Operating costs: Definition, formula and examples

In cost accounting, controlling operating expenses is crucial to preserving the financial stability of your company. These charges cover the regular costs required to maintain the efficient operation of your organization.

Monitoring these expenses guarantees that your operations remain effective and profitable, regardless of how big or small your company is. Knowing your business's running costs will help you make better judgments about anything from product pricing to growth planning.

You'll have more control over the financial future of your business if you know how to compute operating costs using the appropriate formula.

What are operating costs in cost accounting?

Operating costs in cost accounting refer to the expenses you incur during the normal course of running your business. These costs are unavoidable if you want your business to stay functional and competitive. They typically include rent, utilities, payroll, marketing, and the cost of goods sold (COGS).

By tracking and analyzing these expenses, you can better understand your company's financial efficiency and areas where you can cut unnecessary spending. Knowing your operating cost in business also allows you to set accurate budgets, create profitable pricing strategies, and plan for long-term growth.

Mastering how to calculate operating cost and apply the operating cost formula is crucial for improving profitability and sustaining success.

Why do you need an in-depth understanding of operating costs?

Having a comprehensive understanding of operating costs is essential for businesses at any stage.

Whether you’re a startup or a large corporation, tracking operating costs allows you to make informed decisions, improve profitability, and ensure financial health. Here’s why understanding operating costs is key to your business success.

Financial health

● Profitability analysis

With an accurate breakdown of operating costs, profitability analysis becomes much easier. By subtracting your operating costs from revenue, you can determine your net profit, which reflects how efficiently your business is operating.

If your operating costs are too high, it may signal that you need to optimize processes to maintain a healthy profit margin.

● Budgeting

An understanding of operating costs is crucial for budgeting. It enables you to plan for future expenses and allocate resources efficiently. Properly budgeting for operating costs allows businesses to anticipate costs and avoid unexpected financial strain.

This proactive approach can help businesses prepare for growth and ensure they have sufficient funds to cover day-to-day operations.

Cost management

● Cost analysis

Regular cost analysis ensures that businesses are not overspending in any area. By regularly reviewing your operating costs, you can track which expenses are rising and determine whether they’re justified.

This insight helps you control costs better and maintain sustainable spending practices. Streamlining these costs can result in higher profitability and more efficient use of available capital.

● Cost reduction

An in-depth understanding of operating costs is vital for cost reduction strategies. By pinpointing areas of waste or inefficiency, you can make informed decisions about where to cut costs.

This can involve renegotiating supplier contracts, reducing energy consumption, or optimizing labor costs to reduce the overall operating expenditure.

Strategic decision-making

● Pricing strategies

Your pricing strategies are directly impacted by operating costs. If your costs are high, you’ll need to adjust your pricing to maintain profitability. A strong understanding of your operating expenses allows you to set competitive yet sustainable prices, ensuring you remain profitable while offering value to customers.

These decisions, supported by a clear picture of your financial landscape, will be more informed and aligned with your long-term business goals.

● Investing strategies

Investing strategies also rely on an understanding of operating costs. If operating costs are high, it could affect your ability to invest in new projects, hire talent, or expand operations.

By tracking your operating costs, you can free up funds to reinvest in growth opportunities, ensuring your investments align with the financial health of your business.

Risk management

● Financial forecasting

Financial forecasting becomes more reliable when you have a clear understanding of operating costs. By incorporating accurate cost data into your forecasts, you can predict future expenses and plan for various financial scenarios.

This enables businesses to prepare for seasonal fluctuations or economic downturns and helps make informed decisions regarding capital allocation and resource management.

● Financial readiness

Being financially ready is essential, and operating costs are a key factor in determining your business’s readiness. Understanding your ongoing expenses enables you to maintain adequate reserves and prepare for unexpected financial challenges.

It also supports your efforts to secure funding, as investors and lenders will want to see that you can manage costs effectively.

Benchmarking

● Performance measurement

Performance measurement relies heavily on understanding operating costs. By comparing your operating costs to your revenue, you can measure how effectively your business is performing.

If operating costs are too high, it could indicate inefficiencies or areas where costs need to be reduced to improve overall business performance.

● Industry-standard measurement

Measuring your operating costs against industry standards ensures that your business is aligned with the best practices in your field.

If your operating costs are above average, it may be an indication that you need to review your cost structure and look for opportunities to reduce unnecessary expenses while maintaining quality and service.

Stakeholder communication

● Transparent communication

With a clear understanding of operating costs, you can maintain transparent communication with employees, investors, and other stakeholders.

Being upfront about expenses fosters trust and creates a culture of accountability. Transparency also helps manage expectations and ensures that all parties are aligned with the business’s financial objectives.

● Detailed reporting

Detailed reporting is essential to track your operating costs. With regular, thorough reports on operating expenses, you can keep stakeholders informed about how money is being spent and identify areas for improvement.

These reports are valuable for assessing the effectiveness of your cost management strategies and for making data-driven decisions.

Sustainability

● Regulatory compliance

Regulatory compliance is directly linked to your operating costs. Understanding the legal and tax implications of your operating costs helps ensure that your business is compliant with local laws.

It also helps avoid penalties or fines related to improper expense reporting, ensuring your business remains in good standing with regulatory authorities. It also ensures that your business can continue to thrive over the long term, contributing to a sustainable business model that aligns with economic, environmental, and social goals.

● Change adoption

Finally, understanding operating costs helps your business stay flexible and adapt to change.

Whether you’re facing rising costs, changes in market conditions, or new regulations, having a clear picture of your operating expenses enables you to quickly adjust your strategy and stay competitive. This adaptability is crucial for long-term business success.

What are the 5 fundamental components of operating costs?

Understanding operating costs is key to managing your business effectively. These costs represent the expenses incurred during normal operations, impacting profitability.

By breaking them down into five fundamental components direct costs, indirect costs, fixed costs, variable costs, and semi-variable costs you can better analyze and control your financial outflows. Each component plays a unique role in your cost structure, influencing budgeting and decision-making.

Direct costs

Direct costs are expenses you can trace directly to producing a specific product or service. These include raw materials, labor for manufacturing, and packaging. For example, if you run a bakery, the flour and bakers’ wages are direct costs.

Accurately tracking these helps you determine product profitability. Since they tie directly to production, managing direct costs efficiently ensures you maintain competitive pricing while covering essential expenses.

Indirect costs

Indirect costs are expenses not directly tied to a specific product or service but necessary for operations. Think utilities, rent, or administrative salaries. For instance, if you own a factory, the electricity bill supports all production but isn’t linked to one item.

Allocating these costs across products can be tricky. Monitoring indirect costs ensures you don’t overlook overhead, which can erode profits if left unchecked.

Fixed costs

Fixed costs remain constant regardless of your production or sales volume. Examples include rent, insurance, and equipment leases. If you operate a retail store, your monthly rent stays the same whether you sell 10 or 1,000 items.

These costs provide stability in budgeting but can strain cash flow during low sales. Understanding fixed costs helps you plan for long-term commitments and maintain financial resilience.

Variable costs

Variable costs fluctuate with your production or sales volume. These include raw materials, shipping fees, and sales commissions. For example, if you produce T-shirts, fabric costs rise with higher output. Variable costs are manageable by adjusting production levels.

Keeping a close eye on them allows you to scale operations efficiently, ensuring you don’t overspend when demand drops or underprepare when sales surge.

Semi-variable costs

Semi-variable costs have both fixed and variable components, scaling partially with activity. For instance, your phone bill may include a fixed monthly fee plus charges for extra usage. If you run a delivery service, driver wages might include a base salary plus overtime.

These costs require careful monitoring, as they can escalate unexpectedly. Managing semi-variable costs helps you balance operational flexibility with cost predictability.

