How to train employees in US for responsible prepaid card usage

Empowering responsible spending

Prepaid cards are transforming how businesses manage employee expenses by promoting accountability and financial discipline. Unlike traditional credit cards, prepaid cards are preloaded with a set amount, ensuring employees spend within allocated budgets. This approach minimizes the risk of overspending and eliminates the need for reimbursements.

Real-time tracking features provide transparency, allowing finance teams to monitor transactions instantly. Additionally, automated reporting simplifies expense management, reducing administrative burdens.

By implementing prepaid cards, companies not only streamline their expense processes but also foster a culture of responsible spending among employees. This proactive measure enhances financial control and supports overall organizational efficiency.

The rise of prepaid cards for business expense management

Businesses across the U.S. are increasingly adopting prepaid cards as a streamlined alternative to traditional credit cards and reimbursement processes. These cards offer enhanced control over employee spending by allowing companies to predefine budgets and restrict usage to approved categories.

With real-time transaction tracking and automated expense reporting, prepaid cards simplify financial oversight and reduce administrative burdens.

Additionally, they mitigate risks associated with overspending and fraud, as funds are limited to the preloaded amount. This shift towards prepaid solutions reflects a broader trend of leveraging technology to improve financial management and operational efficiency in the corporate landscape.

The importance of training for responsible card use

Implementing prepaid cards in your business offers numerous advantages, but their effectiveness hinges on proper employee usage. Without adequate training, there's a risk of misuse, non-compliance with company policies, and potential financial discrepancies.

Educating employees on the correct use of prepaid cards ensures they understand spending limits, approved expenses, and the importance of timely reporting. This proactive approach minimizes errors, fosters trust, and upholds the integrity of the company's financial practices.

Moreover, ongoing training and support can adapt to evolving business needs, ensuring sustained compliance and efficiency.

Best practices for using prepaid cards responsibly

Training your employees on prepaid card use isn’t just about telling them what not to do—it’s about giving them the knowledge and confidence to use the card effectively and ethically.

To ensure responsible use, your team should be well-versed in how the card functions, understand your internal policies, and know exactly what they can and can’t spend on. A structured onboarding process combined with ongoing support helps avoid confusion, reduces the chance of policy violations, and promotes accountability.

Here’s what to cover in your training sessions:

1. Understanding card functionality

Prepaid cards are preloaded with a specific amount, ensuring employees spend within set limits. Unlike credit cards, they don't allow overdrafts, promoting disciplined spending.

Employees should regularly check their card balances and be aware of any transaction restrictions. Understanding these features helps prevent declined transactions and ensures smooth operations.

2. Adhering to company policies

Clear company policies are essential for effective prepaid card usage. These policies should outline spending limits, approved expense categories, and procedures for obtaining necessary approvals.

Regular training sessions can reinforce these guidelines, ensuring employees are well-informed and compliant. Consistent adherence to these policies safeguards the company's financial integrity.

3. Recognizing permitted vs. prohibited expenses

Employees must distinguish between allowable and non-allowable expenses. Permitted expenses typically include business-related travel, client meals, and office supplies.

Conversely, personal purchases, entertainment unrelated to business, and cash withdrawals are usually prohibited. Providing a detailed list of approved and restricted expenses can prevent misuse and promote responsible spending.

Get the perfect prepaid card for your business!

Essential skills for effective prepaid card management

While understanding policies is important, your employees also need hands-on skills to use prepaid cards effectively in real-world situations. This part of the training should focus on day-to-day operations—how to activate the card, make purchases, report expenses, and handle issues like returns or disputes.

When your team is confident in these areas, they’re less likely to make errors and more likely to uphold your company’s financial integrity.

Card activation and security best practices

Begin by guiding employees through the secure activation process of their prepaid cards. Emphasize the importance of safeguarding card details, such as the card number and CVV, and advise against sharing this information.

Instruct them to store cards securely and to report any lost or stolen cards immediately to prevent unauthorized transactions.

Implementing these practices helps protect both the employee and the organization from potential fraud.

Making purchases (online & offline)

Train employees on the proper procedures for making purchases using prepaid cards, both online and in physical stores.

Clarify any restrictions, such as merchant categories or transaction limits, and ensure they understand the process for verifying available balances before initiating a purchase.

Encourage them to retain receipts for all transactions, as these are crucial for expense reporting and reconciliation.

Real-time expense reporting and receipt capture

Introduce employees to expense tracking software that facilitates real-time reporting and digital receipt capture.

Demonstrate how to upload receipts promptly after each transaction, categorize expenses accurately, and submit reports in a timely manner. This practice not only streamlines the reimbursement process but also enhances transparency and accountability within the organization.

Handling disputes and returns

Educate employees on the appropriate steps to take when disputing unauthorized transactions or handling returns. Provide clear guidelines on documenting issues, communicating with vendors, and notifying the finance department.

Ensure they understand the importance of acting promptly to resolve such matters, as delays can complicate the dispute resolution process.

Understanding regulations: Maintaining compliance and accountability

Responsible use of prepaid cards isn’t just about internal policies—it’s also about staying on the right side of the law. As an employee, your actions directly impact the company’s compliance with tax regulations and audit readiness.

That’s why your training should include a clear understanding of documentation standards, reporting practices, and the consequences of misuse.

Understanding tax implications (GST & income tax)

Employees must maintain meticulous records of all business-related expenses to ensure IRS compliance and facilitate accurate tax deductions. This includes preserving receipts, canceled checks, and other supporting documents for the duration required to substantiate items reported on tax returns.

