How to reduce corporate credit card processing fees: A complete guide

Corporate credit cards empower you to streamline expenses, improve cash flow, and earn valuable rewards. However, they also come with hidden costs that can silently erode your profits. From annual maintenance and processing charges to interchange fees, these expenses can add up quickly if left unchecked.

Understanding how to reduce corporate credit card fees is essential for maintaining financial control and maximizing your working capital. By strategically monitoring transactions, negotiating better rates, and leveraging automation, you can limit unnecessary costs without compromising efficiency.

This guide helps you uncover practical ways to manage fees more effectively, ensuring your business retains more of its hard-earned revenue while continuing to benefit from the convenience and flexibility of corporate credit cards.

Why corporate credit card fees matter for small businesses

The link between fees and profit margins

Even minor corporate credit card processing fees can significantly reduce your profit margins over time. When every transaction incurs a percentage-based charge, these costs accumulate quickly, particularly for high-volume businesses.

By analyzing and optimizing your payment methods, you can prevent profit leaks and ensure each dollar spent contributes directly to sustainable business growth.

Why smaller businesses pay higher rates

As a small business, you often lack the negotiation leverage that larger enterprises have with banks or payment networks.

This disadvantage leads to higher small business credit card fees, impacting your bottom line. Building a strong transaction history and exploring alternative issuers can help you qualify for better terms and lower overall processing rates.

The cost of convenience for customers

Accepting credit card payments improves convenience for your clients, but it comes at a price. Every card swipe includes processing charges that accumulate across transactions.

While offering flexible payment options enhances customer experience, managing these expenses strategically allows you to maintain convenience without letting associated fees erode your operational efficiency or profitability.

Why ignoring fees hurts long-term growth

Overlooking small, recurring card charges may seem harmless initially, but they quietly hinder long-term scalability. When compounded, these expenses can restrict reinvestment opportunities, affecting innovation and expansion.

By proactively reviewing and managing card-related costs, you strengthen your business’s financial foundation, making it easier to scale sustainably while maintaining optimal cash flow and operational agility.

Understanding corporate credit card processing fees

Breaking down the payment chain

Every time a card transaction occurs, several parties share the fee. The bank issuing the card, the payment network, and the processor each take a portion.

Understanding this payment chain helps you identify where to focus when trying to reduce corporate credit card fees and negotiate lower overall costs effectively.

Interchange fees vs. assessment fees

Interchange fees go to the issuing bank, while assessment fees are collected by card networks like Visa or Mastercard. Both charges are unavoidable but vary by card type.

Learning this distinction gives you a clearer view of where your money flows and where strategic adjustments can minimize overall expense exposure.

Variable costs based on card type

Corporate, rewards, and premium cards often come with higher transaction costs because of additional benefits and risk levels. These differences impact your total processing expense.

Understanding how card categories influence fees enables smarter financial planning, helping your business manage payments efficiently while maintaining service quality and ensuring transparent cost tracking for every transaction.

How transaction volume affects rates

Higher transaction volumes usually qualify you for better pricing tiers from processors. Consistent, high-value transactions lower per-sale costs, improving your margins.

By leveraging your business’s payment data and volume, you can negotiate more competitive rates, creating a practical path toward reducing corporate credit card fees and improving your company’s long-term financial efficiency.

Common types of corporate credit card processing fees

These core charges are deducted automatically from every card payment. Interchange fees go to banks, while networks collect assessment costs.

Together, they form the foundation of corporate credit card pricing structures. Regularly reviewing these expenses allows you to identify savings opportunities that support your corporate credit card fee reduction strategy effectively.

Payment processors and gateways handle secure transaction routing between banks and networks. Their service charges often include transaction, setup, or integration costs.

Comparing processor options ensures your small business avoids hidden markups, reducing overheads associated with credit card fees for small businesses and supporting transparent, cost-efficient payment management in your daily operations.

Processors may add costs to maintain PCI compliance or prevent fraudulent transactions. These are crucial for security, but can quietly raise your monthly expenses.

Evaluating service providers that bundle compliance affordably helps you maintain protection standards while optimizing spending and ensuring safety without excessive or unnecessary recurring financial burdens.

Some processors impose fixed monthly charges covering customer support, reporting, or hardware leasing. These contractual fees can accumulate unnoticed.

Regularly reviewing your service terms ensures you pay only for features you use, helping your business maintain flexibility, reduce operational costs, and manage financial commitments more strategically and transparently over time.

Chargebacks occur when customers dispute transactions, often leading to retrieval fees. These expenses can escalate quickly with frequent disputes.

By improving verification practices and customer communication, you reduce occurrences and related costs, strengthening financial control and ensuring smoother payment operations that support long-term profitability and customer satisfaction.

Comparing pricing models for credit card processing

Understanding different pricing models for credit card processing helps businesses choose the most cost-effective option. By comparing structures and fees, companies can optimize expenses, improve transparency, and manage payment costs more efficiently.

1. Flat-rate pricing

Flat-rate pricing offers a single percentage per transaction, simplifying budgeting. However, this model may overcharge low-risk businesses.

For example, a café processing hundreds of low-ticket sales daily pays more in accumulated corporate credit card processing fees than necessary, reducing profit margins that could otherwise strengthen daily cash flow and operational flexibility.

2. Interchange-plus model

The interchange-plus model charges the actual interchange rate plus a transparent markup. This structure benefits businesses with consistent transaction volumes.

For instance, a marketing agency processing high-value invoices saves more compared to flat rates. Understanding this clarity helps you track true costs accurately and make informed decisions for scalable payment management.

3. Tiered pricing

Tiered pricing groups transactions into qualified, mid-qualified, or non-qualified categories with different rates. While it seems flexible, hidden markups are common.

A boutique retail store, for instance, often sees higher bills because many of its card transactions fall into non-qualified tiers, limiting potential savings and making real cost prediction difficult.

4. Subscription-based models

Subscription-based processing offers a fixed monthly fee plus minimal transaction costs. This setup suits high-volume merchants. For example, an e-commerce business processing thousands of orders monthly pays predictable costs.

The model improves budgeting while enhancing transparency, making it easier to manage recurring payments and maintain stability in financial planning.

5. Which model benefits small businesses most

For smaller firms, interchange-plus often delivers the best balance of transparency and savings. It scales with growth and adapts to varying sales volumes.

For example, a local consulting firm benefits from lower small business credit card fees, ensuring better control over expenditures without sacrificing the flexibility to accept diverse payment types.

The real cost of corporate credit card fees on small business profitability

The hidden margin drain

Transaction fees seem minor but quickly add up. For example, a digital design agency loses $800 monthly to small deductions.

