Liquid vs non liquid assets - Detailed comparison

Businesses maintain ownership over a range of different properties, each with its own type and function.

It is important to keep track of these properties and manage them because your business is likely to have a wide range of needs, each of which can be satisfied by a particular property or asset.

An asset is basically anything that a company owns or considers to be of financial value. Assets, again, can be classified into two categories depending on how easy they are to convert into cash - liquid or non-liquid.

In the liquid vs non-liquid assets distinction, it is key to know what they are, what they mean for your business, and how you can use them to your advantage if you are to get the best out of your owned properties.

What is a liquid asset?

Any asset you own that can be easily liquidated or converted into cash without it losing much value is a liquid asset. Liquidity is essentially a term used to portray how readily an asset can be converted to yield cash.

Liquid assets make up an important part of company assets because they’re the go-to option in case the company urgently needs funds.

In cases of emergencies or unexpected expenses such as large-scale repairs, medical bills, etc. companies turn to liquid assets, like cash assets, as the primary source of funds.

What is an example of a liquid asset?

Here are some common liquid asset examples that companies turn to when they need immediate funding.

● Cash- Any cash assets you have stored in checking or savings accounts can be used as liquid cash assets. Cash is also the most liquid asset companies own.

● Stocks- Investments made in common and most preferred stock shares to be publicly bought, sold, or traded.

● Bank accounts- Any funds that can be withdrawn from bank accounts count as liquid assets.

● Mutual funds- Mutual funds fall under the liquid asset class since shares can be sold by investors whenever they want and money is received within a short period of time.

● Money market assets- Another form of mutual funds these are low-risk, low-yielding short-term investments that can be easily converted to cash.

● Accounts receivables- Any money due to be received by the company in exchange for services or products provided earlier.

● Exchange-traded funds- A type of investment fund that is traded on the stock exchange.

● Marketable debt securities- A short-term bond held by the company, issued by another public company.

● Certificate of deposit- CDs may also be liquid based on the terms and conditions agreed upon.

● Precious metals- Precious metals like gold and silver are also often used as currency and can also be easily converted to cash.

What is a non-liquid asset?

Non-liquid or illiquid assets include property that is not easily liquidatable, i.e. they cannot be readily converted into cash without losing out on overall value. This means that even if these assets are converted into cash it will come at a significant loss.

Real estate, for example, is one such asset that is never liquid. Selling real estate to pay for emergencies is not a preferable circumstance.

If you do find yourself in a position where you need to sell such assets you’ll have to do it at a ‘fire-sale rate’, a much lower than market value rate.

What is an example of a non-liquid asset?

These are some common non-liquid assets examples that companies own.

Real estate- The most commonly used non-liquid asset example, forms of real estate are never liquid. Land, property, etc. is very hard to sell on short notice and hence cannot be easily converted into cash.

Collectibles- High-value collectibles like jewelry, gold, etc. appreciate and are also difficult to sell easily and are hence non-liquid or illiquid assets.

Vehicles and business equipment- Similar to collectibles, vehicles and business equipment are also hard to liquidate and are also non-cash assets.

Retirement accounts- These are long-term investments meant to support retirement. If liquidated prematurely they can cost you taxes and/or penalties.

Why does asset liquidity matter to your business?

Liquidity is important to your business for a number of different factors. Here are some of the most important reasons.

1. Keep a check on financial health

Even though cash is important for a company to manage its financial obligations, too much of it can derail future investment opportunities.

Keeping liquidity in check helps you find the right balance and keep just the amount of cash you need.

2. Helps secure loans and other funding

Liquidity ratios are important to banks when they determine your company’s ability to repay debts.

3. Helps compare and gauge performance

By tracking the liquidity of competitors you can keep a check on how you are performing in comparison to them.

4. Helps handle operational costs

The liquidity status of your company also indicates how much resources you have available to manage daily operational costs.

5. Helps mitigate emergencies

Liquidity status also helps you keep track of how many resources you have at your disposal in case of emergencies.

4 main benefits of having liquid assets

Here are some of the most effective ways in which liquid assets help businesses.

Less risk

Liquid assets are relatively low on risk. They are not susceptible to market volatilities like long-term assets and they also provide a safety buffer against emergency expenditures

Better Financial profile

The balance between liquid and non-liquid or non-cash assets is what determines the financial profile of a company. Too many non-liquid assets owned leave little resources for emergencies, operations, and incidental costs.

A good financial profile is where there is a balance between the two asset classes.

Cash available whenever you need it

Cash liquidity is another boost that liquid assets give to company finances.

The ability to easily use cash whenever emergencies arise or operational costs increase helps companies stay in control of unforeseen events that could harm company finances.

Being prepared

Finally, liquid assets help you stay prepared against future emergencies and unprecedented circumstances that might require immediate funds.

