Non-operating expenses: Definition, examples & how to calculate it

Understanding business expenses is crucial for accurate financial reporting. One essential category often overlooked is non operating expenses in accounting. These costs are not tied to your company’s core business operations and typically arise from incidental or irregular activities.

Unlike operating expenses, which reflect everyday business functions, non-operating expenses stem from financing or one-time events, such as interest payments or losses from asset sales.

Identifying and separating these expenses helps you evaluate your true operating performance and gain a clearer picture of profitability. In this guide, we’ll break down what non-operating expenses are, how they differ from others, and why they matter.

What are non-operating expenses in accounting?

Non operating expenses in accounting refer to costs that are not directly related to a company’s core operational activities. These are expenses that occur outside regular business functions and are usually reported separately on the income statement to give a clear picture of operational profitability.

Common examples include interest expenses on borrowed funds, losses from selling long-term assets, foreign exchange losses, and legal settlement costs. These expenses don't impact day-to-day business operations but can significantly affect net income.

By isolating non-operating expenses, businesses can assess their operational efficiency and make informed financial decisions. Investors and analysts also rely on this distinction to accurately evaluate company performance and potential profitability over time.

Why do you need an in-depth understanding of non-operating expenses?

Understanding non operating expenses in accounting is helpful when analyzing your business's real financial health.

It differentiates operational spending from incidental loss, enabling improved planning, performance analysis, and decision-making across multiple financial parameters like profitability, taxation, and investment planning.

1. Financial analysis

In finance, the separation of operating and non operating expenses during financial analysis prevents you from misinterpreting your company's core profitability. These expenses, often consisting of one-off losses or interest charges, can distort financial ratios if not separated.

Separating them, you can have a better sense of actual operating margins, EBITDA, and performance trends, leading to improved investment and management decisions. Analysts significantly rely on this clarity while analyzing a company's long-term financial sustainability.

2. Strategic investment decisions

Strategic decisions like expansion, mergers, or acquisitions require proper comprehension of your firm's operating efficiency. Failure to correct non-operating expenses (example: restructuring costs or legal settlements) in decision-making will lead to improper forecasts.

CFOs and investors project core profitability separately to decide if your firm's operating earnings justify new investments. Hence, knowing how to account for non-operating items has a direct impact on the accuracy of long-term planning and investment feasibility.

3. Key performance metrics

Operating margin, net margin, and return on assets (ROA) are affected by non-core expenses. For example, if you count foreign exchange losses when calculating profit margins, it results in a skewed outcome.

Having the capability to study non operating expenses in accounting entails that you can put anomalies behind and quantify actual performance. The ease improves in-house benchmarking and helps depict your company's value and performance accurately to investors and stakeholders.

4. Tax implications

Accurate classifying and accounting for non operating expenses play a significant role in proper filing for taxes. Non-operating elements like interest expenses, which are potentially deductible, still hold ambiguity to be deductible among them. Misclassifying them results in either paying in excess or non-compliance.

Knowledge regarding what is acceptable based on the proper formula for non operating expenses mitigates regulations and following these rules, while achieving maximum tax efficacy helps reduce exposure to financial risk as well as punitive legal enforcement.

5. Cost management

Accounting separation of non operating costs gives a more accurate perspective regarding controllable vs. uncontrollable expenses. Even though you may not reduce every non-operating expense, understanding them is valuable for long-run cost planning.

For example, the identification of a persistent non operating expense, illustration as high-interest debt, reflects the need to refinance or better manage the capital structure. This preventive measure can significantly save unnecessary spending over the long term.

6. Risk management

A deep understanding of non operating expenses in accounting is essential to effective risk management. Non operating expenses like judgment settlements or write-downs of assets can be signs of underlying issues.

By closely monitoring non operating expenses example, data regularly, you can identify recurring patterns that indicate financial vulnerabilities. This advanced insight allows your business to take corrective action early on, reduce exposure to financial disruption, and build a better, strategically sound foundation for future resilience and growth.

7. Comparative analysis

Sound comparative analysis requires eliminating distortions created by non-operating expenses in financial reporting. A one-time non-operating expense event, such as a loss due to a natural disaster, distorts performance metrics if not addressed.

By normalizing financials across peers using an identical non-operating expenses formula, those distortions are removed, and you can be sure you're making sound comparisons.

It aids in making higher-quality benchmarking, and your case is more strongly supported when conducting competitive analyses, strategic planning, and investor presentations with clean, comparable data.

What are the types of non-operating expenses?

Non operating expenses represent costs not related to core business activities. These include irregular, one-time, or indirect expenses that must be tracked separately.

Understanding each type is crucial for applying the correct non operating expenses formula and maintaining accurate financial analysis.

1. Interest payments

Interest payments are a common example. They result from borrowed capital—such as loans or credit lines—and don’t reflect core operational efficiency. Though recurring, interest doesn’t stem from primary business activities.

As part of non operating expenses in accounting, these payments are excluded from operating profit calculations using the non operating expenses formula, allowing for better visibility into true operating margins and overall financial health.

2. Losses on investments

Investment losses occur when businesses sell securities or financial assets below their purchase price. Such losses are treated as non operating expenses in accounting since they are not tied to daily operations.

A typical example includes equity losses from depreciating stock values. These should be isolated using the non operating expenses formulato ensure clarity in profitability assessment and to avoid overstating operational inefficiencies.

3. Foreign exchange losses

Currency fluctuations can lead to foreign exchange losses, especially for companies engaged in international transactions. These are classified under non non operating expenses in accounting, as they are driven by external economic factors rather than internal operations.

For instance, a loss from converting euros to rupees at a lower rate is a non operating expenses example. Apply the non operating expenses formula to adjust financials and maintain consistency across reporting periods.

4. Losses on sales or write-off of assets

Selling business assets below book value or writing them off due to obsolescence creates a example. These losses are unrelated to day-to-day operations and reflect poor asset utilization or unexpected depreciation.

As per non operating expenses in accounting guidelines, such losses are excluded from operating profit. Use the formula to isolate and analyze their impact separately for better performance and asset management insights.