Over time, these cuts lower profits, proving how corporate credit card fee reduction is essential for sustaining healthy margins and improving overall financial performance across recurring payment cycles.

Compounded annual costs on revenue

Yearly fee accumulation can heavily impact revenue. A catering company processing $500,000 annually might lose $12,000 to transaction charges.

This loss directly reduces net income, highlighting how unchecked expenses undermine financial targets and make efficiency-focused payment management essential for long-term profitability and stability across seasonal business fluctuations.

Lost opportunities for reinvestment

When fees consume excess funds, reinvestment suffers. For example, a local clothing brand could have allocated $5,000 in savings toward marketing but lost it to processing costs.

Reducing credit card fees for small businesses ensures more capital stays within operations, supporting future innovation and sustainable growth across competitive markets.

How fee volatility creates forecasting challenges

Fluctuating processing rates make budgeting difficult. A tech startup, for instance, struggles to forecast expenses when card networks frequently adjust rates. This unpredictability disrupts financial planning and confidence.

Stabilizing these variables through transparent pricing and consistent monitoring strengthens long-term financial predictability and enhances operational decision-making accuracy.

Balancing fee management with cash flow

Careful fee monitoring protects liquidity. For example, a logistics firm maintaining tight margins struggles when monthly processing costs fluctuate unexpectedly.

Balancing cost management with steady cash flow helps ensure your business remains solvent, agile, and ready to seize opportunities without compromising day-to-day financial stability or growth momentum.

How to identify and track hidden card fees effectively

Reviewing merchant statements regularly

Make it a habit to review your monthly merchant statements line by line. Many providers bundle charges under generic descriptions that disguise avoidable costs.

By consistently checking transaction summaries, you’ll spot patterns, errors, or new fees early, allowing you to act promptly to reduce corporate credit card fees efficiently.

Using analytics tools to pinpoint overcharges

Advanced analytics software can automatically identify patterns of excessive billing. These tools flag suspicious transaction categories or unusual rate fluctuations.

Using them helps you visualize where your money goes, isolate problem areas, and develop targeted strategies for reducing corporate credit card fees while improving visibility across all payment activities.

Comparing fee reports year over year

Annual comparison of fee reports reveals cost trends over time. Sudden spikes may indicate changes in provider policies or unnecessary service additions.

Maintaining detailed yearly records ensures better forecasting and informed negotiation during contract renewals, helping you protect margins and maintain transparent financial control in payment management practices.

Recognizing unnecessary service add-ons

Some processors include optional add-ons like premium support or data storage that inflate bills. Evaluate which services genuinely benefit your operations.

Removing redundant features prevents overspending and contributes to long-term corporate credit card fee reduction, freeing funds for essential business priorities and ensuring greater budget alignment with core goals.

Partnering with consultants for cost audits

Financial consultants specializing in payment systems can uncover hidden or duplicative charges often overlooked internally. They benchmark your fees against industry norms, helping you identify savings opportunities.

Partnering with professionals ensures objective assessment, faster corrections, and improved negotiation outcomes with your payment service providers over time.

How to audit and interpret processing statements

Examine transaction-level details to detect duplicated or mislabeled charges. Providers sometimes repeat small fees across categories, which add up quickly.

Using detailed tracking sheets helps confirm legitimate costs and pinpoint discrepancies, giving you the insights needed to request adjustments and strengthen your ongoing financial oversight process effectively.

Revisit your contract terms yearly to verify rate stability and service relevance. Providers may alter conditions without clear notice.

Reviewing contracts ensures you maintain fair pricing structures, reduce outdated commitments, and strengthen cost accountability, supporting proactive financial management aligned with current business scale and operational priorities.

Compare your rates and conditions with similar businesses in your sector. Benchmarking exposes inflated costs or outdated fee structures.

This context empowers you to negotiate better terms and ensures your payment processing remains competitive, sustainable, and aligned with industry expectations for efficiency and profitability management.

After revising agreements, monitor subsequent statements closely to confirm expected savings materialize. Compare post-renegotiation data with previous months to measure actual gains.

This tracking validates your cost-saving efforts and ensures continued compliance from providers, helping you refine future strategies for cost optimization and contract stability.

Establish quarterly or semi-annual payment reviews to maintain visibility into evolving costs. These evaluations help identify early warning signs of new or rising charges, ensuring prompt corrective action.

Regular performance tracking keeps your processing ecosystem transparent, efficient, and aligned with broader financial health objectives year-round.

How to avoid paying excessive corporate credit card fees effectively

1. Choosing the right pricing model

Select a structure that matches your transaction volume and type. The interchange-plus model suits most small businesses due to its transparency and scalability.

Regularly evaluating available options ensures fair pricing, predictable expenses, and fewer surprises, strengthening your ability to maintain consistent margins and long-term financial efficiency.

2. Leveraging negotiation power with providers

Use your transaction history and volume to negotiate better terms with processors. Providers often offer discounted rates to retain clients.

Demonstrating reliability and consistent sales gives you leverage for lower costs, ensuring more control over your processing expenses and supporting sustainable savings across all business transactions.

3. Reducing fraud and chargebacks to cut costs

Minimizing fraudulent transactions and chargebacks reduces penalty fees. Implement secure payment gateways, verification tools, and employee training to identify suspicious activities early.

Strong fraud prevention measures protect both revenue and reputation, helping your business maintain lower risk profiles and achieve overall cost stability through smarter operational practices.

