What is financial accounting and why is it important for businesses?

You encounter financial accounting every day, whether you realize it or not. From the quarterly earnings reports of major corporations to the tax documents you file annually, financial accounting forms the backbone of the United States' economic infrastructure.

This systematic process of recording, measuring, and communicating financial information enables businesses across the US to operate transparently, comply with regulations, and make informed decisions.

Understanding what is financial accounting becomes crucial as you navigate the complex world of business finance, investment decisions, and regulatory compliance in today's competitive marketplace.

What is financial accounting?

Financial accounting represents the systematic process of recording, summarizing, and communicating a company's financial transactions to external stakeholders. You can think of it as the universal language of business that translates complex economic activities into standardized reports.

The financial accounting meaning encompasses the preparation of financial statements, including balance sheets, income statements, and cash flow statements, which provide a clear picture of your company's financial health. This discipline follows Generally Accepted Accounting Principles (GAAP) in the United States, ensuring consistency and reliability across all business entities.

Why financial accounting matters for US businesses

Financial accounting serves as the cornerstone of business transparency and accountability in the US economy. You benefit from this system because it enables informed decision-making by investors, creditors, and regulatory bodies like the Securities and Exchange Commission (SEC).

The financial accounting meaning extends beyond mere record-keeping; it provides the foundation for tax compliance with the Internal Revenue Service (IRS), facilitates access to capital markets, and builds trust with stakeholders. Without proper financial accounting, your business would struggle to attract investors, secure loans, or demonstrate compliance with federal and state regulations that govern American commerce.

Primary objectives of financial accounting

Providing reliable financial information

You need accurate financial data to make sound business decisions, and financial accounting delivers exactly that. This system ensures you receive a true and fair view of your entity's financial position, performance, and cash flows, enabling stakeholders to understand your business's economic reality.

The reliability of this information stems from standardized accounting principles and rigorous verification processes that eliminate ambiguity and misrepresentation. When you present financial statements prepared through proper financial accounting methods, investors and creditors can confidently assess your company's value and potential.

This reliability becomes particularly crucial when you're seeking external funding or considering strategic partnerships that require transparent financial disclosure.

Assessing solvency and liquidity

Your business's ability to meet financial obligations depends on accurate assessment of solvency and liquidity, which financial accounting makes possible through comprehensive financial statements.

You can evaluate your company's capacity to meet short-term obligations (liquidity) by analyzing current assets against current liabilities, while long-term financial stability (solvency) becomes clear through debt-to-equity ratios and cash flow analysis.

Creditors and potential lenders rely on these assessments when making lending decisions, determining interest rates, and establishing credit limits for your business. The systematic approach of financial accounting ensures you have access to the metrics necessary for maintaining healthy financial relationships with banks, suppliers, and other creditors in the competitive US market.

Facilitating informed decision-making

Financial accounting empowers you and your stakeholders to make well-grounded financial decisions regarding investment, lending, and business dealings. You can analyze trends, compare performance against industry benchmarks, and identify opportunities for growth or areas requiring improvement through comprehensive financial reports.

Investors use this information to determine whether to buy, hold, or sell securities, while creditors assess creditworthiness and establish lending terms.

The standardized nature of financial accounting enables you to compare your business performance against competitors and industry standards, facilitating strategic planning and competitive positioning in the marketplace.

Ensuring compliance and accountability

You must adhere to legal, regulatory, and ethical frameworks established by US authorities, and financial accounting helps you maintain strict compliance with these requirements.

The Securities and Exchange Commission (SEC) mandates specific reporting standards for publicly traded companies, while the Internal Revenue Service (IRS) requires accurate financial records for tax purposes.

Through proper financial accounting practices, you demonstrate corporate governance, promote transparency, and avoid costly penalties associated with non-compliance. This accountability extends to shareholders, employees, and the general public, building trust and credibility for your business operations.

Reporting to external stakeholders

Your financial accounting system primarily serves external users who lack direct access to your company's internal operations, providing them with essential data for evaluation and decision-making.

These stakeholders include investors, creditors, regulatory agencies, customers, suppliers, and the general public, all of whom rely on your financial statements to assess your business's performance and stability.

You must present this information in standardized formats that comply with GAAP requirements, ensuring consistency and comparability across different companies and industries. The external focus of financial accounting distinguishes it from management accounting, which serves internal decision-making needs.

Supporting strategic growth

Financial accounting provides the foundation for strategic planning and business expansion by offering historical performance data and financial trends that inform future decisions. You can identify profitable business segments, assess the return on investment for various projects, and determine the optimal capital structure for growth initiatives.

When you're considering mergers, acquisitions, or new market entry, comprehensive financial records become essential for due diligence processes and valuation exercises.

The insights gained from proper financial accounting enable you to allocate resources efficiently, minimize risks, and capitalize on opportunities that align with your long-term strategic objectives.

What are the fundamental principles and concepts guiding financial accounting?

