What is financial modeling? Process, techniques & best practices

Financial modeling is an essential tool for investors, businesses, and financial analysts to make informed decisions based on data. Through the use of historical information, assumptions, and financial forecasts, it provides a formalized picture of a company's future finances.

It assists in different activities, including budgeting, investment analysis, and risk management. Whether it is for business growth, a merger, or to analyze the effect of market conditions, the financial modeling process yields essential insights.

Knowing what is financial modeling enables businesses to maximize resources, determine financial health, and prepare well for future growth while avoiding risks.

What is financial modeling?

Financial modeling is the process of developing a numerical model to reflect the financial performance of a company. This is usually done by developing spreadsheets that consolidate main financial statements like the income statement, balance sheet, and cash flow statement.

These models are based on history, assumptions, and forecasts to predict future financial performance. Financial modeling serves to inform decision-making processes like budgeting, investment analysis, and strategic planning.

By knowing what is financial modeling, stakeholders can examine various business situations, make investment decisions, and maximize financial plans. Ultimately, financial modeling is an influential tool that equips businesses with the ability to make smart, data-driven decisions that lead to success.

Example of a financial model

An example of a financial model that is most often used is the three-statement model. This model combines the income statement, balance sheet, and statement of cash flows to present a complete picture of a business's financial performance.

The financial modeling process here connects all three statements in a way that any change in one statement, such as an increase in revenue, will automatically be reflected in the other two.

For instance, increased revenues will increase net income on the income statement, which in turn increases cash flows and impacts the assets and liabilities of the company on the balance sheet. The three-statement model is commonly utilized for forecasting purposes, valuations, and investment analysis. The three-statement model forms the basis for sophisticated models in corporate finance.

Components of financial modeling

The financial modeling process contains key elements that, individually and collectively, produce a valid and dependable model. These elements are essential for gauging financial performance, making sound decisions, and predicting business results.

Financial statements

Financial statements are the basis for any financial modeling exercise. The income statement, balance sheet, and cash flow statement are the main statements that are utilized. They give indications of a firm's profitability, financial standing, and cash flow dynamics.

Modeling these statements correctly is paramount since they all interact with each other, enabling firms to anticipate future financial performances. This interaction makes the model a representation of the actual financial standing of the business.

Historical data

Historical information is a central component of the financial modeling process. It consists of historical performance figures such as revenue, costs, profit margins, and growth rates. Examining this information offers functional insights into trends, seasonality, and operating efficiencies.

By drawing on this information, financial models can make more precise forecasts for the future, minimizing the chances of errors. Historical information assists in making realistic assumptions so that the model's projections are based on genuine performance.

Assumptions

Assumptions form an essential part of the financial modeling process, determining how future financial performances are estimated. Assumptions may be such that they can encompass sales growth rates, cost of goods, inflation, or market conditions.

The realism and quality of assumptions have a direct impact on how accurate the outputs of the model are. Financial modeling assumptions are to be underpinned with data, industry trends, or expert opinion so the forecast does not lose relevance. Inadequate assumptions can distort outputs, resulting in bad decisions.

Working capital

Working capital refers to the capital required to manage day-to-day operations. It is calculated as the difference between a company’s current assets and current liabilities. In the financial modeling process, working capital is a critical factor that affects cash flow.

Proper management ensures the business can meet short-term obligations without compromising growth. Accurate working capital projections help businesses maintain liquidity and optimize operational efficiency, ensuring smooth operations and financial stability.

Supporting schedules

Supporting schedules offer detailed breakdowns of different financial components in a model, with each component being accurately accounted for. Depreciation schedules, tax schedules, and capital expenditure schedules are some examples.

Supporting schedules are significant in outlining the effect of individual items on the primary financial statements. By dissecting intricate financial factors, supporting schedules improve the accuracy of the financial modeling process, offering clarity and precision in the overall model.

Investments

Investments are long-term capital expenditures incurred by a business to improve its financial standing or pursue strategic objectives. Investments may take the form of buying assets, investing in research and development, or buying new businesses.

Investments need to be modeled carefully in the financial modeling process to evaluate their effect on future profitability and cash flow. Proper estimation of the return on investments (ROI) enables businesses to determine whether capital deployment supports long-term financial goals and returns shareholder value to the maximum.

Growth margins

The growth margin is the projected rate at which a firm's revenue or profit will grow over a specific period. Forecasting growth margins in the financial modeling process is necessary for future business planning.

Historical data, market trends, and business conditions affect the growth rate. Using realistic growth margins allows the model to accurately capture the firm's expansion potential, enabling firms to make informed decisions on scaling, investments, and resource allocation.

Types of financial models

The financial modeling process involves various types of models, each designed to serve different business purposes. These models help companies make data-driven decisions by providing insights into financial performance and forecasting future outcomes.

1. Three-statement model

The three-statement model is among the most basic forms of financial modeling. It combines the income statement, balance sheet, and cash flow statement into a single integrated model.

For those inquiring about what is financial modeling, this method gives a definite answer: it's the process of creating tools such as the three-statement model to project financial performance and map the interconnections between key financial statements.

This model enables users to observe how alterations in one statement affect the others, and it is therefore priceless for budgeting, valuation, and obtaining a complete picture of a company's financial situation.

2. Forecasting model

A forecasting model is used to predict future financial performance based on historical data, assumptions, and industry trends. This model is crucial in the financial modeling process for making informed decisions about future investments, growth strategies, and resource allocation.

Forecasting models often incorporate multiple scenarios, such as best-case and worst-case, to account for uncertainties in the market. They help businesses adjust their plans and strategies based on anticipated financial outcomes and market conditions.

3. Budget model

A budget model focuses on planning a company’s income, expenses, and profits over a specific period, often yearly. It is a critical tool in the financial modeling process for business planning and resource allocation. This model helps companies track their financial goals and allocate funds effectively.

By establishing a budget, companies can measure performance against projections, adjust their strategies, and optimize spending. Budget models are typically less detailed than other models, but are vital for operational planning.

4. Scenario analysis model

A scenario analysis model evaluates how different scenarios—such as changes in market conditions, interest rates, or economic events—can impact a company’s financial outcomes. By varying key assumptions, businesses can model potential risks and rewards.

This type of financial modeling is often used in strategic planning, risk management, and stress testing. Scenario analysis helps businesses prepare for various outcomes, allowing them to make better-informed decisions in uncertain environments.

5. Discounted cash flow model

The discounted cash flow (DCF) model is used to estimate the value of a business based on its projected future cash flows, discounted to present value. The model is widely used in investment analysis and valuation.

By incorporating financial modeling assumptions like growth rates and discount rates, the DCF model helps determine whether a company or investment is overvalued or undervalued. It is a critical tool for investors to assess long-term value and profitability.

6. Merger & acquisition model

The merger & acquisition (M&A) model is specifically designed to analyze the financial effects of a merger or acquisition. This model helps assess the potential value creation or destruction from combining two companies.

By examining financial metrics such as earnings per share (EPS), synergies, and financing methods, M&A models guide companies in making strategic decisions regarding potential acquisitions. The model helps identify optimal structures for deals and evaluate the impact on shareholder value.

7. Comparable company analysis model

The comparable company analysis (CCA) model is a valuation method that compares a company’s financial metrics with those of similar companies in the industry. This model uses multiples like the price-to-earnings (P/E) ratio, enterprise value-to-EBITDA, and others to assess relative valuation.

