What is finance automation? Benefits, challenges and how to implement

As organizations pursue aggressive growth trajectories, finance teams face unprecedented operational pressure. Rapid expansion across new markets, product lines, and customer segments creates exponential increases in transaction volumes, reporting requirements, and compliance obligations.

Traditional manual processes designed for smaller operational scales quickly become unsustainable bottlenecks that constrain your organization's ability to scale efficiently. Finance automation presents a strategic solution to this challenge.

By digitizing and streamlining core administrative functions, including accounts payable, expense management, financial reconciliation, and reporting workflows, your organization can achieve significant operational leverage.

Automation enables your finance team to redirect focus from routine transactional work toward high-value strategic activities such as financial planning, analysis, and business partnership. This transformation allows your finance operations to scale proportionally with business growth without requiring linear increases in headcount, positioning your organization to support hyper-growth while maintaining operational excellence and financial control.

What is finance automation?

Finance automation for businesses refers to the use of technology and software to streamline and execute financial tasks with minimal human intervention.

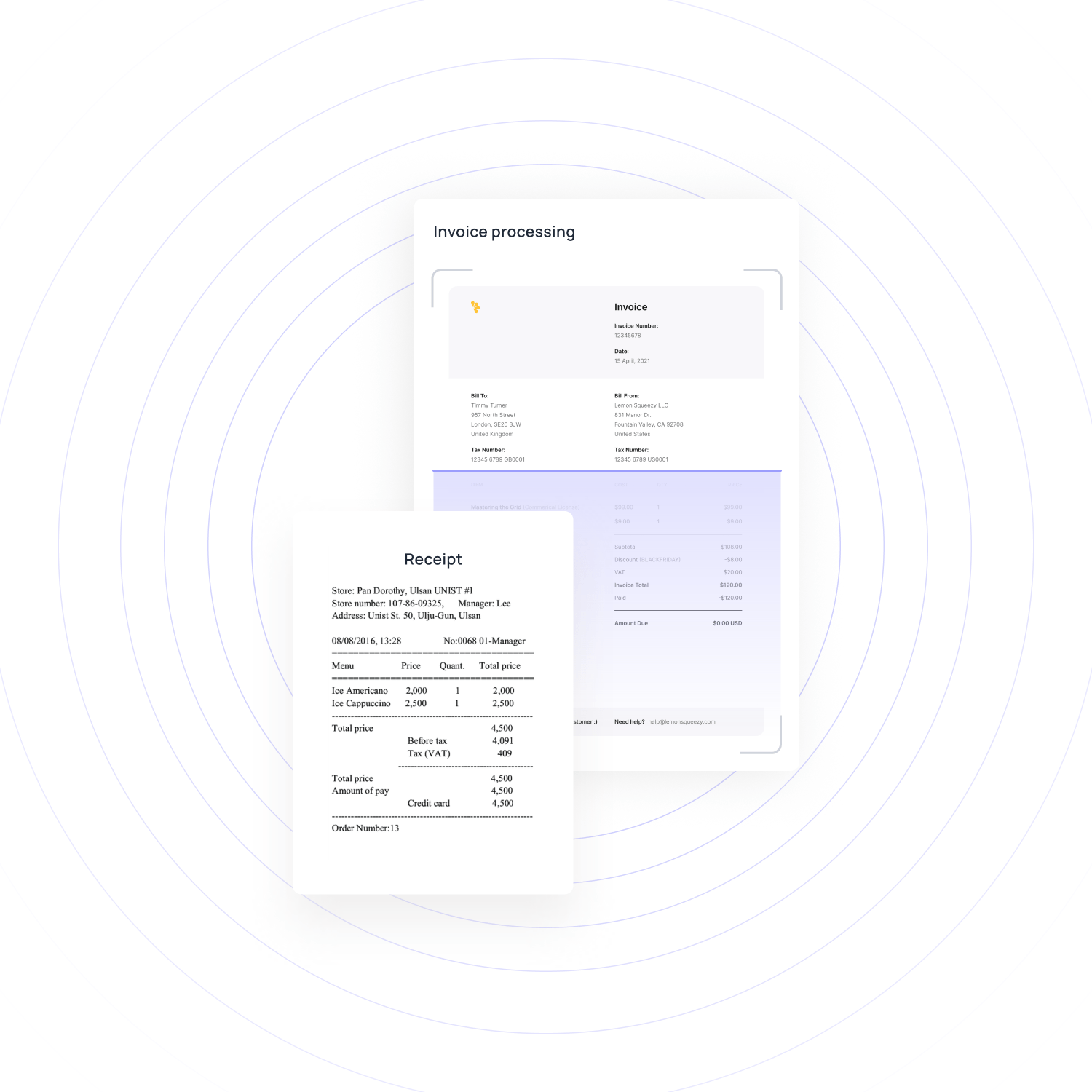

This approach replaces manual, repetitive processes like data entry, invoice processing, and expense tracking with automated systems that work faster and more accurately.

By leveraging artificial intelligence, machine learning, and robotic process automation, companies can transform time-consuming financial operations into efficient, error-free workflows.

Finance automation encompasses everything from accounts payable and receivable to financial reporting and compliance monitoring.

How finance automation works: The core mechanism

Your finance automation system begins by collecting financial data from multiple sources emails, scanned documents, spreadsheets, and digital forms.

Using OCR and artificial intelligence, it extracts relevant information such as invoice numbers, dates, amounts, and account codes. The system validates this data against your existing records, checking for duplicates or errors.

This intelligent OCR capture technology eliminates the need for you to manually type information, reducing data entry time by up to 80% while ensuring accuracy and creating a digital audit trail for every document that enters your financial ecosystem.

Once data is captured, the system applies predefined rules and workflows. These define approval hierarchies, flag exceptions, match purchase orders with invoices, and validate transactions against budgets.

For example, you can set rules to auto-approve recurring bills while routing unusual expenses for review. The system works 24/7, efficiently processing transactions in seconds rather than days.

It enforces compliance policies consistently, ensures proper authorization levels are maintained, and automatically escalates issues when exceptions occur giving full visibility and control without constant manual oversight.