1. Accrual concept

You must recognize revenues and expenses when they occur, regardless of when cash changes hands, under the accrual concept that governs financial accounting. Accrual concept ensures your financial statements reflect the true economic substance of transactions rather than merely tracking cash movements.

When you sell products or provide services, you record revenue immediately, even if customers pay later, and similarly, you record expenses when incurred, not when paid.

This approach provides a more accurate picture of your business performance during specific periods, enabling stakeholders to make informed decisions based on actual economic activity rather than cash timing.

2. Going concern concept

Your financial accounting assumes your business will continue operating indefinitely unless evidence suggests otherwise, which affects how you value assets and report liabilities. Under the going concern concept, you record assets at their historical cost rather than liquidation value, as the assumption presumes normal business operations will continue.

This principle influences depreciation calculations, inventory valuation, and the classification of liabilities between current and non-current categories.

When you prepare financial statements under the going concern assumption, stakeholders can evaluate your business based on its operational capacity rather than its breakup value, providing a more realistic assessment of long-term viability.

3. Monetary unit concept

You express all financial transactions in a common monetary unit—the US dollar—which enables meaningful comparison and aggregation of diverse business activities. The monetary unit concept assumes the dollar maintains stable purchasing power over time, although inflation and deflation can affect this assumption.

Your financial accounting system ignores non-quantifiable factors like employee morale, brand reputation, or customer satisfaction, focusing solely on transactions that can be measured in monetary terms.

This limitation means your financial statements may not capture all aspects of business value, but it ensures objectivity and comparability across different companies and time periods.

4. Business entity concept

You must maintain separate accounting records for your business that are distinct from your personal finances or other business entities you may own. The business entity concept treats your business as a separate economic unit with its own assets, liabilities, revenues, and expenses, regardless of the legal structure.

When you invest personal funds into your business, financial accounting treats this as a capital contribution rather than business revenue, maintaining clear boundaries between different economic entities.

This separation enables accurate performance measurement and ensures stakeholders can assess your business's financial position without confusion from unrelated activities.

5. Cost concept (Historical cost)

You record assets at their original purchase price rather than current market value, following the cost concept that provides objectivity and verifiability in financial accounting. The cost concept ensures your financial statements are based on actual transactions rather than subjective estimates of current worth, though it may not reflect the true economic value of long-held assets.

When you purchase equipment, land, or other assets, you continue to report them at historical cost (less accumulated depreciation) until disposal, providing consistency and reliability in financial reporting.

While this approach may understate asset values during inflationary periods, it prevents manipulation and ensures audit trails remain clear and verifiable.

6. Full disclosure principle

You must provide all material information necessary for stakeholders to make informed decisions about your business, following the full disclosure principle in financial accounting.

This requires you to include detailed notes to financial statements, explaining accounting policies, significant estimates, contingent liabilities, and subsequent events that may affect your company's financial position.

When you have pending lawsuits, significant contracts, or changes in accounting methods, you must disclose these items even if they don't directly appear in the financial statements. This transparency ensures stakeholders have access to the comprehensive information needed for accurate assessment of your business's risks and opportunities.

7. Consistency principle

You must apply accounting methods consistently from period to period, ensuring comparability of your financial statements over time through the consistency principle. When you choose specific accounting methods for inventory valuation, depreciation, or revenue recognition, you should continue using these methods unless compelling reasons justify changes.

If you do change accounting methods, financial accounting requires you to disclose the change, explain the reasons, and quantify the impact on your financial statements.

This consistency enables stakeholders to identify trends, measure performance improvements, and make meaningful comparisons between different accounting periods.

8. Prudent reporting

You should exercise caution when making estimates and judgments in financial accounting, recognizing expenses and liabilities as soon as they become probable, while being more conservative with revenue recognition.

This prudence concept, also known as conservatism, helps protect stakeholders from overly optimistic financial reporting that might mislead decision-making.

When you face uncertainty about asset values or the likelihood of collecting receivables, you should choose the option that is less likely to overstate your financial position. This approach builds credibility with stakeholders and reduces the risk of financial surprises that could damage your business relationships.

9. Matching principle

You must match expenses with the revenues they help generate within the same accounting period, ensuring your financial statements accurately reflect the cost of earning revenue. When you sell products, you should record not only the sale revenue but also the cost of goods sold, sales commissions, and any other expenses directly related to generating that revenue.

This matching ensures your profit calculations reflect the true economic results of business operations rather than arbitrary timing differences.

The matching principle works in conjunction with the accrual concept to provide stakeholders with meaningful information about your business's profitability and operational efficiency.

10. Revenue recognition principle

You should recognize revenue when you have substantially completed the earning process and collection is reasonably assured, regardless of when you receive cash payment. Under current US GAAP standards, you recognize revenue when you transfer control of goods or services to customers in the amount you expect to receive.

This principle ensures your financial accounting reflects the actual economic activity of your business rather than cash collection patterns.