In the financial modeling process, the CCA model helps determine whether a company is undervalued or overvalued compared to its peers, making it a common tool for investors and analysts.

8. Leveraged buyout model

The leveraged buyout (LBO) model is used to assess the feasibility and profitability of acquiring a company using a significant amount of debt. In an LBO, the buyer uses the target company's assets as collateral for financing.

The LBO model is a key tool in financial modeling for private equity firms and investors to evaluate the potential return on investment (ROI) from the acquisition. It forecasts debt repayment schedules, cash flows, and exit strategies.

Strategic uses of financial models for business growth

Financial modeling serves a multitude of purposes across various aspects of business operations. By providing a structured way to analyze financial performance, it supports decision-making, helps evaluate business opportunities, and enhances strategic planning.

Here are some of the key use cases of financial models for your business.

1. Business valuation for investment purposes

Business valuation is one of the primary use cases of financial modeling for investment purposes. By using models such as discounted cash flow (DCF) or comparable company analysis (CCA), businesses can determine their intrinsic value.

Investors rely on these valuations to make informed decisions about acquiring, investing in, or merging with a company. An accurate business valuation model ensures that the investment aligns with strategic goals and financial objectives.

2. Planning budgets and controlling expenses

A budgeting model helps businesses allocate resources efficiently and track expenses. It allows organizations to forecast income, monitor operating costs, and manage cash flow.

By creating a detailed budget, businesses can identify areas where they can reduce costs or reallocate resources. A financial modeling process aids in creating realistic budgets that reflect operational needs while helping businesses stay on track to achieve financial targets, all while maintaining profitability.

3. Evaluating investment opportunities

Investment analysis models provide crucial insights for making informed investment decisions. By assessing expected returns, risks, and financial impacts, businesses can evaluate different investment opportunities.

Financial models help analyze the potential outcomes of investing in projects, assets, or even other companies. These models often include projections for cash flow, profitability, and capital requirements, allowing businesses to compare various investment options and select the one that best aligns with their financial strategy.

4. Analyzing mergers and acquisitions

Merger and acquisition (M&A) analysis involves using financial modeling to evaluate the financial impact of a potential deal. These models analyze factors such as synergies, cost savings, and earnings accretion or dilution from a merger or acquisition.

By assessing the combined company’s financial health, including debt levels and expected returns, businesses can make informed decisions about whether to pursue a deal. M&A models provide a structured framework for deal structuring and valuation.

5. Optimizing resource allocation

Resource allocation models help businesses optimize their use of capital, labor, and other resources. By understanding how to allocate resources effectively, businesses can achieve higher operational efficiency.

Financial models in this area help prioritize investments and operational expenditures, ensuring that resources are deployed to areas that offer the best return. Proper resource allocation models enable businesses to streamline operations, cut unnecessary costs, and focus on areas that drive growth and profitability.

6. Reviewing and interpreting financial statements

Financial statement analysis is essential for understanding the financial health of a company. By using financial modeling, businesses can assess profitability, liquidity, and solvency through a detailed review of income statements, balance sheets, and cash flow statements.

These models identify key performance indicators (KPIs), such as return on assets (ROA) or profit margins, which help businesses monitor their financial performance and make data-driven decisions for improving overall financial stability and growth.

7. Planning scenarios and forecasts

Scenario planning is a key use case for financial modeling in forecasting. Businesses use this method to evaluate the potential impact of different future scenarios, such as economic downturns or changes in market conditions.

By altering key variables, businesses can predict the potential outcomes under various conditions. Scenario planning helps organizations prepare for uncertainty and develop flexible strategies, ensuring they are equipped to respond to unexpected changes in the market or industry.

8. Identifying and managing financial risks

Risk assessment and management is a critical area where financial modeling is applied. Financial models help businesses identify, quantify, and mitigate risks related to cash flow, market fluctuations, and financial stability.

By performing sensitivity and scenario analysis, businesses can understand how various risk factors may affect their financial performance. These models allow companies to proactively manage risks, adjust strategies, and minimize potential losses, ensuring financial resilience in volatile market conditions.

9. Supporting internal decision-making with management accounting

Management accounting involves using financial modeling to analyze operational data for internal decision-making. It provides insights into cost control, profitability analysis, and performance metrics.

Financial models support managers in budgeting, variance analysis, and forecasting, helping businesses track performance against goals. These models enhance decision-making by providing a clear understanding of how internal operations affect financial results.

With accurate management accounting models, companies can improve profitability and efficiency by making informed operational decisions.

Benefits of a financial model for a company

Financial modeling provides companies with powerful tools to forecast future performance, analyze financial health, and plan for growth. By creating detailed and accurate models, businesses can make informed decisions, streamline operations, and stay agile in a competitive market.

Improved decision-making

One of the key benefits of financial modeling is enhanced decision-making. Financial models provide clear, data-driven insights that allow managers to assess different scenarios and make informed choices.

By visualizing potential outcomes, companies can avoid costly mistakes and pursue profitable opportunities. Whether it's assessing a new investment, evaluating a strategic initiative, or adjusting business operations, financial models serve as a vital tool for making decisions based on real financial data and assumptions.

Smarter financial planning

Financial modeling significantly improves a company's financial planning. By forecasting future revenue, expenses, and cash flow, businesses can create comprehensive financial plans that align with their strategic goals.

This allows companies to set realistic objectives, manage capital efficiently, and prepare for any financial challenges ahead. With the ability to simulate different financial scenarios, businesses can refine their plans to ensure they stay on track to meet both short-term and long-term financial goals.

Flexibility amid changing market conditions

The ability to adapt to market changes is another crucial benefit of financial modeling. By running scenario analyses and sensitivity tests, businesses can model the financial impacts of various market conditions, such as economic downturns or shifts in consumer demand.

This adaptability allows companies to be proactive rather than reactive, ensuring they have contingency plans in place. Financial models enable businesses to pivot quickly and strategically, safeguarding their financial health in times of market volatility.

Enabling efficient financial reporting

Financial modeling plays an important role in facilitating accurate financial reporting. By creating structured financial statements and forecasts, businesses can easily prepare reports for stakeholders, regulators, and investors.

These models ensure that financial data is organized and presented clearly, which not only aids in internal decision-making but also boosts external transparency. Well-designed financial models make reporting more efficient, reducing the risk of errors and ensuring compliance with financial regulations and accounting standards.

Effective stakeholder communication

Effective communication with stakeholders is a significant benefit of financial modeling. Models provide a clear, visual representation of a company’s financial health and future projections, making it easier for management to communicate complex financial data to investors, employees, and board members.

Whether discussing potential risks, growth opportunities, or financial strategies, a well-built model helps stakeholders understand the business’s direction, fostering trust and aligning expectations with the company’s financial goals and performance.

Enhancing budgeting accuracy

Financial modeling enhances the accuracy of budgeting by using historical data and assumptions to predict future financial performance. This allows businesses to create more precise budgets that reflect real financial trends and realistic growth expectations.

Accurate budgeting helps organizations manage cash flow, allocate resources efficiently, and avoid overspending. A well-crafted financial model also allows businesses to adjust their budgets as necessary based on new data, ensuring ongoing financial control and stability.