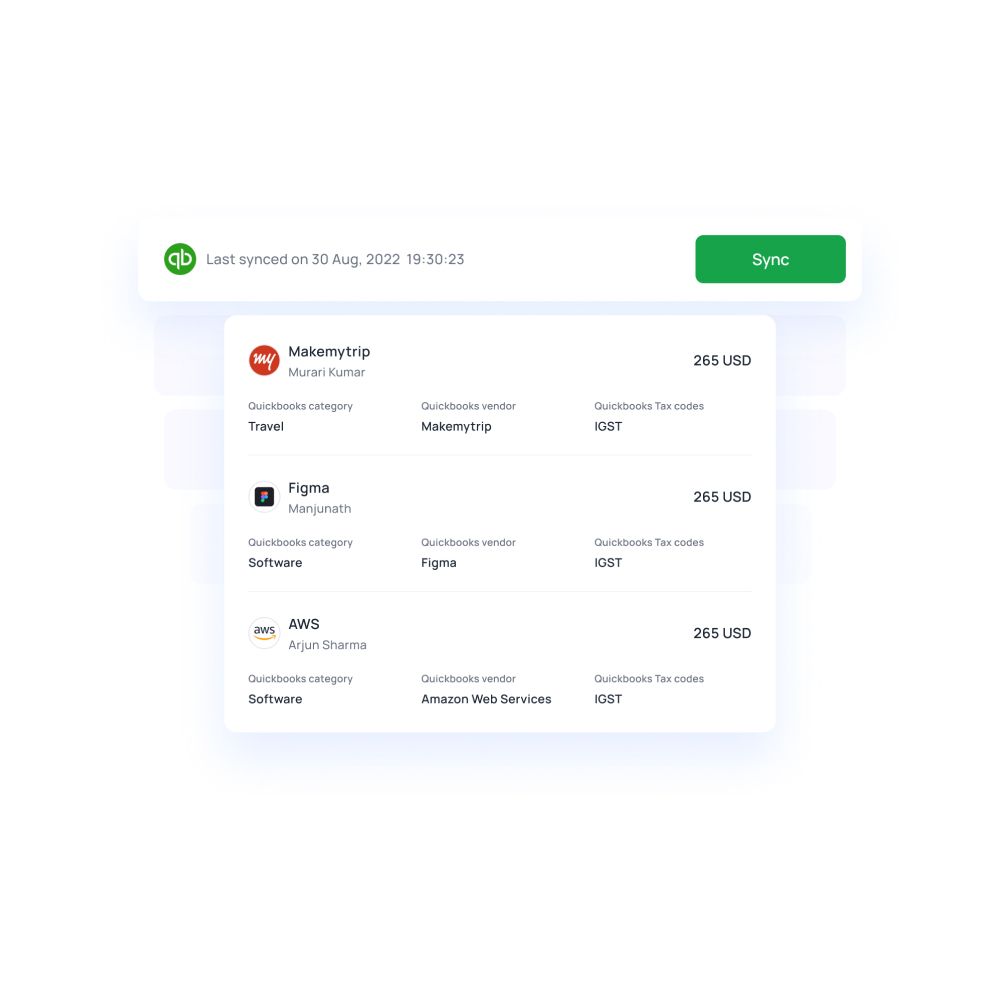

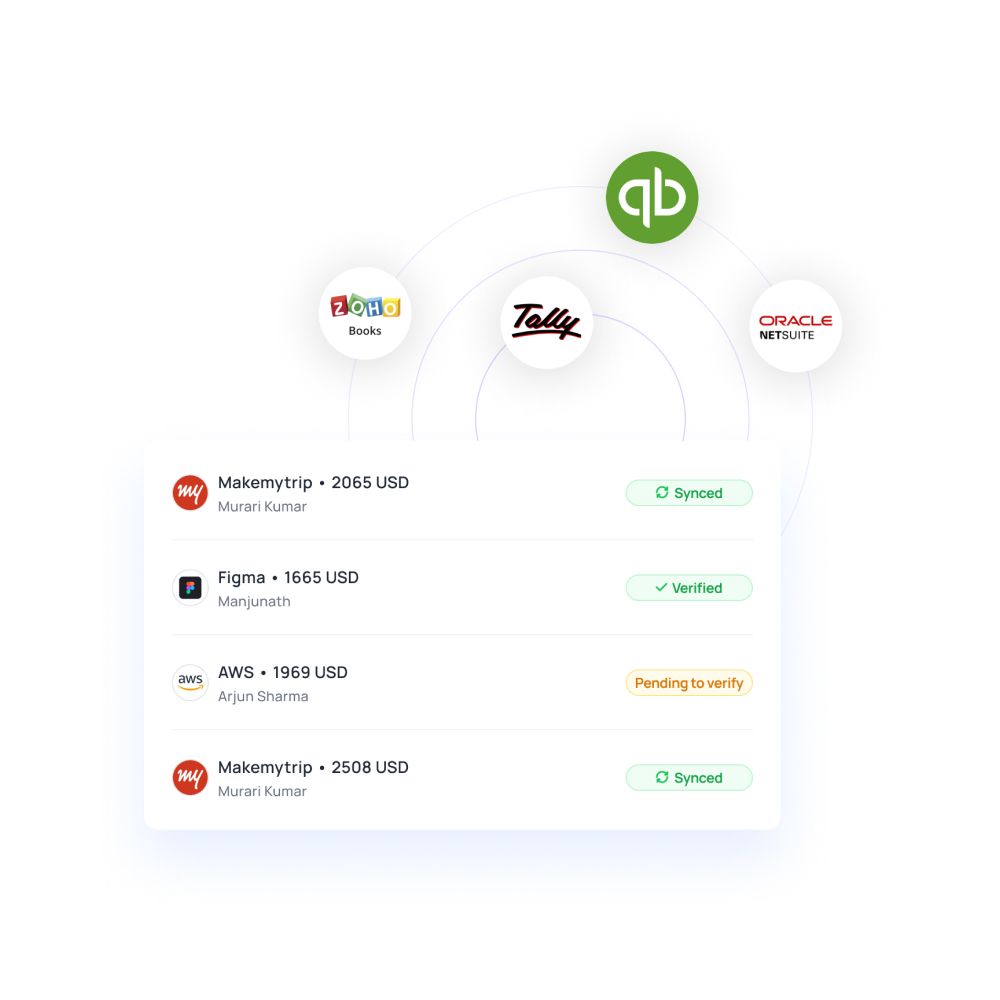

Your finance automation platform connects with your existing technology stack ERP systems, banking platforms, CRM software, and payment gateways through APIs and secure data exchanges.

This integration eliminates data silos by synchronizing information across all your financial systems in real-time. Once an invoice is approved, the system syncs with your accounting, updates budgets, and alerts your payment tool.

You get a unified financial view of your operations without switching tools, ensuring accuracy and enabling instant access to key insights.

Manual vs. automated finance: Key differences

1. Operational efficiency and speed

Manual finance

Your team spends countless hours on repetitive tasks like data entry, invoice matching, and report generation. Each transaction requires multiple touchpoints: receiving documents, manually entering information, routing for approvals, and filing records.

Processing a single invoice can take 5 to 10 days from receipt to payment. Your month-end closing stretches over a week as staff compile data from various sources, create spreadsheets, and reconcile accounts, leaving you waiting for critical financial insights.

Automated finance

Your systems process transactions instantly, handling hundreds of invoices in the time it takes to manually process one. Documents flow automatically through approval workflows based on your rules, eliminating delays and bottlenecks.

You complete the month-end closing in hours instead of days, with reports generated automatically and real-time dashboards providing immediate visibility into your financial position. Your team redirects saved time toward analysis, planning, and strategic initiatives that drive business value.

2. Data accuracy and risk

Manual finance

Your finance operations face constant exposure to human error through typos, transposed numbers, and incorrect account coding. Duplicate payments slip through unnoticed, compliance violations occur due to missed steps, and audit trails become incomplete when documentation gets misfiled.