Fixed costs vs. variable costs

Understanding the difference between fixed costs and variable costs is crucial when managing your business's operating costs in cost accounting.

These costs impact your financial health, profitability, and ability to scale efficiently. Here’s a detailed breakdown of these two types of costs and their significance in business.

1. Definition

● Fixed costs

Fixed costs are expenses that remain constant, regardless of your production or business activity level. These costs do not fluctuate with the volume of goods or services produced and are incurred even if your business produces nothing. Examples include rent, insurance premiums, and salaries.

● Variable costs

Variable costs, on the other hand, change directly with your production or business activity level. The more you produce or sell, the higher these costs will be. Examples include raw materials, commissions, and utility costs tied to production levels.

2. Nature

● Fixed costs

Fixed costs are inherently stable and predictable. These costs remain unchanged for a certain period, making them easier to budget for. No matter how much you produce or sell, fixed costs will stay the same, giving you a sense of financial consistency and reliability in your budgeting process.

● Variable costs

Variable costs are dynamic and fluctuate with your business’s output. The more you produce, the higher these costs will be. While they are more difficult to predict than fixed costs, they give you flexibility, as they adjust in line with your activity levels, helping you manage cash flow during low-demand periods.

3. Impact on financial statement

● Fixed costs

Fixed costs are typically listed under operating expenses on your financial statement, as they occur regularly. Since they do not change with production, these costs have a significant impact on your break-even point and profitability. You’ll need to account for them accurately to determine how much revenue you need to cover these fixed expenses.

● Variable costs

Variable costs, in contrast, are typically listed under cost of goods sold (COGS) on your financial statement. These costs fluctuate with your production levels, meaning they vary based on sales and production activity. An increase in variable costs without a corresponding increase in revenue can negatively affect profitability.

4. Behavior with production level

● Fixed costs

Fixed costs do not change as production levels increase or decrease. Regardless of whether your production level is high or low, these costs will remain constant in the short term. However, over time, some fixed costs may adjust if your business expands or contracts (e.g., higher rent for a larger facility).

● Variable costs

Variable costs directly correlate with production levels. The more you produce, the higher these costs become. For example, manufacturing more units requires more raw materials, leading to increased costs. Managing variable costs effectively is essential to ensure they don’t outpace revenue growth.

5. Cash flow impact

● Fixed costs

Fixed costs have a consistent impact on cash flow, as they are incurred regularly and do not change with production or sales. These costs need to be covered each period, regardless of how much your business produces or sells. Fixed costs can strain cash flow if not managed properly, especially during periods of low revenue.

● Variable costs

Variable costs fluctuate with your business’s sales or production activity. When sales or production are high, variable costs increase, which may strain cash flow. Conversely, during periods of low activity, variable costs decrease, offering some relief and making it easier to manage cash flow during off-peak times.

6. Treatment

● Fixed costs

Fixed costs are treated as predictable and are typically accounted for in your budget as recurring expenses. You’ll allocate funds to cover these costs regularly. These costs should be managed effectively to avoid strain on your cash flow and to ensure you maintain a steady profit margin regardless of production levels.

● Variable costs

Variable costs are treated as flexible and adjusted according to business activity. These costs are often tied directly to your production process or sales volume, so they should be reviewed frequently. Keeping track of variable costs helps prevent overspending and enables you to adjust pricing or production levels accordingly.

7. Level of flexibility

● Fixed costs

Fixed costs offer very little flexibility because they are incurred regardless of the level of business activity. While you can renegotiate or reduce some fixed costs (like rent or salaries), these costs tend to remain constant for the duration of the contract or arrangement. This lack of flexibility can be challenging if your business faces downturns.

● Variable costs

Variable costs are more flexible because they rise and fall with production levels. If demand drops, you can reduce your variable costs by scaling back production. This flexibility helps you control costs in response to changing market conditions, making it easier to maintain profitability during challenging times.

8. Timing of expense recognition

● Fixed costs

Fixed costs are typically recognized at regular intervals, often monthly or annually, since they do not change. You’ll need to allocate these costs within your budget, and they are typically predictable. Recognizing fixed costs in advance is essential for accurate financial forecasting and long-term planning.

● Variable costs

Variable costs are recognized when the related production activity occurs. As production increases, these costs are incurred. You must track them closely to ensure you’re aware of fluctuations. Recognizing variable costs as they occur allows you to adjust operations or pricing to remain profitable.

9. Example

● Fixed costs

An example of fixed costs includes rent for your business premises. Whether you produce 10 or 1,000 units, your rent remains the same. Other examples include insurance premiums, salaries for permanent employees, and lease payments.

These are all considered fixed costs because they remain constant over time, regardless of your business's production or sales.

● Variable costs

An example of variable costs is the cost of raw materials. As your production increases, the cost of raw materials increases accordingly. Other examples include packaging costs, sales commissions, and shipping expenses.

These costs are directly tied to the volume of goods you produce and sell, making them variable.

What are the types of operating costs?

Understanding the various types of operating costs is essential to ensure the financial health of your business. These costs include both fixed and variable expenses that directly impact your daily operations.

Here’s an overview of the different types of operating costs in business that you should be aware of.

Operating expenses

● Selling & marketing expenses

Selling and marketing expenses are costs associated with promoting and selling your products or services. This includes advertising, digital marketing, promotional campaigns, and the salaries of your sales and marketing team.

Effective selling and marketing strategies are essential to drive revenue, but managing these expenses ensures that you are spending efficiently to grow your business without overspending.

● General and administrative expenses

General and administrative (G&A) expenses are the costs related to the overall management of your business. These include administrative staff salaries, office supplies, utilities, and management team salaries.

G&A expenses help maintain smooth operations and ensure your business runs efficiently, but they should be controlled to prevent unnecessary overhead that could affect your bottom line.

● Accounting and legal expenses

Accounting and legal expenses include costs associated with financial management and legal services. This could involve hiring an accountant, paying for audits, legal advice, or managing compliance.

While necessary, these expenses should be monitored and optimized, as they can add up quickly if not properly controlled, especially for small and medium-sized businesses.

● Research & development expenses

Research and development (R&D) expenses are critical for businesses focused on innovation. These costs are related to developing new products, improving existing products, or exploring new markets.

R&D helps your business remain competitive, but it can be a significant expense. It’s important to manage these expenses effectively while ensuring that the investments lead to profitable innovations.

● Depreciation & amortization

Depreciation and amortization refer to the gradual expense of assets over their useful life. Depreciation applies to physical assets like machinery and equipment, while amortization refers to intangible assets like patents and trademarks.

These expenses reflect the loss in value of your business assets over time, and managing them ensures that you allocate the right portion of the cost each period.

● Interest expenses

Interest expenses are the costs of borrowing money for your business. If you have loans or credit lines, the interest you pay is an operating cost.

Managing interest expenses is crucial to controlling debt and ensuring that your borrowing costs don’t become a significant financial burden. These expenses can vary depending on your loan terms and interest rates.

● Insurance premiums

Insurance premiums are recurring costs for protecting your business from risks. This includes business insurance, health insurance for employees, property insurance, and liability insurance. While necessary for mitigating risk, insurance premiums can add to your operating costs.

You must balance the need for adequate coverage with the financial constraints of your business, ensuring you don’t overpay for unnecessary coverage.

● Inventory & rent

Inventory costs refer to the expenses associated with acquiring, storing, and managing products or materials you sell. Rent refers to the costs of leasing space for your operations, such as office space, retail locations, or warehouses.

Both inventory and rent are crucial operating costs that affect your cash flow. Proper inventory management and lease agreements can help minimize these expenses.