When you provide services over time, sell products with warranties, or have complex contract arrangements, you must carefully apply revenue recognition rules to ensure accurate financial reporting that reflects the substance of your business transactions.

The financial accounting cycle: A step-by-step process

Transaction identification

You begin the financial accounting cycle by analyzing business transactions to determine their financial impact and whether they represent recordable events that affect your company's financial position.

This critical first step requires you to examine each business activity and decide if it involves measurable changes to assets, liabilities, or equity that should be captured in your accounting records.

When you purchase inventory, pay salaries, collect customer payments, or incur operating expenses, you must identify these as financial transactions requiring documentation.

Journal entries

You record identified transactions chronologically in journals with detailed debit and credit information, ensuring each entry maintains the fundamental accounting equation that assets equal liabilities plus equity.

Every transaction you record must have at least one debit entry and one credit entry, with total debits always equaling total credits to maintain balance in your financial accounting system.

When you make these entries, you include the date, account names, amounts, and a brief description of the transaction to create a clear audit trail.

Ledger posting

You transfer journal entries to individual account ledgers for organized classification and accumulation of similar transactions, creating a systematic structure for your financial accounting records.

Each account ledger maintains a running balance that reflects all debits and credits posted to that specific account, enabling you to track changes in individual asset, liability, equity, revenue, and expense categories.

This posting process organizes your financial information by account type, making it easier to prepare financial statements and analyze specific aspects of your business performance.

Unadjusted trial balance

You prepare an unadjusted trial balance to verify the arithmetic accuracy of your journal entries and ledger postings before making any adjusting entries to your financial accounting records.

This trial balance lists all account balances from your ledgers, with total debits equaling total credits if your posting process has been error-free. When the trial balance doesn't balance, you must identify and correct posting errors, mathematical mistakes, or missing entries before proceeding to the next step.

While a balanced trial balance doesn't guarantee the absence of all errors, it confirms that your basic double-entry bookkeeping system is functioning correctly and ready for the adjustment process.

Adjusting entries

You make necessary adjustments for accruals, deferrals, and other items to ensure your financial accounting records accurately reflect your business's true financial position at the end of the accounting period.

These adjusting entries typically include recording accrued expenses like salaries or interest payable, recognizing prepaid expenses that have been consumed, recording depreciation on fixed assets, and adjusting for unearned revenue that has been earned.

When you make these adjustments, you're applying the accrual concept and matching principle to ensure your financial statements present a complete and accurate picture of your business activities.

Adjusted trial balance

You compile an adjusted trial balance after making all necessary adjusting entries, ensuring your financial accounting records are ready for financial statement preparation with accurate account balances.

This adjusted trial balance serves as the source document for preparing your income statement, balance sheet, and other financial statements, containing all the corrected and updated account balances.

When you review this trial balance, you can verify that your adjusting entries have been properly recorded and that all account balances reflect the true financial position of your business at the period end.

Financial statements

You generate comprehensive financial statements including the balance sheet, profit and loss statement, and cash flow statement from your adjusted trial balance data, creating the primary output of your financial accounting system.

These statements present your business's financial performance and position in standardized formats that comply with GAAP requirements and meet the information needs of external stakeholders.

When you prepare these statements, you're translating the detailed transaction data from your accounting records into summarized reports that facilitate decision-making by investors, creditors, and other users.

Closing entries

You close temporary accounts, including revenues, expenses, and dividends to retained earnings, preparing your financial accounting system for the next accounting period by zeroing out these temporary balances.

This closing process transfers the net income or loss for the period to retained earnings, ensuring that temporary accounts start the new period with zero balances.

When you make closing entries, you're separating the financial results of one period from the next, enabling accurate period-to-period comparisons and maintaining the integrity of your accounting records.

Post-closing trial

You prepare a post-closing trial balance to ensure no temporary accounts remain open after the closing process and that your financial accounting records are properly prepared for the next accounting period.

This final trial balance should only include permanent accounts (assets, liabilities, and equity) with their correct balances carried forward to the new period. When you review this trial balance, you verify that all temporary accounts have been successfully closed and that the accounting equation remains in balance.

This step confirms that your accounting cycle has been completed correctly and that your books are ready to begin recording transactions for the new accounting period.

Reversing entries

You may optionally reverse certain adjusting entries at the beginning of the new accounting period to simplify subsequent accounting procedures and avoid double-counting of transactions in your financial accounting system.

These reversing entries are particularly useful for accruals that will be paid or collected in the following period, eliminating the need to remember previous adjustments when recording the actual cash transactions.

When you use reversing entries, you're streamlining your accounting process and reducing the likelihood of errors in the new period.

Key financial statements: The output and analytical tools of financial accounting

The balance sheet (Statement of financial position)

● Purpose and structure

The balance sheet serves as a comprehensive snapshot of your company's financial position at a specific point in time, typically at the end of an accounting period. This fundamental statement illustrates what your business owns (assets), what it owes (liabilities), and the owner's stake (equity).