You struggle to maintain consistency across processes as different team members follow varying procedures. These errors cost you money through overpayments, penalties, and the time spent identifying and correcting mistakes after they occur.

Automated finance

Your automated systems eliminate manual entry errors by capturing data directly from source documents with validation checks at every step. The software applies rules consistently, flags duplicates before processing, and creates complete audit trails automatically.

You maintain regulatory compliance through built-in controls that enforce approval hierarchies and documentation requirements. Exception handling catches anomalies immediately, allowing your team to address issues proactively rather than discovering problems during audits or reconciliations.

3. Strategic value and scalability

Manual finance

Your finance team remains trapped in transactional work, with 70% of their time spent on routine processing rather than strategic analysis. As your business grows, you must hire additional staff proportionally to handle increased transaction volume, raising costs without adding strategic value.

Limited visibility into real-time data prevents you from making agile business decisions. Your team lacks bandwidth to provide forward-looking insights, scenario planning, or proactive recommendations to leadership.

Automated finance

Your finance function transforms into a strategic partner, with teams spending 70% of their time on analysis, forecasting, and business partnering. Systems scale effortlessly to handle 10x transaction volume without adding headcount, reducing per-transaction costs as you grow.

Real-time analytics and predictive insights empower you to make data-driven decisions instantly. Your finance professionals evolve into strategic advisors who drive profitability, optimize cash flow, and identify growth opportunities rather than simply recording transactions.

Automation vs. manual finance: What’s more efficient for businesses?

Automation vs. manual finance: What’s more efficient?

Why finance automation is essential for modern businesses

Finance automation has become a business imperative rather than a luxury. By eliminating manual inefficiencies, you reduce operational costs by up to 70% while minimizing costly errors. Automated compliance controls ensure you meet regulatory requirements consistently, avoiding penalties and audit failures.

Most importantly, automation liberates your finance team from transactional work, enabling them to provide strategic insights, forecasting, and data-driven recommendations that directly impact profitability and growth.

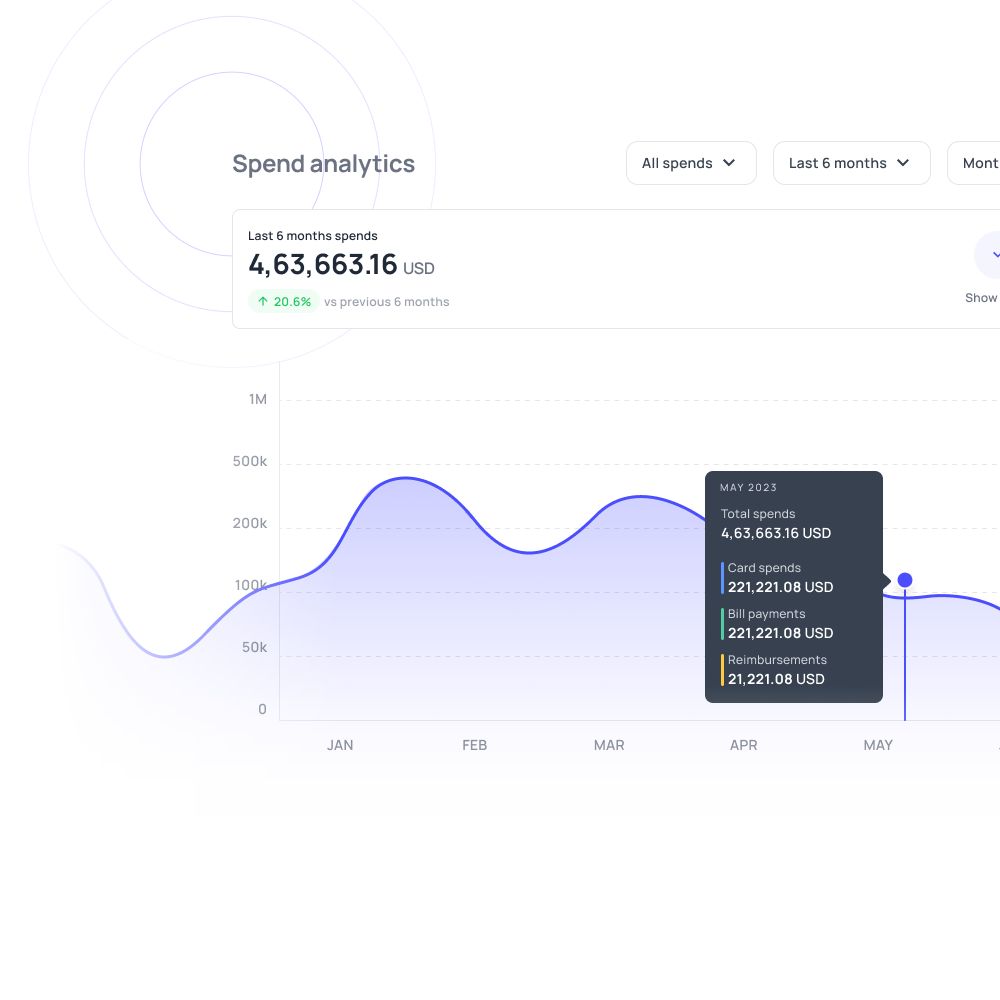

Enables real-time cash flow and budget control

Automation provides instant visibility into your cash position, allowing you to monitor inflows and outflows as they occur. You can track budget utilization across departments in real time, identifying overspending before it impacts your bottom line.

Automated forecasting tools predict future cash requirements based on historical patterns and upcoming obligations, enabling proactive decision-making. This immediate financial intelligence empowers you to optimize working capital and seize time-sensitive opportunities.

Drastically reduces transactional processing costs

By automating routine tasks, you reduce the cost of processing each invoice from $15 to under $3. Your organization eliminates overtime expenses during peak periods like month-end closing, while reducing reliance on temporary staff.

Automated systems prevent costly duplicate payments, late payment penalties, and missed early payment discounts. The efficiency gains allow you to reallocate resources toward higher-value activities, improving your overall return on investment in finance operations.

Fortifies compliance and audit readiness

Automated systems enforce your internal controls consistently, creating complete audit trails for every transaction without additional effort. You maintain regulatory compliance through built-in validation rules that flag exceptions and require proper authorization before processing.

Document retention becomes automatic, with all supporting evidence digitally linked to transactions. When auditors arrive, you provide the requested information instantly rather than spending weeks compiling records, reducing audit costs, and demonstrating strong governance to stakeholders.

Elevates the finance team to a strategic partner role

Finance automation management transforms your department from a back-office function into a value driver. By eliminating 80% of manual processing work, your team gains the capacity to analyze trends, model scenarios, and provide actionable business intelligence.

Finance professionals develop deeper relationships with operational leaders, offering insights that optimize pricing, reduce costs, and improve margins. This strategic elevation increases job satisfaction while positioning finance as an essential contributor to competitive advantage.

The key benefits of finance automation

Finance automation transforms organizational financial operations by eliminating manual processes and reducing human error. By leveraging intelligent systems, businesses accelerate transaction processing, enhance data precision, and optimize resource allocation.