5. Restructuring costs

Expenses incurred during business restructuring—such as layoffs, relocation, or asset reallocation—are non operating expenses in accounting. These are typically one-time costs and don’t recur with normal operations.

A common non operating expenses example includes severance pay during downsizing. Applying the non operating expenses formula helps ensure these costs don’t distort operating profit metrics, enabling accurate financial planning and forecasting during organizational changes.

6. Legal & lawsuit settlements

Legal expenses and settlement payouts from lawsuits can heavily impact financials. As they arise from legal disputes rather than routine operations, they are treated as non operating expenses in accounting.

For instance, a large out-of-court settlement is a notable example. Using the formula ensures these irregular costs are isolated for clearer operational performance evaluations and legal risk assessments.

7. Losses from natural disasters

Events like floods or earthquakes can damage assets, resulting in losses that fall under non operating expenses in accounting. Since such events are rare and uncontrollable, they are excluded from operating costs.

A factory fire causing equipment loss is a prime example. Apply the formula to distinguish these losses from recurring operational inefficiencies, aiding insurance claims and financial planning for future contingencies.

8. Inventory write-offs

Inventory write-offs occur when stock becomes obsolete, damaged, or unsellable. This loss doesn’t stem from regular sales operations and is thus classified under non operating expenses in accounting.

A batch of expired products being discarded is a valid example. Use the non operating expenses formula to separate this cost, allowing finance teams to better assess stock management effectiveness and minimize future inventory risks.

9. Charitable contributions

Donations to charities or nonprofit organizations are a common non operating expenses example. While they can support corporate social responsibility goals, they are not part of core operations. As a result, charitable contributions are categorized as non operating expenses in accounting.

Applying the non operating expenses formula ensures these discretionary costs are not mistaken for routine business expenses, improving transparency and helping stakeholders understand true operational performance.

Steps to calculate non-operating expenses

Calculating non-operating expenses in accounting ensures financial transparency and strategic decision-making. By isolating these costs, you can better understand operational efficiency.

Use the non-operating expenses formula and identify relevant non-operating expenses, example, items to analyze overall financial performance accurately.

1. Identify your expense categories

Start by listing all your business expenses. Categorize them into operating and non operating expenses in accounting. Operating expenses include costs directly tied to daily activities, while non-operating ones relate to interest, write-offs, or investment losses.

Identifying these categories helps ensure proper classification. A clear understanding enables the effective use of the non operating expenses formula and sets a solid foundation for excluding irregular items from operational metrics.

2. Gather financial statements

To use the non-operating expenses formula accurately, gather all relevant financial documents such as income statements, balance sheets, and cash flow statements. These reports will contain example items like interest charges or legal settlements.

Consolidating this data is critical for identifying inconsistencies or unexpected entries. Reviewing financials thoroughly ensures precise tracking of non-operating expenses in accounting and provides the basis for transparent reporting and performance review.

3. Identify your non-operating expenses

Next, pinpoint which costs fall under non-operating expenses in accounting. These may include foreign exchange losses, interest on loans, or asset write-offs. Use previous entries or patterns to find non-operating expenses (example: costs in your reports).

Accurately labeling these items prevents them from skewing operating profit assessments. This step is critical in applying the non-operating expenses formula and preserving the integrity of your financial evaluation process.

4. Calculate total non-operating expenses

Once identified, total your non-operating expenses in accounting by summing each line item. Include only those that fall outside routine operations, such as lawsuit settlements or investment losses. Avoid mixing them with core operating expenses.

A properly calculated total ensures accurate use of the non-operating expenses formula, allowing financial teams to isolate irregularities and assess business performance without distortion from one-time or non-core financial activities.

Formula:

Non-Operating Expenses Formula: Total Non-Operating Expenses = Interest Payments + Asset Write-Offs + Investment Losses + Legal Settlements + Other Irregular Costs

This non-operating expenses formula helps quantify the impact of indirect and extraordinary costs. Use it to subtract from total expenses when analyzing operating efficiency.

5. Analyze the results

After applying the non-operating expenses formula, analyze how these expenses affect overall profitability. For example, compare earnings before and after excluding non-operating costs. A large deviation may indicate frequent irregular costs or one-time hits.

Recognizing such patterns helps optimize future strategies. Reviewing non-operating expenses in accounting also improves forecasting accuracy and ensures your profit margins reflect genuine operational performance, not skewed by exceptional, non-recurring financial activities.

6. Measure key performance indicators

Evaluating key performance indicators (KPIs) like operating margin or EBITDA requires accurate identification of non-operating expenses in accounting. By separating them, you ensure operational KPIs remain undistorted.

For instance, excluding an example like restructuring costs gives a clearer view of actual efficiency. Applying the non-operating expenses formula ensures better benchmarking and highlights core strengths, aiding strategic improvements and stakeholder reporting.

7. Review and adjust accordingly

Regularly review your non-operating expenses in accounting and update classifications based on changing business activities. A new loan might introduce recurring interest, or an asset disposal could affect expense trends.

Use each non-operating expense to refine forecasts and budgets. Apply the formula periodically to maintain financial clarity and ensure stakeholders get a consistent, reliable view of performance, stripped of irregular or one-time disruptions.

How to calculate non-operating expenses?

To calculate non-operating expenses in accounting, begin by examining your income statement. Look for costs unrelated to core business operations—such as interest payments, foreign exchange losses, asset write-offs, or legal settlements.

Use the non-operating expenses formula:

Total Non-Operating Expenses = Sum of All Non-Operating Costs Identified

For a non-operating expenses example, let’s say your business incurred $4,000 in interest, $2,000 in foreign exchange losses, and $1,500 in legal settlement costs during the year. Adding these, your total non-operating expenses would be $7,500.

Accurately using the formula helps you separate recurring operating costs from incidental financial events. This ensures better financial clarity, performance tracking, and informed strategic planning for long-term growth and stability.