Increased operational efficiency

Financial modeling contributes to improved operational efficiency by identifying areas where costs can be reduced or operations streamlined. By analyzing financial data and performance metrics, businesses can uncover inefficiencies and optimize resource allocation.

Models can also track key performance indicators (KPIs) and help businesses evaluate the effectiveness of different strategies. With more informed insights, companies can refine their operations, improving productivity, reducing waste, and ultimately increasing profitability.

Strengthened compliance practices

Compliance with regulatory requirements is crucial for any business, and financial modeling aids in this process by ensuring that financial records and reports are accurate, timely, and meet all relevant standards.

Financial models can automate compliance checks, track changes in regulations, and ensure that financial data aligns with legal requirements. This helps businesses avoid costly penalties, build trust with regulators, and maintain a reputation for financial transparency and accountability in the industry.

Who typically uses financial modeling in business?

Financial modeling is a crucial tool for businesses of all sizes and industries. It helps organizations forecast financial performance, allocate resources effectively, and make informed decisions. Different types of businesses leverage financial modeling based on their unique needs and goals.

1. Startups and small businesses

Startups and small businesses use financial modeling to map out their growth potential, manage cash flow, and attract investors. For these businesses, accurate financial models are essential for understanding revenue streams, estimating expenses, and determining funding requirements.

These models help owners make strategic decisions about scaling operations, entering new markets, or managing capital. Startups often rely on financial modeling to demonstrate their business’s potential and secure funding from investors or venture capitalists.

2. Large corporations

Large corporations use financial modeling for a variety of purposes, including financial forecasting, budgeting, and performance analysis. Large companies rely on these models to assess long-term strategic plans, allocate resources across departments, and evaluate potential mergers or acquisitions.

Financial models enable corporations to monitor profitability, manage risk, and optimize their operations at scale. They also serve as a key tool for communicating financial performance to stakeholders, such as investors, board members, and regulatory bodies.

3. Private equity (PE) & venture capital (VC) firms

Private equity (PE) and venture capital (VC) firms rely heavily on financial modeling to assess potential investments, evaluate risks, and forecast returns. These firms use models like discounted cash flow (DCF) and comparable company analysis (CCA) to value businesses and determine the viability of investment opportunities.

Financial modeling helps PE and VC firms assess growth potential, determine exit strategies, and ensure they invest in businesses that align with their financial objectives and investment criteria.

4. Investment banks

Investment banks use financial modeling as a critical tool in corporate finance advisory, mergers and acquisitions (M&A), and initial public offerings (IPOs). Investment bankers build complex models to evaluate the financial impact of transactions, estimate company valuations, and determine optimal financing structures.

They use financial models to present deals to clients, negotiate terms, and conduct sensitivity analyses to assess the financial risk associated with different strategic options or market conditions.

5. Financial consulting firms

Financial consulting firms use financial modeling to provide clients with strategic advice on budgeting, forecasting, mergers, acquisitions, and investment planning. These firms create models that help businesses identify opportunities for cost savings, evaluate potential business risks, and optimize their capital structure.

By using financial models, consultants help companies navigate complex financial decisions, make data-driven recommendations, and improve overall financial performance, enhancing clients’ ability to meet long-term financial and strategic objectives.

6. Hedge funds

Hedge funds use financial modeling to assess investment opportunities, manage risks, and optimize their portfolios. These models help hedge fund managers forecast asset prices, identify market trends, and develop trading strategies.

By using sophisticated techniques like quantitative analysis and algorithmic modeling, hedge funds can predict market movements, assess the potential risks of their investments, and maximize returns. Financial models are essential for hedge funds in managing complex portfolios and achieving high-risk, high-reward strategies.

The financial modeling process

The financial modeling process involves a series of steps that allow businesses to forecast their future financial performance. By creating a detailed, data-driven model, companies can analyze various scenarios, assess risks, and make informed decisions about their financial strategies and goals.

1. Set your goal

The first step in the financial modeling process is defining the purpose of the model. Are you forecasting future cash flow, evaluating an investment opportunity, or analyzing the impact of a potential merger?

Clearly identifying the objective will guide the structure and complexity of the model. Having a specific purpose in mind ensures that the model is tailored to meet the business's needs and provides relevant insights for decision-making.

2. Gather the right information

Next, you need to gather relevant data to populate the model. This includes historical financial statements, market research, industry trends, and internal company data. The accuracy and quality of the data will significantly impact the reliability of the financial model.

Collecting data from trusted sources, such as past performance, projected growth rates, and expected costs, is essential to building a strong foundation for your model’s projections and assumptions.

3. Determine key drivers

In this step, you identify the key drivers that will impact the financial performance of the business. These might include sales growth, operating costs, capital expenditures, and interest rates.

The financial modeling process focuses on the variables that most significantly affect the company’s financial outcomes. Understanding these drivers allows you to create a model that can be adjusted to reflect changes in these critical factors, providing more accurate and dynamic forecasts.

4. Make realistic assumptions

Creating realistic assumptions is crucial to building a credible financial model. These assumptions are based on historical data, industry benchmarks, and market conditions. For example, assumptions regarding revenue growth, expense increases, and interest rates must be grounded in reality.

Unrealistic assumptions can skew the model’s projections and lead to poor decision-making. By using conservative and evidence-based assumptions, you ensure that the financial model reflects a more accurate potential future outcome.

5. Plan the layout of your model

The next step is designing the structure and layout of the model. A clear and organized layout is key to making the model easy to follow and understand.

This includes deciding how the different financial statements (income statement, balance sheet, and cash flow statement) will be structured and linked. A well-organized model ensures that users can easily navigate between sections and that updates or changes to data can be made efficiently without confusion.

6. Build the income statement

Once the structure is in place, you can begin building the income statement, which shows the company’s revenues, expenses, and profits over a specific period. This is the heart of any financial model, as it provides insight into a company’s profitability.

The income statement includes key components like revenue forecasts, cost of goods sold (COGS), operating expenses, and taxes. Accurate forecasting in this section is critical for understanding potential profit margins and business sustainability.

7. Build the balance sheet

Next, you will build the balance sheet, which provides a snapshot of the company’s financial position at a given point in time. The balance sheet includes assets (both current and long-term), liabilities (current and long-term), and equity.

The financial modeling process ensures that all entries in the balance sheet are correctly linked and that the model is balanced, with total assets equaling total liabilities and equity. This step ensures accurate financial reporting.

8. Run sensitivity tests

Sensitivity analysis involves testing how changes in key assumptions or inputs affect the financial model’s outputs.

For instance, how would changes in sales growth or operating costs impact profitability or cash flow? By performing a sensitivity analysis, you can assess the range of possible outcomes and understand which variables have the greatest impact on the business.

This helps identify risks and areas of uncertainty, allowing for better decision-making in the face of volatility.

9. Validating the scenario model

Scenario modeling is the process of testing the financial model under different conditions, such as best-case, worst-case, and base-case scenarios. This step helps validate the model’s robustness by evaluating how various changes, such as economic downturns, changes in market demand, or shifts in pricing strategy, would affect the business’s financial outcomes.

Scenario modeling helps ensure that the model is flexible and reliable, even under uncertain conditions, providing decision-makers with valuable insights into potential risks and opportunities.