This technological shift empowers finance teams to focus on strategic analysis rather than repetitive tasks, positioning companies for sustainable growth and scalability in increasingly competitive markets.

Accelerating the financial close cycle

Automated workflows dramatically compress month-end and year-end closing timelines by streamlining reconciliations, journal entries, and reporting processes.

Real-time data synchronization eliminates delays associated with manual consolidation, enabling finance teams to deliver insights faster.

This acceleration provides leadership with timely information for critical decision-making, improving organizational agility and responsiveness to market conditions.

Maximizing data accuracy and integrity

Financial automation eliminates transcription errors and inconsistencies in manual data entry, ensuring reliable financial records across all systems.

Automated validation rules and reconciliation processes detect discrepancies immediately, maintaining data integrity throughout the financial ecosystem.

Enhanced accuracy strengthens compliance efforts, supports audit readiness, and builds stakeholder confidence in reported financial information and organizational transparency.

Boosting resource optimization and efficiency

Automation liberates finance professionals from time-consuming, repetitive tasks, allowing strategic reallocation of talent toward value-added activities like forecasting and analysis.

Reduced manual intervention lowers operational costs while increasing processing capacity without proportional headcount expansion.

Teams achieve higher productivity levels, focusing expertise on complex problem-solving, risk management, and driving business performance improvements that directly impact bottom-line results.

Future-proofing for exponential scaling

Automated financial systems provide the infrastructure necessary to support rapid business expansion without operational bottlenecks or proportional cost increases.

Scalable platforms accommodate increased transaction volumes, multiple entities, and complex regulatory requirements seamlessly.

This technological foundation enables organizations to pursue aggressive growth strategies confidently, knowing their financial operations can adapt quickly to evolving business models and market opportunities.

When to modernize your finance automation stack

Recognizing the right moment to upgrade your finance technology infrastructure is crucial for maintaining a competitive advantage. Organizations experiencing process bottlenecks, escalating costs, or compliance challenges should evaluate their current systems.

Closing the books takes too long

When the month-end close consistently extends beyond industry benchmarks typically exceeding five to ten business days your manual processes are hindering organizational agility. Extended closing periods delay critical financial insights, impacting executive decision-making and strategic planning.

Legacy systems requiring extensive manual expense reconciliations, spreadsheet consolidations, and repetitive data validation clearly indicate serious automation deficiencies that modern platforms can resolve efficiently.

Budgets are often exceeded

Recurring budget overruns signal inadequate spending controls and insufficient real-time monitoring capabilities within your financial infrastructure. Manual approval workflows create delays that allow unauthorized expenditures to slip through oversight mechanisms.

When finance teams discover variances only during retrospective analysis rather than preventatively, the organization lacks proactive financial governance that automation provides through instantaneous alerts and enforced spending parameters.

Transaction volume overload

Exponential transaction growth that outpaces team capacity indicates scalability limitations in current processes. When staff consistently work overtime processing invoices, expense reports, or payment requests, operational efficiency suffers dramatically, making automation a critical, urgent need.

This volume-to-headcount imbalance increases errors, burnout, and processing costs. Finance automation for rapidly growing businesses becomes essential to maintain service levels without proportional staffing increases that strain budgets.

Compliance and audit prep is painful

Lengthy, stressful audit preparation periods involving frantic document retrieval and manual trail reconstruction reveal inadequate control documentation and audit trail capabilities. When finance teams spend weeks compiling evidence and explaining process gaps, compliance risk escalates significantly.

Modern automation platforms maintain continuous audit readiness through comprehensive digital documentation, automated compliance checks, and transparent transaction histories that satisfy regulatory requirements effortlessly.

Lack of real-time spend visibility

Inability to access current spending data without generating custom reports or waiting for period-end statements creates strategic blind spots for leadership. When executives cannot monitor budget consumption, or cash flow positions instantaneously, tactical responsiveness suffers.

Delayed financial visibility prevents timely corrective actions, obscures emerging trends, and severely undermines accurate, data-driven decision-making essential for strong competitive market positioning, sustainable growth, and long-term operational excellence.

Essential finance automations that save time

Accounts Payable (AP) management

Automated AP systems eliminate manual invoice data entry through optical character recognition, automatic matching with purchase orders, and intelligent routing for approvals.

These platforms reduce processing time per invoice from 15 minutes to under two minutes while minimizing payment errors and duplicate transactions. Integration with ERP systems ensures seamless posting, accelerates payment cycles for early-payment discounts, and provides comprehensive vendor management dashboards.

Expense management & reconciliation

Modern expense platforms enable employees to capture receipts digitally, automatically extract transaction details, and submit reports through mobile applications within minutes.

Finance automation eliminates tedious manual reconciliation by matching corporate card transactions with submitted expenses, flagging policy violations in real time, and routing approvals based on configurable rules. This streamlined process shortens reimbursement cycles and enhances employee satisfaction.