Significance of non-operating expenses for a business

Understanding non-operating expenses in accounting is crucial for painting an accurate financial picture. Isolating these costs ensures that operational efficiency is measured correctly, risk factors are identified early, and strategic financial decisions are made with greater confidence and transparency.

1. Clear stakeholder communication

Clear identification of non-operating expenses in accounting strengthens stakeholder confidence. Investors and board members need visibility into one-time or irregular expenses like asset sales, losses, or lawsuit settlements.

Using the non-operating expenses formula helps present cleaner operational reports by excluding these unpredictable costs. Offering an example during presentations—such as a foreign exchange loss—makes financial reporting more understandable and keeps stakeholders informed about the real drivers of business performance.

2. Increased transparency

Accurately recording non-operating expenses promotes transparency across your financial statements. By using the formula, businesses can easily separate operational performance from incidental financial impacts.

A common example, like a restructuring cos,t is critical to report distinctly. This transparency aids in building trust with investors, regulators, and partners while preventing misconceptions about core profitability and ensuring a more honest portrayal of your company's financial health.

3. Detailed financial reporting

Detailed financial reporting requires breaking down costs between operating and non-operating expenses in accounting. Applying the formula ensures that entries like investment losses or natural disaster impacts are properly categorized.

A detailed non-operating expenses example clarifies how these costs affect profit margins. This breakdown makes financial reports more comprehensive, assists auditors, and supports management in identifying areas for operational improvement, separate from non-controllable external events.

4. Improved cost control

Understanding non-operating expenses in accounting enables better cost control strategies. Identifying recurring non-operational costs, such as frequent settlement payouts, allows businesses to tackle root causes early.

Applying the formula consistently helps track these costs over time. Analyzing an example like frequent inventory write-offs, can highlight systemic inefficiencies, enabling leadership to develop corrective measures, renegotiate terms, or tighten operational procedures to curb unnecessary financial leaks.

5. Profitability assessment

Profitability assessment becomes more accurate by excluding non-operational costs through the formula. Non-operating expenses in accounting, like lawsuit settlements or losses on asset sales, can distort operating margins if not treated separately.

A clear example, such as interest payments, gives financial analysts the insight needed to adjust profitability figures accordingly. This adjusted view provides a more honest reflection of the core business performance and future earning potential.

6. Cash flow management

Managing cash flow effectively depends on understanding how non-operating expenses in accounting influence liquidity. Sudden expenses, like legal settlements, can disrupt cash reserves. Applying the non-operating expenses formula allows you to predict, allocate, and reserve cash for unexpected costs.

For instance, restructuring payouts helps forecast cash requirements more accurately, ensuring operational funds remain unaffected and long-term liquidity planning stays on track.

7. Investment decision making

Strategic investment decisions hinge on isolating non-operating expenses in accounting. Investors seek businesses with predictable operating earnings. Utilizing the non-operating expenses formula helps present normalized earnings by excluding irregular costs.

An example, such as a one-time foreign exchange loss, can be explained to highlight true operational efficiency. This clarity not only attracts investors but also strengthens internal investment strategies by focusing on consistent, recurring business performance metrics.

8. Improved comparative analysis

Improved comparative analysis across competitors depends on properly excluding non-operating expenses in accounting. Different companies may incur varying non-operational costs, like one-time write-offs or lawsuit settlements.

Standardizing comparisons with the non-operating expenses ensures consistency. Presenting a non-operating expenses example for context helps analysts compare operational strength fairly. This objectivity enables smarter competitive positioning and better decision-making when entering new markets or evaluating mergers and acquisitions.

Why do you need to monitor & manage your non-operating expenses?

Monitoring and managing non-operating expenses in accounting is crucial for building a financially sound and transparent business.

Isolating these irregular costs ensures accurate financial reporting, reduces the risk of errors, and supports better strategic, operational, and compliance-related decision-making.

Helps understand financial performance

Non-operating expenses in accounting provide key insights into the financial performance of a business beyond core operations. Expenses such as foreign exchange losses or legal settlements can distort bottom-line results if left unchecked.

By applying the formula, businesses can isolate these anomalies. A common example, like asset write-offs, highlights areas where performance may appear weaker than it truly is, offering a clearer picture of profitability and operational efficiency.

Improved budgeting & forecasting

Accurately identifying non-operating expenses helps refine budgeting and forecasting models. Applying the non-operating expenses formula lets businesses remove irregularities from trend analysis.

For instance, a non-operating expenses example such as a lawsuit settlement, should not influence next year’s operational budget. By distinguishing between recurring operational costs and one-time expenses, financial teams can better allocate resources and improve the overall accuracy of financial projections for the upcoming fiscal year.

Improved scaling capacity

Scalability depends on a clear understanding of both operational and non-operational costs. Monitoring non-operating expenses in accounting ensures that unexpected losses—such as restructuring charges—don’t derail growth plans.

Using the non-operating expenses formula provides visibility into what truly drives long-term profitability. A relevant non-operating expenses example, like foreign exchange loss from international expansion, allows businesses to adjust scaling strategies while minimizing financial surprises as the business grows.

Decreased financial risk

Consistent tracking of non-operating expenses in accounting can expose financial vulnerabilities early. Unexpected investment losses or asset impairments, when caught through the formula, help forecast risk zones.

A recurring example, like frequent write-offs, may signal deeper structural problems. Addressing these ensures proactive financial adjustments and keeps your business agile in the face of market volatility or regulatory changes.

Reduced risk of tax misconduct

Incorrectly classifying non-operating expenses in accounting can trigger compliance issues or audits. Using the correct non-operating expenses formula to differentiate non-deductible items ensures tax filings remain compliant.

A non-operating expenses example, such as a one-time penalty, must be reported separately. Monitoring these costs reduces misreporting, enables accurate deductions, and ensures that tax strategy aligns with legal standards, protecting your business from financial and reputational damage.

Reduced risk of distorted profitability analysis

Including non-operating expenses in accounting for operating margins can skew profitability assessments. These expenses need to be excluded using the non-operating expenses formula for clean, comparable insights.