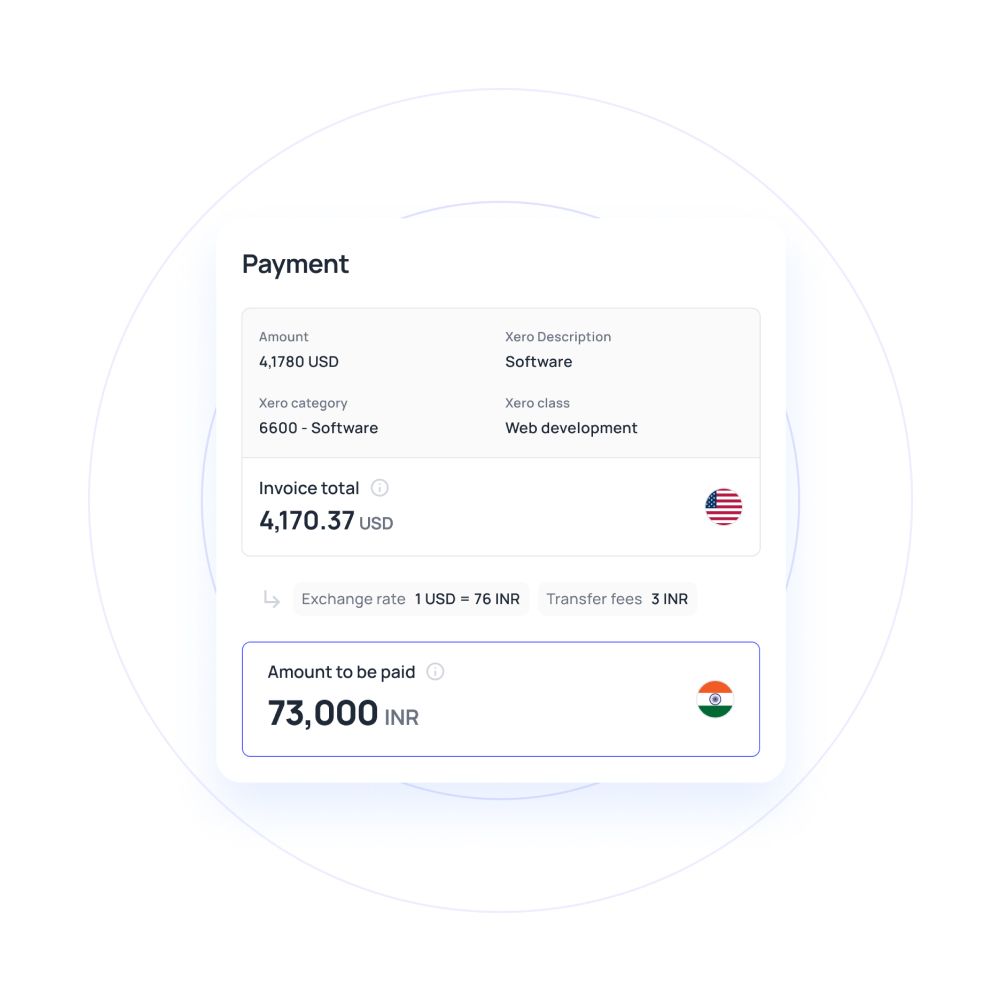

4. Managing cross-border and foreign currency fees

International transactions can involve multiple conversion charges. Opt for multi-currency accounts or global payment platforms to reduce exchange markups.

Monitoring transaction routes helps you avoid unnecessary conversions, ensuring predictable payment costs and improving profit retention when dealing with clients or vendors operating in foreign markets.

5. Creating internal policies for fee efficiency

Establish company-wide guidelines to control how cards are used. Setting transaction limits, approval hierarchies, and spending categories helps minimize avoidable charges.

Educating employees about responsible payment practices ensures consistent cost discipline and supports a structured approach to long-term credit card fee management and accountability.

How to calculate your credit card fees

1. Breakdown of typical credit card processing fees

Processing fees typically include interchange charges, assessment fees, and processor markups. These costs depend on card type, transaction volume, and business category.

Understanding each component helps you identify where expenses originate, giving you the insight to target specific areas for improvement and better financial control overall.

2. Formula to calculate processing fees on a transaction

Use this formula: Processing Fee = Transaction Amount × (Processing Rate ÷ 100)

For example, if your rate is 2.9% and you process a $500 payment, the fee equals $500 × 0.029 = $14.50. Knowing this calculation helps estimate true transaction costs and identify opportunities for reduction.

3. Factors that affect your effective rate

Your effective rate is influenced by average transaction size, card type, business risk level, and processor pricing structure.

Monitoring these elements ensures transparency and helps you compare offers accurately. This awareness supports better decisions when selecting providers or renegotiating terms for long-term financial optimization.

4. Using tools and calculators for accurate estimates

Online calculators and accounting software simplify fee tracking. They automatically compute total charges based on live transaction data.

Using these tools eliminates guesswork, provides real-time cost insights, and helps maintain precise forecasting, making it easier to align processing expenses with your financial goals and business strategy.

5. Why knowing your fees helps optimize costs

Understanding exactly how much you pay empowers you to adjust operations strategically. Awareness drives negotiation leverage, smarter transaction routing, and proactive provider reviews.

Ultimately, knowing your actual costs ensures consistent financial efficiency, helping your business retain more earnings and maintain sustainable profit growth over time.

Recognizing when it’s time to reassess your card processing setup

Spotting signs of inefficient fee structures

If your total processing costs keep rising despite stable transaction volume, your pricing model may be outdated. Look for inconsistent billing, added surcharges, or excessive markups.

Identifying these warning signs early allows you to streamline expenses, renegotiate contracts, and maintain profitability across all payment channels effectively.

Evaluating shifts in transaction volume or payment behavior

Significant growth or decline in transaction counts can impact your current rate eligibility. For instance, an increase in card transactions may qualify you for lower pricing tiers.

Regularly reviewing these shifts ensures your processing plan stays aligned with operational needs and cost structures that support continued efficiency.

Monitoring increases in effective rate over time

Your effective rate represents the true percentage paid per transaction. Gradual increases suggest hidden markups or new provider fees.

Tracking this metric quarterly highlights cost trends, helping you identify inefficiencies early and reinforcing the importance of ongoing financial oversight to preserve margins and operational sustainability.

Knowing when to renegotiate or switch providers

Persistent high costs, poor customer support, or unexplained charges indicate it’s time to renegotiate. If a provider resists fair pricing, switching to a more transparent processor can restore control.

Regularly evaluating competitive offers ensures your business maintains favorable terms, consistent pricing, and optimized financial performance.

Interpreting effective rate reports from processors

Processors often provide summaries showing your effective rate. Review these carefully to ensure reported percentages match real costs. Discrepancies can signal misclassified transactions or hidden fees.

Understanding how to interpret these reports enables better cost management and supports data-driven decisions about potential contract adjustments.

How payment mix and method impact your fees

Balancing payment methods

Credit cards often carry higher interchange costs than debit or ACH transfers. Encouraging customers to use lower-cost payment methods helps significantly reduce average transaction fees.

Maintaining a balanced payment mix ensures flexibility for clients while improving profitability through more cost-effective and transparent payment processing practices overall.

Key benefits of direct or bank transfers

Bank transfers bypass card networks, eliminating percentage-based fees. Encouraging high-value clients to pay directly through ACH or wire options helps retain revenue otherwise lost to processors

This approach improves your net earnings and enhances overall payment processing efficiency for recurring or large business transactions.

Setting transaction thresholds

Establishing a minimum purchase amount for card payments helps offset processing costs. For example, setting a $10 minimum ensures each transaction remains profitable despite fixed per-sale fees.

