Sunk costs and the sunk cost fallacy: A business decision-making guide

You’ve probably faced a situation where you’ve already invested significant resources—like $50,000 on a software rollout that ultimately flops—and feel compelled to press on just to justify what you’ve spent. In economics and decision science, those lost resources are called sunk costs, irreversible expenses that no longer should influence your future choices.

Yet, many fall prey to the sunk cost fallacy, pouring more time or money into a failing venture just to avoid feeling wasteful. For US‑based SMEs, this bias can mean depleted budgets, missed opportunities, and reduced profitability.

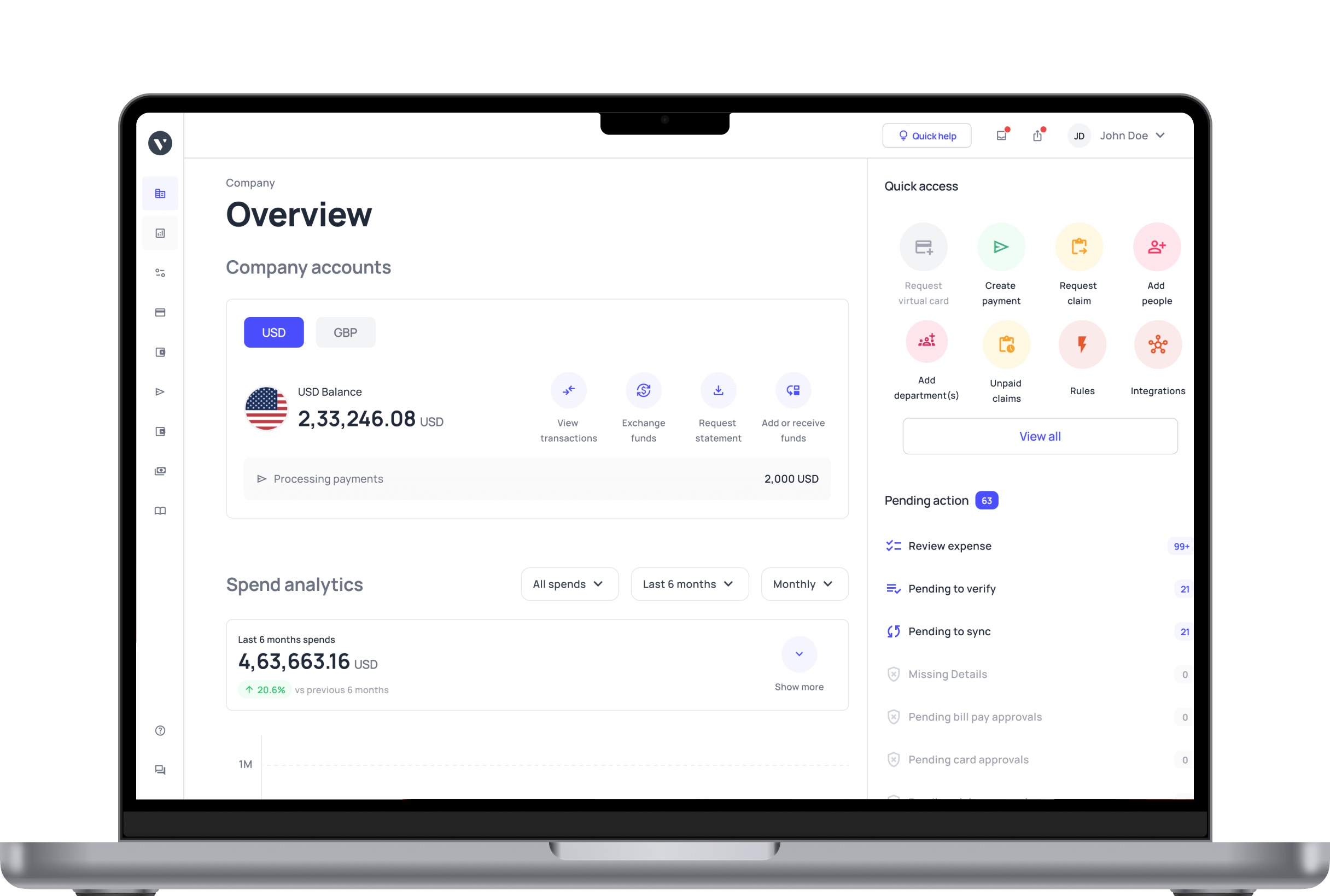

With Volopay’s real‑time analytics, you can monitor spending across projects, flag investments that show diminishing returns, and stop pouring good money after bad. Armed with clear dashboards and automated alerts, you’ll sidestep the fallacy of sunk costs and focus your funds on initiatives with genuine upside.