Corporate spend control

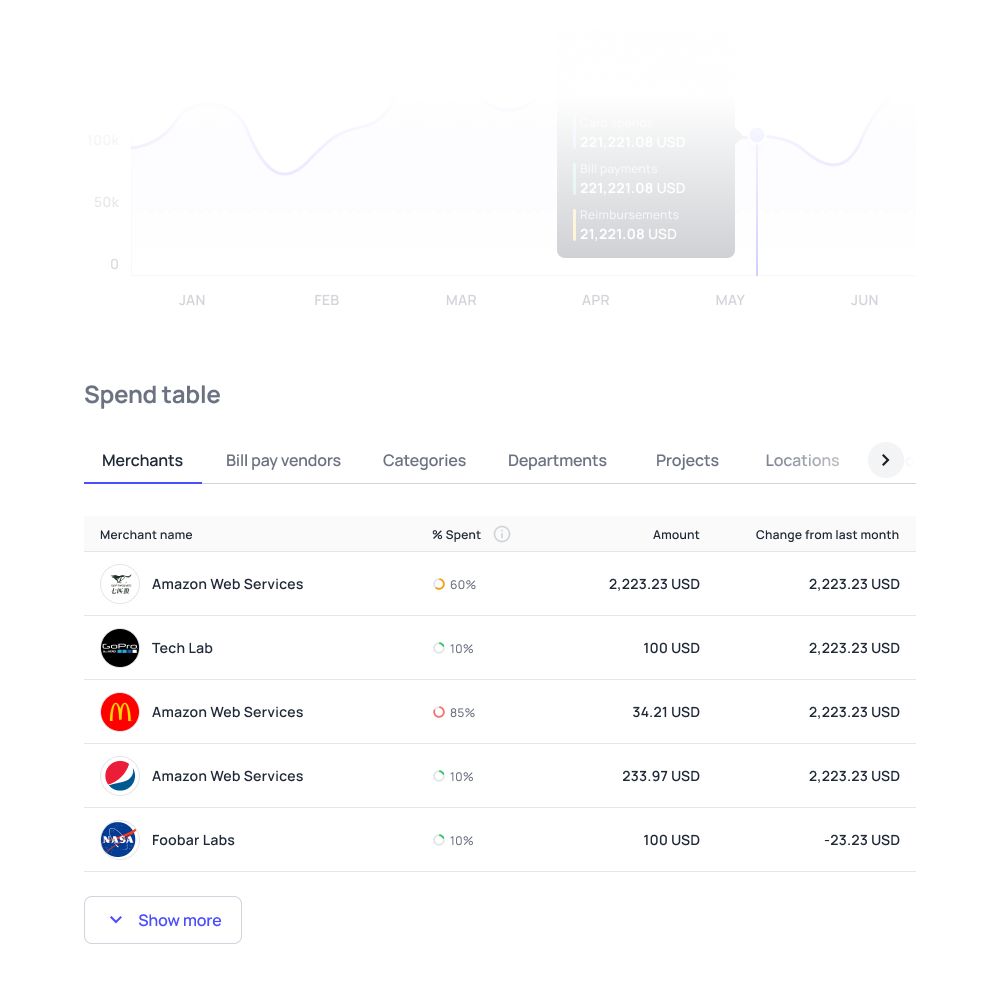

Automated spend management solutions provide pre-purchase controls through configurable approval workflows, budget allocation enforcement, and virtual card generation with transaction-specific limits.

Real-time spending visibility enables finance teams to monitor budget utilization across departments, vendors, and categories instantaneously.

These platforms prevent maverick spending, consolidate vendor relationships for better pricing, and generate comprehensive analytics that inform strategic sourcing decisions and cost optimization initiatives.

Month-end close activities

Automation transforms the month-end close through scheduled reconciliation processes, automatic journal entry generation, and integrated consolidation across multiple entities or systems.

Intelligent platforms perform variance analysis, identify anomalies requiring investigation, and generate standardized financial statements with minimal manual intervention.

This systematic approach compresses close timelines dramatically, improves accuracy through standardized procedures, and allows finance professionals to focus on analysis rather than data compilation.

Why small businesses hesitate to adopt finance automation

1. Perceived high upfront cost and uncertain ROI

Small businesses often view automation as a significant financial burden without guaranteed returns. The initial investment in software licenses, implementation, and training can strain limited budgets.

Many owners struggle to quantify potential savings against immediate expenses, leading to delayed decisions. Without a clear cost-benefit analysis and realistic timelines, the perceived financial risk outweighs the promise of future efficiency gains.

2. Lack of dedicated IT resources and expertise

Most small businesses operate without specialized IT staff, making technology adoption particularly daunting. Finance automation requires technical knowledge for setup, customization, and ongoing maintenance.

Business owners already juggling multiple responsibilities feel overwhelmed by the prospect of learning new systems. This skills gap creates dependency on external consultants, adding to costs and complexity, which further discourages automation initiatives.

3. Fear of disrupting established processes (change resistance)

Comfort with familiar workflows creates psychological barriers to automation. Employees worry about job security, while managers fear productivity dips during transition periods. Long-standing manual processes, though inefficient, provide predictability and control.

The anxiety surrounding change management, staff retraining, and potential operational disruptions often outweighs enthusiasm for modernization, particularly in organizations with risk-averse leadership.

4. Complex data migration and system integration fears

The prospect of transferring years of financial records into new systems intimidates many businesses. Concerns about data loss, accuracy errors, and compatibility with existing tools create significant hesitation.

Finance automation management becomes particularly challenging when legacy systems and spreadsheets contain inconsistent formats. Small businesses worry about maintaining business continuity during migration while ensuring compliance and audit trails remain intact throughout the transition.

Key challenges in adopting finance automation

Compatibility issues with existing systems

Integrating new automation tools with legacy accounting software, banking platforms, and payment processors presents technical hurdles. APIs may be limited or non-existent, requiring custom development work.

Data format mismatches cause synchronization problems, while incompatible workflows force workarounds that diminish efficiency gains. Ensuring seamless communication between multiple systems often demands more time and resources than initially anticipated.

Initial investment and ROI justification

Beyond software costs, businesses must account for implementation fees, employee training, process redesign, and potential productivity losses during rollout.

Calculating return on investment proves challenging when benefits like error reduction and time savings are difficult to quantify precisely. Leadership needs compelling business cases showing break-even timelines and metrics, yet projecting accurate financial impact remains uncertain.

Data quality and migration issues

Poor data hygiene in existing systems compounds migration difficulties. Duplicate entries, inconsistent categorization, incomplete records, and format variations must be cleaned before transfer.

The migration process itself risks data corruption or loss if not properly managed. Validating accuracy across thousands of transactions consumes significant time, while maintaining parallel systems during transition increases workload rather than reducing it initially.

Organizational resistance

Employees used to manual processes may resist new technologies. Lack of stakeholder buy-in undermines success, while poor change management creates knowledge gaps and lowers adoption.

Cultural barriers, generational differences in technology comfort, and fear of redundancy fuel opposition. Without strong leadership commitment and comprehensive training programs, automation initiatives frequently stall or fail completely.

Eliminating core finance bottlenecks with finance automation

1. Slow expense approvals

Manual expense approval workflows create significant delays, with reports often stuck in email chains or physical inboxes. Employees wait days or weeks for reimbursements, while finance teams chase down approvers and manage paper trails.

Automated routing accelerates this process dramatically, sending expenses to the right stakeholders based on predefined rules, triggering escalations for delays, and providing real-time status visibility for all parties involved.

2. Inconsistent GL coding

Without standardized processes, general ledger coding becomes subjective and error-prone. Different team members interpret expense categories differently, leading to misclassified transactions that distort financial reporting and complicate month-end closes.

Automated systems enforce consistent coding rules through intelligent categorization, predefined mappings, and validation checks that catch errors before they enter your financial records, ensuring data integrity across all transactions.

3. Lack of real-time spend visibility

Traditional finance processes rely on backward-looking reports that arrive too late for proactive decision-making. Finance automation provides instant visibility into spending patterns, budget utilization, and cash flow trends through dynamic dashboards.

Leaders can identify cost overruns as they happen, compare actual spend against forecasts in real time, and make informed adjustments before small issues become significant problems requiring reactive corrections.

4. Manual reconciliation drag

Month-end close becomes a marathon of matching transactions, investigating discrepancies, and verifying account balances manually. This labor-intensive process consumes valuable time, delays financial reporting, and increases the risk of overlooked errors.

Automated reconciliation tools match transactions across systems instantly, flag exceptions for review, and maintain complete audit trails, reducing close cycles from weeks to days while improving accuracy.

Finance automation: The strategic implementation process

Assessing current state maturity and defining KPIs

Begin by documenting existing processes, identifying inefficiencies, and understanding where manual effort creates the greatest friction. Establish baseline metrics for cycle times, error rates, and resource allocation.

Define specific, measurable KPIs that align with business objectives whether reducing close time by 40%, cutting processing costs by 30%, or improving approval speeds. These benchmarks guide technology selection and prove ROI post-implementation.

