Push vs pull payments: Decoding the difference!

The world of payments is constantly evolving to suit customer needs. There are many new technological and banking terms cropping up every day.

One important terminology that customers need to be aware of is push vs pull payments. They aren’t new but they can be tricky to understand. Hence, we must get to the root and decode to tell the difference between push and pull payments.

What is a push payment?

Push payments are when a payer instructs the financial institution to send some money to the recipient’s account. Here, the payer has the control to initiate the payment.

Example of what is a push payment-

Cash

Cash is a classic example of push payments. The payer has the cash and holds full control over the payment process. When they buy something, the money is handed over to the merchant signifying the payment process.

Bank transfers

Bank transfers are also a push payment. Here, the sender logs into their online banking account, enters recipients’ details, and sends money over.

Standing orders

Also known as bankers’ orders, standing orders are instructions given to banks to send a fixed amount of money periodically to someone’s account. Think of rent or a mortgage payment.

What is a pull payment?

Pull payments are the opposite of push payments. Here, the recipient requests money to be credited into their account from the payer's account directly.

Different from push payments, here the payee has full control to pull funds from someone’s account.

Example of pull payments-

Direct debits

This is also like standing order. But here the company has the instruction from you to receive money from your account without your authorization. Since this is a direct withdrawal from the payer’s account, this is a pull payment.

Card payments

Card payments are a pull payment because the merchant initiates the payment process. They enter the billing amount in the POS machine and swipe your card to receive the payment from it.

There are also other cases where you use the card virtually during online payments. Just by providing the required information alone, the payment doesn’t get through.

Only after authorization and settlement, the payment that has been reserved in the payer’s account is actually moved to the merchant account.

Checks

Checks are sent to the payee by the payer inputting the amount they can withdraw. Though it’s the payer who hands in the check, it’s not the end of the process.

It’s the payee who deposits the check in their bank and receives the amount in their account. As the actual withdrawal happens when the check is deposited, it can be taken as an example of pull payments.

Pros and cons of push vs pull payments

Only when we compare push vs pull payments, can we know which is best for business purposes. Based on your customers, demographics, industry, and type of business, you can weigh the following factors and choose the best.

1. Pace of transactions

When we compare push vs pull payments in terms of pace of transactions, push payments are faster and quicker. Because every piece of information that’s required to carry through payment is presented first-hand by the payer.

Where and when the payment should happen and which account is the recipient is clearly mentioned. Whereas, in pull payments, the payer may or may not have to authorize the payment every month.

2. Control over the flow of transactions

It is the mindset of the customer to want more control over the payment process when they send money to a payee.

Push payments naturally yield that and put the payer in control. Those who initiate the payment can decide whether they should transfer or not.

Though pull payments can be aborted at any time, it still doesn’t give control over the flow as push payment does. The sender cannot predict when the money will leave their account.

3. Push and pull payments, both are subject to fraud on the payer

Safety and security stand at the top as no one can compromise with data or money theft. Coming to push vs pull payments, both can be subjected to fraud or theft.

In the case of push payments, if the payer provides false information, the payer might be defrauded. Also in pull payments, if the payer gives authorization to wrong person, the payer will be defrauded as money goes to the wrong person now.

Depending on the payment method, the layer of protection varies. The payee can also get defrauded. In the case of push payments, the payee puts trust in the payer to make timely payments and provide goods or services on time.

If the payer doesn’t initiate it instantly, the payer will get cheated. The payee can also get cheated while receiving pull payments. The payee might initiate their payment request.

But there might be a chance that the payer’s account might not have enough funds. This is why certain recurring payments require prior authorization. But it’s not possible for direct debits or checks and they will get bounced.

Streamline all your business payments with Volopay

If your business sells products just once, then push payments are best for your business as receive payments as soon as you sell goods.

But there are businesses that provide SaaS-based services, recurring payments are the only way to collect monthly payments. For such payments, pull payments are the way to go.

Payees can continuously keep receiving money from customers and keep their cash flow afloat. It’s also convenient for customers to send money automatically every month without doing anything from their end.

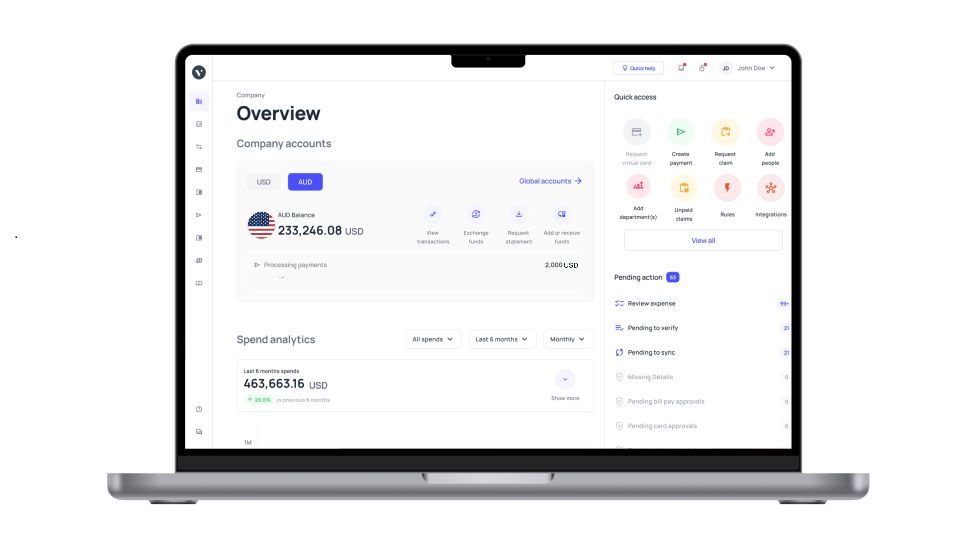

Keep your recurring payment worries at bay. Volopay's accounts payable software and corporate cards help you automate and schedule your recurring payments seamlessly.

Create unlimited virtual cards for multiple vendors and systemize your whole accounting management with Volopay.