions from financial decisions improves long-term outcomes. Training teams to evaluate investments objectively helps minimize emotional bias.

Business impact

Falling into the sunk cost fallacy wastes valuable resources that could be better used elsewhere. Continuing to invest in failing initiatives drains cash flow and limits the ability to capitalize on new opportunities. This inefficient use of funds is a critical concern when comparing opportunity vs sunk cost in decision-making.

Businesses that ignore sunk cost fallacy effects may suffer reduced profitability and growth potential. Being mindful of this trap helps SMEs allocate resources more strategically. It ultimately supports healthier financial management and competitiveness. Avoiding this pitfall enhances agility and responsiveness in dynamic markets.

How opportunity costs drive strategic decision-making

Prioritizing high-value projects

In strategic planning, focusing on projects with the highest return on investment (ROI) ensures that resources generate the best possible outcomes. By carefully evaluating potential benefits, businesses can prioritize initiatives that promise greater profitability and impact.

This approach helps avoid wasting time and capital on less effective ventures. For SMEs, understanding sunk cost vs opportunity cost allows them to shift focus from past expenditures to future gains. Prioritizing high-value projects supports better allocation of limited resources and accelerates business growth.

Additionally, concentrating on high-ROI projects builds stakeholder confidence and improves competitive positioning. This focus enables firms to quickly adapt to changing market demands while maximizing value.

Optimizing resource use

Efficient resource allocation is crucial to maximize business potential and competitiveness. Allocating funds and personnel to areas with the most promising returns helps avoid missed opportunities. This prevents resources from being tied up in less productive activities, enhancing overall efficiency.

By keeping opportunity costs in mind, companies can adjust strategies to focus on where resources deliver the greatest value. Optimal use of resources directly contributes to stronger financial health and operational success.

Moreover, optimizing resources minimizes waste and reduces operational costs, supporting sustainable business practices. This careful allocation empowers companies to respond dynamically to new challenges and growth prospects.

Evaluating trade-offs

Every business decision involves trade-offs, requiring a clear assessment of alternatives. Weighing the benefits and costs of different options helps leaders make informed choices. Understanding what is sacrificed by selecting one path over another sharpens decision-making quality.

This balanced evaluation prevents costly mistakes driven by ignoring sunk cost vs opportunity cost considerations. Regularly assessing trade-offs ensures alignment with business goals and market conditions. It also encourages critical thinking and long-term vision in leadership teams.

Thorough evaluation fosters transparency and accountability in resource management decisions. This process ultimately strengthens a company’s agility in navigating complex market environments.

Long-term growth

A strategic focus on opportunity costs encourages investment in initiatives that promote sustainable growth. Prioritizing future gains over past losses supports innovation and expansion. This mindset helps companies stay competitive by adapting to evolving markets and customer needs.

Emphasizing long-term benefits fosters resilience and scalability. By integrating opportunity cost awareness into planning, businesses secure their position for continued success. It also drives a culture of proactive decision-making and continuous improvement.

Ultimately, this perspective helps SMEs build lasting value and competitive advantage. It further ensures that growth strategies remain relevant and responsive to future opportunities.

Real-world examples of sunk cost vs. opportunity cost in SMEs

1. Failed software project

An SME spent $6,000 on software that ultimately proved unusable and had to be abandoned. This amount represents a sunk cost because the money cannot be recovered regardless of future actions. Meanwhile, the business missed an opportunity by not investing $50,000 into a customer relationship management (CRM) system that could have improved sales and customer retention.

This forgone benefit is the opportunity cost of sticking with the failed project. Understanding the difference between these costs helps companies avoid throwing good money after bad and make smarter investment decisions.

SMEs must evaluate both sunk costs and potential gains when planning technology upgrades or new implementations. Avoiding the sunk cost fallacy can prevent businesses from continuing unprofitable projects just because of prior investments.