10. Present your findings

Once the model is built and validated, the next step is to present the results. This typically involves generating financial reports and visualizations that summarize key metrics such as revenue, profit margins, and cash flow.

Clear communication of the model’s findings is essential, as it helps stakeholders, including investors, management, and board members, understand the financial outlook and make informed decisions. Data visualization tools like graphs, charts, and dashboards can be very effective in this stage.

11. Continuously review and refine the model

Finally, it's important to review and update the financial model regularly to ensure its accuracy over time. As new data becomes available or market conditions change, you may need to revise your assumptions, update financial projections, and revalidate your model.

Regular updates allow the model to remain a relevant tool for decision-making and strategic planning. This ongoing maintenance ensures that your financial model continues to provide useful insights and supports your business’s evolving needs.

Who builds financial models in a business?

Financial models are built by various professionals within an organization who contribute their expertise to ensure the model’s accuracy and effectiveness. These professionals range from financial analysts to CFOs and external consultants, each playing a crucial role in financial decision-making.

1. Financial analysts

Financial analysts are often the primary creators of financial models. They gather data, analyze trends, and build models to forecast the company’s financial future.

They use financial data to create detailed projections, assess financial performance, and support strategic decisions. Their role is crucial in ensuring that the financial model reflects the company’s operational realities and provides valuable insights for management, investors, and stakeholders.

2. Finance managers

Finance managers oversee the financial modeling process, ensuring that models are aligned with the organization’s objectives. They supervise analysts, provide strategic input, and make sure that the financial model adheres to accounting standards and corporate guidelines.

Finance managers are responsible for translating high-level financial objectives into practical, actionable forecasts. They also provide insights into budget allocation, resource management, and risk assessment, ensuring the model supports long-term organizational goals.

3. Chief Financial Officers (CFOs)

The Chief Financial Officer (CFO) plays a critical role in guiding the creation of financial models, especially for strategic decision-making. They provide high-level direction, ensuring that the models align with the company's overall financial goals.

CFOs review models for accuracy and use them to evaluate long-term financial planning, growth strategies, and capital allocation. Their expertise helps ensure that financial models effectively support decision-making at the executive level and for stakeholders.

4. Financial advisors and consultants

Financial advisors and consultants are often brought in to provide expertise in building or validating financial models. They offer an external perspective, helping businesses refine their models, enhance assumptions, and incorporate industry best practices.

These experts also provide advice on the most appropriate modeling techniques for specific business needs. Consultants can help businesses navigate complex financial situations, offering insights that ensure the models are robust, accurate, and aligned with broader financial goals.

5. Investment analysts

Investment analysts use financial models to assess the viability and potential return of investments. They analyze company performance, economic factors, and market trends to create forecasts and recommendations for potential investors.

By building detailed financial models, investment analysts can evaluate stock performance, acquisition opportunities, or mergers. Their models help investors understand the risks and opportunities associated with particular investments, ensuring that decisions are grounded in solid financial projections and data-driven analysis.

6. Risk analysts

Risk analysts are responsible for identifying potential financial risks and building models that predict their impact on the business. They focus on understanding how variables like interest rates, market fluctuations, or regulatory changes affect the company’s financial health.

By building risk models, they help businesses anticipate and mitigate risks. These professionals also ensure that financial models incorporate various risk scenarios to prepare for uncertainties, providing essential support for decision-making and risk management strategies.

7. Educators and researchers

Educators and researchers contribute to financial modeling by developing theoretical frameworks and teaching best practices to students and professionals. Their research often drives innovation in modeling techniques and ensures that the latest academic advancements are incorporated into industry practices.

In business settings, they may be involved in building models for new projects or product developments. Their work helps bridge the gap between academic theory and practical application, influencing the design of effective financial models.

Is accounting expertise necessary to make a financial model?

Creating a financial model requires a foundational understanding of accounting principles, such as the ability to read and interpret financial statements—especially the income statement, balance sheet, and cash flow statement.

A solid grasp of concepts like revenue recognition, cost accounting, cost structures, and working capital is essential for making accurate projections and assumptions.

While advanced accounting knowledge is not always necessary, having a strong grasp of basic accounting ensures that financial models reflect a company’s true financial health and performance.

Technologies & tools used in building a financial model

Various technologies and tools are employed in building financial models to enhance accuracy, efficiency, and scalability. From widely used spreadsheet software to advanced financial modeling platforms and programming languages, these tools help analysts create robust and reliable financial models.

1. Microsoft Excel

Microsoft Excel is the most commonly used tool for building financial models. It offers flexibility, a wide range of functions, and user-friendly features like pivot tables and data analysis tools, which are essential for creating detailed financial projections.

Excel’s ability to handle complex calculations, organize financial data, and visualize trends through charts and graphs makes it indispensable for financial analysts. It’s often the first choice due to its accessibility and familiarity.

2. Google Sheets

Google Sheets is another popular tool for building financial models, especially for collaborative environments. It offers many of the same functionalities as Excel but allows multiple users to work on a model simultaneously in real time.

This cloud-based solution ensures seamless collaboration between team members, especially in remote work setups. While Google Sheets may have some limitations in terms of advanced functions, it’s still an effective tool for simple to moderately complex financial models.

3. Financial modeling software

Financial modeling software includes specialized tools designed specifically for building and managing financial models. These platforms, such as Quantrix or Adaptive Insights, offer advanced capabilities like scenario planning, forecasting, and multi-dimensional modeling.

These tools are designed to streamline the financial modeling process by automating many aspects of data input, calculation, and reporting. They allow for more sophisticated modeling techniques and are particularly useful for large organizations and complex financial situations.

4. Programming languages

Programming languages such as Python, R, and VBA (Visual Basic for Applications) are increasingly used to build more customized and automated financial models. These languages allow for more complex calculations, the integration of various data sources, and the automation of repetitive tasks.

Python, for example, is widely used for data analysis and machine learning in financial forecasting. By using programming languages, analysts can create highly flexible and scalable financial models that go beyond typical spreadsheet limitations.

5. Business intelligence (BI) tools

Business Intelligence (BI) tools, such as Tableau and Power BI, are used to enhance the visualization and reporting aspects of financial models. These tools allow financial analysts to connect various data sources, perform sophisticated analyses, and create interactive dashboards that present financial insights clearly.

BI tools help businesses make data-driven decisions by transforming raw financial data into actionable insights. They improve the presentation of financial models and make complex financial data easier to interpret.

How to validate a financial model?

Validation of a financial model is an integral part of the modeling process aimed at verifying that the outputs produced by the model are accurate, reliable, and relevant. Through validation, problems are highlighted if any, and it ensures the model is achieving its desired purposes effectively.

Meaning

Validating a financial model is about ensuring that the model is correct, coherent, and built on sound assumptions. It entails numerous checks and testing procedures in order to confirm its integrity and functionality prior to utilizing it for making decisions.

● Verification of assumptions

Validation of assumptions is an important process in ensuring a financial model's validity. Assumptions regarding such factors as revenue growth, cost projections, and market conditions are the building blocks of the model.

These assumptions should be realistic, strongly supported by facts, and consistent with the business climate. Verification of assumptions against historical data, industry norms, and experts' views ensures they are true to current realities, enhancing the accuracy and usefulness of the model for decision-making.

● Consistency checks

Consistency checks involve evaluating the model for internal consistency. This involves making sure that all inputs, assumptions, and formulas are in proper alignment and are logically consistent throughout various parts of the model.