A clear non-operating expenses example, like a sudden investment loss, should not diminish the perceived strength of core operations. By monitoring these entries, companies ensure accurate performance reviews and guard against making strategic decisions based on distorted financial interpretations.

Impact on investment decision

Investors analyze non-operating expenses in accounting to evaluate earnings quality. Isolating these costs via the non-operating expenses formula presents a normalized earnings view. A transparent non-operating expenses example, such as a one-time restructuring charge, shows investors that such costs won’t recur.

This builds trust, encourages long-term capital commitments, and reinforces confidence in your leadership’s ability to maintain consistent operational profitability.

Improved budgeting accuracy

Budgeting becomes more precise when non-operating expenses in accounting are tracked properly. These expenses are not part of regular operations and should be filtered out using the formula.

A frequent example—like inventory write-offs—helps businesses adjust future safety stock levels without inflating budget assumptions. Managing these expenses ensures more consistent planning, better cash allocation, and improved alignment between strategic goals and financial execution.

Steps to manage the non-operating expenses of your business

Effective management of non-operating expenses in accounting is critical to maintaining financial stability. By following structured steps like cost analysis, stakeholder involvement, and ongoing adjustments, businesses can minimize unnecessary financial drains and ensure these expenses do not obscure true operational performance or profitability over time.

1. Conduct cost analysis

Begin by conducting a thorough cost analysis to understand where your money is going. Isolating non-operating expenses in accounting from operational ones is crucial. By applying the formula, you can separate routine costs from irregular items.

A typical non-operating expenses example to consider during this phase would be losses from asset disposals. A complete overview of your expenses ensures a strong foundation for further analysis and management strategies.

2. Identify your non-operating expenses

The next step involves identifying all non-operating expenses. Scrutinize financial records to find irregular or one-time expenses, such as legal settlements, foreign exchange losses, or restructuring costs.

The non-operating expenses formula will help you filter these entries systematically. For instance, a non-operating expenses example might include losses from discontinued operations, helping you keep operational metrics clean and transparent for better future comparisons.

3. Involve key stakeholders

Managing non-operating expenses requires input from key stakeholders, including finance, operations, and executive teams. Applying the formula correctly often depends on a collaborative understanding of all financial movements.

A stakeholder might flag a non-operating expenses example, such as a large donation or settlement, that others miss. Engaging a cross-functional team improves accuracy and creates a unified strategy for cost control.

4. Conduct expense estimation

Accurately estimating future non-operating expenses in accounting ensures better planning and resource allocation. Use historical data and the non-operating expenses formula to project possible future costs.

For example, if an example shows recurring small legal fees, you can estimate an annual buffer. Anticipating irregular costs prevents major surprises, allowing smoother cash flow management and improved readiness for unforeseen financial events.

5. Develop a budget

Once you have identified and estimated your non-operating expenses in accounting, create a separate budget category for them. Use insights from the non-operating expenses formula to allocate funds wisely.

For example, if past examples highlight occasional investment losses, budgeting accordingly shields core operational budgets. Clear separation ensures that unexpected expenses don’t derail operational plans or affect critical business initiatives.

6. Set up a cost control strategy

To better control non-operating expenses in accounting, implement proactive cost management strategies. This involves periodic review, approval thresholds for major expenditures, and monitoring via the formula.

A non-operating expenses example, like frequent asset write-offs, can be minimized through stricter asset management. Preventive controls and clear governance reduce both the frequency and impact of unexpected costs on financial statements.

7. Perform variance analysis

Variance analysis helps businesses spot discrepancies between expected and actual non-operating expenses in accounting. Compare estimated figures with real-world results using the non-operating expenses formula.

If a planned $50,000 for lawsuit settlements turns into $120,000, review that variance carefully. Investigating each example strengthens accountability and guides adjustments to forecasting methods, keeping financial reporting sharp and reliable.

8. Implement corrective actions

When variance or unexpected patterns emerge in non-operating expenses in accounting, it’s essential to implement corrective measures. Use the non-operating expenses formula to identify where cost overruns occur.

For example, if an example reveals repeated foreign exchange losses, setting up hedging strategies may be a solution. Proactive adjustments maintain financial stability and reinforce effective management of non-operating costs across the business.

9. Evaluate & communicate to employees

Evaluating and sharing findings about non operating expenses in accounting with employees builds transparency and accountability. Use the formula to present clear insights and foster cost-conscious behavior.

Sharing a relevant non-operating expenses example, such as asset write-offs, helps employees recognize areas of improvement. This approach cultivates financial ownership across teams, making efficient expense management a collective responsibility and encouraging proactive action to reduce non-operating costs.

10. Review and adjust accordingly

Regularly review and refine your strategy for managing non operating expenses in accounting. Leverage insights from the non operating expenses formula and real non-operating expenses example patterns to identify shifts or inefficiencies.

Adapting your approach ensures alignment with current business realities. This ongoing process strengthens cost control, enhances accuracy in financial reporting, and prepares your business to handle future non-operating expenses more strategically and sustainably.

Choose Volopay for seamless expense tracking

Non-operating expenses vs. capital expenses

Understanding the distinction between non operating expenses in accounting and capital expenses is crucial for accurate financial reporting and strategic decision-making. While both impact a company's financial statements, they differ in nature, treatment, and implications, necessitating clear differentiation for effective financial management.

1. Definition

Non-operating costs

Non-operating expenses in accounting refer to costs that are not tied to a company's day-to-day operations. These include interest payments, currency losses, and asset write-downs. They are reported separately to give an accurate picture of operating income.

The non-operating expenses formula helps classify and track these figures consistently, improving the clarity of financial performance reports.

Capital expenses

Capital expenses, or CapEx, refer to funds used by a company to acquire, upgrade, or maintain long-term physical assets like property, equipment, or infrastructure. These are investments made to improve or extend the productive life of the asset.

Unlike non-operating costs, capital expenses are capitalized and depreciated over time rather than being fully expensed immediately.