What is a sunk cost?

A sunk cost refers to any expense you’ve already incurred that cannot be recouped, regardless of how you proceed in the future. These costs should play no role in decision‑making because they’re permanently lost, yet they frequently linger in our minds and influence our actions.

Imagine you spend $50,000 on specialized machinery, only to discover it’s obsolete before production even begins. That $50,000 is a sunk cost—your choice now shouldn’t hinge on recovering it. Similarly, if you pour $200,000 into launching a new product that fails in market testing, that entire outlay becomes a sunk cost.

For SMEs, recognizing what is a sunk cost is crucial for effective financial planning. When you understand that past expenditures—like marketing campaigns, software licenses, or research trials—have no salvageable value, you free yourself to reallocate resources to ventures with better prospects.

For instance, you might abandon an underperforming ad campaign rather than spending additional funds to chase diminishing returns.

In practice, sunk costs arise in many areas:

1. Equipment and capital investments: Money spent on assets that later lose relevance or become unused.

2. Marketing and development initiatives: Budgets allocated to campaigns or prototypes that flop.

3. Training and hiring expenses: Costs for onboarding staff who eventually depart prematurely.

By framing decisions around future benefits instead of past losses, you ensure that every dollar you commit serves your growth objectives, not your regret over previous purchases.

Understanding what a sunk cost is lays the groundwork for a smarter, more agile strategy, helping you avoid the trap of letting irrecoverable expenses dictate your path forward.

Types of sunk costs in business

Businesses like yours routinely encounter various sunk cost categories that, once spent, cannot be recovered. Below are the main types and practical examples to help you identify and manage them effectively.

1. Capital expenditures

When you commit to significant assets—like purchasing a $100,000 production machine—you lock in funds that can quickly become unrecoverable. Beyond the sticker price, you add installation fees, training operators, and ongoing maintenance.

If the machine fails quality checks or is outpaced by newer technology, the entire investment, including depreciation, becomes a sunk cost. Continuing to use it just to justify the expense can lead to escalating repair and energy bills with negligible output gains.

Instead, recognize the sunk cost early: calculate the total outflow—purchase, transport, setup, and upkeep—and compare against potential efficiency improvements from leasing or buying updated equipment. By treating that $100,000 plus ancillary costs as gone, you free capital to invest in assets that drive real productivity gains.

2. Marketing and advertising costs

Marketing budgets often include fees for creative development, media placement, and agency commissions—expenses you’ll never reclaim if campaigns flop. For example, you might spend $20,000 on a social media blitz, covering ad spend, influencer partnerships, and content production.

If engagement metrics and conversions fall short, that outlay is a sunk cost. Doubling down on the same channel to chase missed metrics typically compounds losses, as incremental spend rarely delivers improved ROI without strategic pivots.

Rather than pouring another $5,000, hoping for a turnaround, treat the initial $20,000 as irrecoverable and shift resources to higher‑performing channels—like email marketing or SEO—backed by A/B testing and real‑time analytics to maximize future returns.

3. Research and development

Innovation requires funding for ideation, prototyping, user testing, and iteration. Suppose you allocate $75,000 to build a new software feature, including design sprints, developer hours, and usability trials.

If user feedback indicates limited demand or major functionality gaps, that $75,000 is a sunk cost—all coding, research, and testing fees are gone. Persisting on enhancements in hopes of salvaging the project can drain additional resources without guaranteeing success.

By classifying that R&D spend as unrecoverable, you can pivot your roadmap, reassign your development team to features with proven market interest, and leverage agile methodology to test hypotheses in smaller, lower‑cost increments, ensuring each dollar you spend aligns with user‑validated priorities.

4. Training and hiring costs

Recruitment and onboarding involve expenses such as agency fees, background checks, and in‑house training sessions. Imagine investing $10,000 to recruit and train a marketing manager, covering recruiter commissions, training materials, and mentorship hours.

If the hire leaves after three months, that entire $10,000 is a sunk cost, with no financial return on productivity or expertise. Attempts to recoup this outlay through retention bonuses or extended training often backfire if fit issues persist.