Structuring the unified chart of accounts (COA)

A clean, logical chart of accounts forms the foundation for effective automation. Review your existing COA structure, eliminate redundant or obsolete accounts, and establish clear hierarchies that support both operational needs and reporting requirements.

Create detailed coding guidelines that remove ambiguity, ensure consistency across departments, and enable meaningful financial analysis. This structural work prevents garbage-in-garbage-out scenarios that undermine automation benefits.

Vetting and integrating technology solutions

Evaluate automation platforms against your specific requirements, prioritizing solutions that integrate seamlessly with existing ERP, procurement, and banking systems. Assess vendors on functionality, scalability, support quality, and implementation track records.

Consider API capabilities, data security certifications, and user experience. Pilot test shortlisted solutions with actual workflows before committing, ensuring the technology solves real problems rather than creating new complexity.

Phased rollout, testing, and optimization

Resist the temptation to automate everything simultaneously. Start with high-impact, low-complexity processes like expense approvals or invoice processing. Configure workflows, migrate necessary data, and conduct thorough testing with a pilot group.

Gather feedback, refine rules, and address issues before expanding. This iterative approach builds confidence, allows for mid-course corrections, and demonstrates quick wins that generate momentum for broader adoption across the organization.

Cultivating change management and training

Technology alone doesn't drive transformation—people do. Develop comprehensive training programs tailored to different user roles, from submitters to approvers to finance analysts.

Communicate the "why" behind changes, emphasizing benefits for individual users, not just the finance department. Identify change champions within business units who can provide peer support. Establish feedback channels and remain responsive to concerns, treating implementation as an ongoing dialogue.

Establishing data governance and security protocols

Automation increases data volume and velocity, making robust governance essential. Define data ownership, access controls, and retention policies that comply with regulatory requirements. Implement role-based permissions, ensuring users see only relevant information.

Establish audit trails tracking all system changes and transactions. Regular security reviews, backup procedures, and disaster recovery plans protect against breaches and system failures, maintaining trust and compliance throughout your automated environment.

The 3-layer finance automation framework for scaling finance ops

This framework transforms finance operations from manual transaction processing into a strategic intelligence engine. By automating data capture, workflow execution, and analytical reporting, finance teams shift from administrative tasks to value-driving activities like forecasting, risk management, and strategic planning that directly impact business growth.

Layer 1: Data ingestion and integrity

Automated receipt capture and OCR

Optical character recognition technology automatically extracts transaction data from receipts, invoices, and documents upon upload. This eliminates manual data entry errors, reduces processing time by up to 80%, and creates a searchable digital archive. Mobile apps enable employees to capture receipts instantly, ensuring no expense goes undocumented.

Mandatory policy checks at the point of transaction

Real-time policy validation occurs before transactions are submitted, flagging violations immediately. The system checks spending limits, vendor restrictions, category permissions, and approval requirements against predefined rules. This proactive approach prevents non-compliant expenses from entering the workflow, reducing audit exceptions and ensuring regulatory compliance from the start.

Automated GL coding and validation

Machine learning algorithms analyze transaction details and automatically assign appropriate general ledger codes based on vendor, category, and historical patterns. The system validates coding accuracy against your chart of accounts, identifies anomalies, and learns from corrections. This ensures consistent categorization, accelerates month-end close, and improves financial reporting accuracy.

Layer 2: Process and workflow automation

Dynamic, conditional approval routing

Intelligent routing sends transactions to the appropriate approvers based on amount thresholds, department hierarchies, project codes, and budget ownership. The system automatically escalates stalled approvals and reroutes when approvers are unavailable, ensuring continuous workflow progression without manual intervention or bottlenecks.

Instant purchase order creation

Purchase orders generate automatically from approved requisitions, populating vendor details, line items, pricing, and delivery terms. Integration with procurement systems ensures PO numbers sync across platforms, creating an auditable trail. This acceleration reduces procurement cycle time and enables better vendor relationship management.

Automated invoice matching

Three-way matching automatically reconciles purchase orders, receipts, and invoices without human review. The system identifies discrepancies in quantity, pricing, or terms, flagging exceptions for investigation while auto-approving perfect matches. This streamlines accounts payable, prevents duplicate payments, and optimizes cash flow management through early payment discounts.

Layer 3: Reporting and strategic insight

Real-time budget consumption reporting

Live dashboards display budget utilization across departments, projects, and cost centers with drill-down capabilities to transaction-level detail. Stakeholders receive instant visibility into spending patterns, remaining allocations, and burn rates. Finance automation for businesses enables proactive budget management rather than reactive month-end surprises, supporting better resource allocation decisions.

Automated variance analysis

The system automatically compares actual spending against budgets and forecasts, calculating variances and identifying trends that exceed predefined thresholds. Algorithms detect unusual patterns, seasonal anomalies, and emerging cost overruns. Automated alerts notify budget owners of significant deviations, enabling immediate corrective action before small issues become major financial problems.

Predictive cash flow modeling

Advanced analytics combine historical transaction patterns, outstanding payables and receivables, and seasonal trends to forecast future cash positions. Machine learning models continuously refine predictions based on actual outcomes, improving accuracy over time. This foresight enables strategic decisions about investments, debt management, and working capital optimization that drive sustainable growth.

Achieving data centralization: The unified finance platform

Decentralized finance systems create data inconsistencies, duplicate entries, and reporting delays that obscure the true financial position.

A unified platform aggregates all spending data expenses, procurement, invoices, and corporate card transactions into one repository.

This centralization enables accurate spend analysis, identifies cost-saving opportunities, and supports strategic decision-making with comprehensive, reliable financial intelligence.

Centralized systems apply standardized categorization rules across all transactions, ensuring uniform general ledger coding regardless of entry point or user.

Machine learning algorithms recognize patterns and automatically assign correct codes, while validation rules prevent miscategorization.

This consistency eliminates coding variations, accelerates accounting close processes, and produces reliable financial statements for stakeholder reporting.

Modern finance platforms integrate directly with enterprise resource planning systems through APIs, enabling real-time data synchronization in both directions.

Transactions flow automatically from the finance platform to the ERP general ledger, while master data like vendors, employees, and the chart of accounts sync back.

This eliminates manual data exports, reduces errors, and ensures your accounting systems remain current without any duplicate data entry.

Centralized platforms embed policy rules directly into transaction workflows, enforcing compliance at the point of expenditure rather than after the fact.

The system validates spending against budget availability, approval limits, vendor restrictions, and category permissions before processing.

This proactive enforcement prevents policy violations, reduces audit findings, and ensures regulatory compliance without relying on manual oversight.

Every transaction, approval, modification, and document is timestamped and logged in an unalterable audit trail within the centralized platform.

Finance automation management systems maintain complete visibility into who performed what action, when, and why, with supporting documentation attached to each entry.

This detailed trail simplifies internal and external audits, ensures compliance, and provides forensic clarity for dispute resolution.

Selecting the right finance automation software

Ease of integration with existing ERPs

Evaluate the platform's native connectors for your specific ERP system, including supported data types, synchronization frequency, and bidirectional capabilities.