The importance of audit trails

Establishing comprehensive audit trails is vital for financial transparency and regulatory adherence.

Audit trails provide a chronological record of transactions, enabling organizations to track activities, detect discrepancies, and verify the accuracy of economic data. This practice not only supports internal controls but also simplifies the audit process.

Consequences of misuse

Misuse of corporate prepaid cards can lead to serious repercussions, including disciplinary actions and legal consequences.

Unauthorized transactions, overspending, or fraudulent activities may result in suspension or termination of card privileges, and in severe cases, criminal charges.

Implementing clear policies and providing ongoing training can mitigate these risks and promote responsible card usage.

Fostering a culture of trust and openness

Open communication channels

Encourage employees to ask questions, voice concerns, or report any issues related to prepaid card usage without fear of criticism or retaliation.

Building a transparent environment with open, judgment-free communication promotes mutual trust and reinforces individual accountability.

When employees feel safe speaking up, it becomes easier to identify and resolve problems before they escalate.

Regular review and feedback

Implement periodic reviews of employee spending patterns to identify both positive trends and potential problem areas.

Use these moments to offer constructive, personalized feedback, recognizing compliance and guiding improvement.

Regular dialogue helps employees align with company expectations and ensures consistent policy adherence.

Recognizing exemplary behavior

Make it a point to acknowledge employees who consistently follow spending policies and use their prepaid cards responsibly. Whether through public praise, team announcements, incentives, or formal recognition programs, highlighting ethical behavior reinforces its value.

Recognition not only motivates individuals but also sets a standard for others, helping cultivate a responsible, transparent culture within your organization.

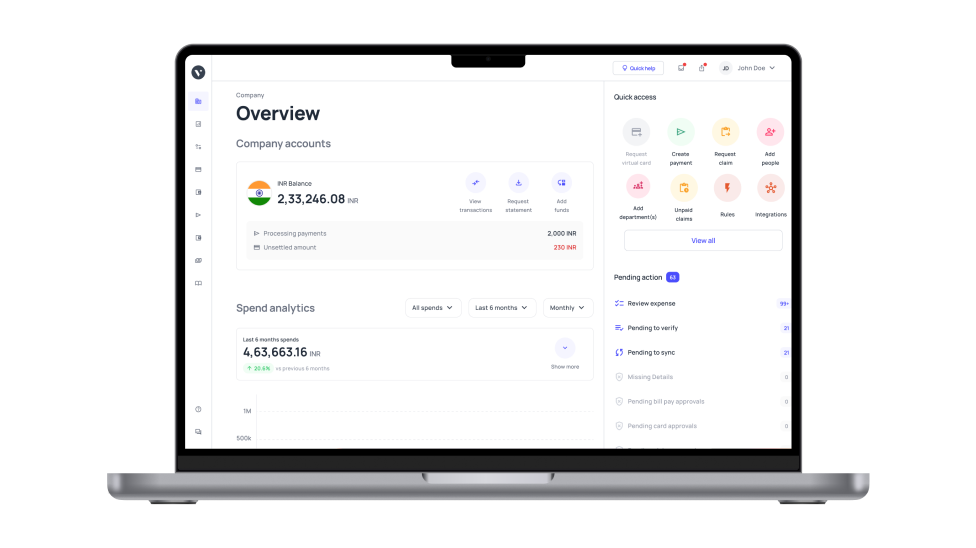

Volopay prepaid cards to streamline your expense management

Volopay offers a comprehensive solution for businesses seeking efficient expense management through its prepaid card system. Designed with user-friendliness in mind, Volopay's platform simplifies employee onboarding, allowing teams to quickly adapt and manage their corporate cards with ease.

Employees can utilize both physical and virtual cards for various business expenses, including travel and subscriptions, with each transaction automatically logged and categorized. Real-time tracking and automated expense reporting provide transparency and reduce administrative burdens.

Additionally, Volopay's integration with accounting systems ensures seamless financial operations, making it an ideal choice for businesses aiming to enhance control over their expenditures.

FAQs on responsible prepaid cards usage

If a prepaid card is lost or stolen, the employee should immediately report it to the finance team or the card administrator. With Volopay, cards can be frozen instantly through the mobile app or web dashboard, minimizing the risk of unauthorized transactions. A replacement card can then be issued promptly.

Prepaid cards can be an excellent tool for managing overseas business expenses. With Volopay, you can issue cards in multiple currencies, helping employees avoid high foreign exchange fees. It's also easy to monitor international spending in real-time, making post-trip reconciliation simpler for both employees and finance teams.

Prepaid cards should strictly be used for business-related expenses. Allowing personal use complicates accounting, affects tax reporting, and can blur audit trails. With Volopay, you can enforce strict merchant and category restrictions to ensure cards are only used for approved business purposes.

Volopay cards come with advanced security features, including two-factor authentication, instant freezing, and transaction alerts. Since they're not linked to your primary bank account, the financial exposure is limited, providing an extra layer of protection.

Yes, you can define custom spending limits per card, per user, or per department. Whether it’s daily caps or monthly allowances, Volopay gives you complete control over how much employees can spend, reducing the risk of overspending.

Absolutely. Volopay integrates with major accounting platforms like Xero, QuickBooks, and NetSuite. Transactions are synced automatically, with receipts and categories attached, saving your team hours on manual bookkeeping.

Volopay cards are ideal for travel, SaaS subscriptions, office supplies, client meetings, and other operational expenses. You can issue cards for individual employees, departments, or specific vendors to track and control spending with greater precision.

Bring Volopay to your business

Get started now