2. Retail store lease

A retail business committed $80,000 to a lease on a physical storefront that failed to generate enough revenue, making this a clear sunk cost. At the same time, the company missed out on the chance to invest $2,000 in launching an e-commerce platform, which could have attracted a broader customer base and higher sales.

The foregone potential revenue from online sales is the opportunity cost of the store lease decision. Recognizing the distinction between these costs is crucial for SMEs deciding between traditional and digital retail models.

This awareness enables better allocation of limited capital toward more profitable ventures. The sunk cost may tempt businesses to keep a failing physical store longer than they should. However, prioritizing opportunity cost analysis supports more agile and profitable business models.

3. Marketing campaign

An SME spent $4,000 on a marketing campaign that did not bring the expected customer engagement or sales, marking this expenditure as a sunk cost. Meanwhile, the company missed an opportunity to invest $20,000 in a focused social media strategy, which could have delivered more targeted and cost-effective marketing results.

The benefits lost by not choosing the social media approach represent the opportunity cost in this situation. Evaluating both sunk costs and potential returns allows SMEs to refine their marketing strategies.

This approach helps avoid repeating ineffective campaigns and drives better budget prioritization for future promotions. Learning from past failures without falling into the sunk cost trap is key for smarter marketing spend. Strategic use of opportunity cost encourages experimentation with new marketing channels that may offer higher returns.

4. Hiring decision

A company invested $15,000 in training an employee who eventually left, making this amount a sunk cost. At the same time, it missed an opportunity to allocate $20,000 toward hiring new talent with skills better aligned to the company’s evolving needs. The forgone benefits of securing more suitable personnel represent the opportunity cost in this example.

Being aware of sunk costs versus opportunity costs helps businesses make more effective hiring and training choices. This understanding encourages firms to focus on long-term workforce planning and talent retention strategies.

Holding onto past investments in underperforming employees can prevent companies from adapting to changing skill requirements. Evaluating opportunity costs enables smarter decisions about where to invest in employee development and recruitment.

The impact of sunk cost and opportunity cost on SME finances

Financial losses from sunk costs

Sunk costs lead to wasted funds when SMEs continue investing in projects that no longer deliver value. For example, money spent on outdated technology or failed product launches cannot be recovered, causing direct financial losses. These irrecoverable expenses drain resources that could be better used elsewhere.

When businesses fail to recognize sunk costs, they risk compounding losses by pouring more money into unproductive ventures. This can weaken the financial health of the company and reduce capital available for new opportunities. Awareness of sunk cost vs opportunity cost helps SMEs cut their losses early and prevent ongoing financial damage.

Managing sunk costs effectively safeguards the company’s overall budget and profitability. In addition, reducing focus on sunk costs frees management to allocate attention to more promising projects, improving decision quality across the organization.

Missed profits from opportunity costs

Opportunity costs represent the profits SMEs forgo when they choose one option over a potentially more lucrative alternative. By not investing in higher-return projects or markets, businesses sacrifice future earnings and growth potential. This lost income can have a significant impact on the company’s bottom line over time.

For example, choosing to allocate funds to low-yield initiatives instead of innovative ventures can stall expansion and reduce competitive advantage. Recognizing opportunity cost in financial planning encourages SMEs to pursue projects with the greatest return on investment.

Understanding the trade-offs involved in decision-making strengthens strategic focus and profitability. Evaluating sunk cost vs opportunity cost ensures resources drive maximum business value. Moreover, being aware of opportunity costs promotes agility, allowing SMEs to pivot quickly as market conditions change. This foresight helps sustain long-term growth even in competitive industries.

Cash flow constraints

Both sunk costs and opportunity costs can contribute to cash flow limitations for SMEs. Funds tied up in non-performing assets or missed investment chances reduce available working capital. This constraint limits a company’s ability to respond quickly to new opportunities or unexpected expenses.

When cash flow is restricted, it becomes challenging to maintain operational efficiency and sustain growth. Effective management of sunk costs frees up capital that can be redirected toward higher-impact uses. Similarly, considering opportunity costs helps prioritize spending that enhances liquidity and financial flexibility.