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity.

This equation must always balance, hence the name "balance sheet." The statement provides stakeholders with crucial information about your company's financial health, enabling them to make informed decisions about investments, lending, and business partnerships.

● Assets

Assets represent everything of value that your company owns or controls, which can be converted into cash or provide future economic benefits. Current assets include cash and cash equivalents, accounts receivable, inventory, prepaid expenses, and short-term investments that you expect to convert to cash within one year.

These assets demonstrate your company's liquidity and ability to meet short-term obligations.

Non-current assets, also called fixed assets, include property, plant, and equipment, long-term investments, intangible assets like patents and trademarks, and goodwill. These assets support your company's long-term operations and growth strategies.

● Liabilities

Liabilities represent your company's financial obligations to external parties, essentially what you owe to creditors, suppliers, and other stakeholders. Current liabilities include accounts payable, short-term loans, unearned revenue, accrued expenses, and the current portion of long-term debt that you must settle within one year.

These obligations directly impact your company's working capital and short-term financial flexibility.

Non-current liabilities encompass long-term loans, deferred tax liabilities, bonds payable, pension obligations, and other debts with maturity periods exceeding one year. These long-term obligations affect your company's capital structure and long-term financial planning.

● Equity (Shareholders' funds)

Equity represents the residual interest in your company's assets after deducting all liabilities, essentially the owner's claim on the business. For corporations, shareholders' equity comprises share capital, which represents the paid-in capital from investors who purchased ownership stakes in your company.

Retained earnings constitute the accumulated profits your company has earned over time, minus any dividends distributed to shareholders. Additional paid-in capital may include premiums paid above the par value of shares.

Treasury stock, if applicable, represents shares your company has repurchased from the market. The equity section reflects the financial foundation and accumulated wealth of your business.

● Interpretation for stakeholders

The balance sheet provides stakeholders with essential insights into your company's financial stability and operational efficiency. Investors analyze the balance sheet to assess solvency, which indicates your ability to meet long-term obligations, and liquidity, which shows your capacity to handle short-term financial demands.

The capital structure revealed through the balance sheet helps stakeholders understand how your company finances its operations and growth through debt versus equity.

Creditors examine asset values and liability levels to determine lending risks, while management uses balance sheet data to make strategic decisions about resource allocation, investment opportunities, and financial planning.

The profit & loss statement (Income statement or statement of comprehensive income)

● Purpose and structure

The profit and loss statement summarizes your company's revenues, expenses, gains, and losses over a specific accounting period, such as a quarter or fiscal year. This dynamic statement showcases your operational performance and profitability by measuring how effectively you generate income and manage costs.

Unlike the balance sheet's point-in-time snapshot, the P&L statement covers a period of time, revealing trends and patterns in your business performance.

The statement follows a structured format, starting with revenues and systematically deducting various expenses to arrive at net profit or loss, providing stakeholders with a clear picture of your company's earning capacity and operational efficiency.

● Revenue recognition

Revenue represents the income your company generates from its primary business activities, including sales revenue from products, service revenue from professional services, and other operating income from ancillary activities. The revenue recognition principle requires you to record revenue when it's earned, regardless of when cash is received.

This accrual-based approach ensures your financial statements accurately reflect your company's performance.

For product sales, you typically recognize revenue when goods are delivered and title transfers to the customer. Service revenue is generally recognized as services are performed or completed. Understanding what is financial accounting and its principles helps you properly recognize revenue according to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

● Cost of goods sold (COGS)

Cost of goods sold represents the direct costs attributable to producing the goods or services your company sells during the accounting period. For manufacturing companies, COGS includes raw materials, direct labor, and manufacturing overhead directly related to production.

Retail companies calculate COGS using the cost of inventory sold to customers. Service companies may include direct labor and materials consumed in providing services. COGS is crucial for calculating gross profit, which measures your company's profitability before considering operating expenses.

The gross profit margin, calculated as gross profit divided by revenue, indicates how efficiently you manage production costs and pricing strategies.

● Operating expenses

Operating expenses encompass all costs incurred in the normal course of your business operations, excluding COGS. Administrative expenses include salaries for management and administrative staff, office rent, utilities, insurance, and professional fees for legal and accounting services.

Selling and distribution expenses cover marketing costs, sales commissions, advertising, shipping, and customer service expenses.

Depreciation expense represents the systematic allocation of asset costs over their useful lives, reflecting the consumption of long-term assets in generating revenue. Research and development expenses, if applicable, support innovation and future growth. Proper classification of operating expenses helps stakeholders understand your cost structure and operational efficiency.

● Non-operating income and expenses

Non-operating items include revenues and expenses that arise from activities outside your company's core business operations. Interest income from investments, dividend income from equity securities, and rental income from unused properties represent non-operating revenues.