2. Components

Non-operating costs

Common components of non operating expenses in accounting include interest payments on loans, foreign exchange losses due to currency fluctuations, restructuring costs, one-time lawsuit settlements, and losses from the sale of long-term assets.

These costs are not part of a company's core operations but still influence the overall financial outcome and should be monitored regularly.

Capital expenses

Capital expenses typically include purchases of property, buildings, heavy machinery, vehicles, and large-scale technological systems. These assets support production, services, or business expansion over multiple accounting periods.

Additional components may include costs associated with upgrading existing assets or acquiring intangible assets such as patents or licenses, which contribute to long-term value creation.

3. Nature

Non-operating costs

The nature of non operating expenses in accounting is generally unpredictable, irregular, and external to routine business activities. These expenses are usually reactive, arising due to market shifts, legal issues, or financial adjustments.

Their volatility makes them important indicators for risk assessment and financial health, despite not being directly linked to productivity or sales.

Capital expenses

Capital expenses are proactive and planned in nature, forming a core part of a company’s growth and infrastructure development strategies. They represent long-term investments aimed at improving operational capabilities or expanding business capacity.

Their nature is strategic and often part of multi-year budgets, subject to asset capitalization and depreciation rules in accounting.

4. Direct relation to production

Non-operating costs

Non-operating expenses have no direct connection to production or day-to-day operations. For example, interest expenses are related to financing, not manufacturing.

A non-operating expenses example is a legal settlement cost incurred after a lawsuit, which doesn’t influence the company’s product creation or service delivery but still affects the bottom line.

Capital expenses

Capital expenses are directly or indirectly connected to production since they often involve purchasing or maintaining physical assets used in operations. For instance, buying new machinery directly boosts production capacity.

Even intangible CapEx like software upgrades supports operational efficiency. Thus, capital expenses contribute tangibly to the production ecosystem and future business output.

5. Impact on financial statement

Non-operating costs

Non-operating expenses in accounting appear on the income statement below the operating income line, affecting the company’s net income but not its gross or operating profits.

Since they are irregular, they are often excluded in adjusted earnings analysis. This presentation helps stakeholders differentiate between core business profitability and peripheral or extraordinary costs.

Capital expenses

Capital expenses are recorded on the balance sheet as assets, not immediately expensed on the income statement. They appear as long-term investments and are gradually depreciated or amortized.

This treatment reflects their enduring value to the business. Depreciation or amortization portions, however, do impact income statements in subsequent accounting periods.

6. Accounting treatment

Non-operating costs

Non-operating expenses are recorded in the same period they’re incurred. They are deducted from income directly and don’t undergo depreciation. Using the non operating expenses formula, businesses subtract operating expenses from total expenses to identify these costs.

This immediate treatment affects net profit and is key to clear financial performance reporting.

Capital expenses

Capital expenses are capitalized and not fully expensed in the current period. Instead, they are recorded as assets and depreciated or amortized over time. This accounting treatment aligns with the matching principle, ensuring costs are recognized in the same periods as the revenues they help generate.

Proper classification supports tax compliance and strategic budgeting.

7. Strategic importance

Non-operating costs

Non-operating expenses in accounting provide insight into areas of risk, such as financing costs or unexpected losses. While they don’t affect core operations directly, they influence net income and investor perception.

Monitoring these expenses helps companies mitigate financial risks, maintain transparency, and make better decisions regarding external factors impacting profitability and cash flow.

Capital expenses

Capital expenses are essential for long-term strategic planning and growth. They represent investments in innovation, capacity, and competitive positioning. High CapEx usually indicates expansion or modernization.

Investors often review capital expenditure trends to assess future potential. Effective CapEx planning ensures resource optimization and helps businesses achieve scalability and operational efficiency over time.

8. Influence on pricing

Non-operating costs

Although not directly used in pricing strategies, non-operating expenses affect overall profitability, which may indirectly influence pricing decisions. If a business incurs significant interest or legal costs, it might raise prices to offset reduced margins.

Still, these expenses are generally excluded from cost-based pricing calculations since they don’t impact production or service delivery.

Capital expenses

Capital expenses influence pricing through their long-term effect on production efficiency and overheads. For instance, new equipment may reduce unit costs, allowing competitive pricing.

Conversely, high CapEx may lead to pricing adjustments to recover investment costs. Businesses must assess how capital spending affects profitability to strike a balance between affordability and return on investment.

9. Example

Non-operating costs

A non operating expenses example is a company paying $100,000 in interest and incurring a $50,000 foreign exchange loss. These don’t result from operational activities like sales or production.

Instead, they arise from financing and market conditions. These costs reduce net income but don’t reflect the company's core operational performance or efficiency.

Capital expenses

Suppose a company purchases factory equipment for $300,000 and a delivery truck for $100,000. These are capital expenses as they’ll be used over several years.

Instead of expensing the full amount immediately, the business depreciates these assets annually. This allows a more accurate representation of profit and asset usage over time in financial statements.

Operating expenses and non-operating expenses : What’s the difference?

Operating expenses are the day-to-day costs required to run core business operations, such as salaries, rent, utilities, and administrative expenses. These are essential to keep the business functional and directly tied to revenue generation.

Non-operating expenses in accounting refer to costs not related to primary business activities. They include interest payments, losses from asset sales, and lawsuit settlements. These are typically irregular and reported separately on the income statement.

For instance, paying employee wages is an operating expense, while paying interest on a business loan is an non-operating expense. It's vital to differentiate between the two to analyze operational efficiency and overall financial health.

The non-operating expenses formula generally isolates these costs by subtracting operating expenses from total expenses, allowing clearer insight into core profitability and non-core financial impact.

Why should you separate non-operating expenses from operating expenses?

Separating non operating expenses from operating expenses is essential in financial reporting to ensure clarity, transparency, and accuracy in evaluating a company’s performance. Operating expenses are directly tied to the core functions of the business, such as manufacturing, administration, and sales.

These reflect the day-to-day cost of running the business. In contrast, non operating expenses in accounting include costs that arise from activities not directly related to the main revenue-generating operations—such as interest payments, foreign exchange losses, and legal settlements.