By balancing sunk cost vs opportunity cost, SMEs can better maintain healthy cash flow and avoid financial bottlenecks. Additionally, consistent monitoring of these costs supports proactive financial planning and risk management. This leads to improved resilience in volatile markets and better preparedness for unforeseen challenges.

Strategic missteps

Ignoring the implications of sunk costs and opportunity costs often leads SMEs to make poor strategic decisions. For example, sticking to failing products or markets due to past investments can prevent innovation and adaptation. Likewise, overlooking opportunity costs may cause companies to miss chances for diversification or market expansion.

These missteps can stunt growth and reduce long-term competitiveness. Companies that integrate sunk cost vs opportunity cost analysis into their strategy tend to make more informed, future-focused decisions. This approach supports sustainable growth and resilience in changing market conditions.

Avoiding emotional bias and focusing on objective financial evaluation improves overall strategic outcomes. Furthermore, educating leadership and teams about these concepts fosters a culture of critical thinking and continuous improvement. This cultural shift is essential for maintaining competitive advantage and long-term success.

Strategies to balance sunk cost and opportunity cost in decision-making

1. Ignore sunk costs

To make sound decisions, it’s crucial to set aside sunk costs and focus solely on the future value of options. Past expenses cannot be recovered, so continuing to consider them may lead to poor choices and wasted resources. Instead, evaluate decisions based on potential returns and risks moving forward.

This mindset helps avoid the sunk cost fallacy, where businesses throw good money after bad. Prioritizing future benefits encourages more flexible and strategic thinking. It allows SMEs to reallocate resources to projects with higher potential.

By ignoring sunk costs, companies can improve agility and adapt to changing market conditions. This approach supports more rational, forward-looking decision-making that maximizes overall value. Recognizing sunk cost vs opportunity cost differences reinforces the importance of this focus.

2. Quantify opportunity costs

Estimating the value of forgone alternatives is essential to understanding the real cost of any decision. By quantifying opportunity costs, businesses can better compare different choices and identify which offers the greatest benefit. This process involves analyzing potential returns, risks, and alignment with strategic goals.

Understanding what is sacrificed helps prioritize investments that generate the highest long-term value. Quantification transforms abstract trade-offs into concrete numbers, making decisions clearer and more objective. It also highlights missed chances that might otherwise be overlooked.

Calculating opportunity costs enables companies to manage scarce resources more efficiently. This disciplined evaluation complements awareness of sunk costs and drives smarter financial planning. Emphasizing sunk cost vs opportunity cost encourages comprehensive cost-benefit analysis.

3. Use data-driven tools

Leveraging analytics platforms like Volopay can provide valuable insights to balance sunk costs and opportunity costs effectively. These tools track spending patterns, project performance, and resource utilization in real time. Data-driven decision-making reduces reliance on intuition or emotional bias, leading to more objective outcomes.

By analyzing financial and operational metrics, businesses can identify underperforming assets and high-value opportunities. Advanced analytics also help forecast future returns and assess risk more accurately. This technology supports continuous monitoring and adjustment of strategies.

Integrating such tools streamlines decision processes and improves transparency across teams. Ultimately, data-driven approaches enhance the ability to allocate resources where they yield the best results. Combining analytics with an understanding of sunk cost vs opportunity cost strengthens overall financial management.

4. Set decision criteria

Establishing clear thresholds for acceptable return on investment (ROI) helps guide decisions and avoid falling into sunk cost traps. Defining these criteria upfront ensures that projects meet minimum profitability or strategic value before committing further resources. This discipline encourages objective evaluation based on quantifiable goals rather than past expenditures.

Decision criteria can include financial metrics, time frames, and alignment with company priorities. Having these benchmarks promotes consistent and repeatable decision-making processes. It also provides a basis for pausing or stopping projects that don’t meet expectations.

By setting ROI thresholds, SMEs can focus on initiatives that drive sustainable growth. This framework supports balancing sunk cost vs opportunity cost considerations more effectively. Clear criteria improve accountability and communication across stakeholders.