Interest expense on loans and bonds, losses from asset disposals, and foreign exchange gains or losses constitute non-operating expenses.

These items appear separately on the income statement to distinguish them from operating performance, enabling stakeholders to evaluate your core business profitability independently from financing and investment activities. Understanding financial accounting principles helps you properly classify and present these items.

● Net profit/loss

Net profit or loss represents the ultimate measure of your company's profitability after accounting for all revenues, expenses, gains, and losses during the reporting period. This bottom-line figure indicates whether your company created value for shareholders and demonstrates the overall effectiveness of your business operations and management decisions.

Positive net profit suggests successful operations and value creation, while net loss indicates that expenses exceeded revenues.

The net profit margin, calculated as net profit divided by revenue, provides insight into your company's profitability relative to its size and helps stakeholders compare performance across different periods and companies.

● Earnings per share (EPS)

Earnings per share represent a key performance metric for publicly traded companies, showing the portion of net profit allocated to each outstanding share of common stock. Basic EPS is calculated by dividing net profit by the weighted average number of outstanding shares during the period.

Diluted EPS considers the potential dilution from convertible securities, stock options, and warrants.

EPS enables investors to compare profitability across companies of different sizes and evaluate the value creation per share. The financial accounting meaning encompasses the standardized calculation and presentation of EPS, which helps investors make informed investment decisions and assess management's effectiveness in generating shareholder value.

The cash flow statement

● Purpose and structure

The cash flow statement tracks the actual cash inflows and outflows from your company's activities over a specific accounting period, providing crucial insights into liquidity and solvency that complement the accrual-based profit and loss statement.

While the P&L shows profitability, the cash flow statement reveals your company's ability to generate cash and meet immediate financial obligations.

The statement is organized into three distinct sections: operating activities, investing activities, and financing activities. This structure helps stakeholders understand how your company generates cash from operations, deploys cash for growth investments, and manages financing relationships with creditors and investors.

● Operating activities

Operating activities represent cash flows generated from your company's primary revenue-generating activities, reflecting the cash-generating capability of your core business operations. Cash inflows include collections from customers, interest received, and dividends received from operating investments.

Cash outflows encompass payments to suppliers for inventory and services, employee salaries and benefits, rent payments, tax payments, and interest paid on operating debt.

The net cash flow from operating activities indicates whether your business generates sufficient cash to sustain operations and fund growth without relying on external financing. Positive operating cash flow demonstrates healthy business fundamentals and operational efficiency.

● Investing activities

Investing activities encompass cash flows related to the acquisition and disposal of long-term assets and investments that support your company's growth strategy and future earning capacity. Cash outflows include purchases of property, plant, and equipment, acquisitions of other businesses, investments in securities, and capital expenditures for expansion.

Cash inflows result from sales of fixed assets, disposal of business segments, and maturity or sale of investment securities.

The investing section reveals your company's commitment to growth and capital allocation decisions, helping stakeholders understand management's strategic priorities and investment philosophy.

● Financing activities

Financing activities detail cash flows from transactions with creditors and investors, showing how your company raises capital and returns value to stakeholders.

Cash inflows include proceeds from issuing common or preferred stock, borrowing through loans or bonds, and receiving capital contributions from owners.

Cash outflows encompass debt repayments, dividend payments to shareholders, share repurchases, and distributions to owners. The financing section reveals your company's capital structure management and dividend policy, helping stakeholders understand how you balance debt and equity financing and your commitment to returning value to shareholders.

● Reconciliation of cash

The cash flow statement reconciles your company's beginning and ending cash balances for the reporting period, providing a complete picture of cash movement and ensuring accuracy in financial reporting.

The statement begins with the cash balance at the start of the period, adds net cash flows from operating, investing, and financing activities, and arrives at the ending cash balance that matches the balance sheet.

This reconciliation helps stakeholders verify the accuracy of cash flow calculations and understand the sources and uses of cash during the period, enabling better assessment of your company's liquidity management and financial flexibility.

Statement of changes in equity

The statement of changes in equity provides a comprehensive analysis of movements in your company's equity accounts during the reporting period. This statement details changes in share capital from new stock issuances or repurchases, movements in retained earnings from net profit and dividend distributions, and adjustments to other comprehensive income items.

The statement connects the beginning and ending equity balances shown on comparative balance sheets, offering stakeholders transparency into how ownership interests and accumulated earnings have evolved throughout the accounting period.

Notes to accounts

Notes to accounts provide essential supplementary information that explains and expands upon the figures presented in the primary financial statements. These notes include significant accounting policies, detailed breakdowns of major balance sheet and income statement items, commitments and contingencies, subsequent events, and other disclosures required by accounting standards.

The notes help stakeholders understand the assumptions, estimates, and judgments underlying the financial statements, enabling more informed analysis and decision-making regarding your company's financial position and performance.