By separating the two, businesses gain a clearer understanding of operational efficiency. It prevents irregular or one-time costs from distorting the picture of profitability and performance. For example, a company might incur a $100,000 legal settlement during a profitable quarter. If not separated, this example could make it appear as though operational performance declined, even though core operations remained strong.

Investors, analysts, and stakeholders often rely on the non operating expenses formula to isolate and examine these non-recurring costs. This allows for better comparison across time periods and with industry peers. It also ensures proper tax treatment and supports improved budgeting, forecasting, and decision-making.

Ultimately, distinguishing non operating expenses in accounting from operational costs enhances the quality of financial analysis. It highlights real business trends and performance, making financial data more useful for strategic planning, investor communication, and regulatory compliance. This level of precision is especially important for companies seeking external funding or planning expansion.

How non-operating expenses affect financial statements

Non-operating expenses in accounting play a critical role in presenting a company's true financial health. These expenses, although unrelated to core business operations, can significantly impact how financial statements are interpreted by investors, analysts, and regulators.

Proper identification and separation of non-operating items allow for more transparent reporting and better financial planning.

1. Impact on income statement

Impact

Non-operating expenses appear separately from operating income on the income statement to provide a clear distinction between recurring business costs and incidental costs. These may include interest payments, asset write-offs, or legal settlements.

Their placement after operating income ensures stakeholders can focus on core profitability before assessing external financial influences. By clearly listing non operating expenses in accounting, businesses help stakeholders understand which profits stem from operations versus non-operating activities, avoiding misinterpretations of profitability.

Example

Suppose a company has an operating profit of $500,000 but reports a $100,000 loss due to foreign currency exchange—this is classified as an example. In the income statement, the loss is deducted after operating profit, resulting in a net income of $400,000.

This segregation ensures that operational success isn't overshadowed by non-core activities, giving a true picture of operational efficiency. The non operating expenses formula helps isolate such costs to analyze their impact clearly.

2. Impact on balance sheet

Impact

While non-operating expenses don’t directly appear on the balance sheet, they indirectly affect it by reducing retained earnings and total equity through the income statement. If frequent or large, these expenses can also signal long-term liabilities or asset devaluation, impacting investor confidence.

Accurate recognition of non operating expenses in accounting helps maintain the integrity of financial ratios and prevents overstatement of net worth or financial stability, particularly in industries where such costs may be recurring.

Example

Consider a scenario where a company pays $200,000 in legal settlements during the fiscal year. This expense reduces net income and subsequently retained earnings. The reduction reflects in the equity section of the balance sheet.

This non-operating expenses example shows how even if not directly listed, these costs influence key metrics on the balance sheet. Using the non-operating expenses formula, businesses can track such impacts more effectively to ensure long-term balance sheet accuracy.

3. Impact on cash flow statement

Impact

In the cash flow statement, non-operating expenses are reflected in the “cash flows from investing” or “financing activities” sections rather than from operations. This allows users to assess how much cash is spent on activities unrelated to daily operations.

Identifying non operating expenses in accounting separately helps businesses gauge their ability to generate operational cash flow independent of other financial activities, ensuring better cash management and transparency for stakeholders.

Example

If a company incurs $50,000 in interest payments, this outflow is recorded under financing activities in the cash flow statement. For example, this doesn't affect cash from operations, which shows the company’s ability to sustain daily business.

The non-operating expenses formula can isolate such costs to prevent skewed interpretations of operational efficiency, particularly in performance reviews and investor reporting.

Switch to Volopay and streamline your expense management

Relationship between non-operating expenses and profit generation

Non-operating expenses in accounting represent costs unrelated to a business’s main operations, yet they significantly influence overall profit generation. These expenses impact net income, operational assessments, and financial forecasting.

Understanding this relationship helps organizations evaluate performance with greater accuracy and make more informed decisions.

1. Net profit calculation

Net profit is calculated after subtracting both operating and non operating expenses in accounting from total revenue. While operating expenses reflect core business efficiency, non-operating costs—like interest payments or asset losses—affect the final bottom line.

The formula isolates such costs to prevent distortion of operational performance analysis. A company might seem profitable operationally, but high non-operating losses can still result in a reduced or even negative net profit.

2. Profitability analysis calculation

For accurate profitability analysis, segregating non-operating expenses is essential. Operational profits showcase business health, while non operating expenses in accounting highlight external financial risks. Analysts often apply the formula to distinguish between the two.

For example, a company with high legal settlements (a common example) may show low overall profit, but its core operations might remain strong—information critical for stakeholders to evaluate real business potential.

3. Cash flow management

Non-operating expenses in accounting can affect cash flow depending on the nature of the expense. Payments like loan interest or lawsuit settlements draw from the company's cash reserves, influencing liquidity.

The formula helps financial planners identify which cash flows are non-recurring or outside operational scope. For instance, a non-operating expenses example, such as a currency exchange loss, impacts the financial outflows but doesn’t reflect inefficiency in regular operations.

4. Long term sustainability

Monitoring non operating expenses in accounting is vital for assessing long-term sustainability. Frequent non-operating losses may signal underlying financial instability, even if core operations appear stable.

By applying the non operating expenses formula, management can recognize red flags early. A recurring example, like foreign exchange los,s may prompt reconsideration of international strategies to avoid profitability erosion and protect long-term financial health.

5. Risk management

Non-operating expenses in accounting are often tied to risks—legal issues, financing decisions, or market fluctuations. Identifying these through the non-operating expenses formula enables better risk mitigation strategies.

For example, interest on high-risk debt is a typical example. Reducing such exposure can directly improve profitability and enhance business resilience, especially during economic downturns or market volatility.

6. Tax implications

Most non operating expenses in accounting are tax-deductible, influencing a company’s taxable income and overall tax liability. Calculating these through the non operating expenses formula ensures accurate tax reporting.

For instance, a non operating expenses example, such as interest on business loans, can reduce taxable income, improving post-tax profitability. Managing this effectively contributes to financial optimization and ensures compliance with tax laws.