This strategy promotes cost balance, protecting your margins while keeping payment flexibility accessible for your customers’ convenience.

Encouraging contactless payments

Digital wallets like Apple Pay or Google Pay typically process faster and may carry lower risk fees. Encouraging these payment methods improves operational efficiency and customer satisfaction.

Over time, higher adoption of secure contactless options reduces fraud exposure and lowers the average cost per transaction for your business.

Tracking customer payment preferences

Regularly analyzing which payment methods customers prefer reveals valuable insights. Shifts in payment behavior can affect your fee exposure.

Monitoring trends allows you to adjust accepted payment types strategically, maintaining profitability and aligning your business’s transaction mix with both cost efficiency and customer convenience.

Smart ways to encourage low-fee transactions

Rewarding customers for debit or ACH usage

Offer small incentives, such as loyalty points or future purchase discounts, to customers who use debit or ACH payments. These methods incur lower processing costs for your business.

Over time, consistent promotion of these options builds customer habits that naturally reduce transaction expenses without affecting convenience or satisfaction.

Offering discounts for bank transfers

Provide a small percentage discount to clients choosing direct bank transfers. This not only reduces your processing fees but also strengthens relationships with cost-conscious customers.

Clear communication about these savings encourages wider adoption, allowing both parties to benefit from streamlined, low-fee payment alternatives that improve profitability.

Setting clear payment policies at checkout

Transparency helps shape customer behavior. Display clear payment options and associated benefits during checkout, emphasizing preferred low-fee methods.

Educating customers about how certain payment types support better pricing and service ensures smoother transactions while protecting your margins and maintaining fairness across multiple payment platforms effectively.

Leveraging loyalty programs for cheaper payments

Integrate payment preferences into loyalty programs by rewarding users who select low-fee methods. For example, offer extra points for debit or ACH purchases.

This behavioral approach aligns savings with engagement, encouraging consistent participation while supporting financial sustainability through reduced transaction costs and improved customer retention.

Minimizing risk factors that trigger extra card fees

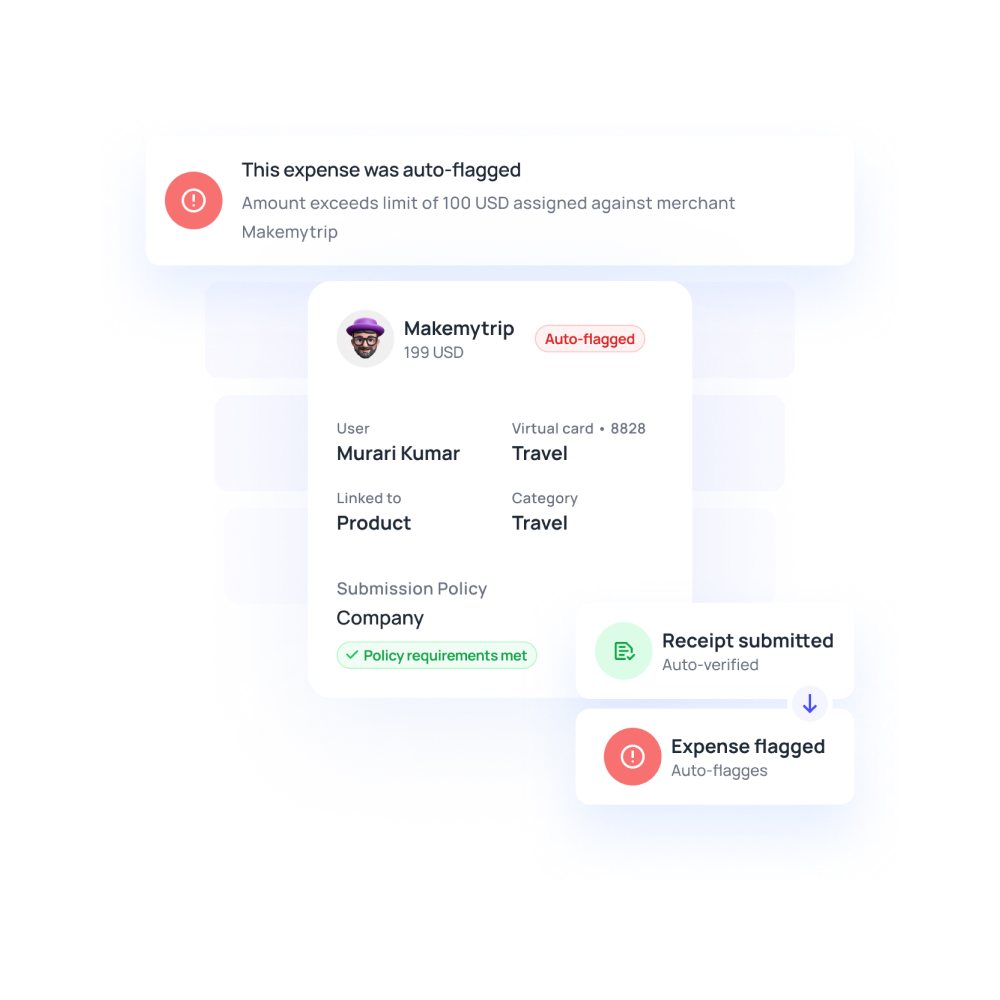

Recognizing transaction dispute patterns

Track when and why chargebacks occur. Identifying recurring dispute triggers, such as unclear refund terms or delivery delays, helps you refine operations.

Analyzing these patterns reduces unnecessary penalties, improving your credibility with processors and lowering associated costs tied to excessive dispute frequency or handling inefficiencies.

Strengthening authentication systems

Use multi-factor authentication and tokenization to secure transactions. These systems deter fraudulent attempts, decreasing the likelihood of penalty-driven fees.

Strengthened verification measures also build trust with both customers and financial partners, ensuring safer payment environments and minimizing risk-related costs from unauthorized or suspicious activities.

Training staff to identify fraud early

Educate employees on spotting red flags like mismatched billing details or unusual purchase behavior. Empowering your team with fraud detection knowledge prevents disputes before they occur.

Well-trained staff protect revenue, reduce chargebacks, and contribute to smoother, lower-cost transaction processes through proactive operational vigilance.

Improving customer communication channels

Clear, responsive communication minimizes misunderstandings that lead to disputes. Offering timely updates, transparent refund policies, and easy support access reassures customers.

Effective communication prevents escalations, reduces chargebacks, and maintains trust, ensuring fewer fee-triggering issues and more predictable, cost-efficient transaction outcomes across all interactions.