Instead, accept the loss, analyze the hiring process for mismatches in skills or culture, and refine your candidate screening criteria. That way, you reduce future turnover and ensure that training investments yield long‑term value rather than repeat sunk costs.

What is sunk cost fallacy?

The sunk cost fallacy is a cognitive bias that convinces you to persist with a losing investment purely because of past expenses, rather than evaluating the project’s future potential.

When you’ve already committed resources—say, $100,000 on a mobile app that continually underperforms—you may feel trapped into spending more, hoping to justify the original outlay. This impulse stems from an emotional need to avoid admitting loss and letting go of sunk investments.

In contrast to rational decision‑making, where you weigh ongoing costs against projected benefits, the sunk cost fallacy clouds your judgment. You end up focusing on what’s irrecoverable, rather than what lies ahead. For a US‑based SME, this bias can erode profitability.

Imagine you’ve poured $250,000 into marketing for an unresponsive audience. Instead of cutting your losses, you double down, allocating another $50,000. That additional spend only magnifies your exposure to sunk costs and rarely yields the turnaround you crave.

Neglecting to account for this bias can distort your budgeting and strategic planning. Your finance team might inflate forecasts to accommodate continued funding of failing projects, diverting resources from high‑potential initiatives. Worse, you risk creating a culture where admitting failure is stigmatized, binding teams to outdated strategies.

To spot this bias, regularly question whether your decisions hinge on past spending or on prospective ROI. Use decision frameworks that exclude sunk amounts and focus purely on marginal costs and benefits.

Volopay’s analytics can automate this process by isolating trending losses and flagging projects where incremental investment would likely compound poor performance.

By recognizing and resisting the sunk cost fallacy, you’ll ensure that each discretionary dollar you spend aligns with future value, freeing you from the fallacy of sunk costs and empowering data‑driven, forward‑looking decisions.

Psychological drivers of the sunk cost fallacy

Several inherent biases and emotions can trap you in the sunk cost fallacy, causing you to irrationally cling to lost investments. Understanding these psychological drivers helps you design decision processes that resist the pull of past costs.

Loss aversion

People feel stronger pain from losses than pleasure from equivalent gains. When you’ve spent $100,000 on a project, the thought of writing off that amount feels like a significant personal defeat.

That fear of “wasting” resources pushes you to continue funding the venture, even when subsequent analyses show negative projected returns.

You’d rather risk throwing more money after a sinking ship than admit that the initial cost is gone. Recognizing loss aversion means reframing decisions: treat sunk expenditures as non‑existent in your profit/loss forecasts and focus on expected future benefits instead.

Commitment bias

Having publicly endorsed or championed a project, you feel compelled to follow through to maintain consistency with past statements and actions. Imagine you pitched an innovation to stakeholders, secured their buy‑in, and allocated $50,000 in development resources.

Abandoning the project midway not only feels like admitting you were wrong but also threatens your credibility. That sunk cost fallacy effect ties your ego to the outcome.

To counter commitment bias, build in periodic review points where projects must meet predefined metrics to continue funding, reducing the emotional burden of reversing course.

Emotional attachment

If you’ve poured your passion, time, and reputation into an initiative, you naturally develop a personal connection that clouds judgment. For example, you might invest $20,000 of your own funds to prototype a product born from your vision.

When consumer feedback is lukewarm, your emotional investment makes it harder to objectively evaluate performance data. You may interpret mediocre results as temporary setbacks rather than clear signals to pivot.

Acknowledging emotional attachment means introducing external data reviews, so third‑party advisors or metrics dashboards can objectively assess progress, helping you detach personal pride from financial choices.

Over‑optimism

Optimism bias leads you to overestimate the probability of success and underestimate costs. After spending $30,000 on seeding a new market, you may irrationally believe future returns will salvage past outlays, even when early sales data disappoint.

That excessive confidence in recovery perpetuates the sunk cost fallacy, making you reluctant to cut losses. Combat over‑optimism with scenario planning: run best‑case, base‑case, and worst‑case forecasts before each funding decision.

By anchoring your expectations to data‑driven scenarios instead of hopeful projections, you ensure that continued investment hinges on objective viability, not wishful thinking.

Real-world examples of sunk costs in business

Explore these SME‑relevant scenarios to see how sunk costs and the sunk cost fallacy play out in practice, and learn how to make better calls.