COGS (Cost of Goods Sold)

● Direct labor cost

Direct labor cost includes the wages, salaries, and benefits paid to employees directly involved in production or service delivery. This expense is tied to the output your business creates. Managing direct labor costs ensures that you are not overspending on labor while maintaining adequate staffing levels for efficient operations.

Balancing labor efficiency with production needs is crucial for controlling overall operating costs.

● Raw materials cost

Raw materials cost represents the cost of the materials needed to produce your products. Whether you're manufacturing goods or assembling components, these costs can vary depending on market prices and supply chain efficiency.

Efficient procurement and inventory management are essential for controlling raw materials costs. The goal is to balance sufficient stock levels while minimizing wastage or overstocking, both of which impact profitability.

● Rent of manufacturing unit

Rent for your manufacturing unit is the lease or rental expense associated with the space used to produce goods. This is typically a fixed cost, but should be factored into your overall operating expenses. Considerations like location, lease terms, and space requirements influence this cost.

Managing rent costs ensures that they align with your production needs and help optimize profitability without wasting valuable resources on unnecessary space.

● Utility costs of manufacturing unit

Utility costs are the expenses for energy, water, heating, cooling, and other essential services that your manufacturing unit requires to operate. These costs are typically variable, depending on your production levels and facility usage.

Efficient energy management can help reduce utility costs and improve profitability. Investing in energy-efficient machinery and practices can lead to long-term savings and a reduced environmental impact.

● GST of manufacturing unit

Goods and Services Tax (GST) on manufacturing units represents the tax you must pay on the goods and services produced. The tax rate varies depending on the region and industry. GST expenses must be carefully tracked and managed to ensure compliance with local tax laws.

Proper tax planning and documentation will help avoid penalties and ensure smooth financial operations for your business.

● Equipment repair costs

Equipment repair costs are the expenses related to maintaining and fixing machinery, tools, or other production assets. These costs are necessary to ensure that your equipment continues to function efficiently and does not cause production delays.

Regular maintenance can help reduce repair costs by preventing major breakdowns. It's essential to account for these expenses to maintain smooth operations and minimize unexpected disruptions.

Steps to calculate operating costs

Identify your cost categories

Start by categorizing your operating costs into direct, indirect, fixed, variable, and semi-variable costs. Direct costs are tied to specific products, like raw materials. Indirect costs, such as utilities, support overall operations. Fixed costs, like rent, remain constant.

Variable costs, like packaging, fluctuate with output. Semi-variable costs, like utility bills, have fixed and variable elements. Clear categorization ensures you account for all expenses accurately when calculating total operating costs.

Gather financial data

Collect all relevant financial records, including invoices, payroll, utility bills, and lease agreements. Use accounting software or spreadsheets to organize data by cost category. Ensure you cover a specific period, like a month or quarter.

Verify data accuracy by cross-checking receipts and bank statements. Comprehensive data collection is crucial for precise calculations, helping you avoid missing expenses that could skew your operating cost analysis and budgeting.

Calculate your fixed costs

List all fixed costs that don’t vary with production, such as rent, insurance, and salaried employee wages. Sum these expenses for your chosen period. For example, if your monthly rent is $2,000 and insurance is $500, your fixed costs total $2,500.

Ensure you include all recurring, unchanging expenses. Accurate fixed cost calculation provides a baseline for budgeting, helping you plan for consistent financial obligations.

Calculate your variable costs

Identify variable costs that change with production levels, like raw materials, packaging, and sales commissions. Multiply the cost per unit by the number of units produced or sold. For instance, if raw materials cost $10 per unit and you produce 1,000 units, your variable cost is $10,000.

Sum all variable costs for the period. This calculation helps you understand costs tied directly to output fluctuations.

Calculate your semi-variable costs

Determine semi-variable costs, which have fixed and variable components, like utility bills or salaries with bonuses. Identify the fixed portion (e.g., base utility fee) and the variable portion (e.g., usage-based charges).

For example, a $100 base utility fee plus $200 in usage totals $300. Sum all semi-variable costs for the period. Accurate calculation ensures you capture both stable and fluctuating elements for comprehensive cost tracking.

Calculate total operating costs

Add your fixed, variable, and semi-variable costs to calculate total operating costs. For example, if fixed costs are $5,000, variable costs are $7,000, and semi-variable costs are $3,000, your total operating cost is $15,000. Ensure all categories are included to avoid underestimating expenses.

This total reflects the full cost of running your business, providing a clear picture for financial planning and profitability analysis.

Formula

Total operating costs = fixed costs + variable costs + semi-variable costs

This formula combines all cost categories to give you a comprehensive view of your operating expenses. Apply it consistently across periods to track trends and ensure accuracy in your calculations.

Analyze the results

Review your total operating costs to identify trends or anomalies. Compare costs against revenue to assess profitability. Break down costs by category to pinpoint high-expense areas. For example, if variable costs are disproportionately high, evaluate production efficiency.

Use this analysis to identify cost-saving. Determine the areas that account for the largest portion of costs and search for any irregularities. This understanding aids in identifying areas that might require adjustments or reductions in order to raise margins.

Measure key performance indicators

To determine operating cost performance. Monitor key performance indicators (KPIs) such as cost per unit, labor efficiency, and overhead rates. Utilize accounting software to track spending in real time and contrast it with income.

To maintain competitiveness and enable data-driven decisions to maximize resource allocation. Consistent update and evaluation of these data facilitate forecasting and budgeting as well as informed decision-making.

Review and adjust accordingly

Determine variations by periodically comparing operating expenditures to the budget and KPIs. To identify areas for cost reductions, conduct reviews on a monthly or quarterly basis. Renew supplier agreements, save expenses, or simplify procedures.

Adopt cost-saving strategies, including labor optimization or energy-efficient procedures, to meet financial objectives. Maintaining profitability and long-term growth becomes possible by proactive management, which ensures expenses stay aligned with your business goals.

How to calculate operating costs?

Operating costs include things like rent, utilities, payroll, and supplies that are incurred during regular business operations.

Calculate by adding up all of the operational costs for a given period, omitting non-operational or capital spending. Sort expenses into two categories: variable (like utilities) and fixed (like rent).

The operating cost formula is:

Operating Cost = COGS + Operating Expenses

Use spreadsheets or software to keep your spending records current and accurate. This enables you to pinpoint areas where you are overspending, appropriately price your products, and increase profit margins.

Understanding the financial health of your company requires knowing how much it costs to operate.v

Example:

Suppose you run a small online electronics store. For the month, you spend $25,000 on purchasing inventory like laptops and accessories (COGS). In addition, your monthly expenses include $5,000 for warehouse rent, $2,000 for utilities and internet, $8,000 for employee salaries, and $3,000 for online advertising.

Here’s how you calculate it:

COGS = $25,000

Operating Expenses = $5,000 + $2,000 + $8,000 + $3,000 = $18,000

So, your Total Operating Cost = $25,000 + $18,000 = $43,000

By calculating this each month, you can keep a close eye on where your money goes and make smarter financial decisions.

Impact of external factors on operating costs of your business

Running a business means navigating external factors that influence your operating costs. From economic shifts to regulatory changes, these elements can significantly affect your bottom line. Understanding their impact helps you adapt and maintain financial stability.

Economic conditions

Economic conditions, like inflation or recession, directly affect your operating costs. During inflation, raw materials and labor costs rise, squeezing margins. In a recession, reduced demand may lower sales, making fixed costs feel heavier. Interest rate hikes increase borrowing costs, impacting cash flow.

Monitoring economic trends allows you to adjust pricing or cut discretionary spending. Staying agile ensures you can weather economic storms while keeping your business competitive and profitable.

Regulatory changes

Regulatory changes can increase your operating costs unexpectedly. New labor laws may mandate higher wages or benefits, raising payroll expenses. Environmental regulations might require costly equipment upgrades or compliance measures.