Implementing chargeback protection services

Partner with processors offering built-in chargeback protection or alerts. These tools automatically flag high-risk transactions, allowing swift action.

By addressing disputes early, you avoid additional processing penalties and protect your revenue streams, keeping operations stable, compliant, and cost-efficient under varying transaction conditions.

Legal and regulatory compliance you should know

Meeting federal and major card network regulations

You must follow federal laws and card network guidelines when applying surcharges or processing payments. Each network Visa, Mastercard, or Amex sets specific rules on fee disclosures and limits.

Staying compliant ensures your business avoids penalties while maintaining trust with financial partners and customers through transparent, rule-abiding transaction practices.

Complying with PCI DSS for secure payment processing

The Payment Card Industry Data Security Standard (PCI DSS) mandates strict measures for storing and handling card data. Compliance includes encryption, access control, and regular audits.

Adhering to PCI DSS prevents breaches, reduces liability, and strengthens your reputation for maintaining high security standards across all digital payment channels.

Ensuring transparent customer fee disclosures

Full transparency in fee communication is a legal and ethical obligation. You must clearly state any surcharges before payment is processed.

Clear disclosures prevent disputes, increase trust, and demonstrate professionalism, ensuring customers fully understand how their payments are handled and why specific transaction-related fees may apply.

Avoiding legal penalties and non-compliance risks

Ignoring regulations or mishandling surcharges can lead to fines, loss of processing privileges, or legal action. Regular compliance reviews and legal consultations safeguard against such risks.

Maintaining current documentation and training employees ensures consistent adherence to all payment-related laws, minimizing exposure to regulatory violations or reputational harm.

Industry-specific corporate credit card fee challenges

Fee challenges differ across industries depending on unique business operations. Each sector faces distinct transaction patterns that directly influence overall processing costs.

Leveraging technology to reduce credit card processing costs

Using AI for fee analysis and prediction

You can use AI-driven analytics to detect inefficiencies, forecast trends, and automatically adjust processing methods for optimal results.

AI identifies hidden cost patterns, adapts to transaction behaviors, and recommends fee-saving adjustments in real time. This proactive, data-driven approach helps lower operational expenses and ensures smarter, more consistent fee management.

Integrating POS systems with accounting tools

Integrating POS systems with accounting software ensures seamless data synchronization across all transactions. You gain real-time visibility into sales, refunds, and processing fees, eliminating manual reconciliation errors.

This integration improves cash flow accuracy, simplifies expense tracking, and enhances overall operational efficiency while providing precise financial insights for informed decision-making and better cost control.

Automating transaction reconciliation

Automation reduces manual reconciliation tasks by matching transactions instantly between your POS, bank, and accounting systems. You save time, minimize human error, and quickly identify discrepancies or double charges.

This streamlined process enhances accuracy, ensures complete transparency, and helps you maintain cleaner financial records while reducing costs related to administrative inefficiencies.

Real-time fraud monitoring and prevention

You can employ real-time fraud detection tools that leverage AI to analyze transaction patterns, identify suspicious behavior, and trigger instant alerts.

These systems prevent fraudulent activities before they occur, reducing chargeback rates and associated fees. Continuous monitoring not only protects your finances but also enhances customer trust and payment security.

Selecting platforms with dynamic fee adjustments

Choose payment platforms that automatically adjust processing routes based on transaction type, card network, or volume. These systems dynamically minimize interchange costs without manual intervention.

You gain continuous cost savings, better transaction efficiency, and an adaptable payment structure that aligns with changing business volumes and evolving card fee models.

Building a sustainable fee reduction strategy

Combining human policy with automation

You should combine strategic human oversight with intelligent automation to balance precision and flexibility.

While automation ensures speed and accuracy in managing fees, human insight supports policy decisions, exception handling, and optimization.

Together, they form a comprehensive approach that maintains compliance, controls costs, and improves long-term payment efficiency.

Reviewing fee and transaction data quarterly

Review your credit card fee structures and transaction reports every quarter to spot emerging cost trends.

This routine analysis highlights inefficient processing routes, excessive charges, or outdated terms.

Regular evaluations empower you to renegotiate better rates, adjust strategies, and ensure that your cost-control measures remain effective.

Setting measurable targets for cost reduction

Establish specific, quantifiable goals for reducing processing expenses, such as lowering your effective rate by a fixed percentage each quarter.

These benchmarks help you consistently track performance, measure improvements, and stay accountable.

Clear targets make it easier to assess which cost-control efforts deliver meaningful financial impact over time.

Training teams for continuous process improvement

Train your finance and operations teams to recognize fee inefficiencies, manage disputes, and use payment technology effectively.

Regular training encourages accountability, enhances awareness, and fosters a culture of proactive optimization.

Well-informed teams can identify unnecessary costs faster and implement practical solutions that sustain ongoing expense reductions.

Using insights to inform long-term financial planning

Use your transaction and fee data insights to shape future financial decisions.

These valuable insights guide budgeting, vendor negotiations, and technology investments effectively.

By integrating fee optimization into your financial strategy, you build a more resilient, cost-efficient payment ecosystem that supports consistent profitability and growth across all operations.

Tracking ROI to guide ongoing optimization

You should track the return on investment from every cost-reduction initiative.

Comparing savings against implementation costs helps you determine which strategies deliver the most value.

Continuous ROI tracking ensures smarter decisions, prioritizes effective tools, and keeps your organization focused on sustainable, data-backed fee optimization efforts over time.

Optimizing payment operations for sustained business profit growth

Standardizing internal payment processes

You can achieve better efficiency by creating unified payment protocols across all departments. Standardizing how invoices, approvals, and settlements occur eliminates duplication and reduces manual errors.

This consistency lowers administrative burdens and ensures faster fund flow, helping your business maintain financial discipline while minimizing the operational complexities often associated with unstructured payment systems.

Creating policies for fee accountability

Establishing internal accountability ensures every fee has a clear justification. By defining responsibilities for tracking and approving payment charges, you minimize unnecessary costs.

Transparent reporting frameworks allow you to identify recurring inefficiencies and hold teams accountable for financial management. This systematic approach strengthens compliance while supporting continuous corporate credit card fee reduction efforts.

Aligning payment data with budget forecasts

Integrating payment analytics with budget projections helps you plan accurately and maintain expense discipline. When transaction data reflects real-time costs, forecasting becomes more precise.

This alignment lets you anticipate upcoming expenditures, identify fee trends, and prevent unexpected financial deviations, ultimately ensuring payment activities support long-term profitability and strategic fiscal planning across your organization.