1. Failed software implementation

Your company invests $70,000 in a new CRM platform, covering licensing, customization, and staff training. After rollout, users find the interface unintuitive and error‑prone, leading to adoption rates below 20%.

You face a choice: cut your losses and revert to the old system or spend an additional $25,000 on consultants to patch issues. Opting for the latter often stems from the sunk cost fallacy, as you hope to justify the $70,000 already spent.

Yet, math tells a different story: if adoption fails to exceed 60% after fixes, the extra $25,000 merely deepens your sunk losses. Recognizing that the initial investment is unrecoverable lets you pivot to a solution that drives real user engagement, rather than doubling down on a failing tool.

2. Unprofitable store location

Imagine leasing a brick‑and‑mortar shop in a suburban strip mall for $100,000 per year, with build‑out costs of $50,000. After six months, foot traffic is half of projections, and monthly sales cover only 40% of expenses.

You could renew the lease at $100,000 annually, hoping a new marketing push will boost traffic. That decision reflects the sunk cost fallacy, driven by your need to validate the $150,000 already sunk.

Instead, analyze opportunity costs: redirecting $150,000 into an online channel or pop‑up events could yield better returns. By treating the lease and build‑out costs as gone, you free capital to test more agile, lower‑risk formats that align with consumer behavior.

3. Obsolete inventory

An electronics retailer stocks 500 units of a gadget at $800 each, totaling $400,000. Months later, a competitor releases a superior model, making your inventory virtually unsellable at full price.

You face storage fees of $10,000 per month or steep discounting that erodes margins. Holding onto stock to preserve list price exemplifies the sunk cost fallacy, since the $400,000 paid is irreversible.

Instead, calculate break‑even discount thresholds: perhaps selling at 30% off recovers $280,000, reducing sunk losses from $400,000 to $120,000. By acting swiftly, you minimize ongoing storage costs and recover more value than waiting for unlikely full‑price sales, turning a sinking stockpile into a managed exit.

4. Ineffective marketing campaign

Your team allocates $30,000 to a digital ad campaign targeting a niche audience, including video production and ad placement. After a month, conversion rates hover at 0.2%, far below the 1% benchmark needed for profitability.

The instinct to pour another $20,000 into the same creative feeds the sunk cost fallacy, as you hope past spending will pay off.

Instead, treat the initial $30,000 as a sunk cost, and shift your remaining budget to alternative strategies—like targeted email sequences or influencer collaborations—backed by A/B tests.

That pivot not only curbs further losses but often uncovers more receptive audiences, turning budgets meant to chase losses into avenues for genuine customer growth.

How the sunk cost fallacy impacts SME decision-making

Recognizing the sunk cost fallacy and its ripple effects is vital for protecting your bottom line and organizational agility. When you let irrecoverable expenses dictate your moves, you risk cascading consequences that affect finances, opportunities, adaptability, and team morale.

Below are the key areas where sunk cost biases can derail your SME’s strategic execution and profitability.

1. Financial losses

Continuing to invest in failing projects because you’ve already spent money amplifies your total losses. For example, if you’ve sunk $150,000 into a product line that consistently undercuts break-even pricing, then allocate another $50,000 in hopes of a turnaround, you’re increasing your overall deficit from $150,000 to $200,000.

That additional spend rarely reverses course; instead, it deepens the hole. By disregarding sunk expenditures and evaluating only prospective cash flows, you avoid expenditures where the projected net present value (NPV) is negative.

This approach ensures you don’t worsen financial outcomes by chasing unrecoverable past investments, keeping losses contained and maintaining healthier balance sheets.

2. Missed opportunities

Money tied up in unproductive ventures can’t be redeployed to high‑potential projects. Suppose $100,000 remains parked in a stagnant market test; those funds could instead seed a promising digital service with double‑digit growth forecasts.

However, the sunk cost fallacy pushes you to double down on the original test, depriving more lucrative efforts of capital. Over time, this misallocation closes the window on emerging trends, as late pivots often incur higher entry costs.

By treating prior spends as sunk costs, you free capital to chase fresh opportunities, boosting innovation pipelines and ensuring that your most productive avenues receive timely funding.

3. Reduced agility

Adherence to past investments hampers your ability to pivot in dynamic markets. For instance, if you’ve spent months and $80,000 on developing a bespoke platform that no longer aligns with evolving customer needs, persisting with that build wastes both time and money.