Tax policy shifts could alter your financial obligations. Staying informed about upcoming regulations helps you budget for compliance costs. Proactively adapting to these changes minimizes disruptions, ensuring your business remains compliant without sacrificing operational efficiency or profitability.

Market competition

Market competition forces you to adjust operating costs to stay competitive. Rivals offering lower prices may push you to streamline production or negotiate better supplier deals. Investing in marketing to differentiate your brand can raise costs but boost sales.

Failing to match competitors’ innovations risks losing market share. Analyzing competitors’ strategies helps you optimize costs without compromising quality, ensuring your business remains attractive to customers while maintaining healthy profit margins.

Supply chain disruptions

Supply chain disruptions, like shipping delays or supplier shortages, can spike your operating costs. Sourcing alternative materials often comes at a premium, and expedited shipping fees add up. Inventory shortages may halt production, increasing labor inefficiencies.

Building resilient supplier networks and maintaining buffer stock can mitigate these risks. By anticipating disruptions, you control costs and ensure smooth operations, keeping your business reliable even during global supply chain challenges.

Technological changes

Technological changes can both increase and reduce your operating costs. Adopting new software or automation may involve upfront investments, but streamlines processes, saving labor costs long-term. However, outdated systems can lead to inefficiencies or cybersecurity risks, raising expenses.

Staying current with industry tech trends helps you balance adoption costs with productivity gains. Strategic tech investments ensure your business remains efficient, competitive, and adaptable in a rapidly evolving digital landscape.

Geopolitical factors

Geopolitical factors, like trade tariffs or international conflicts, can disrupt your operating costs. Tariffs may increase import costs for raw materials, while sanctions could limit supplier options. Political instability in key markets might affect demand or logistics.

Diversifying your supply chain and monitoring global events helps mitigate these risks. By staying proactive, you can adjust sourcing or pricing strategies, ensuring your business remains stable despite geopolitical uncertainties.

Financing costs

Financing costs, driven by interest rates and credit availability, impact your operating expenses. Higher interest rates raise loan repayment costs, straining cash flow. Tightened credit markets may limit access to capital, forcing reliance on costly short-term financing.

Maintaining a strong credit profile and exploring diverse funding options helps manage these costs. By optimizing your financing strategy, you ensure your business can fund operations without excessive financial burdens.

Steps to manage the operating costs of your business

Effectively managing operating costs is crucial for your business’s profitability and sustainability. These nine steps guide you through analyzing, planning, and adjusting costs to ensure financial health.

1. Conduct cost analysis

Start by conducting a thorough cost analysis to understand your business’s expense structure. Review financial statements to categorize costs into direct, indirect, fixed, variable, and semi-variable. Use accounting software to track spending patterns over time.

This analysis reveals where your money goes, highlighting areas of inefficiency. By understanding your cost baseline, you can make informed decisions to reduce waste and prioritize resources, setting the stage for effective cost management.

2. Identify cost drivers

Next, identify the key cost drivers impacting your expenses. These could include labor hours, raw material prices, or energy consumption. For example, if you run a restaurant, food waste might be a major driver. Analyze operational processes to pinpoint what inflates costs.

Understanding these drivers helps you focus on high-impact areas. By addressing root causes, you can implement targeted strategies to control expenses without compromising quality or output.

3. Involve key stakeholders

Engage key stakeholders, such as department heads and employees, in cost management efforts. Their insights into daily operations can uncover hidden inefficiencies. For instance, your production team might suggest equipment upgrades to save time.

Hold regular meetings to discuss cost-saving ideas and foster collaboration. Involving stakeholders ensures buy-in for cost-control initiatives, aligning everyone toward shared financial goals while leveraging diverse perspectives to optimize your business’s operations.

4. Conduct cost estimation

Conduct cost estimation to forecast future expenses based on historical data and market trends. Estimate costs for materials, labor, and overhead for upcoming projects or periods. Use tools like spreadsheets or forecasting software for accuracy.

For example, if you’re launching a new product, estimate production costs. Accurate estimations help you anticipate financial needs, avoid surprises, and allocate resources efficiently, ensuring your business remains financially prepared for growth.

5. Develop a budget

Develop a detailed budget to allocate resources effectively. Break it down by department, project, or cost category, aligning with your cost analysis and estimations. Include buffers for unexpected expenses. For instance, if you run a retail store, budget for rent, inventory, and marketing.

A well-crafted budget acts as a roadmap, guiding spending decisions and preventing overspending, ensuring your business operates within its financial limits.

6. Setup a cost control strategy

Set up a cost control strategy to monitor and reduce expenses. Implement measures like negotiating supplier contracts, optimizing energy use, or automating repetitive tasks. For example, switching to bulk purchasing can lower material costs.

Assign responsibilities to team members to enforce controls. A proactive strategy minimizes waste and ensures spending aligns with your budget, helping you maintain profitability while supporting your business’s operational needs.

7. Perform variance analysis

Perform variance analysis to compare actual spending against your budget. Identify discrepancies, such as overspending on utilities or underbudgeted labor costs. Use accounting tools to generate variance reports monthly or quarterly.

For instance, if shipping costs exceed projections, investigate the cause. This analysis highlights where your business deviates from plans, enabling you to address issues promptly and refine cost management practices for better financial control.

8. Implement corrective actions

Implement corrective actions to address variances and inefficiencies. If labor costs are high, consider cross-training staff to improve flexibility. If material costs spike, source alternative suppliers. Act swiftly to prevent small issues from escalating.

Document actions taken and monitor their impact. By correcting deviations, you realign your business with its budget, ensuring resources are used efficiently and maintaining profitability despite unexpected challenges or market shifts.

9. Review and adjust accordingly

Regularly review your cost management processes and adjust as needed. Assess the effectiveness of your strategies quarterly or annually, considering market changes or business growth. For example, if demand rises, revisit your budget to accommodate increased production costs.

Solicit feedback from stakeholders to refine approaches. Continuous review ensures your cost management remains relevant, helping you adapt to evolving conditions while keeping your business financially resilient and competitive.

Operating costs vs. SG&A expenses

When managing your business's finances, it's essential to understand the distinction between operating costs and SG&A expenses. Both are integral to your overall expense structure, but they differ in their nature and impact on your business’s financial health.

Let's explore these two types of expenses in detail and understand their role in business accounting.

Definition

● Operating costs

Operating costs refer to the expenses required to run your business’s core activities, such as producing goods or providing services. These costs are directly tied to the production process and include direct materials, labor, and manufacturing overhead.

Managing operating costs effectively ensures that your business can maintain profitability and operational efficiency.

● SG&A expenses

SG&A stands for Selling, General, and Administrative expenses. These are the costs associated with running your business, excluding the direct costs of production. SG&A includes expenses such as marketing, sales commissions, office rent, and administrative staff salaries.

While not directly tied to production, SG&A expenses are crucial for your business's growth and daily operations.

Components

● Operating costs

The components of operating costs include direct labor, direct materials, and manufacturing overhead. These costs are incurred when producing a product or delivering a service. For example, wages paid to factory workers or the cost of raw materials are operating costs.

Efficient management of these components helps you control the cost of production and maintain a healthy profit margin.

● SG&A expenses

SG&A expenses are divided into three primary categories selling expenses, general expenses, and administrative expenses. Selling expenses include marketing and sales commissions, general expenses involve overhead costs like office rent and utilities, and administrative expenses cover salaries for non-production staff.

These costs, while necessary, don’t directly contribute to the production of goods or services but are essential for business operations.

Nature

● Operating costs

Operating costs are typically variable and fluctuate depending on your production levels. As production increases, operating costs rise since more materials and labor are required.

These costs are essential to your core business functions, and controlling them directly impacts profitability. Managing operating costs is crucial to ensuring your business remains financially viable.