Tax implications of non-operating expenses

Non-operating expenses in accounting can significantly influence a business’s tax liability. These expenses—though unrelated to daily operations—are often tax-deductible, reducing the company’s taxable income. Examples include interest payments, asset write-offs, legal settlements, and foreign exchange losses.

Accurately identifying and recording them using the non operating expenses formula ensures proper tax reporting and compliance with regulations. It’s crucial to differentiate between deductible and non-deductible non-operating costs to avoid tax misstatements.

A common non-operating expenses example would be interest paid on business loans, which typically qualifies for a deduction. However, penalties or certain legal fees might not. Clear documentation of non-operating costs also helps during audits and supports transparency with tax authorities.

Ultimately, a well-maintained record of these expenses enables better financial planning and reduces the risk of overpaying or underpaying taxes, which can have long-term financial consequences for a business.

Strategies for managing non-operating expenses

Effectively managing non operating expenses in accounting helps improve financial performance and strengthens long-term sustainability. While these costs lie outside a company’s core activities, they can significantly influence overall profitability.

Using the non-operating expenses formula, businesses can identify, track, and control such costs. The following strategies are essential to maintain financial stability and transparency.

Ensure detailed expense tracking

Accurate tracking of all non operating expenses in accounting is crucial. Maintaining detailed logs ensures these costs are clearly separated from operational expenses. Use digital tools or software to automate tracking.

Applying the formula helps categorize expenses correctly. A useful example is tracking interest on long-term loans. This clarity improves reporting accuracy and helps evaluate the true profitability of business operations.

Set clear budgeting policies

Setting up policies that specifically address non operating expenses in accounting allows better budget allocation. These policies should define acceptable non-operating costs and set monthly or quarterly limits.

Applying the formula while budgeting helps identify recurring patterns. For instance, if a business routinely incurs losses on asset sales—a common non-operating expenses example—budgeting can help cushion its financial impact and improve forecasting.

Re-negotiating supplier contracts

Sometimes, non operating expenses in accounting arise from unfavorable financing or service agreements. Re-negotiating terms with suppliers or lenders can reduce interest payments or penalty clauses.

Use the non operating expenses formula to assess current cost levels and determine savings potential. A relevant example is excessive lease termination fees—negotiating better terms upfront can save substantial costs over time.

Conduct cost-benefit analysis

Before committing to decisions likely to generate non operating expenses in accounting, conduct a thorough cost-benefit analysis. This ensures the benefits outweigh the associated costs. Use the formula to project the potential financial impact.

A non-operating expenses example like a one-time restructuring charge may be acceptable if it leads to higher operational efficiency in the future. Weighing pros and cons allows informed financial choices.

Conduct regular audits

Auditing helps verify the accuracy of non operating expenses in accounting and ensures compliance with reporting standards. These audits also detect inefficiencies or waste. Use the formula to isolate such costs and monitor changes over time.

An example that may surface during audits is foreign exchange losses due to mismanagement—flagging this early allows businesses to take corrective action.

Adopting sustainable energy measures

Long-term non operating expenses in accounting can be reduced through energy efficiency initiatives. Switching to solar power or energy-efficient systems may require upfront investment, but reduce future non-operating costs.

Use the non operating expenses formula to evaluate current energy-related non-operating costs. A common non-operating expenses example is high utility bills caused by energy wastage—adopting sustainable solutions can mitigate these recurring losses.

Review financing options

Analyzing and restructuring existing loans or credit lines helps manage non-operating expenses, especially those tied to interest payments. By using the formula, businesses can determine which debts are the costliest.

A expenses example is high-interest loans that significantly reduce profit margins—switching to lower-interest options improves financial efficiency and long-term sustainability.