Assess API flexibility for custom integrations, middleware requirements, and historical data migration processes. Request integration timelines, technical requirements, and references from organizations with similar technology stacks to understand true implementation complexity.

Scalability and handling future transaction volume

Examine the platform's architecture to ensure it accommodates growing transaction volumes, additional entities, and expanded user bases without performance degradation.

Review pricing models to understand how costs scale with usage, and confirm the system supports multi-currency, multi-entity, and international operations. Verify that the vendor's infrastructure can handle peak loads and provide performance guarantees.

User experience and adoption rate

Prioritize intuitive interfaces that require minimal training, as user adoption directly impacts ROI and overall efficiency. Thoroughly test the platform with actual employees across different roles, departments, and varying technical skill levels.

Request adoption metrics and time-to-proficiency data from existing customers. Evaluate mobile functionality, offline capabilities, and accessibility features that facilitate seamless usage across your organization's diverse workforce.

Reporting, analytics, and forecasting capabilities

Assess pre-built reporting templates, custom report builders, and dashboard visualization options to ensure they meet your analytical requirements. Verify the platform offers real-time data access, and export functionality.

Evaluate advanced features like predictive analytics, scenario modeling, and AI-driven insights that transform historical data into forward-looking strategic intelligence for leadership decision-making.

Security, compliance, and audit features

Verify the platform maintains SOC 2 Type II certification, GDPR compliance, and industry-specific regulatory standards relevant to your sector. Evaluate data encryption methods, access controls, role-based permissions, and multi-factor authentication capabilities.

Review audit trail functionality, data retention policies, backup procedures, and disaster recovery protocols to ensure comprehensive security and compliance framework alignment.

Total Cost of Ownership (TCO) and ROI Assessment

Calculate total costs, including licensing, implementation, training, support, integration maintenance, and infrastructure. Compare these against measurable benefits: reduced processing time, fewer manual tasks, error reduction, early payment discounts, and redeployed staff capacity.

Request detailed ROI projections with realistic timelines, and verify claims with customer references experiencing similar organizational complexity.

Measuring ROI from finance automation

Quantifying automation returns requires establishing baseline metrics before implementation and tracking improvements across operational efficiency, cost reduction, and risk mitigation dimensions.

Comprehensive ROI measurement encompasses tangible benefits like processing cost reductions and intangible gains such as enhanced decision-making capabilities. Organizations that systematically track these metrics demonstrate clear value realization and secure continued investment in digital transformation initiatives.

1. Tracking reduction in cost per transaction (CPT)

Cost per transaction measures the total expense of processing individual financial activities, including labor, technology, and overhead costs. Automation reduces CPT by eliminating manual data entry, accelerating approval workflows, and minimizing error correction cycles.

Organizations typically reduce CPT by 60-80% post-automation, with enterprise implementations processing thousands of transactions monthly, translating reductions into substantial annual savings that directly improve operational margins.

2. Measuring savings in close time and labor

Financial close duration directly impacts reporting timeliness and finance team capacity for strategic work. Automation accelerates data consolidation, reconciliation, and reporting generation through systematic workflows and real-time data availability.

Organizations commonly reduce close cycles from 10-15 days to 3-5 days, freeing hundreds of staff hours monthly. These efficiency gains enable finance teams to redirect capacity toward analysis, forecasting, and strategic partnerships with business units.

3. Assessing the reduction in compliance risk

Compliance risk manifests as audit findings, regulatory penalties, and reputational damage from policy violations or reporting inaccuracies. Automation embeds controls directly into transaction workflows, creates comprehensive audit trails, and enforces policy adherence systematically.

Quantify risk reduction through decreased audit exceptions, eliminated compliance violations, reduced external audit fees, and lower insurance premiums. These improvements protect organizational reputation and prevent costly regulatory interventions.

4. Calculating the overall impact on financial ratios

Automation improvements cascade into key financial performance indicators that stakeholders monitor closely. Accelerated cash conversion cycles improve working capital ratios through faster invoice processing and payment optimization.

Reduced operational costs enhance EBITDA margins and operating efficiency ratios. Improved forecast accuracy supports better capital allocation decisions, strengthening return on invested capital. These ratio improvements demonstrate automation's strategic contribution beyond operational efficiency gains.

5. ROI metrics comparison: Before vs after automation

Before automation

Organizations operating with manual processes experience extended cycle times, elevated error rates, and resource-intensive workflows. These baseline metrics reflect typical performance ranges across mid-market and enterprise organizations prior to implementing comprehensive automation platforms.

After automation

The implementation of integrated finance automation platforms delivers measurable performance improvements across all operational dimensions. These quantified enhancements represent conservative estimates based on documented case studies and vendor-reported outcomes from successful deployments across diverse industries and organizational sizes.

ROI impact

Performance metric improvements translate directly into cost savings through reduced labor requirements, faster cash access through accelerated cycles, and risk mitigation through enhanced accuracy. Additionally, freed capacity enables finance teams to contribute strategic value through analysis, planning, and business partnership rather than transactional processing activities.

Best practices for finance automation efficiency

Continuous monitoring of system usage

Track system performance metrics, user adoption rates, and transaction volumes in real-time to identify bottlenecks early. Implement dashboard monitoring tools that flag anomalies, processing delays, or unusual activity patterns.

Regular monitoring enables proactive issue resolution, prevents workflow disruptions, and ensures your finance automation infrastructure operates at optimal capacity while maintaining compliance standards.

Regular audits of automated coding accuracy

Schedule periodic reviews of automated account coding, categorization rules, and approval workflows to maintain data integrity. Validate that transactions are correctly classified according to your chart of accounts and tax requirements.

These audits catch configuration drift, identify outdated rules, and ensure your automation logic remains aligned with evolving business structures and regulatory requirements.

Iterative workflow optimization

Continuously refine automated processes based on user feedback, performance data, and changing business needs. Test new approval hierarchies, streamline exception handling, and eliminate redundant steps that slow processing times.

This iterative approach keeps workflows agile, reduces manual touchpoints, and ensures your systems adapt to organizational growth and market dynamics effectively.

Ongoing training and team education

Invest in regular training sessions that keep finance teams updated on system enhancements, new features, and emerging best practices. Develop internal champions who can troubleshoot common issues and mentor colleagues.

Well-trained teams maximize system utilization, reduce user errors, and drive innovation by suggesting improvements based on hands-on experience with automation tools.

Leveraging analytics for strategic forecasting

Utilize automated data collection to generate predictive insights, cash flow projections, and spend pattern analyses. Transform transactional data into strategic intelligence that informs budgeting decisions, vendor negotiations, and resource allocation.

Advanced analytics capabilities turn your automation platform from a processing tool into a strategic asset that drives informed decision-making across the organization.

How Volopay delivers unified finance automation

Volopay's comprehensive accounting automation platform that consolidates spend management, accounts payable, corporate cards and expense tracking into a single ecosystem. By eliminating fragmented systems and manual reconciliation,

Volopay enables finance teams to gain complete visibility over corporate spending while automating repetitive tasks. This unified approach accelerates month-end closes and empowers strategic financial decision-making.