● SG&A expenses

SG&A expenses, on the other hand, are fixed or semi-variable. While some SG&A costs, like salaries and rent, remain constant, others, like commissions and marketing spend, can vary.

These expenses are not directly tied to production but are necessary for business growth and management. Effectively managing SG&A expenses ensures a more balanced operational cost structure.

Direct relation to production

● Operating costs

Operating costs are directly related to production. They arise from activities such as manufacturing products or providing services. As the volume of production increases, operating costs increase proportionally.

Understanding and managing operating costs is essential for maintaining cost-efficiency and determining the profitability of each unit produced.

● SG&A expenses

SG&A expenses, however, are not directly related to the production process. These costs support the overall functioning of the business but don’t directly contribute to creating products or services.

While critical for business operations, SG&A expenses should be carefully monitored to ensure they don’t inflate overall business expenses without contributing directly to the bottom line.

Impact on financial statement

● Operating costs

Operating costs appear on the income statement as part of your cost of goods sold (COGS). These costs are deducted from revenue to calculate your gross profit.

The management of operating costs is crucial because it directly impacts your gross margin, which is a key indicator of profitability.

● SG&A expenses

SG&A expenses, on the other hand, are listed separately on the income statement. These expenses are subtracted from gross profit to determine your operating profit.

Effective control of SG&A expenses helps improve operating efficiency and ensures that your business can grow while maintaining profitability.

Time-frame

● Operating costs

Operating costs typically occur in the short term and fluctuate with production cycles. As long as production continues, these costs are incurred regularly.

For businesses with seasonal production, operating costs may be higher during peak seasons and lower during off-seasons. Understanding this cyclical nature is important for cash flow management and cost control.

● SG&A expenses

SG&A expenses, however, are more consistent over time and typically represent fixed or semi-fixed costs. These expenses remain stable even if production levels fluctuate. For instance, your rent or administrative salaries remain the same whether you're operating at full capacity or scaling down production.

These expenses should be budgeted regularly for sustainable business operations.

Accounting treatment

● Operating costs

In accounting, operating costs are treated as part of the cost of goods sold (COGS) or operating expenses, depending on the nature of the cost. These are deducted directly from revenue in the income statement.

Proper allocation of operating costs is crucial for accurate financial reporting and understanding the true cost of production.

● SG&A expenses

SG&A expenses are typically treated as operating expenses on the income statement, distinct from direct production costs. These are subtracted from gross profit to calculate operating income.

Managing SG&A expenses efficiently allows businesses to enhance profitability by ensuring that these non-production-related costs are in line with revenue generation.

Strategic importance

● Operating costs

Managing operating costs is crucial for strategic decision-making. If operating costs are too high, your business may struggle to remain profitable.

By monitoring and controlling these costs, you can determine the most efficient ways to produce goods or services, which directly influences your competitive advantage in the market.

● SG&A expenses

SG&A expenses, while not directly related to production, are important for business growth and strategic planning. These costs impact your ability to market products, expand operations, and scale your business.

Controlling SG&A expenses helps ensure that your business grows efficiently without overburdening your resources, allowing for better long-term planning and stability.

Influence on pricing

● Operating costs

Operating costs significantly influence your pricing strategy. If operating costs are high, you may need to adjust your prices to maintain profitability.

On the other hand, if you can reduce operating costs through efficiency improvements, you may have the flexibility to lower prices or increase profit margins without sacrificing quality.

● SG&A expenses

SG&A expenses also impact pricing, but in a more indirect way. These expenses often reflect the costs of marketing, sales, and administration that support your product or service.

Understanding SG&A expenses helps you determine whether you need to increase prices to cover these costs while maintaining competitive positioning in the market.

Example

● Operating costs

An example of operating costs would be a manufacturer paying for raw materials, wages for assembly line workers, and utility costs to keep the machines running.

These are costs directly tied to the production of goods. Managing these costs effectively helps the company optimize its production process and maintain a profitable margin.

● SG&A expenses

An example of SG&A expenses would be a retail store paying for advertising campaigns, the salaries of its marketing team, and rent for the storefront.

These costs help the business promote and sell its products, but are not directly tied to production. Effective management of SG&A expenses is key to balancing growth and profitability.

Operating expenses and operating costs: What’s the difference?

Although the terms "operating expenses" and "operating costs" are occasionally employed interchangeably, they share certain differences. Operating costs in business include all expenses directly and indirectly related to your daily operations.

This includes the cost of goods sold (COGS) and operating expenses. In contrast, operating expenses refer only to the indirect costs, like rent, utilities, salaries, and marketing. For example, if you run a logistics company, your running costs would comprise office rent, internet fees, driver salary (COGS), and vehicle gasoline.

However, driver salary and gasoline would not be included in operating expenses alone. Understanding this difference gives you clear insights into spending, which improves budget management and overall productivity.

Separating these can help you identify areas where you may reduce expenses, such as negotiating rent, while maintaining a high level of production quality, which will ultimately increase your bottom line.

What are the risks of cutting operating costs?

Cutting operating costs can boost short-term profits, but it carries risks that may harm your business’s long-term success.

From stifling innovation to damaging your brand, these seven risks highlight the need for strategic cost reduction to avoid unintended consequences.

Reduced innovation

Slashing budgets for research and development can stifle innovation. If you cut funding for new product designs or technology upgrades, your business may lag behind competitors. For example, reducing R&D in a tech firm could delay software updates, losing market share.

Innovation drives growth and differentiation. Without it, you risk offering outdated products or services, making it harder to attract customers and maintain a competitive edge in your industry.

Operational inefficiencies

Cost-cutting measures, like reducing maintenance budgets, can lead to operational inefficiencies. If you delay equipment repairs in a factory, breakdowns may halt production, increasing downtime costs. Understaffing to save on labor can overwhelm workers, slowing processes.

These inefficiencies erode productivity and raise long-term expenses. Balancing cost reductions with operational needs ensures your business runs smoothly, avoiding disruptions that could negate the savings you aimed to achieve.

Deteriorated customer experience

Cutting costs in customer-facing areas, like support staff or product quality, can harm customer experience. If you reduce call center hours, customers may face long wait times, leading to frustration. Lower-quality materials might result in defective products, driving complaints.

Poor experiences push customers to competitors. Prioritizing customer satisfaction while trimming costs helps you retain loyalty, ensuring your business remains a preferred choice in a competitive market.

Supply chain issues

Reducing supply chain costs, such as switching to cheaper suppliers, can create issues. Lower-cost vendors may deliver subpar materials or unreliable shipments, disrupting production. For instance, if you run a bakery and source cheaper flour, product quality could suffer.

Weak supply chains lead to delays and stockouts. Maintaining reliable supplier relationships ensures consistent operations, preventing cost-cutting from compromising your ability to meet customer demand effectively.

Impaired employee morale

Cost cuts like layoffs or reduced benefits can impair employee morale. If you eliminate bonuses in your retail store, staff may feel undervalued, leading to lower productivity or higher turnover. Replacing skilled workers is costly and disrupts operations.

Low morale also affects customer interactions. Investing in employee well-being while managing costs fosters loyalty and efficiency, ensuring your team remains motivated to drive your business’s success.

Short-term focus

Focusing solely on immediate cost savings can jeopardize long-term goals. If you cut training programs to save money, your workforce may lack skills for future challenges, hindering growth. Short-term fixes, like deferring equipment upgrades, increase future repair costs.

Balancing short- and long-term priorities ensures sustainable profitability. Strategic cost management aligns with your vision, preventing quick wins from undermining your business’s ability to thrive over time.

Deteriorated brand image

Cost-cutting that compromises quality or service can damage your brand image. If you reduce packaging quality to save costs, customers may perceive your products as cheap. Negative reviews or social media backlash can erode trust.