Development backlogs extend, feature requests pile up, and competitors seize market share with more responsive offerings. Recognizing the sunk cost fallacy at play allows you to decommission outdated initiatives, reallocate teams to agile micro‑projects, and iterate based on real‑time feedback.

This flexibility increases your execution speed and market responsiveness—key advantages for SMEs operating in fast‑moving sectors.

4. Employee morale and trust

Forcing teams to keep working on doomed projects damages engagement and erodes trust in leadership. When staff see continued funding for failing initiatives—like backing a marketing campaign after its third failed iteration—they question decision‑making processes and become cynical about new directives.

This demotivation can spike turnover rates and sap creativity, as employees lose confidence that their efforts will yield a meaningful impact. By candidly acknowledging sunk losses, setting transparent exit criteria, and encouraging open discussions on project viability, you cultivate a culture where data drives decisions, not ego.

That trust fosters employee buy‑in, improves retention, and motivates teams to tackle ventures with clear success metrics, rather than chasing lost causes.

Strategies to avoid the sunk cost fallacy

Taking intentional steps can help you sidestep the sunk cost fallacy and ensure you allocate resources to initiatives with true upside. Here are five practical strategies.

Focus on future value

Instead of fixating on irrecoverable past spend, concentrate on projected returns. For instance, if a project has already consumed $100,000 with no sign of breaking even, evaluate its remaining budget against forecasted benefits, not sunk costs.

Ask: Will spending the next $20,000 generate at least $30,000 in additional value? If not, cut losses immediately. By consistently framing decisions around future net present value (NPV) and payback periods, you steer clear of throwing good money after bad.

Using this forward‑looking lens, you redirect capital to new product launches or marketing channels with compelling ROI projections, maximizing growth potential while minimizing wasted spend.

Use data-driven analytics

Leverage tools like Volopay to track project performance in real time. Dashboards can surface spending trends, highlight projects where costs are outpacing benefits, and calculate key metrics such as cost per acquisition and ROI.

By automating alerts when thresholds—like cost-per-lead exceeding $50—are breached, you add objective guardrails against emotionally driven funding decisions. Replace gut feelings with empirical insights:

Review hard data on customer conversion rates, churn, and revenue impact before greenlighting additional spend. This disciplined approach transforms subjective judgment calls into quantifiable evaluations, making it easier to terminate underperforming initiatives swiftly and reallocate budgets to ventures that consistently deliver positive financial outcomes.

Set clear exit criteria

Before launching any project, define specific stop‑loss thresholds and performance milestones. For example, agree that if a software trial doesn’t reach 1,000 active users within three months, you’ll discontinue development.

Or commit to halting a marketing campaign if it fails to achieve a 2% click‑through rate for two consecutive weeks. Document these criteria and share them with stakeholders to foster accountability.

When milestones aren’t met, refer back to the pre‑agreed metrics rather than debating based on prior spending. Clear exit points remove ambiguity and reduce personal biases, ensuring that decisions pivot on preset data triggers, not retrospective justifications of sunk costs.

Seek external perspectives

Bringing in outside advisors or cross-functional peers can offset internal biases. An external consultant, board member, or even a colleague from another department can provide an unbiased assessment of project viability. For instance, you might spend $20,000 on hiring a third‑party analyst to review a struggling initiative.

Their fresh take, backed by industry benchmarks, can help you recognize when to pull funding, even if internal teams feel invested. External audits or peer reviews act as checks and balances, preventing echo chambers where everyone rationalizes continued investment due to collective commitment.

This diverse input ensures that tough decisions—like ending a $75,000 pilot—are grounded in objective analysis, not sunk cost rationalizations.

Foster a culture of flexibility

Encourage teams to view pivoting as a strategic strength rather than a failure. Celebrate examples where abandoning low‑ROI projects led to successful new ventures. For instance, highlight how reallocating a $50,000 budget from an ineffective campaign into a high‑growth channel drove 3x better returns.

Embed agile methodologies—like sprint reviews and retrospectives—into workflows so reallocation becomes routine. Train managers to frame stopping projects as data‑driven choices, not admissions of past mistakes.

When flexibility is valued, employees feel empowered to suggest course corrections without fear of reproach. This cultural shift transforms the sunk cost fallacy from a liability into a learning opportunity, reprioritizing resources to maximize innovation and long‑term profitability.