As an example, the input data in the income statement should correspond to the forecasts in the cash flow statement. Consistent data or calculations can cause errors and inaccurate results, so it is important to ensure that the model works as an integrated system.

● Sensitivity analysis

Sensitivity analysis checks the impact of variations in important assumptions or inputs on the outputs of the model. For instance, what would happen to profitability or cash flow if sales growth or interest rates were changed?

Sensitivity analysis determines which variables have the most influence on the financial model so that you can estimate the range of possibilities. This step determines the sensitivity of the model to changes, giving you a sense of where there may be risk or opportunity.

● Testing scenarios

Scenario testing refers to the process of checking how various scenarios affect the outcome of the model. Scenarios can consist of best-case, worst-case, and base-case forecasts, enabling businesses to see what could happen under different circumstances.

By testing various scenarios, you can observe how various factors, such as changes in market demand, rising costs, or recession, impact the business's bottom line. This ensures the model is robust and can handle unforeseen circumstances.

● Re-checking calculations

Re-checking calculations is a key aspect of verifying a financial model. Verifying that all mathematical equations and calculations are correct avoids mistakes that can skew the results of the model.

Checking formulas, total sums, and major metrics again ensures that the financial information is handled properly and the model performs as intended. A mistake in the calculations can result in inaccurate projections, so high attention to detail is paramount during this verification process.

● Peer review

Peer review entails getting other experts or stakeholders, e.g., managers or financial analysts, to critique the model in terms of its accuracy and reliability. Peer reviewers can spot flaws or areas that the original modeler might not have noticed.

This collaborative method brings a different angle to the model's logic, structure, and assumptions. Peer review also lends credibility because it ensures the model is in line with professional standards and financial modeling best practices.

Importance

Validating a financial model is important because it makes sure the model is accurate and reliable. Without validation, the outputs from the model can be misleading, resulting in business risk and poor decision-making.

● Accuracy

Precision is essential for the success of a financial model. If assumptions, data, or calculations are in error, the outputs of the model will not be reliable. Validation guarantees that every element of the model relies on accurate and precise data.

Precise models reflect the real financial situation, enabling companies to make sound decisions. Without precision, a model's projections could result in expensive errors or lost opportunities.

● Credibility

Credibility is one of the most important elements of financial model validation. A model that has been rigorously validated and vetted by experts will be more likely to be believed by stakeholders, investors, and decision-makers.

Reliable models give assurance that the financial forecasts are founded on good logic, robust data, and realistic assumptions. Unreliable or unvalidated models can harm a business's reputation and erode stakeholder trust, so credibility is critical to effective decision-making.

● Risk management

Risk management is another reason why it is essential to validate a financial model. A model that has not been validated can fail to consider possible risks, resulting in ineffective risk mitigation strategies.

Validation ensures that the weaknesses of the financial model are identified and that it properly reflects possible risks, including changes in market conditions or operating costs. This allows businesses to create contingency plans and steer clear of unexpected financial pitfalls.

● Compliance

Compliance is an important element of financial modeling. Most industries have regulatory requirements that call for transparent and accurate financial reporting. Validation of the financial model guarantees that it meets these regulatory requirements and accounting rules and guidelines.

A non-validated model can inadvertently cause non-compliance, resulting in legal sanctions and reputational loss. Validation ensures that the model is industry standard and regulatory compliant, protecting the business operations.

● Enhanced user understanding

Validation also increases the user's awareness of the financial model. A validated and tested model is better understood, makes more sense, and is more easily interpreted by stakeholders. Management and investors are able to have confidence in the results and the decisions made as a result of the model.

Utilizing rigorous validation, the model as a communication device is stronger and allows users to understand critical financial information and make strategic, well-informed business decisions.

Role of financial forecasting in validating a financial model

Financial forecasting plays a crucial role in validating a financial model. It involves predicting future financial outcomes based on historical data and market trends. Accurate forecasting ensures that the model's assumptions are realistic, providing a solid foundation for decision-making.

1. Building the foundation for assumptions

Financial forecasting helps build the foundation for the assumptions used in the model. By analyzing past financial data and considering market trends, businesses can establish more accurate forecasts for key variables such as revenue growth, costs, and capital expenditures.

These forecasts provide a realistic basis for assumptions, ensuring they align with both historical performance and future expectations. Reliable assumptions lead to more accurate financial projections and better-informed business strategies.

2. Developing scenarios

Scenario development is a critical part of financial forecasting. By creating different future scenarios—such as best-case, worst-case, and base-case—businesses can evaluate how various conditions might affect financial outcomes.

For example, how would an economic downturn impact revenue, or how would higher costs influence profitability? Forecasting these scenarios helps validate the financial model by ensuring that it is flexible and can accommodate changes in the business environment, thereby improving its robustness.

3. Performance benchmarking

Performance benchmarking involves comparing the financial model's projections against industry standards and past performance. By using financial forecasting, businesses can set realistic benchmarks for revenue, margins, and growth.

These benchmarks help validate the model by providing context for the projections. If the forecasted performance significantly deviates from industry norms or historical results, it may signal a need to reassess the assumptions or methods used in the model, ensuring its credibility.

4. Estimation of expenses

Accurate expense estimation is vital to a financial model’s validity, and financial forecasting plays a key role in this process. By projecting future costs based on historical trends and market expectations, businesses can estimate operating expenses, capital expenditures, and other liabilities.

These forecasts help validate the financial model’s cost assumptions, ensuring they are reasonable. Without proper expense estimation, the model may overestimate profitability, leading to unrealistic business forecasts and potential financial mismanagement.

5. Revenue projections

Revenue projections are a core component of financial forecasting and directly impact the validation of a financial model. Forecasting future sales based on market trends, historical performance, and external factors allows businesses to estimate expected revenues accurately.

These projections serve as a check on the model’s assumptions about income growth and demand. By aligning revenue projections with realistic expectations, businesses can avoid overestimating their financial potential and ensure that the model accurately reflects the market landscape.

6. Dynamic analysis

Dynamic analysis in financial forecasting involves testing how changes in key variables, such as market conditions, costs, or pricing, affect the overall financial outcomes. This analysis is essential for validating a financial model, as it helps businesses understand how different factors interact.

By dynamically adjusting key assumptions, businesses can test the sensitivity of the model’s predictions to fluctuations, ensuring that the model is adaptable and can provide reliable insights under various future conditions.

Techniques of financial forecasting

Financial forecasting techniques help businesses predict future financial outcomes based on historical data and market trends. These methods allow for better decision-making by providing insights into potential revenue, expenses, and overall financial performance. Various techniques ensure a comprehensive forecast.

Scenario analysis

Scenario analysis involves evaluating how different scenarios affect the financial model. By creating best-case, worst-case, and base-case scenarios, businesses can test how changes in key assumptions, such as market conditions or costs, will influence financial outcomes.

This method helps to assess risk and uncertainty, offering valuable insights into potential future outcomes. It ensures the model is robust and adaptable to different situations, enhancing its overall reliability and decision-making capacity.

Time series analysis

Time series analysis uses historical data points, such as sales, revenue, or stock prices, to forecast future financial trends. By analyzing patterns over time, such as seasonal fluctuations or cyclical trends, businesses can predict future performance with greater accuracy.