Importance of financial accounting for US businesses

Ensuring regulatory compliance and avoiding penalties

You must comply with numerous federal and state regulations that require accurate financial reporting, and financial accounting provides the framework for meeting these obligations while avoiding costly penalties and legal complications.

The Securities and Exchange Commission (SEC) mandates specific reporting requirements for publicly traded companies, while the Internal Revenue Service (IRS) requires detailed financial records for tax compliance, and various state agencies impose additional reporting requirements that vary by location and industry.

When you maintain proper financial accounting records, you demonstrate due diligence to regulatory authorities and reduce the risk of audits, investigations, and penalties that could severely impact your business operations and reputation.

Informed strategic decision-making and business planning

Your strategic decisions require accurate financial information, and financial accounting provides the data foundation for evaluating opportunities, assessing risks, and allocating resources effectively across different business areas and time horizons.

When you analyze financial statements and trends, you can identify profitable products or services, assess market opportunities, evaluate the return on investment for various projects, and determine optimal capital structure for growth initiatives. This information enables you to make data-driven decisions about expansion, contraction, diversification, or other strategic moves that align with your long-term objectives.

The financial accounting meaning encompasses this strategic dimension, where accounting information becomes the basis for competitive advantage and sustainable growth.

Attracting investors and securing funding

You need external capital for growth and expansion, and financial accounting provides the credible financial information that investors and lenders require when evaluating your business as an investment or lending opportunity.

Professional investors, banks, and other financial institutions rely on your financial statements, cash flow projections, and historical performance data to assess risk, determine appropriate returns, and structure investment or lending terms.

When you present well-prepared financial statements that comply with GAAP standards, you demonstrate professionalism and transparency that builds confidence among potential investors and lenders.

Performance measurement, analysis, and benchmarking

You require objective measures of business performance to evaluate management effectiveness, operational efficiency, and competitive positioning, all of which financial accounting provides through standardized metrics and ratios.

When you calculate return on assets, profit margins, debt ratios, and other financial indicators, you can assess your company's performance against industry benchmarks, historical trends, and strategic targets.

This analysis helps you identify strengths to leverage, weaknesses to address, and opportunities for improvement in operational efficiency, cost management, and revenue generation.

Effective tax planning and management

You face complex federal, state, and local tax obligations that require careful planning and accurate record-keeping, which financial accounting supports through detailed transaction records and proper documentation of deductible expenses and taxable income.

When you maintain comprehensive financial records, you can identify tax-saving opportunities, ensure compliance with tax laws, and support your tax positions during audits or disputes with tax authorities. Proper financial accounting also enables you to implement tax-efficient strategies for your business.

Enhanced budgeting and future forecasting

You need to plan for future operations and cash flows, and financial accounting provides the historical data and analytical framework necessary for creating realistic budgets, forecasting future performance, and managing cash flow effectively.

When you use financial statement analysis and trend identification, you can project future revenues, expenses, and capital requirements, enabling proactive management of resources and strategic planning for growth or contraction cycles.

This forecasting capability helps you anticipate funding needs, identify potential cash flow problems, and make informed decisions about timing for major investments or expenditures.

Fraud detection, prevention, and risk mitigation

You face various internal and external fraud risks that proper financial accounting systems help detect and prevent through segregation of duties, documentation requirements, and regular reconciliation procedures that create accountability and transparency.

When you implement strong internal controls and regular financial reporting processes. You can identify unusual transactions, unexplained variances, and other indicators of potential fraud or error before they become significant problems.

Facilitating mergers, acquisitions, and disposals

You may engage in merger and acquisition activities that require comprehensive financial information for due diligence, valuation, and negotiation purposes. All of which depend on accurate and complete financial accounting records.

When you're buying or selling a business, potential partners need detailed financial statements, tax returns, and supporting documentation to assess value, identify risks, and structure transactions appropriately.

Building stakeholder trust and credibility

You depend on relationships with customers, suppliers, employees, and other stakeholders who rely on your financial stability and operational transparency, which financial accounting demonstrates through regular financial reporting and compliance with professional standards.

When you consistently provide accurate financial information and maintain transparent business practices. You build trust that enhances your reputation, strengthens business relationships, and creates competitive advantages in the marketplace.

Effective communication of financial health

You must communicate your business's financial performance and position to various stakeholders, and financial accounting provides the standardized language and formats necessary for clear, consistent, and comparable financial communication.

When you prepare financial statements according to GAAP standards, you ensure that investors, creditors, employees, and other stakeholders.

You can understand and interpret your financial information accurately, facilitating informed decision-making and maintaining strong stakeholder relationships that support your business objectives.

Financial accounting vs. management accounting: Key distinctions

Primary purpose and target audience

You use financial accounting primarily to communicate financial information to external stakeholders, including investors, creditors, regulatory agencies, and the general public, while management accounting serves internal decision-making needs for managers, executives, and operational personnel.