Tools and technologies to mitigate sunk costs

Modern software solutions can help you spot what is a sunk cost early and prevent further losses. Here are four key technology categories that empower US‑based SMEs to monitor, analyze, and control expenditures before they slip into irrecoverable territory.

1. Expense management software

Expense management platforms—such as Volopay—automate the tracking of all project‑related outflows in real time. By integrating with your corporate cards, bank accounts, and accounting systems, these tools categorize spend, allocate costs to specific projects, and flag anomalies.

For example, if you’ve already spent $200,000 on a pilot program, Volopay can alert you when monthly expenses exceed a preset threshold, indicating you may be chasing a sunk cost.

Customizable reports let you drill down into vendor payments, subscription renewals, and discretionary budgets, so you avoid blind spots. With centralized visibility and automated alerts, you can identify underperforming initiatives before they consume more capital, effectively cutting off further sunk expenditures.

2. Budgeting tools

Selective budgeting solutions allow you to define and enforce spending limits across departments and projects. Suppose you set a $50,000 budget for a marketing campaign; once transactions hit 80% of that cap, the system can automatically restrict further charges and require managerial approvals for any additional spend.

This preemptive control stops you from inadvertently exceeding budgets on ventures that have already become sunk costs. Historical analysis features help you compare projected vs. actual spend, revealing patterns of overshoot.

By pairing forward‑looking budget scenarios with real‑time spend monitoring, you ensure teams remain within financial guardrails, preventing the gradual accumulation of unrecoverable costs and keeping resources aligned with your strategic priorities.

3. Analytics dashboards

Interactive dashboards synthesize expenditure and performance metrics, giving you a holistic view of ROI trends. For example, an analytics widget might chart cost per acquisition against revenue generated per channel, making it easy to see when a project’s cost curve crosses into negative territory.

If you notice a campaign’s break-even point remains elusive after $30,000 in spend, the dashboard visually signals that you’re locking in at a sunk cost. Drill‑through capabilities let you segment data by vendor, category, or timeline—helping you pinpoint where returns fall short.

Leveraging these visual insights, you can make data‑driven calls to halt funding on underperforming projects and reallocate resources to channels demonstrating sustainable growth.

4. Forecasting models

Predictive forecasting tools leverage historical spend and performance data to model future outcomes. By simulating scenarios—like extending a project’s budget by $20,000—you can estimate likely ROI, payback periods, and worst‑case losses.

For instance, before topping up a $100,000 R&D initiative, your finance team can run forecasts that show a 70% probability of negative net present value (NPV). That insight transforms what could become a sunk cost into a calculated decision.

Advanced platforms incorporate machine learning to refine predictions over time, improving accuracy as more data flows in. With solid forecasting, you base investment choices on quantitative risk‑reward assessments, rather than emotional desires to recover past expenditures.

Sunk costs vs other cost types

Understanding what is a sunk cost and how it differs from related cost categories helps you make precise financial decisions.

Below, we compare sunk costs with fixed, variable, opportunity, and marginal costs—clarifying when past expenses matter and when they don’t.

1. Sunk costs vs. fixed costs

Fixed costs—such as facility rent or annual software subscriptions—are unavoidable and recur regardless of production volume. Though they’re predictable, they’re not necessarily irrecoverable. In contrast, sunk costs are past expenditures you can no longer reclaim, like the initial outlay on obsolete machinery.

For example, if you pay $10,000 monthly rent, you can decide to vacate and recover part of a security deposit, but you cannot reverse the $100,000 purchase of equipment that now sits unused.

Recognizing this distinction ensures you treat future fixed costs as negotiable or stoppable, while truly disregarding sunk expenses in decision models.

2. Sunk costs vs. variable costs

Variable costs—materials, utilities, and labor tied to production levels—fluctuate with output, so you can adjust them in real time. If you produce 1,000 units, you may spend $5,000 on raw materials; cut production, and costs drop accordingly.

Sunk costs, however, remain unaffected by output: the $200,000 you invested in product R&D won’t decrease with reduced manufacturing.

Understanding this helps you shift focus: optimize variable costs to improve margins while ignoring sunk amounts when evaluating cost–benefit analyses for scaling or downsizing operations.