This technique assumes that past behavior is a good indicator of future outcomes. It helps refine forecasts, especially when there are clear trends or regular patterns, making it useful for businesses with stable, predictable operations.

Regression analysis

Regression analysis examines the relationship between variables to forecast financial outcomes. For example, it may analyze how changes in advertising spending affect sales.

By identifying correlations between independent variables (such as marketing budget) and dependent variables (like revenue), businesses can create models that predict future results based on past data. This technique is valuable for understanding cause-and-effect relationships and can be applied to predict revenue, costs, and other key metrics in the financial model.

Top-down forecasting

Top-down forecasting begins with high-level market data and applies it to estimate future financial outcomes. This technique starts by analyzing macroeconomic factors, industry trends, or total market size, and then breaks the data down to a specific company or division level.

It’s often used when external factors, such as market growth or industry performance, are the primary drivers. This approach helps businesses forecast in a broader context before refining predictions at the granular level.

Bottom-up forecasting

Bottom-up forecasting takes a more detailed approach, starting with individual operational units or departments to predict overall financial performance. It involves aggregating data from specific departments, such as sales or production, to build a comprehensive forecast for the entire business.

This method allows for a more granular understanding of how individual activities impact financial outcomes. Bottom-up forecasting is valuable for businesses with detailed internal data and operations, providing highly specific and actionable insights.

Challenges businesses face when building financial models

Developing a financial model for your business is not without challenges. From maintaining accuracy in data to aligning the expectations of stakeholders, every factor demands attention. Addressing these challenges is key to developing solid, effective financial models that inform decision-making and business strategy.

Intricate financial model design

It is not an easy task to develop a financial model that identifies all relevant variables and offers actionable information. The model has to reflect different monetary drivers, market considerations, and business processes, making the task daunting.

The model ought to be flexible but not so complicated that users cannot grasp or implement it. Finding the middle ground between complexity and simplicity is quite a test, especially when incorporating various assumptions, scenarios, and variables in the model's development.

Access to reliable, quality data

One of the most important obstacles in creating a correct financial model is access to high-quality, reliable data. Incorrect, stale, or partial data can seriously impact the output of the model, resulting in poor business decisions.

Having access to consistent data within departments, sources, and systems is a prerequisite for the creation of a reliable financial model. Businesses will struggle when the data is distributed across multiple platforms or when authenticity cannot be confirmed.

Accuracy in forecasting

Getting accuracy in forecasting is a typical challenge in constructing a financial model. Forecasts are based on several assumptions, such as revenue growth, cost trends, and market forces, which are uncertain.

Minor variations in assumptions can result in major variations in forecasted results. Financial modeling also involves projecting uncertain factors like economic changes, regulatory changes, or technological disruption, making exact forecasting a challenging task that can affect the reliability of the model.

Understanding user capacity

The financial model needs to be built with the understanding that not all users will have the same level of expertise. Some users may not be familiar with complex financial terms or calculations.

Therefore, the model must be user-friendly, with clear documentation, an intuitive layout, and easy-to-understand results. A lack of understanding among stakeholders may lead to misinterpretation or misuse of the financial model, which can undermine its effectiveness.

Integration with current systems

Integrating the financial model into current business systems, like accounting software, CRM systems, or ERP systems, is usually a major hurdle. In the absence of integration, data input and retrieval are done manually, and this can introduce inefficiencies and errors.

Furthermore, failure to integrate smoothly can complicate the updating of the model in real-time or upon changes in business dynamics. It is crucial that the model be able to work well with current systems to make it sustainable and efficient.

Capacity for identifying errors

The intricacy of a financial model raises the probability of mistakes, either through data input errors, formula calculation errors, or invalid assumptions. Error detection and rectification are key challenges.

Small errors can produce huge discrepancies if the model is not adequately inspected. The development of error-checking features, such as automatic warning or consistency tests, is a critical component to enhance the model's accuracy and stakeholder faith in the findings.

Responding to regulatory changes

Regulatory changes, including tax regulations, accounting rules, or rules within a specific industry, can pose tremendous challenges to financial modeling. Financial models need to respond rapidly to regulatory changes to continue being relevant and compliant.

Tying up regulatory updates into the model means the need for continuous monitoring and revising assumptions. Failure to provide for regulatory changes can render a financial model outdated or incorrect, and thereby cause legal or financial issues for the organization.

Aligning model with stakeholder expectations

Aligning the financial model with the priorities and expectations of multiple stakeholders can be a challenging endeavor. Multiple departments or business units can have multiple objectives, and the model has to reconcile these views.

The stakeholders can also have different levels of knowledge regarding financial forecasting, and this can create misaligned expectations. Effective communication, feedback loops, and cooperation are required to ensure the model meets the needs of all stakeholders and is well accepted.

Meeting deadlines

Time limits and strict deadlines are typical issues in creating a financial model. The creation of a precise, all-encompassing model needs time for data collection, assumption confirmation, and several versions of testing.

Nevertheless, companies frequently require rapid turnaround times for strategic planning or reporting. Under these circumstances, creating a detailed and credible model is hurried, which degrades its precision and worth. Providing adequate time and resources is essential to making the model successful.

Common mistakes to avoid while making a financial model

Creating an effective financial model requires attention to detail and a well-structured process. Mistakes can compromise the model’s reliability and accuracy, leading to flawed decision-making. Avoiding common pitfalls ensures that the model serves as a valuable tool for forecasting and analysis.

Using outdated data

One of the most critical mistakes in the financial modeling process is using outdated data. Financial models depend heavily on accurate and timely data to make reliable projections.

Relying on old or incorrect information can lead to poor assumptions, which may skew the results of the model. Regularly updating the data sources and validating the accuracy of the data are essential steps in ensuring the model’s integrity and usefulness in decision-making.

Neglecting validation

Neglecting validation is another common mistake that can undermine the accuracy of a financial model. It’s vital to regularly check and verify the assumptions, inputs, and outputs of the model to ensure they align with real-world conditions.

Without validation, a model might produce misleading results that do not reflect actual business performance. By performing consistency checks and engaging in peer reviews, you can ensure the model's reliability and identify potential errors early.

Ignoring seasonal changes

Overlooking seasonal changes is a mistake that can distort the forecasted outcomes of a financial model. Business performance often varies across seasons, and these fluctuations should be incorporated into the model’s assumptions.

For example, sales in retail may spike during the holiday season. Neglecting such cyclical variations could lead to inaccurate revenue or expense forecasts. Ensuring the model accounts for seasonality helps create more realistic and actionable projections.

Overlooking external factors

External factors such as economic shifts, regulatory changes, and market disruptions can significantly impact the accuracy of a financial model. Many times, these external elements are overlooked or underestimated during the modeling process.

For example, sudden market volatility or a regulatory change can drastically alter the model’s assumptions. It's essential to consider these variables and incorporate them into the model to make sure it remains relevant and adaptable to unexpected events.

Excluding key stakeholders

Not involving key stakeholders early in the financial modeling process can lead to a model that doesn't reflect the real needs or goals of the business. Input from different departments or business units helps ensure the model is comprehensive and aligned with the organization’s objectives.

By getting feedback from stakeholders like finance teams, sales, and operations, the model can better address critical concerns and provide insights that are relevant to all involved parties.