The external focus of financial accounting requires compliance with standardized reporting formats and regulatory requirements, whereas management accounting can be customized to meet specific internal information needs and decision-making requirements.

Nature of information

Your financial accounting system focuses on historical financial data that documents completed transactions and past performance, providing a retrospective view of business operations that emphasizes accuracy and verifiability.

Management accounting incorporates both historical and forward-looking information, including budgets, forecasts, variance analysis, and predictive modeling that helps you make future-oriented decisions and control ongoing operations.

When you analyze financial information for external reporting, you emphasize reliability and objectivity, but internal management information can include estimates, projections, and non-financial data.

Adherence to standards and regulations

You must prepare financial accounting reports according to strict GAAP standards and comply with SEC, IRS, and other regulatory requirements that govern external financial reporting in the United States.

Management accounting operates without mandatory standards or regulatory requirements, allowing you to design information systems and reporting formats that best serve your specific business needs and management style.

When you deviate from GAAP in internal reporting, you can focus on economic substance rather than accounting form, providing managers with information that may be more relevant for decision-making but would not be appropriate for external financial statements.

Periodicity of reporting

Your financial accounting follows mandatory reporting periods, including quarterly and annual financial statements for public companies, with specific deadlines imposed by regulatory authorities and stock exchanges.

Management accounting can be produced on any schedule that meets your operational needs, including daily, weekly, monthly, or project-based reporting that aligns with business cycles and decision-making requirements.

Focus and level of detail

You prepare financial accounting statements that provide summarized, company-wide financial information suitable for external stakeholders who need broad overviews rather than detailed operational data.

Management accounting provides detailed information about specific products, services, departments, or business segments that enables you to identify performance drivers, control costs, and optimize resource allocation at the operational level.

When you analyze internal performance, you can access granular data about individual transactions, customer profitability, product margins, and operational efficiency.

Time orientation

Your financial accounting emphasizes historical accuracy and documentation of completed transactions, providing stakeholders with verified information about past performance and current financial position.

Management accounting balances historical analysis with future planning, incorporating budgets, forecasts, and scenario analysis that help you anticipate challenges, identify opportunities, and make proactive decisions.

When you use management accounting information, you're looking forward to influencing future outcomes rather than simply documenting past results, making this information more action-oriented and decision-relevant for operational management purposes.

Common challenges faced by US businesses in financial accounting

1. Complexity of tax laws

You face the burden of navigating a tax system that constantly evolves at the federal, state, and local levels. Changes in deductions, credits, and filing requirements demand constant monitoring and adjustments in your accounting practices.

Keeping your books compliant requires expert knowledge and quick adaptation to shifting regulations, which often complicates your overall financial accounting strategy.

2. Data accuracy and integrity

Maintaining precise and reliable financial records becomes increasingly difficult as your business scales. If you handle thousands of transactions daily, even a minor discrepancy can distort reports or attract IRS attention.

Ensuring that your financial accounting data remains error-free and consistent across systems calls for robust validation mechanisms and vigilant monitoring.

3. Demand for skilled professionals

The US market continues to see a shortage of professionals well-versed in GAAP, tax codes, and software like QuickBooks, NetSuite, or Xero.

You may struggle to find individuals who combine technical expertise with strategic insight, leaving critical financial accounting tasks under-supported or delayed, especially during tax season or audits.

4. Adherence to GAAP

US companies must align their reporting practices with Generally Accepted Accounting Principles (GAAP). This includes consistency in revenue recognition, inventory valuation, and expense classification.

You need to continuously audit your internal controls and accounting policies to ensure reports meet GAAP standards, especially when preparing for investor presentations or regulatory filings.

5. Cybersecurity risks

As your operations become more digital, so do the threats to your financial systems. Cyberattacks can expose sensitive accounting data, including payroll, client information, and financial statements.

Without strong encryption, multi-factor authentication, and regular software updates, your financial accounting data may be vulnerable to breaches or manipulation.

6. State-specific compliance

If you operate across multiple states, you're dealing with different tax rates, deadlines, and reporting rules. Each state may have unique regulations on sales tax, franchise tax, or employee classification.

You must build flexible compliance systems that accommodate this complexity to avoid penalties and ensure accuracy in financial accounting practices.

Role of technology and accounting software in the US

Automation of processes

You save time and effort by using software that automates data entry, ledger updates, and invoice tracking. Modern platforms reduce human error, streamline workflows, and ensure consistency across your systems. This automation transforms your financial accounting operations into a more structured, scalable, and error-free environment.

Improved accuracy and compliance

Automated validations and in-built regulatory updates help you stay compliant with US tax laws. These tools track changes and apply updates across your financial data, reducing compliance risks. Your financial accounting system becomes more reliable and audit-ready, with minimal need for constant manual adjustments.

Real-time reporting

Accessing real-time dashboards and reports helps you make faster financial decisions. You can monitor cash flow, revenue trends, and expense spikes instantly.