3. Sunk costs vs. opportunity costs

Opportunity costs represent the benefits forgone by choosing one option over another, like spending $100,000 on marketing instead of investing in product development, potentially missing higher returns. Unlike sunk costs, which are irretrievable past spending, opportunity costs are prospective: they guide where you deploy resources moving forward.

For instance, if you’ve already spent $50,000 on an ad campaign (a sunk cost), you lose nothing by ignoring that expense in deciding whether to allocate the next $50,000 to a new channel.

Instead, evaluate the opportunity cost of not seeding a high‑growth market, leveraging comparative ROI projections.

4. Sunk costs vs. marginal costs

Marginal costs are the incremental expenses incurred by producing one additional unit, such as an extra $2,000 for overtime labor to fulfill a big order. These costs directly affect profitability analyses and decision thresholds. In contrast, sunk costs—like a $1 lakh investment in a pilot phase—don’t change with marginal increments.

When deciding whether to ramp up production, focus on marginal cost versus marginal revenue, ignoring the sunk pilot spend.

This approach ensures you invest only when each additional dollar spent delivers net positive returns, rather than trying to offset past irreversible investments.

Industry-specific sunk cost challenges

Different SME sectors face unique sunk cost risks based on their core operations. These four industry profiles demonstrate how sector dynamics shape irrecoverable expenses and fallacy pitfalls.

Technology startups

Tech ventures often pour substantial capital into R&D and product development before achieving product-market fit. Suppose you invest $500,000 in a prototype app, funding design, coding sprints, and beta testing.

If user engagement metrics remain below thresholds, that entire outlay becomes a sunk cost. Yet, founders may resist pivoting due to emotional attachment and fear of appearing inconsistent to investors. This sunk cost fallacy delays necessary strategic shifts, burning through the runway.

To mitigate, set milestone-based funding tranches—linking each $100,000 disbursement to clear user acquisition or engagement targets. By gating funds, you avoid prepaying large R&D phases and ensure capital flows align with validated traction.

Retail

Retail SMEs frequently invest in inventory and store fixtures, which can rapidly lose value due to changing trends or economic shifts. For instance, a boutique might spend $200,000 on seasonal clothing lines that fail to resonate, leaving racks of unsold merchandise.

That inventory cost—plus $30,000 in store displays—is a sunk cost once the season passes. However, retailers often double down with clearance promotions that further erode margins to avoid admitting loss.

By employing data-driven inventory management and predefined discount thresholds—for example, marking down unsold stock by 40% after 60 days—you recognize sunk costs and prioritize cash flow over preserving list prices.

Manufacturing

Manufacturers face sunk costs in machinery, tooling, and production line setups. If you allocate $1 million to install new equipment but then switch product lines due to market demand shifts, those initial capital expenditures become irrecoverable.

Attempts to repurpose or retrofit machinery can incur exorbitant modification costs, deepening sunk losses. Moreover, maintenance contracts may lock you into further payments. Counter this by leasing machinery or using modular production systems where you incur lower upfront costs and can scale capacity dynamically.

When planning capital investments, perform scenario analyses that include potential obsolescence rates and adjust financing structures accordingly, ensuring you’re not locked into massive irrecoverable outlays.

Consulting

Consultancies invest in client acquisition through proposals, pitches, and initial research activities with no guaranteed returns. You might spend $20,000 on proposal development and expert interviews for a potential contract, only to lose the bid. Those business development costs are actually what is a sunk cost once the opportunity slips away.

To avoid compounding this fallacy, track win rates and set limits on proposal budgets, like capping business development spend at 5% of expected project value. Additionally, use standardized pitch templates and reusable research frameworks to reduce per-proposal expenses.

By managing BD investments as projects with clear ROI metrics, you contain sunk costs and focus resources on high-probability opportunities.

How Volopay helps SMEs avoid the sunk cost fallacy

Volopay’s comprehensive expense management platform equips you with features that directly counter the sunk cost fallacy, ensuring your SME makes informed decisions and avoids pouring good money after bad.

Below are four core capabilities—and real‑world examples of how each helps you preserve capital and drive profitability.

Real‑time analytics

Volopay’s real‑time analytics dashboard continuously monitors your spend streams, calculating metrics such as cost per project and cumulative outflows. As soon as a venture’s spend curve deviates from approved budgets—say, exceeding $25,000 in unplanned fixes—it flags the discrepancy.

For example, during a software upgrade pilot, analytics revealed that maintenance expenses had soared 30% above projections, signaling a potential sunk cost trap.