5. Consult stakeholders

Gaining input from diverse stakeholders offers objective perspectives that help mitigate biases related to sunk and opportunity costs. Engaging team members from finance, operations, and strategy provides a broader understanding of potential risks and benefits. This collaboration fosters more balanced discussions and better-informed decisions.

Stakeholders may highlight alternatives or costs that individual decision-makers overlook. Additionally, involving key personnel increases buy-in and accountability for outcomes. Open dialogue helps identify when sunk costs are unduly influencing choices or when opportunity costs are underestimated.

This collective approach strengthens decision quality and supports organizational alignment. Regular consultations ensure decisions reflect shared goals rather than individual biases. Incorporating stakeholder feedback is an important part of mastering sunk cost vs opportunity cost trade-offs.

Tools to manage sunk cost and opportunity cost effectively

Expense management software

Expense management software helps businesses keep a clear record of all past expenditures, including sunk costs. By tracking these costs accurately, companies can avoid the trap of considering unrecoverable expenses when making new decisions.

This software provides detailed reports on spending patterns, helping managers identify where resources have already been committed. It supports better budgeting and financial control by making sunk costs transparent and accessible.

With this clarity, businesses can focus on future opportunities rather than dwelling on past losses. Expense management tools also streamline approval workflows, ensuring spending aligns with current strategic priorities. Overall, these platforms play a critical role in helping SMEs understand sunk cost vs opportunity cost. They reduce financial blind spots and promote rational resource allocation.

Budgeting tools

Budgeting tools are essential for preventing overspending on projects with sunk cost risks. They allow businesses to set strict spending limits and monitor actual expenses against planned budgets in real time. This control helps avoid continuous funding of failing initiatives due to emotional attachment or commitment bias.

Budgeting software enables managers to allocate funds effectively across competing priorities, minimizing the risk of sunk cost overruns. By enforcing financial discipline, these tools encourage decision-makers to focus on projects that offer the best future returns.

They also facilitate scenario analysis to evaluate how reallocating budgets could improve overall performance. Using budgeting tools enhances the ability to balance sunk cost vs opportunity cost considerations in day-to-day operations. This ensures resources are not wasted on sunk costs but directed toward profitable opportunities.

Analytics platforms

Analytics platforms provide businesses with the ability to compare opportunity costs by analyzing data on alternative investments and resource uses. These tools aggregate financial, operational, and market data to evaluate the potential returns of different options.

By modeling various scenarios, analytics platforms reveal the trade-offs involved in choosing one project over another. This data-driven approach supports more objective and strategic decision-making. It helps identify the options with the highest expected value, reducing the influence of sunk cost fallacy.

Analytics platforms also enable ongoing performance tracking, so adjustments can be made based on real-time results. Leveraging these tools allows companies to better understand sunk cost vs opportunity cost dynamics and optimize resource allocation. Ultimately, analytics platforms enhance transparency and improve overall financial health.

Forecasting tools

Forecasting tools assist businesses in predicting the future value of investments and projects, which is key to assessing opportunity costs accurately. These tools use historical data, market trends, and statistical models to estimate potential revenues, costs, and risks.

With reliable forecasts, companies can prioritize initiatives with the greatest long-term benefit rather than focusing on sunk costs. Forecasting also enables early identification of projects likely to underperform, helping avoid further investment in sunk costs. By anticipating future outcomes, businesses can make more informed choices that align with their strategic goals.

These tools facilitate scenario planning and stress testing to prepare for uncertainties. Incorporating forecasting tools strengthens financial decision-making and balances the tension between sunk cost vs opportunity cost considerations. This proactive approach supports sustainable growth and efficient capital use.

Behavioral biases influencing sunk cost and opportunity cost decisions

Loss aversion

Loss aversion is a psychological tendency where people prefer avoiding losses over acquiring equivalent gains. In decision-making, this bias causes individuals to hold on to failing projects or investments simply because they don’t want to admit a loss.