Poor scenario planning

Poor scenario planning is a mistake that can undermine the flexibility and usefulness of a financial model. It’s important to consider multiple scenarios, including best-case, worst-case, and most likely outcomes, to understand how the business may perform under different conditions.

Without robust scenario analysis, the model may not provide valuable insights into how various factors could impact the company’s financial health. Scenario planning helps create a more resilient and adaptable model.

Failing to update the model regularly

A financial model is a dynamic tool that should be regularly updated to reflect changing business conditions, market trends, and updated financial data. Failing to update the model regularly can make it obsolete, leading to inaccurate forecasting and ineffective decision-making.

Ensure that the model is revised as new information becomes available, and reassess assumptions periodically to align with the current state of the business. Regular updates ensure the model stays relevant and actionable.

Critical KPIs for assessing financial model effectiveness

1. User engagement metrics

● Definition

User engagement metrics track how actively stakeholders interact with your financial model. These KPIs assess whether the model is being used consistently by decision-makers and if the insights generated are leading to actionable results.

● Example

For example, the number of times key decision-makers access the model or request updates can serve as an engagement metric. A company might track how often the model’s forecasts are used in board meetings, helping measure its value to executives.

High engagement often correlates with better adoption, and in turn, more effective financial decision-making. Tracking this KPI helps optimize the model’s usage over time.

2. Model variance analysis

● Definition

Model variance analysis measures the difference between projected financial results in your financial model and the actual outcomes. It helps evaluate how well the model's assumptions align with real-world performance, offering insights into forecast accuracy.

● Example

For instance, if your model predicted a 10% revenue growth but actual results showed only 7%, this variance of 3% should be analyzed. This helps identify areas where assumptions or market conditions were misjudged, allowing for adjustments.

Conducting variance analysis periodically ensures that the financial model remains relevant and improves future projections by refining assumptions based on real-world data.

3. Cash flow variance

● Definition

Cash flow variance analyzes the difference between projected cash inflows and outflows in your financial model versus the actual cash flow. This KPI helps identify liquidity issues, such as underestimating expenses or overestimating revenue, which could impact cash management.

● Example

For example, if your financial model forecasted a $500,000 cash inflow in Q1 but actual cash receipts were only $400,000, the variance would be $100,000.

By reviewing this variance, you can assess whether there were delays in customer payments or if other cash flow assumptions were too optimistic, helping refine cash management strategies for the future.

4. Financial forecasting accuracy

● Definition

Financial forecasting accuracy measures the precision of the financial predictions made by your financial model. It is crucial for evaluating how reliable your assumptions and forecasting techniques are, as accuracy drives better business decision-making.

● Example

For example, if your financial model predicted a 15% annual revenue increase and actual growth was 12%, the accuracy would be assessed as 80% (12%/15%).

Regularly measuring forecasting accuracy helps identify any recurring over- or underestimations, providing insights to fine-tune the assumptions used in the model. By improving forecasting accuracy, you reduce the risk of misinformed decisions and improve long-term financial planning.

Best practices in building a financial model for your company

Building a financial model requires strategic planning and best practices to ensure that it is accurate, reliable, and useful for decision-making. Following proven methods enhances the model's effectiveness and ensures it remains adaptable to changing business conditions. Below are key best practices for creating an efficient financial model.

Use standardized templates

Using standardized templates is essential in maintaining consistency and structure across multiple models within the company. These templates provide a predefined framework that ensures uniformity, reduces errors, and saves time.

Standardized templates also make it easier to compare models over time and across departments, ensuring all financial data is captured and analyzed in the same format. Consistency in structure helps both users and stakeholders understand and trust the financial model.

Validate your financial model

Validating your financial model is crucial to ensure that it produces accurate, reliable results. This process involves verifying the assumptions, formulas, and calculations within the model.

You should perform consistency checks to ensure there are no discrepancies or errors in the data. Engaging in peer reviews and testing different scenarios also helps validate the model’s accuracy and robustness. A validated model boosts confidence in its outputs and helps avoid costly mistakes.

Establish a feedback loop with end users

Establishing a feedback loop with the model’s end users, such as department heads, analysts, and decision-makers, is vital for ongoing improvement. Users can provide insights into how the model is being applied, highlight potential issues, and suggest adjustments based on real-world applications.

Regular feedback allows you to refine the model, make necessary updates, and adapt to evolving business needs. This continuous improvement ensures that the model remains relevant and actionable.

Maintain clarity

Clarity is key when building a financial model. A complex model that is difficult to understand will lead to misinterpretation and incorrect decisions. It’s essential to keep the layout simple, organize the data logically, and clearly label each section.

Avoid unnecessary jargon and ensure that key metrics are easy to track and interpret. A model with clear explanations and visual aids makes it easier for all stakeholders to grasp and use effectively.

Implement a version control system

Version control is a best practice that ensures all updates and changes to a financial model are documented and tracked. This system allows you to maintain different iterations of the model, making it easier to roll back to previous versions if necessary.

It also enables teams to collaborate efficiently without overwriting each other’s work. A good version control system enhances transparency, reduces errors, and ensures that the most current version of the model is always used.

Setting alerts for key metrics

Setting up alerts for key financial metrics ensures that critical data points, such as cash flow, profit margins, and cost variances, are continuously monitored. These alerts can be automated to notify relevant stakeholders when values exceed or fall below predetermined thresholds.

By implementing these notifications, you enable timely responses to potential issues, preventing financial problems from escalating. Alerts also help ensure that decision-makers stay informed and can make quick adjustments when necessary.

Integrate visualization tools

Visualization tools are essential for communicating the outputs of a financial model in a more accessible and digestible format. Graphs, charts, and dashboards can highlight key financial metrics, trends, and projections.

By integrating visual elements into the model, you can make complex data more understandable and actionable for decision-makers. Visualizations help stakeholders quickly grasp the financial health of the business and assess different scenarios, fostering better decision-making.

Creating a scenario library

A scenario library is a collection of predefined scenarios based on different assumptions or business conditions, such as changes in market conditions, regulatory shifts, or economic downturns.

Creating a scenario library for your financial model allows you to easily test how various circumstances affect the financial outlook. It adds flexibility and adaptability to the model, enabling decision-makers to evaluate multiple potential outcomes and determine the best course of action in different situations.

Set benchmarks against industry standards

Comparing your financial model with industry standards and benchmarks helps you assess the performance of your business relative to others in your sector. Industry benchmarks provide a point of reference for profitability, growth rates, and operational efficiency.

Setting these benchmarks helps identify areas for improvement, evaluate financial health, and guide strategic decisions. Aligning the model with industry standards ensures that your business is competitive and operating within best practices in its market.

Integrate an expense management system

A strong financial model should include real-time expense tracking to ensure both accuracy and efficiency. Integrating an expense management system automates reporting, minimizes manual errors, and offers instant visibility into business spending.

By connecting expense data directly to your financial model, you can enhance budget forecasting, enforce spending guidelines, and simplify approval workflows—leading to better cash flow control. This integration makes expense tracking more seamless, transparent, and aligned with your overall financial planning.