With instant alerts, you can halt further spending immediately, assess root causes, and decide whether to pivot or discontinue. This transparency stops losses before they compound, turning reactive cost control into proactive financial stewardship.

Budget controls

Volopay's built‑in budgeting software capabilities let you define spending limits by project, department, or cardholder. Suppose you allocate $50,000 for a marketing initiative; Volopay lets you set hard caps and approval workflows.

Once your team hits 80% of the threshold, automatic notifications trigger manager reviews, and any transaction beyond the cap is blocked until explicitly approved. If a campaign threatens to become a sunk cost, such as unplanned ad buys pushing spend to $55,000, the system stops transactions in their tracks.

By enforcing predefined budgets, you prevent runaway costs and make strategic pauses instead of emotional continuations driven by past spend.

Approval workflows

Volopay’s customizable approval workflows ensure that additional spend goes through decision gates aligned with your exit criteria. For instance, you can require that any transaction over $10,000 for an underperforming project receive sign‑off from both finance and the project lead.

This dual‑approval checkpoint guards against impulsive funding boosts aimed at recouping sunk investments. In one case, a retail SME blocked a $15,000 stock replenishment that lacked sales justification, prompting a review that revealed poor inventory turnover.

By routing funding requests through structured approvals, you add psychological and procedural barriers to the sunk cost fallacy, reinforcing decisions grounded in future ROI, not past outlays.

Integration with accounting

Seamless integration with accounting systems brings your transactional data into one unified view. Every expense—whether a $200 vendor payment or a $5,000 subscription renewal—is automatically synced, categorized, and tagged by project.

This holistic visibility makes it easy to separate ongoing operational costs from what is a sunk cost item. For example, when reviewing month‑end reports, you can filter out past irrecoverable expenditures and focus on current cash flows.

Finance teams can generate adjusted P&L statements that exclude sunk amounts, providing a clearer lens on actionable budgets. Integrating expense data with your ledger keeps your financial models accurate and your decisions future‑focused.

FAQs about sunk costs and the sunk cost fallacy

Loss aversion and commitment bias drive many entrepreneurs to justify past spend, leading them to continue funding underperforming projects. When you’ve already invested—say, $50,000 in a pilot—your desire to avoid admitting mistakes clouds objective analysis. Recognizing what is a sunk cost helps you focus on future ROI, not past losses.

Adhering to irrecoverable expenses forces you to allocate capital inefficiently, causing financial losses and missed growth opportunities. When you chase a sunk cost fallacy trap, projects with positive projections suffer for lack of funding. By treating past outlays as non‑factors, you preserve resources for initiatives that promise genuine profitability.

A common example to understand what is a sunk cost includes failed software rollouts, unprofitable leases, obsolete inventory, and ineffective marketing campaigns. Once you’ve spent on licenses, rent, or ad spend, those dollars are gone, regardless of subsequent strategy changes. Identifying these costs early prevents further investment in losing ventures.

You avoid the sunk cost fallacy by focusing on marginal costs and projected benefits, setting clear exit criteria, and using data‑driven analytics. Tools like Volopay automate spend tracking and flag projects below ROI thresholds. By reviewing metrics—not past spending—you make decisions anchored in future upside.

Volopay’s real‑time analytics, budget controls, and approval workflows spotlight potential sunk cost scenarios before they escalate. By integrating with accounting, it surfaces unrecoverable expenses and enforces stop‑loss triggers. You stay agile, directing resources to profitable channels rather than chasing diminishing returns.

No. Sunk costs are irreversible past expenditures that shouldn’t influence future decisions; fixed costs, like rent, recur and can often be renegotiated or eliminated. You might vacate a leased space to cut fixed costs, but you can’t recover a $100,000 machinery purchase that’s now obsolete, making it a true sunk cost.

No. By definition, what is a sunk cost is irretrievable, whether you spent $10,000 on ineffective ads or $200,000 on a failed prototype. Accepting this reality frees you to reprioritize budgets based on current and future value, rather than futile attempts to recoup past expenditures.

Analytics dashboards reveal spend trends and ROI, highlighting when a venture crosses into the fallacy of sunk costs territory. By comparing actual spend against performance benchmarks in real time, you spot unrecoverable projects early. This visibility empowers swift pivots, reallocating funds to high‑growth initiatives and blocking further losses.