This reluctance leads to throwing good money after bad, ignoring the opportunity cost of reallocating resources elsewhere. Loss aversion can cause businesses to overvalue sunk costs and resist cutting their losses, even when better alternatives exist.

Recognizing this bias helps decision-makers avoid emotional traps and focus on maximizing future value. Overcoming loss aversion encourages more rational, forward-looking financial choices.

Over-optimism

Over-optimism occurs when decision-makers overestimate the likelihood of positive outcomes and underestimate risks or costs. This bias can make managers believe that sunk investments will eventually pay off, causing them to ignore better opportunities.

Over-optimism skews evaluations of opportunity costs by focusing too heavily on hoped-for returns rather than realistic scenarios. It often results in continued investment in underperforming projects, driven by unwarranted confidence.

Being aware of over-optimism helps businesses apply more critical scrutiny to decisions and consider potential downsides. Reducing this bias promotes balanced assessments of sunk cost versus opportunity cost.

Anchoring bias

Anchoring bias happens when individuals rely too heavily on an initial piece of information or past experience when making decisions. In the context of sunk cost, this can lead to overemphasizing previous expenditures and sticking to earlier commitments.

This fixation may prevent a clear evaluation of opportunity costs by anchoring attention to what has already been spent. Anchoring bias limits flexibility and encourages suboptimal resource allocation based on outdated information.

Understanding this bias helps decision-makers break free from initial anchors and reassess options objectively. It promotes better financial judgment by focusing on current and future value rather than past costs.

Status quo bias

Status quo bias is the preference to maintain current conditions instead of making changes, even when alternatives offer better outcomes. This bias can cause businesses to continue investing in failing projects due to comfort with existing decisions and fear of uncertainty.

It undermines the consideration of opportunity costs by favoring familiar paths over potentially more profitable options. Status quo bias reduces innovation and adaptability, limiting growth potential.

Recognizing this bias allows companies to challenge inertia and make decisions that better align with long-term goals. Overcoming status quo bias encourages proactive evaluation of sunk costs and opportunity costs in strategic planning.

How Volopay helps SMEs navigate sunk cost and opportunity cost

Volopay's comprehensive expense management platform empowers finance teams to track, control, and analyze every dollar spent—giving them the clarity needed to identify unproductive expenses and pivot quickly.

With real-time visibility, automated workflows, and smart budgeting tools, SMEs can avoid falling into the sunk cost trap and better evaluate the trade-offs between current spending and future opportunities.

By eliminating guesswork and manual processes, Volopay helps businesses stay agile, make data-driven decisions, and build a leaner, more profitable operation.

Real-time analytics

Volopay’s real-time analytics provide SMEs with clear visibility into both sunk costs and opportunity costs, helping identify where money has been spent and where potential gains are being missed. These insights enable businesses to monitor ongoing expenses and forecast the impact of various decisions.

By analyzing spending patterns, SMEs can make more informed choices that optimize resource allocation. This proactive approach prevents unnecessary losses and uncovers opportunities for better investment.

The platform’s dashboards simplify complex financial data, making it easier for managers to act quickly and strategically. This continuous monitoring empowers SMEs to adjust their strategies promptly based on evolving financial trends.

Budget controls

Volopay’s budgeting software capabilities help SMEs set spending limits, preventing excess expenditures that often lead to sunk costs. By capping budgets for departments or projects, businesses avoid overspending on unproductive ventures. This feature encourages disciplined financial management and aligns spending with strategic priorities.

Budget controls also reduce impulsive purchases and ensure funds are reserved for high-value opportunities. With clear budget boundaries, SMEs can maintain greater control over cash flow and reduce wasteful spending.

Ultimately, these controls support smarter financial decisions and healthier business growth. They also facilitate accountability by clearly defining spending authority across teams.

Approval workflows

The multi-level approval workflows in Volopay enforce a structured decision-making process, ensuring that expenditures undergo proper review before approval. This system reduces emotional or biased spending that contributes to sunk cost fallacies.