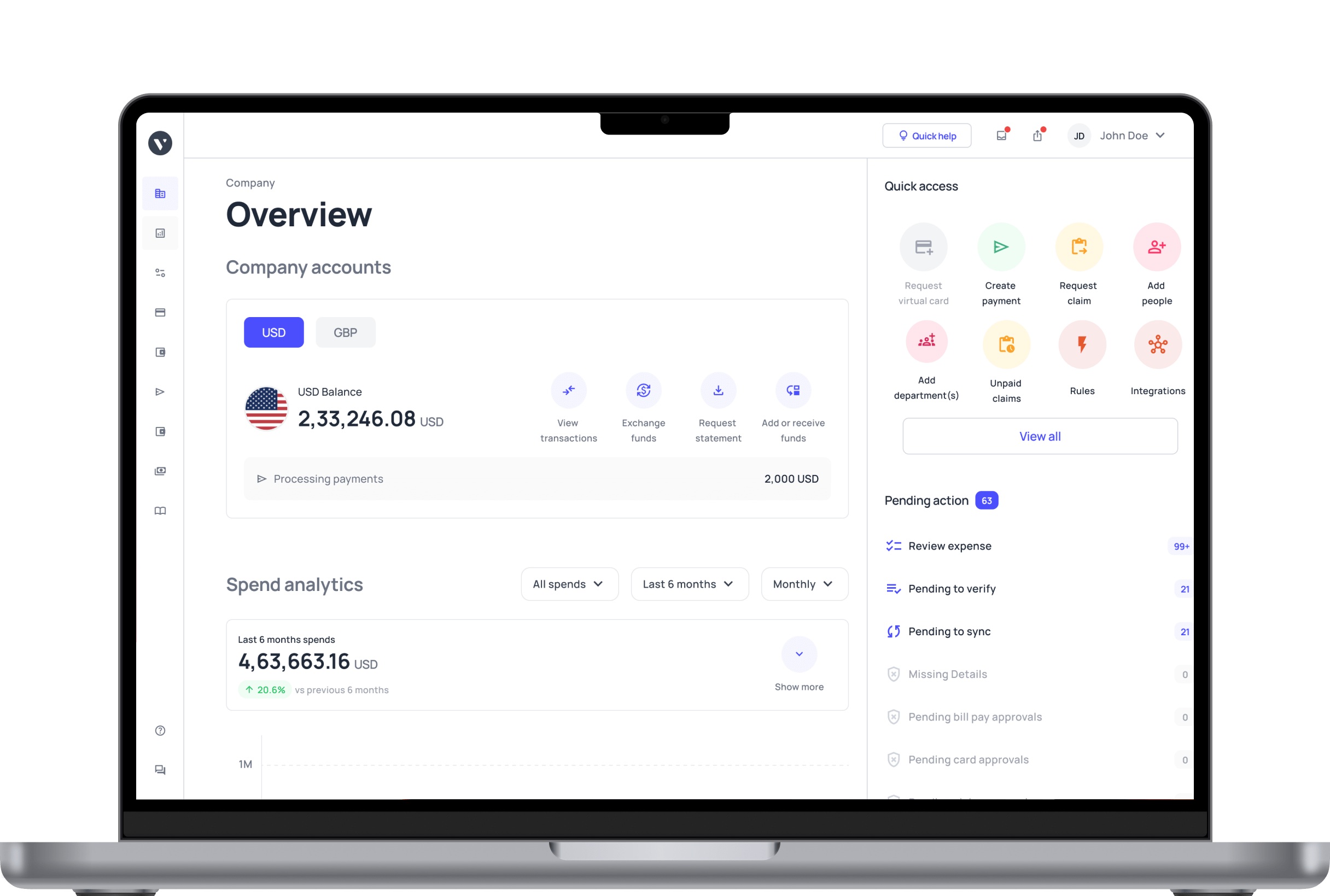

Choose Volopay's all-in-one expense management platform for your business

Volopay offers an all-in-one expense management platform designed to streamline business financial operations. With powerful tools for automated expense reporting, customizable spend controls, and real-time tracking, it helps businesses maintain transparency and control over their non-operating expenses.

This platform can significantly reduce administrative burden, improve compliance, and help with financial planning, ensuring that your business runs smoothly and efficiently.

Automated expense reporting

Volopay automates the entire expense reporting process, allowing businesses to eliminate manual data entry and paperwork. This automation helps you instantly capture, categorize, and record all transactions, ensuring accurate and timely reporting of non operating expenses.

By using this feature, businesses can reduce errors, improve compliance, and free up valuable time. Automated expense reporting also simplifies tax reporting and ensures no expense is overlooked, offering full transparency in financial reporting.

Customizable spend controls

With Volopay, you can set customizable spend controls that align with your business's budgetary needs. Whether it's a spending limit for each department or restricting certain types of expenses in accounting, these controls give you full oversight of your financial activities.

By using the non operating expenses formula, you can define acceptable levels for different categories, ensuring you don't exceed the budget on discretionary expenses like legal fees or interest payments.

Detailed spend analytics

Volopay’s platform provides detailed spend analytics that help businesses understand their financial habits. It generates real-time reports on non-operating expense, offering valuable insights into trends, categories, and individual spending behaviors.

By analyzing these metrics, businesses can identify areas where expenses may be unnecessarily high, such as excessive administrative costs or penalties, and make informed decisions to optimize overall spending, improving profitability and financial performance.

Automated expense reconciliation

Volopay’s automated expense reconciliation feature simplifies the matching of transaction records with receipts. This tool ensures that every Non-operating expenses in accounting, whether it's related to interest payments, asset losses, or legal settlements, is accurately recorded.

Automating reconciliation reduces the manual effort required for tracking financial discrepancies and ensures all data is aligned with the company’s accounts. This feature significantly speeds up the reconciliation process and boosts overall accounting efficiency.

Schedule payments and smart triggers

Volopay enables businesses to schedule payments and set smart triggers for recurring non-operating expenses, such as loan repayments or subscription fees. By automating these payments, you reduce the risk of missing deadlines and incurring penalties.

The platform’s smart triggers notify you before a payment is due, ensuring timely and consistent cash flow management. This helps businesses maintain financial discipline and avoid unnecessary delays in managing non-operating expenses.

Real-time expense tracking

Volopay’s real-time expense tracking gives businesses immediate access to their financial activities, allowing them to monitor non operating expenses in accountingas they occur. This feature ensures that business owners and financial managers are always aware of spending patterns, from interest costs to legal settlements.

With instant tracking, you can identify overspending, make quick adjustments, and take corrective action before issues escalate, leading to better cash flow management.

Integration capabilities

Volopay’s platform integrates seamlessly with various accounting software, ensuring that your non operating expenses in accounting are accurately reflected in your financial statements. Integration with tools like QuickBooks, Xero, and other ERP systems allows for easy synchronization of data, reducing the risk of errors and improving financial visibility.

This capability ensures that all financial transactions, including non-operating expenses, are consistent across all platforms, enhancing the accuracy and efficiency of your accounting processes.

Chose Volopay, the all-in-one expense management solution

FAQs

Volopay employs industry-leading security measures, including encryption, multi-factor authentication, and secure data storage, ensuring that all sensitive financial information is protected against unauthorized access and cyber threats.

Volopay allows businesses to automate recurring payments and set smart triggers. This ensures timely payments, reduces administrative workload, and prevents missing deadlines, ultimately improving the efficiency of managing recurring non-operating expenses.

Volopay offers multiple support channels, including live chat, email support, and a dedicated account manager, providing businesses with timely assistance for managing non operating expenses and resolving any issues promptly.

Changes in interest rates impact non operating expenses such as loan interest payments. An increase in interest rates raises borrowing costs, thereby increasing the non-operating expenses associated with financing, such as interest payments.

Non-operating expenses, like interest and losses, influence a company's financial health. High non-operating expenses can divert resources away from investments, affecting long-term strategy by limiting funds available for capital projects or expansion.

Depreciation is generally considered an operating cost since it's related to asset wear and tear. However, certain depreciation methods could impact non-operating expenses, depending on the financial structure.

Volopay helps businesses manage a variety of non-operating expenses, including interest payments, legal settlements, and asset write-offs. It streamlines the tracking and reporting of all financial outflows, simplifying expense management.