Using KPIs to track processing efficiency

Tracking key performance indicators like processing speed, average transaction cost, and reconciliation time allows you to measure system performance effectively. These metrics reveal inefficiencies and cost leakages within payment operations.

By analyzing KPI trends, you can enhance cash flow predictability and improve decision-making around expense management and future payment system investments.

Integrating insights into forecasting tools

When you integrate fee insights into financial forecasting platforms, you can project more accurate expense estimates. This approach highlights areas where cost savings are achievable and identifies high-fee transaction categories.

Over time, the data-driven integration of payment intelligence fosters smarter budgeting, reduced uncertainty, and greater control over your financial growth trajectory.

How reducing corporate credit card fees boosts business profit margins

1. Modeling ROI from reduced fees

You can calculate ROI from the fee reduction by comparing pre- and post-optimization costs. Even a 1% drop in processing expenses increases profitability significantly over multiple quarters.

This data-backed modeling highlights how optimizing vendor contracts or renegotiating rates directly supports measurable and sustainable gains in small business profit margins and growth.

2. Translating savings into expansion opportunities

When you lower corporate credit card processing fees, the freed capital can fuel expansion. For instance, the savings from reduced payment costs may fund technology upgrades, new hires, or marketing initiatives.

Redirecting these funds strategically ensures small businesses convert cost efficiency into tangible growth opportunities and stronger market positioning.

3. Lowering break-even points with cost cuts

Reducing unnecessary fees directly lowers your business’s break-even threshold, allowing you to achieve profitability faster. By minimizing high transaction and gateway costs, your operational margin expands.

This enhanced cost efficiency strengthens resilience and gives your business more flexibility to reinvest profits or adjust pricing to maintain competitiveness sustainably.

4. Turning fee insights into financial strategy

You can transform fee analytics into proactive financial strategies by monitoring spending behaviors and transaction trends. These insights allow you to make informed decisions about pricing, vendor selection, and payment terms.

Over time, leveraging these analytics helps you sustain consistent profit growth through smarter expense governance and long-term financial optimization.

5. Building long-term resilience through savings

Consistently lowering processing costs strengthens long-term business stability. By implementing ongoing monitoring systems and periodic audits, you sustain efficient payment operations.

Reduced fees enhance liquidity, mitigate risk exposure, and improve flexibility during economic fluctuations. This financial resilience ensures your business remains well-positioned for continuous growth and market adaptability.

Choosing the right corporate card program for long-term savings

Assessing transparency in fee breakdown

You should prioritize card programs that provide full transparency in fee structures. Clear visibility into interchange, service, and processing charges helps you track actual expenses accurately.

Transparent reporting prevents unexpected costs, enabling confident financial planning and sustainable cost control that supports continuous improvements in payment operations efficiency.

Evaluating long-term scalability options

As your transaction volume grows, your card program must scale without steep cost increases. Evaluate providers offering flexible pricing structures and adaptive transaction tiers.

Scalable solutions accommodate higher business activity without proportionally raising costs, ensuring continued financial efficiency and seamless expansion across markets or departments as your operations evolve.

Reviewing support responsiveness and SLAs

Strong service-level agreements and responsive customer support significantly affect operational stability. Ensure your provider offers quick resolution times, clear communication, and reliable technical support.

Proactive assistance reduces downtime, prevents fee disputes, and safeguards payment continuity, contributing to smooth operations and ongoing cost management across all business payment channels.

Analyzing integration ecosystem strength

A robust integration ecosystem allows seamless syncing between card systems, accounting platforms, and expense tools. Evaluate whether your provider supports open APIs and real-time data sharing.

Strong integration minimizes manual entry errors, enhances reporting accuracy, and improves overall operational efficiency essential for long-term payment optimization and sustainable growth.

Understanding contract renewal flexibility

Before committing to a long-term card program, review renewal terms carefully. Flexible contracts allow you to renegotiate based on performance or market changes.

This adaptability ensures your payment systems remain cost-effective, protects against rising fees, and keeps your financial partnerships aligned with evolving business objectives and cost-control goals.

The future trends of small business payments

Predictive fee optimization using AI

You’ll see AI-driven tools automatically predict and adjust transaction fees in real time. By analyzing historical data and processor behaviors, AI identifies patterns to minimize costs.

This proactive optimization will empower small businesses to gain more control over fee structures, ensuring smarter, data-backed financial decisions and sustainable long-term savings.

Instant settlements via real-time payments

Instant settlement technology will redefine how small businesses manage cash flow. With real-time payments, funds are transferred and cleared immediately, reducing dependency on delayed card transactions.

This improvement accelerates liquidity cycles, eliminates unnecessary waiting periods, and helps you reinvest profits faster, boosting operational agility and maintaining stable financial health effortlessly.

Cross-border efficiency through global gateways

Global payment gateways will simplify cross-border transactions, eliminating redundant conversion layers and excess intermediary fees. Small businesses can expect faster international settlements and transparent currency exchange.

This innovation enhances global competitiveness by lowering transaction complexity, making it easier for you to manage international sales efficiently while maintaining higher profit margins.

The role of blockchain in fee reduction

Blockchain-based systems will bring transparency and cost efficiency to small business payments. Decentralized transaction ledgers eliminate intermediaries, reducing processing and verification expenses.

With secure smart contracts automating settlements, you gain faster, tamper-proof financial operations. This reduces overhead while boosting trust and efficiency in both domestic and international payment ecosystems.

Preparing for next-gen payment regulation

Evolving global payment regulations will demand stronger transparency, data protection, and fee disclosures. Staying compliant will ensure smoother operations and avoid penalties.

Small businesses must adopt tools that automatically monitor policy changes. By preparing early, you can maintain compliance while optimizing fee efficiency under newer financial governance standards globally.