Managers can evaluate each request based on financial impact and strategic alignment, promoting more rational choices. Automated workflows streamline approvals while maintaining accountability across teams.

This helps prevent unnecessary commitments and encourages considering opportunity costs effectively. By fostering transparency, Volopay aids SMEs in balancing short-term spending with long-term goals. This process also enhances compliance and reduces the risk of financial mismanagement.

Accounting integration

Volopay’s seamless accounting integration links expense tracking with financial records, offering comprehensive clarity on costs. This connection makes it easier to distinguish sunk costs from ongoing expenses and analyze opportunity costs accurately.

Integrated accounting data enhances reporting and auditing processes, reducing errors and manual effort. Businesses gain a real-time view of financial health, enabling more strategic planning and resource management.

This feature supports timely interventions to curb wasteful spending and optimize investments. Ultimately, accounting integration improves financial discipline and decision-making for SMEs. It also simplifies tax preparation and regulatory compliance, reducing administrative burdens.

FAQs

Opportunity cost represents the value of the next best alternative that is given up when making a decision. For example, if $20,000 is not invested in a promising new venture, that forgone profit is the opportunity cost. Recognizing opportunity costs helps businesses avoid missing valuable alternatives. This concept supports smarter financial and strategic planning.

Sunk costs are past expenses that cannot be recovered, while opportunity costs represent future benefits missed by choosing one option over another. Sunk costs should not influence future decisions because they are irretrievable. Opportunity costs, however, are critical for evaluating the best path forward and maximizing potential returns.

Sunk costs cause people to irrationally continue investing in losing projects to avoid feeling they wasted money. This emotional attachment often results in throwing good resources after bad, ignoring better opportunities, and hurting overall performance. The sunk cost fallacy blinds decision-makers to more profitable alternatives. Overcoming this bias is essential for effective business management.

Opportunity costs help decision-makers compare the value of different options by highlighting what benefits are sacrificed. This forward-looking approach encourages businesses to prioritize projects that maximize returns and long-term growth. It sharpens focus on future rewards rather than past losses. Ultimately, it supports more strategic resource allocation.

Examples include money spent on failed software, marketing campaigns that did not generate sales, training employees who leave, and research and development on unsuccessful products. These costs cannot be recovered, but often influence ongoing decisions. They may cause businesses to stick with ineffective strategies. Recognizing sunk costs helps prevent unnecessary continued spending.

Opportunity costs include choosing one project over a more profitable one, allocating staff to less valuable tasks, missing emerging market trends, or investing budget in low-return areas instead of high-growth opportunities. These costs represent missed chances to improve profitability. Understanding them aids better prioritization. SMEs can then invest resources where they deliver the greatest value.

SMEs can avoid sunk cost traps by focusing on future benefits rather than past expenses. They should evaluate decisions based on expected returns and be willing to cut losses when projects no longer add value. Developing an objective mindset reduces emotional bias. Training teams on this concept supports healthier financial decisions.

To calculate opportunity costs, SMEs compare the potential returns of alternative options they forgo. This involves estimating future profits, costs, and risks to understand what is sacrificed when choosing one path. Accurate data improves these calculations. Regularly reviewing alternatives ensures resources are well allocated.

Volopay provides tools like real-time analytics and budget controls that identify sunk and opportunity costs early. Its approval workflows and accounting integration help SMEs make rational spending decisions and optimize resource allocation. This reduces the chance of emotional decision-making. It empowers teams to focus on high-value projects.

Yes, sunk costs appear in financial statements as past expenses. They are recorded but should not influence future decisions since they cannot be recovered or changed. Companies track them for transparency and audit purposes. However, smart management ignores them when planning ahead.

Opportunity costs are often estimated rather than exact because they involve forecasting potential benefits. Though not always recorded financially, quantifying opportunity costs aids better strategic planning and resource allocation. Using projections helps visualize potential gains or losses. This practice enhances decision accuracy and prioritization.