A weakened brand loses market appeal, impacting sales. Protecting your brand’s reputation by maintaining quality and reliability ensures cost reductions don’t alienate customers or diminish your business’s standing in the marketplace.

Strategies for managing operating costs

Managing operating costs is crucial for ensuring the long-term financial health of your business. Whether you are a startup or an established enterprise, adopting effective cost management strategies can help you optimize expenditures, improve efficiency, and maintain profitability.

Here are several strategies to help you manage your operating costs effectively.

1. Benchmarking

Benchmarking involves comparing your business’s operating costs with those of similar organizations or industry standards. By evaluating the cost structures of your competitors or industry leaders, you can identify areas where your business may be overspending.

This comparison can provide valuable insights into cost-saving opportunities, efficiency improvements, and best practices that can be adopted to reduce unnecessary operating costs.

2. Analyzing workforce requirements

Assessing your workforce needs helps ensure that your staffing levels align with your business's current production or service demands. Overstaffing leads to unnecessary payroll expenses, while understaffing can affect productivity.

Regularly analyzing your workforce requirements allows you to optimize your staffing levels, reduce labor costs, and improve operational efficiency, all of which contribute to better management of your operating costs.

3. Re-negotiating supplier contracts

Supplier contracts are often a significant component of your operating costs. By reviewing and re-negotiating contracts with suppliers, you can secure better rates, more favorable terms, or bulk discounts. This can significantly reduce your procurement costs.

Maintaining strong relationships with suppliers and leveraging your purchasing volume can help you negotiate cost reductions, ensuring your business remains cost-efficient without sacrificing quality.

4. Conducting regular audits

Audits are a powerful tool for identifying inefficiencies and cost overruns within your business. By conducting regular audits, you can uncover areas where your business is overspending or underutilizing resources.

Regular audits allow you to review your financial statements, operations, and procedures to ensure you’re managing your operating costs effectively. They also help you maintain compliance and optimize cost control measures to improve profitability.

5. Adopting just-in-time inventory system:

A just-in-time (JIT) inventory system helps reduce the holding costs associated with storing large quantities of inventory. By ordering stock only as needed for production or sales, you minimize inventory-related expenses and reduce waste.

JIT can also free up cash flow, allowing you to invest in other areas of your business. Efficient inventory management is key to managing operating costs while ensuring product availability.

6. Adopting sustainable energy measures

Implementing sustainable energy solutions, such as solar panels or energy-efficient lighting, can reduce your utility expenses over time. While there may be an initial investment, the long-term savings on electricity bills can significantly lower your operating costs.

Additionally, sustainability measures can enhance your company’s reputation, attract eco-conscious customers, and potentially qualify you for tax incentives, further offsetting operational expenses.

7. Automating repetitive tasks

Automation is a powerful tool for reducing labor costs and improving operational efficiency. By automating repetitive tasks, such as data entry, invoicing, and inventory management, you can save time, reduce human error, and increase productivity.

Whether through specialized software or technology, automation allows you to allocate resources more effectively, cut down on operating costs, and focus on tasks that directly contribute to business growth.

8. Adjust & review pricing

Regularly reviewing and adjusting your pricing strategy helps ensure that your business is adequately covering its operating costs while remaining competitive. If operating costs increase, you may need to raise prices to maintain profitability.

Conversely, if you identify areas where costs can be reduced, you might lower prices to attract more customers. A flexible pricing model is essential to managing operating costs effectively and ensuring consistent cash flow.

9. Conducting cost-benefit analysis

A cost-benefit analysis helps you evaluate the financial impact of different business decisions and strategies. By comparing the costs associated with a project or investment to the expected benefits, you can determine whether the initiative is worth pursuing.

This analysis allows you to make more informed decisions, prioritize cost-effective projects, and ensure that your spending aligns with your business’s long-term financial goals.

10. Outsourcing

Outsourcing non-core functions, such as accounting, IT support, or customer service, can reduce operating costs by leveraging specialized expertise at a lower cost. Instead of hiring full-time employees for these roles, outsourcing allows you to access skilled professionals without the overhead costs associated with in-house staff.

Outsourcing helps your business focus on its core competencies while reducing labor and operational expenses, leading to better cost management.

Relationship between operating costs and profit generation

Understanding the relationship between operating costs and profit generation is essential for maintaining a profitable business. Operating costs directly impact your business’s profitability, and by carefully managing them, you can enhance your financial outcomes.

In this article, we’ll explore how operating costs affect various aspects of your business's profitability and strategies to optimize them for sustainable growth.

Cost structure

Your cost structure plays a critical role in determining your profit margins. Operating costs are an essential part of your cost structure, as they encompass expenses like wages, rent, and utility bills that directly support your business’s day-to-day operations.

By understanding the proportion of fixed versus variable costs in your business, you can assess where to focus your cost-reduction efforts. A well-balanced cost structure enables you to generate profits while keeping operating costs under control.

Net profit calculation

Your net profit calculation is a fundamental financial metric that shows your business's profitability after all costs, including operating costs, have been deducted from revenue. Operating costs impact your bottom line directly higher operating costs reduce the net profit, while lower operating costs improve profitability.

Regularly calculating your net profit allows you to track the efficiency of your cost management strategies and identify areas where you can cut costs or optimize spending for better profitability.

Impact of sales and marketing expenses

Sales and marketing expenses are a part of your operating costs that significantly influence your revenue generation. By carefully managing these expenses, you can maximize return on investment (ROI).

High marketing and sales costs can eat into profits, but when spent efficiently, they help boost sales and attract customers, leading to higher revenues. Balancing these expenses with other operating costs is key to maximizing profitability.

Pricing strategy

Your pricing strategy is intricately linked to operating costs and profit generation. If your operating costs are high, you may need to increase your prices to maintain profitability. On the other hand, if you can lower operating costs, you have more flexibility in adjusting your pricing strategy.

A well-optimized pricing strategy ensures that you cover your operating costs and achieve a desired profit margin. Constantly reviewing your pricing model in relation to your operating costs helps keep your business profitable.

Break-even analysis

Break-even analysis is a tool that helps you understand the point at which your revenue covers your operating costs and you start generating profit. It calculates how many units of a product or service you need to sell to break even, considering your operating costs.

Knowing your break-even point allows you to set sales targets, adjust your operating costs, and determine pricing strategies that lead to profitability. It’s a critical metric for managing your business’s financial health.

Adaptation to market changes

Your ability to adapt to market changes directly influences your operating costs and, consequently, your profit generation. Market fluctuations, such as changes in supply chain costs, labor expenses, or regulatory conditions, can affect your operating costs.

Businesses that are flexible and can adjust to these changes more efficiently are better positioned to maintain or increase profitability. By continuously monitoring and responding to market conditions, you can optimize your operating costs and safeguard your profits.

Sustainable profitability

Sustainable profitability is the long-term goal of managing your operating costs effectively. It’s not just about cutting costs, but about strategically investing in areas that lead to sustained growth and profits.

Managing operating costs while maintaining the quality of your products or services ensures your business remains competitive and profitable in the long term. This balance is essential for the stability and growth of your business.

Scaling capacity

As your business grows, your scaling capacity becomes essential to managing operating costs and generating profits. With increased demand, you may need to scale your operations, which can introduce higher operating costs.

However, effective scaling ensures that these costs are offset by higher sales and more efficient processes. Managing your scaling capacity effectively allows you to generate more profit without proportionally increasing your operating costs, thereby improving overall profitability.

Risk management

Effective risk management is crucial in minimizing the impact of unforeseen events on your operating costs and profits. Operational risks such as supply chain disruptions, regulatory changes, or economic downturns can increase your operating costs.