By integrating software into your decision-making processes, your business remains agile and responsive to market conditions with accurate financial accounting insights.

Data security and backup

You benefit from multi-layered security that includes data encryption, role-based access, and secure cloud backups. These features protect your financial accounting records against loss, cyber threats, and accidental deletion. In case of system failure, disaster recovery tools ensure your data remains intact and accessible.

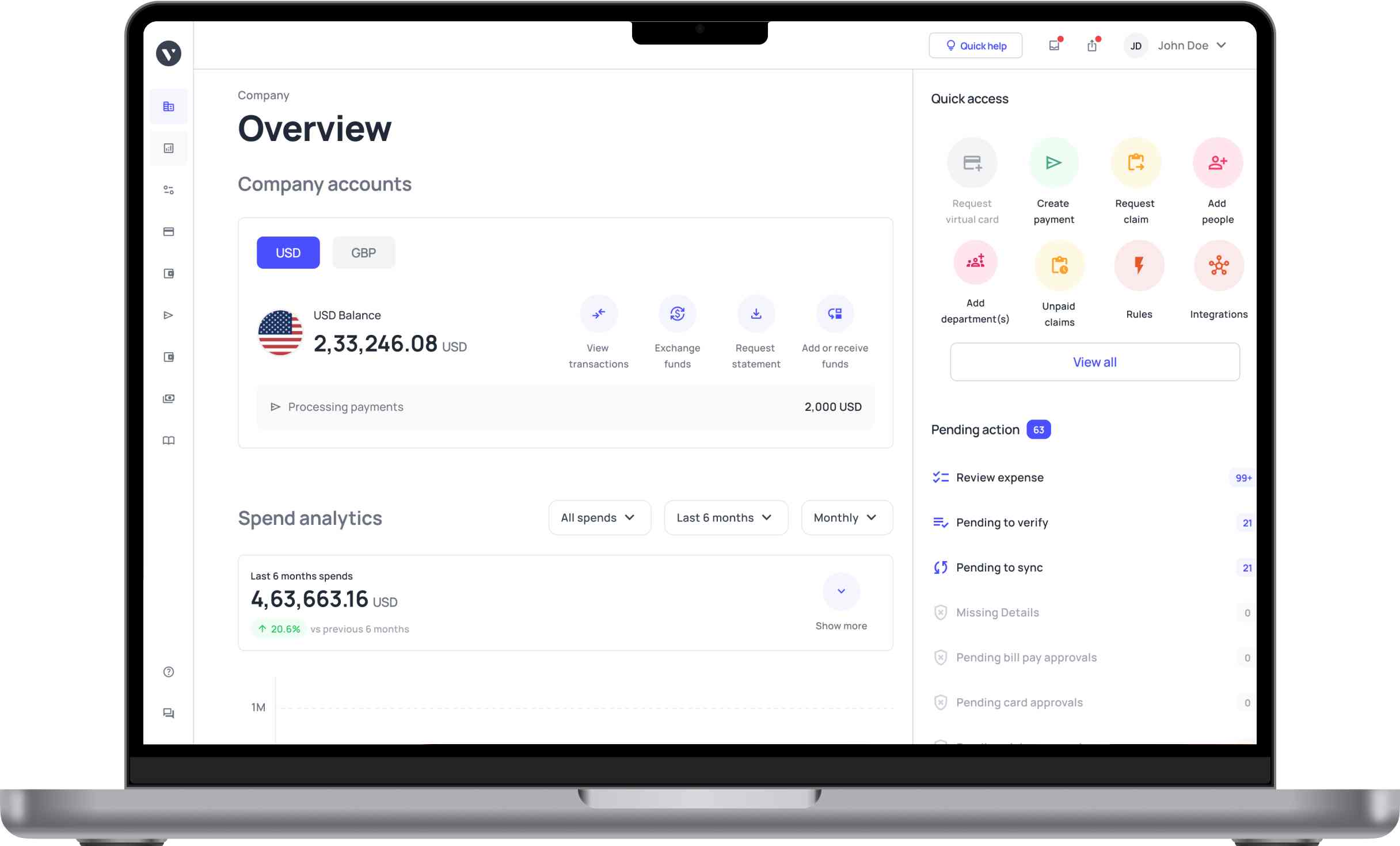

Experience streamlined financial operations with Volopay

Accounting process automation

You can simplify your financial accounting workflow through Volopay’s accounting automation software. The platform syncs with tools like Xero, QuickBooks, and NetSuite, enabling real-time expense recording, reconciliation, and categorization.

This eliminates manual work, reduces errors, and gives you a clear picture of your financial health without extra effort.

Beyond just expenses: A holistic approach to financial management

With Volopay, you get more than just expense tracking. You gain access to smart corporate cards, multi-level approvals, cross-border payments, reimbursements, seamless integrations and accounts payable automation, all within one platform.

This all-in-one suite helps you manage financial accounting operations more effectively while giving your finance team full visibility and control.