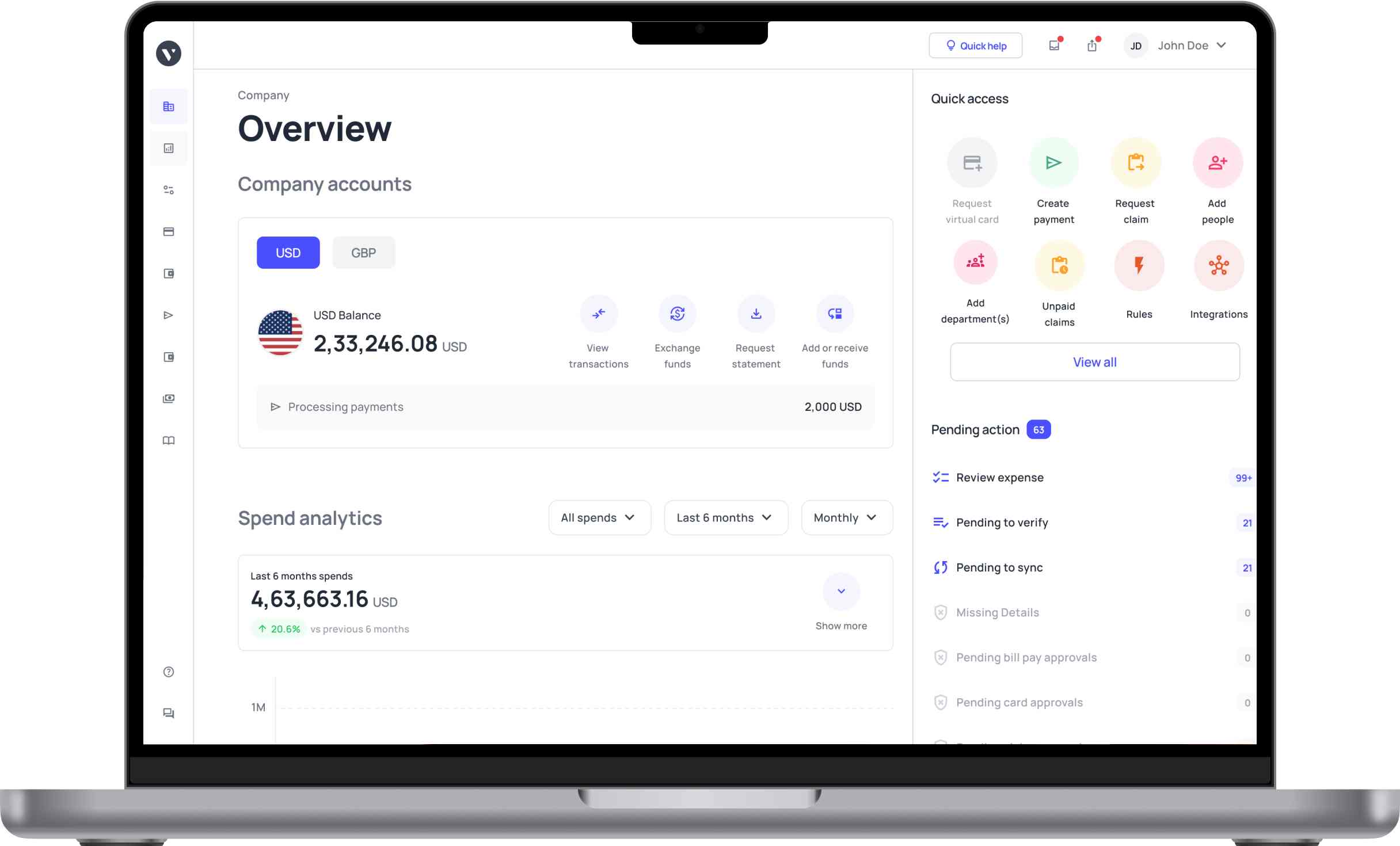

Volopay: The smarter way to manage business spend

Volopay enables your business to simplify expense management, automate workflows, and eliminate unnecessary credit-related costs. By unifying spending controls, accounting integrations, and real-time visibility, you gain full command over your finances.

It’s a modern solution designed to enhance efficiency, lower costs, and maximize financial transparency across every business transaction.

No hidden charges, just real spend control

Volopay eliminates traditional credit pitfalls by offering feature-packed corporate cards. You get access to real funds—loaded in advance and used without any interest or hidden fees.

This transparent system ensures every transaction reflects real-time balances, giving you complete clarity and helping your business avoid the unpredictable costs that often accompany conventional corporate credit cards.

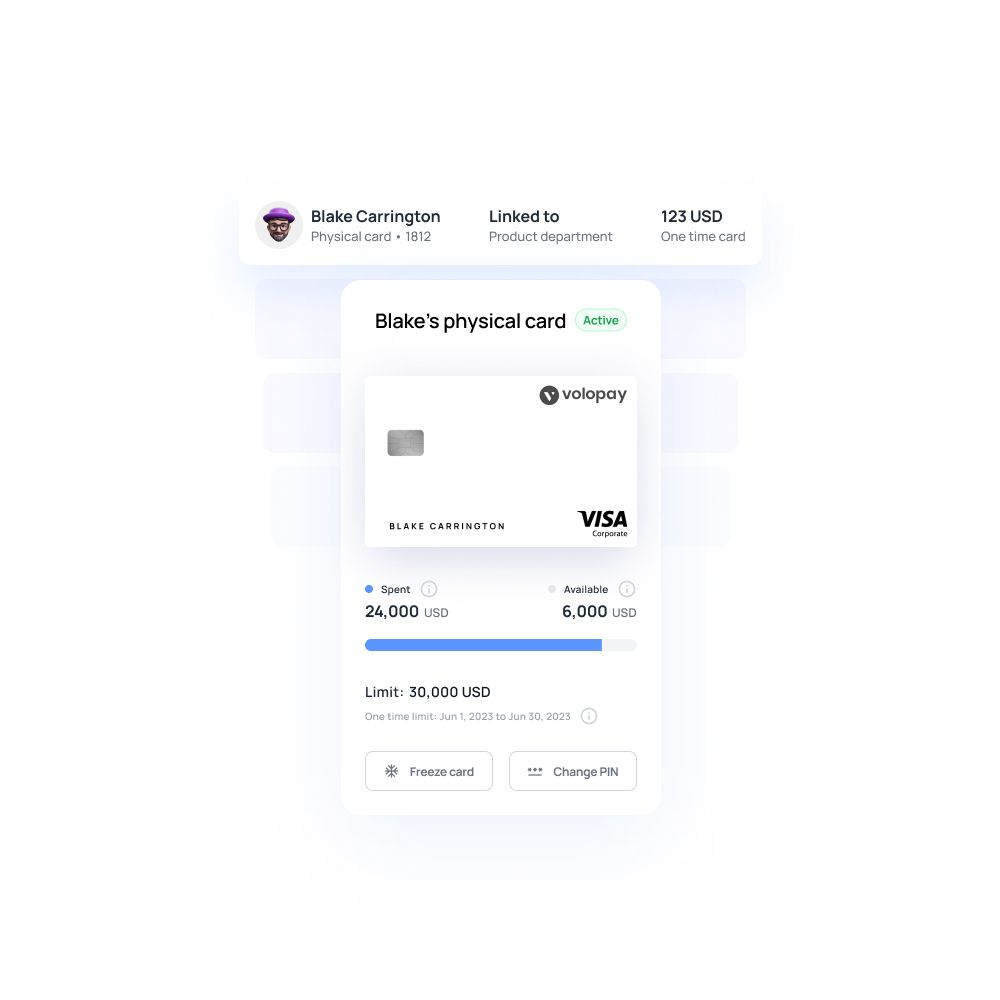

Built-in spend limits and policy enforcement

With Volopay, you can set predefined spending limits across teams, departments, or projects. Automated policy enforcement ensures every purchase aligns with business rules.