By implementing strategies to manage these risks, you can prevent unnecessary cost increases and maintain profitability. Proactively managing risks ensures that your operating costs remain manageable and your profits stay stable.

What are the key performance indicators to monitor your operating costs?

Monitoring operating costs is vital for your business’s financial health. Key performance indicators (KPIs) provide insights into cost efficiency and profitability.

These seven KPIs help you track expenses, optimize resources, and make data-driven decisions to ensure sustainable growth.

1. Operating expense ratio

The operating expense ratio (OER) measures your operating costs relative to revenue. Calculate it as:

Operating expense ratio (OER) = Total operating expenses ÷ Net sales

A high OER, say 80%, signals inefficiency, as most revenue covers costs.

For example, if your retail store’s expenses consume too much income, profits suffer. Monitoring OER helps you identify areas to cut costs, ensuring your business maximizes revenue while keeping expenses proportionate and manageable.

2. Cost of Goods Sold (COGS)

Cost of goods sold (COGS) tracks direct costs like materials and labor for producing your products. If you run a bakery, flour and bakers’ wages are COGS. Calculate it by adding beginning inventory to purchases, then subtracting ending inventory.

High COGS reduces margins. Regularly reviewing COGS helps you negotiate better supplier deals or streamline production, ensuring your business maintains profitability without sacrificing product quality.

3. Gross profit margin

Gross profit margin shows how efficiently you produce goods relative to sales.

Calculate it as:

Gross profit margin = (Revenue - COGS) ÷ Revenue × 100

A low margin, like 20%, indicates high production costs. For instance, if your clothing store’s margin drops, material costs may rise.

Monitoring this KPI helps you adjust pricing or reduce COGS, ensuring your business retains enough revenue to cover operating expenses and generate profits.

4. Net profit margin

Net profit margin measures overall profitability after all expenses.

Calculate it as

Net profit margin = (Net Income ÷ Revenue) × 100

A 5% margin means you keep $0.05 per dollar of sales. If your restaurant’s margin shrinks, rising overheads may be the culprit. Tracking this KPI helps you balance operating costs with revenue, ensuring your business remains financially viable and can reinvest profits for growth or weather downturns.

5. Inventory turnover ratio

The inventory turnover ratio indicates how quickly you sell and replace inventory.

Calculate it as

Inventory Turnover Ratio = COGS ÷ Average Inventory

A low ratio, like 2, suggests overstocking or slow sales. If your electronics store holds unsold gadgets, cash is tied up. Monitoring this KPI helps you optimize stock levels, reducing storage costs and waste. Efficient turnover ensures your business meets demand without excess inventory dragging down operating efficiency.

6. Budget variance ratio

The budget variance ratio compares actual spending to your budgeted amounts.

Calculate it as

Budget variance ratio = (Actual Costs - Budgeted Costs) ÷ Budgeted Costs × 100

A 10% positive variance means overspending. If your marketing campaign exceeds budget, investigate why. Tracking this KPI helps you identify cost overruns early, enabling corrective actions. Staying within budget ensures your business allocates resources effectively, maintaining financial discipline across operations.

7. Return on assets

Return on assets (ROA) measures how efficiently you use assets to generate profit.

Calculate it as

Return on assets (ROA) = Net Income ÷ Total Assets × 100

A 10% ROA means $0.10 profit per asset dollar. If your factory’s ROA declines, equipment may be underutilized. Monitoring ROA helps you optimize asset use, reducing unnecessary costs. High ROA indicates your business maximizes resources, enhancing profitability while controlling operating expenses effectively.

Best practices for managing operating costs

Managing operating costs effectively is key to ensuring your business remains profitable and competitive. By adopting best practices, you can streamline your operations, identify cost-saving opportunities, and make better financial decisions.

Here are the best practices that can help you manage your operating costs in business and improve your cost management strategies.

Incentivize employee engagement

To manage your operating costs effectively, you should incentivize employee engagement. Motivated employees tend to be more efficient and can help identify cost-saving opportunities within their departments.

By offering rewards or bonuses for ideas that help reduce waste, improve processes, or optimize resource use, you can create a culture of cost-consciousness that drives overall savings and productivity in your organization.

Monitor your costs regularly

Monitoring your costs regularly is essential to ensure that your operating costs stay within the desired range. Regular assessments allow you to detect rising costs early, identify inefficiencies, and adjust your budget accordingly.

Tracking these costs on a monthly or quarterly basis will help you stay proactive rather than reactive, making it easier to manage and control your finances.

Renegotiate with vendors & suppliers

One of the most effective ways to lower your operating costs is to renegotiate with vendors and suppliers. Regularly review your contracts and look for opportunities to negotiate better terms, discounts, or more favorable payment schedules.

Building strong, long-term relationships with suppliers can lead to mutually beneficial arrangements, ultimately lowering your operating costs while maintaining the quality of goods and services.

Prioritize expenses based on contribution

When managing operating costs, it’s important to prioritize expenses based on their contribution to your overall business objectives. Identify which costs are essential to driving revenue and growth, and which ones can be reduced or eliminated without negatively impacting your operations.

By focusing on high-priority expenses, you ensure that every dollar spent contributes to your business's success.

Encourage cross-departmental collaboration

It is a smart strategy to help manage operating costs. When departments collaborate, they can share resources, reduce duplication of efforts, and find innovative solutions for cost management.

For example, the marketing and sales teams can work together to optimize spending on campaigns, while HR and finance can collaborate on reducing employee turnover, which can significantly reduce recruiting and training costs.

Set up an expense management system

An expense management system is crucial for tracking and controlling your operating costs. By setting up an organized system, you can better monitor spending, ensure compliance with budgets, and streamline approval workflows.

This system will help prevent overspending, reduce administrative tasks, and give you greater visibility over your company’s financial health.

Incorporate real-time monitoring tools

Incorporating real-time monitoring tools is essential for effectively managing operating costs. These tools allow you to track expenses as they occur, giving you immediate insights into how money is being spent.

With real-time data, you can quickly address any issues or discrepancies and ensure that your spending aligns with your business objectives. By having access to up-to-the-minute financial data, you can make more informed decisions and take timely corrective actions.

Develop a detailed budget

A detailed budget is a fundamental tool for managing operating costs. It allows you to plan for future expenses, set realistic financial targets, and allocate resources effectively. Make sure your budget accounts for all operating expenses, including fixed and variable costs, and regularly update it as business conditions change.

Having a comprehensive budget in place will help you stay on track and avoid unnecessary expenditures.

Review & revise budgets periodically

It’s important to review and revise your budgets periodically to ensure that they reflect the current state of your business and the market. As your business evolves, so should your financial plans.

Regular budget reviews allow you to adjust for changes in income, inflation, or unexpected costs, helping you keep your operating costs under control. Budget revisions also help identify areas where you might be overspending and where you can cut costs.

Conduct industry benchmarking

It is a powerful way to assess your operating costs relative to your competitors. By comparing your cost structure with industry standards, you can identify areas where you may be overspending or where you can be more efficient.

Benchmarking provides valuable insights into cost-saving opportunities and can help you adjust your pricing, supplier relationships, and operational strategies to remain competitive in the marketplace.

Ensure an in-depth understanding of your costs

To effectively manage your operating costs, you must have an in-depth understanding of your costs. Familiarize yourself with every line item in your financial reports, from fixed and variable costs to hidden expenses.

Regularly analyzing your cost breakdowns helps you spot inefficiencies, identify high-cost areas, and make informed decisions on cost reduction. Understanding the full scope of your costs will empower you to manage them proactively and optimize your business operations.

Monitor essential KPIs

It is critical for tracking your cost management efforts and evaluating their impact on profitability. KPIs related to operating costs, such as cost per unit, labor cost ratio, or cost of goods sold (COGS), help you keep a close eye on the efficiency of your operations.