Centralized spend control

Manage corporate cards, reimbursements, and vendor payments from one intuitive platform with customizable approval workflows. Set spending limits, define category restrictions, and enforce policy compliance automatically.

Centralized control eliminates shadow spending, reduces maverick purchases, and gives finance leaders real-time authority over organizational expenditures without creating bottlenecks for operational teams.

End-to-end AP automation

Streamline invoice processing from receipt to payment with intelligent OCR technology, automated three-way matching, and scheduled payment execution.

Finance automation for businesses eliminates manual data entry, reduces processing times from days to minutes, and minimizes payment errors.

Volopay's AP automation integrates seamlessly with approval hierarchies, ensuring proper authorization while maintaining audit trails for compliance.

Real-time spend visibility

Access live dashboards that display current burn rates, departmental spending, and budget utilization across all payment channels.

Real-time visibility eliminates the delay between transactions and reporting, enabling immediate course corrections when spending deviates from plans.

Finance teams can identify cost-saving opportunities, detect policy violations instantly, and make data-driven decisions without waiting for month-end reports.

Seamless system sync

Integrate Volopay with existing ERP systems, accounting, and HRIS platforms through native connectors and APIs that synchronize data automatically.

Eliminate duplicate data entry, maintain consistent records across systems, and ensure your general ledger reflects current transaction data.

Seamless synchronization reduces reconciliation time, minimizes discrepancies, and creates a single source of truth for financial reporting.

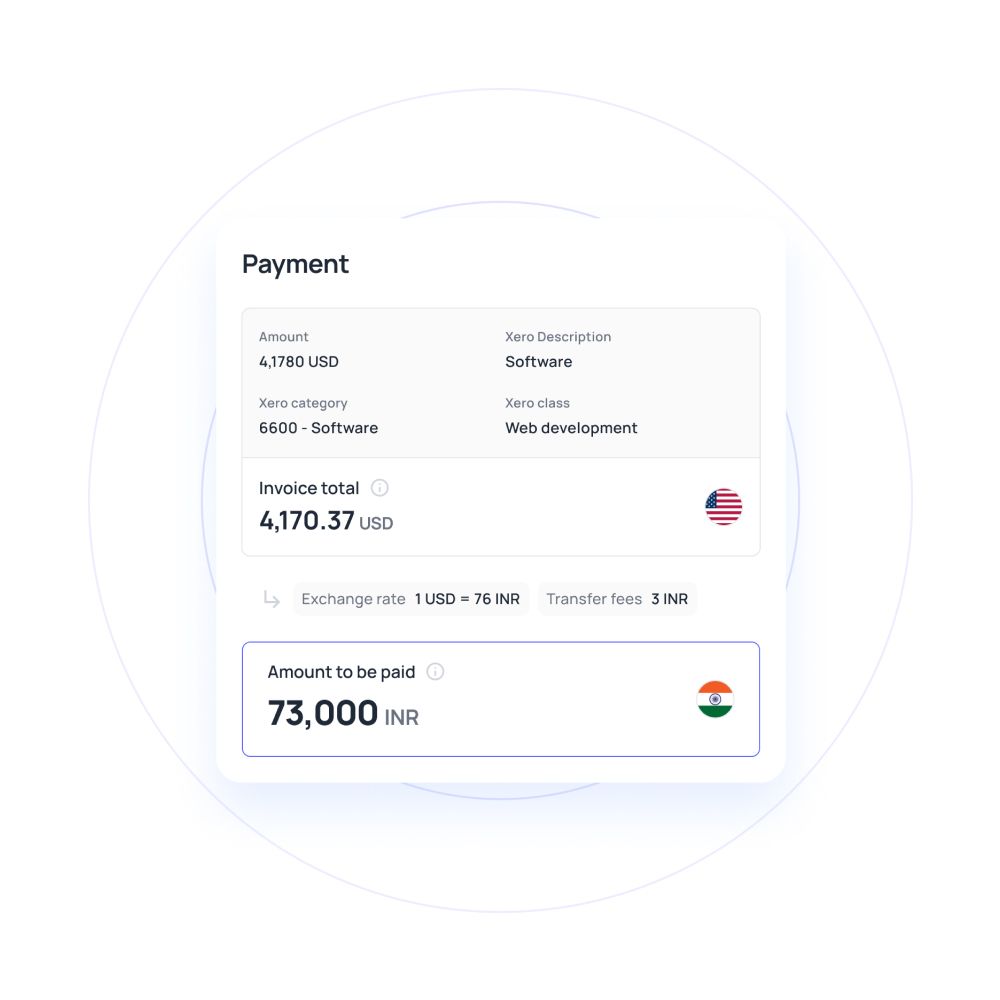

Multi-currency transaction management

Process international payments, manage foreign exchange rates, and maintain multi-currency accounts without manual conversion calculations.

Volopay automatically applies current exchange rates, tracks currency fluctuations, and provides transparent fee structures for cross-border transactions.

This capability simplifies global operations, reduces forex-related losses, and enables accurate financial reporting across diverse geographic markets.

Bring Volopay to your business

Get started now

FAQs about finance automation

Absolutely. You can benefit from finance automation regardless of your company's size. Modern platforms offer scalable pricing and features tailored to smaller teams, helping you eliminate manual data entry, reduce errors, and free up valuable time for strategic growth activities without requiring large IT investments.

Automation provides you with real-time financial data, predictive analytics, and comprehensive spending insights that inform your strategic choices. You gain immediate visibility into cash flow trends, budget performance, and cost patterns, enabling you to make proactive decisions about resource allocation, vendor negotiations, and business expansion opportunities.

Avoid rushing implementation without proper planning, neglecting team training, or automating broken processes. You should map your current workflows first, ensure stakeholder buy-in, and choose solutions that integrate with your existing systems. Don't overlook data migration quality or fail to establish clear success metrics for measuring automation ROI.

Volopay automates invoice processing, expense approvals, payment execution, and reconciliation tasks that traditionally consume hours of manual effort. You'll eliminate repetitive data entry, automatic coding transactions, and instant report generation. This automation frees your team to focus on analysis, strategy, and value-added activities instead of administrative tasks.

Volopay offers you an intuitive, all-in-one platform with transparent pricing and quick implementation timelines suited for small teams. You don't need dedicated IT resources or extensive training the user-friendly interface and responsive support help you transition smoothly. You can start with essential features and scale functionality as your business grows.

Volopay maintains comprehensive audit trails, automatically captures supporting documentation, and enforces approval hierarchies that satisfy compliance requirements. You receive organized, searchable records with timestamps and user attribution, making audit preparation effortless. The platform ensures policy adherence through built-in controls, reducing your compliance risks and accelerating audit completion.

Yes, Volopay grows with you seamlessly. You can add users, expand approval workflows, integrate additional subsidiaries, and manage increasing transaction volumes without platform limitations. The system accommodates multi-entity structures, supports global expansion with multi-currency capabilities, and adapts to your evolving financial processes as your business complexity increases.