Try Volopay for building up your liquid asset

Liquid assets are a critical component of the modern-day business’s survival kit. Not only does it cushion a company against market volatilities but, by helping overall operations, liquid assets can also contribute to long-term growth.

With a good balance of liquid vs non-liquid assets, a company can maintain both strong financial health as well as account for its financial security. This is where Volopay comes in.

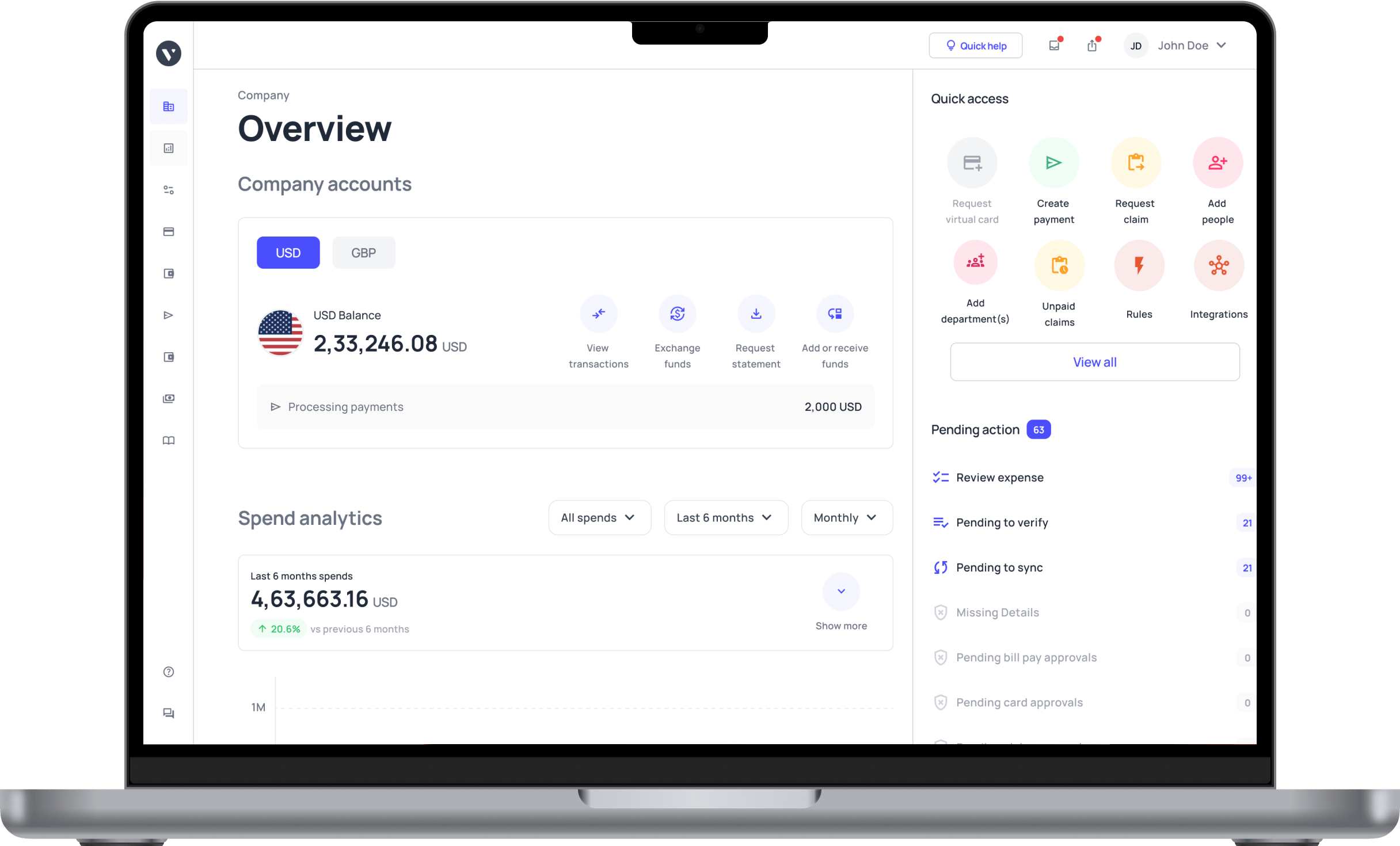

Our software is specially built for businesses to help them gain access to cash, convert, and transfer it without any hassles and at a rapid pace, all around the globe. Real-time updates of expenses, transfers, and approvals help you manage this cash and your liquid assets with ease. Streamline your asset management by consolidating expense management on Volopay’s one unified platform.

Volopay corporate cards and the features they come with also help your accounting teams manage books, payroll, etc. easily and without errors. Moreover, auto-approvals and custom approvals help you pay bills on time, every time.

The software also seamlessly integrates with your existing accounting systems. With Volopay, eradicate transaction costs - send and receive money faster than ever - earn loads of cashbacks, benefits, discounts, and at the same time maintain constant visibility over all your expenses.