By regularly monitoring these KPIs, you can spot trends, assess performance, and adjust strategies to ensure cost efficiency.

Technological advancements in managing your operating costs

Leveraging technology is essential for managing your operating costs efficiently. From data analytics to expense management software, these advancements streamline processes and enhance decision-making.

Adopting these tools helps you optimize resources and boost your business’s financial performance.

Data analytics

Data analytics tools help you monitor and reduce operating costs by analyzing spending patterns. Platforms like Tableau or Power BI identify inefficiencies, such as high utility expenses in your office. Predictive analytics forecasts future costs, aiding budgeting.

By visualizing cost drivers, you can make informed decisions, like renegotiating supplier contracts. Implementing analytics ensures you uncover hidden savings, keeping your business competitive while maintaining control over operational expenses.

Cloud computing

Cloud computing cuts operating costs by replacing expensive on-site servers with scalable solutions like AWS or Google Cloud. If you run a retail business, cloud-based inventory systems reduce IT maintenance costs.

Pay-as-you-go models align expenses with usage, avoiding overinvestment. Enhanced collaboration through cloud tools boosts efficiency. Adopting cloud computing ensures your business saves on infrastructure while staying agile and prepared for growth without hefty upfront costs.

Corporate cards

Corporate cards streamline expense tracking and control operating costs. Cards like Brex or Amex offer real-time spending visibility, preventing budget overruns. If your sales team travels, cards categorize expenses automatically, simplifying reconciliation.

Rewards programs offset costs through cashback or discounts. Setting spending limits ensures compliance with budgets. Using corporate cards enhances financial oversight, helping your business manage cash flow and reduce administrative overhead effectively.

Expense management software

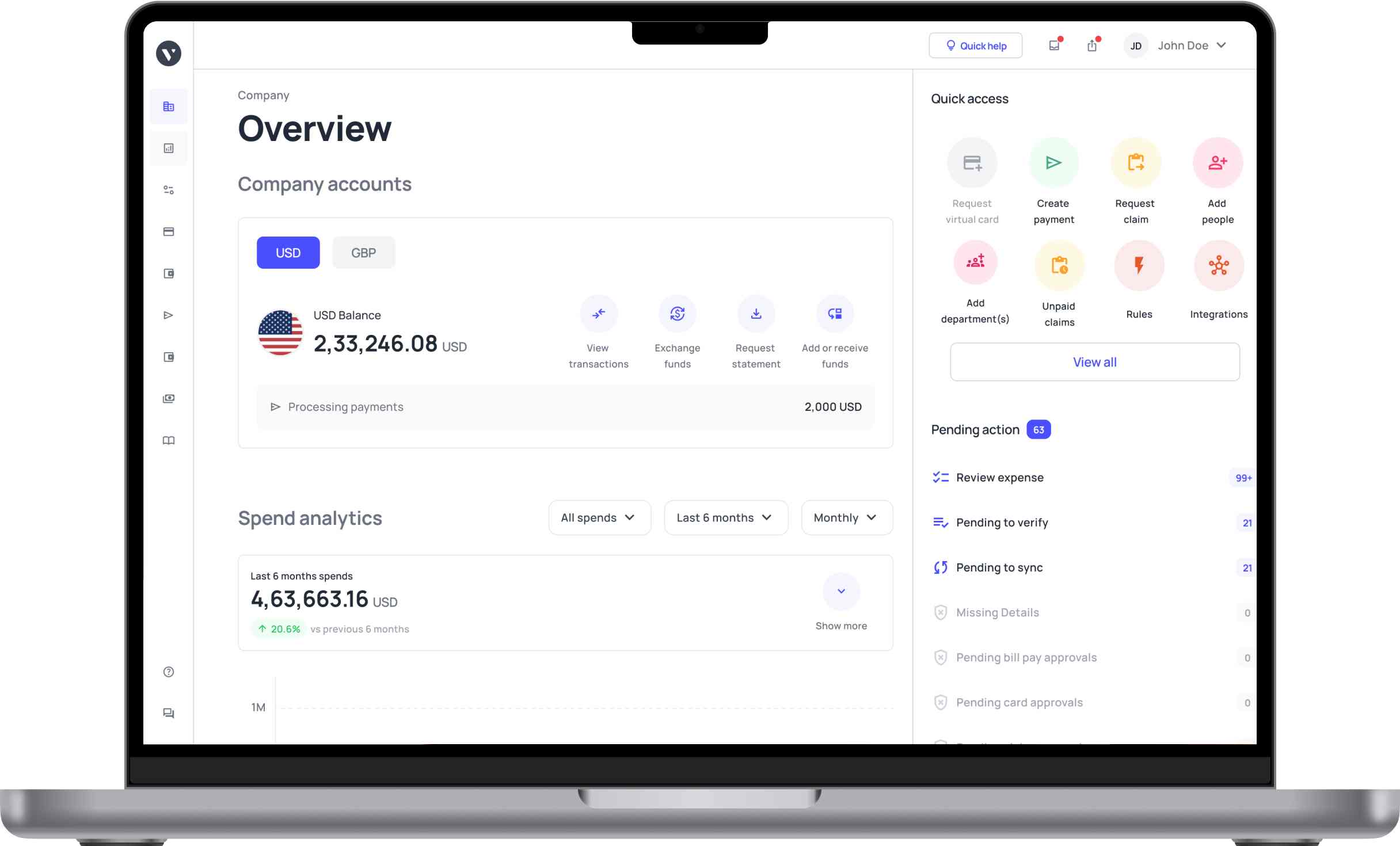

Expense management software, like Volopay, automates cost tracking for your business. It digitizes receipts, categorizes spending, and flags policy violations. For example, if your marketing team overspends on ads, the software alerts you instantly.

Integration with accounting systems reduces manual errors. By streamlining expense reporting, you save time and gain insights into cost trends, ensuring your business maintains tight control over operating expenses.

How does an expense management software help in managing your operating costs?

Expense management software is a powerful tool for controlling your operating costs. By automating tracking and providing insights, it streamlines expense oversight.

These five features help you monitor spending, ensure compliance, and optimize financial efficiency.

1. Employee spending reports in real time

Expense management software provides real-time employee spending reports, giving you instant visibility into costs. If your sales team incurs travel expenses, tools like Volopay track transactions as they happen.

This allows you to spot overspending immediately, such as unauthorized dining costs. Real-time data helps you address issues before they escalate, ensuring your business stays within budget and maintains tight control over operational expenses without delays.

2. Dashboards for a broad view of costs

A centralized dashboard offers a broad view of your business’s costs, consolidating expenses across departments. Platforms display spending categories, like utilities or marketing, in one interface. If your office’s utility costs spike, the dashboard highlights it.

This holistic perspective helps you identify trends and allocate resources effectively, ensuring you manage operating costs proactively while keeping your financial strategy aligned with business goals.

3. Analytics and insights into spending

Analytics in expense management software uncovers spending patterns and cost-saving opportunities. For instance, analytics might reveal excessive software subscriptions in your IT department. By identifying high-cost areas, you can renegotiate contracts or eliminate redundancies.

Predictive insights forecast future expenses, aiding budgeting. Leveraging these analytics ensures you make data-driven decisions, optimizing operating costs while maintaining the efficiency and competitiveness of your business.

4. Automated reporting of costs

Automated reporting eliminates manual expense tracking, saving time and reducing errors. Software generates detailed cost reports, categorizing expenses like travel or supplies. If your marketing team submits receipts, automation organizes them instantly.

These reports integrate with accounting systems, streamlining reconciliations. By automating cost reporting, you gain accurate insights into operating expenses, allowing you to focus on strategic decisions rather than administrative tasks.

5. Compliance with spend policies