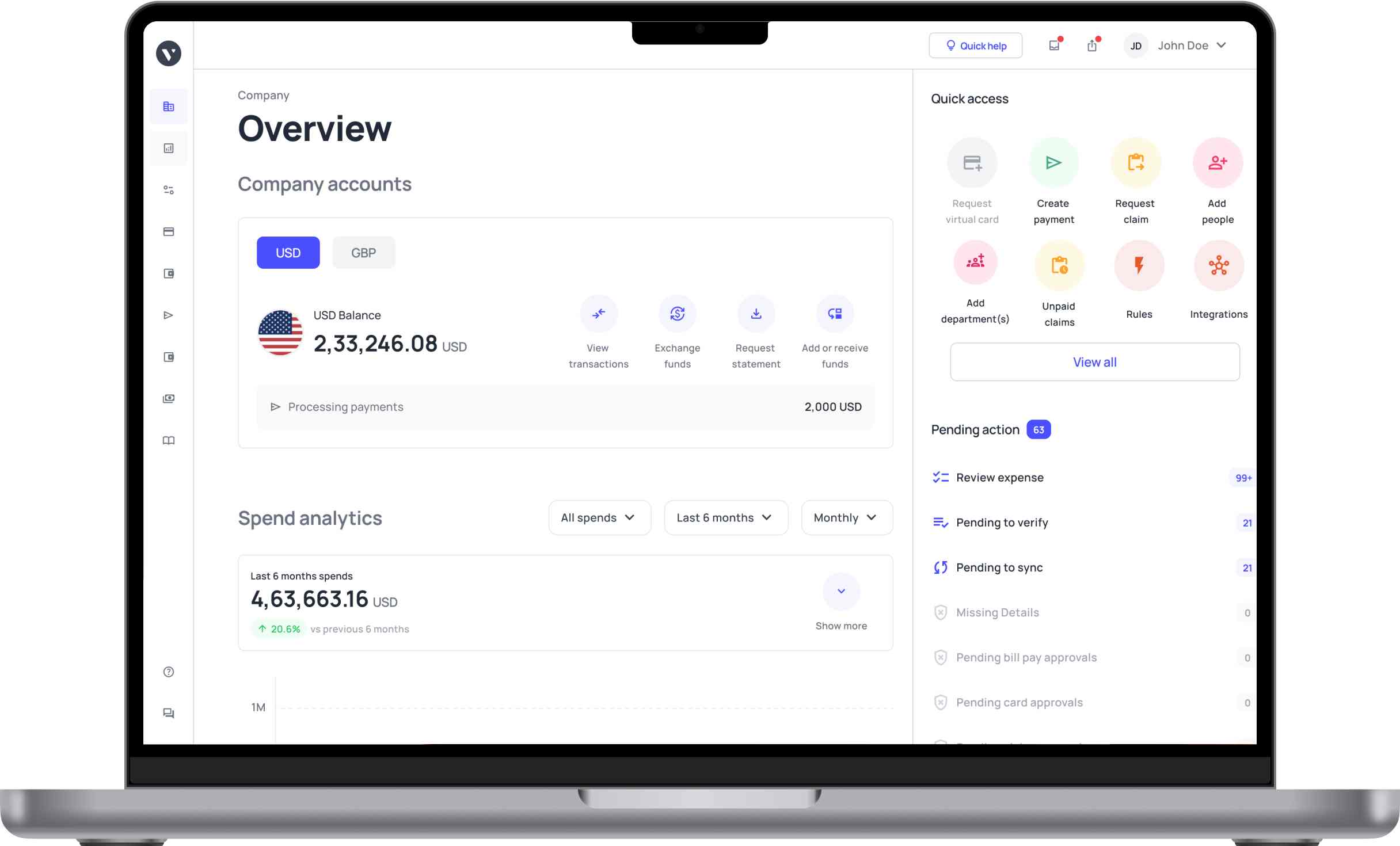

Redefine your financial tracking experience with Volopay

Volopay's all-in-one expense management software aims to simplify and make the financial management process more efficient. It allows companies to automate and monitor their expenses in real time, connect with existing infrastructure, and access essential insights about their spending behavior.

Expense management capabilities

Volopay's diverse expense management features, combined with powerful budgeting software capabilities, provide companies with an effective solution for managing expenditures.

It offers a unified platform where employees can report, track, and control business expenses, while finance teams can easily approve or reject requests. This process saves time spent on manual data entry and enhances financial report accuracy. Volopay saves companies time and resources by automating the whole process.

Real-time expense visibility

One of the best things about Volopay is real-time visibility into expenses. Through this feature, companies can track and monitor expenses in real-time, enabling finance teams to get immediate insights into spending patterns.

This feature facilitates improved financial control, as managers can easily identify trends and anomalies. Real-time tracking improves decision-making by offering current information, enabling companies to remain within budget and detect areas for cost savings early on.

Integration with existing systems

Volopay’s system integrations enable organizations to easily connect their expense management platform with current financial systems, accounting software, and payment systems. Whether you have accounting software such as QuickBooks or ERPs such as Xero, Volopay can easily sync, cutting down on data entry errors and eliminating duplication.

These integrations also give you an even more accurate and complete picture of your financial data, making it easier to report and maintain consistency throughout all business systems.

Automated reconciliation

With Volopay's automated reconciliation, companies can make it easier to reconcile expenses with financial records. The system will automatically match transactions from different sources, including credit cards and bank accounts, to verify that all expenses are properly recorded.

This minimizes the possibility of human error, accelerates the reconciliation process, and makes sure that all financial records are current. Automated reconciliation saves time and effort for finance teams.

Mobile app access

Volopay’s mobile app allows companies to monitor and keep track of expenditures remotely. Workers and managers are able to load receipts, authorize or reject requests, and review real-time expenditures using their cell phones.

The mobile feature is particularly useful for companies with field staff or staff who travel frequently. It guarantees that financial monitoring is consistent and accurate wherever staff members are located, allowing seamless financial management at all times.

Comprehensive customizable dashboard

Volopay provides a personalized analytics dashboard that enables companies to build a customized view of their finances. The dashboard can be customized to show the most important financial metrics, including total spending, departmental spending, or cost-saving potential.

This ability to customize gives managers the freedom to concentrate on the most important data points to their business, making it simpler to spot trends, streamline spending, and make sound financial decisions in real-time.

FAQs

Yes, a financial model is often used to predict future revenue projections by analyzing historical data, market trends, and key assumptions. While it can provide valuable insights, it’s important to remember that projections are estimates based on available information.

To ensure accuracy, maintain clear communication with stakeholders, establish standard assumptions, and validate inputs regularly. A financial modeling process should include feedback loops to check assumptions, data integrity, and consistency.

Non-financial metrics such as customer satisfaction or employee productivity can be integrated by quantifying their impact on financial outcomes. This can be done by linking metrics to revenue, cost, or growth in the financial model.

Tailor your financial model by adjusting the assumptions, key drivers, and structure based on the specific needs of the industry. For example, a tech startup model might emphasize R&D costs, while a retail model might focus on inventory turnover.

The level of detail in your financial model should match the complexity of your business and the purpose of the model. Consider the decision-making needs, available data, and time constraints when deciding how granular your model should be.

One common pitfall is neglecting validation. Even experienced analysts may overlook regularly reviewing and updating assumptions and calculations, leading to errors and inaccurate results over time.

Startups often face challenges due to limited historical data, unpredictable cash flows, and the need to account for high growth potential. These factors make forecasting and financial modeling more difficult, requiring flexible and adaptable models.