This proactive control prevents overspending and unauthorized expenses, fostering financial discipline while simplifying expense approvals for faster, more compliant, and cost-efficient corporate expense management.

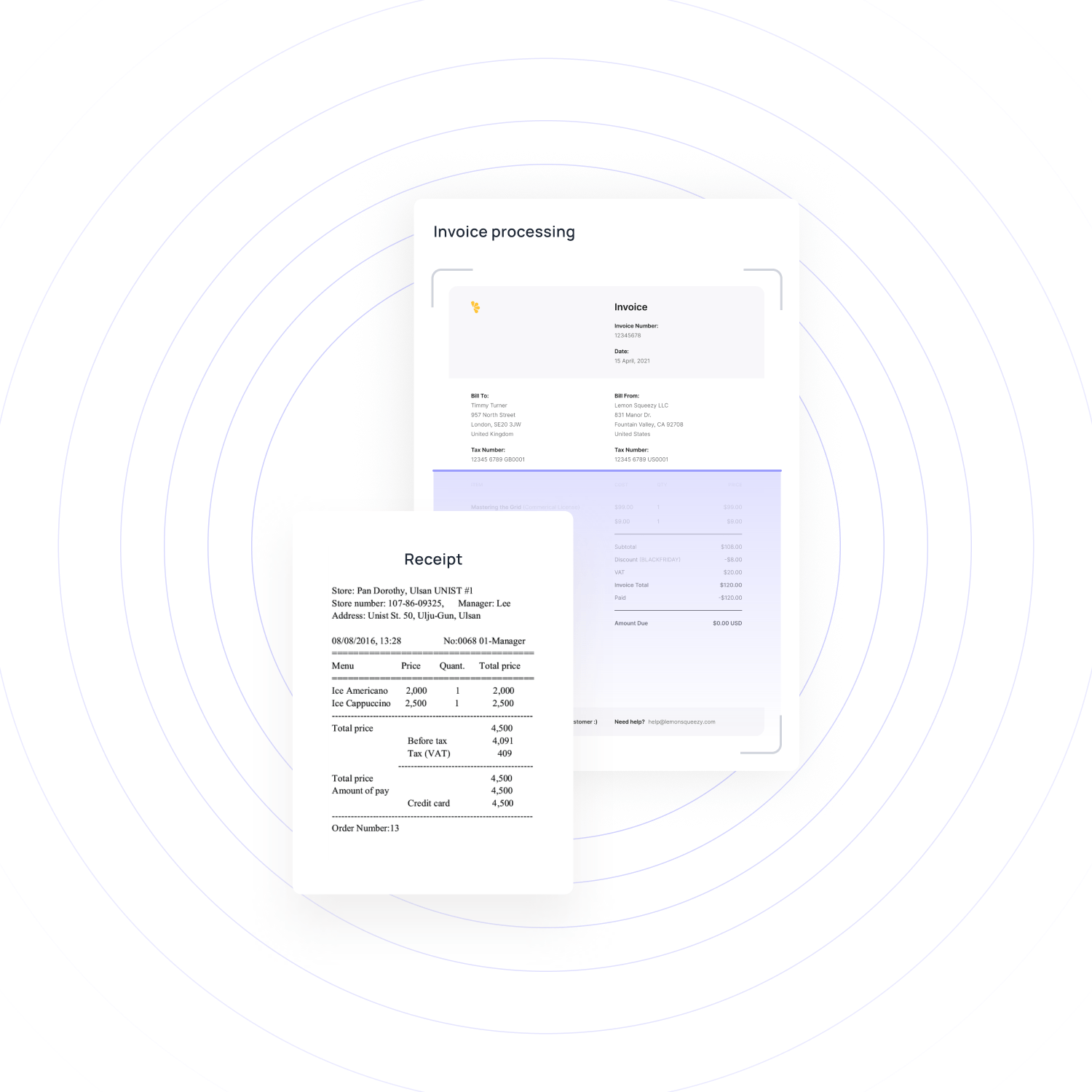

Automated receipts and accounting sync

You no longer need to chase employees for receipts or manual reconciliations. Volopay automates receipt capture through digital uploads and instantly syncs expenses with accounting platforms.

This integration streamlines bookkeeping, reduces data entry errors, and ensures every transaction is properly categorized for audit readiness and financial transparency.

Seamless domestic and international payments

Volopay allows you to make business transfers both domestically and internationally. Using ACH and local payment rails, you minimize transaction fees while maintaining fast, reliable settlements.

This feature ensures your business can manage vendor payments globally without overpaying on cross-border costs, improving financial efficiency and operational scalability.

Unified dashboard for full visibility and control

With Volopay’s centralized dashboard, you can monitor every business expense in real time. The unified view offers detailed analytics, approval tracking, real time reporting and budget insights in one place.

This visibility allows you to identify spending trends, reduce inefficiencies, and make faster, data-driven financial decisions that drive profitability.

Bring Volopay to your business

Get started now

FAQs

Small businesses often pay higher fees because they process fewer transactions and have lower bargaining power. Larger enterprises negotiate better interchange rates due to higher volume, stronger financial credibility, and established risk profiles that lower processor costs significantly.

Corporate card transactions include interchange fees, assessment charges, and payment processor costs. Additional expenses may involve gateway access, fraud protection, or chargeback handling. Together, these components form the total cost businesses incur for accepting and managing credit card payments efficiently.

To minimize chargebacks, you should use strong verification tools, maintain clear transaction records, and provide transparent refund policies. Enhancing communication and ensuring secure payment authentication significantly lowers dispute risks and associated financial penalties.

Volopay automates expense tracking, optimizes payment workflows, and minimizes unnecessary transaction charges. With transparent pricing, real-time insights, and integrated controls, it helps businesses effectively reduce corporate credit card fees while maintaining compliance and improving financial efficiency.

Yes, Volopay is ideal for startups and global teams. We support multi-currency transactions, enable low-cost international payments, and ensure unified expense management, offering transparent control and seamless cross-border financial operations for growing businesses.